Navigating the complexities of student loan consolidation can feel overwhelming. Understanding whether your loans have been successfully consolidated is crucial for effective repayment planning and financial well-being. This guide provides a clear path to verifying your consolidation status, outlining the steps to take and the information you need to gather along the way. We’ll explore various methods for locating your loan information, interpreting your loan statements, and addressing potential issues that might arise during the process.

From understanding the benefits and drawbacks of consolidation to knowing how to contact your loan servicer, this comprehensive resource equips you with the knowledge and tools necessary to confidently manage your student loan debt. We’ll cover everything from checking your loan servicer’s website to deciphering your loan statements and understanding the implications of consolidation on your repayment plan and credit score.

Understanding Loan Consolidation

Student loan consolidation is the process of combining multiple federal student loans into a single loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount. Understanding the benefits and drawbacks is crucial before making a decision.

Benefits of Student Loan Consolidation

Consolidation offers several advantages. A single monthly payment streamlines budgeting and reduces the risk of missed payments. It can also simplify the repayment process by dealing with one loan servicer instead of multiple. Furthermore, depending on your situation and the chosen consolidation plan, you may qualify for income-driven repayment plans, potentially lowering your monthly payments further. However, it’s important to note that these benefits must be weighed against the potential drawbacks.

Drawbacks of Student Loan Consolidation

While consolidation simplifies repayment, it’s not always beneficial. Consolidating loans might result in a higher overall interest rate than the weighted average of your existing loans, leading to paying more interest over the life of the loan. Furthermore, consolidating federal loans into a private loan can lead to the loss of federal loan benefits, such as income-driven repayment plans and loan forgiveness programs. It’s essential to carefully evaluate your existing loan terms and the terms offered through consolidation before proceeding.

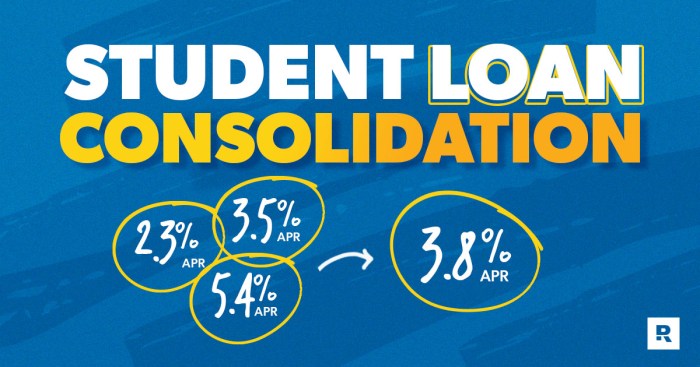

Interest Rates Before and After Consolidation

Your interest rate after consolidation will depend on the type of consolidation and your loan terms. For federal loan consolidation, a weighted average of your existing loan interest rates is usually used to determine the new rate. This means your new rate will likely be a weighted average of your current interest rates, and it may be higher, lower, or the same. For example, if you have loans with rates of 4%, 5%, and 6%, your consolidated rate might be around 5%. However, if you consolidate federal loans into a private loan, the interest rate will be determined by the private lender and is often based on your credit score, potentially leading to a higher rate.

Checking Your Loan Servicer’s Website for Consolidation Information

1. Locate your loan servicer: Find the name of the company managing your student loans. This information is typically available on your loan statements or the National Student Loan Data System (NSLDS) website.

2. Visit the servicer’s website: Go to your loan servicer’s official website.

3. Log in to your account: Access your online account using your login credentials.

4. Navigate to the consolidation section: Look for sections labeled “Consolidation,” “Refinancing,” or similar. The exact location may vary depending on the servicer.

5. Review your consolidation options: Check the available consolidation options, including interest rates, repayment plans, and any fees associated with the process.

