Navigating the complexities of higher education often involves understanding the intricacies of student financing. Subsidized student loans, a cornerstone of federal financial aid, offer a crucial pathway to academic success for many. This guide unravels the mechanics of these loans, exploring eligibility, repayment options, and the broader economic implications, empowering you to make informed decisions about your educational journey.

From understanding eligibility requirements based on income and academic level to navigating the application process and various repayment plans, this exploration aims to demystify the world of subsidized student loans. We will delve into the role of the federal government, explore loan forgiveness programs, and address the potential long-term financial implications of borrowing. Ultimately, the goal is to provide a clear and comprehensive understanding of this vital aspect of higher education funding.

Eligibility Criteria for Subsidized Student Loans

Subsidized federal student loans help students finance their education by offering interest-free loans while they are enrolled in school at least half-time and during grace periods. Understanding the eligibility criteria is crucial for students seeking financial aid. These criteria are established by the U.S. Department of Education and can change, so it’s always best to check the most up-to-date information on the Federal Student Aid website.

Eligibility for subsidized federal student loans hinges on several factors, primarily focusing on financial need and academic standing. The process involves completing the Free Application for Federal Student Aid (FAFSA), which determines eligibility based on provided financial information.

Financial Need and Income Limitations

Determining financial need involves assessing the student’s and their family’s (if the student is a dependent) financial situation. The FAFSA uses a complex formula considering income, assets, family size, and other factors to calculate the Expected Family Contribution (EFC). A lower EFC generally indicates greater financial need and a higher likelihood of receiving subsidized loans. For dependent students, parental income and assets significantly influence the EFC calculation. The government sets income thresholds; if a family’s income exceeds these thresholds, the student may not qualify for subsidized loans, even if they demonstrate some level of financial need. Independent students, however, have their financial need assessed based solely on their own income and assets. Specific income limitations are published annually by the Department of Education and are subject to change.

Parental Contribution Expectations for Dependent Students

For dependent students, parental contribution plays a crucial role in determining eligibility. The FAFSA collects detailed information about parents’ income, assets, and tax returns. This information is used to calculate the Expected Family Contribution (EFC), a measure of how much the family is expected to contribute towards the student’s education. A higher EFC generally reduces the amount of federal student aid, including subsidized loans, a student may receive. The expectation is that parents contribute to their dependent children’s education to the extent of their financial ability, as determined by the FAFSA formula. Failure to provide accurate information on the FAFSA can lead to ineligibility or the need for repayment of funds already received.

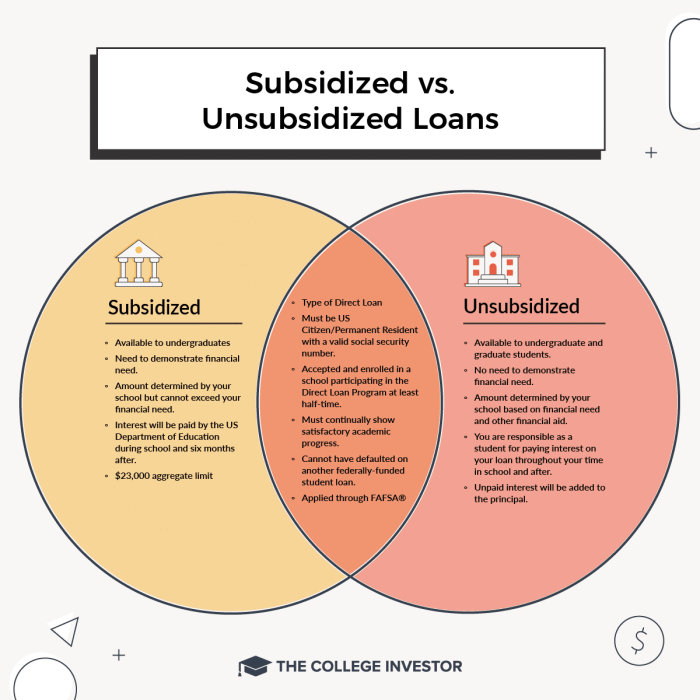

Undergraduate versus Graduate Student Eligibility

While both undergraduate and graduate students can receive federal student loans, the eligibility criteria and loan amounts may differ. Generally, undergraduate students are more likely to qualify for subsidized loans because of the emphasis on demonstrated financial need. Graduate students often have access to unsubsidized loans, where interest accrues while the student is in school. The availability of subsidized loans for graduate students is often more limited, and the loan amounts may be smaller than those available to undergraduate students. This difference reflects the assumption that graduate students may have more established financial resources or higher earning potential after graduation.

