Navigating the complexities of student loan debt can feel overwhelming, but refinancing offers a potential pathway to more manageable payments and lower overall costs. Understanding how student loan refinancing works is crucial for borrowers seeking to optimize their repayment strategy and potentially save thousands of dollars over the life of their loan. This guide explores the process, benefits, and risks involved, empowering you to make informed decisions about your financial future.

Refinancing your student loans involves replacing your existing federal or private student loans with a new loan from a private lender. This new loan typically comes with a different interest rate, loan term, and repayment schedule. The process involves applying with a lender, undergoing a credit check, and negotiating the terms of your new loan. Careful consideration of factors such as interest rates, fees, and eligibility requirements is crucial to ensure refinancing aligns with your financial goals.

Understanding Student Loan Refinancing

Refinancing your student loans can be a strategic move to potentially lower your monthly payments and save money over the life of your loan. It involves replacing your existing student loan(s) with a new loan from a different lender, often at a more favorable interest rate. This process can simplify your repayment by consolidating multiple loans into a single, manageable payment.

The process of refinancing a student loan begins with comparing offers from different lenders. Each lender will assess your creditworthiness, income, and debt-to-income ratio to determine the interest rate and terms they can offer. Once you’ve selected a lender and loan terms, you’ll submit an application, providing necessary documentation such as proof of income and your existing loan details. After approval, the lender will pay off your existing loans, and you’ll begin making payments on your new refinanced loan. The entire process can take several weeks, depending on the lender and your individual circumstances.

Types of Student Loans That Can Be Refinanced

Several types of federal and private student loans are eligible for refinancing. Federal student loans, such as Direct Subsidized and Unsubsidized Loans, and Federal PLUS Loans, can be refinanced, but this will result in the loss of federal protections such as income-driven repayment plans and loan forgiveness programs. Private student loans, issued by banks and credit unions, are also commonly refinanced. It’s crucial to understand the implications of refinancing federal loans before proceeding, as you’ll forfeit certain benefits. Eligibility criteria vary by lender, but generally include a good credit score and a stable income.

Step-by-Step Guide to Applying for Student Loan Refinancing

- Check Your Credit Score: A higher credit score typically leads to better interest rates. Review your credit report for accuracy and address any issues.

- Compare Lenders and Rates: Research different lenders and compare their interest rates, fees, and repayment terms. Use online comparison tools to streamline this process.

- Gather Necessary Documents: This typically includes proof of income, your student loan details (loan amounts, interest rates, and lenders), and your Social Security number.

- Complete the Application: Submit your application online or via mail, providing all required information accurately and completely.

- Review and Sign Loan Documents: Carefully review all loan documents before signing to ensure you understand the terms and conditions.

- Monitor Loan Disbursement: Track the progress of your loan disbursement and ensure your existing loans are paid off by the new lender.

Situations Where Refinancing Is Beneficial

Refinancing can be advantageous in several scenarios. For example, if you have a high interest rate on your existing student loans, refinancing to a lower rate can significantly reduce your overall interest payments. Consolidating multiple loans into one simplifies repayment and provides a clearer picture of your debt. Furthermore, extending your loan term might lower your monthly payment, though it will increase the total interest paid over the life of the loan. A borrower with improved credit since taking out their original loans may also qualify for a lower interest rate upon refinancing.

Pros and Cons of Refinancing Student Loans

| Feature | Pros | Cons |

|---|---|---|

| Interest Rate | Potentially lower interest rate, leading to lower monthly payments and reduced total interest paid. | Higher interest rate possible if credit score has worsened since initial loan disbursement. |

| Monthly Payment | Lower monthly payments possible through loan term extension or lower interest rate. | Higher monthly payments possible if a shorter loan term is chosen, or if the interest rate offered is higher. |

| Loan Term | Flexibility to choose a longer or shorter loan term to suit your budget. | Longer loan terms result in higher total interest paid, while shorter terms may lead to higher monthly payments. |

| Consolidation | Simplifies repayment by consolidating multiple loans into one. | Loss of federal benefits like income-driven repayment plans and potential loan forgiveness programs if refinancing federal loans. |

Eligibility Criteria for Refinancing

Successfully refinancing your student loans hinges on meeting specific eligibility requirements set by lenders. These criteria vary between lenders, but generally revolve around your creditworthiness, income stability, and the type of loans you wish to refinance. Understanding these requirements is crucial for a smooth and successful refinancing process.

