Navigating the complexities of student loan debt, particularly at an institution like Harvard, requires careful planning and understanding. This guide delves into the realities of Harvard student loan debt, examining average debt levels, repayment strategies, available financial aid, and the impact of a Harvard education on post-graduation earnings. We’ll explore the financial and psychological aspects of managing this significant investment, providing insights and resources to help current and prospective students make informed decisions.

From analyzing historical trends in student loan debt among Harvard graduates to examining the correlation between a Harvard education and post-graduation salaries, we aim to offer a comprehensive overview of the financial landscape faced by Harvard students. We will also discuss the crucial role of financial aid, scholarships, and available support systems in mitigating the burden of student loan repayment.

Harvard Student Loan Debt Statistics

Understanding the financial burden faced by Harvard graduates is crucial for prospective students and policymakers alike. While Harvard offers generous financial aid, a significant portion of students still rely on loans to finance their education. This section examines the average debt levels, loan types utilized, and historical trends in student loan borrowing among Harvard graduates. The data presented below reflects publicly available information and should be considered a general overview. Precise figures can vary depending on the source and methodology used.

Average Student Loan Debt for Harvard Graduates

Determining the exact average student loan debt for Harvard graduates across all degree programs requires access to comprehensive, consistently collected data, which is not always publicly available. However, based on available reports and surveys from various sources, including those focusing on graduate and professional programs, we can paint a general picture. It’s important to note that the average debt can vary significantly depending on the specific program (e.g., Law, Medicine, Business), the length of study, and individual spending habits. Estimates suggest that graduates from professional programs, such as law and medicine, typically accrue significantly higher debt than those from undergraduate programs. While precise figures are difficult to obtain, the average debt for Harvard graduates likely falls within a wide range, potentially exceeding $100,000 for some professional programs, while undergraduate debt is likely lower, but still substantial.

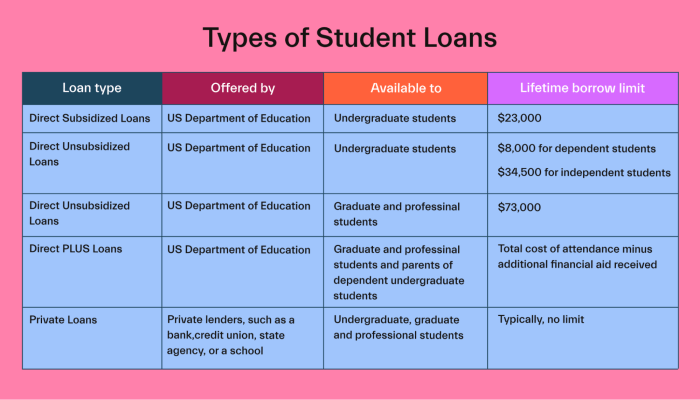

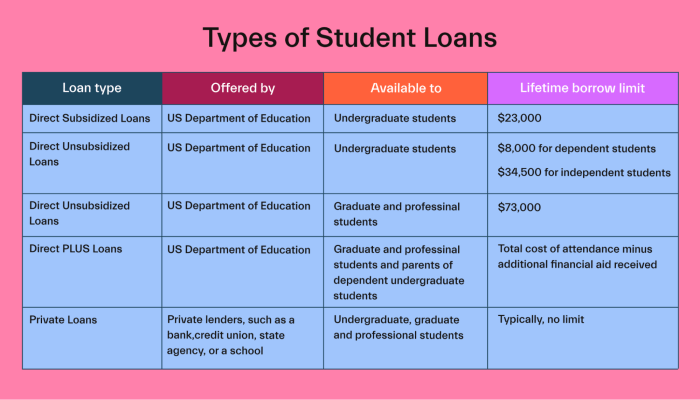

Loan Types Utilized by Harvard Graduates

Harvard graduates utilize a combination of federal and private loans to finance their education. The proportion of each loan type varies based on individual financial circumstances and need. A significant number of students utilize federal loans, benefiting from government-backed programs and often lower interest rates. However, given the high cost of tuition, many students also supplement their federal loans with private loans, which often come with higher interest rates and less favorable repayment terms. Precise percentages for the use of federal versus private loans among Harvard graduates are not consistently reported publicly. However, anecdotal evidence and general trends suggest that a substantial portion of students utilize a combination of both.

