Navigating the complex world of financing a health professions education can feel overwhelming. The high cost of tuition and the significant time investment required often leave aspiring doctors, nurses, and other healthcare professionals grappling with substantial student loan debt. Understanding the various loan types, repayment options, and the long-term impact on career choices is crucial for successfully managing this financial burden and achieving professional fulfillment.

This guide provides a detailed overview of health professions student loans, offering insights into different loan options, effective debt management strategies, and resources available to help navigate this challenging landscape. We’ll explore how loan debt can influence career paths, and discuss the importance of financial planning to mitigate potential long-term financial strain.

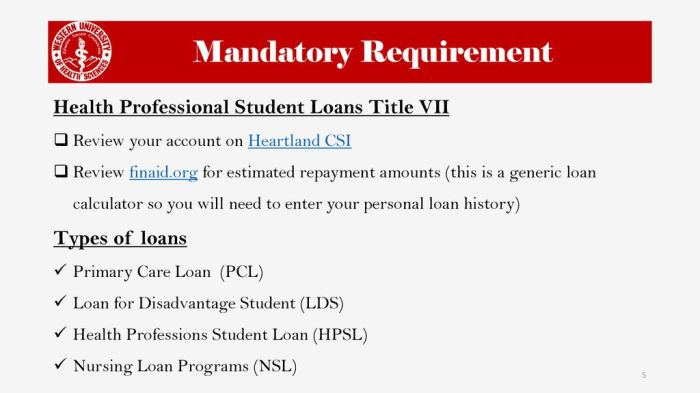

Types of Health Professions Student Loans

Securing funding for a health professions education can be a significant undertaking. Understanding the various loan options available is crucial for making informed financial decisions that will impact your future career. This section details the different types of student loans, highlighting their key features to help you navigate this process effectively.

Federal Health Professions Student Loans

Federal student loans are generally considered the most advantageous option for health professions students due to their borrower protections and often lower interest rates compared to private loans. These loans are offered through the federal government and are typically less risky than private loans. They come in two main varieties: subsidized and unsubsidized. Subsidized loans don’t accrue interest while you’re in school, during grace periods, or during deferment periods. Unsubsidized loans begin accruing interest immediately.

Private Health Professions Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. While they can fill funding gaps left by federal loans, they often come with higher interest rates and less flexible repayment options. Eligibility criteria are typically stricter, requiring a co-signer in many cases, especially for students with limited credit history. Before considering a private loan, it’s vital to compare rates and terms from multiple lenders to find the most favorable option. It is crucial to carefully review the terms and conditions of any private loan before signing.

Subsidized vs. Unsubsidized Federal Loans

The key difference between subsidized and unsubsidized federal loans lies in the interest accrual. Subsidized loans are need-based, meaning the government pays the interest while you’re enrolled at least half-time, during grace periods, and during deferment. Unsubsidized loans accrue interest from the moment the loan is disbursed, regardless of your enrollment status. Choosing between these loan types depends on your financial need and ability to manage accumulating interest.

Interest Rates, Repayment Terms, and Eligibility

Interest rates, repayment terms, and eligibility criteria vary depending on the loan type and lender. Federal loan interest rates are set annually by the government and are generally lower than private loan rates. Repayment terms for federal loans typically begin six months after graduation or leaving school (grace period), with various repayment plans available (standard, extended, income-driven). Eligibility for federal loans is determined by factors such as enrollment status, citizenship, and credit history (though credit history is less of a factor for federal loans than for private loans). Private loan interest rates, repayment terms, and eligibility criteria are determined by the lender and are subject to their specific policies and your individual creditworthiness.

| Loan Type | Interest Rate | Repayment Terms | Eligibility |

|---|---|---|---|

| Federal Subsidized Loan | Variable; set annually by the government (generally lower than private loans) | Typically begins 6 months after graduation; various repayment plans available | Enrollment status, citizenship, financial need |

| Federal Unsubsidized Loan | Variable; set annually by the government (generally lower than private loans) | Typically begins 6 months after graduation; various repayment plans available | Enrollment status, citizenship |

| Private Loan | Variable; set by the lender (generally higher than federal loans) | Varies by lender; may require immediate repayment or have shorter repayment terms | Creditworthiness, co-signer often required |

Managing Health Professions Student Loan Debt

Navigating the complexities of health professions student loan debt is a crucial aspect of your journey. The significant investment in your education requires a proactive and well-informed approach to repayment. Understanding various strategies and available resources will help you manage your debt effectively and minimize its long-term impact on your financial well-being. This section will explore practical strategies for managing your student loans, both during and after your program.

