Navigating the world of student loans can feel overwhelming, especially when understanding how interest rates impact your overall repayment. This seemingly simple concept unfolds into a complex interplay of loan types, repayment plans, and individual financial circumstances. Understanding these intricacies is crucial for responsible borrowing and ultimately, minimizing your long-term financial burden.

From the initial loan disbursement to the final payment, interest accrues, potentially significantly increasing your total debt. This guide will demystify the process, exploring various loan types, interest calculation methods, and strategies to manage your interest payments effectively. We’ll cover everything from fixed versus variable rates to the impact of different repayment plans, empowering you to make informed decisions about your student loan journey.

Types of Student Loans and Interest Rates

Understanding the different types of student loans and their associated interest rates is crucial for effective financial planning during and after your education. The interest rate significantly impacts the total cost of your loan, so careful consideration is essential. This section will break down the key differences between federal and private loans, explore fixed versus variable rates, and provide typical interest rate ranges.

Federal Student Loans

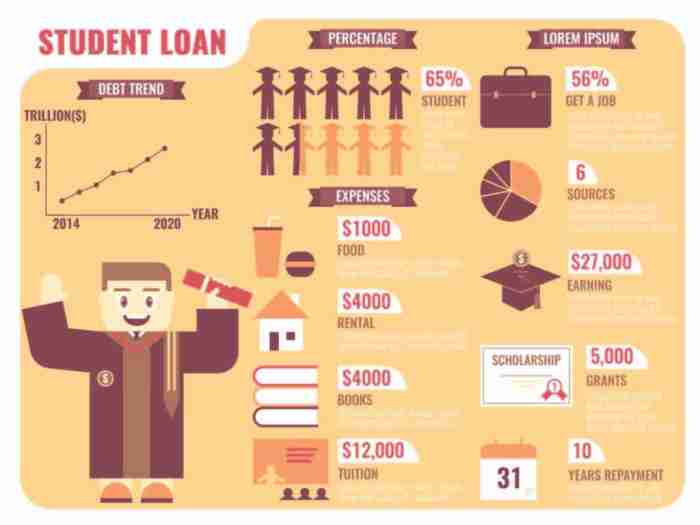

Federal student loans are offered by the U.S. government and generally offer more favorable terms than private loans, including lower interest rates and various repayment options. These loans are typically disbursed directly to the educational institution to cover tuition and other educational expenses. There are several types of federal student loans, each with its own eligibility requirements and interest rate structure. These include subsidized and unsubsidized Stafford Loans, PLUS Loans (for parents and graduate students), and Perkins Loans (a need-based loan program).

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. These loans are often used to supplement federal loans or cover expenses not covered by federal aid. Unlike federal loans, private loans are subject to credit checks and have varying eligibility requirements. Interest rates on private loans tend to be higher than federal loan rates and are often tied to market interest rates. The terms and conditions of private loans can vary significantly between lenders, so it’s crucial to compare offers before selecting a loan.

Fixed Versus Variable Interest Rates

Student loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the life of the loan, making it easier to budget and predict your monthly payments. A variable interest rate fluctuates based on market conditions, which means your monthly payments could change over time. While variable rates may initially be lower than fixed rates, they carry the risk of increasing significantly, potentially leading to higher overall loan costs. The choice between a fixed and variable rate depends on individual risk tolerance and financial circumstances. For example, a borrower with a longer repayment period might be more comfortable with a fixed rate to avoid the uncertainty of fluctuating payments. Conversely, a borrower with a shorter repayment period might opt for a variable rate hoping to benefit from potentially lower initial interest rates.

