Navigating the world of student loans can feel overwhelming, a labyrinth of federal programs, private lenders, and repayment options. This guide aims to illuminate the path, providing a clear understanding of the process from application to repayment, empowering you to make informed decisions about financing your education.

Securing funding for higher education is a significant step, requiring careful consideration of various loan types, eligibility criteria, and long-term financial implications. Understanding the nuances of federal versus private loans, exploring repayment strategies, and recognizing potential scams are crucial aspects of this journey. This guide will equip you with the knowledge necessary to confidently manage your student loan experience.

Understanding Student Loan Types

Navigating the world of student loans can feel overwhelming, but understanding the different types available is crucial for making informed financial decisions. The primary distinction lies between federal and private loans, each with its own set of benefits, drawbacks, and repayment options.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government and generally offer more borrower protections than private loans. These protections include flexible repayment plans, income-driven repayment options, and loan forgiveness programs. Private student loans, on the other hand, are provided by banks, credit unions, and other private lenders. Their terms and conditions are often less favorable to borrowers, and they typically lack the same level of government oversight and protection. Eligibility for federal loans is generally based on financial need and enrollment status, while private loan eligibility depends on creditworthiness and co-signer availability.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal student loans, allowing borrowers to tailor their monthly payments to their financial circumstances. These include the Standard Repayment Plan (fixed monthly payments over 10 years), the Graduated Repayment Plan (payments start low and gradually increase), the Extended Repayment Plan (payments spread over a longer period), and income-driven repayment plans (payments are based on your income and family size). Income-driven repayment plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, can significantly lower monthly payments, but they may result in a longer repayment period and higher total interest paid.

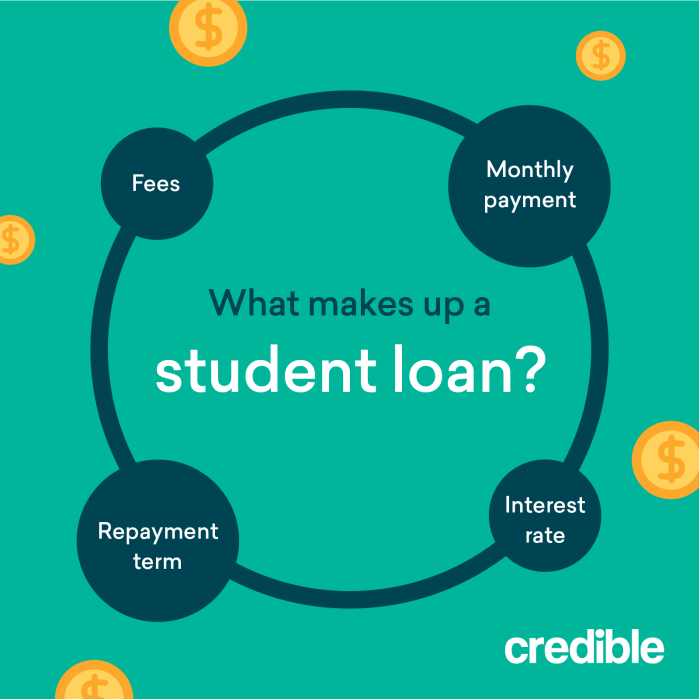

Interest Rates and Fees

Interest rates and fees vary significantly between federal and private student loans, and even within each category. Federal student loan interest rates are typically lower than private loan rates and are set by the government. Private loan rates are variable and depend on the borrower’s credit score and other factors. Federal loans may have origination fees, which are deducted from the loan disbursement, while private loans may have additional fees, such as application fees or prepayment penalties. For example, a subsidized federal Stafford loan might have a fixed interest rate of 4.99% while a private loan from a bank might have a variable interest rate ranging from 6% to 12% depending on creditworthiness.

