Navigating the complexities of student loan repayment can be daunting. Understanding the process, from initial borrowing to potential default, is crucial for responsible financial management. This guide explores the intricacies of student loan default, outlining the steps leading to default, its significant consequences, and strategies for prevention and recovery. We will examine various factors contributing to default, explore available resources for struggling borrowers, and highlight the long-term implications of this serious financial situation.

We’ll delve into the specific steps involved in defaulting on a student loan, the various contributing factors such as unemployment and unforeseen life events, and the critical importance of proactive strategies for prevention. We’ll also discuss the potential ramifications of default, including damage to your credit score and legal repercussions, along with available rehabilitation and consolidation options.

Understanding Student Loan Default

Student loan default is a serious financial situation with significant consequences. It occurs when a borrower fails to make payments on their student loans for a specified period, leading to a range of negative impacts on their credit and financial well-being. Understanding the process and implications of default is crucial for borrowers to avoid this detrimental outcome.

Definition of Student Loan Default

Student loan default is officially defined as failing to make any payments on your federal student loans for 270 days (nine months). This applies to both subsidized and unsubsidized federal loans, as well as Federal PLUS loans. Private student loans have their own, often shorter, default periods, usually Artikeld in the loan agreement. Once a loan enters default, the lender considers the entire loan balance due immediately.

Consequences of Student Loan Default

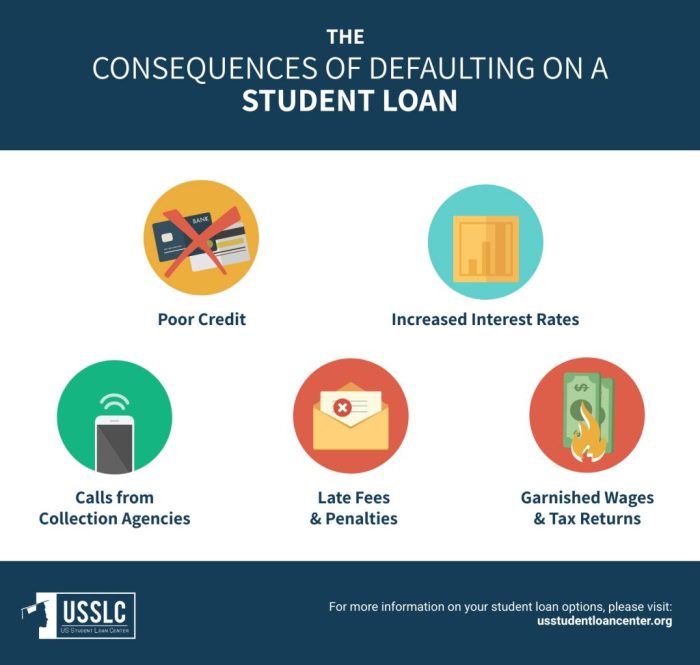

The consequences of student loan default are severe and far-reaching. They include:

- Damaged Credit Score: Defaulting on student loans significantly lowers your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. The negative impact can last for seven years or more.

- Wage Garnishment: The government can garnish your wages to collect the defaulted loan amount. This means a portion of your paycheck will be automatically deducted to repay the debt.

- Tax Refund Offset: Your federal and state tax refunds can be seized to repay the defaulted loan. This means you may not receive any refund at all.

- Loss of Federal Financial Aid Eligibility: You will be ineligible for future federal student loans or grants. This can significantly impact your ability to pursue further education.

- Difficulty Obtaining Government Jobs: Some government jobs require a clean credit history, and a defaulted student loan will likely disqualify you.

- Collection Agency Involvement: Your loan will be transferred to a collection agency, which will aggressively pursue repayment. This can lead to additional fees and legal action.

Process of Student Loan Default

The process of a student loan entering default status generally follows these steps:

- Missed Payments: You fail to make your scheduled loan payments.

- Delinquency: After several missed payments, your loan becomes delinquent. You will receive notices from your loan servicer.