Key Eligibility Factors

| Factor | Undergraduate Students | Graduate Students | Dependent/Independent Status |

|---|---|---|---|

| Federal Student Aid (FAFSA) Completion | Required | Required | Required for both |

| Demonstrated Financial Need | Usually required for subsidized loans | Less emphasis; often unsubsidized loans | Influences need-based aid |

| Enrollment Status | At least half-time | At least half-time | Applies to both |

| Credit History | Generally not a factor for subsidized loans | May be a factor for unsubsidized loans | Impacts loan approval for unsubsidized loans |

| U.S. Citizenship or Eligible Non-Citizen Status | Required | Required | Applies to both |

Interest Rates and Repayment Plans

Understanding the interest rates and repayment options for subsidized student loans is crucial for effective financial planning during and after your education. This section details how these aspects function, enabling you to make informed decisions about your loan.

Interest rates for subsidized federal student loans are determined by the U.S. Department of Education and are set annually. The rate is typically tied to the 10-year Treasury note, with a fixed percentage added. This means the rate fluctuates based on market conditions but remains consistent for the life of your loan. For example, if the 10-year Treasury note yield is 3%, and the added percentage is 2.5%, the subsidized loan interest rate would be 5.5%. It’s important to note that these rates can change yearly, so checking the current rates from official government sources before borrowing is advisable.

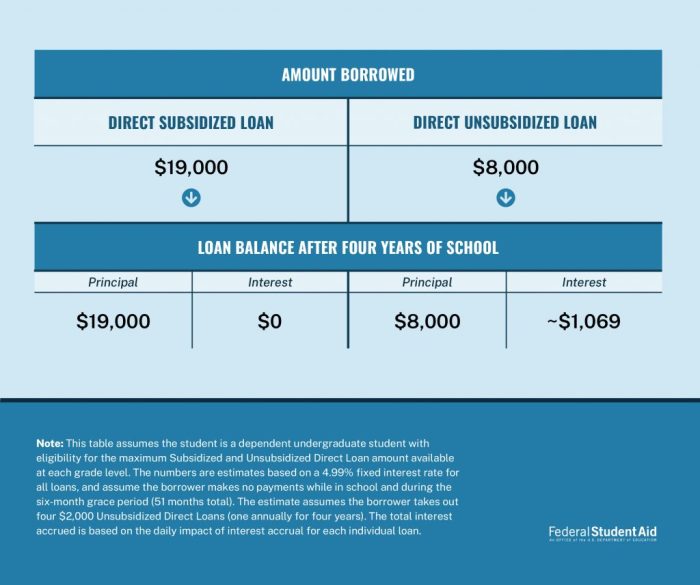

Subsidized vs. Unsubsidized Loan Interest Accrual

A key difference between subsidized and unsubsidized loans lies in how interest accrues while you’re in school. With subsidized loans, the government pays the interest while you are enrolled at least half-time in an eligible program of study and during certain grace periods. This means your loan balance doesn’t grow during these periods. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, even while you’re still studying. This accumulated interest is added to your principal loan amount, increasing the total amount you eventually owe. This can significantly impact the overall cost of your education.

Repayment Plan Options

Once you graduate or leave school, you’ll enter a grace period (usually six months) before repayment begins. Several repayment plans are available to help you manage your student loan debt. Choosing the right plan depends on your financial situation and your long-term goals.

| Repayment Plan | Description | Monthly Payment | Loan Term |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payments over 10 years. | Higher monthly payments | 10 years |

| Graduated Repayment Plan | Payments start low and gradually increase over 10 years. | Lower initial payments, higher later payments | 10 years |

| Extended Repayment Plan | Fixed monthly payments over a longer period (up to 25 years). | Lower monthly payments, higher total interest paid | Up to 25 years |

| Income-Driven Repayment (IDR) Plans | Monthly payments are based on your income and family size. Several plans exist, such as ICR, PAYE, REPAYE, and IBR. | Variable monthly payments, potentially lower than other plans | 20-25 years; potential for loan forgiveness after 20-25 years depending on plan and income. |

Loan Limits and Application Process

Understanding the maximum loan amounts and the application procedure for subsidized federal student loans is crucial for prospective students. This section will clarify the loan limits and provide a step-by-step guide to successfully navigating the application process. Accurate information and careful planning are key to securing the financial assistance needed for higher education.

