Securing a subsidized student loan can significantly ease the financial burden of higher education. Understanding the eligibility criteria, however, is crucial. This guide navigates the process of qualifying for these loans, explaining the requirements, the application process, and what to expect afterward. We’ll explore the intricacies of financial need assessment, the various loan types available, and the importance of maintaining satisfactory academic progress. By the end, you’ll have a clearer understanding of your chances of securing this valuable financial aid.

From determining your dependency status and completing the FAFSA form to understanding repayment options and avoiding default, we aim to provide comprehensive information to empower you in your pursuit of higher education. We’ll delve into the key differences between subsidized and unsubsidized loans, clarifying the impact of financial need and exploring the various repayment plans available to ensure a smooth and manageable repayment process.

Eligibility Requirements for Subsidized Student Loans

Securing a subsidized federal student loan involves meeting specific eligibility criteria. These requirements ensure that federal funds are allocated to students who demonstrate the greatest financial need and are pursuing their education in a responsible manner. Understanding these requirements is crucial for prospective borrowers to determine their eligibility for this valuable form of financial aid.

General Eligibility Criteria

To qualify for a subsidized federal student loan, you must be a U.S. citizen or eligible non-citizen. You must also be enrolled or accepted for enrollment at least half-time in an eligible degree or certificate program at a participating school. Furthermore, you must demonstrate financial need, as determined by the Free Application for Federal Student Aid (FAFSA). This involves providing accurate financial information on the FAFSA form, which is then used to calculate your Expected Family Contribution (EFC). A lower EFC generally indicates greater financial need and a higher likelihood of qualifying for subsidized loans. Finally, you must maintain satisfactory academic progress as defined by your institution. This typically involves maintaining a minimum GPA and completing a minimum number of credits per academic year.

Enrollment Status Requirements

Subsidized federal student loans typically require at least half-time enrollment. The definition of half-time enrollment varies depending on the institution but generally translates to a minimum number of credit hours per semester or academic year. For example, a student might need to enroll in at least six credit hours to be considered a half-time student at one institution, while another might require twelve. It’s essential to check with your institution’s financial aid office to determine their specific definition of half-time enrollment. While some loan programs might offer flexibility for part-time students, subsidized loans are generally more readily available to those enrolled at least half-time. Full-time enrollment, which typically involves a higher number of credit hours, doesn’t automatically guarantee eligibility, but it often makes it easier to qualify.

Determining Dependency Status

Determining your dependency status is a critical step in the FAFSA process and significantly impacts your eligibility for subsidized loans. The FAFSA uses a set of questions to determine whether you are considered a dependent or independent student. The process is as follows:

- Answer the FAFSA questions honestly and accurately: The FAFSA will ask about your marital status, age, parental support, and financial situation. Be truthful in your responses, as inaccuracies can lead to delays or denial of your financial aid application.

- Review the IRS guidelines for dependency: The IRS provides clear guidelines on dependency status. Familiarizing yourself with these guidelines will help you understand the criteria used in the FAFSA.

- Seek clarification if needed: If you are unsure about how to answer a question on the FAFSA, contact your school’s financial aid office for assistance. They can help clarify the criteria and ensure you complete the form accurately.

Examples of Non-Qualification Based on Dependency Status

Several situations can lead to a student being classified as independent, even if they might have traditionally been considered a dependent. For example, a married student, regardless of age, is automatically considered independent. Similarly, a student who is an orphan or ward of the court is also considered independent. A student who is a veteran or has served on active duty in the U.S. armed forces is generally classified as independent. Students who are parents with legal dependents might also qualify as independent, depending on their specific circumstances. Conversely, a student who is under 24 and financially dependent on their parents will typically be considered a dependent student. Each situation is evaluated individually based on the answers provided on the FAFSA.

