The pursuit of higher education is often intertwined with the significant financial commitment of student loans. This guide delves into the complexities of higher education student loans, exploring the rising costs of tuition, diverse repayment options, and the long-term impact on graduates’ financial well-being. We’ll examine government policies, alternative funding sources, and even the psychological effects of student loan debt, offering a holistic understanding of this critical aspect of the educational landscape.

From understanding the factors driving escalating tuition fees to navigating the intricacies of repayment plans and exploring alternative funding strategies, this guide aims to equip students and graduates with the knowledge and resources needed to make informed decisions about financing their education and managing their debt effectively. We’ll consider both the practical and emotional implications, providing a balanced perspective on this increasingly crucial topic.

The Rising Cost of Higher Education

The escalating cost of higher education in the United States is a significant concern, impacting students, families, and the national economy. This increase is driven by a complex interplay of factors, leading to substantial increases in student loan debt and impacting accessibility to higher education for many.

Factors Contributing to Increasing Tuition Costs

Several interconnected factors contribute to the rising cost of tuition and fees. Decreased state funding for public institutions has forced them to raise tuition to compensate for budget shortfalls. Administrative expenses, including salaries for non-teaching staff and technology investments, have also grown significantly. Demand for specialized facilities and equipment, particularly in fields like science and engineering, requires substantial investment. Furthermore, the increasing emphasis on smaller class sizes and more individualized instruction contributes to higher per-student costs. Finally, the rising cost of healthcare and employee benefits further adds to institutional expenses.

Historical Trends in Student Loan Debt Accumulation

Student loan debt has dramatically increased over the past few decades. In the 1980s, student loan debt was relatively manageable. However, starting in the 1990s, the cost of tuition began to outpace inflation, and the availability of student loans increased, leading to a steady rise in debt levels. The Great Recession of 2008 exacerbated this trend, as job prospects for graduates declined, making it more difficult to repay loans. This resulted in a significant surge in student loan debt, reaching trillions of dollars in recent years. The consequences of this debt burden have been far-reaching, affecting individuals’ financial stability, delaying major life decisions like homeownership and starting families, and impacting the overall economy.

Tuition Cost Comparison Across Institutions

Tuition costs vary significantly depending on the type of institution and its location. Private universities generally have significantly higher tuition costs than public universities. Public universities, in turn, typically charge more than community colleges. Within each category, geographical location plays a crucial role; institutions in high-cost areas of living tend to have higher tuition fees. For example, a private university in a major metropolitan area will typically have a much higher tuition cost than a public community college in a rural area. This disparity in costs creates significant inequities in access to higher education, favoring students from higher socioeconomic backgrounds.

Average Tuition Costs and Student Loan Debt by Degree Program

The following table presents estimated average tuition costs and average student loan debt for various degree programs. These figures are averages and can vary considerably depending on the institution, program length, and individual student circumstances. It’s important to remember that these are estimates and may not reflect the exact costs at every institution.

| Degree Program | Average Annual Tuition (Public) | Average Annual Tuition (Private) | Average Student Loan Debt (Upon Graduation) |

|---|---|---|---|

| Associate’s Degree | $3,500 | $10,000 | $10,000 |

| Bachelor’s Degree | $10,000 | $35,000 | $30,000 |

| Master’s Degree | $15,000 | $45,000 | $50,000 |

| Professional Degree (e.g., Law, Medicine) | N/A | $60,000+ | $100,000+ |

Student Loan Repayment Options

Navigating the complexities of student loan repayment can feel daunting, but understanding the available options is crucial for long-term financial well-being. Choosing the right repayment plan significantly impacts your monthly payments, the total interest paid, and your overall financial health. This section will explore various repayment plans and their potential long-term implications.

Standard Repayment Plan

The standard repayment plan is the most common option. It involves fixed monthly payments over a 10-year period. This plan offers predictability, as your payment amount remains consistent throughout the repayment term. However, the fixed monthly payments can be substantial, especially for borrowers with large loan balances. For example, a borrower with a $50,000 loan at a 6% interest rate would face monthly payments of approximately $590, totaling over $70,000 in payments over the life of the loan. The advantage is a shorter repayment period, minimizing the total interest paid compared to some income-driven plans. However, it may lead to financial strain for borrowers with limited income immediately after graduation.

