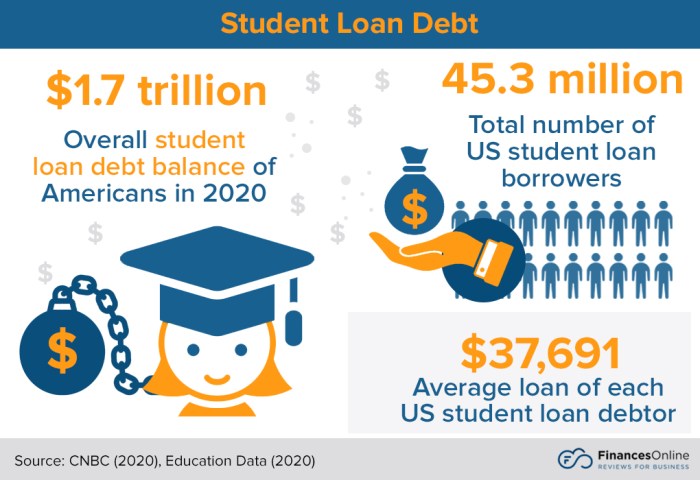

Navigating the complex world of graduate student loans can feel daunting. This guide provides a clear understanding of the various loan types available, the application process, and crucial factors to consider before borrowing. From federal loan programs like Direct Unsubsidized and Grad PLUS loans to the intricacies of private loans, we’ll demystify the process, empowering you to make informed financial decisions for your graduate education.

Understanding the nuances of interest rates, repayment plans, and potential loan forgiveness options is vital for responsible borrowing. This comprehensive overview will equip you with the knowledge to manage your student loan debt effectively and plan for a financially secure future after graduation. We’ll cover budgeting strategies, the impact on credit scores, and steps to minimize the long-term financial implications of student loans.

Eligibility for Graduate Student Loans

Securing funding for graduate school often involves navigating the complexities of student loans. Understanding the eligibility requirements for both federal and private loan programs is crucial for prospective graduate students. This section Artikels the key criteria you’ll need to meet to access these funding sources.

Federal Graduate Student Loan Eligibility

To be eligible for federal graduate student loans, you must be a U.S. citizen or eligible non-citizen, be enrolled at least half-time in a graduate degree program at a participating institution, maintain satisfactory academic progress, and have a valid Social Security number. You will also need to complete the Free Application for Federal Student Aid (FAFSA) and be accepted into a graduate program. Federal loans are generally easier to qualify for than private loans because they don’t require a credit check. However, your eligibility may be limited by aggregate loan limits.

Private Graduate Student Loan Eligibility

Private graduate student loans, offered by banks and other financial institutions, have stricter eligibility requirements. These loans often require a credit check, and your credit history significantly impacts your approval chances and the interest rate you’ll receive. A strong credit score, a steady income, and a low debt-to-income ratio generally improve your eligibility. Some lenders may also require a co-signer, particularly if your credit history is limited or weak. The specific requirements vary among lenders, so comparing offers from multiple institutions is recommended.

Credit History Requirements for Private Graduate Student Loans

Private lenders assess your creditworthiness based on your credit history. A good credit score, typically above 670, usually improves your chances of approval and results in a lower interest rate. Lenders review your credit report, checking for factors like payment history, outstanding debts, and credit utilization. A history of missed payments or high debt levels can significantly affect your eligibility, potentially leading to loan denial or higher interest rates. Having a co-signer with good credit can sometimes offset a less-than-perfect credit history.

Comparison of Federal and Private Graduate Student Loan Eligibility

Federal graduate student loans generally have less stringent eligibility requirements than private loans. Federal loans primarily focus on enrollment status and satisfactory academic progress, while private loans heavily weigh credit history and financial stability. Federal loans offer fixed interest rates and income-driven repayment plans, while private loan interest rates are variable and repayment options may be less flexible. Choosing between federal and private loans depends on your individual financial circumstances and creditworthiness.