Student Loan Interest Rate Comparison

The following table summarizes the typical interest rate ranges and grace periods for different types of student loans. Remember that these are typical ranges, and actual rates may vary depending on the lender, creditworthiness, and other factors.

| Loan Type | Interest Rate Type | Typical Interest Rate Range | Grace Period |

|---|---|---|---|

| Federal Subsidized Stafford Loan | Fixed | Variable, check current rates on studentaid.gov | 6 months after graduation or leaving school |

| Federal Unsubsidized Stafford Loan | Fixed | Variable, check current rates on studentaid.gov | 6 months after graduation or leaving school |

| Federal PLUS Loan | Fixed | Variable, check current rates on studentaid.gov | 6 months after graduation or leaving school |

| Private Student Loan | Fixed or Variable | Highly variable, depending on creditworthiness and market conditions. Can range from 5% to 15% or more. | Varies by lender; often 6 months or less. |

How Interest Accrues on Student Loans

Understanding how interest accrues on your student loans is crucial for effective repayment planning. The way interest accumulates differs depending on the loan type and your current life stage – whether you’re in school, during a grace period, or in repayment. This section will clarify the process, including the impact of capitalization.

Interest Accrual on Unsubsidized and Subsidized Loans

Unsubsidized and subsidized loans handle interest differently. With unsubsidized loans, interest accrues from the moment the loan is disbursed, regardless of your enrollment status. This means interest adds to your principal balance even while you’re in school, during a grace period, or in deferment. Subsidized loans, however, do not accrue interest while you are enrolled at least half-time in an eligible degree program. Interest begins to accrue once the grace period ends, or if deferment is not in place. During the grace period (typically six months after graduation or leaving school), and during deferment periods (granted under specific circumstances), interest will still accrue on unsubsidized loans, but not on subsidized loans (unless the deferment is specifically for unsubsidized loans).

Capitalization of Interest

Interest capitalization is the process of adding accumulated interest to your principal loan balance. This increases the amount you owe, leading to higher future interest payments. Capitalization typically occurs at the end of a deferment period or grace period, or if you have missed payments. When interest capitalizes, it becomes part of your new principal balance, upon which future interest will be calculated. This can significantly increase the total cost of your loan over time.

Example of Interest Calculation and Capitalization

Let’s illustrate with an example. Suppose you have a $10,000 unsubsidized loan with a 5% annual interest rate. During a one-year deferment, the interest accrued would be $10,000 * 0.05 = $500. If this interest is capitalized, your new principal balance becomes $10,500. In the following year, the interest calculation would be based on this increased principal, resulting in higher interest charges than if the interest hadn’t been capitalized. For instance, the interest for the second year would be $10,500 * 0.05 = $525. The total interest paid over the two years, including capitalization, is $1025, whereas it would have been only $1000 if the interest hadn’t been capitalized.

Flowchart Illustrating Interest Accrual

The following flowchart visually represents the process of interest accrual on a student loan:

[Imagine a flowchart here. The flowchart would begin with “Loan Disbursement.” This would branch into two paths: “Subsidized Loan” and “Unsubsidized Loan.” The “Unsubsidized Loan” path would show continuous interest accrual, regardless of in-school, grace period, or deferment status. The “Subsidized Loan” path would show no interest accrual during in-school periods (at least half-time enrollment). Both paths would eventually lead to “Repayment Period,” where interest continues to accrue. Finally, both paths would converge at “Capitalization (if applicable),” leading to a new principal balance. The flowchart would clearly indicate the points where interest is calculated and added to the principal.]

Factors Influencing Student Loan Interest Rates

Understanding the factors that determine your student loan interest rate is crucial for managing your debt effectively. The rate you receive significantly impacts the total cost of your education, so it’s important to be aware of the key influences. These factors vary depending on whether you’re borrowing through the federal government or a private lender.

Several interconnected factors influence the interest rate applied to your student loans. These factors are not always weighted equally, and their impact can vary depending on the type of loan and the lender. Creditworthiness plays a particularly significant role for private loans, while for federal loans, factors like loan type and repayment plan are more influential.

Credit History and Credit Score

A strong credit history, reflected in a high credit score, is paramount for securing favorable interest rates, especially on private student loans. Lenders assess your creditworthiness to gauge your ability to repay the loan. A higher credit score indicates a lower risk to the lender, leading to a lower interest rate. Conversely, a poor credit history or low credit score will likely result in higher interest rates or even loan denial. For example, a borrower with an excellent credit score (750 or above) might qualify for a significantly lower interest rate than a borrower with a poor credit score (below 600).

