Navigating the complexities of graduate school often involves the significant financial hurdle of student loans. Graduate PLUS loans, a crucial component of federal student aid, offer a lifeline for many aspiring professionals. Understanding their intricacies, from eligibility requirements to repayment strategies, is paramount to ensuring a financially sound path towards a graduate degree and beyond. This guide delves into the key aspects of Graduate PLUS loans, providing a clear and concise overview for prospective and current graduate students.

This exploration covers not only the mechanics of obtaining and managing these loans but also the broader implications they have on a graduate student’s financial well-being, career trajectory, and long-term financial health. We’ll examine strategies for minimizing debt, exploring options like income-driven repayment plans and loan forgiveness programs. Ultimately, our aim is to empower graduate students with the knowledge needed to make informed decisions about their financial future.

Understanding Graduate Plus Loans

Graduate PLUS loans are a crucial funding option for graduate students pursuing advanced degrees. They offer a potentially significant source of financial assistance, but understanding their intricacies is vital for responsible borrowing. This section will clarify the eligibility requirements, associated costs, and repayment options to help you make informed decisions.

Graduate PLUS Loan Eligibility Criteria

Eligibility for a Graduate PLUS loan hinges primarily on creditworthiness. Unlike some other federal student loan programs, Graduate PLUS loans require a credit check. Applicants must meet specific credit history requirements, demonstrating a responsible financial history. The specific criteria can vary slightly depending on the lender, but generally involve a lack of recent bankruptcies, serious delinquencies, or other significant negative credit events. Furthermore, applicants must be enrolled at least half-time in a graduate or professional degree program at a participating institution. Finally, they must meet the general eligibility requirements for federal student aid, such as being a U.S. citizen or eligible non-citizen and maintaining satisfactory academic progress.

Graduate PLUS Loan Interest Rates and Fees

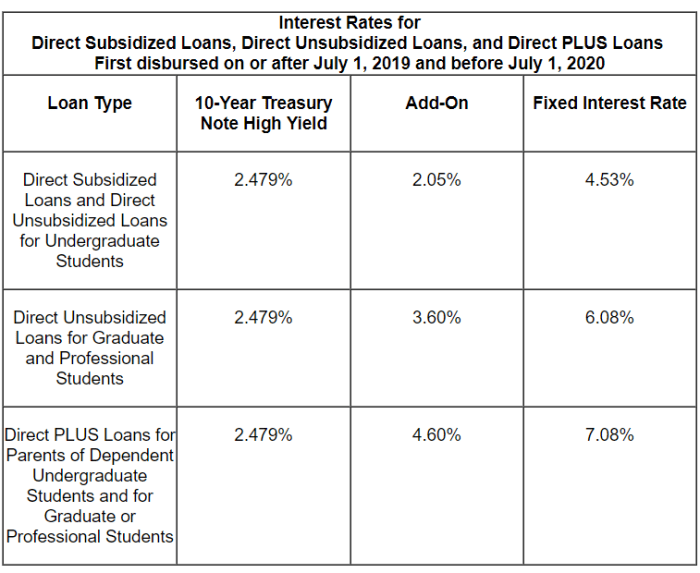

Graduate PLUS loan interest rates are variable and are determined by the U.S. Department of Education each year. These rates are typically higher than those for undergraduate federal student loans. In addition to the interest rate, borrowers will incur an origination fee, which is a percentage of the loan amount. This fee is deducted from the loan disbursement, meaning you receive less money than you borrow. For example, a $20,000 loan with a 4% origination fee would result in a disbursement of $19,200. It is important to carefully review the loan documents to understand the exact interest rate and fees applicable to your specific loan. The interest accrues from the moment the loan is disbursed, so budgeting for repayment is essential.

Comparison of Graduate PLUS Loans to Other Federal Student Loan Programs

Graduate PLUS loans differ significantly from other federal student loan programs, particularly subsidized and unsubsidized Stafford loans. Stafford loans, available to both undergraduate and graduate students, often have lower interest rates and may offer subsidized options where the government pays the interest while the student is enrolled at least half-time. Graduate PLUS loans, conversely, are unsubsidized, meaning interest accrues from disbursement. Furthermore, Graduate PLUS loans require a credit check, unlike Stafford loans, which generally do not. The higher interest rates and the requirement for a credit check make Graduate PLUS loans a less favorable option if other federal loan programs can sufficiently cover educational expenses. However, Graduate PLUS loans can fill the gap when other funding sources are insufficient.