Graduated Repayment Plan

Unlike the standard plan, the graduated repayment plan features lower monthly payments initially, which gradually increase over time. This can be appealing to recent graduates who anticipate higher earning potential in the future. While the initial payments are more manageable, the total interest paid often exceeds that of the standard plan because of the longer repayment period. For instance, the same $50,000 loan at 6% interest might start with lower monthly payments but ultimately cost significantly more over a longer repayment period (potentially 10-20 years), resulting in a higher total interest burden.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans link your monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans generally result in lower monthly payments, but repayment periods are often extended to 20 or 25 years. The long repayment period means you’ll pay significantly more in interest over the life of the loan. For example, a borrower with a low income after graduation might only pay a small percentage of their income monthly, but this could lead to a much higher total interest payment compared to the standard plan. However, the lower monthly payments can provide crucial financial breathing room during early career stages.

Loan Consolidation and Refinancing

Borrowers often consider consolidating or refinancing their student loans to simplify repayment. Consolidation combines multiple loans into a single loan, potentially resulting in a simpler repayment process. Refinancing involves replacing existing loans with a new loan, often at a lower interest rate. Both can offer advantages. Consolidation can streamline payments, while refinancing can lower your monthly payments and reduce the total interest paid. However, refinancing might lose benefits associated with federal loans, such as income-driven repayment options or forgiveness programs. Carefully weigh the pros and cons before making a decision. A crucial consideration is the impact on potential loan forgiveness programs. Consolidation or refinancing might eliminate eligibility for certain programs.

Choosing a Repayment Plan: A Flowchart

[Imagine a flowchart here. The flowchart would begin with a box labeled “Assess Your Financial Situation (Income, Expenses, Debt)”. This would branch to two boxes: “High Income/Low Debt” and “Low Income/High Debt”. The “High Income/Low Debt” box would lead to “Standard or Graduated Repayment Plan”. The “Low Income/High Debt” box would lead to “Income-Driven Repayment Plan (IBR, PAYE, REPAYE)”. Each of these would then lead to a box labeled “Apply Online/Through Servicer”. Finally, all paths converge at a box labeled “Monitor Payments and Adjust as Needed”. Each box would have connecting arrows indicating the flow.]

The Impact of Student Loan Debt on Graduates

The substantial rise in higher education costs has left many graduates burdened with significant student loan debt, profoundly impacting their career choices, financial decisions, and overall well-being. This debt casts a long shadow over their early adulthood, influencing everything from their housing choices to their ability to start a family. Understanding the consequences of this debt is crucial for both individuals and policymakers alike.

Career Choices and Financial Decisions

Student loan debt often influences the career paths graduates pursue. The pressure to quickly repay loans can lead individuals to prioritize higher-paying jobs, even if those jobs don’t align with their passions or long-term career goals. This can result in career dissatisfaction and a feeling of being trapped in a financially driven career path. Furthermore, the weight of debt can make it difficult to take risks, such as starting a business or pursuing further education, which could ultimately lead to greater financial success in the long run. Graduates might delay investing in their professional development, such as attending conferences or obtaining certifications, due to financial constraints. This can limit their career advancement opportunities.

Challenges Faced by Graduates with Significant Student Loan Debt

High levels of student loan debt present numerous challenges for graduates. One significant hurdle is delayed homeownership. The substantial monthly loan payments, combined with other living expenses, can make saving for a down payment and securing a mortgage extremely difficult, pushing back the timeline for achieving this significant life milestone. Similarly, starting a family can be delayed or postponed due to financial pressures. The cost of childcare, coupled with student loan repayments, can make raising a family financially challenging, leading many young couples to delay having children or choose to have fewer children than they had initially planned. Moreover, the stress associated with managing significant debt can negatively impact mental and physical health.

Financial Well-being: A Comparison

Studies consistently demonstrate a significant difference in the financial well-being of graduates with and without student loan debt. Those burdened with debt often experience lower credit scores, impacting their ability to secure loans for major purchases like cars or homes. They may also struggle to save for retirement, jeopardizing their financial security in later life. Graduates without significant debt, on the other hand, typically have greater financial flexibility, allowing them to invest in their future, pursue their passions, and enjoy a higher quality of life. For example, a study by the Federal Reserve found that households with student loan debt had significantly lower net worth than households without such debt.

Resources and Support Services for Graduates

Numerous resources and support services are available to assist graduates struggling with student loan repayment. These include:

- Income-Driven Repayment Plans: These plans adjust monthly payments based on income and family size, making repayment more manageable.

- Student Loan Counseling Services: Non-profit organizations and government agencies offer free counseling services to help graduates understand their repayment options and develop a repayment strategy.

- Deferment and Forbearance: Temporary pauses in repayment may be available under certain circumstances, such as unemployment or financial hardship.

