Navigating the complexities of student loan debt can feel overwhelming, especially when faced with high interest rates that significantly impact your repayment journey. Understanding the various strategies available to lower your interest rate is crucial to minimizing long-term costs and achieving financial freedom sooner. This guide explores practical methods, from refinancing options to government programs, empowering you to take control of your student loan debt and pave the way for a more secure financial future.

This comprehensive guide delves into the intricacies of student loan interest rates, exploring different loan types, repayment plans, and available government assistance programs. We’ll examine the advantages and disadvantages of refinancing, the importance of maintaining a good credit score, and strategies for effective debt management. By the end, you’ll possess the knowledge and tools to make informed decisions about lowering your student loan interest rate and achieving your financial goals.

Understanding Your Student Loan Interest Rate

Understanding your student loan interest rate is crucial for managing your debt effectively. The interest rate determines how much extra you’ll pay on top of the principal loan amount, significantly impacting your overall repayment costs. Several factors influence this rate, and it’s essential to know how these factors interact to determine your individual rate.

Factors Influencing Student Loan Interest Rates

Several key factors influence the interest rate you’ll receive on your student loans. These factors vary depending on whether you’re borrowing through a federal or private lending program. For federal loans, credit history typically isn’t a factor, while for private loans, it plays a significant role. Other influencing factors include the type of loan, the current market interest rates, and the lender’s risk assessment. The loan’s term also plays a part; longer repayment terms might lead to higher interest rates. Finally, your educational program might indirectly influence your interest rate through the lender’s risk assessment related to that specific program.

Types of Student Loans and Their Interest Rates

Student loans are broadly categorized into federal and private loans. Federal student loans are offered by the U.S. government and generally have lower, fixed interest rates than private loans. Federal loans include subsidized and unsubsidized loans, as well as PLUS loans for parents and graduate students. Private student loans, on the other hand, are offered by banks and credit unions, and their interest rates are variable and often higher, reflecting the lender’s assessment of the borrower’s creditworthiness.

Interest Capitalization: How It Affects Your Loan Cost

Interest capitalization is the process of adding accrued interest to your principal loan balance. This means that the interest you haven’t paid during periods like grace periods or deferments is added to your principal, increasing the amount you owe. This process compounds the interest, leading to a larger total loan cost over time. For example, if you have a $10,000 loan with a 5% interest rate and a one-year grace period, you might accrue $500 in interest. After the grace period, your principal balance will become $10,500, and future interest calculations will be based on this higher amount. This effect is amplified over the loan’s life, significantly increasing the total repayment amount.

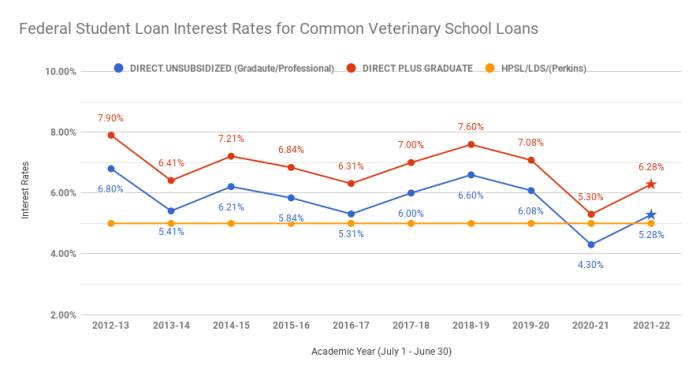

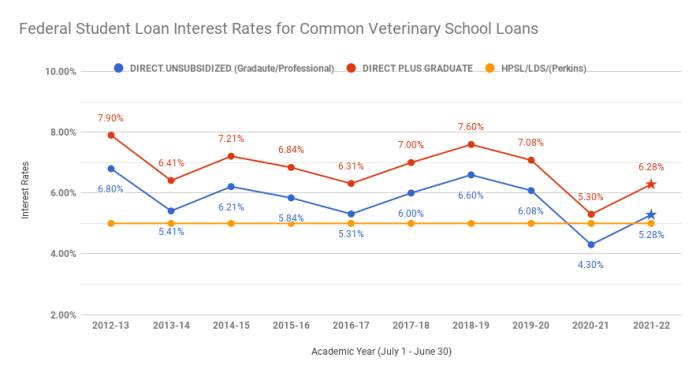

Comparison of Student Loan Interest Rates

| Loan Type | Interest Rate Type | Typical Interest Rate Range (as of October 26, 2023 – Note: Rates are subject to change) | Credit Check Required? |

