Navigating the complexities of graduate school often involves significant financial burdens. Graduate student loan deferment offers a potential lifeline for students facing unexpected financial hardship or career transitions. Understanding the eligibility criteria, application process, and long-term implications is crucial for making informed decisions about your financial future. This guide provides a comprehensive overview of graduate student loan deferment, empowering you to make the best choices for your unique circumstances.

From exploring various deferment programs and their eligibility requirements to understanding the impact on your credit score and exploring alternative repayment options, we aim to demystify the process and provide practical strategies for managing your student loan debt effectively. We’ll delve into the specifics of each deferment type, the necessary documentation, and the potential pitfalls to avoid during the application process. Ultimately, this guide serves as your roadmap to successfully navigating the challenges of graduate student loan repayment.

Eligibility Criteria for Graduate Student Loan Deferment

Securing a deferment on your graduate student loans can provide crucial financial relief during challenging times. Eligibility, however, depends on several factors and varies across different deferment programs. Understanding these criteria is vital to successfully applying for and obtaining a deferment.

General Eligibility Requirements for Deferment

Generally, to be eligible for a graduate student loan deferment, you must be enrolled at least half-time in a graduate degree program at an eligible institution. This typically means carrying a minimum course load as defined by your school. Furthermore, your loans must be eligible for deferment; not all loan types qualify. Finally, you will need to demonstrate that you meet the specific criteria of the deferment program you are applying for. This might involve submitting documentation to support your claim.

Income-Based Repayment Plans and Their Impact on Deferment

Income-driven repayment (IDR) plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), are designed to make your monthly payments more manageable based on your income and family size. While these plans don’t directly offer deferment, they can significantly reduce your monthly payments, potentially alleviating the need for a deferment. If your income is exceptionally low, an IDR plan might effectively provide a similar level of financial relief. However, it’s crucial to understand that IDR plans typically extend the loan repayment period, resulting in potentially higher overall interest payments.

Circumstances Qualifying for Deferment

Several specific circumstances can qualify you for a deferment. These often include unemployment, where you’ve lost your job through no fault of your own and are actively seeking employment. Economic hardship, demonstrated by a significant reduction in income or unexpected expenses, is another common qualifying factor. For example, a serious illness requiring extensive medical treatment or a major unexpected home repair could constitute economic hardship. In some cases, military service or participation in certain national service programs can also qualify you for a deferment. Documentation will be required to support your claim in each case.

Comparison of Deferment Program Eligibility Criteria

Different deferment programs may have slightly varying eligibility criteria. For instance, a deferment based on unemployment might require you to actively search for a job and provide evidence of your job search efforts. Conversely, a deferment based on economic hardship might necessitate documentation of your reduced income and significant unexpected expenses. It’s essential to carefully review the specific requirements of the program you are applying for. The application process and required documentation can also differ.

Summary of Eligibility Requirements for Various Deferment Options

| Deferment Type | General Requirements | Specific Requirements | Documentation Needed |

|---|---|---|---|

| Unemployment Deferment | Graduate student, at least half-time enrollment, eligible loans | Proof of unemployment, active job search | Unemployment verification, job application records |

| Economic Hardship Deferment | Graduate student, at least half-time enrollment, eligible loans | Significant reduction in income, unexpected expenses | Income statements, medical bills, repair estimates |

| Military Deferment | Graduate student, at least half-time enrollment, eligible loans | Active duty military service | Military orders, deployment documentation |

Application Process for Graduate Student Loan Deferment

Applying for a graduate student loan deferment involves several steps and requires careful attention to detail. Understanding the process and gathering the necessary documentation beforehand can significantly streamline the application and increase the chances of a successful outcome. This section provides a comprehensive guide to navigating the deferment application process.

Step-by-Step Application Guide

The application process typically begins with accessing the relevant online portal or contacting your loan servicer directly. Following a clear and organized process will ensure a smoother experience.

- Locate Your Loan Servicer: Identify the company responsible for servicing your graduate student loans. This information is usually available on your loan documents or through the National Student Loan Data System (NSLDS).

