Navigating the complex world of student loan repayment can feel daunting, but understanding your options and creating a solid plan empowers you to take control of your financial future. This guide provides a structured approach, from understanding your loan details to implementing effective budgeting strategies and exploring alternative repayment methods. We’ll demystify the process, equipping you with the knowledge and tools to successfully manage your student loan debt.

Successfully repaying student loans requires a proactive and strategic approach. This involves not only understanding the intricacies of different loan types and repayment plans but also developing sound financial habits and a realistic budget. By carefully considering your financial situation and exploring all available options, you can create a personalized repayment plan that aligns with your goals and minimizes long-term financial strain.

Understanding Your Student Loans

Before you begin repaying your student loans, it’s crucial to understand the specifics of your loan portfolio. Knowing the type of loans you have, their terms, and your repayment options will empower you to make informed decisions about your repayment strategy. This section will guide you through the process of gathering and understanding your loan information.

Federal vs. Private Student Loans

Student loans are broadly categorized into federal and private loans. Federal loans are offered by the U.S. government and typically offer more borrower protections, such as income-driven repayment plans and loan forgiveness programs. Private loans, on the other hand, are provided by banks, credit unions, and other private lenders. These loans often have less flexible repayment options and may come with higher interest rates. Understanding this distinction is key to navigating your repayment journey.

Accessing Your Loan Details Online

Accessing your loan information online is typically straightforward. Most lenders provide online portals where you can view your loan balance, interest rate, payment history, and repayment schedule. The specific steps may vary depending on your lender, but generally involve creating an online account using your loan information or Social Security number. You’ll usually need to register with the lender’s website and verify your identity. Once logged in, you’ll have access to a comprehensive dashboard displaying all your relevant loan details. For federal student loans, you can access your information through the National Student Loan Data System (NSLDS).

Loan Terms and Conditions

Each loan agreement Artikels the specific terms and conditions, including the interest rate, repayment plan, and any associated fees. Your interest rate will significantly impact the total amount you repay. Fixed interest rates remain constant throughout the loan term, while variable rates fluctuate based on market conditions. Understanding your repayment plan – whether it’s a standard, graduated, or income-driven plan – is crucial for budgeting and managing your repayments. Carefully review your loan documents to understand all applicable fees, such as late payment fees or origination fees.

Summary of Loan Information

The following table summarizes key information from your loan documents. Remember to replace the example data with your actual loan details.

| Loan Type | Lender | Interest Rate | Principal Balance |

|---|---|---|---|

| Federal Direct Unsubsidized Loan | Department of Education | 4.5% | $20,000 |

| Private Student Loan | Example Private Lender | 7.0% | $10,000 |

Choosing a Repayment Plan

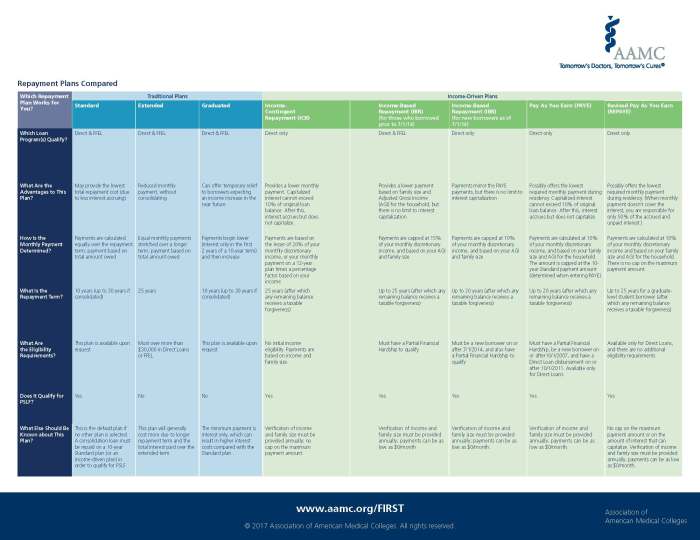

Selecting the right student loan repayment plan is crucial for managing your debt effectively and minimizing long-term costs. The best plan depends heavily on your individual financial situation, income, and long-term goals. Several options exist, each with its own advantages and disadvantages. Careful consideration of these factors will help you navigate the process and make an informed decision.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeframe, leading to lower overall interest costs compared to longer-term plans. However, the fixed monthly payments can be substantial, potentially straining your budget, especially in the early years of your career. For example, a $30,000 loan at a 5% interest rate would require approximately $315 monthly payments under this plan.

