Navigating the world of student loans can feel overwhelming, especially when you’re unsure where to begin. Understanding your loan details—from the type of loan you have to your repayment options—is crucial for responsible financial management. This guide provides a clear path to finding the information you need, empowering you to take control of your student loan journey.

From locating your loan servicer and accessing your loan details online to exploring repayment plans and understanding loan forgiveness programs, we’ll cover all the essential steps. We’ll also address common concerns and provide helpful resources to guide you through every stage of the process, ensuring a smoother and more informed experience.

Understanding Your Student Loan Situation

Navigating the world of student loans can feel overwhelming, but understanding the basics of your loan type and accessing your loan information is the first step towards effective repayment. This section will guide you through identifying your loan type, accessing your loan information, and organizing your records.

Federal Student Loan Types

Federal student loans are offered by the U.S. government and come in several forms, each with its own repayment terms and interest rates. Knowing which type of loan you have is crucial for understanding your repayment responsibilities. The main types include:

- Direct Subsidized Loans: The government pays the interest while you’re in school at least half-time, during grace periods, and during periods of deferment.

- Direct Unsubsidized Loans: Interest accrues from the time the loan is disbursed, even while you’re in school.

- Direct PLUS Loans: These loans are available to graduate and professional students, and parents of undergraduate students. Credit checks are typically required.

- Federal Perkins Loans: These loans are offered by participating colleges and universities and have lower interest rates than other federal loans. However, they are less commonly available now.

Obtaining Your NSLDS Report

The National Student Loan Data System (NSLDS) is a centralized database containing information on federal student loans. Accessing your NSLDS report provides a comprehensive overview of your federal student loan history. To obtain your report:

- Visit the NSLDS website (studentaid.gov/nslds).

- You will need your Federal Student Aid (FSA) ID to log in. If you don’t have one, you’ll need to create one on the website.

- Once logged in, you can view your loan information, including loan amounts, loan types, and servicer information.

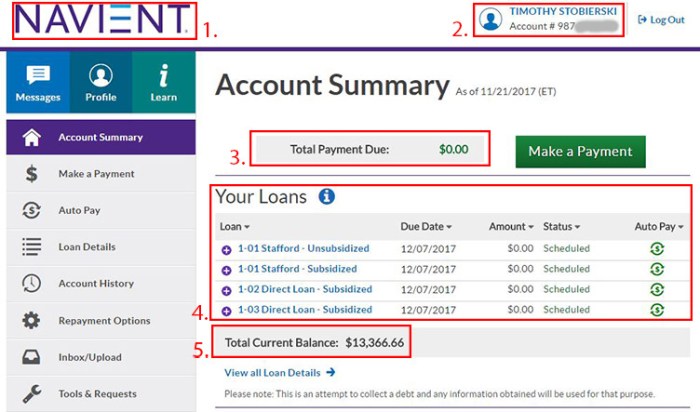

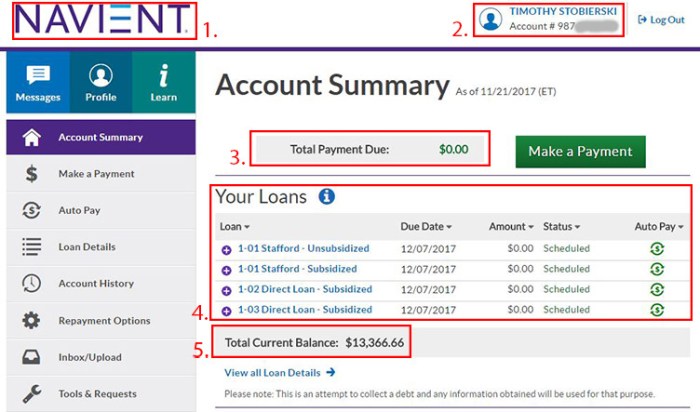

Accessing Your Loan Servicer’s Website

Your loan servicer is the company responsible for managing your student loans. They handle billing, payment processing, and other important functions. To access your loan servicer’s website:

- Locate your loan servicer’s name on your NSLDS report or your loan documents.

