Navigating the complexities of student loan repayment can be challenging, especially during unforeseen financial hardships. This guide provides a comprehensive overview of hardship withdrawals for student loans, exploring eligibility criteria, the application process, and the financial implications involved. We’ll delve into alternative solutions, legal protections, and long-term financial planning strategies to help you navigate these difficult circumstances effectively.

Understanding your options is crucial when facing financial distress. Whether you’re struggling with unemployment, medical expenses, or other unforeseen events, knowing your rights and available resources can significantly alleviate stress and pave the way for a more stable financial future. This guide aims to empower you with the knowledge needed to make informed decisions regarding your student loans.

Eligibility Criteria for Hardship Withdrawals

Securing a hardship withdrawal from your student loans requires meeting specific eligibility criteria. These criteria vary depending on the type of loan and the lender, but generally revolve around demonstrating a significant financial setback impacting your ability to make your loan payments. Understanding these requirements is crucial for a successful application.

Income Requirements for Hardship Withdrawals

Eligibility often hinges on demonstrating a substantial decrease in income. Lenders typically look for a significant drop below a certain threshold, often defined as a percentage reduction from your previous income or a fall below the poverty line for your household size. The exact percentage or income threshold varies widely based on the loan program and the lender’s internal policies. For example, some programs may require a 20% reduction in income, while others may use a more flexible assessment based on your individual circumstances. Supporting documentation, such as pay stubs, tax returns, and employment verification, is crucial to substantiate your claim.

Documentation Needed to Support a Hardship Withdrawal Claim

Providing comprehensive documentation is vital for a successful hardship withdrawal application. This typically includes proof of income reduction (such as recent pay stubs or tax returns), documentation of unexpected expenses (like medical bills or repair invoices), and potentially proof of job loss or unemployment (such as a termination letter or unemployment benefits statement). Depending on the specific hardship claimed, additional documents might be required. For instance, if claiming hardship due to a medical emergency, supporting documentation from a healthcare provider would be necessary. Failure to provide sufficient documentation can lead to the rejection of your application.

Comparison of Eligibility Criteria Across Different Student Loan Programs

Eligibility criteria for hardship withdrawals differ significantly across various student loan programs. Federal student loan programs, such as those managed by the Department of Education, generally offer more lenient hardship programs, including income-driven repayment plans and forbearance options. These programs often consider a broader range of hardships and offer more flexible documentation requirements. In contrast, private student loans typically have stricter criteria and may require more stringent proof of financial hardship. The specific requirements for each program should be carefully reviewed on the lender’s website or through direct contact with the lender. It’s important to understand the specific requirements of your loan type before applying.

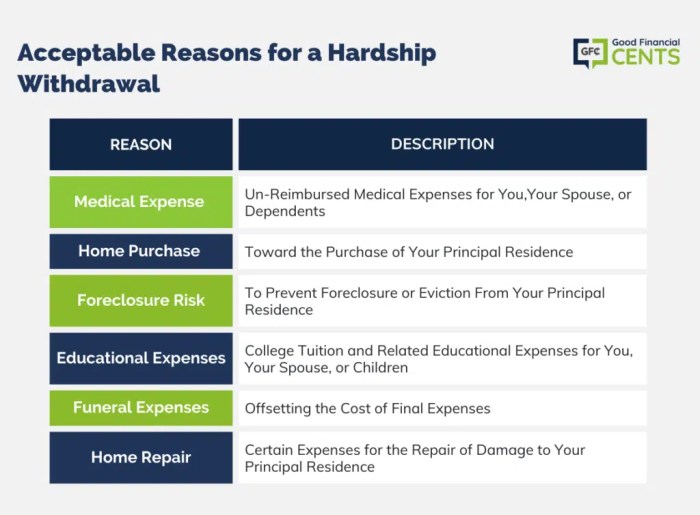

Examples of Acceptable Hardship Situations

Several situations qualify as acceptable hardships for student loan withdrawal. These include, but are not limited to, job loss or significant reduction in income, unexpected medical expenses requiring substantial financial outlay, death of a primary wage earner in the household, and natural disasters resulting in significant property damage or displacement. Each situation necessitates providing comprehensive supporting documentation to verify the hardship and its impact on your ability to manage student loan payments. The lender will assess the severity and duration of the hardship to determine eligibility. For instance, a temporary job loss may warrant a short-term forbearance, while a prolonged period of unemployment might justify a longer-term hardship plan or withdrawal.