Extended Repayment Plan

This plan extends the repayment period to up to 25 years, resulting in lower monthly payments than the Standard Repayment Plan. The lower payments provide immediate relief to borrowers facing financial constraints. However, significantly extending the repayment period leads to higher overall interest payments over the life of the loan. Using the same $30,000 loan example, a 25-year repayment plan would reduce monthly payments but increase the total interest paid by a substantial amount.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) link your monthly payments to your income and family size. These plans include options like Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). IDRs offer lower monthly payments, making them particularly attractive for borrowers with low incomes or high debt-to-income ratios. However, because payments are lower, the repayment period is often extended beyond 20 years, leading to higher total interest paid over the loan’s lifetime. Furthermore, any remaining balance after 20 or 25 years (depending on the plan) may be forgiven, but this forgiven amount is typically considered taxable income.

Decision-Making Flowchart for Choosing a Repayment Plan

The selection of the optimal repayment plan requires careful consideration of individual circumstances. A flowchart can aid in this process:

| Question | Answer | Next Step |

|---|---|---|

| Can I comfortably afford the payments of a Standard Repayment Plan? | Yes | Choose Standard Repayment Plan |

| No | Consider Extended or Income-Driven Plan | |

| Is my income low relative to my debt? | Yes | Choose an Income-Driven Repayment Plan |

| No | Choose Extended Repayment Plan |

Implications of Repayment Plans on Long-Term Costs and Credit Score

Choosing a repayment plan significantly impacts both long-term costs and credit score. Standard repayment plans minimize interest paid but require higher monthly payments. Extended repayment plans lower monthly payments but increase total interest paid. Income-driven repayment plans offer the lowest monthly payments but often lead to the highest total interest paid and potential tax implications from loan forgiveness. Consistent on-time payments, regardless of the plan chosen, are crucial for maintaining a good credit score. Late or missed payments can negatively affect your creditworthiness, making it harder to obtain loans or credit in the future. For instance, a consistently poor payment history could result in a lower credit score, increasing the interest rate on future loans.

Budgeting and Financial Planning

Effective budgeting and financial planning are crucial for successfully repaying student loans. Creating a realistic budget that prioritizes loan payments allows you to visualize your financial situation and develop a clear path towards becoming debt-free. This involves tracking income and expenses, identifying areas for savings, and exploring opportunities to increase your income.

Sample Monthly Budget Prioritizing Student Loan Repayment

A well-structured budget allocates a specific amount each month towards your student loan payments. This amount should be realistic, factoring in your income and other essential expenses. The remaining funds are then allocated to necessities like housing, food, transportation, and utilities. Any leftover money can be used for savings, investments, or discretionary spending. Below is an example of a monthly budget:

| Category | Amount ($) |

|---|---|

| Student Loan Payment | 500 |

| Housing | 1000 |

| Food | 300 |

| Transportation | 150 |

| Utilities | 100 |

| Savings | 150 |

| Other Expenses | 100 |

| Total Expenses | 1300 |

| Net Income (Example) | 2000 |

This is a sample budget, and your specific amounts will vary depending on your income and expenses. Remember to adjust this budget to reflect your personal financial situation.

Tracking Income and Expenses Effectively

Accurate tracking of income and expenses is fundamental to effective budgeting. This can be achieved through various methods, such as using budgeting apps, spreadsheets, or even a simple notebook. Consistent recording of every transaction provides a clear picture of your spending habits and helps identify areas where you can cut back.

Reducing Spending to Allocate More Funds Towards Loan Repayment

Identifying areas where you can reduce spending is crucial for freeing up more money for loan repayment. This may involve analyzing your spending habits to pinpoint unnecessary expenses. Examples include reducing dining out, cutting back on entertainment subscriptions, or finding cheaper alternatives for groceries or transportation.

Strategies for Increasing Income to Accelerate Loan Repayment

Increasing your income can significantly accelerate loan repayment. This can be achieved through various strategies, including seeking a higher-paying job, taking on a part-time job or freelance work, or exploring opportunities for promotions or raises in your current position. Additionally, monetizing skills or hobbies, such as offering tutoring services or selling handmade crafts online, can provide additional income streams.

