Securing a subsidized student loan can significantly ease the financial burden of higher education. Understanding the eligibility requirements, however, is crucial for successful application. This guide navigates the complexities of federal student aid, outlining the key factors that determine your qualification for this valuable financial assistance.

From understanding your Expected Family Contribution (EFC) to maintaining satisfactory academic progress, we’ll explore the entire process, demystifying the often-confusing world of subsidized student loans. We will also delve into the application process itself, offering tips and strategies to ensure a smooth and efficient experience.

Eligibility Criteria for Subsidized Loans

Securing a subsidized federal student loan hinges on meeting specific eligibility requirements set by the U.S. Department of Education. These requirements focus primarily on financial need and enrollment status. Understanding these criteria is crucial for successful application and securing financial aid for higher education.

Federal Income Requirements

Eligibility for subsidized federal student loans is directly tied to your demonstrated financial need. This need is assessed through the Expected Family Contribution (EFC) calculation, which considers your family’s income, assets, and family size. The lower your EFC, the greater your demonstrated financial need and the higher your likelihood of qualifying for subsidized loans. The Free Application for Federal Student Aid (FAFSA) is the primary tool used to determine your EFC and, subsequently, your eligibility for subsidized loans. There isn’t a specific income cutoff; instead, eligibility is determined on a sliding scale based on your EFC in relation to the cost of attendance at your chosen institution.

Dependency Status Considerations

Your dependency status significantly impacts your eligibility for subsidized loans. Dependent students are generally those under age 24 who are claimed as dependents on their parents’ tax returns. Independent students, on the other hand, have greater financial responsibility and often have higher chances of qualifying for subsidized loans, even with higher incomes, as their financial need is assessed based solely on their own income and assets. Factors determining independent status include age (24 or older), marital status (married), veteran status, and having legal dependents.

Determining Your Expected Family Contribution (EFC)

The EFC calculation is a complex process, but understanding the basic steps is important. First, you complete the FAFSA, providing detailed information about your family’s financial situation. The FAFSA then uses a formula to calculate your EFC, which is an estimate of how much your family is expected to contribute toward your education. This formula considers various factors, including parental income, assets, family size, and the number of family members attending college. The EFC is then compared to the cost of attendance at your school to determine your financial need. A lower EFC indicates greater financial need and higher chances of subsidized loan eligibility.

Acceptable Documentation for Verification

To verify the information you provide on the FAFSA, the federal government may request supporting documentation. Acceptable documents include tax returns (Form 1040, W-2s), pay stubs, bank statements, and documentation proving dependency status such as a marriage certificate or birth certificate. Failure to provide requested documentation can delay or prevent the processing of your financial aid application. It is crucial to maintain accurate records and respond promptly to any verification requests.

Comparison of Subsidized and Unsubsidized Loan Eligibility

| Requirement | Subsidized Loans | Unsubsidized Loans |

|---|---|---|

| Financial Need | Required | Not Required |

| Interest Accrual While in School | No | Yes |

| Dependency Status | Affects EFC Calculation | Affects EFC Calculation (for dependents) |

| Enrollment Status | Must be enrolled at least half-time | Must be enrolled at least half-time |

Maintaining Eligibility During Enrollment

Maintaining eligibility for subsidized student loans requires consistent academic progress. Lenders and the government want to ensure that students are using the funds responsibly and working towards degree completion. Failure to meet specific academic standards can lead to the loss of eligibility, impacting your ability to receive further financial aid.

Academic Progress Requirements and Their Implications

Satisfactory Academic Progress Standards

Institutions define satisfactory academic progress (SAP) using a combination of factors. These typically include Grade Point Average (GPA), completion rate (the number of credits completed versus attempted), and maximum time frame allowed to complete a degree. Specific requirements vary by institution and program, so it’s crucial to review your school’s policy, often found in the financial aid office’s section of the school’s website or student handbook. Failing to meet these standards can result in the suspension or termination of your subsidized loan eligibility. For example, a student consistently failing courses or exceeding the maximum time limit allowed for their degree program might lose their eligibility. This necessitates a plan of action to regain eligibility, often involving improved academic performance and/or a meeting with an academic advisor.

Consequences of Failing to Meet SAP Standards

The consequences of not meeting SAP standards can be severe. Your subsidized loan eligibility may be suspended, meaning you won’t receive further funding until you demonstrate improvement. In some cases, you may be required to repay a portion or all of your existing subsidized loans. Additionally, your overall financial aid package, including grants and scholarships, might be affected. This can create significant financial hardship, potentially leading to the interruption or termination of your studies. Understanding the SAP standards and actively working towards them is therefore paramount.