- Default Notification: After 270 days of non-payment, your loan officially enters default. You will receive formal notification of this status.

- Collection Actions: The government or your loan servicer will initiate collection actions, such as wage garnishment or tax refund offset.

Examples of Situations Leading to Student Loan Default

Several factors can contribute to student loan default. These include:

- Job Loss or Reduced Income: Unexpected unemployment or a significant decrease in income can make it challenging to manage loan payments.

- Unexpected Expenses: Medical emergencies, family crises, or unexpected home repairs can strain finances and make loan payments difficult.

- Poor Financial Planning: Lack of a budget, inadequate understanding of loan repayment terms, or failure to prioritize loan payments can lead to default.

- High Debt Burden: Having a large amount of student loan debt relative to income can make repayment a significant challenge.

- Failure to Utilize Repayment Options: Not exploring income-driven repayment plans or other options available through the government can exacerbate the situation.

Factors Contributing to Student Loan Default

Student loan default, the failure to make timely payments on your student loans, is a serious financial setback with long-term consequences. Several interconnected factors often contribute to this outcome, highlighting the complex interplay between personal circumstances and financial planning. Understanding these factors is crucial for both borrowers and lenders in preventing defaults and mitigating their impact.

Financial Difficulties Contributing to Default

Many borrowers face significant financial challenges that hinder their ability to repay student loans. These challenges often stem from a combination of factors, including low income, high debt levels (beyond student loans), and unexpected expenses. A common scenario involves individuals graduating into a competitive job market with limited earning potential, making it difficult to manage monthly loan payments alongside other living expenses like rent, utilities, and food. High levels of consumer debt, such as credit card debt, can further exacerbate the situation, diverting funds away from loan repayment.

Unemployment’s Impact on Student Loan Repayment

Unemployment significantly increases the risk of student loan default. The loss of income immediately disrupts a borrower’s ability to meet their monthly payment obligations. Even short periods of unemployment can lead to missed payments and trigger the default process, especially for those with limited savings or access to emergency funds. The longer the unemployment period, the greater the likelihood of default, as arrears accumulate and the financial strain intensifies. For example, a recent graduate with a significant loan balance who loses their job shortly after graduation may find it extremely difficult to make payments, leading to a rapid accumulation of missed payments and eventual default.

Unexpected Life Events and Student Loan Default

Unexpected life events, such as serious illness, injury, or family emergencies, can severely impact a borrower’s financial stability and repayment capacity. Medical expenses, often substantial and unpredictable, can quickly deplete savings and make loan payments unaffordable. Similarly, family emergencies, such as the need to provide care for a sick relative or unexpected relocation, can create significant financial burdens, leading to missed loan payments and, ultimately, default. These events often occur without warning, leaving borrowers with little time to adjust their budgets or seek financial assistance.

Repayment Plan Comparison and Default Risk

Choosing the right repayment plan is crucial in managing student loan debt and minimizing the risk of default. Different plans offer varying monthly payment amounts, eligibility requirements, and potential long-term implications. Understanding these differences is essential for borrowers to make informed decisions. While some plans offer lower monthly payments initially, they may lead to higher overall interest payments and potentially increase the long-term debt burden, indirectly increasing default risk if circumstances change. Conversely, plans with higher initial payments may reduce the overall interest paid and decrease the likelihood of default.

Comparison of Student Loan Repayment Plans

| Plan Name | Monthly Payment Calculation | Eligibility Requirements | Potential Impact on Default |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payment over 10 years | All federal student loans | Higher monthly payments may increase risk if income decreases |

| Graduated Repayment Plan | Payments start low and increase every two years | All federal student loans | Lower initial payments may lead to higher overall cost and increased risk over time |

| Income-Driven Repayment (IDR) Plans (e.g., ICR, PAYE, REPAYE) | Based on income and family size | Federal student loans | Lower monthly payments reduce short-term risk, but potential for loan forgiveness may increase long-term cost if not managed carefully |

| Extended Repayment Plan | Fixed monthly payment over 25 years | All federal student loans | Lower monthly payments, but significantly higher overall interest paid, potentially increasing risk if income doesn’t increase accordingly |

Default Prevention Strategies

Preventing student loan default requires proactive planning and a commitment to responsible financial management. Understanding your repayment options, budgeting effectively, and maintaining open communication with your loan servicer are crucial steps in avoiding default and preserving your financial well-being. This section Artikels strategies to help you navigate your student loan debt successfully.

