Navigating the world of student loans can feel overwhelming, especially when faced with the intricacies of unsubsidized loans. Understanding how these loans function—from eligibility requirements to repayment options—is crucial for responsible financial planning during and after your education. This guide will demystify the process, providing a clear understanding of unsubsidized federal student loans and equipping you with the knowledge to make informed decisions about your financial future.

This exploration will cover key aspects, including eligibility criteria, interest accrual, loan limits and fees, the potential consequences of default, and a comparison with private loan options. We’ll also delve into the application process and offer practical strategies for managing your student loan debt effectively. By the end, you’ll have a comprehensive grasp of unsubsidized student loans and be better prepared to manage your educational financing.

Eligibility Criteria for Unsubsidized Loans

Unsubsidized federal student loans are a crucial funding source for many students pursuing higher education. Understanding the eligibility requirements is key to successfully accessing these funds and planning your educational finances. Eligibility hinges on several factors, including your student status, enrollment status, and financial background.

The basic requirements for unsubsidized federal student loans are relatively straightforward. Generally, you must be a U.S. citizen or eligible non-citizen, be enrolled or accepted for enrollment at least half-time in a degree or certificate program at an eligible institution, and demonstrate financial need (though unlike subsidized loans, interest accrues regardless of need). However, the specific requirements can vary depending on whether you’re an undergraduate or graduate student, and your dependent status.

Undergraduate and Graduate Student Eligibility Differences

Undergraduate and graduate students face slightly different eligibility criteria. While both need to meet the basic requirements of U.S. citizenship or eligible non-citizen status and enrollment, the loan limits differ significantly. Graduate students are typically eligible for higher loan amounts than undergraduates. This reflects the generally higher costs associated with graduate-level programs and the expectation of higher earning potential after graduation. Furthermore, some graduate programs may have specific loan requirements or eligibility criteria beyond the standard federal loan program.

Factors Affecting Eligibility

Several factors beyond basic student status can impact eligibility for unsubsidized loans. Credit history, while not a direct requirement, can indirectly affect your eligibility if you are applying for a PLUS loan (Parent PLUS or Graduate PLUS). A poor credit history might make it more difficult to secure a PLUS loan, which often requires a credit check. Other factors that can influence eligibility include your enrollment status (full-time vs. part-time), your school’s participation in the federal student aid program, and your satisfactory academic progress (SAP). Maintaining satisfactory academic progress is crucial; failing to do so can lead to the loss of eligibility for federal student aid, including unsubsidized loans.

Eligibility Requirements: Dependent vs. Independent Students

| Requirement | Dependent Student | Independent Student |

|---|---|---|

| Age | Under 24 | 24 or older |

| Financial Dependency | Financially dependent on parents or guardians | Not financially dependent on parents or guardians |

| Marital Status | Unmarried | Married, divorced, or widowed |

| Parental Information | Required to provide parental information on the FAFSA | Not required to provide parental information |

Interest Accrual and Repayment

Unsubsidized student loans begin accruing interest from the moment the loan is disbursed, unlike subsidized loans. Understanding how this interest accrues and the various repayment options available is crucial for effective financial planning after graduation. This section will detail the mechanics of interest accrual and explore the different repayment plans borrowers can choose from.

Interest on unsubsidized loans starts accumulating immediately, even while you’re still in school. This means that the principal loan amount will grow larger over time, increasing the total amount you eventually owe. The interest rate is fixed for the life of the loan and is determined at the time the loan is disbursed. The interest that accrues during your studies is added to your principal balance, a process known as capitalization. This capitalized interest increases the total amount you will need to repay once you enter repayment.

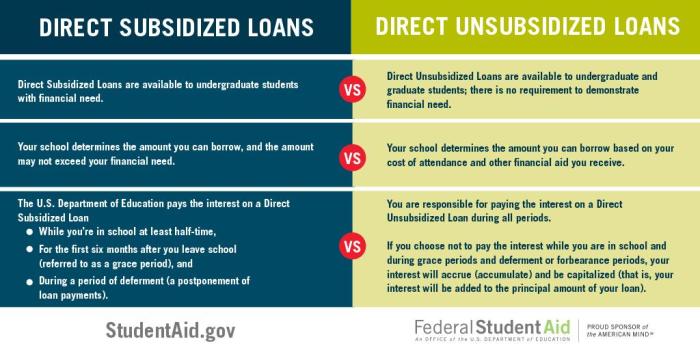

Interest Accrual on Unsubsidized vs. Subsidized Loans

Unsubsidized loans accrue interest from the loan disbursement date, regardless of your enrollment status. In contrast, subsidized loans do not accrue interest while the borrower is enrolled at least half-time in an eligible degree program and during certain grace periods. This key difference significantly impacts the total cost of borrowing. For example, a student with a $10,000 unsubsidized loan at a 5% interest rate will owe more than a student with a $10,000 subsidized loan at the same interest rate after four years of college, even if both students borrow the same amount. The difference stems from the interest that accrues on the unsubsidized loan during the four years.