Undergraduate vs. Graduate Student Eligibility

| Requirement | Undergraduate Eligibility | Graduate Eligibility | Notes |

|---|---|---|---|

| U.S. Citizenship or Eligible Non-Citizen Status | Required | Required | Must provide documentation |

| Enrollment Status | At least half-time | At least half-time | Specific credit hour requirements vary by institution |

| Financial Need | Demonstrated through FAFSA | Demonstrated through FAFSA | Lower EFC generally indicates greater need |

| Satisfactory Academic Progress | Required | Required | Minimum GPA and credit completion requirements vary by institution |

| Dependency Status | Dependent or Independent (as determined by FAFSA) | Dependent or Independent (as determined by FAFSA) | Independent status often simplifies the process but doesn’t guarantee eligibility |

Financial Need Assessment for Subsidized Loans

Determining your financial need for a subsidized student loan is a crucial step in the federal student aid process. The amount of financial aid you receive, including subsidized loans, is directly tied to your demonstrated need as calculated by the Free Application for Federal Student Aid (FAFSA). This assessment considers various factors related to your family’s financial situation and your educational expenses.

The FAFSA utilizes a complex formula to determine your Expected Family Contribution (EFC). This isn’t the exact amount your family is expected to pay, but rather a measure used to calculate your financial need. The lower your EFC, the greater your demonstrated financial need and thus your eligibility for subsidized loans. The FAFSA process itself is designed to be a standardized approach, ensuring fairness and consistency across all applicants.

Factors Considered in FAFSA Calculation

The FAFSA considers several key factors to calculate your EFC. These factors provide a comprehensive picture of your family’s financial resources and ability to contribute to your education. Understanding these factors can help you better prepare for the FAFSA application process.

The primary factors include:

- Parents’ Income: This includes both parents’ adjusted gross income (AGI) from their tax returns, as well as any untaxed income they may receive. The FAFSA considers both wage income and income from investments.

- Parents’ Assets: This includes the value of assets such as savings accounts, checking accounts, investments (stocks, bonds), and retirement accounts. The FAFSA uses a formula to determine the contribution from these assets.

- Student’s Income and Assets: Similar to parents, the student’s income (from employment, etc.) and assets are also taken into account. This aspect is especially relevant for independent students.

- Family Size: The number of people in your household, including yourself and your dependents, affects the calculation. Larger families often have a higher EFC because they may have more expenses.

- Number of Family Members in College: If you have siblings also attending college, the FAFSA will consider this as well. This can impact the overall family contribution.

Financial Need Assessment Flowchart

The following flowchart illustrates the process of determining financial need for subsidized student loans using the FAFSA.

[Flowchart Description:] The flowchart would begin with the “Start” box. It would then branch to a box indicating “Complete the FAFSA,” followed by a box labeled “FAFSA Data Processing.” This would lead to a box calculating the “Expected Family Contribution (EFC).” From there, the process would branch based on the EFC: a low EFC would lead to a box indicating “High Financial Need, Eligible for Subsidized Loans,” while a high EFC would lead to a box indicating “Low Financial Need, Limited or No Subsidized Loan Eligibility.” Finally, the flowchart would conclude with an “End” box.