Available Resources for Borrowers Facing Financial Hardship

Numerous resources exist to assist borrowers experiencing financial difficulties. These resources can provide crucial support in navigating repayment challenges and preventing default. Many programs offer temporary payment modifications or alternative repayment plans tailored to individual circumstances.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payment on your income and family size. Examples include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans can significantly lower monthly payments, making them more manageable during periods of financial strain.

- Deferment and Forbearance: These options temporarily postpone your payments. Deferment is typically granted due to specific circumstances like returning to school or experiencing unemployment, while forbearance is often granted for temporary financial hardship. It’s crucial to understand that interest may still accrue during deferment and forbearance, potentially increasing your overall loan balance.

- Student Loan Counseling: Nonprofit credit counseling agencies provide free or low-cost guidance on managing student loan debt. They can help you explore repayment options, create a budget, and develop a long-term debt management strategy. They can also help you navigate the complexities of various repayment plans.

- Federal Student Aid Website: The official website (studentaid.gov) offers comprehensive information on repayment plans, hardship options, and other resources available to borrowers.

Step-by-Step Plan for Borrowers Struggling with Payments

A structured approach is essential for managing student loan debt effectively, particularly during financial hardship. Following a step-by-step plan can help you regain control of your finances and avoid default.

- Assess Your Financial Situation: Create a detailed budget outlining your income and expenses. Identify areas where you can reduce spending and free up funds for loan payments.

- Contact Your Loan Servicer: Communicate openly and honestly with your loan servicer about your financial difficulties. Explain your situation and inquire about available repayment options, such as IDR plans, deferment, or forbearance.

- Explore Repayment Options: Research and compare different repayment plans to find one that best suits your financial circumstances. Consider factors such as monthly payment amount, loan term, and total interest paid.

- Create a Realistic Budget: Develop a budget that prioritizes essential expenses and allocates funds for your student loan payments. Track your spending carefully to ensure you stay within your budget.

- Seek Professional Help: If you’re struggling to manage your finances independently, consider seeking help from a financial advisor or credit counselor. They can provide personalized guidance and support.

Effective Budgeting Techniques for Managing Student Loan Debt

Effective budgeting is fundamental to managing student loan debt and preventing default. Prioritizing loan payments within a comprehensive budget is crucial.

One effective budgeting method is the 50/30/20 rule. This approach allocates 50% of your after-tax income to needs (housing, food, transportation, utilities), 30% to wants (entertainment, dining out, subscriptions), and 20% to savings and debt repayment. By meticulously tracking expenses and adhering to this allocation, you can ensure sufficient funds are available for student loan payments. For example, a person earning $5,000 after taxes would allocate $2,500 to needs, $1,500 to wants, and $1,000 to savings and debt repayment. This $1,000 could then be further allocated between savings and student loan payments based on individual priorities and financial circumstances. Another technique is the zero-based budget, where every dollar is assigned a purpose, ensuring all income is accounted for and minimizing unnecessary spending. This method necessitates careful tracking and categorization of all expenses, leading to a clearer picture of spending habits and facilitating better financial control.

Communicating Effectively with Loan Servicers Regarding Financial Difficulties

Open and proactive communication with your loan servicer is vital when facing financial challenges. Clearly and concisely explaining your situation and actively seeking solutions can significantly improve your chances of securing assistance and avoiding default.

