Great Lakes Student Loan Services plays a significant role in the lives of millions of student loan borrowers across the United States. Understanding its history, the services it provides, and the various repayment options available is crucial for effective loan management and financial well-being. This comprehensive guide delves into the intricacies of Great Lakes, offering insights into its operations, customer support, and the resources it offers to borrowers striving for financial success.

From its origins to its current position as a major student loan servicer, Great Lakes has shaped the landscape of student loan repayment. This exploration will cover key aspects, including loan management strategies, online tools, customer service best practices, and the importance of financial literacy in navigating the complexities of student loan debt.

Company Overview

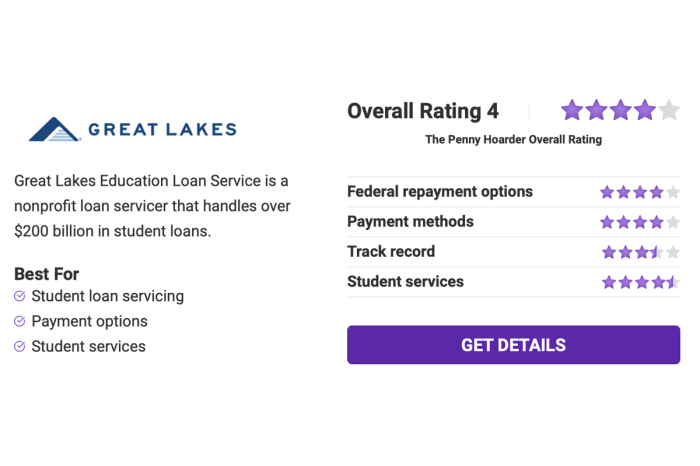

Great Lakes Higher Education Corporation & Student Loan Marketing Association (Great Lakes) is a significant player in the US student loan servicing industry. Its history spans several decades, marked by evolution and adaptation to the changing landscape of higher education financing. Understanding its operations provides valuable insight into the complexities of student loan management.

Great Lakes’ History and Evolution

Established in 1967, Great Lakes initially focused on assisting students in obtaining federal student loans. Over time, it expanded its services to encompass a broader range of federal and private student loans, becoming one of the largest student loan servicers in the nation. This growth reflects the increasing reliance on student loans to finance higher education and the evolving needs of borrowers. Key milestones in its history include strategic partnerships, technological advancements to improve customer service, and continuous adaptation to federal regulations governing student loan programs.

Services Offered by Great Lakes

Great Lakes offers a comprehensive suite of services for borrowers. These include loan repayment options such as standard repayment plans, income-driven repayment plans (IDR), and deferment or forbearance programs. They also provide account management tools, allowing borrowers to access their account information, make payments, and manage their loan details online. The types of loans they handle include Federal Family Education Loan (FFEL) Program loans, Federal Direct Loan Program loans, and in some cases, private student loans. Their services aim to assist borrowers in navigating the complexities of loan repayment and managing their student loan debt effectively.

Great Lakes’ Customer Base and Market Reach

Great Lakes services millions of student loan borrowers across the United States. Their customer base is diverse, encompassing students from various educational backgrounds and income levels. The company’s market reach extends nationwide, reflecting its role as a major player in the national student loan servicing landscape. The sheer volume of borrowers they serve highlights their significant impact on the student loan market.

Comparison with Other Major Student Loan Servicers

The student loan servicing industry includes several large players, each with its own strengths and focus. A direct comparison helps illustrate Great Lakes’ position within this competitive market.

| Name | Services Offered | Customer Base Size (Approximate) | Notable Features |

|---|---|---|---|

| Great Lakes | Federal & (some) Private Loan Servicing, Repayment Plan Options, Online Account Management | Millions | Long history, large scale operations |

| Navient | Federal & Private Loan Servicing, Repayment Counseling, Debt Consolidation | Millions | Extensive experience in private loan servicing |

| Nelnet | Federal & Private Loan Servicing, Repayment Assistance, Online Tools | Millions | Strong focus on technology and online services |

| AES/PHEAA | Federal Loan Servicing, Repayment Plans, Borrower Assistance | Millions | Long-standing history in federal student loan servicing |

Loan Management and Repayment Options

Managing your student loans effectively is crucial for your financial well-being. Great Lakes offers a variety of repayment plans and options designed to help you find a solution that fits your budget and circumstances. Understanding these options and how to navigate the application process can significantly impact your repayment journey.

Repayment Plan Options

Great Lakes offers several repayment plans to cater to diverse financial situations. These include Standard Repayment, Graduated Repayment, Extended Repayment, and Income-Driven Repayment (IDR) plans. The Standard Repayment plan involves fixed monthly payments over a 10-year period. Graduated Repayment starts with lower payments that gradually increase over time, also spanning 10 years. Extended Repayment offers lower monthly payments spread over a longer period, up to 25 years. IDR plans, discussed in more detail below, base your monthly payment on your income and family size. Choosing the right plan depends on your individual financial circumstances and long-term goals.

