Navigating the complexities of student loan repayment can feel overwhelming, especially when you’re unsure where your loans are held. Understanding your loan servicer and accessing your loan information are crucial first steps towards effective repayment. This guide provides a clear path to locating your student loans, empowering you to take control of your financial future.

This process often involves checking your loan documents, utilizing online resources like the National Student Loan Data System (NSLDS), and contacting your lender directly. We’ll explore each of these methods, providing practical steps and tips to help you efficiently locate your student loan information and understand your repayment options.

Understanding Your Loan Servicer

Your student loan servicer acts as the intermediary between you and your lender. They handle the day-to-day management of your loans, including processing payments, answering your questions, and providing information about your loan terms and repayment options. Understanding your servicer’s role is crucial for effectively managing your student loan debt.

Student loan servicers are responsible for a wide range of tasks, from collecting your monthly payments to providing details about your loan balance, interest rate, and repayment schedule. They also handle forbearance and deferment requests, answer your questions about loan forgiveness programs, and assist with consolidation or refinancing options. Essentially, they are your point of contact for everything related to your student loans.

Common Student Loan Servicers in the United States

Several companies manage federal student loans. Knowing which company services your loans is the first step in effectively managing your debt. While the list of servicers can change, some of the most common include Nelnet, Navient, Great Lakes, FedLoan Servicing (now mostly transferred to Aidvantage), and MOHELA. It’s important to note that the servicer for your loans may change over time, so regularly checking your account information is recommended.

Locating Your Loan Servicer’s Contact Information

Finding your loan servicer’s contact information is straightforward using your loan documents or the National Student Loan Data System (NSLDS).

Your loan documents, such as your promissory note or welcome letter, will clearly state the name and contact information of your servicer. This is the most reliable source. If you can’t locate your documents, the NSLDS is a free, centralized database maintained by the U.S. Department of Education. You can access it online using your FSA ID, which allows you to view your federal student loan information, including your current servicer.

Comparison of Student Loan Servicer Features and Services

While most servicers offer similar core services, there can be variations in customer service responsiveness, online tools, and available repayment options. The following table offers a general comparison, but it’s important to check each servicer’s website for the most up-to-date information.

| Servicer | Online Account Management | Customer Service Accessibility | Repayment Plan Options |

|---|---|---|---|

| Nelnet | Robust online portal with detailed information and payment options. | Multiple contact methods including phone, email, and online chat. | Offers standard, graduated, extended, and income-driven repayment plans. |

| Navient | Comprehensive online platform with tools for managing payments and exploring repayment options. | Phone, email, and online support available. | Provides various repayment plan options, including income-driven plans. |

| Great Lakes | User-friendly online account access with payment and loan information. | Offers phone and online support. | Offers a range of repayment options to suit individual needs. |

| Aidvantage | Online portal for managing loans, making payments, and accessing account information. | Contact options typically include phone and email support. | Provides various repayment plans, including income-driven options. |

Utilizing the National Student Loan Data System (NSLDS)

The National Student Loan Data System (NSLDS) is a central database containing information on federal student loans. It’s a valuable resource for anyone needing to understand their loan details, including the lender and servicer. Accessing this information is crucial for effective loan management and repayment planning.

The NSLDS website provides a centralized location to view your federal student loan information, regardless of how many loans you have or from which lenders you borrowed. This eliminates the need to contact multiple lenders individually. Through the NSLDS, you can gain a comprehensive overview of your federal student loan portfolio.

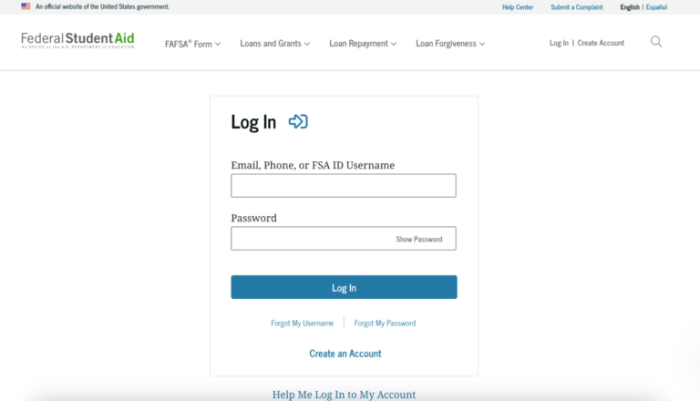

Accessing the NSLDS Website and Account Creation

To begin, navigate to the official NSLDS website. You will be presented with a login screen. If you are a first-time user, you will need to create an account. This typically involves providing your Social Security number, date of birth, and other identifying information to verify your identity. The website will guide you through a series of steps to securely create your account and establish a username and password. After successfully completing the account creation process, you will be able to log in and access your student loan information. Remember to keep your login credentials secure.