Exploring Additional Repayment Options

Successfully managing your student loans often involves exploring options beyond the standard repayment plans. Understanding alternative strategies can significantly impact your long-term financial health and ease the burden of repayment. This section Artikels several key options to consider.

Loan Refinancing

Refinancing your student loans involves taking out a new loan to pay off your existing ones. The primary benefit is the potential for a lower interest rate, leading to significant savings over the life of the loan. This is particularly advantageous if your credit score has improved since you initially took out your loans or if interest rates have fallen. The process typically involves applying through a private lender, who will assess your creditworthiness and offer a new loan with potentially more favorable terms. However, it’s crucial to carefully compare offers from multiple lenders and consider any fees associated with refinancing. Be aware that refinancing federal student loans into private loans may mean losing access to federal repayment programs like income-driven repayment plans or loan forgiveness programs.

Loan Forbearance and Deferment

For borrowers experiencing temporary financial hardship, forbearance and deferment offer temporary pauses or reductions in loan payments. Forbearance involves temporarily suspending or reducing your payments, but interest typically continues to accrue. Deferment, on the other hand, postpones both payments and interest accrual for a specific period, though this depends on the type of loan and the reason for deferment. Applying for either requires demonstrating financial hardship through documentation such as proof of unemployment or medical bills. These options provide short-term relief, but it’s essential to develop a repayment plan for when the forbearance or deferment period ends to avoid accumulating significant debt. The specific eligibility requirements and limitations vary depending on the type of loan (federal or private).

Loan Consolidation

Loan consolidation combines multiple student loans into a single loan with a new repayment schedule. This can simplify repayment by reducing the number of payments and potentially lowering your monthly payment amount. However, the overall interest rate and total repayment cost might not necessarily decrease. The new interest rate is usually a weighted average of your existing loan interest rates. Consolidation can be beneficial for organization and simplification, but careful consideration of the overall cost is crucial. Consolidating federal loans typically involves using a federal consolidation program, while private loan consolidation requires working with a private lender. It’s advisable to compare the terms of consolidation options before making a decision.

Resources for Borrowers Struggling with Loan Repayment

Navigating student loan repayment can be challenging. Several resources are available to assist borrowers:

The National Foundation for Credit Counseling (NFCC): The NFCC offers free and low-cost credit counseling services, including assistance with student loan repayment strategies.

The Student Loan Borrower Assistance website: This government website provides comprehensive information about federal student loan programs, repayment options, and assistance for borrowers facing difficulties.

Your loan servicer: Your loan servicer is a valuable resource for information about your specific loans, repayment plans, and available options. They can provide personalized guidance and support.

Maintaining Good Financial Habits

Successfully repaying your student loans isn’t just about making payments; it’s about cultivating sound financial habits that benefit you long after your loans are paid off. Building good credit, budgeting effectively, and avoiding common pitfalls are crucial steps in achieving long-term financial well-being. This section will explore strategies to help you navigate this process effectively.

Building good credit while repaying student loans is achievable and significantly improves your financial future. Consistent and timely payments are key to establishing a positive credit history. This demonstrates responsibility to lenders, making you a more attractive candidate for future loans, credit cards, and even better interest rates. Furthermore, a strong credit score can positively impact your ability to secure better deals on insurance, rental agreements, and even employment opportunities.

Credit Building Strategies

Making on-time student loan payments is the most direct way to build credit. Your payment history is a significant factor in your credit score. Consider also obtaining a credit card and using it responsibly. Keep your credit utilization low (ideally below 30% of your available credit) and pay your balance in full each month. Avoid opening multiple credit cards simultaneously, as this can negatively impact your score. Regularly check your credit report for errors and monitor your credit score to track your progress.

The Importance of Consistent and Timely Payments

Consistent and timely student loan payments are paramount for several reasons. First, it prevents late payment fees, which can significantly increase your overall loan cost. Second, a history of on-time payments demonstrates financial responsibility to lenders and credit bureaus, positively impacting your credit score. Third, maintaining a good payment history opens doors to better financial opportunities in the future, such as securing loans with lower interest rates or qualifying for favorable credit card terms. Missing payments, even once, can negatively impact your credit score for years, leading to higher interest rates and limited access to credit.

