Securing funding for higher education is a crucial step for many students. The Direct Stafford Loan program offers a pathway to financial aid, but navigating the application process can feel daunting. This guide demystifies the process, providing a clear and concise overview of eligibility requirements, application procedures, and post-approval steps. We’ll explore the intricacies of the FAFSA form, different loan types, and the responsibilities involved in accepting and repaying your loan. By the end, you’ll have a comprehensive understanding of how to successfully apply for a Direct Stafford Loan.

Understanding the nuances of federal student aid is key to a smooth and successful application process. This guide aims to provide clear, actionable steps to help students navigate the complexities of the Direct Stafford Loan program, empowering them to make informed decisions about their financial future. We will cover everything from initial eligibility to repayment options, ensuring a comprehensive understanding of the entire process.

Eligibility Requirements for Direct Stafford Loans

Securing a Direct Stafford Loan hinges on meeting specific eligibility criteria established by the federal government. These guidelines ensure that federal funds are allocated appropriately to students who genuinely need financial assistance to pursue higher education. Understanding these requirements is crucial for prospective borrowers.

Federal Student Eligibility Guidelines

To be eligible for a Direct Stafford Loan, students must meet several key requirements. These include being a U.S. citizen or eligible non-citizen, having a valid Social Security number, and being enrolled or accepted for enrollment at least half-time in a degree or certificate program at an eligible institution. Furthermore, students must demonstrate financial need (for subsidized loans) or simply meet the basic requirements (for unsubsidized loans). Maintaining satisfactory academic progress is also typically a requirement.

Enrollment Status Requirements

The level of enrollment significantly impacts Stafford Loan eligibility. While full-time enrollment generally allows for the maximum loan amount, part-time students can still qualify, albeit for potentially smaller loan amounts. The definition of “full-time” and “part-time” varies depending on the institution’s credit hour requirements. It’s essential to check with the school’s financial aid office for their specific definitions.

Dependency Status and its Influence

A student’s dependency status—whether dependent or independent—influences their eligibility and the amount of financial aid they may receive. Dependent students are typically those who rely financially on their parents or guardians. Their parents’ income and assets are considered when determining their financial need for subsidized loans. Independent students, on the other hand, have greater autonomy in the financial aid process, as their financial situation is assessed without considering their parents’ income.

Situations Leading to Disqualification

Several factors can disqualify a student from receiving a Direct Stafford Loan. These include having a defaulted federal student loan, owing a refund on a previous federal student aid, or failing to maintain satisfactory academic progress as defined by their institution. Additionally, providing false or misleading information on the loan application can also lead to disqualification. Students with a history of drug convictions may also face limitations.

Eligibility Factors Summary

| Eligibility Factor | Requirement | Example of Meeting Requirement | Example of Not Meeting Requirement |

|---|---|---|---|

| U.S. Citizenship/Eligible Non-citizen | Must be a U.S. citizen or eligible non-citizen | Possessing a U.S. passport or a permanent resident card. | Being an undocumented immigrant without legal status. |

| Enrollment Status | Enrolled at least half-time in an eligible program | Enrolled in 12 credit hours at a university (meeting the university’s definition of half-time enrollment). | Enrolled in only 3 credit hours, falling below the institution’s minimum for half-time status. |

| Satisfactory Academic Progress | Maintaining a minimum GPA and progressing towards degree completion as per the institution’s guidelines. | Maintaining a GPA above 2.0 and completing at least 67% of required coursework each semester. | Failing to meet the minimum GPA requirement or failing to progress adequately towards degree completion, leading to academic probation. |

| Financial Need (for Subsidized Loans) | Demonstrating a financial need based on the FAFSA (Free Application for Federal Student Aid) data. | A family with a low income and high educational costs would likely qualify. | A family with high income and low educational costs would likely not qualify. |

| No Default on Federal Student Loans | No history of defaulting on previous federal student loans. | Having consistently repaid all previous federal student loans. | Having defaulted on a previous Perkins loan. |

Completing the FAFSA Form

The Free Application for Federal Student Aid (FAFSA) is the gateway to receiving federal student aid, including Direct Stafford Loans. Completing this form accurately and on time is crucial for determining your eligibility and securing the financial assistance you need for your education. The FAFSA collects information about you, your family, and your finances to calculate your Expected Family Contribution (EFC), a key factor in determining your financial need and the amount of aid you may receive.

The FAFSA requires a significant amount of information to accurately assess your financial situation. This data is used to determine your eligibility for various federal student aid programs. Providing accurate and complete information is paramount to ensuring a smooth and successful application process.

Information Required in the FAFSA Form

The FAFSA requests detailed information about both the student and their family. This includes personal data such as Social Security numbers, addresses, and dates of birth. It also requires financial information such as tax returns, W-2s, and bank statements. Specific information requested often includes income, assets, and untaxed income. Failure to provide accurate and complete information can lead to delays in processing or even ineligibility for aid.