Applying for Income-Driven Repayment Plans

Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, link your monthly payment to your income and family size. To apply for an IDR plan, you’ll typically need to complete an application through the Federal Student Aid website (StudentAid.gov). This involves providing information about your income, family size, and loan details. The application process may require documentation to verify your income, such as tax returns or pay stubs. Once approved, your monthly payment will be recalculated based on your provided information. It is important to recertify your income annually to ensure your payment remains accurate and reflects your current financial situation.

Forbearance and Deferment Options

Forbearance and deferment offer temporary pauses or reductions in your loan payments during periods of financial hardship. Forbearance allows for a temporary suspension or reduction of your monthly payments, but interest may continue to accrue. Deferment suspends both your payments and interest accrual under specific circumstances, such as unemployment or enrollment in school. Eligibility requirements vary depending on the type of loan and the reason for requesting forbearance or deferment. Applying for forbearance or deferment typically involves submitting an application through Great Lakes, providing documentation to support your request.

Calculating Monthly Payments

Calculating monthly payments can be done using online loan calculators provided by Great Lakes or other reputable financial websites. These calculators typically require inputting your loan amount, interest rate, and loan term to determine your estimated monthly payment. For example, a $20,000 loan with a 5% interest rate and a 10-year repayment period would result in an approximate monthly payment of $212.47 (using a standard amortization formula). However, remember that these are estimates, and the actual amount may vary slightly based on the specific repayment plan and other factors.

The exact formula for calculating monthly payments is complex and involves several variables, but loan calculators simplify this process significantly.

Account Management and Online Tools

Managing your Great Lakes student loans is simplified through our secure online account portal. This portal provides convenient access to your loan information, allowing you to track payments, update personal details, and explore repayment options all in one place. It’s designed for ease of use and offers several features to help you stay organized and on top of your loan responsibilities.

The Great Lakes online account portal offers a centralized hub for all your student loan needs. Accessing your account is straightforward and secure, providing a comprehensive view of your loan details. The portal’s design prioritizes user-friendliness, ensuring a smooth and intuitive experience for managing your loans.

Accessing and Managing Loan Information Online

Accessing your account requires your Great Lakes account number and a password. Once logged in, your dashboard provides a summary of your loan balances, payment due dates, and repayment plan details. You can view your complete loan history, download statements, and update your contact information, ensuring your records are always accurate and up-to-date. Detailed information about each loan, including interest rates and accrued interest, is readily available. The system allows for easy navigation between different loan accounts if you have multiple loans.

Making Online Payments

The online portal simplifies the payment process. To make a payment, navigate to the “Make a Payment” section of your account. You’ll be prompted to enter the payment amount. You can then choose your preferred payment method, such as electronic bank transfer or debit/credit card. The system provides confirmation upon successful payment submission, and you can view your payment history anytime. The system also allows for scheduling future payments to ensure timely and consistent repayments. Remember to always allow sufficient processing time before your payment due date.

Visual Representation of Key Online Portal Features

Imagine a clean, intuitive dashboard. At the top, a welcome message displays your name and account number. Below, several clearly labeled sections are visible. The first section, “Loan Summary,” shows a concise overview of your total loan balance, payment due date, and current repayment plan. Next, the “Payment History” section presents a chronological list of past payments with dates and amounts. A “Contact Information” section allows you to easily update your address, phone number, and email address. Finally, large, easily clickable buttons provide quick access to making a payment, downloading statements, and updating personal information. The overall design is modern and uncluttered, ensuring easy navigation and a positive user experience.

Summary

Successfully managing student loan debt requires proactive engagement and a thorough understanding of the available resources. Great Lakes Student Loan Services, with its diverse range of services and support options, provides a pathway for borrowers to navigate their repayment journey effectively. By utilizing the online tools, understanding repayment plans, and leveraging the financial literacy resources offered, borrowers can confidently work towards achieving financial freedom. This guide serves as a starting point for a successful and informed approach to student loan repayment with Great Lakes.

FAQ Explained

What happens if I miss a student loan payment with Great Lakes?

Missing a payment can negatively impact your credit score and may lead to late fees. Contact Great Lakes immediately to explore options like forbearance or deferment to avoid further penalties.

How can I consolidate my federal student loans with Great Lakes?

Great Lakes doesn’t directly consolidate loans. Consolidation is handled through the federal government’s website, StudentAid.gov.

Does Great Lakes offer loan forgiveness programs?

Great Lakes doesn’t offer loan forgiveness programs. They service loans, but eligibility for forgiveness programs (like Public Service Loan Forgiveness) is determined by the federal government.

How do I update my contact information with Great Lakes?

You can usually update your contact information through your online account portal. Alternatively, you can contact their customer service department directly via phone or email.