The allure of “guaranteed approval” student loans is undeniable, promising financial access for higher education regardless of credit history. This seemingly straightforward solution, however, often masks complexities and potential pitfalls. Understanding the true meaning of “guaranteed approval,” the associated risks, and available alternatives is crucial for making informed decisions about financing your education.

This guide delves into the intricacies of guaranteed approval student loans, examining various loan types, application processes, and long-term financial implications. We’ll compare these loans to traditional options and explore alternative funding sources, empowering you to navigate the complexities of student loan financing with confidence and clarity.

Understanding “Guaranteed Approval Student Loans”

The term “guaranteed approval student loan” is often used in marketing materials to attract prospective borrowers. However, it’s crucial to understand the nuances of this phrase and the implications it holds for your financial future. While the promise of guaranteed approval sounds appealing, the reality is often more complex than advertised.

The meaning of “guaranteed approval” in the context of student loans is misleading. No legitimate lender can truly guarantee loan approval to everyone who applies. Instead, these loans typically have significantly relaxed qualification requirements compared to traditional student loans. This does not mean approval is automatic; rather, it suggests that the lender will likely approve a broader range of applicants, potentially including those with less-than-perfect credit histories or lower incomes.

Typical Requirements and Qualifications for Student Loan Applications

Traditional student loan applications usually involve a thorough review of the applicant’s credit history, income, debt-to-income ratio, and academic record. Lenders assess the applicant’s ability to repay the loan based on these factors. They may require a co-signer if the applicant’s creditworthiness is deemed insufficient. The application process can be rigorous and time-consuming. For example, a student applying for a Federal Stafford Loan will need to complete the FAFSA (Free Application for Federal Student Aid) and meet specific eligibility criteria. Private lenders will have their own application processes, but will also generally consider credit score, income, and debt levels.

Comparison of “Guaranteed Approval” Loans and Traditional Student Loans

“Guaranteed approval” loans often target students with less-than-ideal credit or financial situations. They typically come with higher interest rates and fees than traditional student loans. Traditional student loans, on the other hand, are generally offered at lower interest rates to applicants with good credit and strong financial profiles. The terms and conditions of traditional loans are often more favorable. For instance, a student with excellent credit might qualify for a lower interest rate and a longer repayment period on a traditional private loan than they would on a “guaranteed approval” loan.

Potential Risks and Drawbacks of “Guaranteed Approval” Loans

The seemingly attractive promise of guaranteed approval often masks significant risks. The higher interest rates and fees associated with these loans can lead to substantially larger total repayment amounts over the loan’s life. Borrowers may find themselves struggling to make payments, potentially leading to default and damaging their credit scores further. Additionally, these loans may have less favorable repayment terms, such as shorter repayment periods or limited options for deferment or forbearance. For example, a “guaranteed approval” loan might carry an interest rate of 15% or more, compared to a traditional loan with a rate of 7-10%. This difference can result in thousands of dollars in additional interest charges over the loan’s term.

Types of Loans Marketed as “Guaranteed Approval”

While the term “guaranteed approval” is often used in marketing to attract students, it’s crucial to understand that no loan truly guarantees approval. Lenders still assess applicants’ creditworthiness and financial situations. However, some loans are designed to be more accessible than others, leading to higher approval rates and the use of this marketing term. This section explores the types of student loans frequently advertised with this claim.

Several types of student loans are often marketed as offering “guaranteed approval.” These loans generally cater to borrowers with less-than-perfect credit or limited financial history. However, it’s important to remember that even with these loans, meeting certain minimum requirements is still necessary. The ease of approval usually comes with a trade-off: higher interest rates and potentially less favorable repayment terms.