|---|---|---|---|

| Federal Subsidized Loan (Undergraduate) | Fixed | 5-7% (This is an approximation and varies based on loan origination date and other factors) | No |

| Federal Unsubsidized Loan (Undergraduate) | Fixed | 5-7% (This is an approximation and varies based on loan origination date and other factors) | No |

| Federal PLUS Loan (Graduate/Parent) | Fixed | 7-9% (This is an approximation and varies based on loan origination date and other factors) | Yes (Credit check for borrowers) |

| Private Student Loan | Variable or Fixed | 3-15% (This is a broad range, highly variable based on credit score and other factors) | Yes |

Disclaimer: The interest rate ranges provided in the table are approximations and are subject to change. Actual interest rates will vary depending on several factors, including the lender, the borrower’s creditworthiness (for private loans), and the prevailing market interest rates. It’s crucial to check with individual lenders for the most up-to-date interest rate information.

Refinancing Your Student Loans

Refinancing your student loans involves replacing your existing federal or private student loans with a new loan from a private lender. This can be a strategic move to potentially lower your monthly payments and overall interest costs, but it’s crucial to understand the implications before proceeding. This section will explore the advantages, disadvantages, and process of refinancing your student loans.

Advantages and Disadvantages of Refinancing Student Loans

Refinancing can offer several benefits. Lower interest rates are the primary draw, leading to reduced monthly payments and faster loan payoff. Streamlining multiple loans into a single payment simplifies repayment. However, refinancing also carries risks. You might lose federal loan protections, such as income-driven repayment plans or deferment options. Additionally, a higher interest rate than your current rate could negate any benefits. Finally, the application process itself requires a good credit score and can impact your credit temporarily.

Interest Rates Offered by Different Refinancing Lenders

Interest rates offered by refinancing lenders vary significantly based on several factors, including your credit score, loan amount, loan term, and the lender’s current market conditions. For example, a lender might offer a 6% interest rate to a borrower with excellent credit and a large loan amount, while offering a higher rate, perhaps 8%, to a borrower with a lower credit score and a smaller loan amount. These rates are dynamic and change frequently. It’s essential to shop around and compare offers from multiple lenders before making a decision. Some lenders may specialize in certain types of loans, such as graduate student loans, offering potentially better rates for those specific situations.

Tips for Finding the Best Refinancing Options

Finding the best refinancing option requires diligent research and comparison shopping. Begin by checking your credit report for accuracy. Then, obtain pre-qualification offers from several lenders to understand your potential interest rates without impacting your credit score. Carefully compare not only interest rates but also fees, repayment terms, and any additional features offered. Consider lenders with transparent and straightforward processes and excellent customer service reviews. Remember, the lowest interest rate isn’t always the best deal; the total cost of the loan, including fees, is crucial.

Credit Score Requirements and Impact on Interest Rates

Your credit score plays a pivotal role in determining your eligibility for refinancing and the interest rate you’ll receive. Lenders generally prefer borrowers with high credit scores (typically 700 or above) as they are considered lower risk. A higher credit score usually translates to a lower interest rate. Conversely, a lower credit score may result in a higher interest rate or even disqualification from refinancing. Improving your credit score before applying can significantly improve your chances of securing a favorable interest rate. For instance, a borrower with a 750 credit score might qualify for a 5% interest rate, while a borrower with a 650 credit score might receive a rate of 7% or higher, or might not qualify at all.

Refinancing Process Flowchart

The refinancing process can be visualized using a flowchart:

[Start] –> [Check Credit Score and Report] –> [Gather Financial Documents] –> [Compare Lender Offers] –> [Choose Lender and Loan Terms] –> [Submit Application] –> [Loan Approval/Denial] –> [Loan Closing and Disbursement] –> [End]

Each step involves specific actions and documentation. For example, “Gather Financial Documents” would entail collecting pay stubs, tax returns, and other relevant financial information. “Compare Lender Offers” would involve reviewing interest rates, fees, and repayment terms from different lenders. “Loan Closing and Disbursement” involves the finalization of the loan agreement and the transfer of funds to pay off the existing loans.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer a lifeline for student loan borrowers struggling with high monthly payments. These plans tie your monthly payment amount to your income and family size, making them a potentially powerful tool for managing your student loan debt. Understanding how they work and which plan best suits your circumstances is crucial for long-term financial health.