- Search for your loan servicer’s website online. Most servicers have user-friendly websites with secure login portals.

- Log in using your username and password (you may need to create an account if this is your first time accessing the website).

- Once logged in, you’ll typically find a dashboard showing your loan balance, payment due date, repayment plan, and other relevant information.

Organizing Loan Information from Multiple Servicers

If you have loans from multiple servicers, keeping track of everything can be challenging. To stay organized:

Consider creating a spreadsheet to consolidate all your loan information. Include details such as loan servicer name, loan type, loan balance, interest rate, minimum monthly payment, and due date for each loan. Regularly update this spreadsheet to reflect any changes in your loan balances or payment schedules. This centralized record will help you stay on top of your repayment responsibilities.

Locating Your Loan Servicer

Knowing who your student loan servicer is crucial for managing your loans effectively. Your servicer handles your payments, provides account information, and assists with any loan-related questions or issues. Fortunately, there are several ways to identify your servicer.

Finding your loan servicer typically involves reviewing your loan documents. Your original loan paperwork, such as your promissory note or welcome letter, should clearly state the name and contact information of your servicer. Statements and other correspondence from your servicer will also contain this information. If you have access to your online student loan account, this will often display your current servicer as well. Check any email correspondence you may have received regarding your loans; this may contain a link to your loan servicer’s website.

Finding Your Servicer When Loan Documents Are Unavailable

If you can’t locate your loan documents, a systematic approach will help you identify your servicer. The following flowchart Artikels the steps to take:

[Flowchart Description: The flowchart begins with a “Start” box. It then branches to “Do you have access to the National Student Loan Data System (NSLDS)?”. A “Yes” branch leads to a box indicating checking NSLDS for servicer information, followed by an “End” box. A “No” branch leads to “Contact the Federal Student Aid website”. This leads to a box stating “Use the contact information to inquire about your servicer”. This box then leads to an “End” box. The flowchart visually represents the decision-making process and the paths to finding the servicer information.]

Common Student Loan Servicers

The following table compares contact information and services offered by some common student loan servicers. Note that servicers can change, and this information may not be exhaustive or completely up-to-date. Always verify information directly with the servicer or the Department of Education.

| Servicer Name | Phone Number | Website URL | Key Services |

|---|---|---|---|

| (Example Servicer 1 – Replace with actual servicer) | (Example Phone Number – Replace with actual number) | (Example Website URL – Replace with actual URL) | (Example Services – e.g., Payment processing, account management, deferment/forbearance applications) |

| (Example Servicer 2 – Replace with actual servicer) | (Example Phone Number – Replace with actual number) | (Example Website URL – Replace with actual URL) | (Example Services – e.g., Payment processing, account management, income-driven repayment plan enrollment) |

| (Example Servicer 3 – Replace with actual servicer) | (Example Phone Number – Replace with actual number) | (Example Website URL – Replace with actual URL) | (Example Services – e.g., Payment processing, customer support, loan consolidation options) |

The Department of Education’s Role in Student Loan Servicing

The U.S. Department of Education (ED) plays a significant oversight role in the student loan servicing process. While private companies handle the day-to-day servicing of many federal student loans, the ED establishes the standards and regulations that servicers must follow. The ED also monitors servicers’ performance to ensure borrowers receive fair and accurate treatment. Borrowers can contact the ED if they have concerns about their servicer’s actions or if they are unable to resolve an issue directly with their servicer. The ED provides resources and support to help borrowers understand their loan options and manage their repayment.

Accessing Your Loan Details

Once you’ve located your loan servicer, accessing your loan details is usually straightforward. Most servicers offer secure online portals providing a comprehensive overview of your student loan(s). This allows you to track payments, understand your repayment plan, and manage your account effectively.

Logging into Your Loan Servicer’s Online Account

Accessing your online account typically involves navigating to your servicer’s website and locating a login portal, usually clearly labeled as “My Account,” “Login,” or a similar phrase. You’ll need your username and password, which you may have created during the initial loan process or may have received in a welcome email. If you’ve forgotten your login details, most servicers offer password reset options, often involving answering security questions or receiving a verification code via email or text message. If you encounter difficulties logging in, contacting your servicer’s customer support is recommended. They can provide assistance and verify your identity to regain access to your account.