Identifying Student Loan Details Using the NSLDS

Once logged in, the NSLDS dashboard will present a summary of your federal student loan information. This summary typically includes the total amount borrowed, the number of loans, and a list of your lenders and servicers. By clicking on individual loan entries, you can access detailed information about each loan, including the loan type (e.g., Direct Subsidized Loan, Direct Unsubsidized Loan, Federal Perkins Loan), the original loan amount, the outstanding balance, the interest rate, and the repayment plan. The system clearly displays the name and contact information of the servicer responsible for managing each loan.

Understanding Loan Types and Interest Rates

The NSLDS displays different loan types, each with its own associated interest rate. Understanding these differences is vital for effective financial planning. For instance, subsidized loans may offer lower interest rates and defer interest accrual during certain periods (like while you are enrolled in school at least half-time), while unsubsidized loans accrue interest regardless of enrollment status. The NSLDS clearly indicates the interest rate for each loan, allowing you to compare the cost of borrowing across your different loans. This information is presented in a clear and concise manner, facilitating easy comparison and understanding.

Step-by-Step Guide to Retrieving Loan Information

1. Navigate to the NSLDS website: Open your web browser and go to the official NSLDS website address.

2. Create an account (if necessary): If you don’t have an account, click the “Create Account” or similar button. You’ll be prompted to provide personal information for verification. Follow the on-screen instructions carefully.

3. Log in: Enter your username and password. If you forgot your password, use the password reset functionality.

4. Access your loan information: Once logged in, the NSLDS dashboard will display a summary of your federal student loans.

5. Review loan details: Click on individual loans to see detailed information, including lender, servicer, loan type, interest rate, and outstanding balance. A screen showing a table of your loans with columns for each detail will appear.

6. Download or print (optional): Many systems allow you to download or print a summary of your loan information for your records.

Contacting Your Lender Directly

If you’ve had trouble locating your student loan information through the NSLDS or by contacting your loan servicer, contacting your lender directly is a viable next step. This approach allows you to obtain precise details about your loans from the source. Remember to gather your personal information beforehand to expedite the process.

Direct communication with your lender offers a personalized approach to managing your student loan debt. They possess the most comprehensive and up-to-date information concerning your specific loans. This method is particularly helpful when dealing with complex situations or requiring clarification on specific loan terms.

Methods of Contacting Your Lender

Several avenues exist for contacting your student loan lender. Choosing the best method depends on your preference and the urgency of your inquiry. Each method has its advantages and disadvantages.

- Phone: Provides immediate interaction and allows for clarification of complex issues. However, hold times can be lengthy, and you may not receive a detailed written record of the conversation.

- Email: Offers a convenient way to contact your lender, allowing for a documented record of your inquiry and response. However, it can be slower than a phone call and may not be suitable for urgent matters.

- Mail: A formal method suitable for sensitive information or situations requiring a paper trail. However, it’s the slowest method, and tracking your correspondence can be challenging.

Providing Necessary Identification Details

When contacting your lender, be prepared to provide identifying information to verify your identity and access your loan details. This typically includes your full name, date of birth, Social Security number (or student ID number), and loan account number(s). Failure to provide this information may delay or prevent access to your loan information.

Information Provided by Your Lender

Your lender will typically provide a comprehensive overview of your student loan portfolio. This information commonly includes:

- Outstanding Loan Balances: The current amount you owe on each loan.

- Repayment Plans: Details of your current repayment plan, including monthly payments, interest rates, and repayment term.

- Interest Rates: The interest rate applied to each of your loans, which may vary depending on the loan type and terms.

- Loan History: A record of your past payments and any delinquencies.

Reviewing Your Financial Aid Documents

Your financial aid award letters and acceptance packages are invaluable resources for tracking down your student loan information. These documents, often overlooked after the initial excitement of college acceptance, contain crucial details about your financial aid package, including the specifics of any student loans you received. Carefully reviewing these documents can save you considerable time and frustration in your search for loan details.

Your financial aid documents provide a detailed record of your financial aid package, including grants, scholarships, and loans. This information is essential for understanding the overall financial picture of your education and identifying the source of your student loans. The specific lender, loan type, loan amount, and interest rate are all typically included in these documents. This information is crucial for managing your loans effectively and making timely payments.

Key Information in Financial Aid Documents

Financial aid award letters and acceptance packages typically include several key pieces of information relevant to your student loans. This information helps you identify your lender and understand the terms of your loans. The absence of any of this data should prompt you to seek further clarification from your institution.

- Lender Name and Contact Information: This identifies the institution that provided the loan. This could be a government agency (like the Department of Education) or a private lender (like Sallie Mae or Discover).

- Loan Type: This specifies the type of loan (e.g., subsidized or unsubsidized federal loan, private loan). This impacts interest accrual and repayment terms.