Step-by-Step Guide to Completing the FAFSA Online

The FAFSA is completed online through the official Federal Student Aid website. The process generally involves creating an FSA ID, gathering necessary financial documents, and carefully inputting all required information.

- Create an FSA ID: This is a username and password that you will use to access and manage your FAFSA information. Both the student and a parent (if the student is a dependent) will need an FSA ID.

- Gather Required Documents: Before starting the application, gather your tax returns (federal and state), W-2s, and other relevant financial documents. Having this information readily available will streamline the process.

- Complete the Application: The online application is a series of questions that guide you through the process. Answer each question carefully and accurately. Use the help features provided if you encounter any difficulties.

- Review and Submit: Once you have completed the application, carefully review all the information you have entered. Ensure that everything is accurate and complete before submitting. Submitting an incomplete or inaccurate application can cause delays.

- Track Your Application: After submitting your FAFSA, you can track its status online. This allows you to monitor the progress of your application and be notified of any requests for additional information.

Importance of Accuracy and Timely Submission

Accuracy is paramount when completing the FAFSA. Inaccurate information can lead to delays in processing your application, a reduction in your financial aid award, or even ineligibility for aid. Furthermore, submitting your FAFSA on time is equally important, as many financial aid programs have deadlines. Meeting these deadlines ensures that you are considered for all available aid. Submitting late could mean missing out on valuable financial assistance. For example, a student who submits their FAFSA late might miss the deadline for state-based grants or scholarships.

FAFSA Completion Process Flowchart

A flowchart depicting the FAFSA completion process would visually represent the steps:

[Descriptive Flowchart] Imagine a flowchart starting with a box labeled “Start,” leading to a box “Create FSA ID.” This connects to “Gather Required Documents,” which then flows to “Complete the Online Application.” Next is “Review and Submit,” followed by “Track Application Status.” Finally, an end box labeled “FAFSA Complete” concludes the flowchart. Each box would contain a brief description of the step. The arrows connecting the boxes would represent the flow of the process.

Understanding Loan Types and Limits

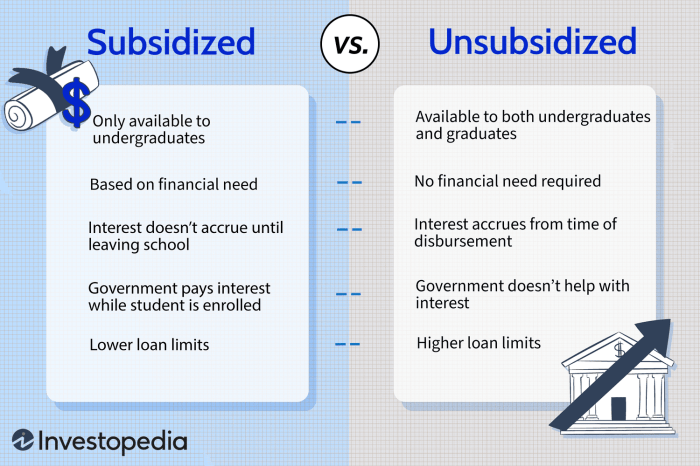

Direct Stafford Loans come in two varieties: subsidized and unsubsidized. Understanding the differences between these loan types is crucial for responsible borrowing and financial planning during your education. The key distinctions lie in interest accrual and eligibility criteria, impacting the overall cost of your loan. Knowing your loan limits is equally important to avoid exceeding your borrowing capacity.

Direct Stafford Loan Types

Direct Subsidized and Unsubsidized Loans are the two main types of Stafford Loans. Subsidized loans offer interest rate subsidies from the government while you are enrolled at least half-time, during grace periods, and during certain deferment periods. Unsubsidized loans, on the other hand, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. This means the final amount you repay on an unsubsidized loan will be higher than the initial loan amount.

Subsidized vs. Unsubsidized Loans: A Comparison

The primary difference between subsidized and unsubsidized loans is the interest subsidy. With subsidized loans, the government pays the interest while you’re in school at least half-time, during grace periods, and in some deferment periods. This means your loan balance doesn’t increase during these times. Unsubsidized loans, however, accrue interest throughout your loan’s life, leading to a larger total repayment amount. Eligibility for subsidized loans is based on financial need, as determined by your FAFSA. Unsubsidized loans are available to all eligible students, regardless of financial need.