Lenders assess several key factors to determine your eligibility. A strong credit history is paramount, as it demonstrates your ability to manage debt responsibly. Similarly, a consistent and sufficient income stream assures lenders of your capacity to make timely payments on the refinanced loan. The types of loans you hold also play a role; some lenders may only refinance federal loans, while others may accept private loans or a combination of both. Finally, the loan amount you seek to refinance and the loan term you desire will also influence lender decisions.

Credit Score and Income Requirements

Credit scores serve as a primary indicator of creditworthiness. Most lenders prefer applicants with credit scores above 670, although some may accept applicants with slightly lower scores, potentially with a higher interest rate. The required minimum credit score varies depending on the lender and the specific loan terms. Simultaneously, lenders assess your income to ensure you have the financial capacity to repay the refinanced loan. Income requirements typically involve demonstrating a stable income history, often requiring several months or years of consistent employment. The specific income requirements depend on the loan amount and the lender’s risk assessment. For example, a lender might require a minimum annual income of $40,000 for a $50,000 loan, while another might require $60,000 for the same loan amount, reflecting their individual risk tolerance and lending policies.

The Role of Co-signers

A co-signer can significantly improve your chances of approval, particularly if you have a lower credit score or limited income history. A co-signer essentially acts as a guarantor, agreeing to make payments if you default. This reduces the lender’s risk, making approval more likely. However, choosing a co-signer is a significant decision, as they assume considerable financial responsibility. The co-signer must meet the lender’s eligibility criteria, which often include a strong credit score and stable income.

Comparison of Eligibility Criteria Across Lenders

Eligibility criteria differ substantially across various lenders. Some lenders may be more lenient with credit score requirements, while others may prioritize income stability. Some may specialize in refinancing federal loans, while others focus on private loans. For example, Lender A might require a minimum credit score of 660 and a debt-to-income ratio below 40%, while Lender B might demand a 680 credit score and a debt-to-income ratio below 35%. It’s crucial to compare the eligibility criteria of multiple lenders before applying to find the best fit for your financial situation.

Reasons for Loan Refinancing Application Denial

Understanding common reasons for denial can help you prepare a stronger application.

Several factors often lead to loan refinancing application rejection. It is essential to address these proactively to increase your chances of approval.

- Low credit score: A credit score below the lender’s minimum requirement is a frequent cause for denial.

- Insufficient income: Lack of demonstrable income or an income insufficient to support the loan repayment is another common reason.

- High debt-to-income ratio: A high ratio of debt to income indicates a high level of financial strain, making lenders hesitant to approve the application.

- Negative credit history: Serious credit issues such as bankruptcies, foreclosures, or late payments can significantly impact eligibility.

- Incomplete application: Missing information or inaccurate details in the application can lead to rejection.

- Type of loans: Some lenders may not refinance certain types of student loans.

Interest Rates and Loan Terms

Refinancing your student loans offers the potential to lower your monthly payments and save money over the life of the loan. However, understanding the interest rates and loan terms involved is crucial for making an informed decision. This section will detail how these factors influence your refinancing experience.

Interest rates on refinanced student loans are determined by several factors, primarily your creditworthiness. Lenders assess your credit score, debt-to-income ratio, and income stability to gauge your risk. A higher credit score generally translates to a lower interest rate, as lenders perceive you as a less risky borrower. Other factors such as the type of loan (e.g., federal vs. private), loan amount, and the prevailing market interest rates also play a role. The lender’s own pricing models and profit margins will also impact the final interest rate offered.

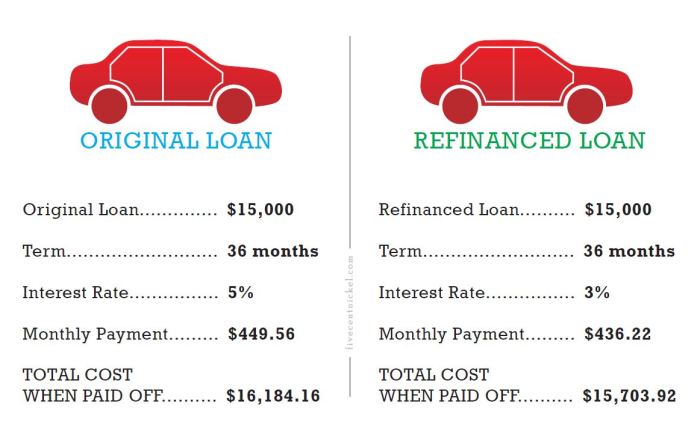

Interest Rate Scenarios and Repayment Impact

Let’s consider two scenarios to illustrate the impact of interest rates on repayment. Suppose you have a $50,000 loan. In Scenario A, you secure a refinancing loan with a 6% fixed interest rate over a 10-year term. In Scenario B, you get a 8% fixed interest rate over the same 10-year term. While the principal is the same, the higher interest rate in Scenario B will result in significantly higher total interest paid over the life of the loan and higher monthly payments. The difference can amount to thousands of dollars. For instance, in Scenario A, your monthly payment would be approximately $550, whereas in Scenario B, it would be around $600, with a substantial difference in total interest paid.