Comparison of Loan Consolidation Programs

| Program | Eligibility | Interest Rate | Repayment Options |

|---|---|---|---|

| Federal Direct Consolidation Loan | Federal student loans | Weighted average of existing loans | Standard, graduated, extended, income-driven |

| Private Loan Consolidation | Federal and/or private student loans | Variable or fixed, based on creditworthiness | Varies by lender |

Locating Your Loan Information

After consolidating your federal student loans, confirming the successful consolidation is crucial. This involves locating your loan information through various reliable channels. Understanding where to look and what information to seek will significantly simplify the process.

Locating your updated loan information requires knowing your loan servicer and accessing your NSLDS account. These steps, combined with gathering relevant documentation, provide a comprehensive overview of your consolidated loans.

Finding Your Federal Student Loan Servicer

Your federal student loan servicer is the company responsible for managing your loan payments and providing account information. To find your servicer, you can visit the Federal Student Aid website (StudentAid.gov). This website offers a tool that allows you to log in using your FSA ID and quickly identify your current servicer. Alternatively, you can review your loan documents, such as your monthly statements or welcome letters, which clearly state your servicer’s name and contact information. If you’ve recently consolidated your loans, your new servicer’s information will be available through these methods.

Accessing Your National Student Loan Data System (NSLDS) Account

The National Student Loan Data System (NSLDS) is a central database containing information on federal student loans. To access your NSLDS account, you’ll need your FSA ID. Once logged in, you can view a comprehensive summary of your federal student loan history, including details of any consolidations. This includes your loan balances, interest rates, payment history, and servicer information. The NSLDS provides a single point of access for all your federal student loan information, regardless of the number of loans or servicers involved.

Key Information to Track Loan Consolidation Status

Several key pieces of information are crucial for tracking your loan consolidation status. This includes your new loan’s unique identifier (usually a loan number assigned after consolidation), the consolidated loan balance, the new interest rate (which should reflect the weighted average of your previous loans), and the name and contact information of your new loan servicer. Regularly checking your NSLDS account and your monthly statements from your new servicer will help you confirm the accuracy and completeness of the consolidation.

Checklist of Documents for Verifying Consolidated Loans

Gathering the following documents helps confirm your loan consolidation: your loan consolidation confirmation notice (sent by your servicer after successful consolidation), your most recent monthly statement from your new loan servicer, your NSLDS account summary showing the consolidated loan details, and any correspondence you received from your previous loan servicers regarding the consolidation process. Keeping these documents organized in a safe place will be beneficial for future reference.

Reasons for Difficulty Locating Loan Information Online

There are several reasons why someone might encounter difficulties locating their loan information online. Incorrect FSA ID or password details are a frequent cause. Another reason could be a delay in the loan consolidation process, where the updated information isn’t immediately reflected online. In some cases, technical issues with the NSLDS website or the servicer’s website might also create temporary access problems. Finally, if the loans weren’t federal loans, they wouldn’t appear in the NSLDS. Addressing these potential issues systematically should resolve most problems.

Verifying Consolidation Status

Confirming that your student loans have been successfully consolidated is a crucial step in managing your debt. Understanding how to interpret your loan servicer’s statements and knowing what to look for will help ensure you’re on the right track. This section will guide you through the process of verifying your consolidation status.

Interpreting Loan Servicer Statements to Confirm Consolidation

After consolidation, your loan servicer will provide statements reflecting the changes. These statements will show a single loan amount, representing the total of your previously separate loans. The statement should clearly indicate that the loan is a consolidated loan and provide a unique loan identification number for this new consolidated loan. Crucially, it will also reflect a new repayment schedule, often with a single monthly payment amount and a new interest rate. The absence of individual loan details from your previous loans will also signify successful consolidation.

Consolidated Loan Statement Examples

A consolidated loan statement might list a single loan number, a new, lower interest rate (often a weighted average of your previous rates), and a single monthly payment amount. For instance, imagine you had three loans totaling $30,000 with varying interest rates. Your consolidated statement would show a single loan amount of $30,000, a new, consolidated interest rate, and one payment amount. It would no longer list the individual loan details of the original three loans. Conversely, a statement showing separate loans with individual balances and interest rates indicates that consolidation has not yet been completed.