The Application Process for Hardship Withdrawals

Applying for a hardship withdrawal from your student loans involves a straightforward process, but it’s crucial to gather all necessary documentation beforehand to ensure a smooth and timely application. This section details the steps involved, required forms, and the typical processing timeline.

Step-by-Step Application Procedure

The application process for a hardship withdrawal typically involves five key steps. First, you will need to carefully review the eligibility criteria to confirm you meet all the requirements. Second, you will need to download and complete the official hardship withdrawal application form. Third, you must gather and organize all supporting documentation as Artikeld in the next section. Fourth, submit your completed application and supporting documents to the designated office, either electronically or by mail, depending on the lender’s instructions. Finally, you will need to follow up on the status of your application after a reasonable period, as Artikeld below.

Required Forms and Documents

Submitting a complete application is vital for efficient processing. The required forms and documents typically include:

- Completed Hardship Withdrawal Application Form: This form will request detailed personal information, financial details, and an explanation of your hardship circumstances.

- Proof of Income: This could be pay stubs, tax returns, or bank statements demonstrating your current financial situation.

- Documentation of Hardship: This is a crucial component and will vary depending on the type of hardship claimed. Examples include medical bills for significant illness, proof of job loss, or legal documents related to a significant financial setback. Provide as much relevant documentation as possible to support your claim.

- Government-issued Identification: A copy of your driver’s license, passport, or other official identification is usually required.

It is strongly recommended to keep copies of all submitted documents for your records.

Typical Processing Time

The processing time for hardship withdrawal applications can vary depending on the lender and the complexity of the application. However, a reasonable expectation is to receive a decision within 4-6 weeks of submitting a complete application. In some cases, especially if additional information is required, the process may take longer. It is advisable to check with your lender for their specific processing times and to follow up if you haven’t received a response within the expected timeframe. For example, a lender might take longer to process an application involving complex medical documentation compared to a straightforward application for job loss.

Application Process Flowchart

The following describes a visual representation of the application process:

[Imagine a flowchart here. The flowchart would begin with “Start,” then proceed to “Review Eligibility Criteria,” followed by “Complete Application Form,” then “Gather Supporting Documents,” then “Submit Application,” then “Await Decision (4-6 weeks),” and finally “End.” Arrows would connect each step, indicating the flow of the process. There might be a loop back from “Await Decision” to “Submit Additional Documents” if further information is required.]

Financial Implications of Hardship Withdrawals

Taking a hardship withdrawal from your student loans can have significant financial consequences, impacting both your immediate finances and your long-term financial health. Understanding these implications is crucial before making such a decision. Careful consideration of the tax implications, potential impact on future loan eligibility, and a comparison to alternative solutions are essential steps in this process.

Tax Consequences of Hardship Withdrawals

Generally, hardship withdrawals from student loans are considered taxable income. This means the withdrawn amount will be added to your annual income and will be subject to federal and possibly state income taxes. The tax liability will depend on your overall income bracket for the tax year. For example, if you withdraw $5,000 and are in the 22% tax bracket, you could expect to owe approximately $1,100 in federal taxes. It’s important to consult a tax professional or refer to IRS Publication 970, Tax Benefits for Education, for precise guidance on your specific situation. Failing to account for these taxes can lead to unexpected financial burdens.

Impact on Future Loan Eligibility

The impact of a hardship withdrawal on future loan eligibility varies depending on the lender and the specific loan program. Some lenders may view a hardship withdrawal negatively, potentially affecting your ability to secure future loans or impacting the interest rates offered. For instance, a lender might perceive a hardship withdrawal as an indicator of poor financial management, leading them to assess your creditworthiness more cautiously. Always check with your lender to understand their specific policies regarding hardship withdrawals and their potential effects on future borrowing.