Repayment Plan Options

After graduation, borrowers typically have a grace period (usually six months) before repayment begins. Several repayment plans are available, each with its own advantages and disadvantages. The choice depends on the borrower’s financial situation and repayment preferences.

The most common repayment plans include:

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s the simplest option, but it typically results in higher monthly payments.

- Extended Repayment Plan: This plan allows for longer repayment periods (up to 25 years), resulting in lower monthly payments but higher total interest paid over the life of the loan.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time. This can be helpful for borrowers who anticipate higher income in the future.

- Income-Driven Repayment (IDR) Plans: These plans base monthly payments on your income and family size. Several IDR plans exist (e.g., ICR, PAYE, REPAYE,IBR), each with its own eligibility requirements and payment calculation methods. While monthly payments are typically lower, total interest paid over the life of the loan may be higher, and remaining balances may be forgiven after 20-25 years, depending on the plan and income.

Sample Repayment Schedule

The following table illustrates the impact of different repayment plans on total interest paid for a $20,000 loan at a 5% interest rate. These figures are illustrative and do not account for potential changes in interest rates or income.

| Repayment Plan | Loan Amount | Interest Rate | Total Interest Paid (Estimate) |

|---|---|---|---|

| Standard (10 years) | $20,000 | 5% | $4,700 (approx.) |

| Extended (25 years) | $20,000 | 5% | $14,000 (approx.) |

| Graduated (10 years) | $20,000 | 5% | $4,700 (approx.) |

| IDR Plan (20 years, example) | $20,000 | 5% | $12,000 (approx.) – Highly variable based on income. |

Loan Limits and Fees

Understanding the loan limits and associated fees for unsubsidized federal student loans is crucial for effective financial planning during your education. These limits and fees can significantly impact the total amount you borrow and the overall cost of your degree. Careful consideration of these factors is essential to avoid unnecessary debt.

Unsubsidized federal student loans, unlike subsidized loans, accrue interest from the moment the loan is disbursed, even while you’re still in school. Knowing the limits and fees will help you make informed borrowing decisions and manage your repayment effectively.

Annual and Aggregate Loan Limits

The maximum amount you can borrow annually and over the course of your education is determined by your year in school (dependent and independent status also plays a role) and your school’s policies. These limits are set by the federal government and are subject to change. It’s always best to check the official Federal Student Aid website for the most up-to-date information.

- Dependent Undergraduate Students: The annual loan limit for dependent undergraduates is generally capped at a certain amount, increasing each year of college. For example, in a recent year, a first-year student might have been limited to $5,500, rising to $6,500 in the second year, $7,500 in the third year, and potentially higher in subsequent years. The aggregate loan limit (total amount borrowed over the course of your undergraduate education) would have been significantly higher, likely in the range of $31,000.

- Independent Undergraduate Students: Independent undergraduates typically have higher annual and aggregate loan limits. These limits are usually greater than those for dependent students, reflecting the increased financial responsibilities independent students often bear.

- Graduate Students: Graduate students also have specific annual and aggregate loan limits, usually higher than those for undergraduates. These limits reflect the typically higher costs associated with graduate-level education.

Origination Fees

Unsubsidized federal student loans typically incur origination fees. These fees are a percentage of the loan amount and are deducted from the total loan disbursement. This means you receive less money than the total loan amount approved. The fee amount varies depending on the loan type and the year in which the loan is disbursed. These fees are set by the government and are non-negotiable.

- Fee Calculation: The fee is calculated as a percentage of the loan amount. For example, a 1.057% origination fee on a $10,000 loan would result in a fee of approximately $105.70, leaving the borrower with $9,894.30.

- Impact on Borrowing: Because the fee is deducted upfront, it’s important to factor it into your overall borrowing strategy. The actual amount you receive is less than the total loan amount.