Graduate Student Loan Comparison Table

| Loan Type | Eligibility Requirements | Interest Rate | Repayment Options |

|---|---|---|---|

| Federal Graduate PLUS Loan | U.S. citizen or eligible non-citizen, enrolled at least half-time, satisfactory academic progress, FAFSA completion | Fixed, determined annually | Standard, income-driven repayment plans |

| Private Graduate Student Loan | Credit check, good credit history, sufficient income, may require co-signer | Variable or fixed, depends on creditworthiness | Variable, lender-specific |

Types of Graduate Student Loans

Securing funding for graduate school often involves navigating the landscape of student loans. Understanding the different types available is crucial for making informed financial decisions. Federal loans generally offer more favorable terms than private loans, but both play a significant role in financing graduate education.

Federal Graduate Student Loans

Federal graduate student loans are offered by the U.S. Department of Education and typically come with lower interest rates and more flexible repayment options compared to private loans. These loans are generally considered a more attractive option due to their borrower protections.

Direct Unsubsidized Loans

Direct Unsubsidized Loans are available to graduate students regardless of financial need. Interest accrues from the time the loan is disbursed, meaning the total amount owed will grow even before repayment begins. The loan amount is determined by your school’s cost of attendance minus any other financial aid received. Borrowers are responsible for paying all accumulated interest.

Grad PLUS Loans

Grad PLUS Loans are credit-based loans designed to cover the remaining educational costs after other financial aid has been applied. Unlike unsubsidized loans, a credit check is required, and borrowers must meet specific credit history requirements. Interest accrues from disbursement, and borrowers are responsible for all interest charges. A creditworthy co-signer may be required if a borrower’s credit history doesn’t meet the lender’s standards.

Private Graduate Student Loans

Private graduate student loans are offered by banks, credit unions, and other private lenders. These loans are often more expensive than federal loans, with higher interest rates and potentially less favorable repayment terms. The interest rates and loan terms are determined by the lender’s assessment of the borrower’s creditworthiness. Private loan options can be appealing for students who have exhausted their federal loan limits or need additional funding. However, they should be considered carefully due to the potentially higher costs.

Comparison of Federal and Private Graduate Student Loans

| Feature | Federal Graduate Loans (e.g., Direct Unsubsidized, Grad PLUS) | Private Graduate Loans |

|---|---|---|

| Interest Rates | Generally lower | Generally higher, variable rates common |

| Credit Check | Not required for Direct Unsubsidized; required for Grad PLUS | Always required |

| Repayment Options | More flexible options, including income-driven repayment plans | Fewer repayment options, less flexibility |

| Borrower Protections | Stronger borrower protections, including deferment and forbearance options | Fewer borrower protections |

| Fees | Origination fees may apply | Origination fees and other fees may apply |

The Loan Application Process

Securing funding for graduate school often involves navigating the complexities of student loan applications. Understanding the process for both federal and private loans is crucial for a smooth and successful application experience. This section Artikels the key steps involved in applying for graduate student loans.

Federal Graduate Student Loan Application

Applying for federal graduate student loans begins with completing the Free Application for Federal Student Aid (FAFSA). This application determines your eligibility for various federal student aid programs, including federal student loans. The information you provide will be used to calculate your Expected Family Contribution (EFC), a key factor in determining your financial aid package. The FAFSA is a comprehensive application requiring accurate and detailed information.

- Step 1: Gather Necessary Information: Before starting the FAFSA, collect your Social Security number, federal tax returns, W-2s, and other relevant financial documents. You will also need your school’s Federal School Code.

- Step 2: Create an FSA ID: You and at least one parent (if you are a dependent student) will need an FSA ID to access and sign the FAFSA. This is a username and password combination used to securely access your FAFSA data.

- Step 3: Complete the FAFSA Online: The FAFSA is completed online through the official website. Carefully answer all questions accurately and completely. Any inaccuracies can delay the processing of your application.

- Step 4: Review and Submit: Before submitting, thoroughly review all the information you’ve provided to ensure accuracy. Once submitted, you cannot make changes without contacting the Federal Student Aid office.

- Step 5: Await Processing and Notification: After submission, the FAFSA is processed, and your school will be notified of your eligibility for federal student aid. You will receive a Student Aid Report (SAR) summarizing your information and eligibility.

