Navigating the world of student loans can feel overwhelming, especially when understanding how interest rates impact your repayment journey. This guide demystifies the complexities of student loan interest, exploring the various factors that influence rates, and providing practical strategies for managing your debt effectively. From federal versus private loans to the nuances of fixed and variable rates, we’ll equip you with the knowledge to make informed decisions about your financial future.

Understanding interest rates is crucial for long-term financial planning. The choices you make regarding loan types and repayment plans will significantly impact the total amount you repay. This guide will break down the key concepts, providing clear explanations and illustrative examples to empower you to take control of your student loan debt.

Types of Student Loans and Interest Rates

Understanding the different types of student loans and their associated interest rates is crucial for effective financial planning during and after your education. The interest rate significantly impacts the total cost of your loan and your monthly payments. This section will clarify the key distinctions between federal and private loans and explore the implications of fixed versus variable interest rates.

Federal and Private Student Loans

Federal student loans are offered by the U.S. government and generally come with more borrower protections and potentially lower interest rates than private loans. Private student loans, on the other hand, are provided by banks, credit unions, and other private lenders. Their interest rates are typically higher and are based on your creditworthiness. Federal loans often have income-driven repayment plans and options for loan forgiveness, which are not always available with private loans. The interest rate for a federal loan depends on the loan type (e.g., subsidized or unsubsidized) and the loan’s disbursement year. Private loan interest rates are determined by a lender’s assessment of your credit history, income, and other factors.

Fixed and Variable Interest Rates

Student loans can have either fixed or variable interest rates. A fixed interest rate remains the same for the life of the loan, making it easier to budget and predict future payments. A variable interest rate, however, fluctuates based on an underlying index, such as the prime rate or LIBOR. This means your monthly payments could change over time, potentially increasing if the index rate rises. While a variable rate might start lower than a fixed rate, the potential for increases introduces significant uncertainty.

Interest Rate Calculation Examples

Let’s consider two hypothetical scenarios:

Scenario 1: A student takes out a $10,000 federal subsidized loan with a fixed interest rate of 4.5% for 10 years. The annual interest accrued would be $450 ($10,000 x 0.045). This interest is usually added to the principal balance. The total amount to be repaid after 10 years, excluding any fees, would be significantly more than $10,000. The exact amount would depend on the amortization schedule used to calculate monthly payments.

Scenario 2: A student secures a $10,000 private loan with a variable interest rate of 6% (initial rate) for 10 years. If the interest rate remains constant, the annual interest would be $600 ($10,000 x 0.06). However, if the variable rate increases to 7% after three years, the annual interest would increase accordingly. This demonstrates the uncertainty associated with variable interest rates. The total repayment amount is harder to predict due to the fluctuating interest.

Comparison of Student Loan Interest Rate Types

| Loan Type | Interest Rate Type | Typical Interest Rate Range | Advantages/Disadvantages |

|---|---|---|---|

| Federal Subsidized | Fixed | 1-7% (varies by year) | Advantages: Lower rates, government protections; Disadvantages: May have borrowing limits |

| Federal Unsubsidized | Fixed | 1-7% (varies by year) | Advantages: No income requirements; Disadvantages: Interest accrues while in school |

| Private Loan | Fixed or Variable | 4-15%+ | Advantages: Higher borrowing limits; Disadvantages: Higher rates, less borrower protection |

Factors Influencing Student Loan Interest Rates

Several key factors interact to determine the interest rate you’ll receive on your student loan. Lenders use a complex calculation, weighing various aspects of your financial profile and the current economic climate to arrive at a final rate. Understanding these factors can help you navigate the loan application process more effectively and potentially secure a more favorable interest rate.

Lenders assess numerous aspects of a borrower’s financial situation and the broader economic context to set interest rates. These factors influence the perceived risk associated with lending money. A higher perceived risk generally translates to a higher interest rate for the borrower.

Credit History and Credit Score

Your credit history plays a significant role in determining your student loan interest rate. A strong credit history, characterized by consistent on-time payments and low credit utilization, signals to lenders that you’re a responsible borrower. This lowers their perceived risk, resulting in a potentially lower interest rate. Conversely, a poor credit history, marked by late payments, defaults, or high credit utilization, indicates higher risk and consequently, a higher interest rate. For example, a borrower with an excellent credit score (750 or above) might qualify for a significantly lower interest rate than a borrower with a fair credit score (650-699). The difference could be several percentage points, leading to substantial savings over the life of the loan.