Effective management of health professions student loan debt hinges on meticulous budgeting and comprehensive financial planning. These are not simply suggestions; they are essential components of a successful financial strategy. Failing to plan effectively can lead to significant financial stress and potentially hinder your career progression. A proactive approach, however, can significantly alleviate these pressures.

Budgeting and Financial Planning for Health Professions Students

Creating a realistic budget is paramount. This involves tracking all income and expenses, identifying areas where spending can be reduced, and allocating funds for loan repayments. A detailed budget allows you to visualize your financial situation, prioritize essential expenses, and create a plan for consistently contributing to your loan repayment. For example, a student might track their income from part-time work, scholarships, and loans, alongside expenses such as rent, groceries, tuition, and transportation. This detailed view allows for informed decision-making regarding spending and repayment strategies. Furthermore, regular financial planning, involving consultations with financial advisors if needed, can help you create a long-term strategy for managing your debt and achieving your financial goals. This might include setting savings goals, investing wisely, and exploring different repayment options to optimize your financial situation.

Loan Repayment Options

Several loan repayment options exist to help manage your debt. Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. These plans, such as the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR) plans, offer lower monthly payments but often extend the repayment period, potentially leading to higher overall interest payments. Loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program, offer the possibility of having remaining loan balances forgiven after a certain number of qualifying payments. Eligibility criteria vary, so careful review of program requirements is essential. For instance, PSLF requires 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization. Understanding these options and their implications is vital in choosing the best strategy for your individual circumstances.

Minimizing Interest Accrual on Student Loans

Making consistent and timely payments is crucial for minimizing interest accrual. Even small extra payments can significantly reduce the total interest paid over the life of the loan. The following tips can help:

- Prioritize High-Interest Loans: Focus extra payments on loans with the highest interest rates to reduce the overall interest burden more quickly.

- Explore Refinancing Options: Refinancing can lower your interest rate, leading to lower monthly payments and less interest paid over time. However, carefully compare offers and understand the terms before refinancing.

- Make Bi-Weekly Payments: Making half your monthly payment every two weeks effectively makes an extra monthly payment each year, accelerating loan repayment.

- Automate Payments: Setting up automatic payments ensures consistent and timely payments, avoiding late fees and preventing negative impacts on your credit score.

- Consolidate Loans: Consolidating multiple loans into a single loan can simplify repayment and potentially lower your interest rate, depending on the terms offered.

The Impact of Student Loan Debt on Career Choices

The substantial financial burden of health professions student loans significantly influences the career paths chosen by graduates. The sheer magnitude of debt can create pressure to prioritize higher-paying specialties, potentially overshadowing personal passions and career fulfillment. This necessitates careful consideration of both financial stability and professional satisfaction.

Career Paths Offering Better Loan Repayment Opportunities

High-earning specialties naturally offer faster loan repayment. However, opportunities exist beyond simply choosing the highest-paying field. For example, some hospitals and healthcare systems offer loan repayment assistance programs for physicians and other healthcare professionals who commit to working in underserved areas or specific specialties facing shortages. Furthermore, negotiating higher salaries based on experience and market demand can also accelerate repayment. Strategic career planning, including exploring loan forgiveness programs and negotiating compensation packages, can greatly alleviate the financial pressure.