Graduate PLUS Loan Repayment Plans

Several repayment plans are available for Graduate PLUS loans, allowing borrowers to tailor their repayment schedule to their financial circumstances. These include standard repayment plans (fixed monthly payments over 10 years), extended repayment plans (longer repayment periods, resulting in lower monthly payments but higher total interest), graduated repayment plans (payments increase over time), and income-driven repayment plans (payments based on income and family size). Choosing the right repayment plan depends on individual circumstances and financial projections. It’s crucial to explore the various options and their long-term implications before committing to a specific plan. Careful consideration should be given to the total interest paid over the life of the loan under each plan.

Managing Graduate Plus Loan Debt

Successfully navigating graduate school often involves significant financial planning, and a key component of this is effectively managing Graduate PLUS loan debt. Understanding repayment options, budgeting effectively, and employing strategies to minimize interest are crucial for long-term financial health. This section provides practical guidance to help you manage your Graduate PLUS loan debt responsibly.

Sample Graduate Student Budget Incorporating Graduate PLUS Loan Payments

Creating a realistic budget is paramount to successful loan repayment. This example demonstrates a potential monthly budget for a graduate student, including Graduate PLUS loan payments. Remember, this is a template; your specific budget will depend on your individual expenses, income, and loan amount.

| Income | Amount |

|---|---|

| Graduate Assistantship/Part-time Job | $2,500 |

| Expenses | Amount |

| Rent | $1,200 |

| Utilities | $200 |

| Groceries | $300 |

| Transportation | $150 |

| Student Loan Payment (Graduate PLUS) | $400 |

| Books/Supplies | $50 |

| Personal Expenses | $100 |

| Savings | $100 |

This budget shows a balance between essential expenses and loan repayment, with a small amount allocated to savings. Adjust the amounts based on your specific circumstances. Tracking your expenses diligently is crucial to ensure your budget remains accurate and effective.

Applying for Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. These plans can significantly lower your monthly payments, making them more manageable, especially during periods of lower income.

- Determine Eligibility: Check if you qualify for an IDR plan. Eligibility criteria vary depending on the plan.

- Choose a Plan: Research the different IDR plans (Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE)) to determine which best suits your needs. Consider factors like payment caps and loan forgiveness provisions.

- Gather Necessary Documents: You will need tax returns, pay stubs, and other documentation to verify your income and family size.

- Complete the Application: Submit the application through the student loan servicer’s website. This typically involves completing an online form and uploading required documents.

- Monitor Your Account: Regularly check your loan account to ensure your payments are correctly calculated and applied.

Strategies for Minimizing Interest Accrual on Graduate PLUS Loans

Minimizing interest is vital to reduce the overall cost of your loans. Strategies include:

- Make Extra Payments: Even small extra payments can significantly reduce the principal balance and shorten the repayment period.

- Refinance Your Loans: Consider refinancing your loans to a lower interest rate, but carefully compare offers and fees before refinancing.

- Pay More Than the Minimum: Consistently paying more than the minimum payment accelerates repayment and reduces total interest paid.

Resources for Borrowers Struggling with Graduate PLUS Loan Repayment

Numerous resources are available to assist borrowers facing challenges with repayment.

- Your Loan Servicer: Contact your loan servicer to discuss repayment options, including forbearance, deferment, and IDR plans.

- National Student Loan Data System (NSLDS): This website provides a central location to access your federal student loan information.

- Student Loan Counseling Services: Non-profit organizations offer free or low-cost counseling services to help you manage your student loan debt.

- Federal Student Aid Website: This website provides comprehensive information about federal student loans and repayment options.

The Impact of Graduate Plus Loans on Graduate Students

Graduate PLUS loans can significantly influence the financial trajectory and career choices of graduate students. The substantial debt incurred can create both opportunities and challenges, shaping their post-graduation experiences in profound ways. Understanding these impacts is crucial for informed decision-making during and after graduate studies.