Key Features of Federal Student Loans

| Loan Type | Subsidized/Unsubsidized | Interest Accrual | Eligibility |

|---|---|---|---|

| Direct Subsidized Loan | Subsidized | Interest does not accrue while the borrower is in school at least half-time, during grace periods, and during deferment. | Demonstrated financial need |

| Direct Unsubsidized Loan | Unsubsidized | Interest accrues from the time the loan is disbursed. | No demonstrated financial need required |

| Direct PLUS Loan (Graduate/Parent) | Unsubsidized | Interest accrues from the time the loan is disbursed. | Credit check required (Graduate/Parent) |

| Federal Family Education Loan (FFEL) Program Loans (Discontinued) | Subsidized/Unsubsidized | Varied based on specific loan type. | Eligibility criteria varied based on lender and loan type. |

The Application Process

Securing student loans, whether federal or private, involves a distinct application process. Understanding the steps and requirements for each type is crucial for a smooth and successful application. This section details the procedures for both federal and private student loans, providing tips for efficient completion.

Federal Student Loan Application

Applying for federal student loans primarily involves completing the Free Application for Federal Student Aid (FAFSA). This form collects information about your financial situation, family income, and other relevant details to determine your eligibility for federal student aid. The FAFSA data is used by your chosen college or university and federal agencies to calculate your financial need and determine your eligibility for grants, scholarships, and loans.

- FAFSA Completion: Begin by creating an FSA ID, which is your personal username and password used to access and manage your FAFSA information. You’ll need your Social Security number, federal tax information (yours and your parents’, if applicable), and your high school information. The FAFSA requires accurate and complete information; inaccuracies can delay or prevent the processing of your application.

- School Selection: Indicate the college or university you plan to attend. The FAFSA will transmit your information directly to the institution, simplifying the financial aid process for the school.

- Review and Submission: Before submitting your FAFSA, carefully review all the information for accuracy. Once submitted, you will receive a Student Aid Report (SAR) confirming your submission and providing an overview of your eligibility for federal aid.

- Award Notification: Your chosen school will notify you of your financial aid award package, including any federal student loans offered. This package Artikels the loan amounts, interest rates, and repayment terms.

Private Student Loan Application

Private student loans are offered by banks and other financial institutions. The application process for private student loans differs significantly from the federal process, often involving a more rigorous credit check and potentially requiring a co-signer.

- Credit Check and Score: Lenders will assess your credit history and credit score. A higher credit score generally leads to more favorable loan terms (lower interest rates).

- Co-Signer Requirement: If you lack a strong credit history, a co-signer (typically a parent or guardian with good credit) may be required to guarantee the loan. The co-signer assumes responsibility for the loan repayment if you default.

- Income Verification: Lenders will verify your income and ability to repay the loan. This may involve providing tax returns or pay stubs.

- Loan Application Completion: Complete the loan application, providing accurate and complete information about your education, financial situation, and co-signer details (if applicable).

- Loan Approval and Terms: The lender will review your application and notify you of their decision. If approved, you’ll receive information about the loan terms, including the interest rate, repayment schedule, and fees.

Tips for Efficient and Accurate Application Completion

Gathering all necessary documentation beforehand, such as tax returns, W-2s, and Social Security numbers, streamlines the process. Carefully review all forms before submitting to minimize errors and delays. If you encounter any difficulties, contact the financial aid office at your school or the lender directly for assistance. Keeping organized records of all your applications and correspondence is crucial for tracking your progress and managing your loans effectively. Finally, compare loan offers carefully before accepting any loan to ensure you’re getting the best possible terms.

Repayment Strategies and Options

Navigating student loan repayment can feel daunting, but understanding the available options is crucial for managing your debt effectively and minimizing long-term financial strain. Choosing the right repayment plan depends on your individual financial situation, income, and loan type. Several strategies exist, each with its own advantages and disadvantages.

Understanding the nuances of different repayment plans allows for informed decision-making, leading to a more manageable debt trajectory. This section will explore various repayment options and strategies for effective debt management.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. Borrowers make fixed monthly payments over a 10-year period. This plan results in the highest monthly payments but the lowest total interest paid over the life of the loan. For example, a $30,000 loan at a 5% interest rate would have a monthly payment of approximately $317 and a total interest paid of around $10,000. The predictability of this plan is appealing to many borrowers who prefer a structured and relatively short repayment timeline.

Extended Repayment Plan

An extended repayment plan allows for longer repayment periods, typically up to 25 years. This reduces monthly payments but increases the total interest paid. Using the same $30,000 loan example, a 25-year repayment plan would result in lower monthly payments (around $160), but the total interest paid would significantly increase to approximately $22,000. This option is beneficial for borrowers with lower incomes or those who prioritize lower monthly payments.