Fixed versus Variable Interest Rates

Refinanced student loans can come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan term, providing predictability in your monthly payments. A variable interest rate, however, fluctuates based on market conditions. While a variable rate might start lower than a fixed rate, it could increase over time, potentially leading to higher monthly payments. The choice between fixed and variable depends on your risk tolerance and financial outlook. Those seeking stability often prefer fixed rates, while others willing to accept some risk might opt for a potentially lower starting rate with a variable option.

Loan Term Options

Refinancing allows you to choose a loan term that aligns with your financial capabilities. Common loan terms range from 5 to 15 years. Shorter terms lead to higher monthly payments but less total interest paid over the loan’s lifetime. Conversely, longer terms result in lower monthly payments but higher overall interest costs. The optimal loan term involves balancing affordability with minimizing long-term interest expenses.

Loan Term and Monthly Payment Comparison

The following table illustrates how different loan terms and interest rates impact monthly payments on a $50,000 loan. These are illustrative examples, and actual payments may vary based on the lender and individual circumstances.

| Loan Term (Years) | Interest Rate (Fixed) | Approximate Monthly Payment | Total Interest Paid (Approximate) |

|---|---|---|---|

| 5 | 7% | $980 | $9,800 |

| 10 | 7% | $580 | $19,600 |

| 15 | 7% | $440 | $29,400 |

| 10 | 9% | $640 | $24,000 |

Choosing a Lender

Selecting the right lender for your student loan refinancing is crucial, as it directly impacts your interest rate, repayment terms, and overall borrowing experience. A thorough comparison of lenders is essential to securing the best possible deal. This involves understanding their offerings, evaluating their reliability, and negotiating favorable terms.

Comparing Lender Features

Different lenders offer varying features, including interest rates, repayment options (fixed vs. variable), fees, and customer service levels. Some lenders may specialize in refinancing specific types of student loans, such as federal or private loans, or cater to borrowers with particular credit profiles. For example, one lender might offer a lower interest rate for borrowers with excellent credit scores, while another might prioritize flexible repayment plans. Comparing these features side-by-side allows you to identify the lender that best aligns with your individual financial situation and needs.

Key Factors in Lender Selection

Several key factors should guide your lender selection. Interest rates are paramount; a lower rate translates to significant savings over the life of the loan. However, it’s crucial to consider all associated fees, including origination fees, prepayment penalties, and late payment fees. The quality of customer service is also vital; readily available and responsive customer support can be invaluable if you encounter any issues during the refinancing process. Finally, the lender’s reputation and financial stability should be thoroughly investigated. A lender with a history of excellent customer service and sound financial practices minimizes the risk of future problems.

Reviewing Lender Reviews and Ratings

Before committing to a lender, thoroughly review their online reviews and ratings from independent sources. Websites like the Better Business Bureau (BBB) and Trustpilot provide valuable insights into a lender’s customer service, transparency, and overall performance. Negative reviews can highlight potential red flags, such as difficulties in contacting customer service or unexpected fees. Positive reviews, on the other hand, can indicate a positive borrowing experience. Remember to consider both the quantity and quality of reviews, paying attention to recurring themes and patterns.

Negotiating Better Terms

While many lenders offer fixed terms, some flexibility might be possible. If you have a strong credit score and a stable income, you might be able to negotiate a lower interest rate or more favorable repayment terms. This typically involves presenting your financial strength and comparing offers from multiple lenders to demonstrate your bargaining power. Be prepared to walk away if the lender isn’t willing to meet your needs. This shows you’re a serious borrower who values a good deal.

Lender Evaluation Checklist

To streamline the lender selection process, utilize a checklist to ensure you consider all critical aspects. This checklist should include:

- Interest rate offered (fixed vs. variable)

- All associated fees (origination, prepayment, late payment)

- Repayment options and terms (length of loan, monthly payments)

- Customer service reputation (reviews and ratings)

- Lender’s financial stability and accreditation

- Loan eligibility requirements

- Transparency of terms and conditions

The Refinancing Application Process

Refinancing your student loans can significantly impact your monthly payments and overall loan cost. The application process itself, however, requires careful attention to detail and accurate information. A well-prepared application will streamline the process and increase your chances of approval. Conversely, errors or omissions can lead to delays or even rejection.

