Navigating the world of student loan interest can feel overwhelming, but understanding how it works is crucial for responsible financial planning. From fixed versus variable rates to the impact of capitalization and repayment plans, the intricacies of student loan interest significantly affect the total cost of your education. This guide will demystify the process, providing a clear understanding of how interest accrues, the factors influencing rates, and strategies to manage and minimize your overall debt.

This exploration will cover various aspects, including the different types of student loan interest, how interest accrues over time, factors affecting interest rates, and the impact of various repayment plans. We’ll delve into practical examples and provide actionable strategies to help you manage your student loan debt effectively.

Types of Student Loan Interest

Understanding the different types of interest applied to your student loans is crucial for effective financial planning. The interest rate significantly impacts the total amount you’ll repay, so it’s important to know the distinctions between fixed and variable rates, and how interest capitalization affects your overall debt.

Fixed Versus Variable Interest Rates

Student loans typically come with either a fixed or a variable interest rate. A fixed interest rate remains constant throughout the loan’s repayment period. This provides predictability and allows borrowers to accurately budget for their monthly payments. In contrast, a variable interest rate fluctuates based on an underlying benchmark index, such as the prime rate or LIBOR (although LIBOR is being phased out). This means your monthly payment could increase or decrease over time, depending on market conditions. While a variable rate might start lower than a fixed rate, it carries the risk of significantly higher payments if the benchmark index rises.

Interest Capitalization

Interest capitalization occurs when accrued but unpaid interest is added to the principal loan balance. This effectively increases the amount of your loan. For example, if you have a subsidized loan where interest is not accruing while you’re in school, once you leave school, the accumulated interest will be capitalized. This means you’ll be paying interest on the interest that accrued during your studies. The impact of capitalization is compounded over time, leading to a higher total repayment amount. Loans with longer grace periods before repayment begins will have more significant capitalization effects.

Examples of Interest Rate Impact on Loan Cost

The following table illustrates how different interest rates and loan terms affect the total interest paid over the life of a loan. These are simplified examples and do not account for potential fees or other loan-specific factors.

| Loan Amount | Interest Rate | Loan Term (Years) | Total Interest Paid |

|---|---|---|---|

| $20,000 | 5% Fixed | 10 | $6,158 |

| $20,000 | 7% Fixed | 10 | $8,910 |

| $20,000 | 5% Fixed | 15 | $9,578 |

| $20,000 | 7% Variable (assuming average rate of 7% over 10 years) | 10 | Approximately $8,910 (Note: Actual amount will vary based on rate fluctuations) |

Interest Accrual and Payment

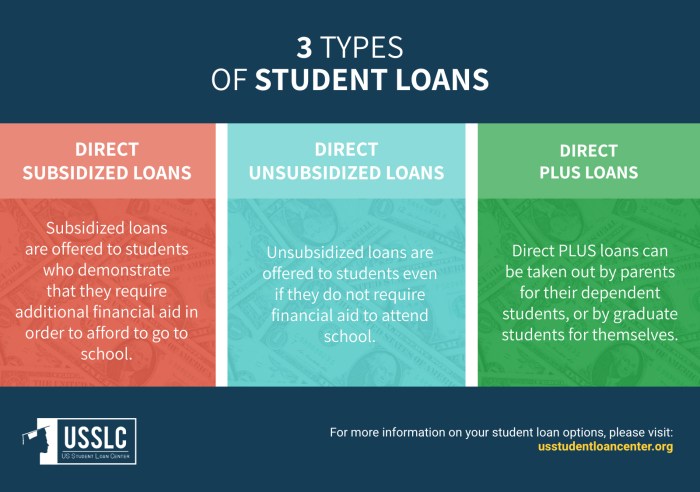

Understanding how interest accrues and how payments are applied is crucial for managing your student loan debt effectively. This section will clarify the differences between subsidized and unsubsidized loans and explain the mechanics of interest-only versus principal and interest payments. We will also provide a step-by-step guide to calculating your monthly interest payment.

Interest accrual on federal student loans depends on whether the loan is subsidized or unsubsidized. Unsubsidized loans accrue interest from the moment the loan is disbursed, regardless of your enrollment status. This means interest is added to your principal balance daily, even while you are in school, and this accumulating interest increases your overall loan balance. Subsidized loans, on the other hand, do not accrue interest while you are enrolled at least half-time in school, during a grace period, or while you are in deferment. Once these periods end, interest begins to accrue.

Interest Accrual on Subsidized and Unsubsidized Loans

Unsubsidized loans begin accruing interest immediately upon disbursement. This means the borrower is responsible for all accrued interest. For example, if a student receives a $10,000 unsubsidized loan with a 5% annual interest rate, they will owe interest on that $10,000 even before they make their first payment. In contrast, subsidized loans only begin accruing interest after the grace period ends or if the borrower is no longer enrolled at least half-time. The government pays the interest on subsidized loans while the borrower is in school and meets eligibility requirements. This means the principal balance does not increase during these periods.

