Securing a student loan can be a pivotal step towards higher education, but understanding the qualification process is crucial. Navigating the complexities of federal and private loans, credit scores, and required documentation can feel overwhelming. This guide provides a clear and concise overview, empowering you to confidently pursue your educational goals.

From eligibility criteria and necessary paperwork to understanding the impact of your credit history and exploring various loan options, we’ll demystify the entire student loan application process. We’ll compare federal and private loans, highlighting their key differences and helping you choose the best option for your individual circumstances. We’ll also delve into repayment plans and strategies for managing your student loan debt effectively.

Required Documentation for Student Loan Applications

Securing a student loan requires submitting various documents to verify your identity, financial status, and academic enrollment. The specific requirements may vary depending on the lender and the type of loan, but generally, you’ll need to provide a comprehensive set of paperwork. Failing to provide complete and accurate documentation can significantly delay the loan approval process.

Types of Required Documents

Lenders require documentation to assess your eligibility and creditworthiness. This ensures responsible lending practices and minimizes risk. The documents typically requested fall into several categories, each serving a specific purpose in the application process.

Tax Returns

Tax returns (both yours and your parents’, if applicable) provide crucial information about your and your family’s income and financial resources. This helps lenders determine your ability to repay the loan. They look at your adjusted gross income (AGI) to gauge your financial capacity. For example, a consistently high AGI might indicate a stronger repayment capability compared to someone with a fluctuating or low income. Providing accurate and complete tax returns is paramount for a smooth application process.

Academic Transcripts

Official academic transcripts, obtained directly from your educational institution, verify your enrollment status, GPA, and completed coursework. This information is essential for confirming that you are actively pursuing your education and are eligible for student loan funding. A high GPA might reflect a higher likelihood of completing your studies and, consequently, increasing the chance of successful loan repayment. In contrast, a consistently low GPA might raise concerns.

Proof of Identity

Valid government-issued identification, such as a driver’s license, passport, or state ID card, is necessary to verify your identity. This is a fundamental step in preventing fraud and ensuring that the loan is disbursed to the correct individual. A mismatch in information between the application and the ID can cause delays or rejection of the application.

Proof of Residency

Documentation confirming your current address, such as a utility bill, bank statement, or lease agreement, is often required. This helps lenders verify your contact information and ensures that communication regarding your loan is received promptly. An outdated or incorrect address can lead to missed communications and potential complications.

Step-by-Step Guide to Gathering Documentation

1. Create a Checklist: Start by making a checklist of all the required documents based on the lender’s specific requirements.

2. Request Transcripts: Contact your educational institution’s registrar’s office to request official transcripts. Allow ample time for processing.

3. Gather Tax Documents: Obtain copies of your (and your parents’, if required) tax returns for the past few years.

4. Collect Identification: Locate your valid government-issued photo ID.

5. Proof of Residency: Gather a recent utility bill or other proof of your current address.

6. Organize Documents: Organize all documents neatly and clearly label them.

7. Verify Accuracy: Carefully review all documents for accuracy and completeness before submission.

Checklist of Required Documents

- Completed student loan application form

- Official academic transcripts

- Tax returns (yours and your parents’, if required)

- Government-issued photo identification

- Proof of residency (utility bill, bank statement, etc.)

Impact of Missing or Incomplete Documentation

Missing or incomplete documentation will inevitably delay the loan application process. Lenders cannot process your application until all required documents are received and verified. This can cause significant delays in receiving your loan funds, potentially impacting your ability to pay for tuition, fees, and other educational expenses. In some cases, incomplete applications might even lead to rejection. Promptly addressing any requests for additional information is crucial to expedite the process.

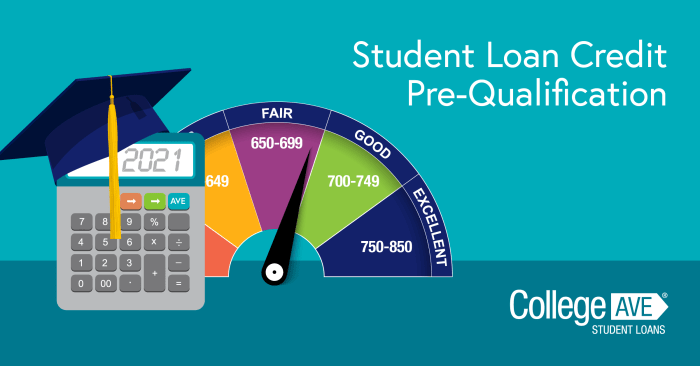

Understanding Credit Scores and Their Impact

Securing a student loan often hinges on your creditworthiness, assessed primarily through your credit score and history. Lenders use this information to gauge your ability to repay the loan, influencing their decision to approve your application and the terms they offer. A strong credit history demonstrates responsible financial management, increasing your chances of approval and potentially securing more favorable interest rates.