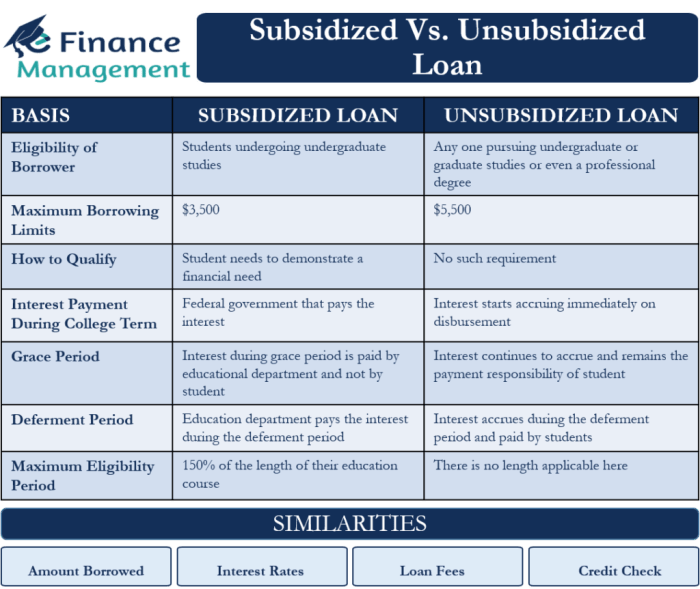

Subsidized vs. Unsubsidized Loans and Financial Need

Subsidized and unsubsidized loans differ significantly in their relationship to financial need. Subsidized loans are only available to students who demonstrate financial need, as determined by the FAFSA. The government pays the interest on subsidized loans while you are in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized loans, on the other hand, are available to all students regardless of financial need. Interest begins accruing on unsubsidized loans as soon as the loan is disbursed, even while you are in school.

Expected Family Contribution (EFC) vs. Actual Financial Need

The EFC is an estimate of your family’s contribution towards your education, while your actual financial need represents the difference between your cost of attendance and your EFC. For example, if your cost of attendance is $20,000 and your EFC is $5,000, your financial need is $15,000. The EFC is a calculation based on the information provided on the FAFSA; it does not necessarily reflect your family’s actual ability to pay, nor does it account for unexpected expenses or changes in circumstances. Financial aid awards are typically based on the calculated financial need.

Types of Subsidized Student Loans and their Features

Understanding the different types of subsidized student loans and their features is crucial for effectively managing your educational finances. This section will clarify the distinctions between various federal loan programs, highlighting key aspects like interest rates, repayment options, and deferment periods. We’ll also explore how these factors influence the overall cost of your education.

Subsidized federal student loans are designed to help students finance their education by offering interest subsidies during periods of deferment (such as while in school or during grace periods). The primary type of subsidized loan is the subsidized Stafford loan, but it’s important to understand its relationship to other federal aid programs like the Pell Grant.

Federal Pell Grants and Subsidized Loans

Federal Pell Grants are need-based grants awarded to undergraduate students demonstrating exceptional financial need. Unlike loans, Pell Grants do not need to be repaid. A student’s eligibility for a Pell Grant significantly impacts their eligibility for subsidized Stafford loans. Students with greater financial need often receive larger Pell Grants, reducing the amount they need to borrow in subsidized loans. The Pell Grant is considered first in meeting a student’s financial need, with subsidized loans filling any remaining gap. The maximum Pell Grant award amount varies annually and is determined by factors such as the student’s Expected Family Contribution (EFC) and cost of attendance.

Subsidized Stafford Loans and Other Federal Student Loan Programs

Subsidized Stafford loans are specifically designed for undergraduate students demonstrating financial need. Unlike unsubsidized Stafford loans, the government pays the interest on subsidized loans while the student is enrolled at least half-time or during a grace period. This significantly reduces the total amount repaid. Other federal student loan programs, such as unsubsidized Stafford loans, PLUS loans (for parents and graduate students), and Perkins Loans (now largely discontinued), do not offer the same interest subsidy. These loans accrue interest from the moment they are disbursed, regardless of the student’s enrollment status. The interest rates for these different loan types also vary, typically with subsidized Stafford loans having the lowest rates.

Types of Federal Student Loan Programs

The following list summarizes key features of different federal student loan programs. Note that interest rates and repayment plans are subject to change and should be verified with the official Federal Student Aid website.

- Subsidized Stafford Loans: These loans are available to undergraduate students with financial need. The government pays the interest during deferment periods. Interest rates are generally lower than other federal loan programs. Repayment typically begins six months after graduation or leaving school. Deferment options are available while enrolled at least half-time, during periods of economic hardship, or for certain types of military service.

- Unsubsidized Stafford Loans: These loans are available to both undergraduate and graduate students, regardless of financial need. Interest accrues from the time the loan is disbursed. Interest rates are typically higher than subsidized Stafford loans. Repayment options and deferment possibilities are similar to subsidized Stafford loans.