- Gather Required Documentation: Collect all necessary documents to support your deferment request. This typically includes proof of enrollment in a qualifying graduate program, documentation of hardship (if applicable), and potentially other supporting evidence as requested by your servicer.

- Complete the Application Form: Carefully complete the deferment application form provided by your loan servicer. Ensure all information is accurate and complete to avoid delays in processing.

- Submit Your Application: Submit your completed application form and supporting documentation through the designated method (online portal, mail, or fax). Retain copies of all submitted materials for your records.

- Monitor Your Application Status: After submitting your application, regularly check its status through your loan servicer’s online portal or by contacting them directly. This proactive approach helps identify and address any potential issues promptly.

Required Documentation

Providing complete and accurate documentation is crucial for a swift and successful deferment application. Failure to do so can lead to delays or rejection of the application.

- Proof of Enrollment: This typically involves an official transcript or enrollment verification from your graduate program.

- Documentation of Hardship (if applicable): If applying for a deferment due to hardship, provide supporting evidence such as medical bills, proof of unemployment, or other relevant documentation.

- Government-Issued Identification: A valid driver’s license or passport is usually required to verify your identity.

- Other Supporting Documents: Your loan servicer may request additional documents depending on your specific circumstances. Always check their requirements carefully.

Application Processing Timeline

The processing time for deferment applications can vary depending on several factors, including the loan servicer, the volume of applications, and the completeness of your submitted documentation.

Typical processing times range from a few weeks to several months.

For example, a straightforward application with complete documentation might be processed within 4-6 weeks, while a more complex application requiring additional verification could take up to 12 weeks or longer. It’s always best to apply well in advance of when you need the deferment to take effect.

Potential Application Challenges

Applicants may encounter various challenges during the application process. Understanding these potential obstacles can help mitigate them and ensure a smoother experience.

- Incomplete or Inaccurate Documentation: Submitting incomplete or inaccurate documentation is a common cause of application delays. Carefully review all materials before submission.

- Communication Issues: Difficulties in contacting your loan servicer or obtaining timely responses can be frustrating. Maintain clear and consistent communication with your servicer.

- Technical Difficulties: Technical issues with online portals or submission systems can disrupt the application process. Try alternative methods of contact or seek technical support if needed.

- Denial of Deferment: In some cases, applications may be denied if they do not meet the eligibility criteria. Understand the reasons for denial and explore available options.

Application Process Flowchart

A visual representation of the application process can be helpful. Imagine a flowchart beginning with “Locate Loan Servicer,” branching to “Gather Documentation,” then proceeding to “Complete Application,” followed by “Submit Application,” and finally “Monitor Application Status.” Each step would have a clear indication of the next step, creating a linear pathway illustrating the entire process. Any potential challenges, such as incomplete documentation, would be depicted as a branch leading to a “Resolve Issue” step before rejoining the main process flow. The flowchart would clearly show the sequential nature of the steps and highlight potential points of delay or complication.

Types of Graduate Student Loan Deferment Programs

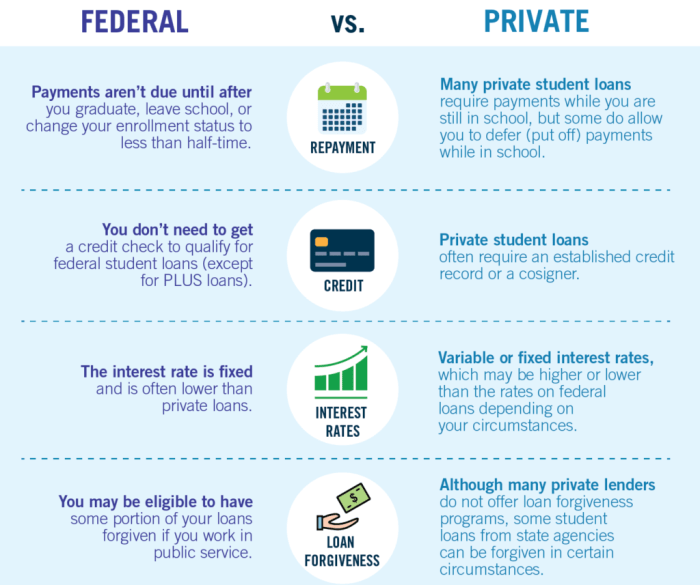

Understanding the different types of graduate student loan deferment programs is crucial for navigating the complexities of repayment. The availability and specifics of these programs can vary depending on your loan type (federal or private), lender, and individual circumstances. Choosing the right deferment option can significantly impact your short-term and long-term financial well-being.

