Navigating the complexities of student loan repayment can feel overwhelming, especially when understanding how interest rates are determined. The seemingly simple act of borrowing money for education transforms into a multifaceted financial journey influenced by various factors. This exploration will demystify the process, offering clarity on how your interest rate is calculated and what elements contribute to its final figure. Understanding these nuances is crucial for making informed financial decisions and effectively managing your student loan debt.

From the distinction between fixed and variable rates to the impact of your credit score and loan type, we’ll delve into the intricate details. We’ll also examine the mechanics of simple and compound interest calculations, providing practical examples to illustrate their impact on your overall repayment. Ultimately, the goal is to empower you with the knowledge needed to navigate the student loan landscape with confidence.

Types of Student Loans and Their Interest Rates

Understanding the different types of student loans and their associated interest rates is crucial for responsible financial planning. The interest rate you’ll pay significantly impacts the total cost of your education and your repayment burden. Federal and private loans differ considerably in their terms and conditions, influencing the overall cost of borrowing.

Federal student loans are offered by the U.S. government and generally have more favorable terms than private loans. These loans offer various repayment plans and potential forgiveness programs. Private student loans, on the other hand, are offered by banks and other private lenders, and their terms are determined by the lender’s assessment of the borrower’s creditworthiness.

Federal Student Loan Interest Rates

Federal student loans are categorized into several types, each with its own interest rate. These rates are set annually by the government and are generally lower than private loan rates. The specific rate you receive depends on the loan type and the year the loan was disbursed. For example, subsidized loans often have lower rates than unsubsidized loans because the government pays the interest while the borrower is in school.

| Loan Type | Interest Rate Range (Example – subject to change annually) | Repayment Plan | Loan Forgiveness Options |

|---|---|---|---|

| Subsidized Federal Stafford Loan | 0% – 5% (Undergraduate) | Standard, Graduated, Income-Driven | Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness |

| Unsubsidized Federal Stafford Loan | 1% – 6% (Undergraduate) | Standard, Graduated, Income-Driven | Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness |

| Federal PLUS Loan (Graduate/Parent) | 5% – 8% | Standard, Graduated, Income-Driven | Limited options compared to Stafford Loans |

Note: These interest rate ranges are examples and are subject to change each year. It is crucial to check the official Federal Student Aid website for the most up-to-date information.

Private Student Loan Interest Rates

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike federal loans, private loan interest rates are variable and depend on several factors, including the borrower’s credit history, credit score, and the loan’s terms. Borrowers with excellent credit typically qualify for lower interest rates. Those with poor credit or limited credit history may face significantly higher rates, potentially adding thousands of dollars to the total cost of the loan over its lifetime.

| Loan Type | Interest Rate Range (Example – Highly Variable) | Repayment Plan | Loan Forgiveness Options |

|---|---|---|---|

| Private Student Loan (Undergraduate) | 3% – 15% (or higher) | Typically fixed, but can vary | Generally, no government loan forgiveness programs apply. |

| Private Student Loan (Graduate) | 4% – 18% (or higher) | Typically fixed, but can vary | Generally, no government loan forgiveness programs apply. |

Example: A borrower with a high credit score might secure a private loan with an interest rate around 5%, while a borrower with a lower credit score might receive a rate of 12% or higher. This difference can substantially increase the total cost of borrowing.

Fixed vs. Variable Interest Rates

Choosing between a fixed and variable interest rate for your student loans is a significant decision that can impact your overall repayment costs. Understanding the core differences between these two rate types is crucial for making an informed choice that aligns with your financial situation and risk tolerance. This section will compare and contrast fixed and variable rates, highlighting their advantages and disadvantages to help you navigate this important decision.

Fixed interest rates remain constant throughout the life of your loan. This predictability offers a sense of security, allowing you to accurately budget for your monthly payments and avoid the uncertainty associated with fluctuating interest rates. Conversely, variable interest rates fluctuate based on an underlying benchmark rate, such as the prime rate or LIBOR (London Interbank Offered Rate, though its use is declining). This means your monthly payments could increase or decrease over time, depending on market conditions.