The refinancing application process typically involves several key steps. Understanding these steps and preparing the necessary documentation beforehand will make the process much smoother.

Required Documentation

Lenders require specific documentation to verify your income, creditworthiness, and the details of your existing student loans. Providing complete and accurate documentation is crucial for a timely and successful application. Missing or inaccurate documents will likely delay the process and may lead to rejection.

- Proof of Identity: This usually includes a government-issued ID, such as a driver’s license or passport.

- Income Verification: Lenders will typically request pay stubs, tax returns (W-2s or 1040s), or bank statements to verify your income.

- Student Loan Details: You’ll need to provide information about your existing student loans, including the lender, loan amounts, interest rates, and account numbers. This often involves providing loan statements or accessing your loan information online through the National Student Loan Data System (NSLDS).

- Credit Report: Most lenders will pull your credit report to assess your creditworthiness. While you don’t typically need to provide this directly, maintaining a good credit score is essential for approval.

- Co-signer Information (if applicable): If you’re using a co-signer, they will need to provide similar documentation as you, including proof of identity and income verification.

Application Completion Steps

Accuracy is paramount throughout the application process. Inaccuracies can lead to delays, requests for additional information, or even application rejection. Double-checking all information before submission is highly recommended.

- Complete the Online Application: Most lenders offer online applications. Carefully fill out all required fields with accurate information. Pay close attention to details such as your Social Security number, address, and employment history.

- Upload Required Documents: Gather all necessary documentation as Artikeld above and upload them securely through the lender’s online portal. Ensure the documents are clear, legible, and in the requested format.

- Review and Submit: Before submitting your application, thoroughly review all the information you’ve provided to ensure accuracy. Any errors at this stage can cause significant delays.

- Monitor Your Application Status: After submitting your application, keep an eye on its status through the lender’s online portal or by contacting customer service. This will help you stay informed about the progress of your application.

Impact of Application Errors

Errors on your application can significantly impact the processing time and even the outcome of your refinancing request. Minor errors might result in delays while more significant inaccuracies could lead to a rejection. For example, providing an incorrect Social Security number or income information could result in your application being flagged for review, potentially delaying the approval process. More serious errors, such as providing falsified information, could lead to a complete rejection of your application.

Potential Risks and Benefits

Refinancing student loans can offer significant advantages, but it’s crucial to carefully weigh the potential benefits against the inherent risks. Understanding these aspects is vital for making an informed decision that aligns with your individual financial circumstances and long-term goals. A thorough assessment will help determine if refinancing is the right choice for you.

Refinancing involves replacing your existing student loans with a new loan from a private lender. This often comes with the allure of lower interest rates and potentially simplified repayment plans. However, this transition also carries potential drawbacks that could negatively impact your financial health if not properly considered.

Loss of Federal Protections

Federal student loans offer several crucial protections, including income-driven repayment plans, deferment options during financial hardship, and loan forgiveness programs (depending on your loan type and employment). Refinancing your federal loans with a private lender typically forfeits these benefits. This means you lose the safety net provided by the government in case of unforeseen circumstances, such as job loss or medical emergencies. For example, if you refinance your federal student loans and then experience unexpected unemployment, you may not be eligible for the same deferment or forbearance options you would have had with your original federal loans. This could lead to delinquency and negatively affect your credit score.

Scenarios Where Refinancing Could Be Detrimental

Several situations highlight the potential downsides of refinancing. For instance, individuals with high debt loads and unstable income might find themselves struggling to manage payments under a refinanced loan with a shorter repayment term, even if the interest rate is lower. Similarly, borrowers who anticipate needing income-driven repayment plans or loan forgiveness programs in the future should carefully consider the implications of losing these federal protections before refinancing. Someone pursuing a career in public service, for example, might forfeit the potential for Public Service Loan Forgiveness (PSLF) by refinancing their federal loans.

Benefits of Refinancing

The primary benefit of refinancing is often a lower interest rate. This translates to significant savings over the life of the loan. A lower interest rate can reduce your monthly payment, freeing up cash flow for other financial priorities. Furthermore, refinancing can simplify your payments by consolidating multiple loans into a single, manageable payment. This streamlined approach improves financial organization and reduces the administrative burden of managing various loan accounts.