Credit History and Credit Scores in Student Loan Approval

Your credit history, a record of your past borrowing and repayment behavior, plays a crucial role in student loan applications. Lenders review this history to evaluate your creditworthiness. A longer history with consistent on-time payments generally leads to a higher credit score, making you a less risky borrower. Conversely, a shorter history, missed payments, or bankruptcies can negatively impact your score and hinder your loan application. Many federal student loans don’t require a credit check, but private lenders almost always do. A good credit score can significantly improve your chances of loan approval, especially with private lenders.

The Role of a Co-signer with Poor Credit

If you have a poor credit history or a low credit score, a co-signer can significantly improve your chances of loan approval. A co-signer is an individual with good credit who agrees to be jointly responsible for repaying the loan. The lender considers the co-signer’s credit history and score when assessing the risk, essentially using their strong credit to offset your weaker credit profile. While this helps secure the loan, it’s crucial to remember that both the applicant and co-signer are legally obligated to repay the debt.

Impact of Credit Scores on Interest Rates and Loan Terms

Credit scores directly influence the interest rates and loan terms offered. Borrowers with higher credit scores are generally considered lower risk and are rewarded with lower interest rates and potentially more favorable repayment terms. Conversely, those with lower credit scores face higher interest rates and potentially less attractive loan options, such as shorter repayment periods or higher origination fees. This means a higher credit score can save you considerable money over the life of the loan. For example, a borrower with a 750 credit score might qualify for a 4% interest rate on a private loan, while a borrower with a 600 credit score might receive an 8% interest rate on the same loan.

Strategies for Improving Credit Scores Before Applying for a Student Loan

Improving your credit score before applying for a student loan can significantly benefit your application. Several strategies can help. First, consistently pay all bills on time. This is the single most important factor in your credit score. Second, keep your credit utilization low; try to keep your credit card balances below 30% of your credit limit. Third, avoid opening multiple new credit accounts in a short period. Finally, check your credit report regularly for errors and dispute any inaccuracies. Even small improvements in your credit score can translate into substantial savings on interest payments over the life of your student loan.

Credit Score and Interest Rate Correlation

| Credit Score Range | Federal Loan Interest Rate | Private Loan Interest Rate (Example Range) | Impact on Loan Approval |

|---|---|---|---|

| 750-850 (Excellent) | Variable, but generally favorable | 4% – 6% | High likelihood of approval, best interest rates and terms |

| 680-749 (Good) | Variable, generally favorable | 6% – 8% | High likelihood of approval, favorable interest rates and terms |

| 620-679 (Fair) | Variable, may be less favorable | 8% – 12% | Approval possible, but higher interest rates and potentially less favorable terms |

| Below 620 (Poor) | May require a co-signer | 12% + or loan denial | Approval unlikely without a co-signer; significantly higher interest rates or loan denial |

Federal vs. Private Student Loans

Choosing between federal and private student loans is a crucial decision impacting your financial future. Understanding their key differences regarding benefits, drawbacks, repayment, and default implications is vital for making an informed choice. This section will compare and contrast these loan types to help you navigate this important process.

Repayment Options for Federal and Private Student Loans

Federal student loans offer various repayment plans designed to accommodate diverse financial situations. These include standard repayment, extended repayment, graduated repayment, and income-driven repayment plans. Income-driven plans tie your monthly payment to your income and family size, potentially resulting in lower monthly payments but potentially extending the repayment period. Private student loans, conversely, typically offer fewer repayment options, often limited to a standard repayment plan with a fixed monthly payment. The terms and conditions are set by the private lender, and flexibility is usually less prevalent compared to federal loans.