Interest-Only Payments versus Principal and Interest Payments

An interest-only payment covers only the interest that has accrued on the loan. This prevents the loan balance from growing, but it doesn’t reduce the principal amount. A principal and interest payment covers both the accrued interest and a portion of the principal loan amount. This payment strategy reduces the principal balance over time, leading to a faster repayment and ultimately lower overall interest costs. Choosing between these payment methods depends on individual financial circumstances and loan repayment plans. For instance, during periods of financial hardship, an interest-only payment may be more manageable, preventing the loan from growing further while the borrower works to improve their financial situation. However, in the long run, principal and interest payments are more efficient for debt reduction.

Calculating Monthly Interest Payment

Calculating your monthly interest payment requires understanding the following factors: the principal loan amount (P), the annual interest rate (r), and the number of payment periods per year (n). Here’s a step-by-step guide:

- Convert the annual interest rate to a monthly rate: Divide the annual interest rate by 12. For example, a 5% annual interest rate becomes 0.05/12 = 0.004167 monthly rate.

- Determine the number of monthly payments: This depends on your loan’s repayment term. A 10-year loan has 120 monthly payments (10 years * 12 months/year).

- Calculate the monthly interest payment using the following formula:

Monthly Interest Payment = P * r

Where:

- P = Principal loan amount

- r = Monthly interest rate

- Example: Let’s say you have a $10,000 loan with a 5% annual interest rate. The monthly interest rate is 0.004167 (0.05/12). The monthly interest payment for the first month would be $10,000 * 0.004167 = $41.67.

Note: This calculation only provides the interest portion of the payment. The total monthly payment on a standard amortization plan will include both interest and principal. Many online loan calculators can provide a more comprehensive calculation, factoring in the loan term and amortization schedule.

Factors Affecting Interest Rates

Several key factors influence the interest rate you’ll receive on your student loans. Understanding these factors can help you make informed borrowing decisions and potentially secure a more favorable interest rate. Lenders assess your creditworthiness and the loan’s characteristics to determine the risk involved in lending you money. Higher risk translates to higher interest rates, and vice-versa.

Lenders use a variety of factors to assess the risk associated with lending to a student. These factors contribute to the overall interest rate offered.

Credit History and Score

Your credit history plays a significant role in determining your interest rate. A strong credit history, reflected in a high credit score, indicates a lower risk to the lender. Conversely, a poor credit history or low credit score suggests a higher risk, resulting in a higher interest rate. Lenders use credit scores (like FICO scores) and your credit report to assess your creditworthiness. Factors considered within your credit report include payment history, amounts owed, length of credit history, new credit, and credit mix. A longer history of responsible credit management generally leads to lower rates.

Loan Type: Federal vs. Private

Federal student loans generally offer fixed interest rates that are set by the government and are usually lower than those offered by private lenders. These rates are often influenced by broader economic factors like prevailing interest rates. Private student loans, on the other hand, are offered by banks and other financial institutions, and their interest rates are typically variable and determined by the borrower’s creditworthiness and other factors. Private loan interest rates can fluctuate with market conditions and are usually higher than federal loan rates for borrowers with less-than-stellar credit.

Loan Term

The length of your loan term, or repayment period, also affects your interest rate. Longer loan terms generally result in lower monthly payments, but you’ll pay more interest overall because the loan accrues interest over a longer period. Shorter loan terms mean higher monthly payments but less interest paid over the life of the loan. This is because you’re paying down the principal faster, reducing the amount of time interest is accruing.

Hypothetical Scenario: Credit Score and Loan Term Influence

Let’s consider two hypothetical borrowers applying for a $10,000 student loan:

- Borrower A: Excellent credit score (750+), chooses a 10-year loan term. They are likely to receive a lower interest rate, perhaps around 5%, resulting in lower overall interest payments over the life of the loan.

- Borrower B: Fair credit score (650), chooses a 15-year loan term. They are likely to receive a higher interest rate, perhaps around 8%, leading to significantly higher total interest payments due to the longer repayment period and higher interest rate.

This scenario highlights how credit score and loan term interact to significantly impact the overall cost of the loan. Borrower A benefits from a strong credit history and a shorter loan term, resulting in substantial savings on interest. Borrower B, on the other hand, faces a higher cost due to a lower credit score and a longer repayment period. It’s important to note that these are hypothetical examples; actual rates vary depending on the lender and prevailing market conditions.

Repayment Plans and Interest

Choosing a student loan repayment plan significantly impacts the total interest you’ll pay over the life of the loan. Understanding the differences between various plans is crucial for minimizing long-term costs. This section explores how different repayment options affect your monthly payments, loan term, and overall interest burden.

