Navigating the complex landscape of student loan debt can be daunting, particularly when confronted with the highest interest rates. Understanding these rates is crucial for borrowers to make informed decisions about their education financing and long-term financial well-being. This exploration delves into the factors influencing these rates, historical trends, and strategies for managing high-interest loan burdens. We’ll also compare student loan interest rates to other forms of debt, providing a comprehensive overview to empower informed financial planning.

From the impact of government policies to the various repayment options available, we aim to provide clarity and actionable insights. This analysis will equip you with the knowledge necessary to effectively manage your student loan debt and navigate the challenges associated with high interest rates.

Understanding the Current Highest Student Loan Interest Rates

Navigating the complex landscape of student loan interest rates can be daunting. Understanding the factors that influence these rates is crucial for borrowers to make informed decisions about their education financing. This section will break down the key aspects of current student loan interest rates in the United States.

Factors Influencing Highest Student Loan Interest Rates

Several factors contribute to the variability in student loan interest rates. These include the type of loan (federal vs. private), the borrower’s creditworthiness (for private loans), prevailing market interest rates, and the loan’s repayment plan. Federal student loans generally have lower interest rates than private loans because they are backed by the government and carry less risk for lenders. However, even within the federal loan system, interest rates can vary depending on the loan type and the borrower’s financial situation. Private loan interest rates, on the other hand, are heavily influenced by the borrower’s credit history, income, and the overall economic climate. Higher credit risk translates to higher interest rates for private loans.

Federal Student Loan Interest Rates

The federal government offers several types of student loans, each with its own interest rate. These include subsidized and unsubsidized Stafford Loans, PLUS Loans (for parents and graduate students), and Consolidation Loans. Subsidized Stafford Loans have lower interest rates than unsubsidized loans because the government pays the interest while the student is enrolled at least half-time. Unsubsidized Stafford Loans accrue interest throughout the loan period, including while the student is in school. PLUS loans often carry higher interest rates than Stafford Loans due to the increased risk associated with lending to parents or graduate students. Consolidation loans can simplify repayment but might not necessarily result in lower overall interest costs. The exact interest rates for these loans are set annually and are available on the official Federal Student Aid website. For example, the interest rate for a Direct Subsidized Loan for the 2023-2024 academic year was 4.99%.

Comparison of Federal and Private Student Loan Interest Rates

Currently, private student loans generally have higher interest rates than federal student loans. This is due to the higher risk associated with private lending. Private lenders assess the borrower’s creditworthiness, and those with poor credit scores will face significantly higher interest rates. While federal loan interest rates are fixed for the life of the loan, private loan interest rates can be fixed or variable, making them potentially more volatile. A borrower with excellent credit might secure a private loan with a competitive interest rate, but individuals with less-than-perfect credit will likely pay a substantially higher premium. The difference in interest rates between federal and private loans can significantly impact the total cost of borrowing over the life of the loan.

Student Loan Interest Rates and Repayment Plans

The choice of repayment plan can influence the total interest paid over the life of a student loan, even if the initial interest rate remains constant. Longer repayment periods, while resulting in lower monthly payments, will ultimately lead to a higher total interest paid. Conversely, shorter repayment periods mean higher monthly payments but lower overall interest costs.

| Loan Type | Interest Rate (Example) | Repayment Period (Example) | Total Interest Paid (Example) |

|---|---|---|---|

| Direct Subsidized Loan | 4.99% | 10 years | $2,500 |

| Direct Unsubsidized Loan | 6.54% | 10 years | $3,500 |

| Private Loan (Good Credit) | 7.00% | 15 years | $5,000 |

| Private Loan (Poor Credit) | 12.00% | 15 years | $8,000 |

Historical Trends in Student Loan Interest Rates

Over the past two decades, student loan interest rates in the United States have experienced significant fluctuations, influenced by a complex interplay of economic factors and government policies. Understanding these historical trends provides valuable context for navigating the current landscape of student loan debt.

The fluctuation of student loan interest rates over the past 20 years reflects broader economic shifts and targeted governmental interventions. Rates haven’t followed a simple upward or downward trajectory; instead, they’ve responded dynamically to changes in the overall economy and specific legislative actions.