Fixed Interest Rate Loans

Fixed-rate student loans offer stability and predictability. The interest rate remains the same for the entire loan term, simplifying budgeting and eliminating the risk of unexpected payment increases. This consistency makes long-term financial planning easier. However, a fixed rate might not always be the lowest rate available initially. If interest rates fall significantly after you secure a fixed-rate loan, you might miss out on potential savings.

Variable Interest Rate Loans

Variable-rate student loans offer the potential for lower initial interest rates compared to fixed-rate loans, potentially resulting in lower monthly payments during the early stages of repayment. However, this advantage comes with significant risk. If the benchmark interest rate rises, your monthly payments will increase, potentially making repayment more challenging. Accurate forecasting of future interest rate movements is difficult, making long-term financial planning more complex.

Scenarios Favoring Fixed vs. Variable Rates

A fixed-rate loan is generally preferable when borrowers prioritize stability and predictability in their monthly payments. This is particularly true for those with a limited tolerance for risk or those expecting a period of financial uncertainty. For example, a recent graduate entering a new job with an uncertain income stream might find a fixed rate more manageable.

Conversely, a variable-rate loan might be considered if a borrower anticipates a short repayment period and believes that interest rates are likely to remain low or even decrease. For instance, a borrower with a high income and a plan to aggressively pay down the loan quickly might be willing to accept the risk of potential rate increases in exchange for potentially lower initial payments. However, this strategy requires careful monitoring of interest rate changes and a robust financial plan to manage potential payment increases.

Comparison of Fixed and Variable Interest Rates

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Interest Rate | Remains constant throughout the loan term | Fluctuates based on a benchmark rate |

| Monthly Payment | Predictable and consistent | Can increase or decrease over time |

| Risk | Low risk of payment fluctuations | Higher risk of payment fluctuations |

| Initial Rate | Generally higher than initial variable rates | Generally lower than initial fixed rates |

| Long-term Cost | Potentially higher overall cost if rates fall significantly | Potentially lower overall cost if rates remain low or fall |

| Example: Initial Rate 5%, Potential Future Rate Changes (Illustrative Only) | 5% for the entire loan term | 5% initially, potentially 6% in year 2, 4% in year 3, etc. (depending on market conditions) |

Factors Influencing Student Loan Interest Rates

Several key factors interact to determine the interest rate you’ll receive on your student loans. Understanding these factors can help you make informed decisions about your borrowing and repayment strategies. These factors aren’t equally weighted, and some have a more significant impact than others.

The interest rate on your student loan isn’t arbitrarily assigned; it’s a reflection of your creditworthiness and the current economic climate. Lenders assess your risk, and that assessment translates directly into the interest rate they offer. A higher perceived risk means a higher interest rate, while a lower risk corresponds to a lower rate.

Credit Score’s Influence on Interest Rates

Your credit score is a significant factor in determining your student loan interest rate. Lenders use your credit history to assess your creditworthiness. A higher credit score indicates a lower risk of default, leading to a lower interest rate. Conversely, a lower credit score signifies a higher risk, resulting in a higher interest rate. For example, a borrower with an excellent credit score (750 or above) might qualify for a significantly lower interest rate compared to a borrower with a poor credit score (below 600). The difference can be several percentage points, leading to substantial savings or added costs over the life of the loan.

Loan Amount and Interest Rate Relationship

While not always directly proportional, the loan amount can indirectly influence the interest rate. Larger loan amounts may be perceived as higher risk by some lenders, potentially leading to a slightly higher interest rate. This is often due to the increased financial burden on the borrower and the increased potential for default. However, this effect is usually less significant than the impact of credit score.

Repayment Plan’s Impact on Interest Rate

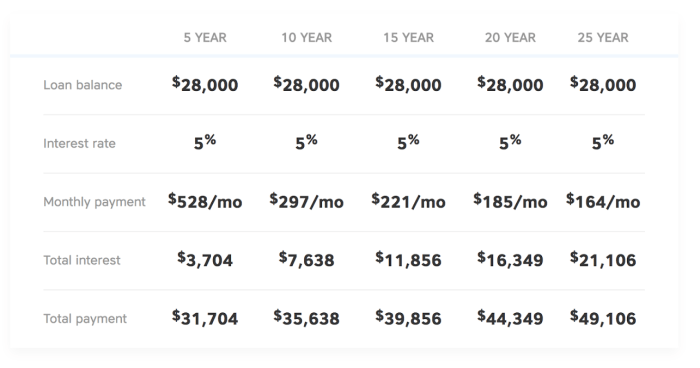

The type of repayment plan you choose typically doesn’t directly affect the initial interest rate offered. However, the choice of repayment plan significantly influences the total interest paid over the life of the loan. For instance, a shorter repayment term will lead to higher monthly payments but lower overall interest paid, while a longer repayment term will result in lower monthly payments but higher total interest paid.