- Loan Consolidation: Combining multiple loans into a single loan can simplify repayment and potentially lower interest rates.

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance of federal student loans after 10 years of qualifying public service employment.

Government Policies and Student Loan Programs

The government plays a crucial role in making higher education accessible and affordable through various financial aid and loan programs. These initiatives aim to support students from diverse socioeconomic backgrounds, ensuring a broader range of individuals can pursue higher education opportunities. The scale and structure of these programs significantly influence student debt levels and the overall accessibility of higher education.

Government involvement in student financial aid primarily manifests through direct loan programs, grants, and tax benefits. These programs are designed to lessen the financial burden associated with tuition, fees, and living expenses, allowing students to focus on their studies. However, the details of these programs, including eligibility criteria and repayment terms, are subject to change based on evolving economic conditions and policy priorities.

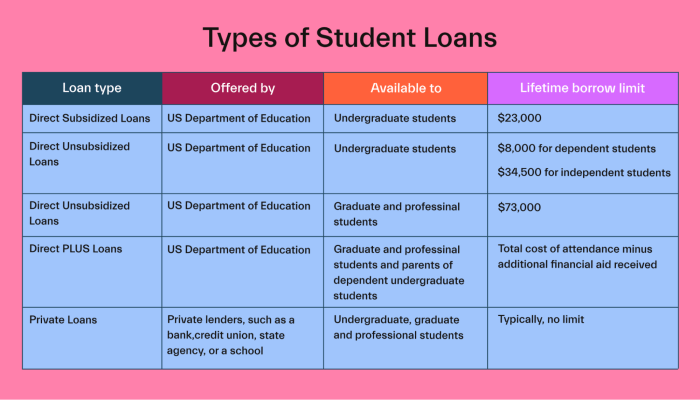

Federal Student Loan Programs and Eligibility

The federal government offers several student loan programs, each with its own eligibility requirements and repayment options. These programs are generally need-based, considering factors such as family income and the student’s demonstrated financial need. The primary programs include the Federal Direct Subsidized Loan, Federal Direct Unsubsidized Loan, and Federal Direct PLUS Loan. Subsidized loans differ from unsubsidized loans in that the government pays the interest while the student is enrolled at least half-time, while unsubsidized loans accrue interest from the time the loan is disbursed. PLUS loans are available to parents of dependent students and to graduate students. Eligibility is determined through the Free Application for Federal Student Aid (FAFSA), a standardized form used by colleges and universities to assess financial need. Applicants must meet specific credit requirements for PLUS loans. Specific income thresholds and other criteria may also apply to some programs.

Consequences of Changes in Government Policies

Alterations in government policies regarding student loan interest rates and repayment terms can have significant repercussions for borrowers. For instance, an increase in interest rates directly translates to higher overall loan costs for students, potentially impacting their ability to repay their debt. Similarly, changes in repayment plans, such as extending repayment periods or offering income-driven repayment options, can affect both the total amount paid over the life of the loan and the monthly payments. For example, the shift towards income-driven repayment plans in recent years has provided relief to many borrowers struggling with high debt payments, but has also increased the overall cost of the loan over its lifespan for some. Conversely, changes that reduce the availability of income-driven repayment options could lead to increased rates of loan default.

Impact of Government Policies on Student Loan Debt and Access to Higher Education

Government policies directly influence both student loan debt levels and access to higher education. For example, increasing the availability of grants and scholarships, or lowering tuition costs through subsidies to institutions, can significantly reduce reliance on loans. Conversely, policies that limit access to financial aid or increase tuition costs can drive up student loan debt and limit access to higher education for low- and middle-income students. The expansion of income-driven repayment plans, for instance, has made higher education more accessible to students who might otherwise have been deterred by the prospect of high debt, while also increasing the overall cost of the loan for some. Conversely, a reduction in funding for these programs could limit access to higher education for many.

Alternative Funding Sources for Higher Education

Securing funding for higher education can be a significant challenge, but thankfully, student loans aren’t the only option. A diverse range of alternative funding sources exists, offering students pathways to finance their education without solely relying on debt. Understanding these options and developing effective strategies to access them is crucial for navigating the complexities of higher education financing.

Beyond loans, several avenues can help offset the costs of tuition, fees, and living expenses. These include scholarships, grants, and work-study programs, each with its own set of advantages and disadvantages. Careful consideration of individual circumstances and proactive application strategies are key to maximizing the potential of these resources.