Private Student Loans

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike federal student loans, these loans aren’t backed by the government, making them riskier for lenders. To compensate for this increased risk, private lenders often implement more stringent requirements and charge higher interest rates. While some private lenders might advertise “guaranteed approval” for certain loan products, this typically means a simplified application process or a lower bar for approval rather than an unconditional guarantee. Examples of lenders offering these types of loans include Sallie Mae, Discover, and Citizens Bank. Interest rates vary significantly based on creditworthiness, the loan amount, and the repayment terms selected. Repayment terms usually range from 5 to 20 years, with longer terms resulting in higher overall interest costs.

Alternative Student Loans

Alternative student loans are another category frequently marketed with “guaranteed approval” claims. These loans are typically aimed at students who may not qualify for federal loans or private loans due to credit history or income limitations. These loans often come with higher interest rates and fees compared to federal or even some private loans. Lenders offering these loans often specialize in working with borrowers who have less-than-perfect credit. Specific lenders and their offerings change over time, so it is crucial to research current options. Repayment terms and interest rates will depend on the lender and the borrower’s individual financial profile.

Income Share Agreements (ISAs)

Income Share Agreements are a less common but growing alternative to traditional student loans. With ISAs, students don’t borrow money upfront; instead, they agree to pay a percentage of their future income for a set period after graduation. While often marketed as having a higher chance of approval than traditional loans, this is due to the unique structure rather than a “guaranteed approval.” The percentage of income paid and the repayment duration vary depending on the program and the student’s projected earnings. The interest rates are not explicitly stated, but the overall cost is determined by the percentage of income paid. These agreements are typically offered by private organizations or educational institutions.

| Loan Type | Interest Rate | Fees | Repayment Options |

|---|---|---|---|

| Private Student Loan | Variable; typically higher than federal loans (e.g., 7-15%) | Origination fees, late payment fees | Fixed-term, graduated, income-based (some lenders) |

| Alternative Student Loan | Variable; often higher than private loans (e.g., 10-20% or more) | Higher origination fees, prepayment penalties (potentially) | Limited options, often fixed-term |

| Income Share Agreement (ISA) | N/A (percentage of income) | Administrative fees (potentially) | Percentage of income for a set period |

The Application Process

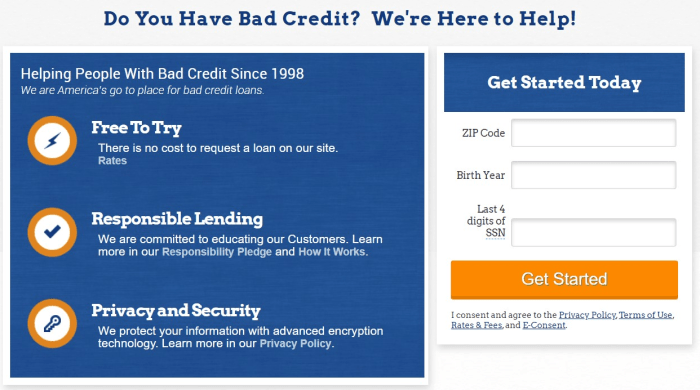

Applying for a loan marketed as having “guaranteed approval” often involves a streamlined process, but it’s crucial to understand that “guaranteed” doesn’t mean automatic. While the approval process might be less stringent than traditional loans, lenders still assess applicants’ creditworthiness and ability to repay. This section details the typical steps involved.

The application process for these loans typically involves providing personal and financial information to the lender, who then reviews the data to determine eligibility. While the term “guaranteed approval” is often used for marketing purposes, it’s essential to remember that lenders still perform a credit check and assess risk. The speed of the process is often a key selling point.

Necessary Documentation and Information

Applicants should be prepared to provide a comprehensive set of documents. This typically includes personal identification (such as a driver’s license or passport), proof of enrollment in a degree program, Social Security number, and banking information. Additionally, lenders may request proof of income, either from employment or other sources. Providing complete and accurate information is vital for a smooth application process. Inaccurate or incomplete information can lead to delays or rejection, even for loans marketed as “guaranteed approval.”