Interpreting Your Loan Statement

Your loan statement is a crucial document that summarizes your loan’s current status. It typically includes several key pieces of information. The principal balance represents the original loan amount minus any payments made. Interest is the cost of borrowing money, calculated on the outstanding principal balance. The repayment schedule Artikels your monthly payment amount, the total number of payments, and the anticipated loan payoff date. You’ll also find details about your current payment status, any late payments, and any fees or penalties incurred. For example, a statement might show a principal balance of $20,000, a monthly interest accrual of $150, a monthly payment of $300, and a remaining repayment period of 72 months.

Common Student Loan Terms

Understanding common student loan terms is essential for effective loan management. Here are a few examples:

- Principal: The original amount of the loan borrowed.

- Interest: The cost of borrowing money, typically expressed as a percentage (annual percentage rate or APR).

- Amortization: The process of paying off a loan through regular payments, gradually reducing both the principal and interest.

- Repayment Schedule: A plan outlining the amount, frequency, and duration of loan payments.

- Deferment: A temporary postponement of loan payments, often granted under specific circumstances (e.g., unemployment).

- Forbearance: A temporary reduction or suspension of loan payments, typically granted due to financial hardship.

- Default: Failure to make loan payments according to the repayment schedule, leading to potential negative consequences.

Calculating Your Monthly Payment

Calculating your monthly payment requires several pieces of information. You’ll need the loan principal (the original amount borrowed), the interest rate (APR), and the loan term (length of the repayment period in months or years). While some online calculators are available, the basic formula for calculating monthly payments is complex and often requires specialized financial software. However, your loan statement will already provide this information, eliminating the need for manual calculation. For example, a $10,000 loan with a 5% APR over 10 years might result in a monthly payment of approximately $106.

Exploring Repayment Options

Choosing the right student loan repayment plan is crucial for managing your debt effectively and minimizing long-term financial strain. Different plans offer varying payment amounts and durations, impacting your monthly budget and the total interest paid over the life of the loan. Understanding the nuances of each plan is essential to make an informed decision that aligns with your individual financial circumstances.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It typically involves fixed monthly payments over a 10-year period. Eligibility is automatic upon loan disbursement and requires no special application. While this plan offers the shortest repayment timeline, leading to less interest paid overall, the monthly payments can be higher than other plans, potentially straining your budget early on. For example, a $30,000 loan at 5% interest would result in approximately $330 monthly payments. The predictability of this plan is advantageous for those who prefer consistent, manageable payments and want to pay off their debt quickly.

Graduated Repayment Plan

The graduated repayment plan features lower initial monthly payments that gradually increase over time. This option can be attractive to recent graduates with potentially lower incomes, allowing them to manage their finances as their earnings grow. Eligibility is generally automatic, similar to the standard plan. However, while the lower starting payments provide short-term relief, the cumulative interest paid over the life of the loan will likely be higher than with the standard plan due to the extended repayment period (typically 10 years). A borrower might start with $200 monthly payments, which could increase to $400 or more over the ten-year period. This plan is suitable for those anticipating income growth but should be carefully considered in light of the increased long-term interest costs.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) tie your monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Eligibility requires applying through your loan servicer and demonstrating your income and family size. These plans generally offer lower monthly payments than standard or graduated plans, making them more manageable for borrowers with limited incomes. However, they often extend the repayment period to 20 or 25 years, potentially resulting in significantly higher interest paid over the loan’s lifetime. The extended repayment period can impact long-term financial goals, such as saving for a house or retirement. For example, a borrower earning $35,000 annually might qualify for a significantly lower monthly payment under an IDR plan compared to a standard plan, but they will pay considerably more in interest over the longer repayment period.

Resources for Borrowers Struggling with Repayment

It’s important to remember that help is available if you’re struggling to manage your student loan payments.

Understanding your options and seeking assistance is key to avoiding delinquency and default.

- Your loan servicer: They can provide information on repayment plans, deferment, forbearance, and other options.