Career Choice Limitations Due to High Student Loan Debt

The weight of significant student loan debt can subtly, yet powerfully, influence career choices after graduation. Graduates may prioritize higher-paying jobs, even if they are less fulfilling, to expedite loan repayment. For example, a student with substantial debt might choose a lucrative corporate position over a lower-paying but personally rewarding career in the non-profit sector. The pressure to repay loans quickly can also limit the exploration of entrepreneurial ventures or less financially secure career paths, which might offer greater long-term fulfillment. This can lead to a feeling of being trapped in a career path chosen primarily for financial reasons rather than personal aspirations. The potential for geographic limitations also exists, as graduates might be forced to accept positions closer to home to reduce living expenses and maximize loan repayment contributions.

Balancing Studies and Loan Repayment Responsibilities

Juggling academic responsibilities with the demands of loan repayment presents a formidable challenge for many graduate students. The financial strain can lead to increased stress and anxiety, potentially impacting academic performance and overall well-being. Many students find themselves working part-time or even full-time jobs alongside their studies, reducing the time available for research, coursework, and networking opportunities crucial for career success. This constant pressure can also negatively impact mental and physical health, further complicating their academic journey. For instance, a student working 20 hours a week while pursuing a demanding graduate program might experience sleep deprivation, impacting their ability to focus and succeed academically.

Financial Comparison: Graduate Students with and without Graduate PLUS Loans

Graduate students relying on Graduate PLUS loans often face a significantly different financial reality compared to their peers without such loans. Those without loans generally have greater financial flexibility, allowing them to focus more fully on their studies, pursue internships or research opportunities, and explore various career options without immediate financial constraints. In contrast, students with substantial PLUS loan debt frequently experience limited financial resources, leading to increased stress and potentially impacting their quality of life during graduate school. They might need to make difficult choices, such as forgoing extracurricular activities or relying on less desirable housing options, to manage their finances. This disparity can create significant inequality in the graduate student experience, affecting academic performance and future career prospects.

Successful Strategies for Graduate Plus Loan Debt Management

Several strategies have proven effective in helping graduate students manage their Graduate PLUS loan debt. Careful budgeting and financial planning are paramount. Creating a realistic budget that accounts for all expenses, including loan repayments, is crucial. Exploring income-driven repayment plans offered by the government can help manage monthly payments. Additionally, actively seeking out high-paying internships or part-time jobs relevant to their field of study can provide additional income to accelerate debt repayment. Some students have successfully negotiated lower interest rates with their lenders, reducing the overall cost of borrowing. Finally, proactive communication with lenders about financial difficulties can prevent default and explore potential solutions. A holistic approach combining careful planning, financial literacy, and strategic resource utilization is key to successfully navigating the challenges of Graduate PLUS loan debt.

Graduate Plus Loan Forgiveness and Consolidation

Navigating the complexities of Graduate PLUS loans often extends beyond understanding repayment options. A crucial aspect involves exploring avenues for loan forgiveness and the potential benefits of consolidation. This section will Artikel the various programs available for loan forgiveness, detail the consolidation process, and analyze the long-term financial implications of both strategies.

Loan Forgiveness Programs

Several federal programs offer partial or complete forgiveness of student loans, though eligibility requirements vary significantly. Understanding these programs is crucial for borrowers seeking to reduce their debt burden. It’s important to note that loan forgiveness programs are often targeted towards specific professions or employment settings. Meeting the requirements often necessitates maintaining employment in a qualifying field for a defined period.

| Program Name | Eligibility Requirements | Forgiveness Amount | Application Process |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Work full-time for a qualifying government or non-profit organization; make 120 qualifying monthly payments under an income-driven repayment plan. | Remaining balance of Direct Loans | Apply through the Federal Student Aid website; requires documentation of employment and loan payments. |

| Teacher Loan Forgiveness | Work full-time for at least five complete and consecutive academic years in a low-income school or educational service agency; meet specific teaching requirements. | Up to $17,500 of Direct Subsidized and Unsubsidized Stafford Loans | Apply through the Federal Student Aid website; requires documentation of employment and teaching service. |

| Income-Driven Repayment (IDR) Plans | Vary by plan (e.g., ICR, PAYE, REPAYE,IBR); generally require demonstrating financial need. | Remaining balance after a specified period (typically 20 or 25 years), depending on the plan. | Apply through your loan servicer; requires annual income verification. |

| State-Specific Loan Forgiveness Programs | Vary widely by state; often require working in specific professions or locations within the state. | Varies significantly depending on the program and state. | Application process varies by state and program; usually involves contacting the relevant state agency. |

Consolidating Graduate PLUS Loans

Consolidating Graduate PLUS loans involves combining multiple federal student loans into a single loan with a new repayment plan. This can simplify repayment by reducing the number of monthly payments and potentially lowering the monthly payment amount, depending on the chosen repayment plan. However, it’s crucial to carefully weigh the potential benefits against any drawbacks before proceeding.

