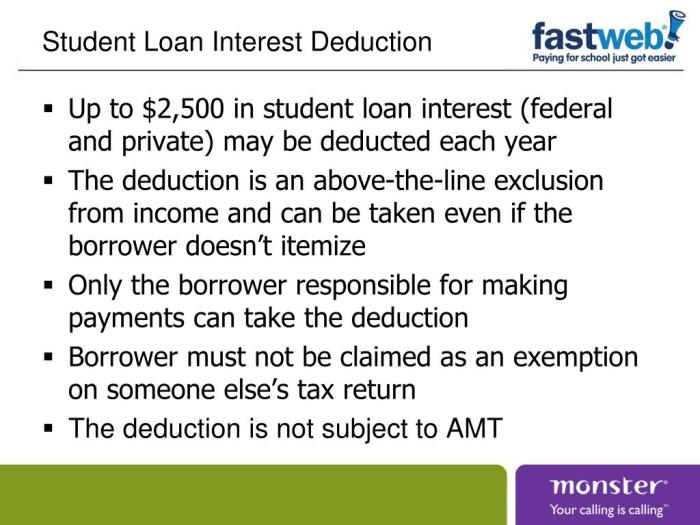

Navigating the complexities of student loan repayment can feel overwhelming, but understanding potential tax benefits like the student loan interest deduction can significantly ease the burden. This deduction allows eligible taxpayers to reduce their taxable income by the amount of interest they paid on qualified student loans during the year. This can translate to substantial savings, making a real difference in your overall financial picture. Let’s explore how this valuable deduction works and how you can potentially benefit.

The student loan interest deduction isn’t a one-size-fits-all benefit; eligibility hinges on factors like your modified adjusted gross income (MAGI), filing status, and the type of student loan. Understanding these criteria is crucial to determine if you qualify and how much you can deduct. We’ll walk you through the process step-by-step, providing clear explanations and examples to illustrate the calculations involved.

Eligibility Requirements for the Student Loan Interest Deduction

The student loan interest deduction allows eligible taxpayers to deduct the amount they paid in student loan interest during the tax year. This can significantly reduce your taxable income and, consequently, your tax liability. However, several eligibility requirements must be met to claim this deduction. Understanding these requirements is crucial to ensure you can accurately claim this benefit.

Adjusted Gross Income (AGI) Limits

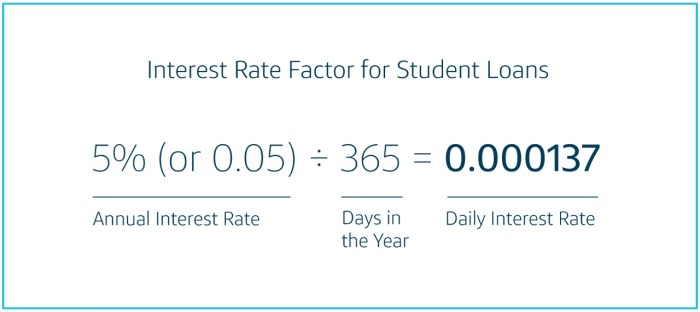

The amount you can deduct is limited based on your Modified Adjusted Gross Income (MAGI). This is your adjusted gross income (AGI) with certain deductions added back in. The MAGI limits are adjusted annually for inflation. For the 2023 tax year, the phaseout range begins when your MAGI exceeds $70,000 for single filers, $140,000 for married filing jointly, and $85,000 for heads of household. If your MAGI exceeds these thresholds, your deduction may be reduced or eliminated entirely. The deduction is completely phased out at higher income levels (higher than the phaseout range), so it’s important to check the current IRS guidelines for the most up-to-date figures. It’s crucial to calculate your MAGI accurately to determine your eligibility.

Qualifying Student Loans

The student loan interest deduction applies only to loans taken out for educational expenses. This includes loans used to pay for undergraduate, graduate, or professional degrees. The loans must be taken out by the student themselves or on their behalf by a parent or other family member. Consolidation loans, which combine multiple student loans into a single loan, also generally qualify. However, loans used for other purposes, such as personal loans or home loans, do not qualify for this deduction. Furthermore, the loan must be for an eligible educational institution.

Determining Eligibility Based on Filing Status

The process for determining eligibility involves several steps:

1. Calculate your Modified Adjusted Gross Income (MAGI): This involves taking your AGI and adding back in certain deductions. Consult IRS Publication 970 for a comprehensive list of items to add back.