When contacting your loan servicer, be prepared to provide documentation supporting your financial hardship, such as proof of income, employment status, or medical expenses. Maintain detailed records of all communication, including dates, times, and the outcome of each conversation. Be polite, respectful, and persistent in your efforts to reach a mutually agreeable solution. Regularly check your loan account online to monitor your payment status and ensure accurate information is reflected. Proactive communication, coupled with detailed documentation and a clear understanding of your financial situation, significantly increases the likelihood of securing assistance and avoiding default.

Consequences of Default

Defaulting on your student loans carries severe and long-lasting consequences that significantly impact your financial well-being. These repercussions extend beyond simply owing the money; they affect your creditworthiness, employment prospects, and overall financial stability for years to come. Understanding these consequences is crucial for preventing default in the first place.

Impact on Credit Score

Student loan default has a devastating effect on your credit score. A default is reported to the major credit bureaus (Equifax, Experian, and TransUnion), resulting in a significant drop in your credit score. This dramatic decrease can make it extremely difficult to obtain credit in the future, impacting your ability to secure loans for a car, mortgage, or even a credit card. The negative impact on your credit report can remain for seven years or even longer, making it challenging to rebuild your credit history after a default. For example, a score of 700 might plummet to below 500, severely limiting your borrowing options and potentially increasing interest rates on future loans.

Wage Garnishment and Tax Refund Offset

The government has several mechanisms to collect on defaulted student loans. Wage garnishment allows the government to directly deduct a portion of your paycheck to repay the debt. The amount garnished can be substantial, significantly reducing your disposable income. Additionally, the government can seize your tax refund through a process called tax refund offset. This means that any refund you are due from the IRS will be applied directly towards your defaulted student loan balance. This can leave you with little to no financial resources at the end of the tax year. For instance, a significant portion – up to 15% – of your disposable income could be garnished, leaving little money for essential living expenses.

Legal Action and Collection Agencies

Defaulting on student loans can lead to legal action. The Department of Education may sue you to recover the debt, potentially resulting in a court judgment against you. This judgment could lead to further asset seizures, such as bank accounts or property. Moreover, your debt may be sold to a collection agency, which will aggressively pursue repayment. Collection agencies are known for their persistent and sometimes harassing tactics, making the situation even more stressful. The legal fees associated with defending yourself against such actions can further compound your financial burden.

Long-Term Financial Implications

The long-term financial implications of student loan default are substantial and far-reaching. Beyond the immediate impact on credit and income, default can affect your ability to rent an apartment, purchase a home, or secure employment in certain fields. Some employers conduct credit checks as part of their hiring process, and a poor credit score resulting from a default could hinder your job prospects. Furthermore, the difficulty in obtaining credit and the potential for wage garnishment can create a cycle of debt and financial instability that is difficult to escape. For example, someone defaulting on a $50,000 loan might find themselves facing years of financial hardship, impacting their ability to save for retirement or their children’s education.

Potential Consequences of Student Loan Default

The consequences of student loan default are serious and multifaceted. Here’s a summary of the potential outcomes:

- Significant drop in credit score

- Wage garnishment

- Tax refund offset

- Lawsuits and legal action

- Collection agency involvement

- Difficulty obtaining credit in the future

- Reduced employment opportunities

- Long-term financial instability

- Potential loss of assets

Rehabilitation and Consolidation Options

Facing student loan default can be daunting, but there are options available to help borrowers regain control of their finances. Rehabilitation and consolidation are two key programs designed to assist borrowers in avoiding the severe consequences of default while working towards repayment. Understanding the nuances of each program is crucial for making informed decisions.

Student Loan Rehabilitation

Student loan rehabilitation is a process that allows borrowers to remove a default from their credit report and reinstate their eligibility for federal student loan benefits. This involves making nine on-time payments over a 10-month period, typically smaller payments than the original loan amount. The payments are made directly to the loan servicer. Successful completion of the rehabilitation process removes the default from the borrower’s credit history, preventing further damage to their financial standing. This also restores access to income-driven repayment plans and other federal student loan benefits.

