Securing funding for higher education is a crucial step for many aspiring students. Understanding the qualification process for student loans, however, can feel overwhelming. This guide navigates the complexities of eligibility, from credit scores and financial need to enrollment status and loan types, providing a clear path towards accessing the financial aid you need to pursue your academic goals.

The journey to securing student loans involves more than just filling out an application. Factors like your credit history, income, and the type of degree you’re pursuing all play a significant role in determining your eligibility. This guide aims to demystify the process, offering insights into both federal and private loan options and empowering you to make informed decisions about your financial future.

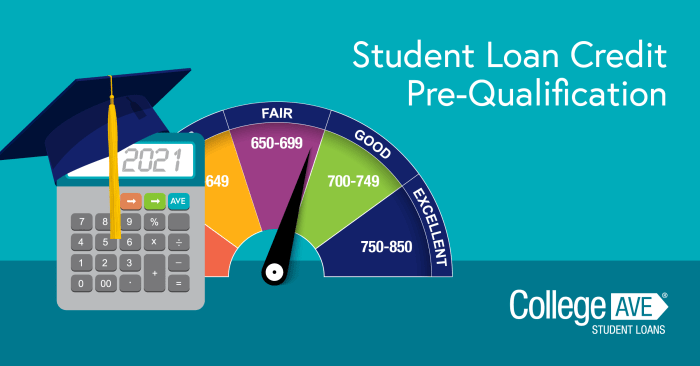

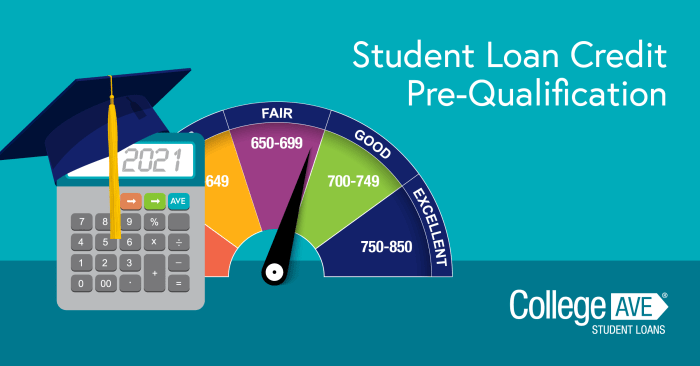

Credit History and Score Impact

Your credit history plays a significant role in determining your eligibility for private student loans. Lenders use your credit score and history to assess your risk as a borrower. A strong credit history demonstrates your responsible financial behavior, making you a more attractive candidate for loan approval. Conversely, a poor credit history can significantly impact your chances of securing a loan or result in less favorable terms.

A low credit score can make it challenging to qualify for private student loans. Lenders perceive individuals with low credit scores as higher-risk borrowers, leading them to either deny the application or offer loans with significantly higher interest rates and less favorable repayment terms. This is because a low score suggests a higher probability of defaulting on the loan. For example, a borrower with a credit score below 670 might face interest rates several percentage points higher than someone with a score above 750, resulting in a substantially larger amount paid in interest over the life of the loan.

Impact of Credit Score on Loan Approval and Interest Rates

The relationship between credit score and loan approval is directly proportional. A higher credit score generally increases the likelihood of loan approval and secures more favorable terms. Conversely, a lower credit score reduces the chances of approval and increases the risk of receiving a loan with a higher interest rate. Many lenders have minimum credit score requirements, often around 660 or higher, for private student loans. Those falling below this threshold might find it exceedingly difficult to secure a loan. The interest rate offered also reflects the perceived risk; a lower credit score typically translates to a higher interest rate, increasing the overall cost of borrowing. This can significantly impact the borrower’s long-term financial well-being.

Strategies for Improving Credit Scores Before Applying for Student Loans

Improving your credit score before applying for student loans is crucial for securing favorable terms. This involves several key steps, including paying all bills on time, consistently, and in full. Late payments severely damage your credit score. Maintaining a low credit utilization ratio (the amount of credit you use compared to your total available credit) is also important; ideally, keep it below 30%. Regularly checking your credit report for errors and disputing any inaccuracies can significantly improve your score. Finally, establishing a longer credit history by responsibly managing existing accounts demonstrates creditworthiness to lenders.

Step-by-Step Guide for Improving Credit Chances

A step-by-step approach can effectively improve your chances of loan approval, even with poor credit.

- Review Your Credit Report: Obtain your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) and thoroughly review it for errors. Dispute any inaccuracies immediately.

- Pay Down Existing Debt: Focus on reducing your outstanding debt, particularly high-interest debt like credit card balances. This lowers your credit utilization ratio.

- Make All Payments On Time: Consistent on-time payments are crucial for improving your credit score. Set up automatic payments to avoid late payments.