2. Determine your filing status: Are you single, married filing jointly, head of household, qualifying widow(er), or married filing separately? Your filing status directly impacts the AGI limits.

3. Compare your MAGI to the applicable AGI limits: Check the current IRS guidelines for the MAGI limits corresponding to your filing status. If your MAGI is below the limit, you may be eligible for the full deduction. If your MAGI falls within the phaseout range, your deduction will be partially reduced. If your MAGI is above the phaseout range, you cannot claim the deduction.

4. Confirm that the loans are qualifying education loans: Ensure the loans meet the criteria discussed previously.

5. Gather your documentation: Collect Form 1098-E, Student Loan Interest Statement, from your lender, which details the interest paid during the tax year.

Eligibility Requirements Comparison Table

| Filing Status | 2023 MAGI Phaseout Begins | 2023 MAGI Phaseout Ends (Deduction Eliminated) | Notes |

|---|---|---|---|

| Single | $70,000 | Higher than phaseout range (check IRS guidelines for the exact amount) | Amounts above the phaseout range result in no deduction. |

| Married Filing Jointly | $140,000 | Higher than phaseout range (check IRS guidelines for the exact amount) | Amounts above the phaseout range result in no deduction. |

| Head of Household | $85,000 | Higher than phaseout range (check IRS guidelines for the exact amount) | Amounts above the phaseout range result in no deduction. |

Documentation and Record Keeping

Claiming the student loan interest deduction requires meticulous record-keeping. The IRS needs proof you actually paid the interest, and the amount you paid. Failing to maintain accurate records can lead to delays in processing your return or even rejection of your deduction. Careful documentation is crucial for a smooth and successful tax filing.

Proper record-keeping ensures you can accurately report your student loan interest payments on your tax return. This not only helps you claim the deduction but also protects you in case of an audit. Maintaining organized records simplifies the tax preparation process and reduces the risk of errors.

Necessary Documentation

To support your student loan interest deduction claim, you will need Form 1098-E, Student Loan Interest Statement. This form is issued by your lender and reports the total amount of interest you paid during the year. If you don’t receive a 1098-E, you can still claim the deduction, but you’ll need to gather supporting documentation such as monthly or annual statements from your lender detailing your loan payments and the interest portion of those payments. Keep all your loan payment records, including bank statements showing payments made, for at least three years after filing your tax return.

Maintaining Accurate Records of Student Loan Interest Payments

Accurate record-keeping is essential for claiming the student loan interest deduction. Any discrepancies between the reported interest and your records can result in delays or denial of your deduction. Therefore, maintaining detailed and organized records is crucial. This involves keeping all your loan statements, payment confirmations, and any other documents related to your student loan interest payments. You should also note the loan’s name, your name, and the relevant tax year.

Best Practices for Organizing and Storing Loan Interest Payment Records

Several methods can help you organize and store your loan interest payment records effectively. A dedicated folder or binder for tax documents is a good starting point. You can organize documents chronologically or by loan type. Digitally scanning documents and storing them securely on a cloud service or external hard drive provides an extra layer of protection against loss or damage. Remember to back up your digital files regularly. Consider using a spreadsheet or dedicated tax software to track your payments. This will facilitate easier compilation during tax season.

Sample Student Loan Interest Payment Tracker

| Date of Payment | Loan Name | Payment Amount | Interest Paid |

|---|---|---|---|

| 2024-01-15 | Sallie Mae Loan | $300 | $25 |

| 2024-02-15 | Sallie Mae Loan | $300 | $22 |

| 2024-03-15 | Federal Direct Loan | $250 | $18 |

Filing Your Tax Return with the Deduction

Claiming the student loan interest deduction is straightforward once you’ve confirmed your eligibility and gathered the necessary documentation. This section details how to incorporate this deduction into your annual tax return using Form 1040. Accurate reporting is crucial to ensure you receive the correct amount of tax relief.