Avoiding Common Student Loan Repayment Pitfalls

Several common pitfalls can hinder successful student loan repayment. One is failing to understand your loan terms and repayment options. Another is neglecting to create a realistic budget that prioritizes loan payments. Ignoring rising interest rates or deferring payments unnecessarily can significantly increase the total cost of your loans. Failing to plan for unexpected expenses can also lead to missed payments and negatively affect your credit. Finally, consolidating loans without careful consideration of the terms can sometimes result in a higher overall cost.

Best Practices for Long-Term Financial Health

Building a strong financial foundation requires consistent effort and planning. The following best practices contribute to long-term financial health:

- Create and stick to a detailed budget that includes all income and expenses, prioritizing student loan payments.

- Track your spending habits to identify areas where you can cut back.

- Automate your student loan payments to ensure timely payments each month.

- Explore options for income maximization, such as a side hustle or seeking higher-paying employment.

- Build an emergency fund to cover unexpected expenses, preventing missed loan payments.

- Regularly review your budget and financial goals to make adjustments as needed.

- Seek professional financial advice if needed to create a personalized financial plan.

Visualizing Loan Repayment

Visualizing your student loan repayment journey can be incredibly motivating and helpful in staying on track. By creating a visual representation of your progress, you can easily monitor your debt reduction and gain a clearer understanding of your financial goals. This allows you to celebrate milestones and adjust your strategy as needed.

Creating a visual representation, such as a graph or chart, provides a tangible and easily understandable picture of your loan repayment progress. This visual aid helps you stay focused on your goal and makes the process less overwhelming. It also allows you to quickly identify areas where you might need to make adjustments to your repayment plan.

Loan Repayment Tracking Table

A simple table can effectively track your loan repayment. This allows you to monitor your progress month by month and see the impact of your payments on the principal balance. The table below demonstrates a sample format. You can easily create a similar table using spreadsheet software like Excel or Google Sheets.

| Month | Payment Amount | Principal Remaining | Interest Paid |

|---|---|---|---|

| January | $250 | $29,750 | $50 |

| February | $250 | $29,500 | $50 |

| March | $250 | $29,250 | $50 |

| April | $250 | $29,000 | $50 |

Note: This is a simplified example. Actual interest paid will vary based on your interest rate and loan balance.

Impact of Consistent Payments on Total Interest Paid

Consistent payments significantly reduce the total interest paid over the life of the loan. A hypothetical chart illustrating this would show two lines: one representing consistent monthly payments and the other representing inconsistent payments (e.g., missed payments or significantly lower payments some months). The line representing consistent payments would show a steeper decline in the principal balance and a lower overall interest paid. The line representing inconsistent payments would show a slower decline in the principal, leading to a much higher total interest paid over the loan’s duration. This is because consistent payments allow you to reduce the principal balance more quickly, thereby reducing the amount of interest accruing on the remaining balance. For example, a $30,000 loan at 5% interest with consistent payments might result in approximately $5,000 in interest paid over 5 years. In contrast, inconsistent payments could easily double or even triple that amount, extending the repayment period and increasing the overall cost.

Closure

Repaying student loans is a significant financial undertaking, but with careful planning and consistent effort, it’s entirely achievable. By understanding your loan terms, choosing the right repayment plan, and actively managing your budget, you can successfully navigate this process and build a strong financial foundation for the future. Remember to utilize available resources and don’t hesitate to seek professional advice if needed. Your commitment to financial responsibility will ultimately lead to greater financial freedom.

FAQ Explained

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage to your credit score, and potential loan default. Contact your lender immediately if you anticipate difficulties making a payment to explore options like forbearance or deferment.

Can I deduct student loan interest from my taxes?

Yes, under certain circumstances, you may be able to deduct the amount you paid in student loan interest. Check the current IRS guidelines for eligibility requirements and limitations.

What is loan consolidation, and is it right for me?

Loan consolidation combines multiple student loans into a single loan, potentially simplifying repayment. However, it may not always lower your interest rate, so carefully weigh the pros and cons before consolidating.

Where can I find additional resources for student loan repayment help?

The National Foundation for Credit Counseling (NFCC) and the U.S. Department of Education website are excellent resources for information and assistance with student loan repayment.