Navigating the complexities of student loan repayment can feel overwhelming, but understanding your options is the first step towards financial freedom. This guide explores various strategies for managing and potentially discharging your student loan debt, from exploring income-driven repayment plans and loan forgiveness programs to considering consolidation and refinancing. We’ll examine the legal aspects, provide practical budgeting tips, and highlight resources for seeking professional assistance. Let’s demystify the process and empower you to take control of your financial future.

The journey to student loan relief often involves a multifaceted approach. This guide aims to equip you with the knowledge and resources necessary to make informed decisions about your repayment strategy. We’ll cover federal and private loan options, explore the nuances of different repayment plans, and delve into the intricacies of loan forgiveness and cancellation programs. By understanding your rights and responsibilities, and by utilizing available resources, you can significantly improve your chances of successfully managing and potentially discharging your student loan debt.

Understanding Your Student Loans

Navigating the world of student loans can feel overwhelming, but understanding the different types, repayment options, and associated costs is crucial for effective financial planning. This section will provide a clear overview to help you manage your student loan debt effectively.

Federal Student Loan Types

Federal student loans are offered by the U.S. government and generally come with more borrower protections than private loans. They are categorized into several types, each with its own eligibility requirements and terms. The main types include:

- Direct Subsidized Loans: These loans are for undergraduate students demonstrating financial need. The government pays the interest while you’re in school, during grace periods, and during periods of deferment.

- Direct Unsubsidized Loans: These loans are available to both undergraduate and graduate students, regardless of financial need. Interest accrues from the time the loan is disbursed, even while you’re in school.

- Direct PLUS Loans: Graduate and professional students, as well as parents of dependent undergraduate students, can borrow these loans. Credit checks are performed, and borrowers must meet specific credit requirements.

Federal Student Loan Repayment Plans

Several repayment plans are available to help borrowers manage their monthly payments. The best plan for you will depend on your individual financial circumstances. Choosing the right plan can significantly impact your total interest paid over the life of the loan.

- Standard Repayment Plan: This plan typically involves fixed monthly payments over 10 years.

- Graduated Repayment Plan: Payments start low and gradually increase over time.

- Extended Repayment Plan: This plan extends the repayment period, leading to lower monthly payments but higher total interest paid.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payment on your income and family size. They include options like the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans.

Interest Rates and Fees

Interest rates and fees vary depending on the type of loan and the year the loan was disbursed. Federal student loan interest rates are set annually by the government, while private loan interest rates are determined by the lender based on creditworthiness. Fees, such as origination fees, might also apply to both federal and private loans. It’s essential to check the specific terms of your loan agreement for detailed information on interest rates and fees. For example, in recent years, federal student loan interest rates have generally ranged from 2% to 7% depending on the loan type and the borrower’s financial situation. Private loan rates, however, can vary significantly, sometimes exceeding 10% for borrowers with less-than-perfect credit.

Federal vs. Private Student Loans

Understanding the key differences between federal and private student loans is vital for making informed borrowing decisions.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower, set annually by the government | Variable, often higher, based on creditworthiness |

| Borrower Protections | More robust, including income-driven repayment plans and deferment options | Fewer protections, repayment options may be limited |

| Eligibility | Based on enrollment status and financial need (for some loans) | Based on creditworthiness and income |

| Fees | Origination fees may apply | Origination fees and other fees may apply |

Exploring Repayment Options

Choosing the right student loan repayment plan is crucial for managing your debt effectively and minimizing long-term financial strain. Several options exist, each with its own set of advantages and disadvantages, tailored to different financial situations and priorities. Understanding these options empowers you to make informed decisions and create a repayment strategy that aligns with your individual circumstances.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans base your monthly payment on your income and family size. This means lower monthly payments compared to standard plans, potentially making repayment more manageable, especially during periods of lower income. However, IDR plans typically extend the repayment period, leading to higher total interest paid over the life of the loan. This extended repayment period can also impact your credit score, as it shows a longer history of debt. Specific IDR plans include Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR), each with slightly different eligibility criteria and calculation methods. For example, a borrower with a low income might find an IDR plan significantly reduces their monthly burden, but the extended repayment term could result in paying thousands more in interest.