Hardship Withdrawal vs. Alternative Solutions

Before opting for a hardship withdrawal, it’s vital to explore alternative solutions. These might include deferment, forbearance, or income-driven repayment plans. Deferment temporarily postpones payments, while forbearance reduces or suspends payments. Income-driven repayment plans adjust your monthly payments based on your income and family size. A hardship withdrawal should be considered only after exhausting all other available options, as it results in immediate repayment of a portion of your loan, unlike deferment or forbearance which only delay payment. Weighing the long-term financial implications of each option is crucial for making an informed decision. For example, deferment or forbearance might lead to accumulating interest, increasing the total loan amount over time. Conversely, an income-driven repayment plan might result in lower monthly payments but extend the repayment period.

Fees Associated with Hardship Withdrawals

The fees associated with hardship withdrawals can vary significantly depending on the lender. Some lenders might charge a flat fee, while others might impose a percentage-based fee. Below is a sample comparison (Note: This data is illustrative and should not be considered definitive. Always check with your lender for the most up-to-date information).

| Lender | Fee Type | Fee Amount | Additional Notes |

|---|---|---|---|

| Lender A | Percentage of Withdrawal | 1% | Minimum fee of $25 |

| Lender B | Flat Fee | $50 | No additional charges |

| Lender C | Percentage of Withdrawal | 0.5% | No minimum fee |

| Lender D | Flat Fee | $75 | Applies only to withdrawals exceeding $1000 |

Alternative Solutions to Hardship Withdrawals

Before considering a hardship withdrawal from your student loans, which can have significant long-term financial implications, it’s crucial to explore alternative options that might provide more favorable outcomes. These alternatives can offer temporary relief without the potential penalties associated with a hardship withdrawal. Understanding your options and their respective benefits and drawbacks is key to making an informed decision.

Exploring alternative solutions allows borrowers to manage their student loan debt effectively while minimizing potential negative impacts on their credit score and future financial prospects. Careful consideration of each option’s eligibility requirements and application process is essential.

Deferment

Deferment temporarily postpones your student loan payments. During a deferment period, interest may or may not accrue depending on the type of loan and the reason for deferment. For example, federal student loans often allow for deferment in cases of unemployment or economic hardship. This provides borrowers with breathing room during challenging financial times.

Advantages of deferment include a temporary pause on payments, potentially preventing default. However, disadvantages include the possibility of accumulating interest, leading to a larger loan balance upon resuming payments. Eligibility for deferment varies depending on the loan type and lender, often requiring documentation of qualifying circumstances.

- Gather required documentation (proof of unemployment, financial hardship, etc.).

- Complete the deferment application through your loan servicer’s website or by mail.

- Submit the application and supporting documentation.

- Monitor your loan account for confirmation of the deferment approval.

Forbearance

Similar to deferment, forbearance temporarily suspends your student loan payments. However, unlike deferment, forbearance is generally granted at the discretion of the lender and interest typically accrues during the forbearance period, increasing the total loan amount owed. Forbearance is often used for short-term financial difficulties that are expected to resolve quickly.

Advantages of forbearance include providing short-term relief from payments. However, the main disadvantage is the accumulation of interest, which can significantly increase the overall loan cost. Eligibility criteria for forbearance are usually less stringent than for deferment, but the lender ultimately decides whether to grant it.

- Contact your loan servicer to request forbearance.

- Provide any requested documentation supporting your need for forbearance.

- Review and sign the forbearance agreement provided by your loan servicer.

- Monitor your loan account for updates regarding the forbearance period.

Income-Driven Repayment Plans

Income-driven repayment plans adjust your monthly payments based on your income and family size. These plans are designed to make student loan repayment more manageable for borrowers facing financial difficulties. Several types of income-driven repayment plans exist, each with its own eligibility criteria and payment calculation methods. These plans often lead to loan forgiveness after a specified period of time, but this forgiveness is taxed as income.

Advantages include lower monthly payments, potentially making repayment more manageable. Disadvantages include potentially longer repayment periods and the tax implications of eventual loan forgiveness. Eligibility typically involves demonstrating your income and family size to your loan servicer.

- Determine your eligibility for different income-driven repayment plans.

- Gather necessary income and family size documentation.

- Apply for the chosen income-driven repayment plan through your loan servicer.

- Regularly update your income and family size information as needed.