Default and its Consequences

Defaulting on your unsubsidized student loans can have serious and long-lasting negative consequences, significantly impacting your financial future. Understanding these repercussions is crucial for responsible loan management. Failure to repay your loans as agreed upon can lead to a range of damaging effects, from impacting your credit score to potentially leading to wage garnishment.

Defaulting on a federal student loan means you have failed to make your payments for 270 days or more (9 months). This is a serious matter with significant ramifications. The consequences extend far beyond simply a negative mark on your credit report; they can affect your ability to secure housing, employment, and even obtain future loans.

Consequences of Default

Defaulting on your student loans has several severe consequences. Your credit score will suffer dramatically, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. The government may also garnish your wages, meaning a portion of your paycheck will be automatically deducted to pay off the debt. Furthermore, you may face tax refund offset, where your tax refund is seized to cover your outstanding debt. In extreme cases, your professional licenses may be revoked, preventing you from working in certain fields. Finally, your ability to obtain federal financial aid in the future will be jeopardized.

Options for Borrowers Facing Difficulty

If you are struggling to make your student loan payments, several options are available to help you avoid default. Contacting your loan servicer is the first and most crucial step. They can discuss your financial situation and explore various repayment plans tailored to your individual circumstances. These plans may include income-driven repayment plans, which base your monthly payments on your income and family size, or deferment or forbearance, which temporarily postpone or reduce your payments. Exploring these options can provide much-needed financial relief and help you avoid default.

Loan Rehabilitation

Loan rehabilitation is a process that can help you restore your defaulted federal student loan to good standing. It involves making nine on-time payments over a 10-month period. Once completed, the default status is removed from your credit report, and you may be eligible for various repayment plans and benefits. While this process requires commitment and discipline, it can significantly improve your creditworthiness and financial outlook. The positive impact on your credit score can be substantial, opening doors to better financial opportunities.

Potential Consequences of Loan Default

| Consequence | Description | Impact | Severity |

|---|---|---|---|

| Damaged Credit Score | Significant drop in credit score, making it difficult to obtain credit. | Limits access to loans, credit cards, and even rental agreements. | High |

| Wage Garnishment | Portion of your wages automatically deducted to repay the loan. | Reduces disposable income and can cause significant financial hardship. | High |

| Tax Refund Offset | Federal tax refund seized to repay the loan. | Loss of anticipated tax refund, potentially impacting financial stability. | Medium |

| Difficulty Obtaining Future Loans | Makes it extremely challenging to obtain future loans, including mortgages and auto loans. | Limits access to major financial products and services. | High |

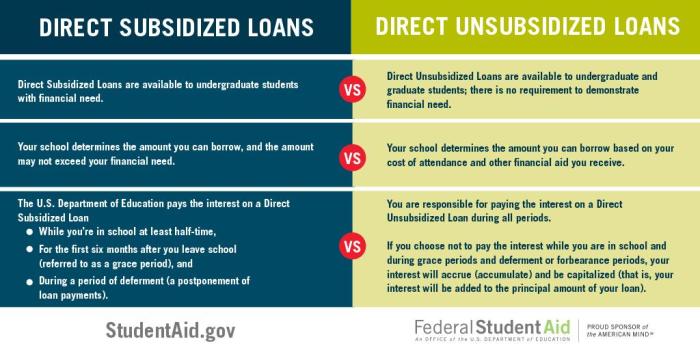

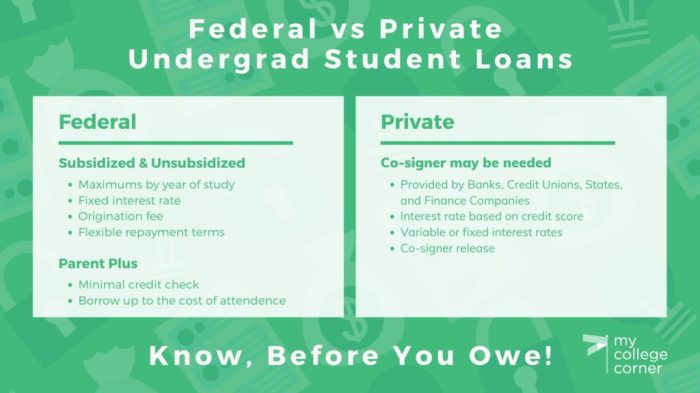

Comparison with Private Loans

Choosing between unsubsidized federal student loans and private student loans requires careful consideration of your individual financial situation and long-term goals. Both offer funding for higher education, but they differ significantly in terms of interest rates, repayment options, and borrower protections. Understanding these differences is crucial for making an informed decision.