In-School Deferment

In-school deferment is generally available to graduate students enrolled at least half-time in a degree or certificate program. This deferment postpones your loan payments while you’re actively pursuing your education. The benefit is obvious: it provides temporary relief from repayment obligations during a period of potentially limited income. The duration of this deferment is typically tied to your enrollment status; it ends when you graduate, withdraw, or drop below half-time enrollment. Limitations include the fact that interest may still accrue on unsubsidized loans during this period, increasing your overall loan balance.

Economic Hardship Deferment

This type of deferment is designed to provide relief to borrowers experiencing significant financial difficulties. Eligibility usually requires documentation proving a temporary inability to make loan payments due to unemployment, underemployment, or other financial setbacks. The benefit lies in the temporary pause on payments, allowing borrowers time to regain financial stability. However, the duration is typically limited, often to a specific period or until certain conditions are met. Furthermore, interest may continue to accrue, depending on the loan type. A borrower might need to demonstrate their financial hardship through documentation such as pay stubs, tax returns, or proof of unemployment benefits.

Deferment for Military Service

Borrowers serving in the military or performing national service may qualify for deferment. This program recognizes the sacrifices made by those serving their country and provides a crucial financial safety net. The benefit is a complete pause on loan payments during active service. The duration aligns with the length of service, offering significant long-term financial stability. Interest accrual depends on the loan type, similar to other deferment programs. Specific documentation from the military branch or national service organization will be required for eligibility.

Comparison of Key Features

The following table summarizes the key features of the discussed deferment programs. Understanding these differences is critical for selecting the most appropriate option for your situation.

| Feature | In-School Deferment | Economic Hardship Deferment | Military Service Deferment |

|---|---|---|---|

| Eligibility | Half-time enrollment in graduate program | Demonstrated economic hardship | Active military or national service |

| Duration | Length of enrollment | Limited period, specific conditions | Length of service |

| Interest Accrual | May accrue on unsubsidized loans | May accrue, depending on loan type | May accrue, depending on loan type |

| Required Documentation | Enrollment verification | Proof of financial hardship | Military/national service documentation |

Impact of Graduate Student Loan Deferment on Credit Score

Deferring your graduate student loans can have a significant impact on your credit score, although the effect isn’t always as severe as some might assume. Understanding how deferment affects your credit report and employing strategies to mitigate potential negative consequences is crucial for maintaining good financial health.

Deferment, unlike default, generally doesn’t immediately tank your credit score. However, it does leave a mark on your credit report, which can influence your creditworthiness. The key is understanding the nuances and how different types of deferment are reported. While your payments are paused, the lender will report the account as “deferred,” indicating that payments are temporarily suspended. This information, while not as damaging as a delinquency, can still negatively affect your credit score, especially if you have multiple accounts in deferment. The length of the deferment period also plays a role; longer periods tend to have a more pronounced negative impact.

Credit Score Impact of Deferment

The impact of a graduate student loan deferment on your credit score depends on several factors, including your existing credit history, the length of the deferment, and your overall credit utilization. Generally, deferment will lower your credit score, but the extent of the decrease is variable. A short deferment period on an otherwise healthy credit profile might result in a minor dip, while a longer deferment period coupled with other credit issues could lead to a more substantial decline. Credit scoring models consider the timely payment history as a significant factor. Since deferment indicates a temporary suspension of payments, it can negatively affect this aspect of your credit report. Lenders interpret this as a potential risk, leading to a lower credit score. The impact, however, is usually less severe than a delinquency or default.