- Avoid Opening New Credit Accounts: Opening multiple new accounts in a short period can negatively impact your credit score. Focus on managing existing accounts responsibly.

- Consider a Secured Credit Card: If you have limited credit history, a secured credit card can help build your credit. You make a security deposit, which becomes your credit limit.

- Monitor Your Progress: Regularly check your credit score to track your progress and identify areas for improvement.

Loan Application Process Based on Credit Score

The following flowchart illustrates how a lender might assess a loan application based on the applicant’s credit score:

[Imagine a flowchart here. The flowchart would begin with “Loan Application Submitted.” It would then branch into two paths based on the credit score: “Credit Score Above 670” leading to “Loan Approval (Potentially with favorable interest rates)” and “Credit Score Below 670” leading to “Loan Application Review (More stringent requirements, higher interest rates, or potential denial). The “Loan Application Review” path could further branch into “Loan Approved (with less favorable terms)” and “Loan Denied”.]

Income and Financial Need

Determining your eligibility for federal student loans often hinges on demonstrating financial need. This assessment considers your income and the overall financial resources available to you and your family. The process aims to ensure that federal aid is directed towards students who genuinely require financial assistance to pursue higher education.

The federal government utilizes the Free Application for Federal Student Aid (FAFSA) to assess financial need. This application gathers detailed information about your income, assets, and family circumstances. The information provided is then used to calculate your Expected Family Contribution (EFC), a measure of your family’s ability to contribute to your education costs. A lower EFC generally indicates a greater financial need. The EFC, along with your cost of attendance (tuition, fees, room, board, etc.), determines your financial need, which in turn influences your eligibility for federal student aid, including subsidized and unsubsidized loans.

Documentation Required to Demonstrate Financial Need

The FAFSA requires extensive documentation to verify income and financial information. This usually includes tax returns (IRS Form 1040), W-2 forms, and pay stubs for both the student and their parents (if applicable). Additional documentation may be requested depending on individual circumstances. For example, self-employed individuals might need to provide Schedule C (Profit or Loss from Business) from their tax return. Students with significant assets might need to provide documentation to verify the value of those assets, such as bank statements or investment account statements. The accuracy and completeness of this documentation are crucial for a successful application.

Income Verification Methods Used by Lenders

Different lenders employ various methods to verify income, ensuring the accuracy of the financial information provided by applicants. While the FAFSA forms the basis for federal student loan programs, private lenders may use more stringent verification procedures.

The methods used to verify income can vary widely, but generally involve cross-referencing information provided on the application with independent sources. This helps to reduce the risk of fraudulent applications and ensures responsible lending practices.

- Tax Return Verification: Lenders often request copies of tax returns to confirm reported income. This is a common and highly effective method.

- Pay Stub Review: Pay stubs provide evidence of current income, showing gross pay, deductions, and net pay. Several pay stubs may be requested to establish a consistent income pattern.

- Bank Statement Review: Reviewing bank statements can provide insight into income, spending habits, and overall financial stability. This method is less direct than tax returns or pay stubs but can still be helpful.

- Employer Verification: Direct contact with the employer to confirm employment and income is sometimes employed. This involves contacting the applicant’s employer to verify the details provided on the application.

- Third-Party Verification Services: Some lenders utilize third-party services specialized in verifying income and employment information. These services access various databases and provide independent verification reports.

Comparison of Financial Need Determination Methods

Federal student loan programs primarily rely on the FAFSA and the resulting EFC calculation to determine financial need. This standardized approach ensures consistent evaluation across all applicants. In contrast, private lenders may have their own criteria and methods for assessing financial need. These might include credit scores, debt-to-income ratios, and other factors not considered in the federal system. Private lenders often have higher standards for loan approval, reflecting the higher risk associated with private lending. Consequently, obtaining a private student loan may be more challenging for applicants with limited financial resources.

Co-Signer Requirements

Securing a student loan can be challenging for applicants with limited credit history or low income. In these situations, a co-signer can significantly improve the chances of loan approval. A co-signer essentially acts as a guarantor, agreeing to repay the loan if the student borrower defaults. Understanding the requirements and responsibilities associated with co-signers is crucial for both the student and the co-signer.

Co-signers play a vital role in the student loan application process by mitigating the risk for lenders. They provide an additional layer of financial security, assuring the lender that the loan will be repaid even if the primary borrower experiences financial difficulties. This reduces the lender’s risk and often makes approval more likely, even for students with less-than-perfect credit.

Co-Signer Evaluation Criteria

Lenders carefully assess the co-signer’s creditworthiness to determine their suitability. They examine various factors to gauge the co-signer’s ability and willingness to repay the loan should the student borrower default. A strong co-signer significantly enhances the loan application’s approval prospects.