Step-by-Step Application Procedure

The application process generally follows these steps:

- Online Application Submission: Most lenders offer online applications, requiring applicants to fill out a form with personal and financial details.

- Document Upload: After completing the online form, applicants usually upload supporting documents like proof of enrollment, identification, and income verification.

- Credit Check: The lender will perform a credit check, though the criteria may be less stringent than for traditional loans. This may involve a soft credit pull, which doesn’t impact credit scores, or a hard pull, which can affect credit scores.

- Loan Offer: If approved, the lender will present a loan offer outlining the terms and conditions, including interest rates, repayment schedules, and fees.

- Acceptance and Disbursement: Once the applicant accepts the loan offer, the funds are typically disbursed directly to the educational institution or to the borrower, depending on the lender’s policy.

Common Pitfalls to Avoid

Understanding common mistakes can help applicants navigate the process effectively.

- Inaccurate Information: Providing false or misleading information can lead to immediate rejection or even legal consequences.

- Ignoring the Fine Print: Carefully review all loan terms and conditions before accepting the loan offer to avoid unexpected fees or interest rates.

- Failing to Compare Offers: Don’t settle for the first offer. Compare rates and terms from multiple lenders to secure the best possible deal, even with loans marketed as “guaranteed approval.”

- Overborrowing: Borrow only the amount you need to avoid unnecessary debt burden. Carefully consider your future repayment capacity.

- Ignoring Financial Aid Options: Explore other financial aid options, such as grants and scholarships, before relying solely on loans. These options can reduce the amount of debt you incur.

Financial Implications and Responsibilities

Securing a “guaranteed approval” student loan might seem appealing, but it’s crucial to understand the long-term financial ramifications before signing on the dotted line. These loans, while accessible, often come with higher interest rates and less favorable repayment terms than traditional student loans. Failing to grasp these implications can lead to significant financial strain in the years following graduation.

Understanding the true cost of a “guaranteed approval” student loan requires a thorough examination of several key factors. Ignoring these aspects can result in unexpected debt burdens and hinder your long-term financial well-being. Responsible borrowing necessitates a realistic assessment of your ability to repay the loan and the potential impact on your future finances.

Repayment Schedules and Interest Accrual

Repayment schedules typically begin after a grace period, often six months after graduation or leaving school. Understanding the length of the repayment period (e.g., 10 years, 20 years) is vital, as longer repayment periods mean more interest paid over the loan’s lifetime. Interest accrues daily on the outstanding loan balance, adding to the total amount you owe. For example, a $10,000 loan with a 10% annual interest rate will accumulate significant interest over a 10-year repayment period, potentially doubling or even tripling the total cost. The type of repayment plan chosen (standard, graduated, income-driven) also significantly impacts monthly payments and the total interest paid.

Strategies for Managing Student Loan Debt

Effective student loan debt management requires proactive planning and disciplined budgeting. Creating a realistic budget that accounts for loan repayments is crucial. Exploring options like refinancing (if interest rates fall) or income-driven repayment plans can help manage monthly payments. Careful budgeting and consistent repayments are essential to avoid delinquency and damage to your credit score. Additionally, prioritizing high-interest loans for repayment can save money in the long run.

Calculating Total Loan Costs

Calculating the total cost of a student loan involves more than just the principal amount borrowed. The total cost encompasses the principal, interest accrued over the repayment period, and any fees associated with the loan. A simple calculation can illustrate this: Let’s assume a $20,000 loan with a 7% annual interest rate and a 10-year repayment period. Using a loan amortization calculator (readily available online), you can determine the total interest paid over the life of the loan, which will significantly increase the overall cost. For instance, this loan could result in a total repayment exceeding $28,000, with approximately $8,000 being interest. This highlights the importance of considering the total cost, not just the initial loan amount.