- The National Student Loan Data System (NSLDS): This website allows you to access your federal student loan information.

- StudentAid.gov: The official U.S. Department of Education website offers comprehensive information on federal student aid.

- Consumer Financial Protection Bureau (CFPB): The CFPB provides resources and guidance on managing debt.

- Nonprofit credit counseling agencies: These agencies offer free or low-cost financial counseling services.

Understanding Loan Forgiveness and Deferment

Navigating the complexities of student loan repayment often involves understanding options like loan forgiveness programs and temporary payment pauses through deferment or forbearance. These options can provide crucial relief, but it’s essential to understand their eligibility criteria and potential consequences.

Eligibility Criteria for Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, each with specific eligibility requirements. These programs often target borrowers working in public service, those with disabilities, or those who have made consistent payments for a significant period. For example, the Public Service Loan Forgiveness (PSLF) program requires 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying government or non-profit organization. Other programs, like the Teacher Loan Forgiveness program, have different eligibility criteria, focusing on specific professions and service requirements. It’s crucial to carefully review the program guidelines for specific details and requirements.

Deferment and Forbearance Differences

Deferment and forbearance are both temporary pauses on student loan payments, but they differ significantly in their eligibility criteria and impact. Deferment is generally granted due to specific circumstances like unemployment, economic hardship, or enrollment in school. The interest on subsidized loans is typically not accrued during a deferment period. Forbearance, on the other hand, is granted when a borrower experiences temporary financial difficulties. Interest usually continues to accrue during forbearance, increasing the total loan amount owed. Choosing between deferment and forbearance depends heavily on individual circumstances and the type of loan held.

Applying for Loan Deferment or Forbearance

Applying for deferment or forbearance typically involves contacting your loan servicer. A step-by-step process usually includes:

- Gathering necessary documentation: This may include proof of unemployment, enrollment in school, or financial hardship.

- Submitting a formal request: This is usually done through your servicer’s online portal or by mail.

- Review and approval: Your servicer will review your application and notify you of their decision.

- Monitoring your account: Regularly check your account to ensure the deferment or forbearance is correctly applied.

The specific requirements and application process may vary depending on your loan servicer and the type of loan you have.

Impact on Credit Score

While deferment and forbearance can provide temporary relief, they can negatively impact your credit score. This is because these actions indicate a delay in loan payments, which can be interpreted as a sign of financial instability by credit bureaus. The severity of the impact depends on several factors, including the length of the deferment or forbearance period and your overall credit history. A borrower with a strong credit history may experience a less significant drop than someone with a weak credit history. It is crucial to weigh the short-term benefits of a payment pause against the potential long-term impact on creditworthiness. Responsible financial planning and timely repayment after the deferment or forbearance period is crucial to mitigate potential negative effects.

Dealing with Delinquency or Default

Falling behind on your student loan payments can have serious consequences. Understanding the implications of delinquency and default is crucial for protecting your financial future. This section Artikels the potential repercussions and details steps you can take to address these challenges.

Delinquency, or missing payments, and default, or failing to make payments for an extended period, trigger significant negative impacts. These include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. The severity of the consequences increases with the length of time the loan remains delinquent or in default. For example, a single missed payment might result in a minor credit score ding, while prolonged default can lead to significant financial hardship and legal action.

Consequences of Delinquency and Default

Delinquency and default significantly impact your financial well-being. A delinquent loan negatively affects your credit score, making it harder to secure loans, mortgages, or even rent an apartment in the future. Default can lead to more severe consequences, such as wage garnishment (a portion of your paycheck being seized to repay the debt), the offsetting of your tax refund, and even legal action. Furthermore, your ability to obtain credit cards or other forms of credit will be severely limited. The negative effects can persist for years, making it challenging to rebuild your financial stability.

Options for Borrowers Facing Delinquency or Default

Several options exist for borrowers struggling with delinquent or defaulted student loans. These include loan rehabilitation, loan consolidation, and income-driven repayment plans. Loan rehabilitation involves making a series of on-time payments to restore your loan to good standing. Consolidation combines multiple loans into a single loan with potentially more manageable monthly payments. Income-driven repayment plans adjust your monthly payments based on your income and family size. It’s important to explore all available options and choose the one best suited to your individual financial circumstances. Contacting your loan servicer is the first step in exploring these options.