Private Graduate Student Loan Application

Private graduate student loans are offered by banks, credit unions, and other financial institutions. The application process for private loans typically involves a more rigorous credit check than federal loans. Many lenders require a good credit history or a co-signer to mitigate the risk of loan default.

- Step 1: Research Lenders and Loan Options: Compare interest rates, fees, and repayment terms from various lenders. Consider factors like loan amounts, repayment periods, and any potential penalties for early repayment.

- Step 2: Pre-qualification: Many lenders offer a pre-qualification process that allows you to check your eligibility without impacting your credit score. This provides a sense of what loan amounts you might qualify for.

- Step 3: Complete the Application: The application process typically involves providing personal information, financial details, and academic information. You may be required to provide documentation to support your application, such as tax returns or pay stubs.

- Step 4: Credit Check and Co-signer Consideration: Lenders will perform a credit check to assess your creditworthiness. If your credit score is low, you may need a co-signer with good credit to qualify for the loan. The co-signer assumes responsibility for the loan repayment if you default.

- Step 5: Loan Approval and Disbursement: Once approved, the funds will be disbursed according to the lender’s terms, often directly to your school.

Interest Rates and Repayment Plans

Understanding interest rates and repayment options is crucial for effectively managing your graduate student loan debt. The interest rate and repayment plan you’ll face depend on the type of loan you obtain – federal or private – and the terms offered by the lender.

Federal Graduate Student Loan Interest Rates

Federal graduate student loan interest rates are set by the government and are typically fixed for the life of the loan. These rates are influenced by various economic factors, including the 10-year Treasury note rate and market conditions. The specific rate you receive will depend on the loan program (e.g., Direct Unsubsidized Loans, Direct Grad PLUS Loans) and the loan disbursement date. It’s important to note that interest begins accruing on unsubsidized loans immediately upon disbursement, while subsidized loans typically defer interest accrual until after graduation or leaving school. The Department of Education publishes the current interest rates annually.

Private Graduate Student Loan Interest Rates

Private graduate student loan interest rates are set by private lenders (banks, credit unions, etc.) and are generally variable, meaning they can fluctuate over the life of the loan. These rates are determined based on several factors, including your credit score, credit history, income, and the loan’s term. Borrowers with excellent credit scores and strong financial histories typically qualify for lower interest rates. Private loan interest rates tend to be higher than federal loan rates, making them a less favorable option unless absolutely necessary.

Graduate Student Loan Repayment Plans

Several repayment plans are available for federal graduate student loans, offering varying monthly payment amounts and loan durations. These plans help borrowers manage their debt according to their financial circumstances.

Comparison of Repayment Plans

The following table compares different repayment plans and their associated costs. Remember, these are examples, and the actual costs will depend on your loan amount, interest rate, and loan term.

| Repayment Plan | Monthly Payment (Example) | Loan Term (Years) | Total Interest Paid (Example) |

|---|---|---|---|

| Standard Repayment | $500 | 10 | $10,000 |

| Graduated Repayment | $300 (increasing annually) | 10 | $12,000 |

| Extended Repayment | $250 | 25 | $25,000 |

*Note: These are illustrative examples only. Actual payments and total interest paid will vary based on individual loan amounts, interest rates, and specific loan terms.*

Interest Rate and Repayment Option Comparison Across Loan Types

Federal graduate student loans generally offer lower interest rates and more flexible repayment options compared to private loans. However, private loans might be considered if federal loan limits are insufficient to cover educational expenses. Carefully weighing the pros and cons of each loan type is essential before making a borrowing decision. Consider factors such as interest rates, repayment terms, and potential fees when comparing loan offers.

Loan Forgiveness and Deferment Options

Navigating the complexities of graduate student loan repayment can be daunting. Fortunately, several options exist to alleviate the burden, including loan forgiveness programs and deferment or forbearance plans. Understanding these options is crucial for effective financial planning after graduation.

Loan forgiveness programs and deferment options offer distinct pathways to manage graduate student loan debt. Forgiveness programs, typically targeted at specific professions or public service roles, eliminate a portion or all of the loan balance. Deferment and forbearance, on the other hand, temporarily postpone or reduce loan payments, providing short-term relief during periods of financial hardship.