Federal unsubsidized loans, offered by the government, generally provide more borrower protections and often more favorable repayment terms than private loans offered by banks and credit unions. However, private loans may offer higher loan amounts in some cases.

Interest Rates and Repayment Terms

Interest rates for both unsubsidized federal and private student loans fluctuate based on market conditions and the borrower’s creditworthiness. Unsubsidized federal loans typically have fixed interest rates determined annually by the government. These rates are generally lower than those offered by private lenders, which can be variable or fixed, and are influenced by factors like credit score, income, and the co-signer’s credit history (if applicable). Repayment terms also vary. Federal loans offer a variety of repayment plans, including income-driven repayment options that adjust payments based on your income and family size. Private loan repayment terms are usually less flexible and may not offer the same level of protection against economic hardship. For example, a federal unsubsidized loan might have a fixed interest rate of 5% with a 10-year repayment period, while a comparable private loan could have a variable interest rate of 7-9% with a shorter, 5-year repayment term.

Advantages and Disadvantages

Let’s examine the advantages and disadvantages of each loan type:

| Feature | Unsubsidized Federal Loans | Private Student Loans |

|---|---|---|

| Advantages | Lower interest rates, government protections (e.g., income-driven repayment plans, deferment options during economic hardship), fixed interest rates (often), easier qualification for most borrowers. | Potentially higher loan amounts, potentially more flexible repayment options (in some cases), co-signer option to improve eligibility. |

| Disadvantages | Loan amounts may be lower than private loans, interest accrues from day one. | Higher interest rates, less borrower protection, stricter eligibility requirements (credit history often required), variable interest rates (often), more difficult to qualify if you have bad credit. |

Situations Favoring Each Loan Type

Unsubsidized federal loans are generally preferred when the borrower has a limited credit history or a lower credit score, or when the need for borrower protections outweighs the potentially lower loan amount. Private loans might be more suitable when a borrower needs a larger loan amount than what is available through federal programs, has excellent credit, and is confident in their ability to manage higher interest rates and less flexible repayment terms. For instance, a student with a strong credit history and a co-signer might opt for a private loan to cover a gap in funding after maximizing federal loan eligibility. Conversely, a student with limited credit history might rely solely on federal unsubsidized loans, even if it means borrowing a smaller amount.

Additional Key Differences

Beyond interest rates and repayment terms, other key differences exist. Unsubsidized federal loans offer several borrower protections, such as deferment and forbearance options during periods of financial hardship. Private loans may not provide such extensive protections. Additionally, federal loans are subject to regulations designed to protect borrowers from predatory lending practices, while private loans are less regulated. Defaulting on a federal loan can have significant consequences, including damage to credit score and potential wage garnishment, but these consequences can also apply to private loans.

Understanding the Loan Application Process

Securing an unsubsidized federal student loan involves a straightforward process, but understanding the steps and required documentation is crucial for a smooth application. This section details the application process, from completing the FAFSA to accepting your loan offer. Careful preparation will significantly improve your chances of a successful application and receiving the financial aid you need.

The application process begins with completing the Free Application for Federal Student Aid (FAFSA). This form gathers information about your financial situation and educational goals to determine your eligibility for federal student aid, including unsubsidized loans. After submitting the FAFSA, your information is sent to your chosen school(s), which then determine your financial aid package, including loan offers. You will then review this package and accept or decline the offered loans.

Completing the Free Application for Federal Student Aid (FAFSA)

The FAFSA is a comprehensive form requiring detailed financial information. Accurate and complete information is essential for a timely and accurate processing of your application. The process generally involves creating an FSA ID, gathering necessary tax information, and answering a series of questions about your family’s income, assets, and household size. The FAFSA website provides detailed instructions and helpful tools to guide you through the process.

Required Documentation for the FAFSA

To complete the FAFSA, you will need several key documents readily available. This includes your Social Security number, your federal income tax returns (IRS Form 1040), W-2s, and other relevant tax records from the previous year. You’ll also need your parents’ tax information if you are a dependent student. Finally, you’ll need your driver’s license or state identification card, and your FSA ID, which is required for electronic signature.

