Navigating the complex world of student loan interest can feel daunting, but understanding how it works is crucial for responsible financial management. This guide unravels the intricacies of student loan interest, from the various types of loans and their associated rates to the impact of repayment plans and strategies for minimizing your overall cost. We’ll explore the mechanics of interest accrual, capitalization, and the long-term financial implications of your choices.

By understanding the factors that influence your interest rate—including your credit score, loan type, and the type of institution you attended—you can make informed decisions that will significantly impact your repayment journey. We will demystify the differences between fixed and variable interest rates, simple and compound interest calculations, and the various repayment options available to you, empowering you to take control of your student loan debt.

Types of Student Loans and Interest Rates

Understanding the different types of student loans and their associated interest rates is crucial for effective financial planning during and after your education. The interest rate you’ll pay significantly impacts the total cost of your loan, so careful consideration is essential. This section will clarify the distinctions between federal and private loans and explain the implications of fixed versus variable interest rates.

Federal and private student loans differ significantly in their interest rate structures and overall terms. Federal student loans are offered by the U.S. government and generally offer more favorable terms, including lower interest rates and various repayment options. Private student loans, on the other hand, are provided by banks, credit unions, and other private lenders. These loans often come with higher interest rates and stricter eligibility requirements, reflecting the higher risk for the lender.

Federal and Private Loan Interest Rate Differences

Federal student loan interest rates are typically lower than those of private student loans. This is because the government subsidizes these loans, mitigating the risk for lenders. Furthermore, federal loan interest rates are often tied to market indices, meaning they can fluctuate over time, but generally remain lower than their private counterparts. Private loan interest rates are set by the lender and tend to be higher, often reflecting the borrower’s creditworthiness and the prevailing market conditions. A borrower with a strong credit history might secure a lower rate, but this is not guaranteed. The difference in interest rates can significantly impact the overall cost of borrowing. For instance, a 1% difference in interest rate over a 10-year repayment period can lead to hundreds, or even thousands, of dollars in additional interest charges.

Fixed vs. Variable Interest Rates

Student loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the life of the loan, providing predictability and allowing for easier budgeting. A variable interest rate, however, fluctuates based on a benchmark index, such as the prime rate or LIBOR (though LIBOR is being phased out). While a variable rate might start lower than a fixed rate, it can increase over time, leading to unpredictable monthly payments and potentially a higher total cost. The choice between a fixed and variable rate depends on individual risk tolerance and financial circumstances. Borrowers who prefer stability and predictability might opt for a fixed rate, even if it’s slightly higher initially. Those comfortable with some risk and the possibility of lower payments in certain market conditions might choose a variable rate.

Examples of Interest Rate Impact

The following table illustrates how different loan types and interest rates affect the total interest paid over a 10-year repayment period, assuming a $20,000 loan amount. These are examples and actual interest rates will vary depending on the lender, creditworthiness, and prevailing market conditions.

| Loan Type | Interest Rate Type | Example Interest Rate | Total Interest Paid (10-year repayment) |

|---|---|---|---|

| Federal Subsidized Loan | Fixed | 4.5% | $3,460 (approximate) |

| Federal Unsubsidized Loan | Fixed | 5.5% | $4,350 (approximate) |

| Private Loan (Good Credit) | Fixed | 7.0% | $5,800 (approximate) |

| Private Loan (Variable) | Variable | 6.0% (initial), potentially higher | $4,900 – $6,000+ (approximate range) |

Accrued Interest and Capitalization

Understanding accrued interest and capitalization is crucial for managing your student loan debt effectively. Accrued interest represents the interest that accumulates on your loan balance over time, even if you’re not making payments. Capitalization, on the other hand, is the process of adding this accrued interest to your principal loan balance, increasing the amount you ultimately owe.

Interest capitalization significantly impacts the total amount you repay. When interest capitalizes, it essentially becomes part of your new principal balance. Future interest calculations are then based on this higher principal amount, leading to a larger overall debt. This snowball effect can dramatically increase the total cost of your loan over its lifespan.

Interest Capitalization Process

Capitalization typically occurs when your student loan enters a period of deferment or forbearance, where you are temporarily not required to make payments. During these periods, interest continues to accrue on your outstanding balance. When the deferment or forbearance ends, the accumulated interest is capitalized, added to your principal balance. This means you’ll now be paying interest on a larger amount, resulting in higher monthly payments and a longer repayment period. The exact timing of capitalization depends on the terms of your specific loan. Some loans may capitalize interest annually, while others might do so at the end of the deferment or forbearance period.