Impact of Economic Conditions on Student Loan Interest Rates

Student loan interest rates, like other interest rates, are closely tied to broader economic conditions. Periods of economic expansion often see lower rates, as the Federal Reserve may lower its benchmark interest rate to stimulate growth. Conversely, during economic downturns or periods of high inflation, rates tend to rise as the Federal Reserve attempts to control inflation and maintain economic stability. For example, the 2008 financial crisis led to a period of lower interest rates across the board, including student loans, as the Federal Reserve implemented expansionary monetary policy. Conversely, periods of strong economic growth, like those seen in the mid-2000s, sometimes corresponded with higher interest rates. The relationship is not always direct or immediate, as other factors, such as government policy, also play a significant role.

Significant Events and Policies Affecting Student Loan Interest Rates

Several key events and policy changes have significantly impacted student loan interest rates over the past two decades. The 2008 financial crisis, as mentioned, led to a period of lower rates. Subsequently, the government implemented various programs to address the growing student loan debt crisis, some of which directly affected interest rates. The introduction of income-driven repayment plans, while not directly impacting interest rates, indirectly influenced the overall cost of borrowing for many students by altering the repayment schedule and overall amount paid. Changes in the way interest rates are set for federal student loans – shifting from a fixed rate based on the Treasury bill rate to a variable rate – also created fluctuations. The ongoing debate surrounding student loan forgiveness and potential future changes to the repayment system will continue to influence the overall student loan landscape and indirectly impact interest rate trends.

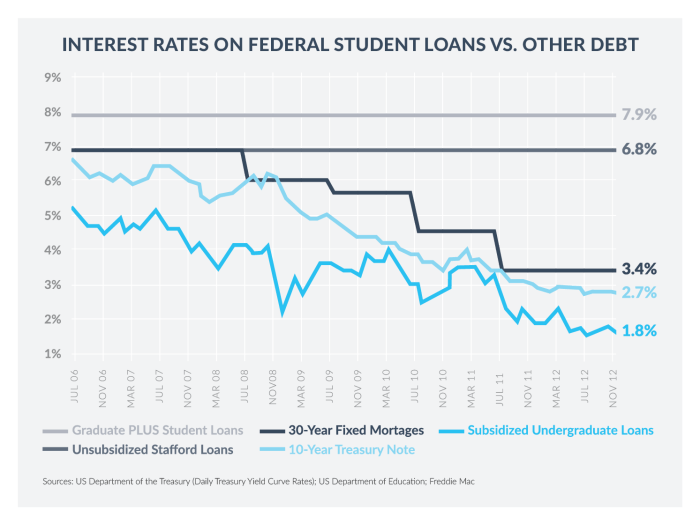

Graphical Representation of Historical Trends

A line graph illustrating the highest student loan interest rate over the past 20 years would show a fluctuating pattern. The x-axis would represent the years (2004-2024), and the y-axis would represent the interest rate percentage. The line itself would depict the highest interest rate charged on federal student loans each year. Key data points would include: (Note: Precise data requires referencing official government sources like the Federal Reserve or Department of Education. This description assumes a hypothetical, illustrative graph based on general trends):

* Around 2006-2007: A relatively high point, potentially reflecting strong economic growth prior to the 2008 crisis.

* 2008-2010: A noticeable dip, reflecting the impact of the financial crisis and subsequent government intervention.

* 2011-2014: A period of gradual increase, potentially due to economic recovery and changing government policies.

* 2015-2018: Fluctuations around a certain level, reflecting the ongoing interplay of economic conditions and government regulations.

* 2019-2024: This section would show the impact of the COVID-19 pandemic and subsequent government actions, potentially including periods of forbearance and interest rate changes. The graph would likely show fluctuations during this period, reflecting the shifting economic and political landscape.

The graph would clearly demonstrate that the highest student loan interest rate hasn’t followed a consistent upward or downward trend but rather a dynamic pattern reflecting economic cycles and policy adjustments.

