Securing a federal student loan can be a pivotal step towards higher education, but navigating the process can feel overwhelming. Understanding eligibility criteria, the FAFSA application, loan types, and repayment plans is crucial for a smooth and successful experience. This guide provides a comprehensive overview, demystifying the process and empowering you to make informed decisions about your financial future.

From exploring different loan options and completing the FAFSA form to managing your debt and avoiding potential scams, we cover all the essential aspects. We aim to provide clarity and confidence as you embark on this important journey towards academic achievement.

Eligibility Requirements for Federal Student Loans

Securing federal student loans involves meeting specific eligibility criteria. These requirements ensure that the loan program effectively supports students pursuing higher education while maintaining responsible lending practices. Understanding these requirements is crucial for prospective borrowers to determine their eligibility and plan accordingly.

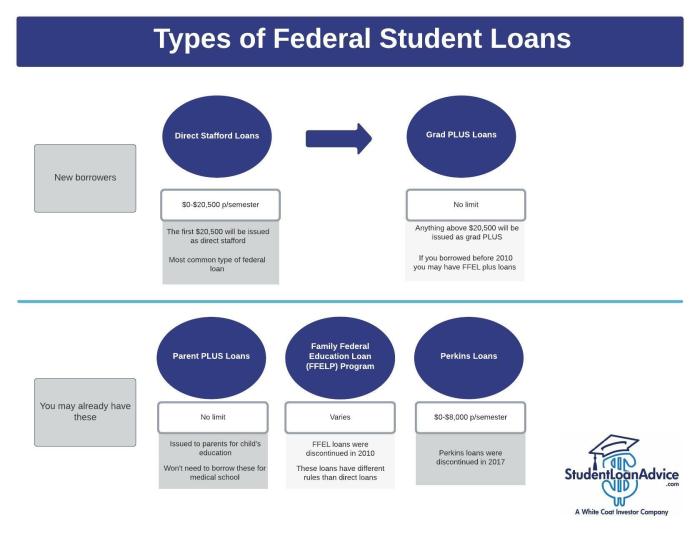

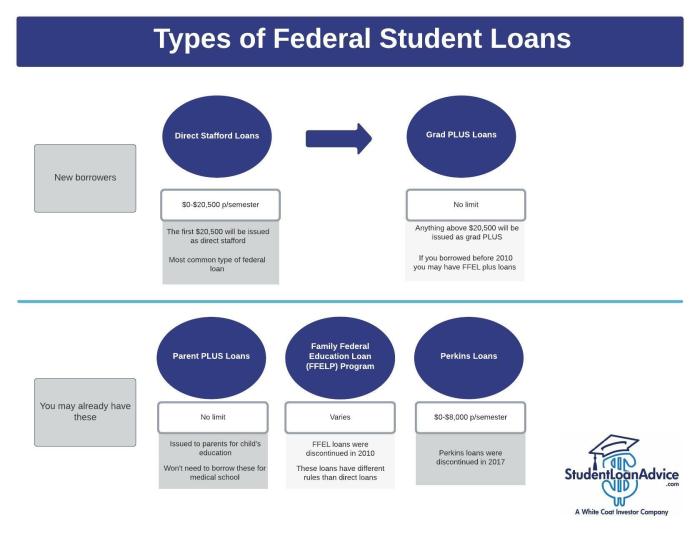

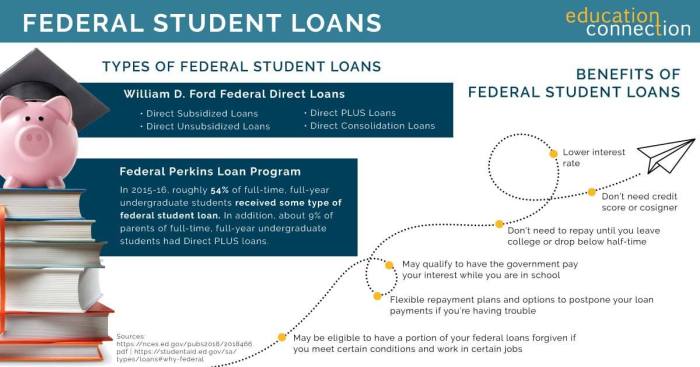

Types of Federal Student Loans

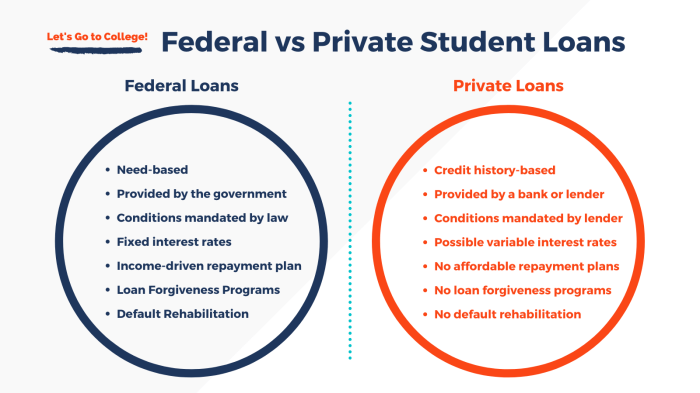

The federal government offers several types of student loans, each with its own eligibility requirements and repayment terms. The most common are Subsidized and Unsubsidized Federal Stafford Loans, Federal PLUS Loans (for parents and graduate students), and Federal Perkins Loans (limited availability). Subsidized Stafford Loans offer interest subsidies while the borrower is enrolled at least half-time, whereas Unsubsidized Stafford Loans accrue interest from the time the loan is disbursed. PLUS loans have different credit and income requirements than Stafford Loans. Perkins loans are need-based and offered at a lower interest rate than other federal loans.

Financial Need and Credit History

Eligibility for federal student loans is often determined by a combination of factors, primarily financial need and, in some cases, credit history. Financial need is assessed using the Free Application for Federal Student Aid (FAFSA), which considers factors like family income, assets, and the number of family members in college. For PLUS loans, a credit check is conducted, and applicants with adverse credit history may be denied. For Stafford loans, a credit check is not required, but the FAFSA information determines eligibility. The process ensures that financial aid is allocated effectively to students who require it.

Determining Eligibility: A Step-by-Step Guide

- Complete the FAFSA: The FAFSA is the primary application for federal student aid. Accurate and complete information is essential for an accurate assessment of financial need.