Impact of Capitalization on Total Loan Amount

The impact of capitalization on the total loan amount can be substantial. Let’s consider a scenario with a $10,000 loan at a 6% annual interest rate. If the loan is deferred for one year, and interest is capitalized at the end of that year, the accrued interest would be $600 ($10,000 x 0.06). This $600 is then added to the principal, resulting in a new principal balance of $10,600. Future interest calculations will now be based on this higher amount, leading to even more interest accruing over the remaining loan term. This compounding effect can significantly increase the total cost of borrowing over the life of the loan.

Deferment and Forbearance’s Effect on Accrued Interest

Deferment and forbearance are both periods where you don’t have to make payments on your student loans. However, they differ in their impact on accrued interest. With deferment, interest may or may not accrue depending on the type of deferment and the loan program. Forbearance, on the other hand, typically allows for interest to accrue, often leading to capitalization upon the forbearance period’s end. This means that choosing between deferment and forbearance should be carefully considered based on the specific terms of the loan and the individual’s financial situation. The consequences of capitalized interest can significantly impact the long-term cost of the loan.

Capitalized vs. Uncapitalized Interest: A Five-Year Scenario

Consider two identical $10,000 student loans with a 5% annual interest rate. Loan A capitalizes interest annually during a two-year deferment period, while Loan B does not. After the two-year deferment, both loans enter a standard 3-year repayment plan.

Year 1 (deferment): Loan A accrues $500 interest, which is capitalized. Loan B accrues $500 interest, which remains unpaid.

Year 2 (deferment): Loan A accrues $525 interest ($10,500 x 0.05), which is capitalized. Loan B accrues $500 interest, which remains unpaid.

Year 3 (repayment): Loan A’s principal is now $11,525. Loan B’s principal is $11,000.

Year 4 (repayment): The difference in principal between Loan A and Loan B continues to grow due to interest accumulating on the higher principal balance of Loan A.

Year 5 (repayment): By the end of the five-year period, Loan A will have a significantly higher total repayment amount than Loan B, showcasing the significant impact of capitalization. The exact difference will depend on the repayment plan’s specifics, but it would be substantial. This demonstrates how capitalization dramatically increases the overall cost of the loan.

Repayment Plans and Interest

Choosing the right student loan repayment plan is crucial, as it significantly impacts the total interest you’ll pay over the life of your loan. Different plans offer varying repayment periods and monthly payments, directly influencing the amount of accrued interest. Understanding these differences is key to making informed financial decisions.

Understanding how different repayment plans affect your interest payments requires careful consideration of your financial situation and long-term goals. Each plan presents a unique balance between manageable monthly payments and the overall cost of borrowing. The longer it takes to repay your loan, the more interest you will accumulate.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It typically involves fixed monthly payments over a 10-year period. While offering a relatively short repayment timeframe, the monthly payments can be substantial, especially for borrowers with significant loan balances.

- Pros: Fastest repayment, lowest total interest paid.

- Cons: Highest monthly payments, may be difficult to manage on a limited budget.

Extended Repayment Plan

An extended repayment plan stretches the repayment period beyond the standard 10 years, often up to 25 years. This results in lower monthly payments, making it more manageable for borrowers with tighter budgets. However, the extended repayment period means you’ll pay significantly more interest over the life of the loan.

- Pros: Lower monthly payments, easier budget management.

- Cons: Much higher total interest paid, longer repayment period.

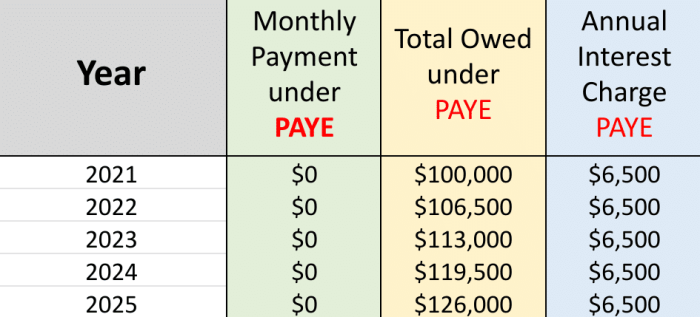

Income-Driven Repayment Plans

Income-driven repayment plans (IDR plans) tie your monthly payments to your income and family size. These plans typically offer lower monthly payments than standard or extended plans, particularly during periods of lower income. However, the repayment period is often extended, potentially leading to higher overall interest payments. Several types of IDR plans exist, each with its own specific calculation method. Examples include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

- Pros: Lower monthly payments, more manageable during periods of low income.