Subsidized federal student loans, offered through the Federal Student Aid program, have annual and aggregate loan limits. These limits vary depending on the student’s year in school (undergraduate or graduate) and their dependency status (dependent or independent). It’s important to note that these limits are subject to change, so it’s always best to check the official Federal Student Aid website for the most up-to-date information.

Annual and Aggregate Loan Limits for Subsidized Federal Student Loans

The maximum amount a student can borrow in subsidized federal student loans varies yearly and cumulatively. For example, a dependent undergraduate student might have an annual limit of $3,500 for their first year, increasing to $4,500 for their second year, and $5,500 for their third and subsequent years. The aggregate limit, representing the total amount a student can borrow over their entire undergraduate career, might be capped at $23,000. Independent undergraduate students generally have higher loan limits. Graduate students also have different loan limit structures, typically with higher annual and aggregate caps. These figures are illustrative and should be verified on the official Federal Student Aid website.

Steps Involved in Applying for Subsidized Federal Student Loans

Applying for subsidized federal student loans involves several steps, beginning with completing the Free Application for Federal Student Aid (FAFSA). Gathering the necessary documentation beforehand significantly streamlines the process. Accurate and complete information is critical for a smooth and efficient application.

- Complete the FAFSA: This form collects information about your financial situation and is used to determine your eligibility for federal student aid, including subsidized loans. You will need your Social Security number, federal tax information (yours and your parents’ if you are a dependent student), and your driver’s license or state identification number.

- Provide Required Documentation: Depending on your circumstances, you may need to submit additional documents to verify the information provided on your FAFSA. This might include tax returns, W-2 forms, or other financial documentation.

- Receive Your Student Aid Report (SAR): After submitting your FAFSA, you will receive a SAR, which summarizes the information you provided and your eligibility for federal student aid. Review this carefully for accuracy.

- Accept Your Loan Offer: Once your school receives your FAFSA and processes your application, they will inform you of your eligibility for subsidized loans and the amount you’ve been offered. You will need to accept the loan offer to receive the funds.

- Complete Entrance Counseling: Before receiving your loan funds, you’ll need to complete entrance counseling, which provides information about your responsibilities as a borrower.

- Master Promissory Note (MPN): You’ll sign a Master Promissory Note, which is a legal agreement outlining your responsibilities in repaying the loan.

Flowchart of the Subsidized Federal Student Loan Application Process

The following flowchart visually represents the key steps involved in applying for subsidized federal student loans. Understanding this process can help you anticipate what to expect and better manage your application.

| Step | Action |

|---|---|

| 1 | Complete the FAFSA |

| 2 | Submit Required Documentation |

| 3 | Receive Student Aid Report (SAR) |

| 4 | Review and Accept Loan Offer |

| 5 | Complete Entrance Counseling |

| 6 | Sign Master Promissory Note (MPN) |

The Role of the Federal Government and Loan Forgiveness Programs

The federal government plays a crucial role in making higher education more accessible through its subsidized student loan program. These loans are offered by the government itself, unlike private loans, and help students manage the costs of tuition, fees, and living expenses. This involvement ensures a consistent and reliable source of funding for students, regardless of their credit history or financial background. The government’s role extends beyond simply providing loans; it also establishes regulations, manages the disbursement process, and oversees loan repayment and forgiveness programs.

The federal government’s involvement in subsidized student loans stems from a commitment to national economic growth and social mobility. By making higher education more attainable, the government aims to increase the skilled workforce and improve overall societal well-being. Subsidized loans, in particular, help students from lower-income backgrounds access college, ultimately contributing to a more equitable and prosperous society.