Loan Forgiveness Programs for Graduate Students

Several federal and state programs offer loan forgiveness for graduate students pursuing careers in specific fields. These programs often require a commitment to public service or work in an area of national need. Eligibility criteria vary significantly between programs, and it’s essential to research the specifics of each.

Public Service Loan Forgiveness (PSLF) Program

The PSLF program forgives the remaining balance on federal Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying employer. Qualifying employers include government organizations (federal, state, local, or tribal) and certain non-profit organizations. To qualify, borrowers must be enrolled in an income-driven repayment plan. The program’s stringent requirements often lead to many borrowers being ineligible, highlighting the need for thorough research and planning before applying.

Teacher Loan Forgiveness Program

This program forgives up to $17,500 in federal student loans for teachers who have completed five consecutive years of full-time teaching in a low-income school or educational service agency. This program specifically targets educators in under-resourced communities and aims to incentivize individuals to pursue teaching careers in those areas. Teachers must meet specific income requirements to be eligible for forgiveness.

Applying for Loan Deferment or Forbearance

The process of applying for loan deferment or forbearance typically involves contacting your loan servicer. Each servicer has its own application process, which may involve submitting documentation to support your request. Generally, you’ll need to demonstrate a valid reason for needing deferment or forbearance, such as unemployment, financial hardship, or medical reasons.

Conditions and Requirements for Loan Forgiveness

Loan forgiveness programs typically have strict eligibility requirements. These requirements often include specific employment, income levels, and the type of loan held. Failure to meet these requirements can result in the loss of forgiveness benefits. It’s crucial to carefully review the program’s terms and conditions before making any decisions. Furthermore, forgiven amounts are generally considered taxable income.

Situations Where Deferment or Forbearance Might Be Beneficial

Deferment or forbearance can provide much-needed financial breathing room during challenging times. For instance, a recent graduate facing unemployment might utilize deferment to pause payments while seeking employment. Someone experiencing a significant medical emergency leading to reduced income could utilize forbearance to lower monthly payments. These options are designed to provide temporary relief, but it’s important to understand that interest may still accrue during deferment or forbearance periods, potentially increasing the overall loan balance.

Managing Graduate Student Loan Debt

Navigating the complexities of graduate school often involves significant financial planning, and a large part of that is understanding and managing student loan debt. Effective strategies are crucial for minimizing long-term financial strain and ensuring a smooth transition into post-graduate life. This section Artikels key strategies for responsible debt management.

Successfully managing graduate student loan debt requires a proactive and organized approach. Ignoring the issue can lead to overwhelming debt and severely impact your financial future. Creating a realistic budget and adhering to a well-defined repayment plan are essential first steps. Understanding the potential consequences of defaulting is equally important to ensure responsible financial behavior.

Budgeting and Debt Management Strategies

Developing a comprehensive budget is paramount. This involves carefully tracking income and expenses to identify areas where savings can be maximized. Prioritize essential expenses such as housing, food, and transportation, while identifying non-essential spending that can be reduced or eliminated. Consider using budgeting apps or spreadsheets to monitor spending and track progress toward financial goals. For example, tracking daily expenses for a month can reveal unexpected spending patterns, allowing for adjustments in the budget. Allocating a specific portion of your monthly income towards loan repayment is also critical.

Creating and Adhering to a Repayment Plan

Once a budget is established, creating a detailed repayment plan is crucial. This plan should Artikel the specific amount allocated to loan repayment each month, taking into account the various loan types and interest rates. Explore different repayment options offered by your lenders, such as standard, extended, or income-driven repayment plans. Consider consolidating multiple loans into a single loan to simplify payments and potentially lower interest rates. Sticking to the repayment plan is essential to avoid accumulating additional interest and late payment fees. Regularly reviewing and adjusting the plan as your financial situation changes is also recommended.

Consequences of Student Loan Default

Defaulting on student loans has severe consequences. These include damage to credit scores, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Furthermore, default can lead to legal action and potential collection fees, significantly increasing the overall debt burden. For instance, a defaulted loan can negatively impact your ability to secure a mortgage or rent an apartment, limiting your housing options. Understanding these potential consequences emphasizes the importance of proactive loan management.