Form 1040 and the Student Loan Interest Deduction

The student loan interest deduction is claimed on Form 1040, specifically on Schedule 1 (Additional Income and Adjustments to Income). You’ll need your Form 1098-E, which your lender provides, showing the total amount of interest you paid during the tax year. Enter this amount on line 21 of Schedule 1. This line is labeled “Student loan interest.” Remember to only deduct the amount of interest you actually paid; do not include any principal payments. The deduction is limited to the actual amount of interest paid, up to the maximum allowed. After completing Schedule 1, transfer the total amount of your adjustments to income (including the student loan interest deduction) to line 12 of Form 1040. This adjusted gross income (AGI) will then be used to calculate your taxable income.

Examples of Reporting the Student Loan Interest Deduction

Let’s consider two scenarios. In the first, John paid $2,000 in student loan interest during the tax year. He will enter “$2,000” on line 21 of Schedule 1. In the second scenario, Jane paid $1,500 in student loan interest, but her modified AGI is such that she can only deduct $1,000. She will report “$1,000” on line 21 of Schedule 1. Both John and Jane will then transfer the relevant amount from Schedule 1 to Form 1040, line 12. The final calculation of their taxable income will reflect this deduction.

Checklist for Filing with the Student Loan Interest Deduction

Properly claiming the deduction requires careful attention to detail. Following these steps will help ensure a smooth and accurate filing process:

- Gather all necessary documentation, including Form 1098-E and any other supporting records of student loan interest payments.

- Carefully review your eligibility requirements to confirm you meet all criteria for the deduction.

- Complete Schedule 1 (Additional Income and Adjustments to Income) of Form 1040, accurately reporting the student loan interest paid on line 21.

- Transfer the total amount of adjustments to income, including the student loan interest deduction, from Schedule 1 to line 12 of Form 1040.

- Review your completed tax return thoroughly before filing to ensure accuracy.

- File your tax return by the applicable deadline to avoid penalties.

Comparison with Other Tax Benefits

The student loan interest deduction isn’t the only tax break available to students and recent graduates. Several other benefits might offer greater financial advantages depending on individual circumstances. Understanding these alternatives is crucial for maximizing tax savings. A comparative analysis helps determine which strategy best suits your specific financial situation.

Several other tax benefits might be more advantageous than the student loan interest deduction, depending on your income, other deductions, and the amount of student loan interest you pay. For example, the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) offer direct reductions in your tax liability, unlike the student loan interest deduction, which reduces your taxable income. The choice between these options depends largely on your educational expenses and income level.

Comparison of Student Loan Interest Deduction with Other Tax Benefits

The following table compares the student loan interest deduction with the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), highlighting key differences to aid in decision-making.

| Tax Benefit | Description | Eligibility Requirements | Maximum Benefit |

|---|---|---|---|

| Student Loan Interest Deduction | Reduces taxable income by the amount of student loan interest paid. | Must have paid student loan interest, be enrolled in a degree program, and meet income limits. | Up to $2,500 of interest paid. (This amount may vary based on adjusted gross income (AGI).) |

| American Opportunity Tax Credit (AOTC) | A credit that can reduce your tax liability by up to $2,500 per eligible student. | Must be pursuing a degree or other credential at an eligible educational institution, be enrolled at least half-time, and meet other requirements. The student cannot have completed the first four years of higher education. | $2,500 maximum credit. |

| Lifetime Learning Credit (LLC) | A credit that can reduce your tax liability by up to $2,000 per tax return. | Can be claimed for undergraduate and graduate courses. There are no restrictions on the number of years the credit can be claimed. | $2,000 maximum credit. |

Scenarios Favoring Different Tax Benefits

The most advantageous tax benefit varies depending on individual circumstances. For example, a student with high student loan interest payments and a relatively low income might find the student loan interest deduction more beneficial than the AOTC or LLC, as the deduction can reduce their taxable income significantly. Conversely, a student with lower student loan interest payments and high educational expenses might find the AOTC or LLC more beneficial, as these credits directly reduce their tax liability.

Impact on Other Tax Credits or Deductions

Claiming the student loan interest deduction might affect other tax credits or deductions. Because it reduces your adjusted gross income (AGI), it could impact the amount of other tax benefits you are eligible to receive. For instance, some tax credits are phased out based on AGI. Therefore, claiming the deduction could increase or decrease the amount of these other benefits you can claim. It’s crucial to consider the overall impact on your tax situation before deciding whether to claim the student loan interest deduction.