Repayment Plan Comparison

The total interest paid on a student loan is directly influenced by the chosen repayment plan. Longer repayment terms generally result in higher total interest costs, while shorter terms lead to higher monthly payments but lower overall interest. Income-driven repayment plans offer lower monthly payments based on income but often extend the repayment period, potentially increasing total interest. The following table illustrates this concept using hypothetical examples. Note that actual figures vary greatly based on loan amount, interest rate, and individual circumstances.

| Repayment Plan | Monthly Payment | Loan Term (Years) | Total Interest Paid |

|---|---|---|---|

| Standard Repayment | $500 | 10 | $6,000 |

| Extended Repayment | $300 | 20 | $18,000 |

| Income-Driven Repayment (Example) | $250 | 25 | $25,000 |

Long-Term Effects of Extended Repayment Plans

Choosing a longer repayment plan, such as an extended or income-driven plan, significantly impacts the total interest paid over the life of the loan. While reducing monthly payments provides immediate financial relief, it often leads to a substantially higher overall interest cost.

Imagine a graph illustrating this concept. The x-axis represents the repayment period (in years), and the y-axis represents the total interest paid (in dollars). Three lines would be plotted, one for each repayment plan (Standard, Extended, Income-Driven). The Standard repayment plan line would show a relatively steep initial incline, then flatten out as the loan is paid off quickly. The Extended repayment plan line would have a gentler incline, extending far to the right, showcasing a much higher total interest paid due to the longer repayment period. The Income-Driven repayment plan line would be the most gradual, extending the furthest along the x-axis and ultimately resulting in the highest total interest paid. This visual representation clearly demonstrates the trade-off between lower monthly payments and increased total interest over time. For example, a $30,000 loan at 6% interest with a standard 10-year repayment plan would result in approximately $6,000 in interest, while the same loan on a 20-year extended plan could accrue over $18,000 in interest. The difference is substantial and highlights the importance of carefully considering the long-term financial implications of each repayment option.

Managing Interest and Reducing Costs

Minimizing the interest paid on student loans is crucial for long-term financial health. Strategic planning and proactive actions can significantly reduce the total repayment amount and free up funds for other financial goals. This section explores effective strategies for managing interest and lowering overall loan costs.

Strategies for minimizing interest involve a multifaceted approach encompassing proactive repayment strategies, careful consideration of refinancing options, and understanding the impact of extra principal payments.

Refinancing Student Loans to Lower Interest Rates

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can be particularly beneficial if interest rates have fallen since you initially took out your loans, or if you’ve improved your credit score. For example, a borrower with a $50,000 loan at 7% interest might refinance to a 4% interest rate, significantly reducing their monthly payments and total interest paid over the loan’s life. However, it’s crucial to carefully compare offers from multiple lenders and consider any associated fees before refinancing. Some lenders may offer attractive initial rates that increase over time, or they may impose prepayment penalties. A thorough review of the terms and conditions is essential.

The Impact of Extra Principal Payments

Making extra payments towards your student loan principal can dramatically accelerate your repayment timeline and reduce the total interest paid. Even small, consistent extra payments can have a substantial impact over time. For instance, an extra $100 per month on a $30,000 loan could save thousands of dollars in interest and shorten the repayment period by several years. The effect is most pronounced early in the loan repayment period, as the extra payment reduces the principal balance more quickly, leading to lower interest accrual in subsequent months. It is important to note that while this strategy is highly effective, it requires careful budgeting and financial discipline.

Additional Strategies for Interest Reduction

Beyond refinancing and extra payments, borrowers can explore several other strategies to manage interest costs. Maintaining a good credit score can improve eligibility for lower interest rates on future loans or refinancing options. Careful budgeting and disciplined saving can enable faster repayment and reduce the total interest paid. Understanding your loan terms and payment options is essential, allowing for informed decisions that align with your financial goals. Finally, exploring government-sponsored programs and loan forgiveness options, if eligible, can further reduce your overall repayment burden.

Summary

Successfully managing student loan interest requires a proactive approach. By understanding the different types of interest rates, how interest accrues, and the various repayment options available, you can make informed decisions that minimize your long-term costs. Remember to explore strategies like refinancing and making extra payments to potentially save money and accelerate your repayment journey. Taking control of your student loan interest is a crucial step towards achieving long-term financial stability.

Frequently Asked Questions

What happens if I don’t make my student loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in collection actions, wage garnishment, or tax refund offset.

Can I deduct student loan interest from my taxes?

You may be able to deduct the interest you paid on student loans, but eligibility depends on your modified adjusted gross income (MAGI) and other factors. Consult the IRS guidelines or a tax professional for details.

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school (under certain conditions), while unsubsidized loans accrue interest regardless of your enrollment status.

How often is my student loan interest calculated?

Interest is typically calculated daily on most student loans and added to your principal balance periodically (monthly or quarterly).