- Loan Amount: This is the total amount of money borrowed for each loan.

- Interest Rate: This is the percentage charged on the outstanding loan balance.

- Repayment Terms: This includes details about when repayment begins, the length of the repayment period, and the monthly payment amount.

- Loan ID Number(s): This unique identifier is essential for tracking your loan(s) online.

Locating Old Financial Aid Documents

Locating old financial aid documents can sometimes be challenging. Many students store these documents digitally, in email inboxes or cloud storage, while others prefer physical copies. Regardless of the method, the passage of time and potential organizational changes can make retrieval difficult.

To overcome these challenges, systematically search your digital and physical files. Consider checking your email inbox (including spam and trash folders), cloud storage services, and any physical filing systems you may have. If you have moved, check storage units or previous addresses where you might have kept such documents. Contacting your college or university’s financial aid office may also yield results; they may retain copies of your financial aid award letters. Remember to use specific s when searching, such as “financial aid,” “student loan,” “award letter,” and the name of your college or university.

Checklist for Confirming Student Loan Details

Before you consider your search complete, it’s crucial to verify the information gathered. Use this checklist to ensure you have all the necessary details.

- Name of Lender: Verify the lender’s name matches the information on your loan documents and any online accounts.

- Loan Type(s): Confirm the type of loan(s) to understand repayment terms and interest rates.

- Loan Amount(s): Check that the loan amount(s) match the information in your documents.

- Interest Rate(s): Note the interest rate(s) and whether it’s fixed or variable.

- Loan ID Number(s): Record the unique identifier(s) for each loan.

- Repayment Start Date: Determine when your repayment period begins.

- Monthly Payment Amount(s): Check your documents to confirm the monthly payment amount(s).

Using Credit Reports

Credit reports, compiled by the three major credit bureaus—Equifax, Experian, and TransUnion—offer another avenue for locating your student loan information. While not as comprehensive as information directly from your loan servicer, they provide a valuable snapshot of your outstanding student loan debt. This method is particularly useful if you’ve lost track of your loan servicer or are unsure of the precise details of your loans.

Obtaining and Interpreting Credit Reports

Obtaining Credit Reports from the Three Major Credit Bureaus

You are entitled to a free credit report from each of the three major credit bureaus annually through AnnualCreditReport.com. This is the only official website authorized by law to provide these free reports; beware of imitations. The process involves providing personal information to verify your identity. Once verified, you can download or view your report online. Each bureau’s report will present your credit history, including any student loan accounts you hold.

Interpreting Credit Report Information on Student Loans

Your credit report lists your accounts, including student loans. Each entry will show the creditor (the lender or loan servicer), account number, credit limit (if applicable), current balance, payment history, and date opened. A negative payment history, such as late or missed payments, will be clearly indicated. Look for entries identified as “student loan,” “education loan,” or similar designations. The credit report won’t provide all the details a loan servicer would, but it will confirm the existence of the loan and some key financial aspects.

Comparison of Credit Report and Loan Servicer Information

While both sources provide information about your student loans, the scope and detail differ significantly. Credit reports offer a concise overview of your loan’s financial status, focusing primarily on payment history and outstanding balance. In contrast, your loan servicer provides a much more comprehensive picture, including loan type, interest rate, repayment plan, and future payment schedule.

Key Differences in Information Provided

| Feature | Credit Report | Loan Servicer |

|---|---|---|

| Loan Type | Generally indicated (e.g., student loan) | Specific loan type (e.g., subsidized Stafford Loan, unsubsidized Federal Loan) |

| Interest Rate | Not provided | Clearly stated |

| Repayment Plan | Not provided | Detailed repayment plan information |

| Payment History | Summarized (e.g., on-time, late, missed payments) | Complete payment history with dates and amounts |

| Outstanding Balance | Current balance | Current balance, principal amount, and accrued interest |

| Contact Information | Creditor’s name (often the loan servicer) | Complete contact information for the servicer |

Final Wrap-Up

Locating your student loans might seem daunting, but with the right tools and information, it’s a manageable task. By utilizing the NSLDS, contacting your lender or servicer, and reviewing your financial aid documents, you can gain a clear understanding of your loan details. Armed with this knowledge, you can confidently plan your repayment strategy and work towards financial freedom.

Common Queries

What if I can’t find my loan documents?

If you can’t locate your loan documents, the NSLDS is your best resource. You may also contact your college’s financial aid office for assistance.

What if my loan servicer’s contact information is outdated?

The NSLDS will have the most up-to-date information regarding your loan servicer. You can also contact your lender directly.

How often should I check my student loan information?

It’s advisable to review your loan information at least annually, or more frequently if your circumstances change.

What if I have multiple student loans from different lenders?

The NSLDS will consolidate this information, providing a comprehensive overview of all your federal student loans.