Situations Jeopardizing Subsidized Loan Eligibility

Several situations can jeopardize your subsidized loan eligibility. These include consistently low GPAs, failing multiple courses, taking an excessive number of courses without completing them, and exceeding the maximum timeframe for degree completion. Excessive withdrawals from courses, particularly if they’re consistently in the same subject area, can also raise concerns about academic preparedness and commitment. Changing majors frequently can also affect your progress towards degree completion, potentially leading to a review of your eligibility. A significant change in academic performance after a period of success might trigger a review of your eligibility. For example, a student who consistently maintains a 3.5 GPA and suddenly drops to a 1.5 GPA might face an eligibility review.

Best Practices for Maintaining Eligibility

Proactive measures are key to maintaining subsidized loan eligibility. Regularly check your academic progress report and compare it to your institution’s SAP standards. Meet with academic advisors to create a plan for success and address any challenges early on. Develop effective study habits, participate actively in class, and seek tutoring or support services if needed. Consider taking a lighter course load if you are struggling to maintain a satisfactory GPA. Open communication with your financial aid office is crucial; if you foresee any potential issues, contact them immediately to discuss options and potential solutions.

Common Reasons for Subsidized Loan Eligibility Loss

Understanding common reasons for eligibility loss is crucial for proactive management.

- Failing to meet the minimum GPA requirement.

- Exceeding the maximum timeframe for degree completion.

- Withdrawing from too many courses.

- Inconsistent academic performance, showing a significant decline in grades.

- Not completing the required number of credits per term or per year.

The FAFSA and Subsidized Loan Application

The Free Application for Federal Student Aid (FAFSA) is the cornerstone of the federal student aid process, including subsidized loan applications. Completing the FAFSA accurately and efficiently is crucial for determining your eligibility for federal student aid, including subsidized loans. This section will guide you through the process.

Information Required for FAFSA Completion

Accurate and complete information is paramount for a successful FAFSA submission. The FAFSA requires details about you, your parents (if you are a dependent student), your income, and your assets. This information is used to calculate your Expected Family Contribution (EFC), a key factor in determining your eligibility for federal student aid. You’ll need tax returns (both yours and your parents’, if applicable), W-2s, and other relevant financial documents readily available to expedite the process. Specific information required includes Social Security numbers, driver’s license numbers, federal tax information (AGI, etc.), bank account information, and details about assets like savings and investments.

Step-by-Step Guide for Submitting the FAFSA Online

The FAFSA application is completed online through the official website, studentaid.gov. Here’s a step-by-step guide:

- Create an FSA ID: Before starting, you and your parent (if applicable) need to create an FSA ID. This acts as your electronic signature and allows you to access and manage your FAFSA data.

- Gather Necessary Information: Collect all required financial documents and personal information as mentioned above.

- Complete the Application: Carefully fill out each section of the online application. Double-check all information for accuracy.

- Review and Submit: Thoroughly review your completed application to ensure everything is correct. Once you’re confident, submit the application electronically.

- Track Your Status: After submission, monitor your application status online to track its progress.

Avoiding Common FAFSA Application Errors

Many errors stem from simple oversights. To avoid these, carefully review each section before submitting. Common mistakes include incorrect Social Security numbers, inaccurate income reporting, and omitting required information. Utilize the FAFSA’s online help resources and consider seeking assistance from a school financial aid advisor if needed. Remember, inaccuracies can delay the processing of your application and potentially affect your eligibility for aid.

FAFSA Application Process Flowchart

The following describes a simplified flowchart illustrating the FAFSA application process:

Start → Create FSA ID(s) → Gather Financial Information → Complete Online Application → Review Application → Submit Application → Track Application Status → Receive Student Aid Offer (if eligible) → End

Understanding Loan Terms and Repayment

Securing a subsidized student loan is a significant step towards financing your education, but understanding the loan terms and repayment process is equally crucial. This section will clarify the interest implications, repayment options, and tools available to manage your loan effectively.

Subsidized Loan Interest Rates

Subsidized loans offer a significant advantage: the government pays the interest while you’re in school (at least half-time) and during certain grace periods. This means your loan balance doesn’t grow during these periods. However, the interest rate itself is determined annually by the federal government and varies. While the rate is fixed for the life of your loan, understanding the current rate is essential for projecting your total repayment cost. For example, a lower interest rate will result in lower overall interest payments. Checking the official Federal Student Aid website will provide the most up-to-date interest rate information.

Grace Period and Repayment Options

After graduation or leaving school, you’ll typically have a grace period before repayment begins. This grace period is usually six months for subsidized federal loans, offering time to find employment and plan your repayment strategy. Several repayment plans are available to suit various financial situations. These plans differ in monthly payment amounts and total repayment time, consequently affecting the total interest paid.