Scholarships

Scholarships represent a significant opportunity for students to receive free money for college. Unlike loans, scholarships don’t need to be repaid. They are often awarded based on academic merit, athletic ability, artistic talent, or demonstrated financial need. Many scholarships are offered by universities, colleges, private organizations, and corporations. Successful strategies for securing scholarships involve thorough research, crafting compelling applications, and meeting deadlines. For instance, a student with a strong academic record might pursue merit-based scholarships offered by their target university or national organizations like the National Merit Scholarship Corporation. Similarly, a talented athlete could explore athletic scholarships offered by colleges with strong athletic programs.

Grants

Grants, like scholarships, are forms of financial aid that do not require repayment. However, grants are typically awarded based on demonstrated financial need, assessed through the Free Application for Federal Student Aid (FAFSA). Federal Pell Grants are a prime example of a need-based grant program, providing funding to undergraduate students with exceptional financial need. State governments and private organizations also offer various grant programs, often targeting specific demographics or academic areas. A student from a low-income family would likely benefit from researching and applying for federal and state grants, as these are designed to assist students facing significant financial barriers to higher education.

Work-Study Programs

Work-study programs provide part-time employment opportunities for students while they are enrolled in school. These programs are typically funded by the federal government or the university itself and allow students to earn money to help cover their educational expenses. While not a direct source of free money like scholarships and grants, work-study offers a valuable opportunity to earn income while gaining practical work experience. A student participating in a work-study program might work in the university library, cafeteria, or administrative offices, earning a wage while contributing to the campus community. The advantage is the flexibility of balancing work and studies, and the income earned directly reduces the overall cost of education.

Strategies for Securing Financial Aid

Securing financial aid requires a proactive and organized approach. Successfully navigating the application process involves careful planning, thorough research, and persistent effort.

- Complete the FAFSA: The FAFSA is the primary application for federal student aid, including grants and loans. Submitting it early is crucial to maximize eligibility for various programs.

- Research Scholarships and Grants: Utilize online databases like Fastweb, Scholarships.com, and Peterson’s to locate potential funding opportunities that align with your academic profile and interests.

- Network and Build Relationships: Connect with your high school counselors, college financial aid offices, and community organizations to learn about local and national scholarship opportunities.

- Craft Compelling Applications: Pay close attention to application deadlines and tailor your essays and materials to highlight your unique strengths and achievements.

- Seek Mentorship and Guidance: Connect with current college students or alumni who have successfully secured financial aid to gain valuable insights and advice.

The Psychological Impact of Student Loan Debt

The rising cost of higher education has led to a significant increase in student loan debt, impacting not only the financial well-being of graduates but also their mental health. The weight of substantial debt can create considerable stress and anxiety, potentially leading to serious mental health challenges. Understanding this connection is crucial for developing effective coping strategies and support systems.

Mental Health Consequences of Student Loan Debt

Carrying a significant student loan burden is frequently linked to increased levels of stress, anxiety, and depression. The constant pressure of repayment, coupled with the uncertainty of future financial stability, can contribute to feelings of overwhelm and hopelessness. Studies have shown a correlation between higher debt levels and a greater likelihood of experiencing mental health issues. The inability to pursue desired life goals, such as homeownership or starting a family, due to debt obligations can further exacerbate these feelings. The long-term implications can include difficulties maintaining healthy relationships, reduced job satisfaction, and even an increased risk of substance abuse.

The Relationship Between Student Loan Debt and Mental Health Challenges

The relationship between student loan debt and mental health is complex and multifaceted. The chronic stress associated with managing debt can disrupt sleep patterns, increase blood pressure, and weaken the immune system, all of which contribute to overall poor physical and mental well-being. Furthermore, the stigma surrounding debt can lead to feelings of shame and isolation, making it difficult for individuals to seek help or support. The fear of financial ruin and the inability to meet financial obligations can lead to a sense of powerlessness and decreased self-esteem. This can manifest as difficulty concentrating, reduced motivation, and feelings of despair.

Coping Mechanisms and Strategies for Managing the Psychological Burden of Student Loan Debt

Developing effective coping mechanisms is essential for managing the psychological burden of student loan debt. These strategies can include seeking professional help from therapists or counselors specializing in financial stress, developing a realistic budget and repayment plan, practicing mindfulness and stress-reduction techniques like meditation or yoga, building a strong support network of friends and family, and prioritizing self-care activities. Financial literacy workshops can also be beneficial in providing individuals with the tools and knowledge to effectively manage their finances. Open communication with lenders about potential repayment difficulties can also alleviate some of the pressure and anxiety associated with debt.