- Review Your Student Aid Report (SAR): The SAR summarizes the information you provided on the FAFSA and provides an estimate of your eligibility for federal student aid.

- Understand Your Eligibility for Different Loan Types: Based on your SAR, you will receive information about your eligibility for various federal student loan programs.

- Accept Your Loan Offer: If you are eligible, you will receive a loan offer specifying the loan amount and terms. You must accept the loan offer to receive the funds.

- Complete Master Promissory Note (MPN): This legally binding agreement Artikels your responsibilities as a borrower.

Comparison of Federal Student Loan Program Eligibility Requirements

| Loan Program | Credit Check Required | Financial Need Assessment | Other Requirements |

|---|---|---|---|

| Subsidized Stafford Loans | No | Yes (FAFSA) | Must be enrolled at least half-time |

| Unsubsidized Stafford Loans | No | Yes (FAFSA) | Must be enrolled at least half-time |

| Federal PLUS Loans (Parent) | Yes | No (Parent’s Creditworthiness) | Must be a parent of a dependent student |

| Federal PLUS Loans (Graduate) | Yes | No (Graduate Student’s Creditworthiness) | Must be enrolled in a graduate program |

| Federal Perkins Loans | No | Yes (Exceptional Financial Need) | Limited availability, determined by the institution |

The FAFSA Application Process

Completing the Free Application for Federal Student Aid (FAFSA) is the crucial first step in securing federal student loans. This application determines your eligibility for various forms of financial aid, including federal grants, loans, and work-study programs. The process, while seemingly complex, is manageable with careful planning and attention to detail.

The FAFSA form gathers essential information about you, your family, and your financial circumstances to assess your need for financial aid. It’s a comprehensive application, requiring accurate and complete information for accurate processing. Submitting an incomplete or inaccurate application can delay or even prevent you from receiving financial aid.

Required Documentation and Information

Gathering the necessary documents before starting the FAFSA application significantly streamlines the process. You will need your Social Security number, your federal tax returns (both yours and your parents’ if you are a dependent student), W-2s, and other relevant financial records. For dependent students, parental information, including their tax information and assets, is also required. Accurate and up-to-date information is paramount; using outdated information will result in delays or inaccuracies in your aid package. Having this information readily available will ensure a smoother application experience. You should also have your driver’s license or state identification ready, along with your FSA ID.