Loan Amount and Type of Loan

The amount you borrow directly impacts your interest rate. Larger loan amounts often carry a higher interest rate because they represent a greater risk to the lender. Furthermore, the type of loan—federal or private—also influences the interest rate. Federal student loans generally offer fixed interest rates determined by Congress, while private student loans have variable interest rates that fluctuate with market conditions, often influenced by the borrower’s creditworthiness. For instance, a $10,000 federal subsidized loan might have a lower interest rate than a $50,000 private unsubsidized loan, even if both borrowers have similar credit profiles.

Repayment Plan

The repayment plan you choose can indirectly influence your interest rate. While the repayment plan itself doesn’t directly alter the initial interest rate, the length of the repayment period affects the total interest paid over the life of the loan. Longer repayment terms, while resulting in lower monthly payments, ultimately lead to higher total interest payments due to the extended period of accruing interest. Therefore, choosing a shorter repayment plan, despite higher monthly payments, can save money on interest in the long run. This is because less interest accrues overall.

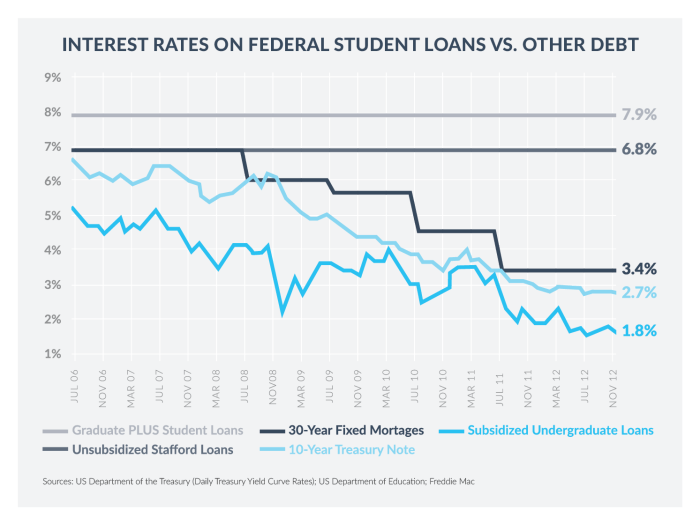

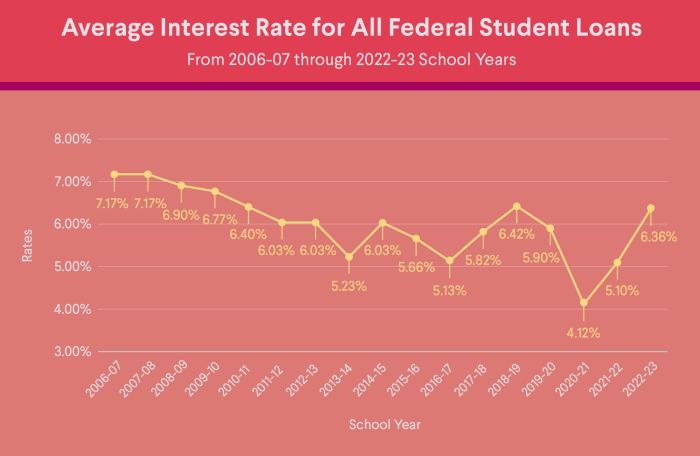

Prevailing Economic Conditions

Economic conditions significantly impact interest rates across the board, including student loans. Factors like inflation, the federal funds rate set by the Federal Reserve, and overall market trends influence the cost of borrowing. During periods of high inflation or rising interest rates, lenders typically increase their rates to offset the increased cost of capital. Conversely, during periods of low inflation and low interest rates, lenders might offer lower rates on student loans. For example, during a period of economic uncertainty, lenders might increase interest rates to compensate for increased risk.

Illustrative Example

Consider two borrowers, both applying for a $20,000 student loan. Borrower A has an excellent credit score and chooses a standard 10-year repayment plan for a federal loan. Borrower B has a fair credit score and opts for a 15-year repayment plan for a private loan. Due to their credit score difference and loan type, Borrower A might receive a 4% interest rate, while Borrower B might receive a 7% interest rate. Over the life of the loan, this 3% difference will result in a significant difference in the total amount of interest paid. Furthermore, the longer repayment period chosen by Borrower B will further increase the total interest paid compared to Borrower A.

Understanding Loan Amortization and Interest Accrual

Understanding how student loan amortization and interest accrual work is crucial for effective repayment planning. This section will explain these concepts and provide a practical example to illustrate the process.