Co-Signer’s Role in Interest Rate Determination

Including a co-signer with a strong credit history can significantly lower your interest rate. The co-signer assumes responsibility for the loan if you default, reducing the lender’s risk. This reduced risk translates to a lower interest rate for the borrower. However, it’s crucial to remember that the co-signer’s credit score is impacted by the loan’s performance.

Economic Climate and Interest Rate Fluctuations

The prevailing economic conditions significantly impact student loan interest rates. Factors like inflation, central bank policies (such as interest rate adjustments by the Federal Reserve), and overall economic growth influence the rates lenders offer. During periods of economic uncertainty or high inflation, interest rates tend to rise, while during periods of economic stability or low inflation, rates may decrease. For example, during periods of low inflation, the Federal Reserve may lower interest rates, leading to potentially lower rates for student loans. Conversely, periods of high inflation often result in increased interest rates across the board, including student loans.

Calculating Simple and Compound Interest

Understanding how simple and compound interest are calculated is crucial for managing student loan debt effectively. The method used significantly impacts the total amount you’ll repay over the life of your loan. Simple interest is calculated only on the principal amount borrowed, while compound interest is calculated on the principal plus accumulated interest. This seemingly small difference can lead to substantial variations in the total repayment amount.

Simple interest is calculated only on the principal amount of the loan. It’s a straightforward calculation, making it easy to understand the total interest accrued over the loan’s lifespan. However, it’s less commonly used for student loans. Compound interest, on the other hand, is calculated on the principal plus any accumulated interest. This means that interest accrues on interest, leading to a larger total repayment amount over time. Most student loans utilize compound interest.

Simple Interest Calculation

The formula for calculating simple interest is: Simple Interest = Principal x Interest Rate x Time. Let’s consider a hypothetical loan of $10,000 with a 5% annual interest rate over a 10-year term. The simple interest calculation would be: $10,000 x 0.05 x 10 = $5,000. In this scenario, the total amount repaid would be $15,000 ($10,000 principal + $5,000 interest).

Compound Interest Calculation

Compound interest is calculated differently. The interest is added to the principal at the end of each compounding period (typically annually, monthly, or quarterly). The interest for the next period is then calculated on this new, higher balance. This compounding effect leads to exponential growth of the debt. The calculation is more complex and usually involves using a formula or a financial calculator.

For our example of a $10,000 loan at 5% annual interest over 10 years, the calculation would be more involved. While a precise calculation requires a financial calculator or spreadsheet software, we can illustrate the concept. After the first year, the interest would be $500 ($10,000 x 0.05). This $500 is added to the principal, making the new principal $10,500. The second year’s interest is calculated on $10,500, and so on. This process repeats for each year. The total interest paid over 10 years would be significantly higher than $5,000, illustrating the power of compounding.

Comparison of Simple and Compound Interest

The following table illustrates the difference in total interest paid under simple and compound interest scenarios for various loan terms, using our example of a $10,000 loan at a 5% annual interest rate. Note that the compound interest figures are approximate, as precise calculations require more sophisticated methods.

| Loan Term (Years) | Simple Interest Paid | Approximate Compound Interest Paid |

|---|---|---|

| 5 | $2,500 | $2,763 |

| 10 | $5,000 | $6,289 |

| 15 | $7,500 | $10,750 |

| 20 | $10,000 | $16,533 |

Understanding Amortization Schedules

An amortization schedule is a detailed table that Artikels the repayment plan for a loan, such as a student loan. It shows the breakdown of each periodic payment (usually monthly) into principal and interest, and tracks the remaining loan balance over the life of the loan. Understanding an amortization schedule helps borrowers visualize their repayment journey and track their progress.