Completing the FAFSA Form

The FAFSA form is completed online through the official website, studentaid.gov. The application process involves providing detailed information about your personal details, family financial background, and educational plans. You will be asked questions regarding your income, assets, household size, and the colleges you plan to attend. It is important to answer all questions truthfully and completely. The system will guide you through each section, providing clear instructions and definitions. Take your time to carefully review each question and ensure accuracy. If you encounter any difficulties, the website offers helpful resources and FAQs. Remember to keep track of your FAFSA Student Aid Report (SAR) once you submit the form.

Common Errors to Avoid

Several common mistakes can hinder the FAFSA application process. One frequent error is providing inaccurate or incomplete financial information. This often leads to delays in processing or incorrect aid calculations. Another common mistake is failing to list all colleges you are considering. It’s crucial to list all institutions, even if you are unsure of your final choice, as this helps ensure you receive all potential aid offers. Using outdated tax information is another significant issue. Always use the most recent tax information available. Finally, neglecting to correct any errors flagged by the system can delay processing. Carefully review the application for errors before submitting.

FAFSA Application Checklist

Before submitting your FAFSA, use this checklist to ensure a smooth and accurate application:

- Gather all required documents: Social Security numbers, tax returns, W-2s, and financial records.

- Create FSA IDs for yourself and your parent(s) (if applicable).

- Complete the FAFSA form online at studentaid.gov.

- Carefully review all entered information for accuracy.

- Ensure all colleges you are considering are listed.

- Submit the FAFSA form before the deadlines set by your chosen colleges.

- Review your Student Aid Report (SAR) for any errors or discrepancies.

- Correct any errors promptly and resubmit if necessary.

Understanding Loan Types and Repayment Plans

Choosing the right federal student loan and understanding repayment options are crucial steps in managing your student debt. This section will Artikel the different types of federal student loans available and the various repayment plans you can choose from after graduation. Understanding these options will help you make informed decisions about financing your education and managing your debt effectively.

Federal Student Loan Types: Subsidized, Unsubsidized, and PLUS Loans

Federal student loans are categorized into three main types: Subsidized, Unsubsidized, and PLUS loans. Each type has distinct characteristics regarding interest accrual, eligibility, and repayment terms. These differences significantly impact the overall cost of borrowing.

- Subsidized Loans: These loans are need-based and the government pays the interest while you’re in school at least half-time, during grace periods, and during periods of deferment. This means your loan balance doesn’t grow while you’re focusing on your studies. Eligibility is determined by your demonstrated financial need as assessed through the FAFSA.

- Unsubsidized Loans: Interest begins to accrue on unsubsidized loans from the moment the loan is disbursed, regardless of your enrollment status. This means the loan balance will increase over time even if you are not making payments. Eligibility is generally broader than for subsidized loans; you don’t need to demonstrate financial need to qualify.

- PLUS Loans: Parent PLUS Loans are available to parents of dependent undergraduate students, while Graduate PLUS Loans are available to graduate and professional students. These loans are credit-based, meaning lenders will check your credit history before approving the loan. Interest accrues from disbursement, and borrowers are responsible for all interest payments.

Interest Rates and Repayment Terms

Interest rates for federal student loans are set annually by the government and vary depending on the loan type and the loan disbursement date. Repayment terms also differ; standard repayment plans typically involve a fixed monthly payment over a 10-year period, but other options are available to better suit individual financial circumstances. For example, a longer repayment period will result in lower monthly payments but higher total interest paid over the life of the loan.

Repayment Plan Options

After graduation, borrowers enter a grace period (typically six months) before repayment begins. Several repayment plans are available, allowing borrowers to tailor their payments to their income and financial situation.

- Standard Repayment Plan: This is the default plan, with fixed monthly payments spread over 10 years.

- Graduated Repayment Plan: Payments start low and gradually increase over time.

- Extended Repayment Plan: This plan extends the repayment period to up to 25 years, leading to lower monthly payments but higher total interest paid.

- Income-Driven Repayment (IDR) Plans: These plans link your monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). After a specific number of years (usually 20-25), any remaining loan balance may be forgiven, though this forgiveness is considered taxable income.

Managing Your Federal Student Loans

Successfully navigating the repayment of federal student loans requires proactive planning and diligent management. Understanding your loan terms, creating a realistic budget, and consistently making payments are crucial steps to avoid the serious consequences of default. This section will Artikel strategies for effective budgeting, emphasize the importance of understanding loan details, and detail the repercussions of loan default.