Student Loan Consolidation

Student loan consolidation involves combining multiple federal student loans into a single loan with a new repayment plan. This simplifies repayment by reducing the number of payments and potentially lowering the monthly payment amount. Consolidation does not, however, erase the original debt; it merely combines it into a more manageable form. Consolidation can be particularly beneficial for borrowers with a mix of loan types (e.g., subsidized and unsubsidized loans) or different interest rates. It can also offer the opportunity to switch to a repayment plan that better suits the borrower’s current financial situation. Note that consolidation does not remove a default.

Comparison of Rehabilitation and Consolidation

Rehabilitation and consolidation are distinct programs serving different purposes. Rehabilitation specifically addresses defaulted loans, removing the default status and restoring benefits. Consolidation, on the other hand, focuses on simplifying repayment, but does not address the issue of default. A borrower may choose to consolidate their loans *after* successfully completing rehabilitation, creating a more manageable repayment structure for their now-reinstated loans. However, consolidating defaulted loans will not automatically rehabilitate them; the default will remain until the rehabilitation process is completed.

Applying for Loan Rehabilitation or Consolidation

Applying for either program involves navigating the official government channels. The process generally begins with contacting your loan servicer directly.

- Contact your loan servicer: Determine which company services your loans and contact them to inquire about rehabilitation or consolidation options. You can usually find this information on your student loan statements or the National Student Loan Data System (NSLDS) website.

- Gather necessary documentation: Prepare any necessary documents, such as proof of income, tax returns, or other financial information, as requested by your servicer.

- Complete the application: Fill out the application for either loan rehabilitation or consolidation, ensuring all information is accurate and complete.

- Submit the application: Submit the completed application and supporting documents to your loan servicer.

- Monitor your application: Track the status of your application and contact your servicer if you have any questions or concerns.

Infographic Illustrating Differences Between Rehabilitation and Consolidation

The infographic would feature two distinct columns, one for rehabilitation and one for consolidation. Each column would include a clear title (“Rehabilitation” and “Consolidation”).

Within each column:

* Icon: A relevant icon (e.g., a broken chain for rehabilitation, signifying the breaking of the default status; a merging of circles for consolidation, representing the merging of loans).

* Definition: A concise definition of the program.

* Key Benefit: The primary benefit (removal of default for rehabilitation; simplified repayment for consolidation).

* Process: A simplified visual representation of the application process (e.g., a flowchart).

* Eligibility: A bullet list of key eligibility requirements.

* Impact on Credit: A clear statement on how each program impacts the borrower’s credit score.

A clear visual separator (e.g., a bold line) would separate the two columns. The infographic’s overall color scheme would be clean and professional, using contrasting colors to highlight key information. The font would be easy to read, and the layout would be intuitive and easy to understand. The infographic would clearly show that while both programs offer solutions for managing student loan debt, they address different aspects of the problem.

Final Review

Defaulting on student loans carries severe and long-lasting financial consequences. Understanding the process, the contributing factors, and the available resources is paramount. By proactively managing your student loan debt, implementing effective budgeting techniques, and utilizing available repayment options, you can significantly reduce the risk of default and protect your financial future. Remember, seeking help early from your loan servicer or a financial advisor can make a substantial difference in navigating financial hardship.

Frequently Asked Questions

What happens if I miss a student loan payment?

Missing a payment doesn’t automatically mean default. However, it triggers late fees and negatively impacts your credit score. Your servicer will likely contact you to discuss repayment options.

Can I negotiate with my loan servicer?

Yes, contacting your loan servicer to discuss your financial difficulties is crucial. They may offer forbearance, deferment, or alternative repayment plans to avoid default.

How long does it take for a student loan to go into default?

The timeframe varies depending on the loan type and servicer, but it generally takes 9 months of missed payments for a federal loan to enter default.

What are the options if my student loans are already in default?

Rehabilitation and consolidation are potential options. Rehabilitation involves making timely payments for a period, while consolidation combines multiple loans into one with potentially more manageable payments. Consult a financial advisor or the Department of Education for guidance.