Examples of Repayment Plans

The Standard Repayment Plan involves fixed monthly payments over a 10-year period. A longer repayment period, such as the Extended Repayment Plan (up to 25 years), results in lower monthly payments but significantly higher total interest paid over the life of the loan. Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR) plan, tie your monthly payment to your income and family size. While monthly payments are typically lower, the repayment period may extend beyond 20 years, leading to higher overall interest costs. For example, a $20,000 loan with a 5% interest rate on a 10-year Standard Repayment plan will have higher monthly payments but lower overall interest compared to the same loan on a 25-year Extended Repayment plan.

Loan Deferment and Forbearance

Life circumstances can sometimes make loan repayment challenging. Deferment and forbearance are options that temporarily postpone or reduce your monthly payments. Deferment typically pauses both principal and interest payments under specific circumstances, such as returning to school or experiencing unemployment. Forbearance, on the other hand, allows for temporary reduction or suspension of payments, but interest may still accrue. It’s crucial to understand the conditions and implications of each before utilizing these options, as they can affect your long-term repayment costs.

Calculating Total Loan Cost

Calculating the total cost of a subsidized loan involves understanding the principal amount borrowed, the interest rate, and the repayment period. A simple calculation isn’t always sufficient, as interest accrual and repayment plan variations significantly impact the total cost. Many online loan calculators are available to help estimate the total cost based on your specific loan details and chosen repayment plan. For instance, using a loan calculator, one can input the loan amount, interest rate, and repayment plan to determine the total amount paid, including principal and interest, over the life of the loan. This allows for a clear understanding of the financial commitment.

Comparing Subsidized Loans with Other Financial Aid

Choosing the right financial aid package is crucial for managing the costs of higher education. Understanding the differences between subsidized and unsubsidized loans, along with the roles of grants and scholarships, is key to making informed decisions about financing your education. This section will clarify these distinctions and help you weigh your options effectively.

