Navigating the complexities of student loan repayment can feel like deciphering a financial enigma. Understanding how interest accrues is crucial to effectively managing your debt and minimizing long-term costs. This guide unravels the intricacies of student loan interest, providing a clear and concise explanation of the processes and factors that influence your total repayment amount.

From fixed versus variable interest rates to the impact of different repayment plans and the mechanics of loan amortization, we will explore the key aspects that determine how much interest you ultimately pay. Armed with this knowledge, you can make informed decisions about your loan repayment strategy and work towards a debt-free future.

Types of Student Loan Interest

Understanding the different types of interest applied to student loans is crucial for effective financial planning. The two primary types are fixed and variable interest rates, each impacting the overall cost of your loan differently. The way interest is calculated and applied, particularly through a process called capitalization, significantly influences the final amount you repay.

Fixed and variable interest rates represent two distinct approaches to calculating the interest charged on your student loan. A fixed interest rate remains constant throughout the loan’s repayment period, providing predictability and stability in your monthly payments. In contrast, a variable interest rate fluctuates based on market conditions, leading to potentially higher or lower payments over time. This variability introduces an element of uncertainty into your repayment plan.

Fixed Interest Rates

With a fixed interest rate, the percentage applied to your principal loan amount remains unchanged for the life of the loan. This offers borrowers a clear understanding of their monthly payments and total repayment cost. Predictability is a major advantage, simplifying budgeting and financial planning. While the rate might be higher than a variable rate at the outset, the consistency protects against unforeseen increases.

Variable Interest Rates

Variable interest rates are tied to an underlying benchmark index, such as the prime rate or LIBOR (London Interbank Offered Rate). These rates adjust periodically, typically every month or quarter, reflecting changes in the market. This means your monthly payment could increase or decrease depending on the index’s movement. While a variable rate may start lower than a fixed rate, the potential for increases presents a risk to borrowers. Careful consideration of market trends and your risk tolerance is essential before opting for a variable rate loan.

Interest Capitalization

Interest capitalization is the process of adding accumulated unpaid interest to the principal loan balance. This typically occurs when a loan enters deferment or forbearance, periods where payments are temporarily suspended. The capitalized interest increases the principal amount, leading to higher overall interest payments over the loan’s lifetime. Understanding how capitalization works is vital to minimize its impact on your total repayment cost.

Examples of Interest Rate Impact

The following table illustrates how different interest rates and loan amounts influence the total interest paid over the life of a 10-year loan. Note that these are simplified examples and do not include factors like fees or specific repayment plans.

| Loan Type | Interest Rate | Loan Amount | Total Interest Paid (Estimate) |

|---|---|---|---|

| Fixed | 6% | $20,000 | $7,696 |

| Variable (Average 5%) | (Fluctuating, average 5%) | $20,000 | $6,152 |

| Fixed | 8% | $20,000 | $10,840 |

| Fixed | 6% | $30,000 | $11,544 |

Interest Accrual Methods

Understanding how interest accrues on your student loans is crucial for effective repayment planning. Different methods exist, each impacting the total interest paid over the loan’s lifespan. The frequency of interest calculation – daily, monthly, or annually – significantly alters the final amount owed.