Standard Repayment Plans versus Extended Repayment Plans

Standard repayment plans involve fixed monthly payments over a 10-year period. This offers the advantage of paying off your loans quickly, minimizing the total interest paid. However, the fixed monthly payments can be substantial, potentially creating financial hardship for some borrowers. Extended repayment plans, on the other hand, stretch the repayment period to up to 25 years. This lowers the monthly payment, making it more affordable, but significantly increases the total interest paid. A borrower might choose a standard plan to minimize long-term costs despite the higher monthly payments, while someone with a lower income might opt for an extended plan to manage their monthly expenses, accepting the increased overall cost.

Applying for an Income-Driven Repayment Plan

Applying for an IDR plan typically involves completing a form online through the student loan servicer’s website. You will need to provide information about your income, family size, and other relevant financial details. The servicer will then calculate your monthly payment based on the chosen IDR plan’s formula. Documentation, such as tax returns or pay stubs, may be required to verify your income. Once approved, your monthly payment will be adjusted accordingly. The application process usually takes several weeks, and it’s important to submit all necessary documentation promptly to avoid delays. Failure to provide accurate information can result in an inaccurate payment calculation and potential future complications.

Choosing a Repayment Plan

The following flowchart illustrates the decision-making process:

[Flowchart Description: The flowchart begins with a starting point “Choosing a Repayment Plan?”. It branches into two main paths: “Can I afford the standard 10-year repayment plan?” Yes leads to “Standard Repayment Plan”. No leads to “Consider Income-Driven Repayment (IDR) Plans?”. Yes leads to “Apply for IDR Plan, considering factors like income, family size, and long-term interest costs.” No leads to “Consider Extended Repayment Plan (longer repayment period, higher total interest).” All paths end with “Chosen Repayment Plan.”]

Loan Forgiveness and Cancellation Programs

Navigating the complexities of student loan repayment can be daunting. Fortunately, several programs exist to offer relief through loan forgiveness or cancellation. Understanding the eligibility criteria and specific requirements for each program is crucial to determining your potential for assistance. This section will Artikel key programs and situations where loan cancellation might be possible.

Public Service Loan Forgiveness (PSLF)

Public Service Loan Forgiveness (PSLF) is a program designed to forgive the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility hinges on several factors. You must have Direct Loans (not Federal Family Education Loans or Perkins Loans), be employed full-time by a qualifying employer, and make 120 qualifying payments. “Qualifying” payments require adherence to an income-driven repayment plan and consistent employment. It’s important to note that even a single missed payment or a period of non-qualifying employment can significantly impact your eligibility. The Department of Education website provides a comprehensive list of qualifying employers and detailed information on the application process.

Teacher Loan Forgiveness

The Teacher Loan Forgiveness program offers forgiveness of up to $17,500 on your Direct Subsidized and Unsubsidized Loans, as well as Stafford Loans. To qualify, you must teach full-time for five complete and consecutive academic years in a low-income school or educational service agency. This program is designed to incentivize individuals to pursue careers in education, particularly in underserved communities. The definition of “low-income school” is clearly defined by the Department of Education and varies by location. Documentation of employment and service is required for forgiveness.

Loan Cancellation Situations

Several situations can lead to loan cancellation, although these are less common than forgiveness programs. For example, a borrower may be eligible for cancellation if their school closes or if they are found to be a victim of fraud or misrepresentation by their institution. In cases of total and permanent disability, loan cancellation may also be an option. These situations require significant documentation and verification from relevant authorities. Each case is reviewed individually, and the process can be lengthy. It is essential to gather all necessary documentation to support your claim.

Resources for Finding Loan Forgiveness Programs

Locating information about loan forgiveness programs can be simplified by using the following resources:

- The U.S. Department of Education website: This website provides comprehensive information on all federal student loan programs, including forgiveness and cancellation options.

- StudentAid.gov: This website offers a user-friendly interface to manage your federal student loans and access information about repayment plans and forgiveness programs.

- Your loan servicer: Your loan servicer can provide personalized guidance and information relevant to your specific loan situation and eligibility for forgiveness programs.

- National Student Loan Data System (NSLDS): NSLDS is a central database that provides information on your federal student loans, including your loan history and repayment status.

Managing Your Student Loan Debt

Successfully navigating student loan repayment requires proactive management and a clear understanding of your financial situation. This involves creating a realistic budget, prioritizing loan payments, and knowing how to handle potential difficulties. Failing to manage your debt effectively can lead to serious financial consequences.