Income-Driven Repayment (IDR) Plans

Income-driven repayment plans link monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically result in lower monthly payments than standard plans, especially in the early years of repayment. However, the repayment period is usually longer (potentially up to 20 or 25 years), and any remaining loan balance may be forgiven after a specified period (often 20 or 25 years), though this forgiveness is considered taxable income. The complexities of these plans require careful consideration and potentially professional financial advice.

Income-Driven vs. Standard Repayment Plans: A Comparison

| Feature | Standard Repayment | Income-Driven Repayment |

|---|---|---|

| Monthly Payment | Higher, fixed amount | Lower, adjusted based on income |

| Repayment Period | Typically 10 years | Typically 20-25 years |

| Total Interest Paid | Lower | Higher |

| Loan Forgiveness | None | Possible after 20-25 years (taxable income) |

Strategies for Managing Student Loan Debt Effectively

Effective student loan debt management requires a proactive approach. Creating a budget, prioritizing loan repayment, and exploring options for reducing monthly payments are crucial steps. Additional strategies include exploring loan refinancing to potentially lower interest rates and making extra payments whenever possible to accelerate repayment. Careful financial planning and discipline are key to successfully managing student loan debt.

Developing a Personal Student Loan Repayment Plan

Effective student loan repayment requires a personalized plan. The following steps can help create a comprehensive strategy:

- List all loans: Compile a list of all your student loans, including lender, loan amount, interest rate, and monthly payment.

- Create a budget: Track your income and expenses to determine how much you can realistically allocate towards loan repayment.

- Choose a repayment plan: Select a repayment plan that aligns with your financial situation and goals. Consider both standard and income-driven options.

- Prioritize loans: Determine which loans to prioritize based on interest rates and balance. Consider strategies like the avalanche method (highest interest first) or the snowball method (smallest balance first).

- Automate payments: Set up automatic payments to ensure consistent and timely repayments.

- Explore additional repayment options: Investigate options like refinancing or income-driven repayment plans to potentially lower your monthly payments.

- Regularly review and adjust: Monitor your progress and adjust your repayment plan as needed based on changes in your financial circumstances.

Understanding Loan Forgiveness and Deferment Options

Navigating the complexities of student loan repayment often involves exploring options for loan forgiveness and deferment. These programs can significantly impact your long-term financial health, offering potential relief from the burden of student debt. Understanding the eligibility criteria and application processes is crucial for maximizing their benefits.

Loan Forgiveness Program Eligibility Requirements

Eligibility for loan forgiveness programs varies widely depending on the specific program. Factors such as loan type, employment sector, and income often play a significant role. For example, the Public Service Loan Forgiveness (PSLF) program has stringent requirements, including working full-time for a qualifying government or non-profit organization and making 120 qualifying monthly payments under an income-driven repayment plan. Other programs, like the Teacher Loan Forgiveness program, may have different eligibility criteria focused on specific professions and teaching locations. It’s essential to thoroughly research the specific program’s requirements before applying.

Applying for Loan Deferment or Forbearance

The processes for applying for loan deferment or forbearance are generally straightforward but require careful attention to detail. Deferment temporarily postpones your loan payments, often due to specific circumstances like unemployment or enrollment in school. Forbearance, on the other hand, allows for a temporary suspension of payments but may accrue interest. Applications typically involve completing a form provided by your loan servicer, providing documentation supporting your request (such as proof of unemployment or enrollment), and submitting the application through the appropriate channels. It’s crucial to understand that while deferment and forbearance offer temporary relief, interest may still accrue during these periods, potentially increasing your overall loan balance.

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program offers complete loan forgiveness after 120 qualifying monthly payments under an income-driven repayment plan for borrowers employed full-time by a government or non-profit organization. To qualify, borrowers must have Direct Loans and meet specific employment and payment requirements. The process involves carefully tracking payments, ensuring they meet PSLF criteria, and regularly submitting employment certification forms. Failure to meet these requirements can result in ineligibility for loan forgiveness. For instance, a teacher working for a private school would not qualify, even if they are making payments.

