The crippling weight of student loan debt is a pervasive issue impacting millions of Americans, shaping their financial futures and life choices in profound ways. This pervasive burden isn’t uniformly distributed; it disproportionately affects specific demographics, exacerbating existing societal inequalities. Understanding the factors driving this escalating debt crisis is crucial to developing effective solutions and mitigating its long-term consequences.

From soaring tuition costs and predatory lending practices to the lack of financial literacy and limited access to affordable repayment options, the challenges are multifaceted. This exploration delves into the demographics most affected, the contributing factors, the far-reaching impacts on individuals and society, and potential pathways toward alleviating this national problem.

The Demographics of High Student Loan Debt

The burden of student loan debt is not evenly distributed across the population. Understanding the demographic factors influencing debt levels is crucial for developing effective policy solutions and targeted support programs. This section will examine the age groups, racial and ethnic backgrounds, geographic locations, income levels, and educational attainment levels most affected by significant student loan debt.

Age Groups Most Burdened by Student Loan Debt

Millennials and Generation Z currently bear the brunt of the student loan debt crisis. These younger generations entered higher education during a period of rising tuition costs and limited financial aid opportunities. While older generations may also have student loan debt, the sheer volume and average debt held by younger borrowers is significantly higher, impacting their ability to purchase homes, start families, and achieve financial stability. This age disparity reflects a trend of escalating tuition costs outpacing wage growth.

Racial and Ethnic Disparities in Student Loan Debt

Significant disparities exist in average student loan debt levels across different racial and ethnic groups. Studies consistently show that Black and Hispanic borrowers often graduate with higher levels of debt compared to their white counterparts. This disparity is partly attributed to factors such as lower family incomes, reduced access to financial aid and scholarships, and the persistent effects of systemic inequalities in education and employment. These factors contribute to a cycle of debt that can be difficult to overcome.

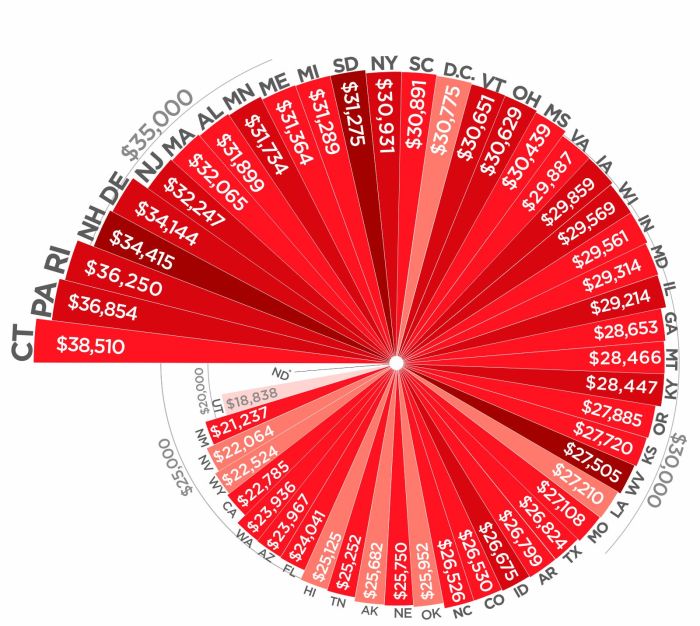

Regional Variations in Student Loan Debt

Student loan debt burdens are not uniformly distributed across the United States. Regions with higher concentrations of prestigious private universities or a higher cost of living tend to have higher average student loan debt. For instance, the Northeast and West Coast often report higher average debt levels compared to the South and Midwest, reflecting variations in tuition costs and the prevalence of graduate programs. These regional differences highlight the need for tailored support programs that address specific local economic and educational contexts.

Correlation Between Income Levels and Student Loan Debt

A strong correlation exists between income levels and student loan debt amounts. Borrowers from lower-income families often accumulate more debt due to limited access to financial resources, such as family contributions or savings for college. They may also rely more heavily on federal loans with less favorable repayment terms. Conversely, borrowers from higher-income families may have access to more financial resources, potentially reducing their reliance on loans or allowing them to choose more affordable educational options.

Distribution of Student Loan Debt Across Educational Attainment Levels

The amount of student loan debt accumulated is often directly related to the level of education pursued. Generally, higher levels of education lead to higher debt accumulation.

| Educational Attainment | Average Debt (Estimate) | Percentage of Borrowers | Notes |

|---|---|---|---|

| Bachelor’s Degree | $37,000 | 60% | Data varies widely depending on the institution and program. |

| Master’s Degree | $70,000 | 25% | Often pursued after significant work experience, increasing the likelihood of higher debt. |

| Doctoral Degree | $100,000+ | 10% | Lengthy programs often lead to substantial debt accumulation. |

| Associate’s Degree | $20,000 | 5% | Shorter programs generally result in lower debt. |

Factors Contributing to High Student Loan Debt

The escalating burden of student loan debt in the United States is a complex issue stemming from a confluence of factors. Understanding these contributing elements is crucial to addressing the crisis and preventing its further exacerbation. This section will examine key drivers behind the rising cost of higher education and the subsequent accumulation of debt by students.