Amortization schedules work by systematically allocating each payment to both interest and principal. In the early stages of repayment, a larger portion of the payment goes towards interest, while a smaller amount reduces the principal balance. As time progresses, the proportion shifts, with a greater portion of each payment applied to the principal, leading to a faster reduction in the outstanding loan amount. This is because the interest is calculated on the remaining principal balance, which decreases with each payment.

Amortization Schedule Breakdown

An amortization schedule typically includes the following information for each payment period:

| Payment Number | Payment Amount | Interest Paid | Principal Paid | Remaining Balance |

|---|---|---|---|---|

| 1 | $300 | $200 | $100 | $9900 |

| 2 | $300 | $198 | $102 | $9800 |

| 3 | $300 | $196 | $104 | $9696 |

| … | … | … | … | … |

| 120 | $300 | $2 | $298 | $0 |

This is a simplified example. Actual schedules can be much longer, depending on the loan term. Note that the interest paid decreases with each payment, while the principal paid increases.

Example Amortization Schedule

Let’s consider a hypothetical student loan of $10,000 with a 5% annual interest rate and a 10-year repayment term (120 monthly payments). The monthly payment, calculated using standard loan amortization formulas, would be approximately $100. Below is a simplified representation of a portion of the amortization schedule:

Visual Representation of an Amortization Schedule

Imagine a bar graph. The initial bar represents the total loan amount ($10,000 in our example). Each subsequent bar represents the remaining principal balance after each monthly payment. The height of each bar gradually decreases over the 120 months until it reaches zero, visually demonstrating the reduction of the principal balance over time. The difference in height between consecutive bars represents the principal paid in that month. A line graph could also be used, plotting the remaining balance against the payment number, showing a steadily declining curve that reaches zero at the end of the loan term. The slope of the line would become steeper as more principal is paid off in later months.

Impact of Loan Consolidation and Refinancing

Consolidating or refinancing your student loans can significantly alter your monthly payments and overall interest costs. Understanding the implications of these strategies is crucial for effective debt management. Both involve combining multiple loans into a single loan, but they differ in their approach and potential outcomes.

Consolidation and refinancing offer distinct advantages and disadvantages. While consolidation typically simplifies repayment by combining multiple loans with varying interest rates and repayment terms into a single, new loan, it may not always lead to a lower interest rate. Refinancing, on the other hand, involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can result in substantial savings over the life of the loan. However, refinancing might involve fees and could potentially extend your repayment period.

Interest Rate Impacts of Consolidation and Refinancing

Consolidating federal student loans typically results in a weighted average interest rate based on the interest rates of your existing loans. This means your new interest rate will be a blend of your previous rates, which may or may not be lower than your highest existing rate. Refinancing, however, aims to secure a lower interest rate than your current highest rate. This is achieved by shopping around for lenders who offer competitive rates based on your credit score and financial situation. For example, if you have several federal loans with rates ranging from 4% to 7%, consolidation would likely result in a rate somewhere between these figures. Refinancing, however, could potentially secure a rate as low as 3% or even lower, depending on market conditions and your creditworthiness.

Benefits of Consolidation and Refinancing

Consolidation simplifies repayment by reducing the number of monthly payments and potentially offering more flexible repayment options. Refinancing, in addition to simplification, often offers lower interest rates, leading to significant long-term savings. For example, refinancing a $50,000 loan from 7% to 4% could save thousands of dollars in interest over the loan’s lifespan. Both options can improve your financial organization and reduce the administrative burden of managing multiple loans.

Drawbacks of Consolidation and Refinancing

Consolidating federal loans might mean losing access to certain repayment plans or forgiveness programs available only to federal loans. Refinancing federal loans into private loans carries the same risk. Furthermore, while refinancing often results in lower interest rates, it might also extend the loan repayment period, potentially leading to paying more interest in the long run despite the lower rate. Additionally, there are typically fees associated with refinancing, which should be factored into the overall cost.