Budgeting and Prioritizing Loan Payments

Effective budgeting is crucial for successful student loan repayment. A well-structured budget allows you to allocate funds for essential expenses while ensuring consistent loan payments. Prioritizing your loans often means focusing on high-interest loans first to minimize long-term interest accrual. Consider using budgeting apps or spreadsheets to track your income and expenses, allowing for a clear visualization of your financial standing. This enables informed decision-making regarding loan repayment strategies.

Consequences of Defaulting on Student Loans

Defaulting on your student loans has severe repercussions. These include damage to your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, where a portion of your paycheck is automatically seized to pay your debt, is a common consequence. Furthermore, the government may take tax refunds to settle your debt. The long-term financial implications of default can be significant, hindering your ability to achieve financial stability. In some cases, default can even lead to legal action.

Negotiating with Your Loan Servicer

Negotiating with your loan servicer can potentially alleviate financial strain. If you are experiencing temporary financial hardship, contacting your servicer to discuss options like forbearance or deferment is crucial. These programs temporarily suspend or reduce your payments. It’s important to clearly explain your situation and provide supporting documentation. You might also be able to negotiate a lower monthly payment amount or consolidate your loans into a single payment plan with a potentially lower interest rate. Remember to document all communications with your servicer.

Sample Budget for Effective Debt Management

A well-structured budget is essential for effective debt management. The following sample budget illustrates how to allocate funds while prioritizing loan payments. Remember that this is a sample, and your individual budget will need to reflect your specific income and expenses.

- Income: $3,000 per month (after taxes)

- Housing: $1,000 (rent or mortgage)

- Transportation: $300 (car payment, gas, insurance)

- Food: $500 (groceries, eating out)

- Utilities: $200 (electricity, water, internet)

- Student Loan Payment: $500 (prioritized high-interest loan)

- Savings: $100 (emergency fund and long-term goals)

- Other Expenses: $400 (entertainment, clothing, etc.)

This sample budget demonstrates a clear allocation of funds, prioritizing essential expenses and student loan repayment while still allowing for savings. Adjusting categories to reflect your personal circumstances is crucial for creating a realistic and effective budget.

Consolidation and Refinancing

Student loan consolidation and refinancing are powerful tools that can significantly impact your repayment journey. Understanding the nuances of each, however, is crucial to making informed decisions that align with your financial goals. Both processes aim to simplify your loan repayment, but they differ significantly in their mechanics and implications.

Advantages and Disadvantages of Student Loan Consolidation

Consolidation, primarily applied to federal student loans, combines multiple federal loans into a single loan with a new repayment plan. A key advantage is the simplification of managing multiple loans and payments. This streamlined approach can make budgeting easier and reduce the risk of missed payments. However, consolidation doesn’t necessarily lower your interest rate. In fact, your new interest rate will be a weighted average of your existing rates, potentially leading to a slightly higher overall interest paid over the life of the loan. Furthermore, you may lose access to certain repayment plans or forgiveness programs available for specific loan types. It’s crucial to carefully weigh these trade-offs before consolidating.

Refinancing Federal vs. Private Student Loans

Refinancing, on the other hand, involves replacing your existing loans (federal or private) with a new loan from a private lender. The process for refinancing federal loans differs significantly from refinancing private loans. Refinancing federal loans often requires a credit check and may involve losing benefits associated with federal loan programs, such as income-driven repayment plans or public service loan forgiveness. Refinancing private loans typically involves a similar process to refinancing any other loan, focusing on credit score, debt-to-income ratio, and the loan amount requested. The lender will assess your creditworthiness and offer a new loan with potentially lower interest rates and/or a more favorable repayment term.

Factors to Consider When Refinancing Student Loans

Several factors influence the decision to refinance. Your credit score is paramount; a higher score usually translates to better interest rates. Your debt-to-income ratio (DTI) also plays a crucial role, as a lower DTI indicates lower financial risk to the lender. The interest rate offered is another key consideration. Compare rates from multiple lenders to ensure you’re securing the most favorable terms. Finally, consider the loan term; a shorter term means higher monthly payments but lower overall interest paid, while a longer term results in lower monthly payments but higher overall interest.