Conditions for Loan Forgiveness Programs

Loan forgiveness programs offer the possibility of having a portion or all of your student loan debt eliminated under specific circumstances. For subsidized federal student loans, forgiveness typically hinges on meeting certain employment criteria, working in specific public service sectors, or demonstrating financial hardship. The specific requirements vary widely depending on the program. Careful consideration of the program’s stipulations is crucial before applying, as failing to meet the conditions can result in the loan forgiveness being revoked.

Comparison of Loan Forgiveness Programs

Several federal loan forgiveness programs exist, each with unique eligibility criteria and benefits. Some programs focus on public service, while others prioritize income-driven repayment plans. For example, the Public Service Loan Forgiveness (PSLF) program forgives remaining federal student loan debt after 120 qualifying monthly payments under an income-driven repayment plan, while the Teacher Loan Forgiveness program forgives up to $17,500 in loans for teachers who meet specific requirements. The key differences lie in the type of employment, the required length of service, and the amount of loan forgiveness offered. It’s vital to thoroughly research the specific program requirements before relying on loan forgiveness as a primary repayment strategy.

Loan Forgiveness Programs: Eligibility Criteria

| Program Name | Eligibility Criteria | Loan Forgiveness Amount | Key Requirements |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Work full-time for a qualifying government or non-profit organization. | Remaining loan balance after 120 qualifying payments. | Make 120 qualifying monthly payments under an income-driven repayment plan. |

| Teacher Loan Forgiveness | Work as a full-time teacher in a low-income school for five complete and consecutive academic years. | Up to $17,500 | Meet specific teaching requirements and complete the required loan forgiveness application. |

| Income-Driven Repayment (IDR) Plans | Demonstrate financial need based on income and family size. | Varies depending on plan and income; potential for forgiveness after 20-25 years. | Enroll in an IDR plan and make timely payments. |

| Federal Perkins Loan Cancellation | Work in specific public service jobs for a set period. | Portion of the loan may be canceled based on years of service. | Specific employment requirements vary based on the type of public service. |

Impact of Subsidized Loans on Students and the Economy

Subsidized student loans play a significant role in shaping both individual financial trajectories and the broader economic landscape. Their impact is multifaceted, offering opportunities for educational attainment while simultaneously presenting potential challenges related to debt accumulation and long-term financial stability. Understanding this dual nature is crucial for informed policymaking and individual financial planning.

Subsidized student loans provide access to higher education for many individuals who might otherwise be unable to afford it. This increased access can lead to a more skilled and productive workforce, boosting economic growth through innovation and increased earning potential. However, the rising cost of education and the increasing reliance on loans have created a complex situation with both positive and negative consequences.

Benefits of Subsidized Student Loans for Students

Access to higher education significantly improves career prospects and earning potential. Subsidized loans reduce the immediate financial burden, allowing students to focus on their studies rather than being overwhelmed by the need to work excessive hours to cover tuition costs. This, in turn, can lead to higher graduation rates and better academic performance. The long-term benefits of a college education, such as increased lifetime earnings and improved health outcomes, often outweigh the costs of borrowing.

Challenges and Drawbacks of Student Loan Debt

The substantial debt burden associated with student loans can significantly impact graduates’ financial well-being. Many graduates struggle to repay their loans, leading to delayed major life decisions such as homeownership, starting a family, or investing in retirement. High levels of student loan debt can also contribute to financial stress and anxiety, affecting mental health and overall quality of life. The risk of default can lead to serious consequences, including damage to credit scores and wage garnishment.

Economic Impact of Subsidized Student Loan Programs

Subsidized student loan programs have a profound impact on both individuals and the national economy. On the individual level, these programs facilitate access to higher education, leading to increased earning potential and improved career opportunities. For the national economy, a more educated workforce translates to increased productivity, innovation, and economic growth. However, excessive student loan debt can hinder consumer spending and economic growth, as individuals allocate a larger portion of their income to loan repayments. This can also lead to decreased investment in other areas of the economy.

Long-Term Financial Implications of Subsidized Loans

The long-term financial implications of borrowing subsidized loans can vary significantly depending on factors such as the amount borrowed, the chosen repayment plan, and the borrower’s post-graduation income.