Debt Levels and Reported Mental Health Challenges

| Debt Level (USD) | Reported Stress Level | Reported Anxiety Level | Reported Depression Level |

|---|---|---|---|

| 0-10,000 | Low to Moderate | Low to Moderate | Low |

| 10,001-50,000 | Moderate to High | Moderate to High | Moderate |

| 50,001-100,000 | High | High | Moderate to High |

| >100,000 | Very High | Very High | High |

*Note: This table represents a generalized correlation and individual experiences may vary. The levels are subjective and based on qualitative observations from various studies. Specific numerical data on this correlation is difficult to present due to the variety of research methodologies and differing definitions of mental health challenges.

Visual Representation of Student Loan Debt Statistics

Visual representations of data are crucial for understanding the complex issue of student loan debt. Graphs and charts can effectively communicate trends and disparities in a way that raw numbers cannot. The following descriptions illustrate how different visual aids can highlight key aspects of this growing concern.

Growth of Student Loan Debt Over the Past Decade (Bar Graph)

A bar graph would effectively illustrate the escalating trend of student loan debt over the past decade. The horizontal axis would represent the years, from 2014 to 2024, while the vertical axis would display the total student loan debt in trillions of US dollars. Each bar would represent a year, with its height corresponding to the total debt for that year. For example, a bar for 2014 might show a height representing $1.2 trillion, while the 2024 bar might reach $2.0 trillion (these are illustrative figures and should be replaced with actual data from a reliable source like the Federal Reserve or the Department of Education). Clear labels on both axes and a descriptive title, such as “Growth of Student Loan Debt: 2014-2024,” would ensure clarity. The graph would clearly demonstrate the substantial increase in student loan debt over time.

Distribution of Student Loan Debt Across Different Age Groups (Pie Chart)

A pie chart would effectively display the proportion of student loan debt held by different age groups. The entire pie would represent the total student loan debt. Each slice would represent a specific age group (e.g., 20-24, 25-29, 30-34, 35-39, 40+), with the size of the slice proportional to the percentage of total debt held by that group. For instance, a slice representing the 25-29 age group might occupy 30% of the pie, indicating that this age group holds 30% of the total student loan debt. Clear labels for each slice, including both the age range and the corresponding percentage, would be crucial for easy interpretation. A title such as “Distribution of Student Loan Debt by Age Group” would clearly communicate the chart’s purpose.

Average Student Loan Debt by Major (Infographic)

An infographic could effectively present the average student loan debt for various college majors. The infographic could use a combination of visual elements, such as icons representing different majors (e.g., a graduation cap for education, a beaker for science), alongside numerical data. Each major would be listed, followed by the average student loan debt for graduates in that field. For example, “Medicine: $250,000,” “Engineering: $100,000,” “Arts: $50,000” (again, these are illustrative figures and should be replaced with accurate data from reputable sources). The infographic could also include a visual comparison, such as a bar chart within the infographic itself, to easily compare the average debt across different majors. The infographic would need a clear title, such as “Average Student Loan Debt by College Major,” and a legend explaining the visual elements used.

Wrap-Up

Navigating the world of higher education student loans requires careful planning and a comprehensive understanding of the available options. By understanding the various factors contributing to rising tuition costs, exploring diverse repayment strategies, and considering alternative funding sources, individuals can approach their educational financing with greater confidence. Ultimately, informed decision-making empowers students to pursue their academic goals while mitigating the potential long-term financial and psychological burdens of student loan debt. This guide serves as a starting point for a more informed and empowered approach to higher education financing.

FAQ Guide

What happens if I can’t repay my student loans?

Defaulting on student loans can have severe consequences, including damage to your credit score, wage garnishment, and tax refund offset. Explore options like income-driven repayment plans or contact your loan servicer to discuss potential solutions before defaulting.

Can I deduct student loan interest from my taxes?

Yes, under certain circumstances, you may be able to deduct the interest you paid on student loans. Eligibility criteria and deduction limits vary, so consult the IRS website or a tax professional for the most up-to-date information.

How do I choose the best repayment plan for my situation?

The best repayment plan depends on your individual financial circumstances and income. Consider factors like your monthly budget, income level, and long-term financial goals. Compare different repayment plans (standard, graduated, income-driven) to determine which best suits your needs.

What are the benefits of loan consolidation?

Consolidating your loans can simplify repayment by combining multiple loans into a single loan with one monthly payment. However, it may not always lower your interest rate, so carefully weigh the pros and cons before consolidating.