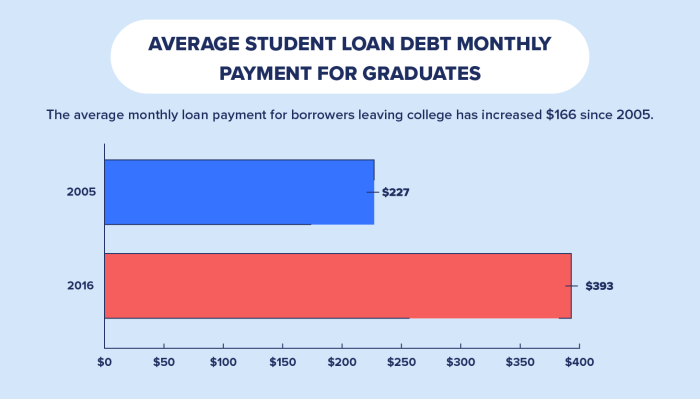

Rising Tuition Costs and Debt Accumulation

The cost of tuition at both public and private colleges and universities has been increasing at a rate far exceeding inflation for several decades. This rapid escalation has forced students to rely more heavily on loans to finance their education. For instance, the average cost of tuition at four-year public colleges has more than doubled in the past 20 years, while the average cost at private institutions has risen even more dramatically. This disparity between the rising cost of education and stagnant or slowly increasing income levels has created a situation where many students are left with no other option than to take out substantial loans. The increasing reliance on loans, coupled with the long repayment periods and often high interest rates, contributes significantly to the overall debt burden.

The Influence of For-Profit Colleges

For-profit colleges have played a significant role in the student loan debt crisis. These institutions often aggressively recruit students, sometimes with misleading marketing practices, and frequently offer programs with questionable job placement outcomes. Their high tuition costs and aggressive loan solicitation practices often leave students with substantial debt and limited job prospects after graduation, leading to default and financial hardship. Studies have shown that students who attend for-profit colleges are disproportionately likely to accumulate high levels of student loan debt compared to their peers attending public or non-profit institutions. The aggressive marketing strategies and often high tuition rates of for-profit colleges exacerbate the problem of student loan debt.

Average Student Loan Debt per Degree Type

The average amount of student loan debt varies significantly depending on the degree pursued. Students pursuing professional degrees such as medicine, law, or dentistry typically incur the highest levels of debt due to the length of their programs and the high cost of tuition. Master’s degrees also tend to carry a higher debt burden than bachelor’s degrees. Conversely, associate’s degrees typically result in lower debt levels. Precise figures fluctuate annually, but reliable sources such as the National Center for Education Statistics provide updated data on average student loan debt by degree type. This variation highlights the importance of considering the cost and potential return on investment when choosing a degree program.

Federal vs. Private Student Loans and Interest Rates

Students typically utilize a combination of federal and private student loans to finance their education. Federal student loans are generally preferred due to their borrower protections, flexible repayment options, and often lower interest rates compared to private loans. However, federal loan limits can be insufficient to cover the full cost of tuition for many students, forcing them to turn to private lenders. Private student loans frequently carry higher interest rates and less favorable repayment terms, contributing to higher overall debt accumulation. The difference in interest rates between federal and private loans can significantly impact the total amount repaid over the life of the loan. Understanding these differences is crucial for students making informed borrowing decisions.

Borrowing Habits Across Family Income Backgrounds

The financial resources available to a student’s family significantly influence their borrowing habits.

- Students from high-income families are more likely to have access to alternative funding sources, such as family contributions, reducing their reliance on loans.

- Students from middle-income families often need to borrow more extensively to cover educational expenses, leading to moderate debt levels.

- Students from low-income families frequently rely heavily on loans, often maximizing their borrowing limits, resulting in the highest levels of student loan debt.

This disparity underscores the socioeconomic inequalities embedded within the higher education system and the significant impact of financial background on student debt levels.

The Impact of High Student Loan Debt

The burden of significant student loan debt extends far beyond the immediate repayment schedule, significantly impacting various aspects of borrowers’ lives, from major financial decisions to overall well-being. The long-term consequences are substantial and far-reaching, affecting not only personal finances but also societal trends.