- Cons: Longer repayment period, potentially higher total interest paid; requires regular income recertification.

Factors Influencing Interest Rates

Several key factors interact to determine the interest rate you’ll pay on your student loans. Understanding these factors can help you strategize for lower interest rates and ultimately, a less expensive repayment journey. These factors aren’t independent; they often influence each other, creating a complex picture of your individual interest rate.

Several significant factors influence the interest rate assigned to a student loan. These include your creditworthiness, the type of loan, and the characteristics of the educational institution you are attending. The interplay of these elements determines the final interest rate offered to the borrower.

Credit Score

A higher credit score generally translates to a lower interest rate. Lenders view a strong credit history as an indicator of responsible financial behavior, reducing their perceived risk in lending you money. Conversely, a poor credit history suggests a higher risk of default, leading lenders to charge a higher interest rate to compensate for that increased risk. For federal student loans, credit history is not usually a direct factor in determining the interest rate during the initial loan disbursement. However, it can impact the interest rates on private student loans significantly.

Loan Type

Different types of student loans come with different interest rates. Federal student loans, subsidized and unsubsidized, generally have lower interest rates than private student loans. This is because the federal government backs these loans, reducing the risk for lenders. Private student loans, on the other hand, are offered by private institutions and carry higher interest rates to reflect the increased risk involved. Furthermore, within the federal loan system, different loan programs (like Grad PLUS loans versus undergraduate Stafford loans) also carry varying interest rates.

School Type

The type of school you attend can also influence your interest rate, primarily for private student loans. Loans for students attending graduate programs or professional schools (like medical or law school) may have higher interest rates than loans for undergraduate students. This is often due to the higher cost of these programs and the associated increased borrowing amounts, making them potentially riskier for lenders. The reputation and accreditation of the institution might also play a subtle role, although this is less direct than other factors.

| Factor | Impact on Interest Rate | Example |

|---|---|---|

| Credit Score | Higher credit score = Lower interest rate; Lower credit score = Higher interest rate | A borrower with a 750 credit score might receive a 5% interest rate on a private loan, while a borrower with a 600 credit score might receive a 9% interest rate on a similar loan. |

| Loan Type | Federal loans generally have lower interest rates than private loans; Different federal loan programs have different rates. | A subsidized federal Stafford loan might have a 4% interest rate, while a private student loan for the same amount might have a 7% interest rate. |

| School Type | Graduate and professional school loans may have higher interest rates than undergraduate loans. | A law school student might receive a 6.5% interest rate on a private loan, while an undergraduate student at the same institution might receive a 5.5% interest rate. |

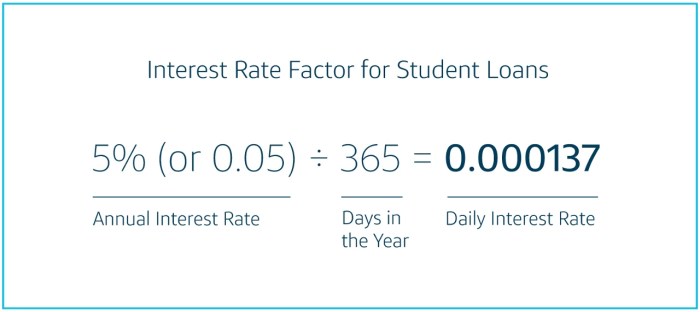

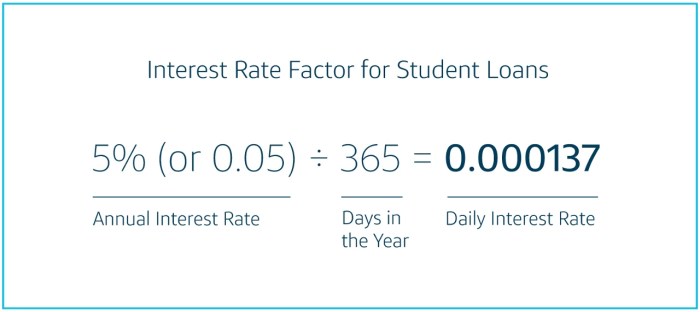

Interest Calculation Methods

Understanding how student loan interest is calculated is crucial for managing your debt effectively. The two primary methods are simple interest and compound interest. While seemingly similar, they lead to significantly different outcomes over time, impacting the total amount you’ll repay.