IDR plans offer lower monthly payments than standard repayment plans, potentially leading to loan forgiveness after a specified period of time (typically 20 or 25 years). However, it’s important to understand that while your monthly payments are lower, you’ll likely pay more in interest over the life of the loan and the forgiven amount is considered taxable income.

Income-Driven Repayment Plan Options

Several federal income-driven repayment plans are available, each with slightly different eligibility requirements and calculation methods. Choosing the right plan depends on your individual financial situation and long-term goals.

| Plan Name | Eligibility | Payment Calculation | Forgiveness Period | Key Features |

|---|---|---|---|---|

| Income-Based Repayment (IBR) | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans (Graduate and Parent) | 10% or 15% of discretionary income, depending on loan origination date. | 20 or 25 years | Lower monthly payments, potential for loan forgiveness after 20 or 25 years of payments. Higher interest accrual. |

| Pay As You Earn (PAYE) | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans (Graduate and Parent) | 10% of discretionary income. | 20 years | Similar to IBR, but with a fixed 10% payment. |

| Revised Pay As You Earn (REPAYE) | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans (Graduate and Parent), FFEL Program Loans (if consolidated into a Direct Consolidation Loan) | 10% of discretionary income. | 20 or 25 years | Covers a wider range of loan types than PAYE. Higher interest accrual possible. |

| Income-Contingent Repayment (ICR) | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans (Graduate and Parent), FFEL Program Loans (if consolidated into a Direct Consolidation Loan) | Either 20% of discretionary income or a fixed payment amount, whichever is less. | 25 years | Payment calculations differ from other plans. |

Examples of Lower Monthly Payments

Let’s say a borrower has $50,000 in student loan debt with a 6% interest rate and a standard 10-year repayment plan. Their monthly payment would be approximately $550. However, under an IDR plan, if their discretionary income is low enough, their monthly payment could be significantly reduced, perhaps to $200 or less, depending on the specific plan and their income. This lower payment would allow them to allocate more funds towards other essential expenses. The exact reduction will depend on factors like income, family size, and the specific IDR plan chosen.

Loan Forgiveness Under IDR Plans

After making qualifying payments for 20 or 25 years (depending on the plan), the remaining balance of your student loans may be forgiven under most IDR plans. It’s important to note that this forgiven amount is considered taxable income in the year it’s forgiven, so it’s crucial to plan accordingly for this potential tax liability. For example, a borrower with $30,000 in remaining loan debt after 20 years could face a substantial tax bill upon forgiveness.

Government Programs and Initiatives

While refinancing and income-driven repayment plans can significantly impact your student loan interest rate, several government programs offer direct assistance. These programs often focus on lowering monthly payments or providing forgiveness under specific circumstances, indirectly impacting your overall interest paid. Understanding these options is crucial for navigating the complexities of student loan repayment.

Government programs aimed at reducing the burden of student loan debt are constantly evolving. Eligibility criteria vary depending on the specific program and your individual circumstances. It’s important to regularly check the official government websites for the most up-to-date information.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program is designed to forgive the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. This program effectively reduces the total interest paid over the life of the loan by eliminating the remaining principal. For example, a borrower with $50,000 in remaining debt after 10 years of payments under an income-driven plan could see their entire balance forgiven, saving potentially thousands of dollars in future interest payments.

Eligibility Requirements for PSLF

To be eligible for PSLF, you must meet several criteria. You must have Direct Loans, be employed full-time by a qualifying employer, and be enrolled in an income-driven repayment plan. The qualifying employer must be a government organization at any level (federal, state, local) or a non-profit organization that is tax-exempt under section 501(c)(3) of the Internal Revenue Code. Maintaining continuous employment and consistent repayment is critical for successful application.

Successful PSLF Application Example

A teacher working in a public school for ten years, consistently making payments under an income-driven repayment plan, successfully had their $60,000 loan balance forgiven through PSLF. This demonstrates how dedicated public service professionals can significantly benefit from this program. The saved interest would have amounted to several thousand dollars over the life of the loan.

Steps to Apply for PSLF

Before applying, ensure you meet all eligibility requirements. The application process can be complex; seeking assistance from a financial advisor or student loan counselor is advisable.

- Consolidate your federal student loans into a Direct Consolidation Loan if necessary.

- Complete the PSLF Employment Certification Form annually, confirming your employment status with your employer.