Potential Impact of Refinancing on Monthly Payments and Overall Interest Paid

The impact of refinancing on your monthly payments and total interest paid can be substantial. Let’s illustrate with an example:

| Scenario | Original Loan | Refinanced Loan | Monthly Payment Difference | Total Interest Paid Difference |

|---|---|---|---|---|

| Example 1: Lower Interest Rate | $50,000, 7%, 10 years | $50,000, 5%, 10 years | -$100 (approx.) | -$4,000 (approx.) |

| Example 2: Longer Loan Term | $50,000, 7%, 10 years | $50,000, 7%, 15 years | -$200 (approx.) | +$7,000 (approx.) |

*Note: These are approximate figures and actual savings or costs will vary depending on the specific loan terms and individual circumstances.* The table highlights that while refinancing can reduce monthly payments, it may increase the total interest paid over the loan’s lifetime if a longer repayment term is chosen. Conversely, securing a lower interest rate can significantly reduce both monthly payments and overall interest paid. It is essential to carefully analyze the potential impact before making a decision.

Seeking Professional Help

Navigating the complexities of student loan debt can be overwhelming, even with a thorough understanding of repayment options and forgiveness programs. Seeking professional guidance can significantly improve your ability to manage your debt effectively and make informed decisions about your financial future. A range of resources are available to provide support and expertise.

Financial counseling and debt management services offer valuable assistance in creating a personalized plan to tackle student loan debt. These services often provide guidance on budgeting, debt consolidation, and negotiating with lenders, ultimately aiming to reduce stress and improve your financial well-being.

Resources for Financial Counseling and Debt Management

Numerous organizations offer free or low-cost financial counseling services. These services are often provided by non-profit credit counseling agencies accredited by the National Foundation for Credit Counseling (NFCC) or other reputable organizations. They can offer personalized guidance based on your individual financial situation and student loan debt. Many universities also have financial aid offices that provide free counseling to their alumni. Additionally, some government agencies offer similar programs, although these programs may have specific eligibility criteria.

The Role of a Credit Counselor in Assisting with Student Loan Debt

A credit counselor acts as a guide, helping you understand your financial situation and develop a manageable plan to repay your student loans. They can help you analyze your budget, identify areas for savings, and explore various repayment options, including income-driven repayment plans and loan consolidation. They can also assist in negotiating with your lenders to potentially lower interest rates or modify repayment terms. Importantly, a reputable credit counselor will not offer solutions that involve paying exorbitant fees or engaging in questionable financial practices. Their primary goal is to empower you to take control of your finances.

Non-Profit Organizations that Provide Student Loan Assistance

Several non-profit organizations specialize in providing support and resources for individuals struggling with student loan debt. These organizations often offer educational materials, workshops, and one-on-one counseling sessions. They may also advocate for policy changes to improve student loan repayment systems. Examples include the National Foundation for Credit Counseling (NFCC) and the Student Borrower Protection Center. These organizations can provide valuable information and guidance on navigating the complexities of student loan repayment.

Questions to Ask a Financial Advisor About Student Loan Debt

Before engaging a financial advisor, it’s crucial to prepare a list of questions to ensure you receive tailored and relevant advice. The answers will help you make informed decisions about your financial future.

- What are the different repayment options available to me given my income and loan types?

- What is the potential long-term cost of each repayment option, considering interest accrual?

- Are there any loan forgiveness or income-driven repayment plans I qualify for?

- Would consolidating or refinancing my loans be beneficial in my specific situation?

- What strategies can you recommend to help me create a realistic budget to manage my student loan payments?

- What are the potential risks and benefits of each repayment strategy?

- What is your fee structure and how will you be compensated for your services?

- What is your experience in assisting clients with student loan debt management?

- Can you provide references from previous clients who have successfully managed their student loan debt with your help?

- What is your process for monitoring my progress and making adjustments to my plan as needed?

Understanding the Legal Aspects

Navigating the complexities of student loan debt often requires understanding the legal rights and responsibilities borrowers possess. This section Artikels key legal considerations, emphasizing the importance of proactive engagement to protect your financial well-being. Failure to understand these aspects can lead to significant financial and legal repercussions.

Borrower Rights and Responsibilities

Borrowers have specific rights and responsibilities under federal and state laws. These rights include the right to accurate information about loan terms, repayment options, and the process for resolving disputes. Responsibilities include making timely payments according to the loan agreement and maintaining open communication with your loan servicer. Failing to fulfill these responsibilities can result in negative consequences, such as default, which can severely impact your credit score and financial future. For example, borrowers have the right to request loan modification or forbearance if facing financial hardship, but the responsibility rests with them to proactively seek these options and provide necessary documentation.