Simple interest and compound interest represent different approaches to calculating the interest charged on a loan’s principal balance. Simple interest is calculated only on the original principal amount, while compound interest is calculated on the principal plus any accumulated interest. This compounding effect significantly increases the total interest paid over the loan’s life.

Simple Interest

Simple interest is calculated only on the principal balance of the loan. The formula is: Interest = Principal x Rate x Time. For example, a $10,000 loan with a 5% annual interest rate will accrue $500 in simple interest each year ($10,000 x 0.05 x 1). The total interest paid over 10 years would be $5,000. This remains consistent regardless of whether or not interest payments are made.

Compound Interest

Compound interest is calculated on the principal balance plus any accumulated interest. This means that interest earned in one period is added to the principal, and subsequent interest calculations are based on this larger amount. The effect of compounding is exponential, leading to a greater total interest paid over time compared to simple interest. While the exact calculation can be complex, the general concept is that interest accrues on interest. For example, in the same scenario of a $10,000 loan at 5% interest, the first year’s interest is $500. In the second year, the interest is calculated on $10,500 ($10,000 + $500), resulting in $525 in interest. This process repeats annually, leading to a larger interest payment than with simple interest.

Comparison of Simple and Compound Interest Accumulation

To illustrate the difference, let’s compare the interest accumulation over a 10-year period for a $10,000 loan at a 5% annual interest rate:

| Year | Simple Interest (5% annual rate) | Compound Interest (5% annual rate) |

|—|—|—|

| 1 | $500 | $500 |

| 2 | $500 | $525 |

| 3 | $500 | $551.25 |

| 4 | $500 | $578.81 |

| 5 | $500 | $607.75 |

| 6 | $500 | $637.96 |

| 7 | $500 | $669.36 |

| 8 | $500 | $702.08 |

| 9 | $500 | $736.13 |

| 10 | $500 | $771.49 |

| Total Interest | $5,000 | $6,077.50 |

As this table demonstrates, the total interest paid under compound interest is significantly higher than under simple interest. Note that this is a simplified example; actual student loan interest calculations might involve more frequent compounding periods (e.g., monthly) and may vary based on the loan type and repayment plan.

Understanding Your Loan Documents

Your student loan promissory note is a legally binding contract outlining the terms and conditions of your loan. Understanding its details, particularly those related to interest, is crucial for responsible repayment and avoiding unexpected costs. Failing to understand these aspects can lead to higher overall loan costs and potential financial difficulties.

Understanding the specifics of your loan documents is paramount to managing your student loan debt effectively. This section will highlight key areas within your promissory note that directly impact your interest payments and overall loan repayment.

Promissory Note Sections Related to Interest

The promissory note contains several sections detailing the interest aspects of your loan. These sections typically include the interest rate, the method of interest calculation (simple or compound), the capitalization policy (when accrued interest is added to the principal), and the repayment schedule. The specific wording might vary slightly depending on the lender, but the core information remains consistent. For instance, the note will clearly state the annual percentage rate (APR), which is the annual interest rate charged on your loan. It will also explain when interest begins accruing – typically from the date of disbursement or after a grace period. The note will specify whether the interest is simple or compound, and, if compound, the frequency of compounding.

Crucial Information on Interest Rates and Calculations

Borrowers need to understand several key pieces of information about their loans’ interest rates and calculations. This includes the specific interest rate (APR), the date interest begins accruing, the method of interest calculation (simple or compound), and the frequency of compounding (if applicable). Understanding the capitalization policy is also crucial; this explains when unpaid interest is added to the principal balance, increasing the amount on which future interest is calculated. For example, a note might state that interest capitalizes annually, meaning that all accrued interest from the previous year is added to the principal balance at the end of the year. This leads to a faster accumulation of interest over the life of the loan.