Tips for Responsible Student Loan Management

Careful planning and proactive management are key to successfully navigating graduate student loan debt. Here are some helpful tips:

- Understand your loan terms thoroughly, including interest rates, repayment schedules, and any associated fees.

- Create a detailed budget and allocate a specific amount towards loan repayment each month.

- Explore different repayment options and choose the one that best fits your financial situation.

- Consider refinancing your loans to potentially lower interest rates and simplify payments.

- Automate your loan payments to avoid missed payments and late fees.

- Monitor your credit report regularly and address any inaccuracies promptly.

- Seek professional financial advice if needed to create a personalized debt management plan.

- Explore loan forgiveness programs if eligible, to reduce your overall debt burden.

The Impact of Graduate Student Loans on Future Finances

Embarking on graduate studies often requires significant financial investment, and graduate student loans can play a crucial role in making this possible. However, it’s vital to understand the long-term financial implications of this debt to make informed decisions and plan effectively for the future. Borrowing responsibly and strategically is key to mitigating potential negative impacts.

Graduate student loan debt can significantly influence your future financial well-being, extending beyond the immediate repayment period. Understanding these long-term effects allows for proactive financial planning and helps avoid potential pitfalls.

Credit Scores and Future Borrowing Capacity

A substantial graduate student loan debt can impact your credit score, particularly if payments are missed or become delinquent. A lower credit score can make it more difficult and expensive to secure future loans, such as mortgages or auto loans. Lenders view a high debt-to-income ratio negatively, potentially resulting in higher interest rates or loan denials. For example, someone with a high debt load might find it challenging to qualify for a mortgage, even if their income is sufficient, because their debt-to-income ratio is too high. Maintaining a good payment history on your student loans is crucial for preserving your creditworthiness.

Minimizing the Impact of Student Loan Debt

Several strategies can help minimize the long-term impact of student loan debt. Careful budgeting and prioritizing loan repayment are essential. Exploring different repayment plans, such as income-driven repayment, can make monthly payments more manageable. Additionally, actively seeking higher-paying employment opportunities after graduation can significantly accelerate debt reduction. For instance, a graduate with a higher-paying job could allocate a larger portion of their income towards loan repayment, shortening the repayment period and reducing the overall interest paid.

Hypothetical Scenario: Long-Term Financial Effects

Let’s consider two hypothetical graduates, both pursuing a Master’s degree. Graduate A borrows $50,000 at a 7% interest rate and chooses a standard 10-year repayment plan. Graduate B borrows $100,000 at the same interest rate but opts for a 20-year repayment plan.

Graduate A will pay approximately $600 per month and will pay roughly $72,000 over the life of the loan. Graduate B will pay approximately $800 per month, but will pay approximately $192,000 over the life of the loan. This illustrates the significant impact of both the loan amount and the repayment plan on total interest paid and the overall financial burden. The longer repayment period, while offering lower monthly payments, results in substantially higher overall costs due to accumulated interest. This scenario highlights the importance of considering the long-term implications of different borrowing amounts and repayment plans before making a decision.

End of Discussion

Securing funding for graduate studies requires careful consideration and planning. By understanding the different types of graduate student loans, their associated costs, and available repayment options, you can make informed decisions that align with your financial goals. Remember, proactive budgeting, responsible borrowing, and exploring loan forgiveness programs can significantly impact your long-term financial well-being. With careful planning and a clear understanding of the process, you can successfully navigate the complexities of graduate student loans and achieve your academic aspirations.

Questions Often Asked

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Can I refinance my graduate student loans?

Yes, refinancing can potentially lower your interest rate, but it often involves private lenders and may impact your eligibility for federal loan forgiveness programs.

What happens if I default on my student loans?

Defaulting can result in wage garnishment, tax refund offset, and damage to your credit score, making it difficult to obtain future loans or credit.

How long does the loan application process typically take?

The timeline varies depending on the lender and the type of loan. Federal loans generally take longer than private loans due to processing times.

Are there income-driven repayment plans for graduate student loans?

Yes, several income-driven repayment plans are available for federal student loans, adjusting your monthly payments based on your income and family size.