Loan amortization is the process of paying off a loan through scheduled payments over a set period. Each payment comprises both principal (the original loan amount) and interest (the cost of borrowing). The proportion of principal and interest in each payment changes over time; initially, a larger portion goes towards interest, and as the loan progresses, a greater share is applied to the principal.

Loan Amortization Schedule

An amortization schedule details each payment’s breakdown of principal and interest. This schedule is typically provided by the lender. It allows borrowers to track their loan’s progress and see how much of their payments are reducing the principal balance. Understanding this schedule is vital for effective financial planning and budgeting.

Interest Accrual on Student Loans

Interest accrues on student loans, meaning interest charges are added to the principal balance over time. This happens even during periods of deferment or forbearance (when payments are temporarily suspended), increasing the total amount owed. During the grace period (the period after graduation before repayment begins), interest may or may not accrue depending on the loan type. For subsidized federal loans, interest typically does not accrue during the grace period. However, for unsubsidized federal loans and private student loans, interest does accrue during the grace period, and this accumulated interest is added to the principal balance, increasing the total loan amount.

Calculating Monthly Payments

Let’s illustrate a monthly payment calculation with a hypothetical example. Suppose a student has a $30,000 loan with a 6% annual interest rate (0.06/12 = 0.005 monthly rate) and a 10-year repayment period (120 months). Using a standard amortization formula (which is complex and often calculated using loan calculators or spreadsheets), the approximate monthly payment would be around $330. This formula considers the present value (loan amount), interest rate, and loan term to calculate the regular payment needed to fully amortize the loan.

Approximate Monthly Payment = P [ i(1 + i)^n ] / [ (1 + i)^n – 1] where P is the principal, i is the monthly interest rate, and n is the number of months.

While this formula provides a theoretical calculation, slight variations can occur due to rounding and the specific methods used by lenders.

Amortization Schedule Visualization

Let’s visualize how the proportion of principal and interest changes over the life of the loan using a text-based representation:

Year | Total Payment | Principal Paid | Interest Paid

——- | ——– | ——– | ——–

1 | $3960 | $1000 | $2960

2 | $3960 | $1300 | $2660

3 | $3960 | $1600 | $2360

… | … | … | …

10 | $3960 | $3000+ | $960-

*(Note: These figures are illustrative and simplified for clarity. Actual amounts will vary based on the precise amortization schedule.)*

This table shows that in the early years, a significant portion of each payment goes toward interest. As the loan progresses, a larger portion of the payment goes toward principal repayment. By the final year, the majority of the payment will be applied to the principal. This is a typical characteristic of amortizing loans.

Repayment Plans and Their Impact on Interest

Choosing the right student loan repayment plan significantly impacts the total amount you pay in interest over the life of your loan. Different plans offer varying repayment schedules and monthly payments, leading to different total costs. Understanding these nuances is crucial for responsible financial planning.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It typically involves fixed monthly payments over a 10-year period. While this plan offers the shortest repayment timeline, leading to less interest accrued overall compared to longer-term plans, the monthly payments can be higher. This can present a challenge for borrowers with limited post-graduation income. The consistent monthly payment ensures predictability, but the higher monthly payment can strain a budget.

Extended Repayment Plan

An extended repayment plan stretches the repayment period beyond the standard 10 years, usually up to 25 years. This results in lower monthly payments, making it more manageable for borrowers with lower incomes. However, the extended repayment period significantly increases the total interest paid over the life of the loan. For example, a $30,000 loan at 6% interest with a 10-year repayment plan might accrue $10,000 in interest, whereas the same loan on a 25-year plan could accrue $25,000 or more in interest. The lower monthly payments provide short-term relief but come at the cost of substantially higher long-term interest costs.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan payments more affordable based on your income and family size. These plans, such as ICR (Income Contingent Repayment), IBR (Income-Based Repayment), PAYE (Pay As You Earn), and REPAYE (Revised Pay As You Earn), calculate monthly payments as a percentage of your discretionary income. Monthly payments are typically lower than standard or extended plans, offering immediate financial relief. However, the repayment period is often extended to 20 or 25 years, potentially leading to higher total interest paid. Furthermore, any remaining loan balance after the repayment period might be forgiven, but this forgiveness is considered taxable income. For instance, a borrower with a low income might see significantly lower monthly payments under an IDR plan, but this could mean they are still paying off the loan decades later, incurring a considerable amount of interest.