Effective Budgeting and Managing Student Loan Debt

Creating a comprehensive budget is paramount to successfully managing student loan debt. This involves carefully tracking income and expenses to identify areas where savings can be maximized and allocate sufficient funds for loan repayments. A well-structured budget provides a clear picture of your financial situation, enabling informed decision-making regarding loan repayment strategies. Unexpected expenses can significantly impact your ability to meet your loan obligations, highlighting the importance of incorporating a buffer or emergency fund into your budget.

Understanding Loan Terms and Repayment Schedules

Thoroughly understanding your loan terms and repayment schedule is vital for responsible loan management. This includes knowing the principal loan amount, interest rate, repayment period, and the type of loan (e.g., subsidized, unsubsidized, PLUS). The repayment schedule Artikels the monthly payment amount and the total amount to be repaid over the loan’s lifetime. Understanding these details allows for accurate budgeting and informed choices regarding repayment options, such as income-driven repayment plans. Failure to comprehend these terms can lead to missed payments, increased interest accrual, and ultimately, default.

Consequences of Defaulting on Federal Student Loans

Defaulting on federal student loans has severe consequences. Default occurs when you fail to make payments for 270 days. The repercussions include damage to your credit score, wage garnishment, tax refund offset, and potential legal action. Your credit score will suffer significantly, making it difficult to obtain loans, rent an apartment, or even secure certain jobs in the future. The government can garnish your wages, seizing a portion of your earnings to repay the debt. They can also offset your tax refund, applying it towards your outstanding loan balance. In extreme cases, legal action may be taken, leading to further financial penalties.

Sample Budget Incorporating Student Loan Payments

A sample budget demonstrates how to integrate student loan payments into your monthly financial plan. This example assumes a monthly net income of $3,000 and a monthly student loan payment of $500. It is important to adjust this based on your individual circumstances.

| Category | Amount |

|---|---|

| Housing (Rent/Mortgage) | $1,000 |

| Student Loan Payment | $500 |

| Food | $400 |

| Transportation | $200 |

| Utilities | $150 |

| Health Insurance | $100 |

| Savings/Emergency Fund | $250 |

| Other Expenses (Entertainment, etc.) | $400 |

| Total Expenses | $3,000 |

Note: This is a simplified example. Your budget will need to reflect your specific income, expenses, and loan repayment amount. It is crucial to regularly review and adjust your budget as needed.

Resources and Additional Support

Securing federal student loans is only half the battle; understanding the resources available for managing and repaying them is equally crucial. This section details the support systems in place to help students navigate the complexities of student loan repayment and explore options for debt relief. Knowing where to turn for assistance can significantly reduce stress and improve your chances of successful repayment.

Navigating the student loan system can feel overwhelming, but numerous resources are available to provide guidance and support. These resources range from government agencies offering direct assistance to private organizations providing financial literacy programs. Understanding these resources is key to effective loan management.

Contact Information for Relevant Government Agencies and Student Loan Servicers

The Federal Student Aid website (studentaid.gov) is the primary resource for information on federal student loans. It provides comprehensive information on loan types, repayment plans, and contact information for relevant agencies. For general inquiries, you can contact the Federal Student Aid Information Center. Specific contact information for your loan servicer will be provided in your loan documents. Remember to always verify the legitimacy of any contact before sharing personal information.

Resources for Students Struggling with Loan Repayment

Many students face challenges in repaying their loans. The government offers several programs designed to help. Income-driven repayment plans adjust your monthly payments based on your income and family size. Deferment and forbearance can temporarily postpone your payments during periods of financial hardship. Counseling services, offered through the government and non-profit organizations, provide guidance on budgeting, financial planning, and debt management strategies. These services can help create a personalized repayment plan to alleviate financial strain. For example, the National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services.

Loan Forgiveness Programs and Other Debt Relief Options

Several loan forgiveness programs exist, but eligibility requirements vary significantly. Public service loan forgiveness (PSLF) forgives the remaining balance of your federal student loans after 120 qualifying monthly payments while working full-time for a qualifying employer. Teacher Loan Forgiveness and other programs target specific professions. It’s essential to carefully review the eligibility criteria for each program to determine if you qualify. Consolidation can simplify repayment by combining multiple loans into a single loan with a potentially lower interest rate. However, carefully consider the long-term implications before consolidating your loans. For example, a longer repayment term may result in paying more interest overall, even with a lower monthly payment.