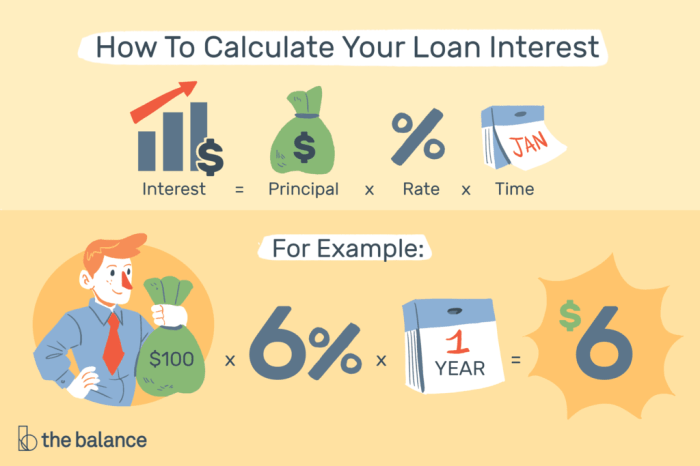

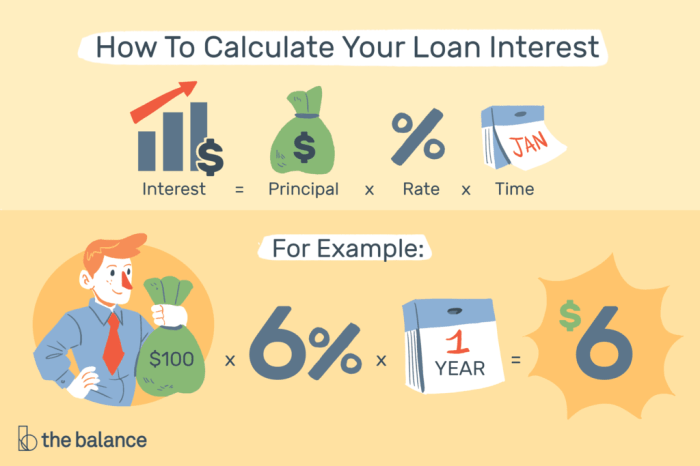

Interest accrual methods refer to how frequently the lender calculates the interest added to your principal loan balance. This calculation is based on your loan’s interest rate and the outstanding principal balance. The more frequently interest is calculated, the faster your debt grows due to the compounding effect.

Daily Interest Accrual

With daily interest accrual, the lender calculates the interest owed each day based on your daily balance. This daily interest is then added to your principal, increasing the amount upon which future interest is calculated. This method leads to the fastest growth in the total interest paid over the loan’s life because interest compounds daily.

Monthly Interest Accrual

Monthly interest accrual involves calculating the interest owed at the end of each month. The monthly interest is added to the principal balance, and the next month’s interest calculation is based on this new, larger amount. While less frequent than daily accrual, this method still results in substantial compounding interest over time.

Annual Interest Accrual

Annual interest accrual is the least frequent method. Interest is calculated only once a year, at the end of the year. The annual interest is then added to the principal, and the next year’s interest is calculated on this increased amount. This method results in the slowest growth of interest compared to daily and monthly accrual.

Comparison of Accrual Methods

The primary difference between these methods lies in the frequency of compounding. Daily accrual leads to the highest total interest paid because interest compounds on a daily basis. Monthly accrual results in less interest than daily accrual but more than annual accrual. Annual accrual results in the lowest total interest paid because interest compounds only once per year. The difference in total interest paid can be significant, especially for larger loans and longer repayment periods.

Daily Interest Accrual Calculation Example

Let’s illustrate daily interest accrual with a $10,000 loan at a 5% annual interest rate over one year.

First, we calculate the daily interest rate: 5% annual rate / 365 days = 0.0137% daily rate (approximately).

Then, we calculate the interest accrued each day and add it to the principal. This process repeats for 365 days. While a precise calculation requires iterative computation, a simplified approximation can be shown:

Day 1: $10,000 * 0.000137 = $1.37 interest; New balance: $10,001.37

Day 2: $10,001.37 * 0.000137 ≈ $1.37 interest; New balance: $10,002.74

…and so on for 365 days.

The total interest paid over the year will be slightly more than $500 due to the daily compounding. A precise calculation using a financial calculator or spreadsheet software would provide the exact amount. Note that this example simplifies the calculation; actual loan interest calculations might involve slightly different methods depending on the lender.