Situations Where Consolidation or Refinancing is Beneficial

Consolidation is beneficial for borrowers overwhelmed by managing multiple loans with different due dates and interest rates. Refinancing is particularly advantageous for individuals with good credit scores and the potential to secure significantly lower interest rates, leading to substantial long-term savings. For instance, a borrower with a high credit score and multiple loans with high interest rates could significantly reduce their overall interest payments by refinancing. Another example is a borrower with federal loans nearing forgiveness but who wants to lower their monthly payments; consolidation might be a suitable option.

Steps Involved in Consolidating or Refinancing Student Loans

Before embarking on either process, it is crucial to thoroughly research and compare available options.

- Check your credit report: A strong credit score improves your chances of securing favorable terms.

- Gather your loan information: Compile details of your existing loans, including balances, interest rates, and lenders.

- Shop around for lenders: Compare interest rates, fees, and repayment terms from multiple lenders.

- Review the terms and conditions carefully: Understand the implications of the new loan agreement before signing.

- Complete the application process: Follow the lender’s instructions and provide all necessary documentation.

Government Subsidies and Interest Rate Subsidies

Government subsidies play a significant role in making higher education more accessible by reducing the financial burden of student loans. These subsidies, primarily offered by the federal government in the United States, directly impact the interest rates borrowers pay, making loans more affordable. Understanding these subsidies is crucial for prospective and current students to navigate the complexities of student loan repayment.

Government subsidies for student loans essentially mean that the government covers a portion of the interest that would otherwise accrue on the loan. This reduces the total amount a borrower ultimately pays back. The impact on interest rates varies depending on the type of loan and the specific subsidy program. For subsidized loans, the government pays the interest while the borrower is in school (under certain eligibility requirements) and during certain grace periods. This prevents the loan balance from growing during these periods, thus reducing the total amount the borrower must repay. Unsubsidized loans, on the other hand, accrue interest from the moment the loan is disbursed, regardless of the borrower’s enrollment status.

Subsidized Loan Eligibility

Several factors determine eligibility for subsidized federal student loans. These primarily revolve around financial need, as demonstrated by the student’s and their family’s income and assets. Students must also be enrolled at least half-time in a degree or certificate program at an eligible institution. Furthermore, the student must be a U.S. citizen or eligible non-citizen, and maintain satisfactory academic progress. A student’s specific eligibility is determined through the Free Application for Federal Student Aid (FAFSA). Borrowers who do not meet the criteria for subsidized loans are typically offered unsubsidized loans, which carry a higher overall cost due to the accumulation of interest.

Implications of Interest Rate Subsidies

Interest rate subsidies directly benefit borrowers by reducing the total cost of their loans. For example, a student with a subsidized loan might have their interest paid during their four years of undergraduate study. This means that when they begin repayment, their loan principal remains unchanged from the initial amount borrowed. Without the subsidy, the loan principal would have increased significantly over those four years, leading to higher monthly payments and a greater overall repayment burden. The savings can be substantial, especially for borrowers with longer repayment terms. This also allows borrowers to focus on their studies without the added stress of accumulating interest while still in school. The reduced overall cost also improves a borrower’s long-term financial stability and reduces the risk of loan default.

Closing Notes

Successfully managing student loan debt requires a thorough understanding of the interest rate calculation process. By grasping the key factors influencing your rate—including loan type, creditworthiness, and economic conditions—you can make more informed decisions about repayment strategies. Remember that proactive planning, such as exploring loan consolidation or refinancing options, can significantly impact your overall financial burden. This understanding empowers you to take control of your financial future and navigate the complexities of student loan repayment with greater confidence and efficiency.

Detailed FAQs

What is the difference between subsidized and unsubsidized student loans?

Subsidized loans don’t accrue interest while you’re in school (or during grace periods), whereas unsubsidized loans do. This means you’ll owe less on a subsidized loan upon graduation.

Can I negotiate my student loan interest rate?

Generally, you can’t directly negotiate interest rates on federal student loans. However, refinancing with a private lender might offer a lower rate, depending on your creditworthiness.

How often are student loan interest rates adjusted?

Federal student loan interest rates are typically set annually, while private loan rates can vary more frequently, depending on market conditions.

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score and lead to late fees, potentially increasing your overall debt. It can also affect your eligibility for future loans.