Loan Type

The type of student loan you obtain significantly affects the interest rate. Federal student loans generally offer lower interest rates than private student loans. This is because federal loans are backed by the government, reducing the risk for lenders. Different types of federal loans (e.g., subsidized vs. unsubsidized) also have varying interest rates. Subsidized loans typically have lower rates because the government pays the interest while the student is in school. Private loans, on the other hand, are offered by banks and other financial institutions, and their interest rates are based on market conditions and the borrower’s creditworthiness.

Repayment Plan

While less impactful than credit score and loan type, the chosen repayment plan can slightly influence the total interest paid over the life of the loan. Shorter repayment terms, although resulting in higher monthly payments, lead to less interest accruing over time compared to longer repayment plans. For example, a 10-year repayment plan will generally accrue less interest than a 20-year repayment plan for the same loan amount and interest rate.

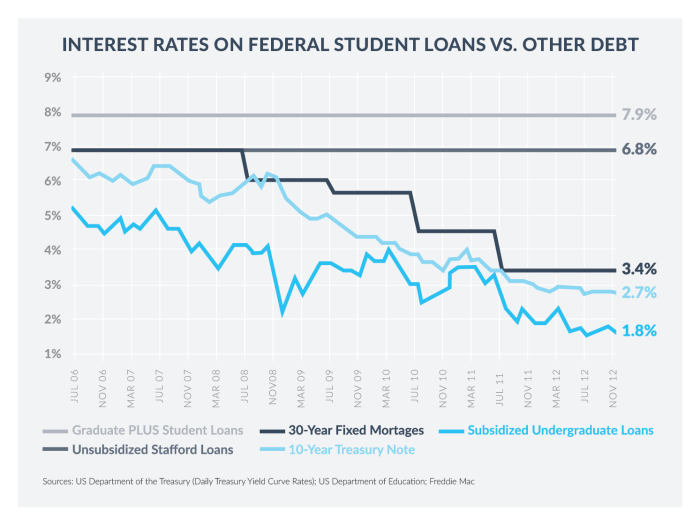

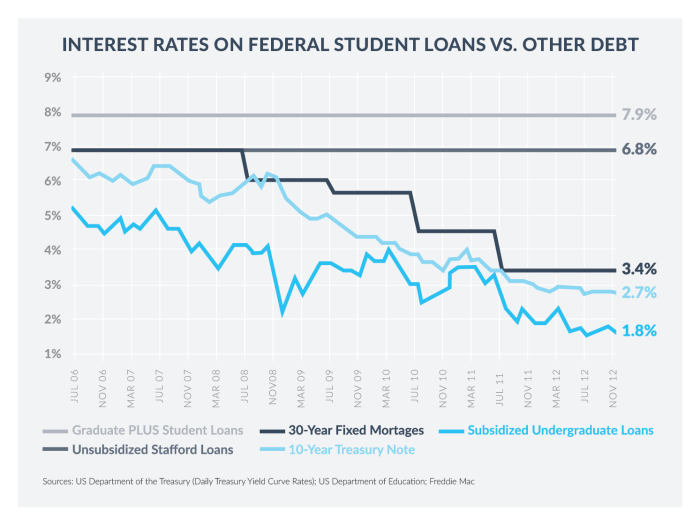

Interest Rate Differences Between Federal and Private Student Loans

Federal student loans usually offer fixed interest rates that are set by the government each year. These rates are generally lower than those offered by private lenders because of the reduced risk associated with government backing. Private student loan interest rates are variable, meaning they can fluctuate based on market conditions and the borrower’s creditworthiness. This variability introduces uncertainty, as the rate can increase or decrease over the loan term. Consequently, private loans tend to have significantly higher interest rates compared to federal loans, especially for borrowers with less-than-perfect credit. A borrower with excellent credit might obtain a relatively low interest rate on a private loan, but this is still typically higher than the rate offered on a comparable federal loan.