Consequences of Defaulting on Federal and Private Student Loans

Defaulting on a federal student loan has significant consequences, including damage to your credit score, wage garnishment, tax refund offset, and potential eligibility restrictions for future federal student aid. The government employs robust collection mechanisms. Defaulting on a private student loan can also severely impact your credit score, leading to difficulties securing loans, credit cards, or even renting an apartment in the future. However, the collection methods employed by private lenders may differ and might not be as extensive as those used for federal loans. The specific consequences vary depending on the lender and the terms of the loan agreement.

Scenarios Favoring Federal or Private Student Loans

Federal student loans are generally preferable for students who need a larger amount of funding or who anticipate difficulty securing private loans due to credit history or income. Their flexible repayment options and government protections against overly aggressive collection practices offer substantial advantages. Private student loans might be a more suitable option for students who have already exhausted their federal loan eligibility, have excellent credit scores, and require a smaller loan amount. A student with a co-signer with strong credit might also find private loans a more attractive option, securing better interest rates. For example, a student with excellent credit might find a lower interest rate on a private loan compared to a federal loan. Conversely, a student with limited credit history might struggle to qualify for a private loan and would rely on federal options.

Advantages and Disadvantages of Federal and Private Student Loans

Understanding the pros and cons of each loan type is crucial for informed decision-making.

- Federal Student Loans: Advantages – Government protections, flexible repayment options, potential for income-driven repayment plans, lower interest rates compared to private loans (generally).

- Federal Student Loans: Disadvantages – May have lower loan limits compared to private loans, application process can be more complex.

- Private Student Loans: Advantages – Potentially higher loan limits, potentially lower interest rates for borrowers with excellent credit and a co-signer.

- Private Student Loans: Disadvantages – Fewer repayment options, higher interest rates for borrowers with poor credit, lack of government protections, more stringent eligibility requirements.

The Application Process and Next Steps

Securing a student loan involves a multi-step process that varies slightly depending on whether you’re applying for a federal or private loan. Understanding these steps, along with the subsequent loan management and potential pitfalls, is crucial for responsible borrowing.

Federal Student Loan Application

The federal student loan application process begins with completing the Free Application for Federal Student Aid (FAFSA). This form collects information about your financial situation and is used to determine your eligibility for federal student aid, including loans, grants, and work-study. After submitting the FAFSA, you’ll receive a Student Aid Report (SAR) summarizing your information. Your school will then use this information to determine your financial aid package. If you are offered federal student loans, you’ll need to accept the offered amount and complete a Master Promissory Note (MPN). This legally binds you to repay the loan according to the terms. Finally, the funds will be disbursed directly to your school to cover tuition, fees, and other eligible expenses.

Private Student Loan Application

Applying for a private student loan typically involves completing an application through a lender’s website or application portal. This application will request detailed personal and financial information, including your credit history (if you have one), income, and the school you plan to attend. Many private lenders require a co-signer, particularly for students with limited or no credit history. The lender will review your application and assess your creditworthiness. Upon approval, you’ll receive a loan offer outlining the terms, interest rate, and repayment schedule. Unlike federal loans, private loan disbursements may be sent directly to the student or to the school, depending on the lender’s policies.

Loan Disbursement

Loan disbursement refers to the process of releasing the loan funds. For federal loans, funds are typically disbursed directly to the educational institution in multiple installments, usually at the beginning of each semester or academic term. Private loan disbursements can vary, sometimes being sent directly to the student to cover educational expenses or other living costs, or directly to the school. Students should always confirm the disbursement method with their lender or financial aid office to avoid any delays or misunderstandings.

Managing Student Loan Debt After Graduation

After graduation, responsible loan management is key. This involves understanding your repayment options, such as standard repayment plans, income-driven repayment plans, and extended repayment plans. Federal loans offer various repayment plans designed to accommodate different financial situations. It’s also crucial to explore options like loan consolidation or refinancing to potentially lower your monthly payments or interest rates. Regularly monitoring your loan accounts, making on-time payments, and staying in communication with your loan servicer are vital steps in responsible debt management.

Avoiding Student Loan Debt Traps

Borrowing only what you absolutely need is paramount. Carefully compare the cost of your education with potential future earnings. Avoid taking out more loans than necessary, and prioritize grants and scholarships as primary funding sources. Understand the terms and conditions of your loans, including interest rates, fees, and repayment schedules. A thorough understanding of these details can help prevent unexpected financial burdens. Finally, create a realistic budget that incorporates your loan repayment obligations to prevent falling behind on payments. For example, budgeting for loan repayments from the time you begin receiving your first disbursement can prevent unexpected financial shocks after graduation.