- Submit your application through the official government website, ensuring all required documentation is included.

- Regularly monitor your progress and contact the relevant agency if you have any questions or concerns.

Strategies for Managing Student Loan Debt

Effectively managing student loan debt requires a proactive and organized approach. This involves careful budgeting, prioritizing payments, and maintaining a healthy credit score to ensure long-term financial well-being. The strategies Artikeld below provide a framework for navigating this process successfully.

Budgeting and Managing Student Loan Payments

Creating a realistic budget is crucial for successfully managing student loan payments. This involves meticulously tracking all income and expenses to identify areas where savings can be maximized. A detailed budget should allocate funds specifically for student loan payments, ensuring these payments are consistently made on time. Consider using budgeting apps or spreadsheets to simplify the process and monitor progress. For example, allocating 20% of your monthly income to debt repayment, including student loans, could significantly accelerate the repayment process. This may require adjustments to discretionary spending, such as reducing entertainment expenses or dining out less frequently. The key is to find a balance between meeting financial obligations and maintaining a reasonable quality of life.

Prioritizing Student Loan Payments

Prioritizing student loan payments alongside other financial obligations requires careful consideration. While it’s essential to meet all obligations, a strategic approach can help manage debt more effectively. Consider using the debt avalanche or debt snowball methods. The debt avalanche method focuses on paying off the loan with the highest interest rate first, while the debt snowball method prioritizes paying off the smallest loan first for motivational purposes. For instance, if you have both high-interest credit card debt and student loans, prioritizing the credit card debt (debt avalanche) might save money on interest in the long run, but paying off the smaller student loan first (debt snowball) might provide a psychological boost to continue your repayment journey. It’s essential to carefully weigh the advantages and disadvantages of each approach based on your individual financial circumstances.

Maintaining a Good Credit Score

A good credit score is paramount for securing favorable interest rates on future loans and accessing other financial products. Maintaining a good credit score requires consistent on-time payments on all debts, including student loans. Other factors contributing to a good credit score include keeping credit utilization low (avoiding maxing out credit cards), maintaining a diverse credit history (a mix of credit types), and avoiding opening multiple new accounts in a short period. A credit score above 700 is generally considered good, and actively monitoring your credit report for errors can help maintain a positive credit profile. Regularly reviewing your credit report through services like AnnualCreditReport.com can help identify and address any inaccuracies that could negatively impact your score.

Tracking Loan Repayment Progress and Adjusting Strategies

Regularly tracking loan repayment progress is crucial for staying on track and making necessary adjustments. This involves monitoring the remaining loan balance, interest accrued, and the total amount paid. Online loan servicing portals typically provide detailed repayment information. By analyzing this data, you can assess the effectiveness of your current repayment strategy. If progress is slower than anticipated, consider exploring options such as refinancing to secure a lower interest rate or consolidating multiple loans into a single payment. Conversely, if you’re consistently ahead of schedule, you might consider increasing your monthly payments to accelerate repayment and reduce the total interest paid over the loan’s lifetime. Adaptability and consistent monitoring are key to successful student loan repayment.

Understanding Loan Forgiveness Programs

Student loan forgiveness programs offer the possibility of eliminating a portion or all of your student loan debt under specific circumstances. These programs are designed to incentivize certain career paths and provide relief to borrowers facing significant financial hardship. Understanding the eligibility requirements and the application process is crucial for those seeking this type of assistance.

Eligibility Requirements for Student Loan Forgiveness Programs

Eligibility for student loan forgiveness programs varies greatly depending on the specific program. Generally, programs require borrowers to meet certain criteria related to the type of loan, the type of employment, the length of employment, and the amount of income earned. Some programs may also have requirements related to the borrower’s repayment history, such as maintaining consistent payments for a set period. Careful review of the specific program guidelines is essential before applying.

Types of Jobs and Careers that Qualify for Loan Forgiveness

Many loan forgiveness programs target public service jobs. These often include positions in government, non-profit organizations, and certain educational institutions. Specific examples include teachers, nurses, social workers, and members of the military. The precise job titles and organizations that qualify vary depending on the program. Some programs may also consider specific types of medical professionals, particularly those working in underserved areas. For example, a physician working in a rural health clinic might be eligible for a different program than a teacher in a large urban school district.