- Federal PLUS Loans: These loans are available to parents of undergraduate students and to graduate students. Credit checks are required, and borrowers must meet certain creditworthiness standards. Interest rates are generally higher than Stafford loans. Repayment begins within 60 days of disbursement. Deferment options are limited.

Calculating the Total Cost of a Subsidized Loan

The total cost of a subsidized loan depends on several factors: the principal amount borrowed, the interest rate, the repayment plan, and the length of any deferment periods. Interest accrues during deferment periods on unsubsidized loans, but not on subsidized loans. To illustrate, consider a $10,000 subsidized Stafford loan with a 5% annual interest rate and a 10-year repayment period. If the borrower is enrolled full-time for four years, no interest accrues during that time. However, if it was an unsubsidized loan, interest would accrue over those four years, increasing the total amount owed at the end of the deferment period. The total cost is calculated by adding the principal amount to the total accumulated interest over the repayment period.

Impact of Different Repayment Plans

Different repayment plans significantly impact the total amount paid over the loan’s lifetime. A standard repayment plan involves fixed monthly payments over a 10-year period. However, income-driven repayment plans adjust monthly payments based on the borrower’s income and family size. While income-driven plans result in lower monthly payments, they often extend the repayment period, leading to higher total interest paid over the life of the loan. For example, a $10,000 loan with a 5% interest rate repaid over 10 years under a standard plan might cost approximately $12,000 in total, while the same loan under an income-driven plan with a 20-year repayment period could cost significantly more due to the extended interest accrual.

The Application Process for Subsidized Student Loans

Securing a subsidized student loan involves several key steps, from completing the Free Application for Federal Student Aid (FAFSA) to understanding your Student Aid Report (SAR) and ultimately accepting your loan offer. Careful attention to detail throughout this process is crucial for a successful application.

Completing the FAFSA Form

The FAFSA is the foundation of the federal student aid process. Accurate completion is paramount. The form requests detailed information about your financial situation, family income, and educational plans. It’s essential to gather all necessary tax documents and personal information before beginning. Double-checking all entries for accuracy is vital, as errors can delay processing or lead to ineligibility. The online FAFSA form provides guidance and instructions for each section, and using the IRS Data Retrieval Tool can help minimize errors by automatically transferring tax information. Remember to sign and submit the FAFSA electronically.

Receiving and Understanding the Student Aid Report (SAR)

After submitting your FAFSA, you’ll receive a Student Aid Report (SAR). This report summarizes the information you provided and calculates your Expected Family Contribution (EFC). The SAR also indicates your eligibility for federal student aid, including subsidized loans. Carefully review the SAR for accuracy; if any information is incorrect, contact the Federal Student Aid office immediately to request corrections. Understanding your EFC is critical, as it’s a key factor in determining your financial need and the amount of subsidized loan aid you may receive. The SAR will list the schools you have listed and the aid they are offering.

Accepting a Subsidized Loan Offer

Once your school processes your FAFSA and determines your eligibility, you’ll receive a financial aid offer. This offer will detail the types and amounts of aid you’re eligible for, including subsidized loans. To accept a subsidized loan offer, you’ll typically need to complete a Master Promissory Note (MPN) and possibly undergo entrance counseling. The MPN is a legally binding agreement outlining your responsibilities as a borrower. Entrance counseling provides information about the terms and conditions of your loan, including repayment options and the importance of responsible borrowing. It’s crucial to carefully read and understand all documents before signing.

Maintaining Satisfactory Academic Progress

Maintaining satisfactory academic progress (SAP) is a requirement for continued eligibility for federal student aid, including subsidized loans. SAP standards vary by institution, but generally involve maintaining a minimum grade point average (GPA) and completing a minimum number of credits per term. Failure to meet SAP requirements can result in the loss of financial aid eligibility. Students should regularly check their school’s academic progress policy and proactively address any academic challenges that may jeopardize their eligibility. Schools will generally notify students of any concerns with their SAP status.