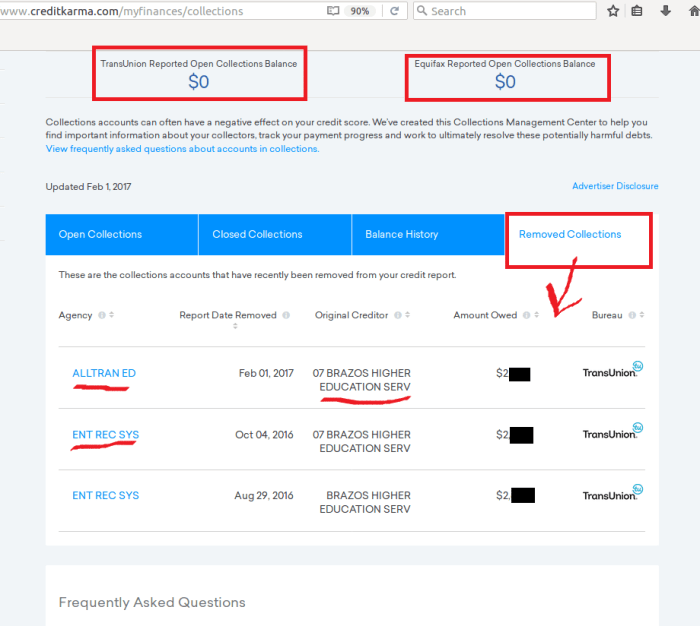

Disputing Inaccurate Credit Report Information

Inaccurate information on your credit report related to student loans can significantly harm your credit score and ability to obtain loans or credit in the future. The Fair Credit Reporting Act (FCRA) provides a process for disputing such inaccuracies. First, obtain a copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion). Carefully review the report for any inaccuracies concerning your student loans, such as incorrect loan amounts, late payments that were actually made on time, or loans that are not yours. If you find errors, you must submit a dispute letter to each bureau detailing the inaccuracies and providing supporting documentation, such as payment confirmations or loan agreements. The credit bureau is then obligated to investigate and correct the error if the information is found to be inaccurate. Failure to respond promptly and thoroughly to the bureau’s investigation could jeopardize your efforts to resolve the issue.

Common Legal Issues Related to Student Loan Debt

Several common legal issues arise concerning student loan debt. These include wage garnishment, tax refund offset, and lawsuits by loan servicers. Wage garnishment is a legal process where a portion of your wages is withheld to repay your student loans. Tax refund offset allows the government to seize a portion of your tax refund to pay off your student loan debt. Loan servicers may pursue legal action against borrowers who have defaulted on their loans. Understanding these potential legal consequences is crucial for borrowers to take proactive steps to avoid default and manage their debt responsibly. For instance, a borrower consistently missing payments might face wage garnishment, leading to a significant reduction in their disposable income.

Consequences of Fraudulent Activity

Fraudulent activity related to student loans can have severe consequences. This includes identity theft, where someone uses your personal information to obtain student loans in your name, and loan scams, where individuals or organizations make false promises about loan forgiveness or repayment assistance. The consequences of such fraudulent activities can be far-reaching, impacting your credit score, financial stability, and even leading to criminal charges. For example, a borrower who falls victim to a loan scam might lose significant funds and suffer severe damage to their credit rating, making it challenging to secure future loans or even rent an apartment. Reporting fraudulent activity to the appropriate authorities, such as the Federal Trade Commission (FTC) and your loan servicer, is crucial to mitigate the damage and prevent further harm.

End of Discussion

Successfully managing and potentially discharging student loan debt requires a proactive and informed approach. This guide has provided a comprehensive overview of available options, from exploring various repayment plans and loan forgiveness programs to understanding the legal aspects and seeking professional assistance. Remember, taking control of your financial future is achievable through careful planning, strategic decision-making, and the utilization of available resources. By understanding your options and actively engaging with the process, you can significantly improve your chances of achieving financial freedom.

Helpful Answers

What happens if I can’t make my student loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in wage garnishment or tax refund offset. Contact your loan servicer immediately to explore options like forbearance or deferment.

Can I discharge my student loans through bankruptcy?

Discharging student loans through bankruptcy is extremely difficult and requires demonstrating undue hardship. This is a high bar to meet, and legal counsel is strongly recommended.

What is the difference between forbearance and deferment?

Forbearance temporarily suspends payments, but interest usually still accrues. Deferment temporarily suspends both payments and interest accrual, often under specific circumstances (e.g., unemployment).

How do I find my student loan servicer?

Your loan servicer information can usually be found on your loan documents or through the National Student Loan Data System (NSLDS).