Examples of Successful Loan Forgiveness Applications

While specific details of successful applications are generally kept confidential due to privacy concerns, the general process usually involves meticulous documentation of employment, income, and loan details. A successful applicant would have diligently tracked their qualifying employment, maintained accurate records of their loan payments, and submitted a complete and accurate application. The process often requires significant paperwork and patience, highlighting the importance of organization and thoroughness. A successful application would demonstrate clear fulfillment of all the program’s requirements.

Comparison of Loan Forgiveness Programs

| Program Name | Loan Type | Eligible Employment | Required Employment Length | Other Requirements |

|---|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Direct Loans | Government or non-profit | 120 qualifying payments | Full-time employment, income-driven repayment plan |

| Teacher Loan Forgiveness | Federal Stafford, Subsidized, and Unsubsidized Loans | Full-time K-12 teacher in a low-income school | 5 consecutive academic years | Must meet specific income requirements |

| National Health Service Corps (NHSC) Loan Repayment Program | Federal student loans | Health professional serving in a Health Professional Shortage Area (HPSA) | Varies depending on location and specialty | Must meet specific requirements regarding location and specialty |

The Impact of Interest Rate Changes

Understanding how interest rate fluctuations affect your student loans is crucial for effective debt management. Changes in interest rates directly impact your monthly payments, the total amount you repay, and the length of your repayment timeline. A thorough understanding of these impacts empowers you to make informed decisions about your repayment strategy.

Interest rate changes significantly influence both your monthly payment amounts and the total cost of your loan. A higher interest rate translates to a larger monthly payment and a substantially higher total repayment amount over the life of the loan. Conversely, a lower interest rate results in smaller monthly payments and a lower overall cost. This is because a higher interest rate means you’re paying more interest on the principal balance each month, increasing the total interest paid over the loan’s term.

Interest Rate Increases and Decreases on Loan Repayment Timelines

An increase in interest rates extends the repayment timeline, even if your monthly payment remains the same. This is because a larger portion of your payment goes towards interest, leaving less to reduce the principal balance. Conversely, a decrease in interest rates shortens the repayment timeline, allowing you to pay off your loan faster, even if you maintain the same monthly payment. For example, a $10,000 loan with a 5% interest rate will take longer to repay than the same loan with a 3% interest rate, assuming the monthly payment amount remains unchanged.

Adjusting Repayment Plans in Response to Interest Rate Changes

Several strategies can help you manage your student loans effectively when interest rates change. If rates rise, consider increasing your monthly payments to reduce the overall interest paid and shorten the repayment period. Alternatively, you might explore refinancing your loans to secure a lower interest rate if available. If rates fall, you can either maintain your current payment and pay off your loan faster or reduce your monthly payments while extending the repayment timeline. It’s important to weigh the benefits of each option based on your financial situation. For instance, if you receive a significant raise, you could use the extra income to increase your loan payments, even with unchanged interest rates. This strategy would be even more impactful if interest rates were also lower.

Visual Representation of Interest Rates and Loan Repayment

Imagine a graph with the x-axis representing interest rates (from low to high) and the y-axis representing the total repayment cost. The line on the graph would show a positive correlation: as interest rates increase, the total repayment cost increases steadily. Another graph could depict the relationship between interest rates and repayment timeline. Here, a similar positive correlation would be observed; higher interest rates would lead to a longer repayment timeline. A third graph could show the relationship between interest rates and monthly payments, with a similar positive correlation showing higher interest rates resulting in higher monthly payments. These graphs visually demonstrate how sensitive loan repayment is to changes in interest rates.

Summary

Successfully lowering your student loan interest rate requires a proactive approach and a thorough understanding of the available options. By carefully considering refinancing possibilities, exploring income-driven repayment plans, and leveraging government programs, you can significantly reduce your overall loan burden. Remember that maintaining a strong credit score is crucial throughout this process. This guide provides a roadmap to navigate the complexities of student loan debt, empowering you to make informed choices and secure a brighter financial future.

Frequently Asked Questions

What is interest capitalization?

Interest capitalization is the process of adding accrued but unpaid interest to your principal loan balance. This increases the total amount you owe and, consequently, the interest you’ll pay over time.

Can I refinance federal student loans?

You can refinance federal student loans with a private lender, but this will convert them to private loans, potentially losing access to federal benefits like income-driven repayment plans and loan forgiveness programs.

How does my credit score affect refinancing options?

A higher credit score typically qualifies you for lower interest rates when refinancing. Lenders view a higher score as a lower risk.

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.