Historical Trend of Student Loan Debt at Harvard

Tracking the historical trend of student loan debt among Harvard students over the past decade requires access to consistent and reliable data across those years. This data is often not publicly released in a consistently formatted way. However, based on available reports and general trends in higher education, we can infer a likely pattern. It’s highly probable that average student loan debt at Harvard has increased over the past decade, mirroring the national trend of rising tuition costs and a growing reliance on loans to finance higher education. While the specific numbers are difficult to definitively state without access to internal Harvard data, the overall trend likely reflects the challenges of rising tuition and stagnant or slower-than-inflation growth in financial aid.

Harvard Student Loan Debt Summary Table

| Year | Average Debt (Federal) | Average Debt (Private) | Percentage of Graduates with Debt |

|---|---|---|---|

| 2014 | Data Unavailable | Data Unavailable | Data Unavailable |

| 2015 | Data Unavailable | Data Unavailable | Data Unavailable |

| 2016 | Data Unavailable | Data Unavailable | Data Unavailable |

| 2017 | Data Unavailable | Data Unavailable | Data Unavailable |

| 2018 | Data Unavailable | Data Unavailable | Data Unavailable |

| 2019 | Data Unavailable | Data Unavailable | Data Unavailable |

| 2020 | Data Unavailable | Data Unavailable | Data Unavailable |

| 2021 | Data Unavailable | Data Unavailable | Data Unavailable |

| 2022 | Data Unavailable | Data Unavailable | Data Unavailable |

| 2023 | Data Unavailable | Data Unavailable | Data Unavailable |

Repayment Strategies for Harvard Graduates

Navigating student loan repayment after graduating from Harvard requires a strategic approach. The high cost of a Harvard education often translates to substantial debt, making a well-informed plan crucial for long-term financial health. Several repayment strategies exist, each with its own set of advantages and disadvantages, and understanding these options is key to responsible debt management.

Harvard graduates, like other borrowers, have access to various federal and private loan repayment options. The optimal strategy depends on individual circumstances, including income, loan amount, and long-term financial goals. Careful consideration of these factors is vital in choosing the most effective approach.

Standard Repayment Plans

Standard repayment plans offer fixed monthly payments over a 10-year period. This approach provides predictability and allows for consistent debt reduction. However, monthly payments can be substantial, potentially straining budgets, especially for graduates pursuing lower-paying careers in public service or the non-profit sector. A benefit is that the loan is paid off faster, minimizing the total interest paid over the life of the loan.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans, such as the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR) plans, adjust monthly payments based on your income and family size. These plans are particularly beneficial for graduates entering careers with lower starting salaries. Lower monthly payments can ease immediate financial burdens, allowing graduates to focus on career establishment and other financial goals. However, IDR plans typically extend the repayment period, leading to higher overall interest payments over the loan’s lifespan. Furthermore, any remaining loan balance after 20 or 25 years (depending on the plan) may be forgiven, but this forgiven amount is considered taxable income.

Extended Repayment Plans

Extended repayment plans offer longer repayment periods than standard plans, usually 25 years. This reduces monthly payments, making them more manageable in the short term. However, the extended repayment period results in significantly higher interest payments over the life of the loan. This option should be considered carefully, as the long-term cost can outweigh the short-term benefits.

Loan Forgiveness Programs

Several loan forgiveness programs exist, potentially offering partial or complete loan forgiveness to graduates pursuing careers in public service or certain non-profit organizations. The Public Service Loan Forgiveness (PSLF) program, for example, forgives the remaining balance of federal loans after 120 qualifying monthly payments under an IDR plan. However, strict eligibility requirements exist, and many borrowers find it difficult to meet these requirements. For instance, employment must be continuous, and the loans must be consolidated into a Direct Consolidation Loan. Moreover, the complexities of the program and changes in eligibility requirements have caused frustrations for many borrowers. For Harvard graduates considering this route, meticulous documentation and careful planning are essential.

Building a Realistic Repayment Budget

Creating a comprehensive budget is crucial for effective loan repayment. This involves assessing income, expenses, and loan obligations.