Comparison of Repayment Plan Features

The choice of repayment plan involves a trade-off between short-term affordability and long-term cost. Here’s a summary:

- Standard Repayment: Shortest repayment period (10 years), highest monthly payments, lowest total interest paid.

- Extended Repayment: Longer repayment period (up to 25 years), lower monthly payments, highest total interest paid.

- Income-Driven Repayment: Monthly payments based on income, potentially very long repayment period (20-25 years), total interest paid varies greatly depending on income and loan amount, potential for loan forgiveness (taxable).

Long-Term Financial Implications

Choosing a repayment plan is a long-term commitment with significant financial implications. A longer repayment period, while offering lower monthly payments, increases the total interest paid, potentially delaying other financial goals like saving for a down payment on a house or retirement. Conversely, higher monthly payments under a standard plan, while leading to less interest paid, might strain your budget in the short term. Careful consideration of your income, financial goals, and risk tolerance is crucial to selecting the most appropriate repayment plan. It’s often advisable to consult a financial advisor to determine the best course of action based on your individual circumstances.

Managing and Reducing Interest Payments

Minimizing the total interest paid on student loans requires proactive strategies and a solid understanding of your loan terms. By implementing effective management techniques, borrowers can significantly reduce their overall repayment burden and save substantial amounts of money over the life of their loans. This section explores various methods for achieving this goal.

Strategies for minimizing interest payments primarily revolve around accelerating repayment and strategically managing loan terms. This includes methods such as making extra payments, refinancing your loans, and carefully selecting a repayment plan that aligns with your financial capabilities and goals. Understanding these strategies is crucial for effective debt management.

Extra Payments and Accelerated Repayment

Making extra payments, even small ones, can dramatically reduce the total interest paid over the life of your loan. Every additional payment reduces the principal balance, meaning less interest accrues on that amount in subsequent months. For example, if you can afford an extra $50 per month, this will considerably shorten your repayment period and reduce the total interest accrued. Consider automating extra payments to ensure consistency and make the process effortless. Even small, consistent extra payments will yield significant long-term savings.

Student Loan Refinancing

Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total interest you pay over the loan’s lifespan. However, it’s crucial to carefully compare offers from multiple lenders and consider the potential risks before refinancing. For instance, refinancing federal loans means losing access to federal repayment programs and protections, such as income-driven repayment plans and loan forgiveness programs.

Refinancing Process: A Step-by-Step Guide

- Check Your Credit Score: A higher credit score typically qualifies you for better interest rates. Review your credit report and address any inaccuracies.

- Shop Around for Lenders: Compare interest rates, fees, and repayment terms from several private lenders. Don’t solely focus on the lowest rate; consider the overall cost.

- Gather Necessary Documents: Prepare your tax returns, pay stubs, and other financial documents required by lenders.

- Apply and Compare Offers: Submit applications to multiple lenders and carefully compare the loan terms and conditions of each offer.

- Choose a Lender and Complete the Process: Select the lender offering the most favorable terms and complete the loan application process.

Risks and Benefits of Refinancing

Refinancing student loans presents both advantages and disadvantages. The primary benefit is the potential for lower interest rates and reduced monthly payments. However, refinancing federal loans eliminates access to federal repayment programs and forgiveness options. Additionally, if your financial situation deteriorates after refinancing, you might lose the protections offered by federal student loan programs. Carefully weigh these factors before making a decision. Consider your long-term financial goals and risk tolerance before proceeding with refinancing.

Last Word

Successfully managing student loan debt requires a proactive and informed approach. By understanding how interest rates work, you can make strategic choices regarding loan selection, repayment plans, and debt reduction strategies. Remember to explore all available options, consider your individual financial circumstances, and seek professional advice when needed to navigate this crucial financial stage of your life successfully. Taking control of your student loans empowers you to build a secure financial future.

Q&A

What is the difference between a grace period and deferment?

A grace period is a temporary period after graduation where you don’t have to make payments, while deferment is a postponement of payments due to hardship, often requiring documentation.

Can I pay off my student loans early without penalty?

Generally, yes. Most federal and private student loans don’t have prepayment penalties. Paying early can save you significantly on interest.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, which has severe financial consequences.

How often are student loan interest rates adjusted?

Fixed interest rates remain constant for the life of the loan. Variable rates can change periodically, typically based on an index like the LIBOR or prime rate. The frequency of adjustment depends on the loan terms.

What is loan consolidation and is it beneficial?

Loan consolidation combines multiple loans into a single loan, potentially simplifying payments and possibly lowering your monthly payment. However, it might extend your repayment period and increase overall interest paid.