Impact of High Interest Rates on Borrowers

High student loan interest rates significantly impact borrowers’ financial well-being, creating a substantial long-term burden that extends far beyond the repayment period. The compounding effect of high interest can dramatically increase the total amount owed, leading to financial strain and limiting future opportunities. Understanding these consequences is crucial for borrowers to navigate their debt effectively.

The financial burden imposed by high student loan interest rates can be substantial, often leading to significant long-term financial consequences. For example, a borrower with a $50,000 loan at a 7% interest rate will pay considerably more in interest over the life of the loan compared to someone with the same loan amount at a 3% interest rate. This difference can amount to tens of thousands of dollars, delaying major life milestones like homeownership, starting a family, or investing in retirement. The higher the interest rate, the larger the proportion of each payment goes towards interest rather than principal, prolonging the repayment process and amplifying the total cost.

Long-Term Financial Consequences of High Interest Rates

Borrowers facing the highest interest rates often experience a cascade of negative financial consequences. Delayed homeownership is a common outcome, as high monthly payments restrict their ability to save for a down payment and meet other mortgage requirements. Similarly, starting a family might be postponed due to the financial constraints imposed by significant loan repayments. Retirement savings are frequently sacrificed, as borrowers prioritize paying down their student loan debt over contributing to retirement accounts. This can lead to a less secure financial future and potentially a lower standard of living in retirement. In some extreme cases, high interest rates can contribute to financial distress, impacting credit scores and overall financial stability. For instance, a borrower might struggle to secure other loans or credit cards, hindering their ability to manage unexpected expenses or invest in opportunities for financial growth.

Repayment Challenges: High vs. Low Interest Rates

Borrowers with high interest rates face significantly more challenging repayment journeys than those with low interest rates. The higher interest accrues faster, meaning the principal balance remains high for a longer period. This results in higher monthly payments and a longer repayment timeline. Conversely, borrowers with low interest rates enjoy lower monthly payments, allowing them to pay down the principal balance more quickly and potentially save money on interest over the life of the loan. The difference in repayment timelines can be substantial, with high-interest loans potentially extending repayment for several extra years or even decades compared to low-interest loans. This disparity has profound implications for long-term financial planning and opportunities.

Strategies for Managing High-Interest Student Loan Debt

Managing high-interest student loan debt requires a proactive and strategic approach. Effective strategies can significantly mitigate the financial burden and accelerate repayment.

The following strategies can help borrowers manage high-interest student loan debt:

- Income-Driven Repayment Plans: Explore government programs that adjust monthly payments based on income and family size. These plans can lower monthly payments, making them more manageable.

- Refinancing: Consider refinancing your loans with a lower interest rate, especially if your credit score has improved since you initially took out the loans. This can significantly reduce your total interest payments.

- Debt Consolidation: Combine multiple loans into a single loan with a potentially lower interest rate. This simplifies repayment and can make budgeting easier.

- Accelerated Repayment: Make extra payments whenever possible to reduce the principal balance and pay off the loan faster, minimizing interest accumulation.

- Budgeting and Financial Planning: Create a detailed budget to track income and expenses, prioritizing student loan payments. Seek professional financial advice to develop a long-term financial plan.

Repayment Options and Strategies for High-Interest Loans

Navigating student loan repayment, especially with high-interest rates, can feel overwhelming. Understanding the various repayment plans available and their implications is crucial for developing a successful repayment strategy. Choosing the right plan can significantly impact the total amount paid and the loan’s lifespan.

Federal Student Loan Repayment Plans

The federal government offers several repayment plans designed to accommodate different financial situations. These plans differ in their payment calculation methods, eligibility requirements, and loan forgiveness provisions. Careful consideration of each plan’s features is essential before making a selection.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. While straightforward, this plan results in higher monthly payments compared to income-driven plans, potentially leading to faster loan payoff but also higher total interest paid due to the shorter repayment period. This plan is suitable for borrowers with stable income and a strong capacity for higher monthly payments.