Potential Changes and Future Considerations

The student loan interest deduction, while currently available, is subject to potential changes based on evolving economic conditions, government priorities, and shifts in tax policy. Understanding these possibilities is crucial for taxpayers who rely on this deduction to manage their student loan debt. Predicting the future with certainty is impossible, but analyzing historical trends and current political discussions provides insight into potential alterations.

The student loan interest deduction’s future is intertwined with broader debates surrounding higher education affordability and federal student loan programs. Changes in government policy regarding student loan forgiveness or repayment plans could indirectly affect the deduction’s relevance and usage. Similarly, broader tax reform initiatives might alter the deduction’s parameters, such as the maximum deductible amount or eligibility requirements. These changes could significantly impact taxpayers’ tax liabilities and overall financial planning.

Potential Adjustments to the Deduction

The maximum amount deductible, currently capped, could be adjusted upwards or downwards. A decrease would reduce the benefit for borrowers, while an increase would provide greater tax relief. Alternatively, the government might alter eligibility requirements, potentially restricting access based on income levels, loan types, or other criteria. For example, the deduction might be phased out for higher-income earners, limiting its impact on those with greater financial capacity. Historical precedent demonstrates such adjustments are not uncommon; past tax laws have shown fluctuations in deduction limits and eligibility criteria in response to budget concerns or policy shifts.

Impact of Changes in Tax Laws or Government Policies

Significant changes to the tax code or federal student loan programs could drastically alter the value and accessibility of the student loan interest deduction. For example, a comprehensive tax reform bill might eliminate the deduction altogether to simplify the tax system or consolidate other tax benefits. Conversely, a significant expansion of student loan forgiveness programs could reduce the number of borrowers who itemize and claim the deduction, rendering it less impactful. Such scenarios would necessitate adjustments in financial planning strategies for those relying on this deduction. Consider the potential impact on a taxpayer currently claiming a $2,500 deduction; a complete elimination would result in a $2,500 increase in their tax liability, assuming their tax bracket remains constant.

Resources for Staying Informed

Staying updated on changes to tax regulations is crucial. The Internal Revenue Service (IRS) website (irs.gov) provides the most reliable and up-to-date information on tax laws and regulations. Tax professionals, such as certified public accountants (CPAs) and enrolled agents (EAs), can also offer valuable insights and guidance. Subscribing to tax newsletters or following reputable financial news sources can provide additional updates on relevant policy changes. Furthermore, many financial institutions and student loan servicers offer resources and educational materials on tax benefits related to student loans.

Long-Term Financial Implications of Claiming This Deduction

The long-term financial implications of claiming the student loan interest deduction can be significant.

- Reduced Tax Liability: The deduction directly reduces taxable income, resulting in lower tax payments each year.

- Faster Debt Repayment: The savings from the deduction can be allocated towards faster repayment of student loans, potentially leading to earlier debt elimination.

- Improved Credit Score: Faster loan repayment can contribute to a better credit score, benefiting future borrowing opportunities.

- Uncertainty Due to Potential Changes: Reliance on the deduction for long-term financial planning involves uncertainty due to the possibility of future modifications to the tax code or eligibility criteria. A sudden change could disrupt carefully laid financial plans.

Conclusive Thoughts

Successfully claiming the student loan interest deduction can provide significant tax relief, making a tangible impact on your post-graduation finances. By carefully reviewing your eligibility, accurately calculating your deduction, and maintaining thorough records, you can maximize this valuable benefit. Remember to stay informed about potential changes in tax laws and regulations to ensure you continue to benefit from this deduction in future tax years. Proper planning and understanding can significantly reduce your tax burden and accelerate your journey towards financial stability.

FAQ Overview

What if I paid off my student loans early? Can I still deduct the interest?

Yes, you can deduct the interest paid even if you paid off your loans early in the year. The deduction is based on the interest paid during the tax year, regardless of when the loan is fully repaid.

Can I deduct interest paid on loans for my spouse or dependent?

No, the deduction is only for interest paid on your own qualified student loans. You cannot claim the deduction for interest paid on loans taken out for someone else.

What happens if my AGI exceeds the limit for the deduction?

If your AGI exceeds the limit, you won’t be able to claim the deduction at all. The deduction is phased out gradually as your income increases, meaning the amount you can deduct will decrease as your income approaches the limit.

Where can I find Form 1040 and instructions for claiming this deduction?

You can find Form 1040 and its instructions on the IRS website (irs.gov). Look for the section related to itemized deductions and student loan interest.