Long-Term Implications of Deferment on Credit History

The long-term implications of deferment on your credit history primarily depend on how you manage your finances both during and after the deferment period. While a deferment period is reflected on your credit report, it doesn’t automatically lead to permanent damage. Once the deferment period ends and you resume making timely payments, your credit score will gradually recover. However, the longer the deferment period, the longer it will take to recover your credit score to its pre-deferment level. Consistent, timely payments after the deferment period demonstrates responsible financial behavior, signaling to lenders that you are a reliable borrower. This positive behavior helps mitigate the negative impact of the previous deferment.

Strategies to Mitigate Negative Impacts on Credit Score During Deferment

Several strategies can help minimize the negative impact of deferment on your credit score. Maintaining a healthy credit utilization ratio (keeping your credit card balances low relative to your credit limits) is vital. Continuing to pay other debts on time demonstrates responsible financial management. Regularly checking your credit report to ensure accuracy and identify any potential issues is also crucial. Open communication with your lender throughout the deferment process can help manage expectations and ensure a smooth transition back to repayment. Consider exploring options like income-driven repayment plans if you anticipate difficulties making payments after the deferment period ends.

Examples of Different Deferment Options and Their Impact on Credit Reporting

Different deferment programs might be reported slightly differently on your credit report. For instance, a deferment granted due to economic hardship might be viewed differently than a deferment for a specific period of graduate study. While both would show up as a deferment, the context surrounding the deferment might subtly influence the scoring models. However, the core principle remains: a deferment will negatively impact your score, but the extent of the impact will vary depending on your specific circumstances and the length of the deferment. The key is to proactively manage your finances and ensure timely payments once the deferment ends.

Credit Reporting Differences Between Deferment and Forbearance

While both deferment and forbearance involve temporary pauses in loan payments, they are reported differently on your credit report. Deferment usually involves a formal agreement with the lender, and the account status is clearly indicated as “deferred.” Forbearance, on the other hand, is often less formal and may not always be explicitly reported as such. The key difference lies in the underlying reason for the payment pause. Deferment typically has a specific, pre-approved reason, while forbearance is often granted due to more immediate financial hardship. Forbearance can sometimes be negatively viewed by lenders, as it might imply a greater level of financial instability compared to a planned deferment. Both can affect your credit score, but the impact of deferment is generally more predictable and less severe than the potential impact of forbearance, particularly if the forbearance is poorly managed.

Financial Implications of Graduate Student Loan Deferment

Deferring graduate student loan payments might seem like a helpful solution during challenging financial times, but it’s crucial to understand the long-term financial consequences. While it provides temporary relief from monthly payments, deferment doesn’t eliminate the debt; instead, it significantly impacts the overall cost of your loans. Understanding these implications is key to making informed decisions.

Interest Accrual During Deferment

During a deferment period, interest continues to accrue on your graduate student loans. This means that while you aren’t making payments on the principal balance, the amount you owe is steadily increasing. The rate at which interest accrues depends on your loan’s interest rate, and this accumulated interest is capitalized, meaning it’s added to your principal loan balance at the end of the deferment period. This results in a larger principal balance and ultimately higher total loan repayment amount. This is a critical factor to consider when evaluating the benefits of deferment.

Increased Total Loan Amount Due to Accumulated Interest

The accumulation of interest during a deferment period leads to a substantially higher total loan amount owed at the end of the deferment period. The longer the deferment, the greater the increase. This increase can significantly impact your long-term financial health, potentially delaying other financial goals like buying a home or investing. Careful consideration of the potential increase is necessary before opting for deferment.

Strategies for Managing Finances During a Deferment Period

While deferment provides temporary relief from payments, proactive financial management is crucial. Strategies include creating a detailed budget to track income and expenses, identifying areas where expenses can be reduced, and exploring alternative income sources to supplement existing funds. Building an emergency fund is also advisable to prepare for unexpected expenses that might arise during the deferment period. Furthermore, exploring options for income generation, such as part-time work or freelancing, can help mitigate the financial strain and reduce reliance on deferment.