Repayment Plans and Interest Rates

Choosing the right student loan repayment plan significantly impacts the total cost of your education. Understanding the various options and their implications is crucial for long-term financial health. Different plans offer varying monthly payment amounts and repayment periods, directly affecting the total interest accrued over the life of the loan.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. Borrowers make fixed monthly payments over a 10-year period. While this plan offers the shortest repayment timeline, resulting in less interest paid overall compared to longer-term plans, the monthly payments can be substantial. This plan is suitable for borrowers with stable incomes and a strong capacity to manage higher monthly payments.

Graduated Repayment Plan

A graduated repayment plan starts with lower monthly payments that gradually increase over time. This option can be appealing to borrowers who anticipate increased income in the future, easing the initial financial burden. However, because the payments are lower initially, you will pay more interest overall than with a standard plan due to the extended repayment period.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) tie your monthly payments to your income and family size. Several types of IDRs exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically result in lower monthly payments, especially during periods of lower income. However, they often extend the repayment period to 20 or 25 years, leading to significantly higher total interest payments over the loan’s lifetime. Forgiveness programs may be available after a certain number of qualifying payments, but this depends on specific plan requirements and eligibility.

Comparison of Repayment Plans

The following table illustrates the potential differences between repayment plans using a hypothetical $30,000 loan with a 5% interest rate. These are simplified examples and actual amounts will vary based on individual loan terms and income.

| Repayment Plan | Approximate Monthly Payment | Approximate Total Interest Paid | Loan Repayment Duration |

|---|---|---|---|

| Standard (10-year) | $317 | $7,000 | 10 years |

| Graduated (10-year) | Starts lower, ends higher | $7,000 – $8,000 (approx.) | 10 years |

| Income-Driven (20-year) | Varies based on income | $15,000 – $20,000 (approx.) | 20 years |

Strategies to Minimize Interest Payments

Minimizing interest payments on student loans is crucial for reducing the overall cost of your education. Strategic planning and consistent effort can significantly lessen the financial burden of loan repayment. Several key strategies can help borrowers achieve this goal, leading to faster debt payoff and substantial savings over the life of the loan.

Making extra payments, refinancing, and understanding your loan terms are essential components of a successful interest reduction strategy. These methods, when applied effectively, can drastically reduce the total interest paid and accelerate the repayment process.

Extra Payments and Their Impact

Making extra payments, even small ones, can substantially reduce the total interest paid over the life of your loan. This is because extra payments directly reduce the principal balance, leading to less interest accruing on the remaining debt. The earlier you start making extra payments, the greater the impact. Consider allocating even a small portion of your monthly budget towards additional payments. For example, an extra $50 per month can make a considerable difference over the long term.

Refinancing Student Loans: Advantages and Disadvantages

Refinancing involves replacing your existing student loans with a new loan from a different lender, typically at a lower interest rate. This can result in lower monthly payments and significantly reduced total interest paid. However, refinancing has potential drawbacks. You may lose benefits associated with federal student loans, such as income-driven repayment plans and loan forgiveness programs. Furthermore, refinancing may extend the repayment period, even if monthly payments are lower, leading to paying interest for a longer time. Carefully weigh the advantages and disadvantages before refinancing.

Example: The Power of Extra Payments

Let’s consider a hypothetical example: Suppose you have a $30,000 student loan with a 7% interest rate and a 10-year repayment term. Your monthly payment would be approximately $346. If you made an extra $100 payment each month, you could pay off the loan in approximately 7 years and 1 month. The total interest paid would be around $7,600. Without the extra payments, you’d pay approximately $11,000 in interest over the 10-year period. This illustrates how even a relatively small extra payment can save thousands of dollars in interest.

Proactive Student Loan Interest Management

Proactive management of student loan interest is key to minimizing long-term costs. The following steps Artikel a practical approach:

- Understand your loan terms: Know your interest rate, repayment terms, and any associated fees.