Factors Influencing Interest Accumulation

Several key factors interact to determine the total interest you’ll pay on your student loans. Understanding these factors allows for informed decision-making regarding loan selection and repayment strategies. The primary influences include the loan’s interest rate, the loan principal, the repayment plan selected, and the loan’s capitalization policy.

Several factors significantly influence the total interest accumulated on student loans. These factors interact in complex ways, and understanding their impact is crucial for effective financial planning. A higher interest rate, for instance, directly translates to higher interest payments over the life of the loan. Similarly, a larger loan principal necessitates higher payments, potentially leading to greater interest accrual. The chosen repayment plan also dramatically alters the total interest paid.

Loan Interest Rate

The interest rate is the percentage of your loan’s principal charged as interest each year. This rate is typically fixed or variable, depending on the loan type. A fixed interest rate remains constant throughout the loan’s term, while a variable rate fluctuates based on market conditions. Higher interest rates lead to significantly greater total interest payments over the life of the loan. For example, a 1% increase in the interest rate on a $30,000 loan could add thousands of dollars to the total cost.

Loan Principal

The loan principal is the original amount borrowed. A larger principal amount will naturally accrue more interest over time. This is simply because a larger base amount is subject to the interest rate calculation. Therefore, borrowing less money, if feasible, directly reduces the total interest paid.

Repayment Plan

The repayment plan significantly impacts the total interest paid. Different plans offer varying monthly payment amounts and loan terms. Standard repayment plans typically involve fixed monthly payments over a 10-year period. Graduated repayment plans start with lower monthly payments that gradually increase over time. Income-driven repayment plans (IDR) tie monthly payments to your income and family size, potentially extending the repayment period significantly. The extended repayment period of IDR plans, while lowering monthly payments, generally results in a higher total interest paid due to the longer period of interest accrual.

Impact of Repayment Plans on Total Interest Paid

The following table illustrates the potential difference in total interest paid under different repayment plans for a hypothetical $30,000 loan with a 5% fixed interest rate. These figures are illustrative and actual amounts will vary based on specific loan terms and individual circumstances. It’s crucial to note that these are simplified examples and do not encompass all potential variables affecting repayment.

| Repayment Plan | Loan Term (Years) | Approximate Monthly Payment | Approximate Total Interest Paid |

|---|---|---|---|

| Standard | 10 | $316 | $9,000 |

| Graduated | 10 | Variable (starts lower) | ~$9,000 – $10,000 (Depending on the specific graduation schedule) |

| Income-Driven (Example: 20-year plan) | 20 | Variable (based on income) | ~$18,000 – $20,000 (Significantly higher due to extended repayment period) |

Understanding Loan Amortization

Loan amortization is the process of gradually paying off a loan over time through regular payments. Understanding amortization is crucial for managing student loan debt effectively, as it directly impacts how much interest you pay and the overall cost of your loan. Each payment made towards a loan is divided between interest and principal repayment. Initially, a larger portion goes towards interest, and as you continue to make payments, a larger portion goes towards the principal loan amount.

Loan amortization schedules systematically detail each payment’s breakdown. These schedules are essential for visualizing repayment progress and predicting future payments. They illustrate the diminishing interest portion and the growing principal repayment component over the loan’s lifespan.

Loan Amortization Calculation and Schedule

To illustrate loan amortization, let’s consider a simplified example. Suppose you have a $10,000 student loan with a 5% annual interest rate (0.05/12 = 0.004167 monthly rate) and a 10-year repayment period (120 months). We can use the following formula to calculate the monthly payment (M):

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* P = Principal loan amount ($10,000)

* i = Monthly interest rate (0.004167)

* n = Number of months (120)

Using this formula, the monthly payment is approximately $106.07. Below is a sample amortization schedule for the first three months:

| Month | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|

| 1 | $10,000.00 | $106.07 | $41.67 | $64.40 | $9,935.60 |

| 2 | $9,935.60 | $106.07 | $41.40 | $64.67 | $9,870.93 |

| 3 | $9,870.93 | $106.07 | $41.13 | $64.94 | $9,805.99 |

Note: These calculations are simplified and may not reflect the precise figures used by lenders due to potential variations in calculation methods.