Student Loan Application Process Flowchart

Imagine a flowchart starting with “Apply for FAFSA (Federal) or Contact Private Lender”. This branches into two parallel paths. The federal path continues with “Receive SAR”, “Accept Loan Offer”, “Complete MPN”, and finally “Loan Disbursement to School”. The private path includes steps like “Complete Private Loan Application”, “Credit Check & Approval”, “Loan Offer”, and “Loan Disbursement (to School or Student)”. Both paths converge at “Begin Repayment After Graduation”. The flowchart visually represents the different stages involved, highlighting the divergence between federal and private loan applications while showing the common outcome of repayment.

Understanding Loan Terms and Repayment Plans

Choosing the right repayment plan for your student loans is crucial, as it significantly impacts your monthly payments and the total amount you ultimately repay. Understanding the various options available and their implications is essential for effective financial planning after graduation. This section will explore different repayment plans, highlighting their key features and potential consequences.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It involves fixed monthly payments over a 10-year period. While this plan offers predictable payments, it often results in higher monthly payments compared to income-driven plans. The advantage lies in its simplicity and the shorter repayment timeframe, minimizing the total interest paid over the life of the loan. However, the higher monthly payments might be a challenge for recent graduates entering the workforce.

Income-Driven Repayment Plans

Income-driven repayment plans are designed to make student loan repayment more manageable by basing your monthly payments on your income and family size. Several plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically extend the repayment period to 20 or 25 years, resulting in lower monthly payments but potentially higher total interest paid over the loan’s lifetime. The lower monthly payments offer flexibility, particularly for borrowers with lower incomes or unexpected financial challenges.

Extended Repayment Plan

This plan allows for longer repayment periods than the standard plan, typically up to 25 years. This reduces monthly payments but increases the total interest paid. It’s suitable for borrowers who need lower monthly payments but are willing to pay more interest over the long term. This option may be preferable for those with a fluctuating income or unexpected financial burdens.

Graduated Repayment Plan

The graduated repayment plan starts with lower monthly payments that gradually increase over time. This option can be helpful for borrowers who anticipate income growth in the future. However, it’s important to note that the increasing payments may become challenging to manage as the loan term progresses.

Comparison of Repayment Plan Options

The following table provides a comparison of various repayment plan options, using a sample loan amount of $30,000 with a 6% interest rate. Note that these are example calculations and actual payments may vary based on individual loan terms and income.

| Repayment Plan | Monthly Payment Example | Total Interest Paid | Loan Forgiveness Potential |

|---|---|---|---|

| Standard (10-year) | $330 | $7,800 (approx.) | None |

| IBR (20-year, assuming a low income) | $150 (approx.) | $18,000 (approx.) | Potential for forgiveness after 20-25 years, depending on income and payments made |

| Extended (25-year) | $180 (approx.) | $27,000 (approx.) | None |

| Graduated (10-year) | Starts low, increases gradually | $7,800 (approx.) – similar to standard, but payment amounts vary over time | None |

Epilogue

Successfully navigating the student loan application process requires careful planning and a thorough understanding of the requirements. By understanding eligibility criteria, gathering necessary documentation, and carefully considering the various loan options available, you can increase your chances of securing funding for your education. Remember to compare interest rates, repayment plans, and potential loan forgiveness programs to make informed decisions that align with your financial goals. Your future education is an investment, and understanding how to finance it wisely is a critical first step.

Expert Answers

What happens if I don’t meet the eligibility requirements for a federal student loan?

You may still be eligible for a private student loan, but these typically have higher interest rates and stricter requirements. Exploring alternative funding options, such as scholarships or grants, may also be necessary.

Can I apply for a student loan if I have a poor credit history?

While a poor credit history can make it harder to qualify for a loan, you might still be able to secure one with a co-signer who has good credit. Alternatively, you may need to focus on improving your credit score before applying.

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school (at least half-time), during grace periods, and during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

How long does the student loan application process typically take?

The processing time varies depending on the lender and the completeness of your application. It can range from a few weeks to several months.