Calculating Potential Savings with Loan Forgiveness Options

Calculating potential savings requires considering the loan’s principal balance, interest rate, and the number of payments remaining under different repayment scenarios. For example, consider a $50,000 loan with a 6% interest rate and a 10-year repayment plan. Without loan forgiveness, the total repayment amount would be significantly higher than if the loan was forgiven after 10 years under a program like PSLF. The exact savings will depend on the specific loan forgiveness program and individual circumstances. Using online loan calculators can help estimate potential savings by comparing the total repayment amount under different scenarios. For instance, a borrower might input their loan details and compare the outcome of a standard repayment plan with one that includes forgiveness after a set period. This comparison would highlight the monetary benefit of the forgiveness program.

Avoiding Student Loan Scams

Navigating the student loan process can be complex, making it an unfortunately fertile ground for scams. Understanding common tactics used by fraudulent loan providers is crucial to protecting your financial future and avoiding significant debt burdens. This section will highlight prevalent scams and provide strategies for safeguarding yourself.

Student loan scams often prey on the anxieties and pressures associated with financing higher education. Scammers exploit the urgency students feel to secure funding, employing deceptive practices to gain access to personal information and money. These scams can range from outright fraud to misleading offers with hidden fees and unfavorable terms.

Common Student Loan Scam Tactics

These scams frequently involve promises that seem too good to be true, such as exceptionally low interest rates or guaranteed loan approval regardless of credit history. They often involve high-pressure sales tactics, urging immediate action before “the offer expires.” Be wary of any loan provider that pressures you into making a quick decision without allowing time for careful consideration.

Examples include unsolicited emails or phone calls offering student loans, websites mimicking legitimate lenders, and individuals posing as government representatives offering loan forgiveness programs that don’t exist. These scams can result in identity theft, financial loss, and significant damage to your credit score.

Red Flags Indicating Potential Student Loan Scams

A visual representation of common scam tactics could be a flowchart. Starting at the top with “Unsolicited Contact,” branches would lead to different scam types: One branch labeled “Fake Website” could illustrate a convincing but illegitimate website mimicking a legitimate lender. Another branch, “High-Pressure Sales,” depicts a salesperson aggressively pushing for immediate decisions and emphasizing limited-time offers. A third branch, “Guaranteed Approval,” shows an offer promising loan approval regardless of creditworthiness. Finally, all branches converge at a common endpoint: “Financial Loss/Identity Theft.”

Specific red flags to watch for include: unsolicited contact via email, text, or phone; requests for upfront fees or payments; promises of guaranteed loan approval without a credit check; websites with poor design or unprofessional appearance; high-pressure sales tactics; unusual or complex loan terms; and a lack of clear contact information for the lender.

Protecting Yourself from Student Loan Scams

Thoroughly research any lender before applying for a loan. Verify their legitimacy through independent sources such as the Better Business Bureau or your state’s attorney general’s office. Never provide personal information or financial details unless you’ve independently verified the lender’s authenticity and the security of their website. Be cautious of unsolicited offers and high-pressure sales tactics. Remember, legitimate lenders will not pressure you into making a hasty decision.

Always compare loan offers from multiple lenders to ensure you’re getting the best possible terms. Understand the terms and conditions of any loan before signing any documents. If something seems too good to be true, it probably is. Report any suspected scams to the appropriate authorities, including the Federal Trade Commission (FTC) and your state’s attorney general.

Last Point

Successfully navigating the student loan process requires careful planning and a thorough understanding of the available options. By carefully considering your eligibility, choosing the right loan type, and developing a sound repayment strategy, you can minimize financial burden and focus on your academic pursuits. Remember to always be vigilant against scams and utilize available resources to ensure a smooth and successful loan experience. Your future financial well-being depends on it.

Quick FAQs

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

What is a co-signer, and why is it needed for some private loans?

A co-signer is someone with good credit who agrees to repay the loan if you can’t. Lenders often require co-signers for students with limited or no credit history.

Can I consolidate my student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new interest rate and repayment plan. Private loans typically cannot be consolidated with federal loans.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including wage garnishment, tax refund offset, and damage to your credit score. It’s crucial to contact your lender if you’re struggling to make payments.

What are income-driven repayment plans?

Income-driven repayment plans base your monthly payments on your income and family size, potentially resulting in lower monthly payments and loan forgiveness after a certain period.