High Student Loan Debt and Homeownership Rates

High student loan debt demonstrably reduces homeownership rates. The significant monthly payments required for loan repayment often leave borrowers with little to no disposable income for saving a down payment or covering other homeownership costs, such as property taxes and insurance. This financial constraint pushes homeownership further into the future, or prevents it altogether, particularly for younger generations. Studies consistently show a negative correlation between student loan debt and homeownership, with individuals carrying large balances significantly less likely to purchase a home compared to their debt-free counterparts. For example, a 2023 study by the National Association of Realtors found that student loan debt was a major factor delaying home purchases for millennials.

High Student Loan Debt and Retirement Planning

Student loan debt presents a considerable obstacle to adequate retirement planning. The substantial monthly payments divert funds that could otherwise be channeled into retirement savings accounts, such as 401(k)s or IRAs. This shortfall in savings during crucial earning years can lead to a significantly smaller nest egg in retirement, potentially resulting in financial insecurity during later life. Furthermore, the longer it takes to pay off student loans, the less time individuals have to build retirement savings, compounding the negative impact. Delaying retirement due to insufficient savings is a common consequence of high student loan debt.

High Student Loan Debt and Delayed Family Formation

The financial strain of substantial student loan debt often leads to delays in family formation. The costs associated with raising children—childcare, education, and healthcare—add significant financial pressure to already burdened budgets. Couples may postpone marriage or having children until their debt is manageable, impacting their life plans and potentially affecting fertility timelines. This delay can have profound emotional and social consequences, as individuals may miss out on important life experiences and family milestones. The financial instability caused by high student loan debt directly impacts the timing and feasibility of having a family.

High Student Loan Debt and Mental Health Challenges

The persistent stress and anxiety associated with managing substantial student loan debt can significantly impact mental health. The overwhelming weight of repayment responsibilities, coupled with the uncertainty of the future, can contribute to feelings of depression, anxiety, and even hopelessness. Studies have shown a clear link between high levels of student loan debt and increased rates of mental health issues, including increased rates of clinical depression and anxiety disorders. The constant worry about financial stability can lead to sleep disturbances, reduced productivity, and strained relationships.

Impact of Student Loan Debt on Life Milestones

| Life Milestone | Minimal Debt | Moderate Debt | High Debt |

|---|---|---|---|

| Marriage | Likely on time or slightly delayed | Potentially significant delay | Significant delay or postponement |

| Having Children | Likely on time or slightly delayed | Significant delay | Significant delay or postponement, potentially never |

| Buying a Car | Likely on time or slightly delayed | Delayed, may opt for used car | Significant delay, may rely on public transport |

| Homeownership | Likely on time or slightly delayed | Significant delay | Significant delay or postponement, potentially never |

Potential Solutions to Address High Student Loan Debt

The crippling weight of student loan debt necessitates a multi-pronged approach involving government intervention, individual responsibility, and systemic changes. Addressing this issue requires a combination of immediate relief measures and long-term strategies to prevent future crises. This section explores potential solutions, focusing on existing programs, policy adjustments, and improvements in financial literacy.

Government Programs Designed to Alleviate Student Loan Debt

The federal government offers several programs aimed at reducing the burden of student loan debt. These programs vary in their eligibility criteria and the type of relief they provide. For example, the Income-Driven Repayment (IDR) plans adjust monthly payments based on income and family size, making repayment more manageable for borrowers facing financial hardship. Another example is the Public Service Loan Forgiveness (PSLF) program, which forgives the remaining balance of federal student loans after 120 qualifying monthly payments for individuals working in public service. However, navigating these programs can be complex, and eligibility requirements are often stringent, leading to many borrowers being excluded from receiving the benefits.

Benefits and Drawbacks of Loan Forgiveness Programs

Loan forgiveness programs, such as the PSLF program or broader proposals for targeted loan forgiveness, offer immediate relief to borrowers, potentially stimulating the economy by freeing up disposable income. However, such programs are often criticized for their high cost to taxpayers and the potential for inequitable distribution of benefits. For instance, some argue that loan forgiveness disproportionately benefits higher earners who may have borrowed larger sums for graduate degrees, while leaving those with smaller loans less relieved. Moreover, the moral hazard argument suggests that widespread forgiveness could incentivize future borrowing without sufficient consideration of repayment ability.

Comparison of Income-Driven Repayment Plans

Several income-driven repayment (IDR) plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans calculate monthly payments based on a borrower’s discretionary income and family size. While these plans offer lower monthly payments, they often extend the repayment period, potentially leading to increased total interest paid over the life of the loan. The differences between these plans lie primarily in the calculation of discretionary income and the maximum repayment period. For example, REPAYE generally offers lower monthly payments than IBR, but the total interest paid might be higher due to a longer repayment period. Choosing the right plan depends on individual circumstances and financial projections.