- Prioritize high-interest loans: Focus extra payments on loans with the highest interest rates to maximize savings.

- Explore refinancing options: Research different lenders and compare interest rates to see if refinancing is beneficial.

- Budget effectively: Allocate a portion of your income towards extra student loan payments.

- Automate payments: Set up automatic payments to ensure consistent and timely payments.

- Consider income-driven repayment plans: If eligible, explore federal income-driven repayment plans to lower monthly payments, though this may extend the repayment period and increase total interest paid.

Understanding the Loan Amortization Schedule

A loan amortization schedule is a detailed table outlining the repayment plan for a loan, showing the breakdown of each payment over the loan’s lifespan. It’s a crucial tool for borrowers to understand their repayment process and the total cost of borrowing, including the interest paid. This schedule provides a clear picture of how much of each payment goes towards principal (the original loan amount) and how much goes towards interest.

Understanding how an amortization schedule is constructed and interpreting its information empowers borrowers to make informed financial decisions and effectively manage their debt.

Amortization Schedule Construction and Example

An amortization schedule is built using a formula that calculates the periodic payment amount based on the loan amount, interest rate, and loan term. Let’s illustrate with a simplified example. Suppose you have a $10,000 student loan with a 5% annual interest rate (0.05/12 monthly rate) and a 5-year repayment term (60 months).

We’ll use a simplified calculation for demonstration. A more precise calculation would involve more complex formulas, often used in loan calculators or spreadsheet software. The basic principle remains the same. For each month, the interest accrued is calculated on the remaining principal balance. This interest is added to the principal, and the total is divided by the number of remaining payments to determine the monthly payment amount. This process is repeated for each month until the loan is fully repaid.

Let’s assume a simplified monthly payment of approximately $189 (this is a simplified example and not a precise calculation).

| Month | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|

| 1 | $10,000.00 | $189.00 | $41.67 | $147.33 | $9,852.67 |

| 2 | $9,852.67 | $189.00 | $41.05 | $147.95 | $9,704.72 |

| 3 | $9,704.72 | $189.00 | $40.44 | $148.56 | $9,556.16 |

| … | … | … | … | … | … |

| 60 | $0.00 | $189.00 | $0.00 | $189.00 | $0.00 |

Amortization Schedule Interpretation and Benefits

The amortization schedule provides a clear picture of the loan repayment journey. Each column in the schedule holds significant information:

* Month: Represents the month of the repayment.

* Beginning Balance: The outstanding loan amount at the start of the month.

* Payment: The fixed monthly payment amount.

* Interest: The portion of the payment that goes towards interest. Note that this decreases over time as the principal balance reduces.

* Principal: The portion of the payment that goes towards reducing the principal loan amount. Note that this increases over time.

* Ending Balance: The remaining loan amount at the end of the month.

By reviewing the schedule, borrowers can easily track their progress, see how much interest they’re paying over time, and plan their finances accordingly. The total interest paid over the life of the loan is readily apparent, allowing for a comprehensive understanding of the overall loan cost. This transparency helps in budgeting and financial planning.

Final Review

Successfully managing student loan debt requires a proactive and informed approach. By understanding how interest rates function, choosing the right repayment plan, and implementing effective strategies to minimize interest payments, you can significantly reduce your long-term financial obligations. Remember, careful planning and a clear understanding of your loan terms are essential for navigating this crucial financial aspect of your education and future.

FAQ Resource

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or in deferment. Unsubsidized loans accrue interest during all these periods.

Can I pay off my student loans faster than the scheduled repayment period?

Yes, making extra payments can significantly reduce the total interest paid and shorten the loan’s lifespan. Contact your loan servicer to confirm the process.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, with serious financial consequences.

What is loan consolidation?

Loan consolidation combines multiple student loans into a single loan, potentially simplifying repayment but may not always lower your interest rate.

How can I find my student loan interest rate?

Your interest rate is typically stated in your loan documents or accessible through your loan servicer’s online portal.