Legal Protections and Consumer Rights

Navigating student loan repayment can be challenging, especially during periods of financial hardship. Fortunately, borrowers are afforded significant legal protections and have recourse through consumer protection agencies. Understanding these rights is crucial for ensuring fair treatment and avoiding potential pitfalls.

Borrowers facing financial hardship possess several key legal rights. These rights often vary depending on the country and specific loan terms, but generally include the right to request a hardship withdrawal or forbearance, the right to be treated fairly and without discrimination by lenders, and the right to accurate and transparent information regarding their loan terms and repayment options. These rights are often enshrined in consumer protection laws and regulations.

The Role of Consumer Protection Agencies

Consumer protection agencies play a vital role in assisting borrowers facing difficulties with their student loans. These agencies offer a range of services, including providing information about borrower rights, mediating disputes between borrowers and lenders, and investigating complaints of unfair or deceptive lending practices. They act as a critical intermediary, ensuring that lenders adhere to the law and treat borrowers fairly. Examples of such agencies include the Consumer Financial Protection Bureau (CFPB) in the United States and similar bodies in other countries. These agencies provide valuable resources, such as online guides, fact sheets, and hotlines, to help borrowers understand their options and navigate the complexities of student loan repayment.

Legal Consequences for Lenders

Lenders who fail to adhere to established hardship withdrawal guidelines or otherwise violate consumer protection laws face potential legal consequences. These consequences can include fines, legal action from borrowers, and reputational damage. In some cases, lenders may be required to repay borrowers’ financial losses or provide other forms of compensation. The severity of the consequences often depends on the nature and extent of the violation, as well as the jurisdiction involved. For instance, a lender repeatedly denying legitimate hardship withdrawals could face significant penalties under relevant consumer protection statutes.

Examples of Successful Cases

While specific details of legal cases are often confidential, numerous examples exist where borrowers have successfully exercised their rights. These cases frequently involve borrowers who have successfully challenged lender denials of hardship withdrawals, secured loan modifications, or obtained compensation for unfair lending practices. These victories often stem from diligent documentation, effective communication with lenders and consumer protection agencies, and, in some instances, legal representation. One example might involve a borrower successfully arguing that a lender failed to adequately consider their documented financial hardship, leading to a court order granting a hardship deferment. Another could involve a group of borrowers collectively suing a lender for deceptive practices related to hardship withdrawal applications. These successes underscore the importance of understanding and exercising one’s legal rights.

Long-Term Financial Planning After a Hardship Withdrawal

A hardship withdrawal from your student loans can significantly impact your financial stability. However, with careful planning and proactive steps, you can rebuild your credit, manage your finances effectively, and prevent future hardship. This section Artikels strategies for long-term financial recovery following a hardship withdrawal.

Rebuilding Credit After a Hardship Withdrawal

A hardship withdrawal may negatively affect your credit score. It’s crucial to understand that this impact is temporary and can be mitigated through responsible financial behavior. Consistent on-time payments on all other debts are key. Consider using credit monitoring services to track your credit report and identify any errors. Building positive credit history after a hardship withdrawal takes time and dedication.

Budgeting and Effective Financial Management Post-Withdrawal

Creating a realistic budget is paramount after a hardship withdrawal. This involves tracking income and expenses meticulously to identify areas for potential savings. Prioritize essential expenses like housing, food, and transportation. Consider reducing discretionary spending to allocate more funds towards debt repayment. Utilizing budgeting apps or spreadsheets can streamline this process and offer valuable insights into spending habits.

Avoiding Future Financial Hardship Related to Student Loans

Preventing future financial hardship requires a multi-faceted approach. Regularly review your loan repayment plan and explore options for refinancing or income-driven repayment plans if your financial situation changes. Building an emergency fund is crucial to cover unexpected expenses and prevent future hardship withdrawals. Regularly communicating with your loan servicer and actively seeking assistance when needed can prevent small issues from escalating into major problems. Financial literacy education can provide valuable tools and knowledge for managing finances effectively.