Lower-Paying but Fulfilling Careers Versus Higher-Paying but Less Desirable Careers

The decision between a lower-paying but personally fulfilling career and a higher-paying but less desirable one is deeply personal and heavily influenced by the weight of student loan debt. A fulfilling career in a field like social work or public health, for example, might offer less immediate financial reward, making loan repayment a significant challenge. Conversely, a lucrative but potentially less satisfying career in a specialized surgical field could provide faster repayment but potentially at the cost of work-life balance and overall job satisfaction. The key is a thorough cost-benefit analysis that weighs financial obligations against long-term career happiness and well-being. A realistic budget and a detailed repayment plan are crucial for making an informed decision.

Comparison of Healthcare Specialties and Average Salaries

The following table compares the average salaries of several healthcare specialties, illustrating the impact of student loan debt on overall financial well-being. These figures are approximate and can vary based on location, experience, and employer. It’s crucial to consult updated salary data from reliable sources like the Bureau of Labor Statistics for the most accurate information.

| Specialty | Average Annual Salary (USD) | Typical Loan Debt (USD) (Estimate) | Estimated Years to Repay (with average repayment plan) |

|---|---|---|---|

| Physician (Surgeon) | $250,000+ | $200,000+ | 5-10+ |

| Physician (Primary Care) | $200,000+ | $200,000+ | 6-12+ |

| Dentist | $150,000+ | $200,000 | 8-15+ |

| Registered Nurse | $75,000 – $100,000 | $50,000 – $100,000 | 5-10+ |

Resources and Support for Health Professions Students with Loan Debt

Navigating the complexities of student loan debt is a significant challenge for many health professions students. Fortunately, numerous resources and support systems exist to help alleviate the financial burden and provide guidance throughout the repayment process. Understanding these options is crucial for effective debt management and achieving long-term financial well-being.

The weight of student loan debt can significantly impact a health professional’s career trajectory and overall financial health. However, access to appropriate resources can dramatically improve the situation. This section Artikels key organizations, programs, and online tools designed to assist health professionals in managing their student loan debt effectively.

Government Agencies and Organizations Offering Assistance

Several government agencies and non-profit organizations provide valuable resources and support for health professionals facing student loan debt. These entities offer a range of services, from financial counseling to loan repayment assistance programs tailored to specific professions. Understanding the services provided by these organizations is the first step towards effective debt management.

- The U.S. Department of Education (ED): The ED administers federal student loan programs and provides resources on repayment options, including income-driven repayment plans, loan consolidation, and forbearance. They also offer information on loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF).

- National Health Service Corps (NHSC): The NHSC offers loan repayment assistance to health professionals who provide primary care services in underserved communities. Eligibility criteria include working in a designated Health Professional Shortage Area (HPSA) for a specific period. The amount of loan repayment assistance varies depending on factors such as the type of service provided and the location of the practice.

- American Medical Association (AMA): The AMA provides resources and tools to help physicians manage their student loan debt, including financial planning resources and information on various loan repayment programs. They often partner with financial institutions to offer tailored services to their members.

- American Dental Association (ADA): Similar to the AMA, the ADA offers resources and support specifically for dentists facing student loan debt. These resources may include financial planning workshops, access to financial advisors specializing in dental professionals’ finances, and information on debt management strategies.

Eligibility Criteria for Loan Repayment Assistance Programs

Eligibility for loan repayment assistance programs varies depending on the specific program and the sponsoring organization. Generally, programs require applicants to meet certain criteria related to their profession, employment location, and income level. Detailed information on specific eligibility requirements is available on the respective program websites.

For example, the NHSC’s loan repayment program requires applicants to be employed in a designated HPSA and provide primary care services for a specific number of years. Other programs may have income-based eligibility criteria, requiring applicants to demonstrate a need for financial assistance based on their income and debt levels. Some programs may prioritize applicants working in specific specialties or serving particular populations.

Online Resources for Managing Health Professions Student Loan Debt

The internet offers a wealth of information on managing student loan debt. Many reputable websites provide valuable tools and resources to help health professionals navigate the complexities of loan repayment.

- StudentAid.gov: The official website for the U.S. Department of Education’s Federal Student Aid programs. Provides information on loan repayment plans, loan forgiveness programs, and other resources.

- National Foundation for Credit Counseling (NFCC): Offers free and low-cost credit counseling services, including assistance with student loan debt management.