Extended Repayment Plan

For borrowers who find the Standard Repayment Plan’s monthly payments too high, the Extended Repayment Plan offers a longer repayment period, typically up to 25 years. This reduces the monthly payment amount but increases the total interest paid over the life of the loan. Eligibility requires a loan balance exceeding $30,000.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. This option can be beneficial for borrowers anticipating income growth, but it ultimately leads to higher overall interest payments compared to a standard plan. This plan is suitable for borrowers who expect significant income increases during the repayment period.

Income-Driven Repayment Plans

Income-driven repayment plans tie monthly payments to a borrower’s income and family size. These plans are designed to make repayment more manageable for borrowers facing financial hardship. Several income-driven repayment plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans generally offer lower monthly payments, but repayment may extend beyond the standard 10-year period, potentially leading to higher total interest paid over the loan’s life. Forgiveness may be available after 20 or 25 years of qualifying payments, depending on the plan.

Comparison of Repayment Plans

The choice between income-driven and standard repayment plans depends heavily on individual financial circumstances. Standard plans offer faster repayment but higher monthly payments, while income-driven plans offer lower payments but potentially longer repayment periods and higher total interest paid. Borrowers should carefully weigh the short-term and long-term implications of each option.

Summary of Key Features of Repayment Plans

| Repayment Plan | Eligibility Criteria | Payment Calculation | Forgiveness Options |

|---|---|---|---|

| Standard | Most federal student loans | Fixed monthly payments over 10 years | None |

| Extended | Loan balance exceeding $30,000 | Fixed monthly payments over up to 25 years | None |

| Graduated | Most federal student loans | Payments increase gradually over time | None |

| IBR, PAYE, REPAYE, ICR | Specific income and family size requirements | Based on discretionary income | Potential forgiveness after 20-25 years of qualifying payments |

The Role of Government Policy in Student Loan Interest Rates

Government policy plays a significant role in shaping the student loan interest rate landscape. Subsidies, loan programs, and regulatory changes directly influence the cost of borrowing for students and, consequently, the overall level of student loan debt. Understanding this influence is crucial for both borrowers and policymakers alike.

Government policies and subsidies significantly affect student loan interest rates. The federal government’s involvement in the student loan market, through programs like the Federal Direct Loan Program, creates a substantial level of competition and often underwrites a portion of the loan’s risk. This reduces the interest rate lenders would otherwise charge, making loans more affordable for students. Conversely, reductions in government subsidies or changes in the structure of these programs can lead to higher interest rates for borrowers. For example, a decrease in government funding for subsidized loans could force lenders to increase rates to compensate for the increased risk.

Government Subsidies and Interest Rate Impacts

Government subsidies directly lower the cost of borrowing for students. These subsidies can take various forms, including direct payments to lenders to offset interest costs, or guarantees that reduce the lender’s risk of default. The magnitude of these subsidies directly impacts the interest rate a student will pay. A larger subsidy translates to a lower interest rate, while a smaller or eliminated subsidy results in a higher rate. For instance, if the government were to reduce its guarantee on student loans, lenders would likely increase interest rates to account for the added risk of borrowers defaulting. This would place a greater financial burden on students.

Potential Impact of Policy Changes on Future Interest Rates

Changes in government policy can significantly alter future student loan interest rates. For example, the introduction of income-driven repayment plans, while beneficial for borrowers in the long run, may lead to increased interest rates in the short term as lenders adjust to the increased risk associated with these plans. Conversely, an increase in government funding allocated to student loan subsidies could lead to lower interest rates. Predicting the exact impact is complex and depends on numerous factors, including economic conditions and the specific nature of the policy changes. However, it’s clear that any change will have a ripple effect on the market. For example, the recent changes in interest rates following periods of economic uncertainty demonstrate this responsiveness.

Government Approaches and High-Interest Borrowers

Different government approaches to student loan debt disproportionately affect borrowers with high-interest rates. Policies that focus on refinancing or consolidation of loans can provide relief to those burdened with high interest rates, allowing them to secure lower rates. Conversely, policies that prioritize austerity or limit loan forgiveness programs can exacerbate the financial difficulties faced by borrowers with high-interest loans. For instance, a policy that restricts eligibility for income-driven repayment plans would leave many high-interest rate borrowers with limited options for managing their debt. This highlights the importance of considering the equity implications of policy decisions in the student loan market.