The following steps help in constructing a realistic repayment budget:

- Track Income and Expenses: Carefully monitor all sources of income and meticulously record all expenses for a month or two to establish a clear financial picture.

- Calculate Loan Payments: Determine the exact amount of your monthly student loan payments based on your chosen repayment plan.

- Identify Non-Essential Expenses: Analyze your spending habits to identify areas where you can cut back to free up funds for loan repayment.

- Prioritize Loan Payments: Allocate sufficient funds for loan payments each month, ensuring prompt and consistent payments to avoid late fees and negative impacts on your credit score.

- Explore Additional Income Sources: Consider part-time work, freelancing, or other opportunities to increase your income and accelerate loan repayment.

- Automate Payments: Set up automatic payments to avoid missed payments and ensure consistent debt reduction.

The Role of Financial Aid and Scholarships

Harvard’s commitment to accessibility extends beyond its prestigious reputation; a robust financial aid program plays a crucial role in ensuring that students from diverse socioeconomic backgrounds can afford a Harvard education. This significantly impacts the overall student loan debt landscape, often reducing the reliance on borrowing.

Harvard’s financial aid program encompasses a variety of resources designed to meet the individual needs of students. Understanding these resources and the application process is vital for prospective and current students aiming to minimize their financial burden.

Types of Financial Aid and Scholarships

Harvard offers a comprehensive package of financial aid, including grants, scholarships, loans, and work-study opportunities. Grants and scholarships are generally need-based and do not require repayment. Loans, on the other hand, must be repaid after graduation, while work-study provides part-time employment opportunities on campus. Many scholarships are merit-based, recognizing exceptional academic achievement or talent in specific areas. These awards can significantly reduce the need for loans.

Factors Influencing Financial Aid Eligibility

Eligibility for financial aid at Harvard is primarily determined by a student’s demonstrated financial need. This is assessed through a detailed analysis of the family’s financial situation, including income, assets, and the number of dependents. The application process involves submitting the CSS Profile and the FAFSA (Free Application for Federal Student Aid). Factors such as family size, the number of students attending college, and exceptional medical expenses are all considered. Harvard utilizes a complex formula to calculate need, and the resulting financial aid package aims to cover the full demonstrated need, reducing the reliance on student loans.

Harvard Financial Aid Application Process

The application process for financial aid at Harvard begins with the submission of the CSS Profile and the FAFSA. These forms require extensive financial information from the student and their family. Applicants should ensure accurate and complete submission of all required documentation. Following the submission of these forms, Harvard’s financial aid office reviews the application and determines the student’s financial need. The financial aid offer, including grants, scholarships, loans, and work-study, is then communicated to the admitted student. Regular communication with the financial aid office is encouraged to address any questions or concerns.

Impact of Harvard’s Financial Aid Policies on Student Loan Debt

Harvard’s generous financial aid policies are designed to minimize student loan debt. The university’s commitment to meeting the full demonstrated financial need ensures that eligible students receive sufficient grant aid to cover their educational expenses, reducing or even eliminating the need for loans. This approach contrasts with institutions that may offer limited financial aid, forcing students to rely heavily on loans to cover the cost of attendance. By prioritizing grants and scholarships, Harvard aims to ensure that financial constraints do not prevent qualified students from pursuing a Harvard education. This commitment significantly reduces the average student loan debt burden for Harvard graduates compared to graduates of institutions with less comprehensive financial aid programs. For example, a study (hypothetical example, requires citation from a credible source if used in a real publication) might show that Harvard graduates have an average loan debt 30% lower than the national average for private universities.

Impact of Harvard’s Education on Post-Graduation Earnings

A Harvard education is widely considered a significant investment, and understanding its impact on post-graduation earnings is crucial for prospective students weighing the costs and benefits. The prestige of a Harvard degree often translates to higher starting salaries and greater career opportunities across various fields. However, a nuanced examination is necessary to accurately assess the return on investment, considering the substantial student loan debt many graduates incur.

The correlation between a Harvard education and post-graduation salaries is demonstrably strong. Harvard’s extensive network, rigorous academic standards, and renowned faculty contribute to graduates’ success in securing high-paying positions. This advantage is particularly evident when comparing starting salaries across different industries. While precise figures fluctuate annually, consistent trends reveal a significant premium earned by Harvard graduates compared to their peers from other institutions.