Benefits and Drawbacks of Loan Consolidation

Consolidation offers several potential benefits, such as a simplified repayment process and a potentially lower monthly payment. However, it’s important to be aware of potential drawbacks. For instance, while the monthly payment may decrease, the overall repayment period might increase, leading to higher total interest paid over the life of the loan. Furthermore, consolidation may impact eligibility for certain loan forgiveness programs, particularly if the loans being consolidated are not Direct Loans. For example, consolidating Federal Family Education Loans (FFEL) into a Direct Consolidation Loan might prevent eligibility for PSLF.

Long-Term Financial Implications

The long-term financial implications of both loan forgiveness and consolidation are significant. Loan forgiveness can provide immediate relief but might have tax consequences depending on the program. For example, forgiven amounts under certain programs may be considered taxable income. Consolidation, while simplifying repayment, may extend the repayment period and ultimately increase the total interest paid. Careful consideration of the long-term costs and benefits is crucial before making a decision. For instance, someone might choose consolidation for simplicity despite paying slightly more interest over time, valuing the convenience and reduced administrative burden. Conversely, another borrower might prioritize minimizing total interest paid, even if it means managing multiple loan payments. The optimal strategy depends entirely on individual financial circumstances and priorities.

The Future of Graduate Plus Loans

The Graduate PLUS loan program, while offering crucial financial support for graduate students, faces a complex and uncertain future. The increasing burden of student loan debt, coupled with evolving economic conditions and political priorities, necessitates a critical examination of the program’s sustainability and its impact on both borrowers and the higher education system. This section explores potential reforms, challenges, and solutions related to the future of Graduate PLUS loans.

Potential Changes and Reforms to the Graduate PLUS Loan Program

Several potential changes could reshape the Graduate PLUS loan program. These include adjustments to interest rates, potentially tying them more closely to market fluctuations or implementing income-based repayment plans that are more generous. Another area of reform could involve stricter eligibility requirements, perhaps focusing on programs with demonstrably high post-graduation earning potential, or requiring a higher level of demonstrated financial need. Finally, increased transparency regarding loan terms and repayment options could empower borrowers to make more informed decisions. For instance, clearer explanations of the long-term financial implications of borrowing could encourage more responsible borrowing habits. The implementation of these reforms would require significant legislative action and careful consideration of their potential consequences.

Challenges Facing the Future of Graduate Student Financing

The future of graduate student financing faces several significant challenges. The rising cost of graduate education continues to outpace inflation, forcing students to borrow increasingly larger sums. This trend is exacerbated by a lack of sufficient grant aid and scholarships, leaving loans as the primary funding source for many. Furthermore, the changing job market, characterized by increasing competition and wage stagnation in some sectors, makes repaying these substantial loans a significant hurdle for many graduates. The long-term economic consequences of high levels of graduate student debt, including reduced consumer spending and hindered economic mobility, present a serious concern. The current system struggles to adequately address the needs of students pursuing advanced degrees in fields with lower average salaries, leading to disproportionate debt burdens for these individuals.

Predictions for the Long-Term Impact of Increasing Graduate Student Loan Debt

The continued increase in graduate student loan debt carries significant long-term implications. We may see a decrease in the number of students pursuing graduate education, particularly those from lower socioeconomic backgrounds who are less likely to have access to alternative funding sources. This could lead to a less diverse and less skilled workforce. Furthermore, the long-term economic impact could be substantial, potentially impacting homeownership rates, retirement savings, and overall economic growth. A scenario similar to the 2008 housing crisis, but driven by student loan debt, is a potential, albeit extreme, consequence. This scenario highlights the importance of proactive measures to address the growing problem.

Potential Solutions to Address the Growing Problem of Graduate Student Loan Debt

Addressing the escalating problem of graduate student loan debt requires a multi-pronged approach. Several potential solutions could mitigate the issue.