Questions Borrowers Should Ask Their Lender About Interest

Before signing any loan documents, borrowers should clarify any uncertainties about the interest terms. They should confirm the APR and whether it’s a fixed or variable rate. They need to understand the exact date interest begins accruing and how interest is calculated. Further, they should inquire about the lender’s capitalization policy and the frequency of compounding. Finally, they should ask about the potential impact of various repayment plans on the total interest paid. These proactive steps ensure clarity and informed decision-making, potentially saving significant money in the long run.

Strategies for Minimizing Interest

Minimizing the interest paid on student loans can significantly reduce the overall cost of your education and improve your long-term financial health. Strategic repayment approaches and proactive financial planning can make a substantial difference in the amount you ultimately pay. This section Artikels several effective strategies to achieve this goal.

Several key strategies can help borrowers significantly reduce the total interest paid on their student loans. These strategies focus on accelerating repayment, leveraging refinancing options, and making informed choices about repayment plans. The long-term financial benefits of these approaches are considerable, leading to faster debt elimination and increased financial flexibility.

Making Extra Payments

Making extra payments, even small ones, can substantially reduce the total interest paid and shorten the loan repayment period. The extra payments directly reduce the principal balance, which means less principal accrues interest over time. For example, if you have a $30,000 loan at 5% interest and make an extra $100 payment per month, you could save thousands of dollars in interest and pay off the loan years earlier. The earlier you start making extra payments, the greater the impact on your total interest paid. Consider setting up automatic transfers from your checking account to your loan servicer to ensure consistent extra payments.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can be particularly beneficial if interest rates have fallen since you initially took out your loans. A lower interest rate translates directly to lower monthly payments and significant long-term savings. For instance, refinancing a $50,000 loan from 7% to 4% could save you tens of thousands of dollars over the life of the loan. However, it’s crucial to carefully compare offers from multiple lenders to secure the best possible rate and terms. Refinancing may also affect your eligibility for certain repayment plans or forgiveness programs, so it’s vital to weigh the pros and cons carefully.

Step-by-Step Guide to Exploring Loan Refinancing Options

- Check your credit score: Lenders use your credit score to determine your eligibility and interest rate. A higher score generally leads to better terms.

- Research lenders: Compare offers from multiple lenders, including banks, credit unions, and online lenders. Pay close attention to interest rates, fees, and repayment terms.

- Gather your financial information: You’ll need documentation such as your student loan details, income verification, and employment history.

- Compare loan offers: Use a loan comparison tool or spreadsheet to carefully compare the total cost of each loan, including interest and fees.

- Apply for pre-approval: This allows you to see what rates you qualify for without impacting your credit score significantly.

- Choose a lender and complete the application: Once you’ve selected a lender, carefully review the terms and conditions before signing any documents.

- Monitor your loan account: After refinancing, regularly check your loan statements to ensure the payments are correctly applied and that the interest rate is as agreed.

Income-Driven Repayment Plans

Income-driven repayment plans adjust your monthly payments based on your income and family size. While these plans may extend the repayment period, they can result in lower monthly payments, making it easier to manage your debt and avoid default. The lower monthly payments mean less stress on your budget, allowing you to allocate more funds to other financial goals. However, keep in mind that extending the repayment period typically means paying more interest over the life of the loan. The long-term cost should be weighed against the short-term benefits of manageable monthly payments. Careful consideration of your individual financial situation is crucial when choosing a repayment plan.

Summary

Successfully managing student loan debt requires a proactive approach and a thorough understanding of how interest works. By carefully considering the various loan types, repayment plans, and interest calculation methods, you can develop a strategy that aligns with your financial goals. Remember to actively engage with your loan documents, ask clarifying questions of your lender, and explore strategies like making extra payments or refinancing to minimize the total interest paid over the life of your loan. Taking control of your student loan repayment empowers you to achieve financial freedom sooner.

User Queries

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially push your loan into default, resulting in further penalties and collection actions.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it often involves replacing federal loans with private loans, potentially losing certain borrower protections.

What is the difference between a grace period and deferment?

A grace period is a temporary period after graduation where payments are not required. Deferment is a postponement of payments due to specific circumstances, such as unemployment or financial hardship. Interest may or may not accrue during these periods depending on the loan type and program.

How often is interest calculated on my student loans?

Interest is typically calculated daily on most student loans and added to your principal balance (capitalized) periodically, often monthly.