Let’s consider two hypothetical scenarios:

- Scenario 1: Successful Repayment: A graduate with a subsidized loan of $30,000 secures a high-paying job after graduation. They diligently repay their loan within 10 years, minimizing interest accrual and maintaining a strong credit score. This scenario demonstrates the potential for positive long-term financial outcomes when borrowing is managed responsibly and aligns with career prospects.

- Scenario 2: Struggling with Repayment: A graduate with a similar loan amount struggles to find employment that matches their education. They face difficulty making loan repayments, potentially leading to loan default, negatively impacting their credit score and future financial opportunities. This scenario highlights the potential risks associated with student loan debt when career prospects don’t meet expectations.

These scenarios illustrate that while subsidized loans can be a powerful tool for accessing higher education, responsible borrowing and careful financial planning are essential to mitigate the potential long-term financial risks.

Defaulting on Subsidized Student Loans

Defaulting on a subsidized student loan carries significant and long-lasting negative consequences. It can severely damage your credit score, making it difficult to obtain loans, rent an apartment, or even secure certain jobs. Understanding the implications of default and the steps to avoid or resolve it is crucial for responsible loan management.

Defaulting on a subsidized student loan means failing to make your loan payments for a period of 270 days or more. This triggers a series of actions by your loan servicer and the federal government, significantly impacting your financial future.

Consequences of Default

The consequences of defaulting on federal student loans are substantial and far-reaching. These include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Furthermore, your ability to obtain certain licenses or employment opportunities may be restricted. The negative impact on your credit history can persist for years, hindering your financial progress. Default also often leads to increased debt due to added fees and collection costs. The longer the default persists, the more severe the consequences become.

Addressing and Resolving Student Loan Defaults

Rehabilitation and consolidation are two primary pathways for addressing defaulted federal student loans. Rehabilitation involves making a series of on-time payments, usually nine, over a ten-month period. Successful rehabilitation can reinstate your eligibility for federal student aid programs and improve your credit standing. Loan consolidation involves combining your defaulted loans into a single loan with a new repayment plan. This can simplify the repayment process and potentially lower your monthly payment, making it more manageable. Both rehabilitation and consolidation require proactive engagement with your loan servicer.

Resources for Borrowers Facing Repayment Difficulties

Several resources are available to help borrowers struggling to repay their student loans. These include income-driven repayment plans, which adjust your monthly payment based on your income and family size. Deferment and forbearance options temporarily postpone or reduce your payments during times of financial hardship. Contacting your loan servicer directly to discuss your situation and explore available options is also crucial. They can provide personalized guidance and help you find a repayment plan that fits your circumstances. Additionally, federal and state agencies offer counseling services to assist with loan management and debt resolution strategies.

Resources and Support for Borrowers at Risk of Default

| Resource | Description | Contact Information | Website |

|---|---|---|---|

| National Student Loan Data System (NSLDS) | Provides access to your federal student loan information. | (800) 433-3243 | studentaid.gov |

| Federal Student Aid | Offers information and resources on managing federal student loans. | studentaid.gov | studentaid.gov |

| Student Loan Counseling | Provides guidance on repayment options and debt management strategies. | Contact your loan servicer or a non-profit credit counseling agency. | Various websites; search for “student loan counseling.” |

| Your Loan Servicer | Your primary point of contact for managing your student loans. | Contact information provided on your loan statements. | Your loan servicer’s website. |

Closing Summary

Securing a higher education often requires strategic financial planning. Subsidized student loans provide a significant opportunity, but understanding their intricacies is paramount. By carefully considering eligibility criteria, repayment options, and potential loan forgiveness programs, students can leverage these resources effectively to achieve their academic aspirations while mitigating the long-term burden of student loan debt. Proactive planning and informed decision-making are key to navigating this crucial aspect of financing higher education.

Q&A

What happens if I lose my eligibility for subsidized loans?

You may still be eligible for unsubsidized loans, which accrue interest while you’re in school. Explore other financial aid options as well.

Can I refinance my subsidized student loans?

Yes, but refinancing federal loans with private lenders might mean losing federal protections and benefits, such as income-driven repayment plans.

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.

Are subsidized loans available for all types of higher education?

Generally, yes, but eligibility criteria and loan limits might vary depending on the program and institution.