Contacting a Student Loan Servicer: A Visual Representation

The process of contacting your student loan servicer can be visualized as a simple flowchart:

1. Identify your servicer: Locate your servicer’s name and contact information on your loan documents or the Federal Student Aid website.

2. Choose your contact method: Select your preferred method – phone, email, or online portal. Most servicers offer multiple options.

3. Gather necessary information: Prepare your student loan account number, social security number, and any relevant questions or documentation.

4. Initiate contact: Use your chosen method to reach out to your servicer.

5. Document the interaction: Keep a record of your communication, including dates, times, and the outcome of your contact.

This structured approach ensures efficient and effective communication with your loan servicer, addressing any issues promptly.

Potential Scams and Avoiding Fraud

Navigating the world of federal student loans requires vigilance, as unscrupulous individuals and organizations may attempt to exploit students seeking financial aid. Understanding common scams and implementing preventative measures is crucial to protect your financial well-being and personal information. This section will Artikel common fraudulent activities and provide strategies for identifying and avoiding them.

Unfortunately, many scams target students applying for federal student loans. These scams often prey on the stress and urgency associated with securing funding for education. They can range from phishing emails mimicking official government communications to fake loan providers offering incredibly favorable terms that are too good to be true. Awareness and caution are your best defenses.

Common Student Loan Scams

Numerous fraudulent schemes exist, designed to deceive students into revealing personal information or paying for services they don’t need. These schemes often involve unsolicited emails, phone calls, or text messages promising quick loan approvals, loan forgiveness programs that don’t exist, or guaranteed loan modifications. Another common tactic involves charging upfront fees for loan processing or consolidation services, which are typically free through legitimate channels. Be wary of any communication that pressures you into immediate action or demands payment before receiving services.

Recognizing and Avoiding Fraudulent Loan Offers

Legitimate federal student loan offers will never ask for upfront payments or fees. The federal government processes loans directly and doesn’t use third-party intermediaries for collecting fees. Always verify the legitimacy of any communication by checking the official websites of the Department of Education or your chosen lender. Look for inconsistencies in email addresses, website URLs, or contact information. If something seems too good to be true (e.g., extremely low interest rates, guaranteed loan forgiveness), it likely is. Never share sensitive personal information, such as your Social Security number or bank account details, unless you are absolutely certain of the recipient’s legitimacy.

Protecting Personal Information and Preventing Identity Theft

Protecting your personal information is paramount throughout the student loan application process. Use strong, unique passwords for all online accounts related to your financial aid. Be cautious about clicking on links in unsolicited emails or text messages, as these may lead to phishing websites designed to steal your data. Regularly monitor your credit report for any suspicious activity. Consider using a credit monitoring service to alert you to potential identity theft. Only share your personal information with trusted and verified sources. Never provide your information over the phone or via email unless you initiated the contact and have independently verified the legitimacy of the recipient.

Verifying the Legitimacy of a Student Loan Offer

Before engaging with any loan offer, independently verify its legitimacy. Contact the lender directly using contact information found on their official website, not through a link provided in an email or text message. Confirm the lender’s registration and licensing with relevant authorities. Compare the loan terms offered against those available through the federal government’s website. If you have any doubts about the legitimacy of an offer, err on the side of caution and do not proceed. The consequences of falling victim to a scam can be severe, leading to financial loss and identity theft. Remember, the federal government will never ask for upfront payments or fees to process your student loans.

Conclusive Thoughts

Successfully obtaining federal student loans involves careful planning and understanding of the various programs and requirements. By diligently completing the FAFSA, understanding your loan options, and proactively managing your repayment, you can effectively leverage these resources to fund your education. Remember to always be vigilant against scams and seek assistance when needed. With careful preparation and a proactive approach, you can confidently navigate the federal student loan process and achieve your educational goals.

Quick FAQs

What if I don’t qualify for subsidized loans?

Unsubsidized loans are still available. Interest accrues while you’re in school, but you can choose to pay it during your studies or defer payment until after graduation.

Can I consolidate my federal student loans?

Yes, consolidating multiple federal loans into a single loan can simplify repayment. However, be aware that this might affect your interest rate and repayment terms.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and ultimately, default. Contact your loan servicer immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Where can I find my FAFSA data after submission?

You can access your FAFSA data and track your application status through the official FAFSA website using your FSA ID.