Navigating the National Student Loan Data System (NSLDS) Website

The NSLDS website is a central database containing information about your federal student loans. To access your loan information, you’ll need your Federal Student Aid ID (FSA ID). The NSLDS website allows you to view your loan history, including the lender, loan type, and outstanding balance. You can also access information about your repayment options and contact your loan servicer through the NSLDS. The website provides a secure and convenient way to manage your federal student loans. To navigate the website effectively, simply log in with your FSA ID and use the intuitive menu options to find the specific information you need.

Understanding Repayment and Default

Securing a subsidized federal student loan is a significant step towards higher education, but understanding the repayment process and potential consequences is equally crucial. This section Artikels various repayment options, the ramifications of default, loan consolidation, and assistance for borrowers facing financial hardship.

Repayment Options for Subsidized Federal Student Loans

Several repayment plans are available to borrowers of subsidized federal student loans, each tailored to different financial situations and repayment preferences. Choosing the right plan can significantly impact your monthly payments and overall repayment period. Factors such as your income, loan amount, and financial goals should be considered when selecting a plan.

Consequences of Defaulting on a Subsidized Student Loan

Defaulting on a subsidized student loan has serious and far-reaching consequences. These consequences can include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future federal student loans or other forms of credit. The impact on your financial future can be substantial and long-lasting. For example, a defaulted loan can make it extremely difficult to qualify for a mortgage or rent an apartment.

Loan Consolidation

Loan consolidation involves combining multiple federal student loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount. However, it’s important to carefully consider the terms of the consolidated loan, including the new interest rate and repayment period, as these factors can impact the total amount you pay over the life of the loan. Consolidation might be beneficial if you have multiple loans with varying interest rates, making it difficult to manage payments effectively.

Loan Forbearance and Deferment

For borrowers experiencing temporary financial hardship, forbearance and deferment offer options to temporarily suspend or reduce their loan payments. Forbearance allows for a temporary suspension of payments, while deferment postpones payments. However, interest may still accrue during forbearance, depending on the type of loan and the terms of the forbearance agreement. Deferment, on the other hand, may or may not accrue interest depending on the specific deferment program. Both options require application and approval through the loan servicer.

Repayment Plan Options

| Plan Name | Payment Amount | Loan Term | Eligibility Criteria |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payment; amount depends on loan amount and interest rate | 10 years | All federal student loan borrowers |

| Graduated Repayment Plan | Payments start low and gradually increase over time | 10 years | All federal student loan borrowers |

| Extended Repayment Plan | Lower monthly payments over a longer repayment period | Up to 25 years | Loan amount exceeding $30,000 |

| Income-Driven Repayment (IDR) Plans (e.g., ICR, PAYE, REPAYE,IBR) | Monthly payments based on income and family size | 20-25 years | All federal student loan borrowers; specific criteria vary by plan |

Last Point

Navigating the world of subsidized student loans can seem daunting, but with a clear understanding of the eligibility requirements and the application process, the journey becomes significantly less complicated. Remember, careful planning and a proactive approach are key to securing and managing these loans effectively. By understanding your financial need, choosing the right repayment plan, and maintaining satisfactory academic progress, you can leverage subsidized student loans to achieve your educational goals without unnecessary financial strain. This guide provides a foundation for your journey; further research and consultation with financial aid professionals can provide additional support.

Answers to Common Questions

What is the difference between subsidized and unsubsidized loans?

Subsidized loans only accrue interest while you’re in school (at least half-time), during grace periods, and in deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I get a subsidized loan if I’m a graduate student?

Yes, but eligibility requirements and loan amounts may differ from undergraduate loans. You’ll still need to demonstrate financial need.

What happens if I don’t maintain satisfactory academic progress?

Failure to maintain satisfactory academic progress can lead to the loss of your eligibility for federal student aid, including subsidized loans.

What if I can’t afford my loan payments?

Several repayment options exist, including income-driven repayment plans, deferment, and forbearance. Contact your loan servicer to explore your options.

How long does the FAFSA process take?

Processing times vary, but generally, you’ll receive your Student Aid Report (SAR) within a few weeks of submitting your FAFSA.