Resources for Loan Rehabilitation and Consolidation

The federal government provides several resources to assist borrowers facing delinquency or default. The Federal Student Aid website (studentaid.gov) offers detailed information on loan rehabilitation and consolidation programs, including eligibility requirements and application procedures. Additionally, many non-profit organizations provide free counseling and assistance to borrowers struggling with student loan debt. These organizations can help you navigate the complexities of the loan repayment process and explore the most appropriate options for your situation. Seeking professional guidance can significantly improve your chances of successfully resolving your student loan debt.

Steps to Take if Contacted by a Debt Collector

If contacted by a debt collector regarding your student loan, remain calm and document the interaction. Obtain the collector’s name, company, and contact information. Request written verification of the debt, including the amount owed and the basis of the claim. Do not agree to any payment plan without fully understanding the terms and conditions. If you believe the debt is incorrect or you have already taken steps to resolve it, inform the collector in writing. Consider seeking legal advice if you are unsure how to proceed. Remember, you have rights under the Fair Debt Collection Practices Act, which protects you from abusive or unfair collection practices.

Visual Representation of Loan Information

Visual aids can significantly improve understanding of complex financial data like student loan repayment. Charts and graphs can clarify the repayment process and help borrowers make informed decisions. Two key visual representations are particularly useful: an amortization schedule and a repayment plan comparison chart.

Amortization Schedule Visualization

An amortization schedule visually displays the breakdown of each loan payment over the life of the loan. Imagine a table with columns for: “Payment Number,” “Payment Amount,” “Interest Paid,” “Principal Paid,” and “Remaining Balance.” Each row represents a single payment, showing how much of that payment goes towards interest and how much reduces the principal balance. The “Payment Amount” column would remain consistent (assuming a fixed-rate loan), while the “Interest Paid” portion decreases with each payment, and the “Principal Paid” portion increases correspondingly. The “Remaining Balance” column would steadily decrease until it reaches zero at the end of the loan term. A line graph could supplement the table, plotting the “Remaining Balance” over time, visually demonstrating the gradual reduction of the debt. This provides a clear picture of how the loan is paid down month by month.

Repayment Plan Comparison Chart

This chart would compare different repayment plan options, such as Standard, Extended, Graduated, and Income-Driven Repayment (IDR) plans. The chart would have columns for: “Repayment Plan,” “Monthly Payment,” “Total Interest Paid,” and “Loan Repayment Period.” Each row would represent a different repayment plan. A bar graph could be used to visually compare the “Monthly Payment” and “Total Interest Paid” for each plan. For instance, a bar graph could clearly show that an IDR plan might result in a lower monthly payment but a higher total interest paid over the life of the loan compared to a Standard plan. This allows for a quick and easy comparison of the financial implications of each repayment option, enabling borrowers to choose the plan that best suits their financial circumstances.

Epilogue

Successfully managing your student loans requires proactive engagement and a clear understanding of your options. By utilizing the resources and strategies Artikeld in this guide, you can effectively track your loan information, explore suitable repayment plans, and navigate any challenges that may arise. Remember, taking control of your student loan situation empowers you to build a secure financial future.

Quick FAQs

What if I can’t find my loan documents?

Contact the National Student Loan Data System (NSLDS) for a comprehensive report of your federal student loans. You can also contact the Department of Education directly.

What if my loan servicer is no longer servicing my loan?

Your loan may have been transferred to a new servicer. Check the NSLDS or contact the Department of Education to find out who your current servicer is.

Can I consolidate my multiple student loans?

Yes, consolidating your loans into a single loan can simplify repayment. Check with your loan servicer or the Department of Education for details and eligibility.

What happens if I miss a student loan payment?

Missing payments can lead to delinquency, negatively impacting your credit score and potentially resulting in default. Contact your servicer immediately if you anticipate difficulties making a payment to explore options like deferment or forbearance.