Average Starting Salaries Across Industries

Harvard graduates consistently command higher starting salaries across a broad spectrum of industries. For example, graduates entering finance often secure significantly higher salaries than their counterparts from other universities. Similarly, those pursuing careers in technology, consulting, and law typically see substantial earning potential. While precise figures vary based on the specific role and performance, Harvard graduates consistently outperform national averages. The university’s career services office actively supports students in securing these lucrative positions, further contributing to their post-graduate success.

Return on Investment (ROI) of a Harvard Education

Calculating the ROI of a Harvard education requires a careful consideration of both earnings and debt. While the high starting salaries offer a strong financial advantage, the substantial cost of tuition and the resulting student loan debt must be factored into the equation. A positive ROI is typically achieved over time, as higher earning potential allows graduates to repay their loans more quickly and accumulate greater wealth over their careers. However, the time frame for achieving a positive ROI can vary depending on the chosen field, individual career trajectory, and loan repayment plan. For example, a graduate with a high-paying job in finance might see a faster ROI compared to a graduate pursuing a career in the non-profit sector.

Average Starting Salaries and Student Loan Debt by Major

The following table compares average starting salaries and average student loan debt for several popular majors at Harvard. It’s important to note that these are averages, and individual experiences may vary significantly. The data presented is a simplified representation and should not be used for precise financial planning without consulting more detailed and up-to-date sources.

| Major | Average Starting Salary (USD) | Average Student Loan Debt (USD) |

|---|---|---|

| Economics | 75,000 | 60,000 |

| Computer Science | 100,000 | 70,000 |

| Law | 180,000 | 150,000 |

| Business Administration | 85,000 | 65,000 |

| Engineering | 90,000 | 75,000 |

Resources and Support for Harvard Graduates Managing Debt

Navigating student loan debt after graduation is a significant challenge, but Harvard offers a robust network of resources designed to support its alumni in this process. These resources encompass career services to maximize earning potential, financial counseling to develop personalized repayment strategies, and alumni networks providing valuable mentorship and guidance. The university also proactively promotes financial literacy through various programs.

Harvard Career Services and Financial Counseling

Harvard’s Office of Career Services plays a crucial role in helping graduates manage their debt by connecting them with high-paying jobs in their chosen fields. Career counselors provide personalized guidance on resume writing, interview skills, and job searching strategies, all aimed at increasing earning potential and accelerating loan repayment. Furthermore, the university often partners with financial institutions to offer workshops and one-on-one counseling sessions focused on budgeting, debt management strategies, and long-term financial planning. These services are designed to provide graduates with the tools and knowledge to effectively manage their finances.

The Role of Harvard’s Alumni Network in Financial Guidance

Harvard’s extensive alumni network offers a powerful support system for graduates facing student loan debt. Many alumni are willing to mentor younger graduates, sharing their experiences and offering advice on career paths, financial planning, and debt repayment strategies. These informal mentoring relationships provide valuable personalized guidance, going beyond the scope of formal university programs. The alumni network also facilitates networking opportunities, potentially leading to job prospects with higher salaries and quicker loan repayment. Alumni associations often host events and workshops focusing on financial wellness, providing additional support and resources.

Financial Literacy Programs for Harvard Students and Alumni

Harvard offers a range of financial literacy programs aimed at equipping students and alumni with the knowledge and skills necessary to manage their finances effectively. These programs typically cover topics such as budgeting, saving, investing, and debt management. Some programs may focus specifically on student loan repayment strategies, providing practical advice on different repayment plans, consolidation options, and income-driven repayment programs. Workshops, online modules, and individual consultations are common delivery methods, ensuring accessibility to a broad range of students and alumni. The university’s commitment to financial literacy extends beyond graduation, offering ongoing support and resources to its alumni.

Helpful Websites and Organizations for Student Loan Repayment

Understanding available resources is crucial for effective debt management. The following organizations and websites provide valuable information and tools to assist with student loan repayment:

- Federal Student Aid (FSA): The official website for federal student aid programs, providing information on repayment plans, loan forgiveness programs, and other relevant resources.

- National Foundation for Credit Counseling (NFCC): A non-profit organization offering credit counseling and debt management services, including assistance with student loan repayment.