Sample Budget Demonstrating Responsible Financial Management After a Hardship Withdrawal

This sample budget demonstrates a realistic approach to financial management following a hardship withdrawal. Remember, this is a template and needs adjustment based on individual circumstances.

| Income | Amount |

|---|---|

| Net Monthly Income | $3000 |

| Expenses | Amount |

| Housing | $1000 |

| Food | $500 |

| Transportation | $300 |

| Utilities | $200 |

| Student Loan Payment (Minimum) | $200 |

| Other Debt Payments | $300 |

| Savings (Emergency Fund) | $500 |

| Total Expenses | $3000 |

Note: This budget prioritizes essential expenses and debt repayment while building an emergency fund. The amount allocated to each category should be adjusted based on individual needs and financial circumstances. Consider exploring additional income streams to accelerate debt repayment and build savings.

Case Studies of Hardship Withdrawals

This section presents three diverse case studies illustrating the application and outcomes of hardship withdrawals for student loans. Each case highlights the unique circumstances faced by the borrower, the steps taken during the application process, and the final resolution. Analyzing these cases provides valuable insights into the factors contributing to successful or unsuccessful applications.

Case Study 1: Medical Emergency Leading to Job Loss

Sarah, a recent graduate with a significant student loan debt, experienced a sudden and severe medical emergency requiring extensive and costly treatment. This resulted in her losing her job due to prolonged absence and inability to work. Sarah applied for a hardship withdrawal, providing extensive documentation including medical bills, doctor’s notes, and proof of job loss. Her application was meticulously prepared, clearly demonstrating her inability to meet her loan repayment obligations. The lender reviewed her documentation and, recognizing the extenuating circumstances, approved her application for a temporary deferment of payments. This deferment allowed Sarah to focus on her recovery and job search without the immediate pressure of loan repayments. The key factor in Sarah’s success was the comprehensive documentation supporting her claim of hardship.

Case Study 2: Business Failure and Subsequent Unemployment

John, a small business owner, had used student loans to fund his startup. Unfortunately, his business failed after a period of economic downturn. This resulted in significant financial losses and subsequent unemployment. John applied for a hardship withdrawal, submitting financial statements showing the business’s failure, tax returns demonstrating losses, and proof of unemployment benefits. However, his application was initially denied. The lender cited insufficient documentation to prove his inability to meet his loan obligations. After appealing the decision and providing additional evidence, including letters of support from business associates, John’s application was eventually approved for a partial loan forgiveness program. This case highlights the importance of thorough documentation and persistence in pursuing a hardship withdrawal. The initial denial underscored the need for a comprehensive and well-supported application. The successful appeal demonstrates the potential for reconsideration with additional evidence.

Case Study 3: Unexpected Family Emergency and Financial Strain

Maria, a single mother, faced an unexpected family emergency requiring significant financial resources. Her elderly parent required expensive long-term care, placing an immense strain on Maria’s already limited budget. She applied for a hardship withdrawal, providing documentation of her parent’s medical condition, care costs, and her own financial statements showing the significant impact on her income. Despite the compelling circumstances, Maria’s application was denied. The lender determined that her financial situation, while challenging, did not meet the criteria for a hardship withdrawal. They advised her to explore alternative solutions, such as income-driven repayment plans. This case illustrates that even with significant hardship, an application may be denied if it does not meet the lender’s specific criteria. The lack of flexibility within the lender’s guidelines ultimately determined the outcome, highlighting the importance of understanding those guidelines before applying.

Last Word

Successfully navigating a hardship withdrawal for student loans requires careful planning and a thorough understanding of the process. By carefully considering eligibility criteria, exploring alternative solutions, and understanding the long-term financial implications, borrowers can mitigate the impact of financial hardship and work towards a more secure financial future. Remember to utilize available resources and seek professional advice when necessary to ensure the best possible outcome.

Question & Answer Hub

What happens to my credit score after a hardship withdrawal?

A hardship withdrawal will likely impact your credit score negatively, but the severity depends on factors like your repayment history before the withdrawal and how you manage your finances afterward.

Can I apply for a hardship withdrawal more than once?

The possibility of multiple hardship withdrawals depends on your lender and the specific circumstances. Each application will be assessed individually.

Are there any fees associated with applying for a hardship withdrawal?

Some lenders may charge fees for processing hardship withdrawal applications. Check with your lender for specifics.

What if my hardship withdrawal application is denied?

If denied, you should understand the reasons for denial and explore alternative options such as deferment or forbearance, or appeal the decision.