Strategies for Improving Financial Literacy Among Students

Improving financial literacy among students is crucial for preventing excessive borrowing and promoting responsible financial decision-making. This includes incorporating comprehensive financial education into high school and college curricula, providing accessible resources and workshops on budgeting, saving, and debt management, and promoting the use of financial planning tools and calculators. Early exposure to these concepts empowers students to make informed decisions about higher education financing, understanding the long-term implications of borrowing and the importance of responsible repayment strategies. Institutions could also offer financial counseling services and integrate financial literacy into orientation programs.

Potential Policy Changes to Reduce the Burden of Student Loan Debt

Several policy changes could significantly reduce the overall burden of student loan debt.

- Increase funding for Pell Grants and other need-based financial aid programs.

- Implement stricter regulations on for-profit colleges and universities to curb predatory lending practices.

- Expand and simplify access to income-driven repayment plans.

- Lower interest rates on federal student loans.

- Increase transparency in college pricing and financial aid information.

- Invest in affordable higher education options, such as community colleges and online learning platforms.

- Explore options for debt cancellation targeted at specific demographics or loan types.

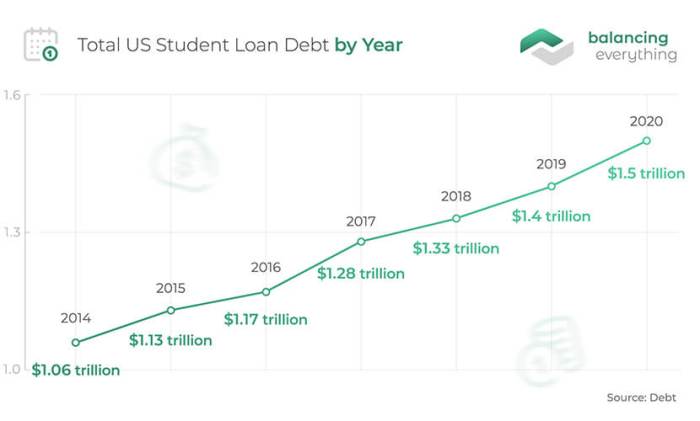

Visual Representation of Student Loan Debt Burden

Visual representations are crucial for understanding the complex landscape of student loan debt. By presenting data graphically, we can more easily identify trends and disparities in debt levels across various demographics and educational paths. Two key visualizations effectively illustrate this burden.

Distribution of Student Loan Debt Across Income Brackets

A compelling visualization would be a modified bar chart, specifically a “population pyramid” style chart, displaying the distribution of student loan debt across different income brackets. The horizontal axis would represent annual income, categorized into ranges (e.g., $0-$25,000, $25,001-$50,000, $50,001-$75,000, and so on). The vertical axis would represent the percentage of individuals within each income bracket carrying student loan debt. The bars would be color-coded, perhaps using a gradient from light blue (low debt percentage) to dark blue (high debt percentage), to clearly show the concentration of debt. This visualization would highlight whether the burden is disproportionately concentrated among lower or higher income earners, or if it is more evenly distributed. The visual impact of the “pyramid” shape would immediately illustrate the relative proportions.

Average Student Loan Debt by Major

A bar chart would effectively compare the average student loan debt for various college majors. The horizontal axis would list different majors (e.g., Medicine, Law, Engineering, Education, Arts), while the vertical axis would represent the average student loan debt in dollars. The bars would be color-coded to easily distinguish between high-debt majors (represented in a darker shade, perhaps red or orange) and low-debt majors (lighter shades, such as green or blue). This visual would quickly reveal which fields of study tend to lead to significantly higher levels of student loan debt upon graduation, allowing for informed decision-making. Error bars could be added to represent the standard deviation of debt within each major, providing a clearer picture of the data variability.

Ending Remarks

The staggering amount of student loan debt in the United States presents a complex societal challenge demanding comprehensive solutions. While government initiatives and individual financial responsibility play crucial roles, a multi-pronged approach is necessary. This includes addressing the root causes of rising tuition costs, promoting financial literacy among students, and expanding access to more equitable and affordable repayment options. Only through concerted effort can we hope to alleviate the burden of student loan debt and pave the way for a more financially secure future for all.

FAQ Explained

What is the average student loan debt in the US?

The average student loan debt varies depending on the degree level and other factors, but it’s typically in the tens of thousands of dollars.

Can I discharge my student loans through bankruptcy?

Generally, student loans are difficult to discharge through bankruptcy. There are very limited exceptions.

What are income-driven repayment plans?

Income-driven repayment plans adjust your monthly payments based on your income and family size, potentially lowering your payments and extending your repayment period.

What resources are available for help with student loan debt?

Many resources are available, including government websites (like StudentAid.gov), non-profit credit counseling agencies, and financial advisors specializing in student loan debt management.