Visual Representation of Amortization

Imagine a bar graph where each bar represents a monthly payment. The bar is divided into two colored sections: one representing the interest paid (initially a larger portion, gradually decreasing), and the other representing the principal paid (initially a smaller portion, gradually increasing). Over time, the interest portion shrinks, while the principal portion grows until the loan is fully repaid. The graph visually demonstrates how the proportion of each payment shifts from predominantly interest to predominantly principal.

In-School Deferment and Forbearance

Navigating the complexities of student loan repayment often involves understanding temporary pauses in repayment, such as in-school deferment and forbearance. These options can provide crucial breathing room while you’re still in school, but it’s vital to understand how they affect your overall loan cost. Both deferment and forbearance temporarily suspend your required monthly payments, but they differ significantly in their impact on interest accumulation.

Understanding the nuances of in-school deferment and forbearance is critical for responsible student loan management. While both offer temporary relief from payments, their effects on interest capitalization and overall loan cost vary considerably. Failing to grasp these differences can lead to unexpectedly higher total loan repayment amounts.

In-School Deferment

In-school deferment is a period where your student loan payments are temporarily suspended while you are enrolled at least half-time in an eligible educational program. During this deferment period, interest may or may not accrue depending on the type of loan. For subsidized federal loans, the government pays the interest while you are in deferment. However, for unsubsidized federal loans and private student loans, interest continues to accrue and is added to your principal balance. This means that your loan balance will increase even though you aren’t making payments.

Forbearance

Forbearance, unlike deferment, is a temporary suspension of loan payments granted due to financial hardship. It’s generally available for both federal and private student loans. Unlike deferment, interest typically accrues on all types of loans during a forbearance period, regardless of whether it is subsidized or unsubsidized. This accumulated interest is usually added to the principal balance at the end of the forbearance period, leading to a larger loan balance that requires higher monthly payments once repayment resumes.

Comparison of In-School Deferment and Forbearance

Understanding the key differences between in-school deferment and forbearance is crucial for minimizing long-term loan costs. The following points highlight the main distinctions and their implications for borrowers.

- Eligibility: In-school deferment is specifically for students enrolled at least half-time in an eligible educational program. Forbearance is granted due to documented financial hardship.

- Interest Accrual: Subsidized federal loans typically do not accrue interest during in-school deferment. Unsubsidized federal loans and private loans accrue interest during both in-school deferment and forbearance.

- Impact on Loan Balance: For unsubsidized loans and private loans, the accumulating interest during deferment and forbearance increases the total loan balance, leading to higher future payments.

- Length of Period: In-school deferment is typically tied to the length of your enrollment. Forbearance periods are typically granted for a specific, limited duration, often requiring renewal.

- Application Process: In-school deferment is often automatic upon enrollment verification. Forbearance usually requires a formal application and documentation of financial hardship.

Wrap-Up

Successfully managing student loan debt requires a thorough understanding of how interest accumulates. By grasping the concepts of interest rates, accrual methods, repayment plans, and the impact of deferment and forbearance, you can develop a strategic approach to repayment. Remember, proactive planning and informed decision-making are key to minimizing your overall interest burden and achieving financial freedom.

Query Resolution

What happens if I don’t make my student loan payments?

Failure to make payments will lead to delinquency, negatively impacting your credit score and potentially resulting in fees, collection actions, and wage garnishment.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing may be an option, depending on your credit score and income. However, be sure to compare offers carefully as refinancing could extend your repayment period.

How does my credit score affect my student loan interest rate?

A higher credit score generally qualifies you for lower interest rates. Lenders consider your creditworthiness when determining the interest rate they offer.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school (under certain conditions), whereas unsubsidized loans accrue interest from the time they’re disbursed.