Consolidated Loan Versus Unsubsidized Loan

A consolidated loan combines multiple federal student loans into one single loan. An unsubsidized loan, on the other hand, is a type of student loan where interest accrues from the moment the loan is disbursed, regardless of your enrollment status. A loan can be both consolidated *and* unsubsidized. For example, you could consolidate several subsidized and unsubsidized loans into a single consolidated loan; however, the interest on the unsubsidized portion would continue to accrue. The key difference lies in the number of loans: consolidated loans are a single loan, while unsubsidized loans are a type of loan among many.

Contacting Your Loan Servicer

If you’re unable to locate information confirming your consolidation status on your own, contacting your loan servicer directly is the next step. Be prepared to provide your personal information, including your Social Security number and loan identification numbers, to verify your identity and access your loan details. They are equipped to provide the necessary clarification and support.

Questions to Ask Your Loan Servicer

Before contacting your loan servicer, it’s helpful to prepare a list of questions. This will help ensure you receive all the necessary information efficiently.

- What is the total amount of my consolidated loan?

- What is the interest rate of my consolidated loan?

- What is my monthly payment amount?

- What is the repayment schedule for my consolidated loan?

- What is the loan identification number for my consolidated loan?

- Are all of my previous loans included in the consolidation?

- What is the date of consolidation?

Understanding Your Loan Terms After Consolidation

Consolidating your student loans can significantly alter your repayment terms, impacting your monthly payments, overall interest paid, and even your credit score. Understanding these changes is crucial before proceeding with consolidation. This section will detail the key differences you might encounter.

Changes in Interest Rate

Consolidation typically results in a weighted average interest rate based on the interest rates of your individual loans. This new rate might be higher, lower, or the same as your highest existing rate, depending on the interest rates of your original loans and the type of consolidation program used. A higher interest rate will lead to paying more in interest over the life of the loan, while a lower rate will result in savings. For example, if you have loans with rates of 5%, 7%, and 9%, your consolidated loan’s rate might fall somewhere between these figures. The exact rate will be clearly stated in your consolidation agreement.

Impact on Repayment Plan Options

Your repayment plan options might change after consolidation. While you may gain access to income-driven repayment plans (IDR) that weren’t available before, due to eligibility requirements, or you might lose access to a plan you were previously using if it’s incompatible with the consolidated loan. For instance, a graduated repayment plan might become unavailable if the consolidation results in a standard repayment plan being the only option under the new loan terms. The available repayment plans will be detailed in your loan documents after consolidation.

Effect on Credit Score

The impact on your credit score is complex. While consolidation itself doesn’t directly lower your score, the changes in your credit utilization (the amount of credit you’re using compared to your total available credit) and the age of your accounts can influence your score. Closing individual accounts associated with the consolidated loans can slightly lower your average credit age, potentially impacting your score negatively. However, a simplified repayment schedule with a consolidated loan can improve your score over time if you consistently make on-time payments.

Comparison of Repayment Terms

Before consolidation, you may have multiple loans with varying interest rates, repayment terms, and due dates. After consolidation, you’ll have a single loan with a single interest rate, a new repayment schedule, and one monthly payment date. For example, you might have had three loans with monthly payments of $100, $200, and $300, totaling $600. After consolidation, your monthly payment might be $550, $650, or a different amount altogether, depending on the chosen repayment plan and the new interest rate.

Visual Representation of Repayment Schedules

Imagine two bar graphs. The first graph represents your pre-consolidation loans. It shows several bars of different heights, each representing a different loan with a varying monthly payment amount. The second graph, representing the post-consolidation loan, shows a single, taller bar, indicating a single monthly payment. The length of each graph along the x-axis represents the loan repayment period. The pre-consolidation graph will likely be longer due to staggered repayment periods, while the post-consolidation graph may be shorter or longer depending on the repayment plan selected. The total area under the bars in both graphs should represent the total amount repaid, though the distribution of payments over time will differ significantly.