Step-by-Step Guide to Completing the FAFSA

The FAFSA process is generally completed online. First, create an FSA ID, which is a username and password you will use to access and manage your FAFSA information. Next, complete the FAFSA form itself, providing accurate information about yourself, your family, and your educational plans. Be sure to review all sections carefully before submitting the application. Once completed, review and submit the form electronically. You will receive a confirmation number, which is crucial for tracking the status of your application.

Accepting or Declining a Loan Offer

After submitting the FAFSA and receiving your financial aid offer from your school, you will have the opportunity to accept or decline the offered unsubsidized loan. This decision should be made carefully, considering your financial needs and ability to repay the loan. The school’s financial aid office will provide clear instructions on how to accept or decline your loan offer. Often, this involves logging into a student portal and electronically signing documents. Remember, accepting a loan obligates you to repay the principal and accrued interest according to the terms Artikeld in your loan agreement.

Managing Unsubsidized Student Loan Debt

Successfully navigating unsubsidized student loan debt requires a proactive and organized approach. Understanding your repayment options, creating a realistic budget, and consistently monitoring your credit score are crucial steps towards responsible debt management and ultimately, financial freedom. Failing to plan effectively can lead to missed payments, negatively impacting your credit history and overall financial well-being.

Budgeting and Financial Planning for Loan Repayment

Effective budgeting is paramount to successful loan repayment. A detailed budget should clearly Artikel your monthly income and expenses, allocating a specific amount towards your student loan payments. This requires careful tracking of all income sources and expenditures, including necessities like housing, food, and transportation, as well as discretionary spending. Consider using budgeting apps or spreadsheets to simplify the process and gain a clear picture of your financial situation. By prioritizing loan payments within your budget, you can ensure timely repayments and avoid accumulating late fees or penalties. For instance, if your monthly income is $3,000 and your necessary expenses total $2,000, you can allocate a portion of the remaining $1,000 towards your student loan payment, ensuring you meet your repayment obligations while maintaining a comfortable standard of living. Adjusting your budget as your financial situation changes is essential for long-term success.

Strategies for Avoiding Default and Maintaining Good Credit

Avoiding student loan default is crucial for maintaining a healthy credit score. Defaulting on your loans can have severe consequences, including damage to your credit report, wage garnishment, and potential legal action. To avoid default, establish a consistent repayment plan and stick to it. Explore various repayment options offered by your loan servicer, such as income-driven repayment plans or deferment/forbearance (if eligible). These options can adjust your monthly payments based on your income and financial circumstances, making repayment more manageable. Regular communication with your loan servicer is also key; contact them immediately if you anticipate difficulty making payments to explore available options before default occurs. Maintaining good credit is vital for future financial opportunities, such as securing a mortgage, car loan, or even obtaining a job. A good credit score reflects your responsible financial behavior, opening doors to better financial prospects.

Resources Available for Borrowers

Numerous resources are available to assist borrowers in managing their unsubsidized student loan debt. Your loan servicer is a primary resource, providing information on repayment plans, payment options, and assistance programs. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, helping borrowers create a budget, manage debt, and explore debt management options. Additionally, many universities and colleges have financial aid offices that can provide guidance and support to alumni struggling with loan repayment. Government websites, such as the Federal Student Aid website (studentaid.gov), offer comprehensive information on student loan programs, repayment options, and available resources. Utilizing these resources can significantly improve your ability to manage your debt effectively and avoid potential financial hardship. Remember, seeking help is a sign of strength, not weakness, and many resources are available to guide you through the process.

Last Point

Securing a higher education often involves utilizing student loans, and understanding the nuances of unsubsidized loans is paramount. From careful consideration of eligibility and loan limits to proactive strategies for repayment and debt management, informed decision-making is key to a successful financial journey. Remember to explore all available resources and seek professional advice when needed to navigate this crucial aspect of financing your education effectively.

Detailed FAQs

What happens to my unsubsidized loan interest while I’m in school?

Interest begins accruing on unsubsidized loans from the moment they’re disbursed, even while you’re still in school. This interest is added to your principal balance, increasing the total amount you owe.

Can I consolidate my unsubsidized loans?

Yes, you can consolidate multiple federal student loans, including unsubsidized loans, into a single Direct Consolidation Loan. This can simplify repayment but may not always lower your interest rate.

What if I can’t afford my unsubsidized loan payments?

Several options exist to help, including income-driven repayment plans, deferment, and forbearance. Contact your loan servicer to explore these options and avoid default.

How do unsubsidized loans affect my credit score?

On-time payments positively impact your credit score. Missed payments or default will severely damage your credit score.