Long-Term Financial Implications: Refinancing vs. Not Refinancing

The long-term financial impact depends on several factors, including your current interest rates, credit score, and future financial projections. If you have federal loans with high interest rates and a strong credit score, refinancing with a private lender offering a substantially lower rate could result in significant long-term savings. However, if you have low interest rates on your federal loans or anticipate needing federal protections, the potential benefits of refinancing might be outweighed by the risks. A detailed comparison of the total interest paid over the life of your current loans versus the projected total interest paid under a refinanced loan is crucial for making an informed decision.

Calculating Potential Savings from Refinancing

Let’s consider a hypothetical scenario: You have $50,000 in federal student loans with a 6% interest rate and a 10-year repayment term. Your monthly payment is approximately $550. If you refinance to a 4% interest rate with the same repayment term, your monthly payment would decrease to roughly $480. Over 10 years, this seemingly small monthly difference of $70 adds up to substantial savings. The total interest paid on the original loan would be approximately $16,000, while the refinanced loan would result in approximately $8,000 in interest. This represents a potential saving of $8,000 over the life of the loan. Remember that this is a simplified example, and actual savings will vary based on individual loan terms and interest rates. Using online loan calculators can help you estimate potential savings based on your specific situation.

Always remember to factor in the potential loss of federal benefits when comparing the long-term costs.

Post-Refinancing Management

Refinancing your student loans can significantly impact your finances, but the process doesn’t end with loan approval. Effective post-refinancing management is crucial to maximizing the benefits and avoiding potential pitfalls. This involves actively monitoring your loan, making timely payments, and maintaining open communication with your lender.

Successful management ensures you benefit from the lower interest rates and potentially more favorable repayment terms secured through refinancing. Proactive steps will help you avoid late payment fees, damage to your credit score, and unnecessary financial stress.

Loan Payment Monitoring and Interest Accrual

After refinancing, promptly obtain and review your new loan documents, including the amortization schedule. This schedule details your monthly payment amount, the principal and interest components of each payment, and the remaining loan balance over the life of the loan. Regularly check your online account portal to verify that payments are processed correctly and track the remaining balance. Note the interest rate and calculate the interest accruing each month to ensure it aligns with your loan agreement. Discrepancies should be reported immediately to your lender.

Strategies for Organized Payment and Avoiding Late Payments

Maintaining organized payment records is essential. Set up automatic payments to avoid missed payments and late fees. Consider linking your loan payment to your checking account to ensure consistent and timely payments. Many lenders offer online payment options with email or text reminders. Utilize these tools to stay informed about upcoming payment due dates. Building a buffer in your budget for loan payments accounts for unexpected expenses and prevents potential late payments.

Communicating with Your Lender

Open communication with your lender is key to a smooth post-refinancing experience. Contact your lender immediately if you anticipate difficulty making a payment. Many lenders offer options such as forbearance or deferment in case of financial hardship. Keep records of all communications with your lender, including emails, letters, and phone calls. If you have questions about your loan terms, payment options, or account status, don’t hesitate to reach out to your lender’s customer service department.

Sample Repayment Schedule

The following table illustrates different repayment strategies for a $30,000 loan refinanced at 6% interest over a 10-year term. Note that these are examples and your actual repayment schedule will vary based on your loan terms and chosen repayment plan.

| Payment Strategy | Monthly Payment | Total Interest Paid | Total Paid |

|---|---|---|---|

| Standard Repayment | $330.38 | $7,245.60 | $37,245.60 |

| Accelerated Repayment (15% higher monthly payment) | $379.94 | $5,174.27 | $35,174.27 |

| Extended Repayment (10-year loan extended to 15 years) | $220.26 | $13,238.40 | $43,238.40 |

Outcome Summary

Successfully refinancing your student loans can significantly impact your financial well-being, offering the potential for lower monthly payments, reduced interest costs, and a simplified repayment process. However, it’s vital to approach refinancing strategically, carefully weighing the potential benefits against the risks involved, such as the loss of federal loan protections. By understanding the intricacies of the process, comparing lenders, and thoroughly evaluating your options, you can confidently navigate the path towards a more manageable and affordable repayment plan.

FAQ Section

What is the impact of a poor credit score on refinancing eligibility?

A lower credit score may limit your eligibility for refinancing or result in higher interest rates. Some lenders may require a co-signer to mitigate the risk.

Can I refinance federal student loans?

Yes, you can refinance federal student loans, but be aware that doing so will typically mean losing federal protections like income-driven repayment plans and potential forgiveness programs.

What documents are typically required for a refinancing application?

Lenders usually require proof of income, employment history, and details of your existing student loans. They may also request tax returns or bank statements.

How long does the refinancing process typically take?

The timeframe varies by lender, but generally, it can take anywhere from a few weeks to a couple of months to complete the entire process.