Long-Term Cost Comparison: Deferment vs. Other Repayment Options

Comparing the long-term cost of deferment to other repayment options, such as income-driven repayment plans or refinancing, is vital. While deferment offers short-term relief, the accumulated interest often leads to a higher total cost over the life of the loan compared to other plans that may have lower monthly payments but potentially lower overall interest paid. Income-driven repayment plans, for instance, base payments on your income, potentially lowering monthly payments and overall cost in the long run, although repayment periods are extended. Refinancing might offer a lower interest rate, leading to lower monthly payments and overall loan cost. A thorough comparison of these options is crucial to making the best financial decision.

Hypothetical Example of Deferment’s Financial Impact

Let’s consider a hypothetical scenario: A graduate student has a $50,000 loan with a 7% interest rate. If they defer payments for two years, and the interest is capitalized at the end of that period, the accumulated interest would be approximately $7,700 (calculated using compound interest). This means their loan balance at the end of the deferment period would be $57,700, significantly increasing the total amount they need to repay. This example highlights the substantial impact of interest accrual during deferment and underscores the importance of considering the long-term financial implications before choosing this option.

Alternatives to Graduate Student Loan Deferment

Deferment, while offering temporary relief, isn’t always the best solution for managing graduate student loan debt. Exploring alternative repayment options can lead to more effective long-term financial strategies, potentially saving you money and improving your credit health. Understanding these alternatives is crucial for making informed decisions about your repayment journey.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans tie your monthly payments to your income and family size. This means your payments will be lower than under the standard repayment plan, potentially making them more manageable, especially during periods of lower income or higher expenses. Several IDR plans exist, each with its own formula for calculating monthly payments and forgiveness terms. These plans typically offer forgiveness of the remaining loan balance after a specified number of years, often 20 or 25, provided you consistently make payments. However, the forgiven amount is considered taxable income. Choosing the right IDR plan depends on individual circumstances and long-term financial goals.

Extended Repayment Plans

Extended repayment plans lengthen the repayment period, resulting in lower monthly payments. This can provide short-term relief by reducing the immediate financial burden. However, extending the repayment term increases the total interest paid over the life of the loan. This option might be suitable for those seeking immediate affordability but should be carefully weighed against the increased long-term cost.

Repayment Plan Comparison: Deferment vs. Income-Driven Repayment

Deferment and IDR plans offer different approaches to managing student loan debt. Deferment temporarily suspends payments, but interest usually continues to accrue, increasing the total loan amount. IDR plans, conversely, adjust payments based on income, offering potentially lower monthly payments but extending the repayment period and potentially leading to loan forgiveness after a set number of years. The choice depends on your immediate financial needs and long-term financial goals. If you anticipate a period of low income, IDR might be more beneficial. If you have a short-term financial hardship and can afford to pay the interest accrued during deferment, that might be a better option.

Switching Between Repayment Plans

Switching between repayment plans is generally a straightforward process. You can typically initiate the change online through your loan servicer’s website. However, it’s essential to carefully review the terms and conditions of each plan before switching, considering factors like monthly payment amounts, total interest paid, and potential loan forgiveness. Contacting your loan servicer directly to discuss your options and confirm the best course of action is highly recommended.

Repayment Plan Options: A Comparison

| Repayment Plan | Monthly Payment | Repayment Period | Interest Accrual |

|---|---|---|---|

| Standard Repayment | Fixed, typically higher | 10 years | Accrues during repayment |

| Extended Repayment | Lower than standard | Up to 25 years | Accrues during repayment |

| Income-Driven Repayment (e.g., ICR, PAYE, REPAYE) | Variable, based on income | 20-25 years, potential forgiveness | Accrues during repayment, but potentially forgiven |

| Deferment | $0 | Temporary, defined period | Usually accrues |

Resources and Support for Graduate Students

Navigating the complexities of graduate school, especially the financial aspects, can be challenging. Fortunately, numerous resources and support systems exist to help graduate students manage their student loan debt and overall financial well-being. Understanding these resources is crucial for successful financial planning during and after graduate studies.

Reputable Organizations Offering Financial Aid Advice

Several organizations provide valuable financial aid advice and guidance to graduate students. These organizations often offer free or low-cost services, including workshops, webinars, and one-on-one consultations. Accessing these resources can significantly improve a student’s understanding of their financial options and aid in making informed decisions.