Potential Policy Changes to Reduce the Burden of High Student Loan Interest Rates

Several policy changes could lessen the burden of high student loan interest rates. These changes would require careful consideration and balance competing interests.

- Increased government subsidies for student loans, leading to lower interest rates for all borrowers.

- Expansion of income-driven repayment plans to make them more accessible to a wider range of borrowers.

- Implementation of targeted loan forgiveness programs for borrowers with exceptionally high interest rates or significant financial hardship.

- Increased funding for financial literacy programs to help students make informed decisions about borrowing and repayment.

- Regulatory changes to increase transparency and competition in the student loan market.

Comparison to Other Forms of Debt

Student loan interest rates often stand out among other forms of consumer debt, impacting borrowers’ financial planning and overall debt management strategies. Understanding how student loan rates compare to those of credit cards, auto loans, and personal loans is crucial for making informed financial decisions.

Student loan interest rates are frequently lower than credit card interest rates, but often higher than those for auto loans or personal loans, particularly for federal student loans. This disparity arises from several factors, including the risk assessment of the borrower, the type of loan, and the role of government subsidies.

Interest Rate Differences and Contributing Factors

Several key factors contribute to the differences observed in interest rates across various debt types. Credit card interest rates tend to be the highest due to the inherent risk associated with unsecured revolving credit. Lenders consider credit card debt riskier because there is no collateral securing the loan. In contrast, auto loans and personal loans often involve collateral (the car or other assets), mitigating some of the lender’s risk and thus allowing for lower interest rates. Federal student loans, while unsecured, benefit from government backing, resulting in lower rates than many private student loans or credit cards. Private student loans, however, may carry interest rates comparable to credit cards, especially for borrowers with less-than-stellar credit histories. The interest rate offered also reflects the prevailing market interest rates at the time the loan is issued.

Implications for Borrowers Managing Multiple Debts

Managing multiple debts with varying interest rates requires a strategic approach. Borrowers with high-interest credit card debt alongside student loans might consider strategies like debt consolidation or balance transfers to lower their overall interest burden. Prioritizing high-interest debt repayment is often recommended, as the interest paid on these debts accumulates more rapidly. A common approach is to make minimum payments on all debts while directing extra funds towards the debt with the highest interest rate, a method known as the avalanche method. Alternatively, the snowball method focuses on paying off the smallest debt first, providing psychological motivation to continue tackling the larger debts.

Comparison of Average Interest Rates

A bar chart visualizing average interest rates across different debt types would illustrate these differences clearly. The horizontal axis would represent the type of debt (Credit Cards, Auto Loans, Federal Student Loans, Private Student Loans, Personal Loans), while the vertical axis would represent the average annual percentage rate (APR). The bars would represent the average APR for each debt type. For example, a realistic representation might show credit cards with an average APR of 18%, auto loans at 6%, federal student loans at 5%, private student loans at 10%, and personal loans at 8%. The chart would visually demonstrate the significant variation in interest rates across these different forms of consumer debt, highlighting the relatively high cost of credit card debt and the potentially lower cost of federal student loans compared to other unsecured options. These are illustrative figures and actual rates vary significantly depending on individual creditworthiness, loan terms, and market conditions.

Summary

In conclusion, understanding the highest student loan interest rates is paramount for borrowers seeking to minimize their financial burden. By analyzing historical trends, comparing repayment options, and considering the impact of government policies, individuals can develop effective strategies to manage their debt. While high interest rates present significant challenges, informed decision-making and proactive planning can significantly improve long-term financial outcomes. Remember to explore all available resources and seek professional financial advice when needed.

FAQ Guide

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest throughout your education.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing can lower your rate, but it often involves private lenders and may lose federal benefits like income-driven repayment plans.

What happens if I default on my student loans?

Defaulting can result in wage garnishment, tax refund offset, and damage to your credit score, making it harder to obtain loans or credit in the future.

Are there any programs to help borrowers with high interest student loans?

Yes, several income-driven repayment plans adjust payments based on your income and family size, potentially leading to loan forgiveness after a certain period.