- Increased Funding for Grants and Scholarships: Expanding access to need-based and merit-based grants and scholarships can significantly reduce reliance on loans.

- Income-Driven Repayment Plans: More generous and flexible income-driven repayment plans could make loan repayment more manageable for borrowers with lower incomes.

- Loan Forgiveness Programs: Targeted loan forgiveness programs for borrowers in public service or specific high-need fields could incentivize individuals to pursue careers in these sectors.

- Increased Transparency and Financial Literacy Education: Improving financial literacy among students and providing clearer information about loan terms and repayment options can empower them to make more informed borrowing decisions.

- Regulatory Oversight of Graduate Programs: Greater oversight of graduate programs could help ensure that tuition costs are justified and aligned with post-graduation earning potential.

Illustrative Examples of Graduate Student Financial Situations

Understanding the realities of Graduate PLUS loan management requires looking at specific scenarios. This section presents two contrasting examples: one of successful debt management and another illustrating the challenges faced by some graduate students. These examples are not exhaustive but offer valuable insights into the diverse experiences of graduate students navigating their financial obligations.

Successful Graduate PLUS Loan Debt Management

Amelia, a recent graduate with a Master’s in Engineering, meticulously planned her finances throughout her graduate program. She secured a part-time job alongside her studies, carefully budgeting her income to cover living expenses and a significant portion of her tuition. She also actively researched and applied for scholarships and grants, reducing her overall reliance on loans. Amelia diligently tracked her loan details, understanding the interest rates and repayment options. Upon graduation, she immediately began making payments, opting for the income-driven repayment plan that aligned with her starting salary. This strategy allowed her to manage her monthly payments comfortably without sacrificing her quality of life. She consistently monitored her credit score and explored options for refinancing at lower interest rates after a year of consistent on-time payments. Amelia’s proactive approach, combined with careful financial planning, resulted in her successfully managing her Graduate PLUS loan debt without undue financial strain. Her disciplined approach serves as a model for other graduate students.

Struggling with Graduate PLUS Loan Debt

In contrast, David, a graduate student pursuing a PhD in History, faced significant financial challenges. He relied heavily on Graduate PLUS loans to cover tuition and living expenses, and lacked a substantial income source during his studies. His initial budget was overly optimistic, and unexpected expenses, such as medical bills, further strained his finances. David found himself struggling to keep up with his loan payments after graduation. He felt overwhelmed by the amount of debt and lacked the financial literacy to understand his repayment options effectively. He lacked a support network to advise him on available resources. David’s situation is unfortunately common for many graduate students, highlighting the need for increased financial literacy programs and accessible support systems for those facing significant debt burdens. He’s now actively seeking guidance from a non-profit credit counseling agency to create a manageable repayment plan and explore options for debt consolidation or forgiveness programs. His experience underscores the importance of comprehensive financial planning and readily available support for graduate students.

Last Point

Successfully managing Graduate PLUS loan debt requires proactive planning, a thorough understanding of available resources, and a commitment to responsible financial management. From careful budgeting and strategic repayment planning to exploring loan forgiveness options and seeking support when needed, a multi-faceted approach is key. By understanding the nuances of these loans and employing effective strategies, graduate students can mitigate the financial burden and focus on achieving their academic and career goals without undue stress. Remember, informed decisions today pave the way for a brighter financial tomorrow.

FAQ

What happens if I can’t make my Graduate PLUS loan payments?

Contact your loan servicer immediately. They can discuss options like deferment, forbearance, or income-driven repayment plans to help you manage your payments.

Can I consolidate my Graduate PLUS loan with other federal loans?

Yes, you can consolidate your Graduate PLUS loans with other federal student loans through the Direct Consolidation Loan program. This simplifies repayment but may not always lower your interest rate.

Are there any tax benefits associated with Graduate PLUS loans?

While you can’t deduct the interest paid on Graduate PLUS loans directly, you might qualify for other tax benefits related to education, depending on your circumstances. Consult a tax professional for personalized advice.

What is the difference between subsidized and unsubsidized Graduate PLUS loans?

Graduate PLUS loans are unsubsidized, meaning interest accrues from the time the loan is disbursed. There is no subsidized version for graduate students.