- The National Association of Student Financial Aid Administrators (NASFAA): NASFAA offers resources and information for students, parents, and professionals involved in student financial aid. They provide a wealth of information on various financial aid programs and strategies.

- The Institute of Student Loan Advisors (ISLA): ISLA is a professional organization dedicated to assisting student loan borrowers. They offer resources and support for navigating the complexities of student loan repayment.

- The Sallie Mae Foundation: While Sallie Mae is a major student loan provider, their foundation provides educational resources and grants to support students in their financial journeys.

Government Agencies Handling Student Loans

Understanding which government agencies handle student loans is essential for effective communication and problem resolution. These agencies provide crucial services related to loan management, repayment plans, and hardship assistance.

- Federal Student Aid (FSA): FSA, a part of the U.S. Department of Education, is the primary source of information and services for federal student loans. Their website offers a comprehensive guide to managing federal student loans, including repayment options and deferment applications.

- The Department of Education: The Department of Education oversees federal student aid programs and can be contacted for general inquiries or if issues arise with the FSA website or services.

Types of Support Services Available to Struggling Borrowers

Many support services are available to graduate students struggling with student loan debt. These services can provide much-needed assistance in managing debt, exploring repayment options, and avoiding default.

- Income-Driven Repayment (IDR) Plans: IDR plans adjust monthly payments based on income and family size, making repayment more manageable for borrowers with limited financial resources. Several IDR plans exist, each with different eligibility requirements and payment calculations.

- Deferment and Forbearance: Deferment and forbearance temporarily postpone loan payments, providing relief during periods of financial hardship. However, interest may still accrue during deferment, except for certain subsidized loans.

- Loan Consolidation: Consolidating multiple loans into a single loan can simplify repayment and potentially lower monthly payments. This can be particularly beneficial for borrowers with multiple loans with varying interest rates.

- Loan Forgiveness Programs: Certain professions, such as teaching and public service, may qualify for loan forgiveness programs, potentially eliminating a portion or all of their student loan debt after meeting specific requirements.

Process of Seeking Financial Counseling

Seeking professional financial counseling can provide personalized guidance and support in managing student loan debt. These counselors can help develop a comprehensive financial plan tailored to individual circumstances.

Financial counseling can involve assessing current financial situations, developing a budget, exploring debt management strategies, and creating a long-term financial plan. Many non-profit organizations offer free or low-cost financial counseling services. Contacting a local credit union or community organization can help identify reputable financial counseling providers in your area.

Resources Available for Borrowers Facing Financial Hardship

For borrowers facing significant financial hardship, several resources offer assistance and support. These resources can help prevent loan default and maintain financial stability.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that provides free and low-cost financial counseling services, including assistance with student loan debt management.

- United Way: United Way offers a wide range of community services, including financial assistance programs and referrals to local resources that can help borrowers facing financial hardship.

- Local Non-Profit Organizations: Many local non-profit organizations offer financial assistance programs and support services to individuals in need. Searching for “financial assistance” or “debt counseling” in your local area can help identify relevant resources.

Final Wrap-Up

Successfully managing graduate student loan debt requires careful planning and a thorough understanding of available options. While deferment can provide temporary relief, it’s crucial to weigh the short-term benefits against the long-term financial implications, including accrued interest. By carefully considering your individual circumstances and exploring all available resources, including alternative repayment plans and financial counseling, you can develop a sustainable strategy for repayment that minimizes financial strain and allows you to focus on your academic and career goals. Remember to proactively manage your finances and seek assistance when needed – your financial well-being is an essential part of your overall success.

Question Bank

What happens to my interest during a deferment period?

Interest typically continues to accrue on your loan during a deferment period, increasing the total amount you owe.

Can I defer my loans multiple times?

The number of times you can defer your loans depends on the specific loan program and lender. There are usually limits.

What if my deferment application is denied?

If denied, review the reasons provided and consider appealing the decision or exploring alternative repayment options.

How does deferment affect my credit score?

While deferment itself doesn’t automatically damage your credit, late payments during deferment or failure to resume repayment afterward can negatively impact your score.

Are there any fees associated with applying for a deferment?

Generally, there are no fees for applying for a deferment, but always check with your lender.