- Financial aid websites of professional organizations: Many professional organizations for health professions (e.g., AMA, ADA, etc.) offer dedicated sections on their websites focusing on financial planning and student loan debt management, often including links to relevant resources and programs.

The Future of Health Professions Student Loan Debt

The escalating cost of medical education coupled with limited loan forgiveness programs paints a concerning picture for the future of healthcare. The current trajectory suggests a continued rise in health professions student loan debt, presenting significant challenges for both individual professionals and the healthcare system as a whole. Understanding potential trends and policy changes is crucial for mitigating the long-term consequences.

The coming years will likely witness a continued increase in health professions student loan debt. Several factors contribute to this projection, including rising tuition costs at medical schools and other health professional programs, a lack of substantial increases in financial aid, and the increasing reliance on loans to finance education. Furthermore, the expanding demand for healthcare professionals in an aging population may not fully offset the financial burdens faced by those entering the field.

Projected Trends and Challenges

Several significant trends are expected to shape the landscape of health professions student loan debt. These include the continued inflation of tuition fees, potentially outpacing any increases in government-backed loan programs. Additionally, a widening gap between the income potential of certain healthcare professions and the sheer magnitude of their loan debt is anticipated. This disparity could lead to career choices influenced more by debt repayment than by passion or societal need, potentially creating workforce shortages in crucial areas. The increasing use of private loans, often with higher interest rates and less favorable repayment terms, also adds complexity and risk to the equation.

Potential Policy Changes and Reforms

Policy changes could significantly alter the future of health professions student loan debt. Increased federal funding for health professional education, including scholarships and grants, could alleviate the reliance on loans. Expansion of loan forgiveness programs, particularly for those working in underserved areas or public health roles, would offer substantial relief. Reforms focused on reducing tuition costs at medical schools and other health professional programs, such as increased government subsidies or incentives for cost-control measures, are also critical. Furthermore, more robust and transparent regulations on private student loans could better protect borrowers.

Long-Term Implications for the Healthcare Workforce

The rising burden of student loan debt poses significant long-term implications for the healthcare workforce. High levels of debt can delay or prevent professionals from entering crucial specialties, particularly those with lower salaries but high societal need. It can also lead to professionals choosing higher-paying positions over those that offer more fulfilling work or contribute to addressing health disparities. The overall effect could be a workforce less diverse, less geographically distributed, and potentially less equipped to address the nation’s most pressing healthcare challenges. Burnout and stress levels are also expected to rise as professionals struggle to balance their professional lives with significant debt repayments.

Illustrative Scenario: The Impact of Increasing Tuition and Stagnant Loan Forgiveness

Imagine Sarah, a bright and dedicated medical student entering school in 2030. Tuition costs have risen dramatically over the past decade, outpacing inflation and leaving Sarah with a loan burden exceeding $400,000 after completing her residency. Despite her desire to practice family medicine in a rural underserved community, the promise of loan forgiveness programs remains largely unfulfilled, with minimal changes made to the existing programs. Faced with this immense debt and limited financial relief, Sarah opts for a higher-paying specialty in a large metropolitan area, a decision driven primarily by financial necessity rather than her initial career aspirations. This scenario highlights the detrimental impact of increasing tuition and stagnant loan forgiveness programs on the future healthcare workforce, potentially leading to maldistribution of healthcare professionals and limiting access to care for vulnerable populations.

End of Discussion

Successfully managing health professions student loan debt requires proactive planning, informed decision-making, and a thorough understanding of available resources. By carefully considering the various loan types, employing effective debt management strategies, and seeking support when needed, aspiring and current health professionals can mitigate the financial burden of their education and pursue fulfilling careers in healthcare. Remember, informed choices today can pave the way for a more secure and prosperous future.

Q&A

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my health professions student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it’s crucial to compare offers carefully and understand the terms before refinancing.

What is loan forgiveness for healthcare professionals?

Several programs offer loan forgiveness or repayment assistance to healthcare professionals who work in underserved areas or specific roles. Eligibility requirements vary depending on the program.

What if I can’t make my loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.