Responsibilities of Borrower and Co-Signer

The student borrower is primarily responsible for repaying the loan according to the agreed-upon terms. This includes making timely payments and adhering to the loan agreement’s stipulations. The co-signer, however, assumes a secondary responsibility. They are legally obligated to repay the loan if the student borrower fails to do so. This shared responsibility necessitates open communication and a clear understanding of the financial commitment involved for both parties.

Situations Requiring a Co-Signer

Several scenarios may necessitate a co-signer for student loan applications. For example, students with limited or no credit history may require a co-signer to demonstrate creditworthiness to the lender. Similarly, students with low income or high debt-to-income ratios may find it difficult to secure a loan without a co-signer. Furthermore, students pursuing expensive programs with high loan amounts may need a co-signer to strengthen their application. In essence, a co-signer can bridge the gap when a student lacks the established financial standing typically required for loan approval.

Factors Affecting Co-Signer Creditworthiness

Lenders consider several key factors when evaluating a co-signer’s creditworthiness. These factors typically include:

- Credit Score: A high credit score demonstrates a history of responsible credit management.

- Credit History Length: A longer credit history indicates a more established track record of creditworthiness.

- Debt-to-Income Ratio: A low debt-to-income ratio suggests the co-signer has sufficient disposable income to manage additional debt.

- Employment History: Stable employment history demonstrates consistent income and financial stability.

- Existing Debt Obligations: The co-signer’s existing debt load influences their ability to handle additional financial responsibilities.

- Income Level: A higher income level provides greater assurance of repayment capability.

Understanding Loan Types and Repayment Plans

Choosing the right student loan and repayment plan is crucial for managing your debt effectively after graduation. Understanding the differences between federal and private loans, along with the various repayment options available, will help you make informed decisions that minimize your long-term financial burden.

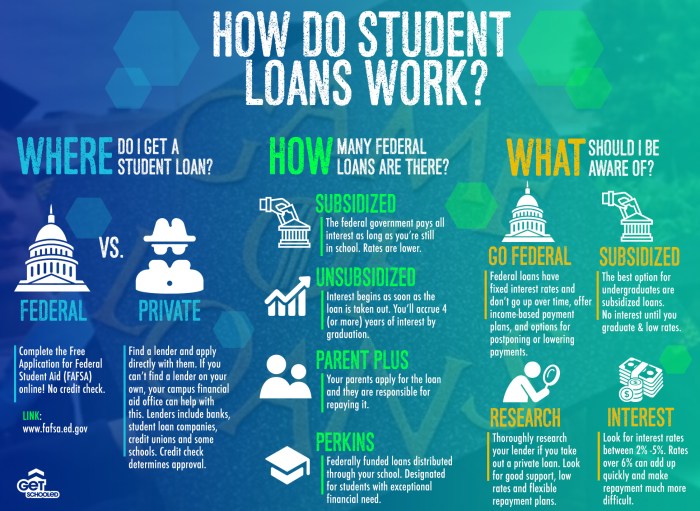

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government and generally offer more borrower protections than private loans. These protections include income-driven repayment plans, loan forgiveness programs, and deferment options during periods of financial hardship. Private student loans, on the other hand, are offered by banks, credit unions, and other private lenders. They often have higher interest rates and fewer borrower protections. Eligibility for federal loans is determined by financial need and enrollment status, while private loan eligibility is primarily based on creditworthiness.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal student loans, each with different terms and implications for total repayment costs. Choosing the right plan depends on your individual financial circumstances and repayment goals.

Interest Rates and Repayment Terms

Interest rates and repayment terms vary significantly depending on the loan type and the lender. Federal student loans typically have lower interest rates than private loans, particularly subsidized loans (where the government pays the interest during certain periods). Repayment terms can range from 10 to 25 years, impacting the total amount paid over the life of the loan. For example, a longer repayment term will result in lower monthly payments but a higher total interest paid. Conversely, a shorter repayment term will result in higher monthly payments but lower total interest paid.

Examples of Repayment Plan Impact on Total Loan Costs

Consider two scenarios: Borrower A chooses a standard 10-year repayment plan for a $20,000 loan at 5% interest, resulting in higher monthly payments but a lower total interest paid over the life of the loan. Borrower B chooses an extended 25-year repayment plan for the same loan amount and interest rate, resulting in lower monthly payments but significantly higher total interest paid over the life of the loan. This illustrates how the choice of repayment plan directly impacts the overall cost of borrowing.