Annual and Aggregate Loan Limits

The maximum amount you can borrow each year and over the course of your education is limited. These limits vary depending on your year of study (undergraduate or graduate) and your dependency status (dependent or independent). For example, for the 2023-2024 academic year, the annual limit for dependent undergraduate students was $5,500 for first-year students, increasing to $6,500 in the second year and $7,500 in subsequent years. Graduate students have higher annual and aggregate limits. It’s essential to check the official Federal Student Aid website for the most up-to-date information on loan limits. Exceeding these limits can lead to loan denial.

Advantages and Disadvantages of Each Loan Type

Understanding the pros and cons of each loan type is crucial for making an informed borrowing decision.

- Subsidized Loans:

- Advantages: No interest accrues while in school at least half-time, during grace periods, and some deferment periods, resulting in lower overall loan costs.

- Disadvantages: Eligibility is based on financial need, meaning some students may not qualify.

- Unsubsidized Loans:

- Advantages: Available to all eligible students, regardless of financial need. Provides more borrowing flexibility.

- Disadvantages: Interest accrues from disbursement, leading to a higher total repayment amount compared to the initial loan amount.

The Loan Acceptance and Disbursement Process

After completing your FAFSA and being notified of your eligibility for a Direct Stafford Loan, your school will provide you with a loan offer. This offer details the loan amount you’ve been approved for, the interest rate, and repayment terms. Understanding this offer and the subsequent steps is crucial for successfully receiving your loan funds.

Reviewing the loan offer is a critical step. Carefully examine the details provided by your school, including the loan amount offered, the interest rate, and the total amount you will owe upon repayment. Compare this to your financial needs and budget to ensure the loan amount is appropriate. Contact your school’s financial aid office if you have any questions or require clarification on any aspect of the offer. Don’t hesitate to seek assistance if you’re unsure about anything.

Accepting or Declining a Loan Offer

Once you’ve reviewed your loan offer, you’ll need to formally accept or decline the loan. This is typically done online through your school’s student portal or the National Student Loan Data System (NSLDS) website. Accepting the loan signifies your agreement to the terms and conditions Artikeld in the offer. Declining a loan means you won’t receive the funds, and you’ll need to explore alternative funding options if necessary. Remember, you can accept only the amount you need, not necessarily the full amount offered.

Loan Disbursement to Student Accounts

After accepting your loan, the funds are disbursed to your student account. The disbursement process usually involves multiple payments, often spread across different semesters or academic terms. Your school will determine the disbursement schedule, and the funds will be credited to your account to cover tuition, fees, and other eligible expenses. The exact timing of disbursement can vary depending on the school’s policies and processing times.

Accessing Loan Funds

Accessing your loan funds typically means that the money is applied directly to your tuition and fees. Any remaining funds may be credited to your student account as a refund. This refund can then be accessed via direct deposit to your bank account or through a check mailed to your address. The method of access will be determined by your school’s policies and your personal banking information provided during the enrollment process. For example, if you have a direct deposit set up, the refund would go directly into your designated bank account. If not, you might receive a paper check.

Potential Disbursement Delays and Solutions

Delays in the disbursement process can occur for various reasons, including incomplete paperwork, errors in your application, or issues with your school’s financial aid processing. To avoid delays, ensure all your paperwork is complete and accurate, and promptly respond to any requests for additional information from your school’s financial aid office. If you experience a delay, contact your school’s financial aid office immediately to inquire about the status of your loan and identify any issues that need to be resolved. Proactive communication is key to resolving these issues efficiently. For example, a missing document could delay disbursement for several weeks.

Master Promissory Note (MPN) and Entrance Counseling

Before you receive your Direct Stafford Loan funds, you’ll need to complete two crucial steps: signing a Master Promissory Note (MPN) and completing entrance counseling. These steps are essential for understanding your loan responsibilities and ensuring a smooth borrowing process.

The MPN and entrance counseling are designed to inform you about your loan obligations and to protect both you and the lender. Failing to complete these steps will prevent you from receiving your loan funds.

Master Promissory Note (MPN) Information

The Master Promissory Note (MPN) is a legally binding agreement between you and the U.S. Department of Education. It Artikels your responsibilities as a borrower, including repayment terms and the consequences of default. This single document covers all your federal student loans of the same type (subsidized, unsubsidized, or both) for the same school year. You only need to sign one MPN per loan type, per school year.

The MPN will require information such as your full name, social security number, date of birth, and loan details. You’ll also be asked to acknowledge your understanding of the terms and conditions of the loan, including repayment options and potential consequences of default. The specific details required may vary slightly depending on the lender, but the core information remains consistent.

Entrance Counseling Requirements

Entrance counseling is a mandatory process designed to educate you about your rights and responsibilities as a borrower. It covers topics such as loan repayment options, the importance of responsible borrowing, and the consequences of defaulting on your loan. This interactive session usually involves reviewing key information and answering questions to confirm your understanding.