Total Loan Cost = Principal + Total Interest + Fees

Alternative Funding Options

Securing funding for higher education extends beyond the realm of loans. Several alternative options exist, each with its own set of advantages and disadvantages. Understanding these alternatives allows students to make informed decisions about financing their education, potentially avoiding the high costs and potential risks associated with “guaranteed approval” loans. These options often provide more manageable repayment terms and may better align with a student’s financial circumstances.

Scholarships and Grants

Scholarships and grants represent non-repayable financial aid. They are awarded based on merit, need, or specific criteria set by the awarding institution or organization. Many scholarships are offered by colleges and universities themselves, while others are provided by private organizations, corporations, or community groups. Grants, similarly, are typically awarded based on financial need, determined through the Free Application for Federal Student Aid (FAFSA).

Work-Study Programs

Work-study programs provide part-time employment opportunities for students, allowing them to earn money to contribute towards their educational expenses. These programs often connect students with jobs on campus or within the surrounding community, providing valuable work experience alongside financial assistance. Eligibility is typically determined by financial need, as assessed through the FAFSA.

Part-Time Employment

Working part-time outside of a formal work-study program offers another avenue for funding education. Students can secure employment in various sectors, balancing work with their academic commitments. This approach provides income to cover tuition, living expenses, or other educational costs. However, managing work and studies requires careful time management and prioritization.

Savings and Family Contributions

Utilizing personal savings and contributions from family members can significantly reduce reliance on loans. Families may contribute directly towards tuition, living expenses, or other educational costs. Students can also supplement these contributions with their own savings accumulated through part-time work or other means. This method eliminates the debt burden associated with loans, though it may require significant pre-planning and financial resources.

Comparison of Funding Options

| Funding Option | Benefits | Drawbacks | Repayment |

|---|---|---|---|

| Guaranteed Approval Loan | Easy access to funds | High interest rates, potential for significant debt | Monthly payments after graduation |

| Scholarships/Grants | Non-repayable funds | Competitive application process, limited availability | None |

| Work-Study | Earned income, valuable work experience | Limited availability, may not cover all expenses | None (income earned directly) |

| Part-Time Employment | Flexibility, supplemental income | Time commitment, potential impact on academics | None (income earned directly) |

| Savings/Family Contributions | Avoids debt, reduces loan reliance | Requires significant pre-planning and financial resources | None |

Legal and Ethical Considerations

The marketing of “guaranteed approval” student loans raises several significant legal and ethical concerns. These concerns stem from the potential for misleading advertising, predatory lending practices, and the exploitation of vulnerable students facing the financial pressures of higher education. Understanding these issues is crucial for both borrowers and lenders to ensure fair and transparent lending practices.

The terms and conditions of any loan agreement are legally binding contracts. Borrowers must carefully review these documents before signing, paying close attention to interest rates, repayment schedules, fees, and any potential penalties for late or missed payments. Failure to understand these terms can lead to unforeseen financial burdens and legal complications.

Understanding Loan Agreement Terms

A thorough understanding of the loan agreement is paramount. This includes clarifying the annual percentage rate (APR), which reflects the total cost of borrowing, encompassing interest and fees. The repayment schedule should be clearly defined, specifying the monthly payment amount, the loan’s duration, and the total amount to be repaid. Any prepayment penalties or late payment fees must be explicitly stated and understood. Furthermore, the loan agreement should clearly Artikel the borrower’s rights and responsibilities, including the process for dispute resolution and the consequences of default. Ignoring or misunderstanding these crucial details can lead to significant financial hardship.

Consumer Protection Rights and Resources

Borrowers have legal rights protecting them from deceptive or predatory lending practices. The Consumer Financial Protection Bureau (CFPB) is a key resource, offering information and assistance to borrowers facing loan-related issues. State Attorney Generals’ offices also provide consumer protection services and can investigate complaints about unfair lending practices. Understanding these resources and knowing how to utilize them is vital for borrowers to protect their rights and address any concerns. For example, the CFPB’s website provides tools and resources to compare loan offers, understand your rights, and file complaints.