Comparison of Loan Types and Repayment Plans

| Loan Type | Interest Rate | Repayment Options | Total Cost Example ($20,000 loan at 5% interest) |

|---|---|---|---|

| Federal Subsidized Loan | Variable, generally lower than private loans | Standard, Graduated, Income-Driven (IBR, PAYE, REPAYE, ICR) | Varies greatly depending on chosen plan; potentially lower total cost with income-driven plans |

| Federal Unsubsidized Loan | Variable, generally lower than private loans | Standard, Graduated, Income-Driven (IBR, PAYE, REPAYE, ICR) | Varies greatly depending on chosen plan; potentially lower total cost with income-driven plans |

| Private Student Loan | Variable, generally higher than federal loans | Standard, often fewer options than federal loans | Potentially higher total cost due to higher interest rates and fewer repayment options |

The Application Process

Applying for student loans, whether federal or private, involves a series of steps that require careful attention to detail. Understanding the nuances of each process is crucial for a smooth and successful application. This section Artikels the steps involved in applying for both federal and private student loans, highlighting key differences and potential challenges.

Federal Student Loan Application (FAFSA)

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal student loans. Completing the FAFSA accurately and efficiently is paramount to receiving the financial aid you’re eligible for. The process involves providing detailed personal and financial information.

- Gather necessary documents: This includes your Social Security number, federal tax returns, W-2s, and bank statements.

- Create an FSA ID: This unique username and password will allow you to access and manage your FAFSA application.

- Complete the FAFSA form online: The online form guides you through each section, requiring information about your income, assets, family size, and educational plans.

- Submit your FAFSA: Once completed and reviewed for accuracy, submit the form electronically.

- Receive your Student Aid Report (SAR): This report summarizes your information and indicates your eligibility for federal student aid.

- Accept your aid offer: After receiving your SAR, you’ll receive offers of financial aid from your chosen institution. You’ll need to accept the loan offer to receive the funds.

Private Student Loan Application

Private student loans are offered by banks and other financial institutions. The application process differs significantly from the FAFSA.

- Research lenders: Compare interest rates, fees, and repayment terms from various lenders.

- Pre-qualify: Many lenders offer pre-qualification tools to estimate your eligibility without impacting your credit score.

- Complete the application: Private loan applications require detailed financial information, including your credit history, income, and debt.

- Provide documentation: You’ll need to provide supporting documents, such as tax returns, pay stubs, and proof of enrollment.

- Await approval: The lender will review your application and notify you of their decision.

- Sign loan documents: Once approved, you’ll need to sign the loan documents and agree to the terms.

Comparison of Federal and Private Loan Application Processes

Federal student loan applications (FAFSA) focus on determining financial need and eligibility based on income and family circumstances. Private loan applications, conversely, heavily weigh credit history and income to assess risk. FAFSA is generally simpler and faster, while private loan applications can be more complex and time-consuming.

Step-by-Step Guide for Completing a Student Loan Application

Regardless of the loan type, careful planning and organization are essential. A step-by-step approach ensures a smoother process.

- Understand your financial needs: Determine the total cost of your education and explore all funding options.

- Gather necessary documents: Compile all required documents before starting the application.

- Complete the application accurately: Double-check all information for accuracy to avoid delays.

- Submit the application on time: Adhere to all deadlines to ensure timely processing.

- Review your loan terms: Carefully review all loan terms and conditions before signing any documents.

Visual Representation of the Application Workflow

Imagine a flowchart. The starting point is “Determine Loan Type (Federal/Private).” This branches into two paths. The Federal path includes boxes for “Gather Documents,” “Complete FAFSA,” “Receive SAR,” and “Accept Aid.” The Private path includes boxes for “Research Lenders,” “Pre-qualify,” “Complete Application,” “Provide Documentation,” and “Sign Loan Documents.” Potential roadblocks, such as incomplete applications or insufficient documentation, are represented as red flags on each path, leading to potential delays or rejection. The successful completion of each path leads to “Loan Approval” and “Disbursement of Funds.”

Conclusion

Successfully navigating the student loan qualification process requires careful planning and a thorough understanding of the various requirements and loan options available. By carefully considering your financial situation, credit history, and educational goals, you can increase your chances of securing the funding you need to achieve your academic aspirations. Remember to thoroughly research different loan programs and compare their terms before making a final decision. Proactive planning and diligent preparation are key to a successful application.

Question Bank

What is the FAFSA and why is it important?

The FAFSA (Free Application for Federal Student Aid) is a form used to determine your eligibility for federal student aid, including grants, loans, and work-study programs. It’s crucial because it unlocks access to many federal student loan options.

Can I get a student loan if I have bad credit?

While a poor credit history can impact your eligibility for private student loans, federal student loans typically don’t require a credit check. However, a co-signer with good credit might be necessary for private loans.

What happens if I don’t complete my degree?

Loan repayment obligations generally begin after you leave school, regardless of whether you completed your degree. Some loan programs may offer forbearance or deferment options in certain circumstances.

What are the different types of repayment plans?

Federal student loans offer various repayment plans, such as standard, graduated, extended, and income-driven repayment plans. Each plan has different payment amounts and durations, impacting the total cost of the loan over time.