The counseling session typically includes information about different repayment plans, interest accrual, and the impact of loan default on your credit score and future financial opportunities. It’s a vital step in ensuring you understand the financial commitment you’re undertaking.

Completing the MPN and Entrance Counseling: A Step-by-Step Guide

- Access the NSLDS Website: Navigate to the National Student Loan Data System (NSLDS) website, a central database for federal student aid. This is where you will complete both the MPN and entrance counseling.

- Login or Create an Account: You will need your FSA ID to log in or create an account. The FSA ID is your personal username and password for accessing federal student aid websites.

- Complete the MPN: Carefully review all the information presented on the MPN and electronically sign the document. Ensure the information is accurate before submitting.

- Complete Entrance Counseling: Follow the on-screen instructions to complete the interactive entrance counseling session. This typically involves reading information and answering questions to demonstrate your understanding.

- Confirmation: Once you’ve completed both the MPN and entrance counseling, you’ll receive confirmation messages. You should save or print these confirmations for your records.

Accessing and Managing the MPN and Entrance Counseling Online

The MPN and entrance counseling are typically completed online through the NSLDS website. After completing the process, you can access and review your MPN and entrance counseling completion records through the same website using your FSA ID. You can also check the status of your loan and view other important information related to your federal student aid. Regularly checking your NSLDS account is recommended to stay informed about your loan status and repayment schedule.

Repayment Options and Responsibilities

Successfully navigating the Direct Stafford Loan process extends beyond receiving the funds; understanding repayment options and responsibilities is crucial for responsible financial management. Failure to plan for repayment can lead to significant financial hardship. This section Artikels the various repayment plans available and emphasizes the importance of proactive planning.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most borrowers. Under this plan, your loan is divided into fixed monthly payments over a 10-year period. The monthly payment amount is determined by the total loan amount, interest rate, and loan term.

| Repayment Plan | Description | Advantages/Disadvantages |

|---|---|---|

| Standard Repayment Plan | Fixed monthly payments over 10 years. | Advantages: Simple and predictable payments. Disadvantages: Higher monthly payments compared to other plans, potentially leading to higher total interest paid. |

| Graduated Repayment Plan | Payments start low and gradually increase over a 10-year period. | Advantages: Lower initial payments, making it easier to manage early in your career. Disadvantages: Payments increase significantly over time, potentially becoming difficult to manage later on. Higher total interest paid compared to the Standard plan. |

| Extended Repayment Plan | Payments are spread over a longer period (up to 25 years, depending on loan amount). | Advantages: Lower monthly payments than the Standard plan. Disadvantages: Significantly higher total interest paid over the life of the loan. |

| Income-Driven Repayment (IDR) Plans | Monthly payments are based on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). | Advantages: Lower monthly payments, potentially more manageable during periods of lower income. Disadvantages: Payments may not cover all interest accrued, potentially leading to loan balance growth. Longer repayment periods, resulting in higher total interest paid. |

Understanding Repayment Terms and Schedules

Understanding your repayment terms, including the interest rate, loan amount, and repayment schedule, is essential for budgeting and avoiding delinquency. Your loan servicer will provide you with a detailed repayment schedule outlining your monthly payment amount, due date, and the total amount you will pay over the life of the loan. Carefully reviewing this schedule and understanding the implications of different repayment plans is crucial.

Deferment and Forbearance Options

Deferment and forbearance are temporary pauses in your loan repayments. Deferment is generally available to borrowers who meet specific criteria, such as returning to school or experiencing unemployment. Forbearance is typically granted due to temporary financial hardship. It’s important to note that interest may continue to accrue during deferment or forbearance, leading to a larger loan balance upon repayment resumption. Both options should be explored only as a last resort, as they can ultimately increase the total cost of the loan.

Final Conclusion

Successfully navigating the Direct Stafford Loan application process requires careful planning and attention to detail. From understanding eligibility requirements and completing the FAFSA to accepting your loan offer and understanding repayment options, each step plays a crucial role in securing the financial support you need for your education. By following the steps Artikeld in this guide, students can confidently apply for and manage their Direct Stafford Loan, paving the way for a successful academic journey. Remember to always seek clarification if you have any questions or concerns throughout the process.

Helpful Answers

What happens if I don’t complete the FAFSA by the deadline?

Missing the deadline may affect your eligibility for federal aid, including Direct Stafford Loans. Contact your school’s financial aid office to discuss your options.

Can I get a Direct Stafford Loan if I’m attending a vocational school?

Yes, provided the school is eligible to participate in the federal student aid program.

What if my financial situation changes after I submit my FAFSA?

You can update your FAFSA information through the FAFSA website. Significant changes may require resubmission.

What are the consequences of defaulting on a Direct Stafford Loan?

Defaulting can result in negative credit reporting, wage garnishment, and tax refund offset.