Dealing with Unsuccessful Searches

If your search for evidence of student loan consolidation proves fruitless, it’s crucial to remain proactive. Several factors could contribute to this difficulty, and a systematic approach is key to resolving the issue and gaining clarity on your loan status. Don’t panic; there are resources and steps you can take to rectify the situation.

Understanding the potential reasons for your unsuccessful search is the first step towards finding a solution. This could range from simple clerical errors to more complex issues involving data transfer problems between loan servicers or even outdated information on your personal records. Taking a methodical approach, using the resources available, and understanding your rights will greatly increase your chances of successfully locating your loan information.

Locating Lost Loan Information

Several avenues exist for locating missing student loan information. Start by checking your credit report. Your student loans, even consolidated ones, will typically appear on your credit report. This is a readily accessible resource, and you are entitled to a free copy annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion). Next, review any past financial statements or tax returns; these documents may contain details about your student loan payments or loan servicer information. Finally, contact the National Student Loan Data System (NSLDS). NSLDS is a central database containing information on federal student loans, and it can be a valuable resource in verifying your loan details.

Disputing Incorrect Loan Status Information

If you discover incorrect information about your loan status, you have the right to dispute it. Begin by carefully documenting the discrepancy. Gather all relevant supporting documentation, such as previous loan statements, payment confirmations, or any communication you’ve had with your loan servicer. Then, submit a formal written dispute to the loan servicer or the relevant government agency (e.g., the Department of Education). Clearly state the inaccuracies you’ve found and provide all supporting evidence. Keep copies of all correspondence for your records. The agency is legally obligated to investigate your claim and respond within a reasonable timeframe. If the dispute isn’t resolved to your satisfaction, you may need to seek further assistance from a consumer protection agency or legal counsel.

Contact Information for Relevant Agencies

For assistance with federal student loans, contact the Federal Student Aid (FSA) office at 1-800-4-FED-AID (1-800-433-3243). Their website, StudentAid.gov, also provides extensive information and resources. For issues involving private student loans, you’ll need to contact your specific loan servicer directly. Their contact information should be available on your loan documents or through a search online. The Consumer Financial Protection Bureau (CFPB) can also provide assistance with resolving consumer financial complaints, including those related to student loans. Their website is consumerfinance.gov.

Potential Reasons for Discrepancies in Loan Information

Several factors can lead to discrepancies in your student loan information. These include data entry errors by loan servicers, system glitches within the loan servicing databases, transfer errors during loan consolidation, changes in loan servicers without proper notification to the borrower, and outdated information in your personal records. Furthermore, errors can occur if you have multiple loans with different servicers, if your name has changed, or if you have multiple social security numbers associated with your loans. Finally, identity theft can also result in inaccurate information being associated with your loan status. Thorough investigation and careful documentation are vital to addressing these issues effectively.

Final Review

Successfully navigating the process of verifying your student loan consolidation status requires diligence and a clear understanding of the resources available to you. By utilizing the methods Artikeld in this guide—from accessing your NSLDS account to directly contacting your loan servicer—you can gain clarity on your loan situation and confidently plan for the future. Remember, proactive management of your student loans is key to long-term financial health. Don’t hesitate to seek assistance if you encounter difficulties; numerous resources are available to help you along the way.

Commonly Asked Questions

What if my loan servicer’s website is unclear?

Contact your loan servicer directly via phone or email. They can provide clarification on your loan status.

How long does it take for consolidation to be reflected online?

It can take several weeks for the consolidation to fully update across all systems. Allow sufficient time before contacting your servicer.

Can I consolidate private and federal student loans together?

Generally, no. Federal and private student loans are typically consolidated separately.

What happens if I can’t find my loan information anywhere?

Contact the National Student Loan Data System (NSLDS) or the Federal Student Aid website for assistance locating your loan details.