Deceptive Lending Practices

Deceptive lending practices in the student loan market can take various forms. One common example is the use of misleading advertising that implies guaranteed approval without disclosing the high interest rates or unfavorable terms often associated with such loans. Another deceptive practice involves concealing fees or adding hidden charges, making the true cost of the loan significantly higher than initially advertised. Predatory lenders may also target vulnerable students who may lack financial literacy or understanding of their rights, pressuring them into accepting loans with unfavorable terms. These practices violate consumer protection laws and can lead to serious financial consequences for borrowers. For instance, a lender might advertise a loan with a low introductory rate, failing to disclose that the rate will significantly increase after a short period, leaving the borrower with a much higher monthly payment than anticipated.

Illustrative Scenarios

Understanding the implications of “guaranteed approval” student loans requires examining real-world examples. The following scenarios illustrate both the potential benefits and the significant risks associated with these types of loans.

Scenario 1: Benefits and Drawbacks for a Hypothetical Student

Sarah, a bright and ambitious student, is accepted into her dream university but faces a significant funding gap. She finds a “guaranteed approval” student loan that promises quick funding without a rigorous credit check. The benefit is immediate access to the funds, allowing her to enroll promptly and avoid delaying her education. However, the loan carries a high interest rate (18%) and substantial origination fees. While Sarah secures the necessary funds, she now faces a much larger debt burden upon graduation than she initially anticipated. The high interest rate significantly increases the total cost of her education, potentially impacting her financial stability in the years following graduation. She also learns that the lender’s “guaranteed approval” only meant she qualified for the loan, not that it was necessarily the best financial decision. This scenario highlights the trade-off between immediate access to funds and the long-term financial consequences of a high-interest loan.

Scenario 2: Negative Consequences of Unclear Loan Terms

Mark secures a “guaranteed approval” student loan without carefully reviewing the terms and conditions. He focuses solely on the “guaranteed” aspect and the ease of application. He overlooks crucial details such as the repayment schedule, the potential for variable interest rates, and the existence of prepayment penalties. After graduation, Mark struggles to find employment in his field. Facing unemployment, he finds himself unable to meet his monthly loan payments. The lender begins collection efforts, impacting his credit score and creating significant financial stress. The variable interest rate, which he failed to fully understand, has also dramatically increased his debt. This scenario underscores the critical importance of thoroughly understanding all aspects of a loan agreement before signing, regardless of the lender’s marketing claims. His failure to read the fine print resulted in severe financial hardship.

Outcome Summary

Securing funding for higher education is a significant undertaking, and the promise of “guaranteed approval” student loans can be tempting. However, a thorough understanding of the terms, potential drawbacks, and available alternatives is paramount. By carefully weighing the pros and cons, exploring alternative funding options, and prioritizing responsible borrowing practices, students can make informed decisions that align with their financial well-being and long-term goals. Remember, a well-informed choice is the first step towards successful financial planning for your future.

FAQ Resource

What does “guaranteed approval” actually mean in the context of student loans?

It often means the lender will approve *someone* for a loan, not necessarily *you* at favorable terms. These loans typically have higher interest rates and fees to compensate for the higher risk the lender takes.

Are there any government-backed guaranteed approval student loans?

No. Government-backed loans, such as Federal Stafford Loans, have eligibility requirements but do not guarantee approval. “Guaranteed approval” is primarily a marketing tactic used by private lenders.

What happens if I can’t repay a guaranteed approval student loan?

Defaulting on a student loan can severely damage your credit score, leading to difficulty obtaining future loans, credit cards, and even renting an apartment. It can also result in wage garnishment or legal action.

How can I compare different guaranteed approval loan offers?

Carefully compare interest rates (APR), fees, repayment terms, and any penalties for early repayment or late payments. Don’t just focus on the approval itself; the overall cost is crucial.