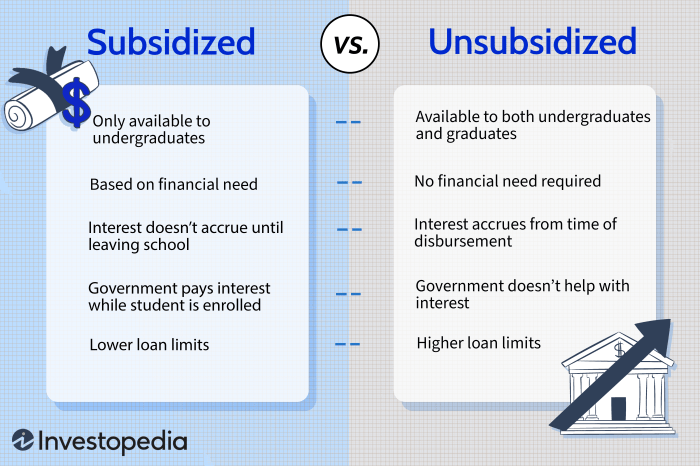

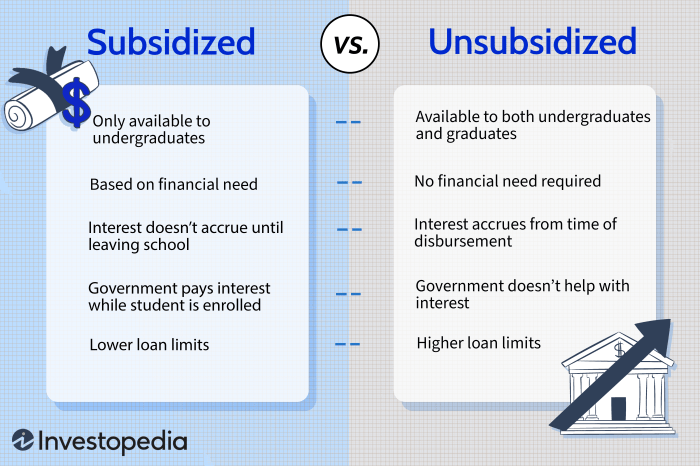

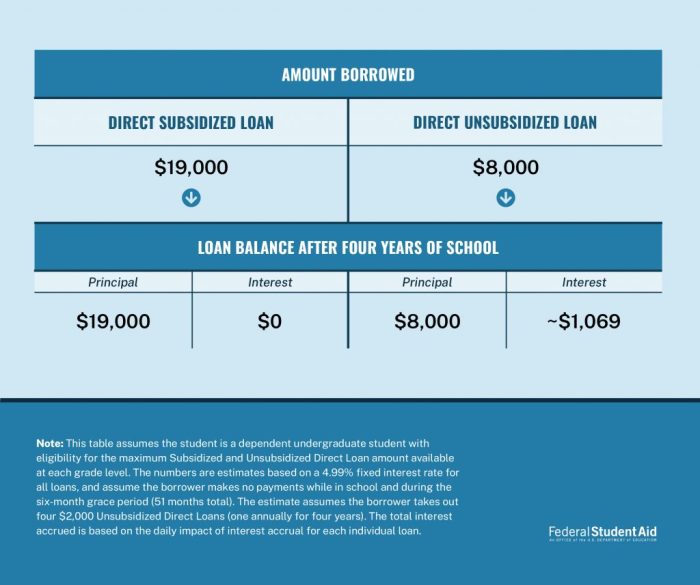

Subsidized vs. Unsubsidized Loans

Subsidized and unsubsidized federal student loans are both designed to help students pay for college, but they differ significantly in how interest accrues. Subsidized loans don’t accrue interest while you’re enrolled at least half-time, during grace periods, and during deferment periods. Unsubsidized loans, however, accrue interest from the time the loan is disbursed, regardless of your enrollment status. This means that by the time you begin repayment, you’ll owe more on an unsubsidized loan than the original principal amount. The interest on unsubsidized loans can be capitalized, meaning it’s added to the principal balance, increasing the total amount you ultimately owe.

Advantages and Disadvantages of Subsidized and Unsubsidized Loans

| Feature | Subsidized Loan | Unsubsidized Loan |

|---|---|---|

| Interest Accrual During School | No interest accrues while enrolled at least half-time. | Interest accrues from disbursement. |

| Total Repayment Amount | Generally lower than unsubsidized loans due to no interest accrual during school. | Generally higher than subsidized loans due to interest accrual during school. |

| Eligibility Requirements | Based on financial need as determined by FAFSA. | Available to students regardless of financial need. |

| Advantage | Lower overall cost due to no interest during school. | Available to a wider range of students. |

| Disadvantage | May not cover the full cost of education for all students. | Higher overall cost due to interest accrual during school. |

The Role of Grants and Scholarships

Grants and scholarships represent “free money” for education, meaning they don’t need to be repaid. They are often awarded based on merit (academic achievement, talent, etc.) or financial need. Securing grants and scholarships can significantly reduce the amount of student loans you need to borrow, ultimately lowering your debt burden after graduation. Many institutions and organizations offer grants and scholarships; proactive searching and application are key to securing these funds.

Exploring Alternative Funding Sources

Beyond federal student loans, grants, and scholarships, there are several alternative funding sources students can explore. These may include private student loans (which typically come with higher interest rates), work-study programs (which provide part-time employment opportunities on campus), and family contributions. Careful consideration of the terms and conditions of each funding option is vital before committing to any particular source. For instance, a private loan might offer a higher loan amount but at a significantly higher interest rate compared to a federal subsidized loan.

Comparison of Financial Aid Options

| Type of Aid | Source | Repayment Required? | Interest Accrual | Eligibility Criteria |

|---|---|---|---|---|

| Subsidized Loan | Federal Government | Yes | No during enrollment (at least half-time) | Demonstrated financial need |

| Unsubsidized Loan | Federal Government | Yes | Yes, from disbursement | Generally available to all students |

| Grants | Federal, State, Institutional, Private Organizations | No | N/A | Varies; often based on financial need or merit |

| Scholarships | Private Organizations, Institutions, Corporations | No | N/A | Varies; often based on merit, academic achievement, or specific criteria |

Final Thoughts

Successfully navigating the subsidized student loan process requires a clear understanding of eligibility criteria and the application procedure. By carefully considering your financial situation, academic standing, and understanding the FAFSA process, you can significantly increase your chances of securing this vital form of financial aid. Remember to thoroughly review all requirements and seek guidance if needed to ensure a successful application and a smoother path towards your educational goals.

FAQ Section

What is the difference between subsidized and unsubsidized loans?

With subsidized loans, the government pays the interest while you’re in school (and sometimes during grace periods). Unsubsidized loans accrue interest from the moment they’re disbursed.

Can I get a subsidized loan if I’m a graduate student?

Generally, subsidized loans are primarily for undergraduate students. Graduate students typically qualify for unsubsidized loans.

What happens if I don’t maintain satisfactory academic progress?

Failure to maintain satisfactory academic progress can result in the loss of eligibility for subsidized loans and other forms of federal financial aid.

What if I make a mistake on my FAFSA application?

Contact the Federal Student Aid office immediately to correct any errors. They can guide you through the amendment process.

How long is the grace period after graduation?

The grace period for federal student loans is typically six months after graduation or leaving school.