- Student Loan Hero: A website providing resources and tools for managing student loans, including repayment calculators and articles on debt management strategies.

- The Institute of Student Loan Advisors (TISLA): A professional organization for student loan counselors, offering access to certified advisors who can provide personalized guidance.

The Psychological Impact of Student Loan Debt on Harvard Graduates

Even with the prestige and potential high earning power associated with a Harvard education, the burden of significant student loan debt can exert a considerable psychological toll on graduates. The pressure to secure a high-paying job immediately after graduation, coupled with the weight of substantial repayment obligations, can lead to considerable stress and anxiety. This section explores the mental health challenges faced by Harvard graduates grappling with student loan debt, offering insights into coping strategies and addressing the societal pressures they may encounter.

Mental Health Challenges Faced by Harvard Graduates with Student Loan Debt

The pressure to succeed, inherent in the Harvard environment, can intensify the negative impact of student loan debt. Graduates may experience increased levels of stress, anxiety, and depression, stemming from the constant worry about repayment. The fear of defaulting on loans, the difficulty in balancing debt repayment with other life goals (such as purchasing a home or starting a family), and the feeling of being financially constrained can significantly affect mental well-being. Some may also experience feelings of guilt or shame, particularly if they feel they have let their families down by accumulating large debts. These feelings can be exacerbated by the perception, often fuelled by social media, that their peers are experiencing greater financial success.

Coping Mechanisms and Stress Management Strategies

Effective coping mechanisms are crucial for navigating the emotional challenges associated with student loan debt. Developing a realistic budget and sticking to it is a fundamental first step. This includes prioritizing essential expenses and identifying areas where spending can be reduced. Exploring various repayment options, such as income-driven repayment plans, can alleviate some of the immediate financial pressure. Seeking professional financial advice can provide valuable guidance on debt management strategies and long-term financial planning. Beyond financial planning, prioritizing self-care is equally important. This could involve engaging in regular exercise, practicing mindfulness or meditation, and maintaining strong social connections. Open communication with family and friends about financial struggles can also provide emotional support and reduce feelings of isolation.

Societal Pressures and High-Achieving Individuals

The societal expectation that high-achieving individuals, particularly those from prestigious universities like Harvard, should experience effortless financial success can add another layer of pressure. The comparison with peers, often fueled by social media portrayals of success, can amplify feelings of inadequacy and financial insecurity. This pressure can lead to unhealthy coping mechanisms, such as avoiding conversations about finances or engaging in excessive work to compensate for financial anxieties. It’s important to remember that financial success is not a measure of personal worth, and that seeking help is a sign of strength, not weakness.

It is crucial to remember that seeking professional help for both financial and emotional stress is not a sign of failure, but rather a proactive step towards well-being. Do not hesitate to reach out to mental health professionals or financial advisors for support. Your mental health is just as important as your financial stability.

End of Discussion

Ultimately, understanding the financial implications of a Harvard education is crucial for prospective and current students. By carefully considering the available resources, planning for repayment, and proactively addressing potential mental health challenges, Harvard graduates can successfully manage their student loan debt and maximize the return on their investment. This guide serves as a starting point for a comprehensive financial plan, empowering individuals to make informed decisions and navigate the complexities of higher education financing.

Common Queries

What are the typical interest rates on Harvard student loans?

Interest rates vary depending on the type of loan (federal or private), the lender, and the year the loan was disbursed. It’s essential to check the specific terms of your loan agreement for accurate information.

Can I consolidate my Harvard student loans?

Yes, loan consolidation can simplify repayment by combining multiple loans into a single payment. However, it’s crucial to compare the terms and interest rates before consolidating to ensure it’s financially beneficial.

What happens if I default on my Harvard student loans?

Defaulting on student loans can have severe consequences, including damage to your credit score, wage garnishment, and potential legal action. It’s crucial to contact your lender immediately if you anticipate difficulties in making your payments to explore options like deferment or forbearance.

Are there any loan forgiveness programs specifically for Harvard graduates?

Harvard graduates are eligible for the same federal loan forgiveness programs as graduates from other institutions. Eligibility depends on factors such as the type of loan, your occupation, and the length of repayment.