Paying off student loans can feel like a marathon, but understanding the variables involved can significantly impact your repayment timeline. This guide explores various strategies to accelerate your repayment, from optimizing your repayment plan to budgeting effectively and considering refinancing options. We’ll delve into the influence of interest rates, explore methods to make extra payments, and help you build a plan that aligns with your financial goals.

We’ll cover everything from analyzing your loan details and choosing the best repayment plan to navigating unexpected life events that might affect your payments. The goal is to empower you with the knowledge and tools to confidently tackle your student loan debt and achieve financial freedom faster.

Understanding Your Student Loan Details

Paying off your student loans quickly depends on several interconnected factors. A clear understanding of these factors empowers you to develop a strategic repayment plan and accelerate your journey to debt freedom. This section will break down the key elements influencing your repayment timeline.

The speed at which you repay your student loans is primarily determined by three major factors: the total loan amount, the interest rate applied to your loan, and the repayment plan you choose. Let’s examine each of these in detail.

Loan Amount, Interest Rate, and Repayment Plan Type

The larger your initial loan amount, the longer it will generally take to repay, even with consistent payments. A higher interest rate also increases the total amount you owe over time, extending your repayment period. Finally, the type of repayment plan significantly impacts your monthly payments and overall repayment timeline. A plan with higher monthly payments will naturally lead to a shorter repayment period.

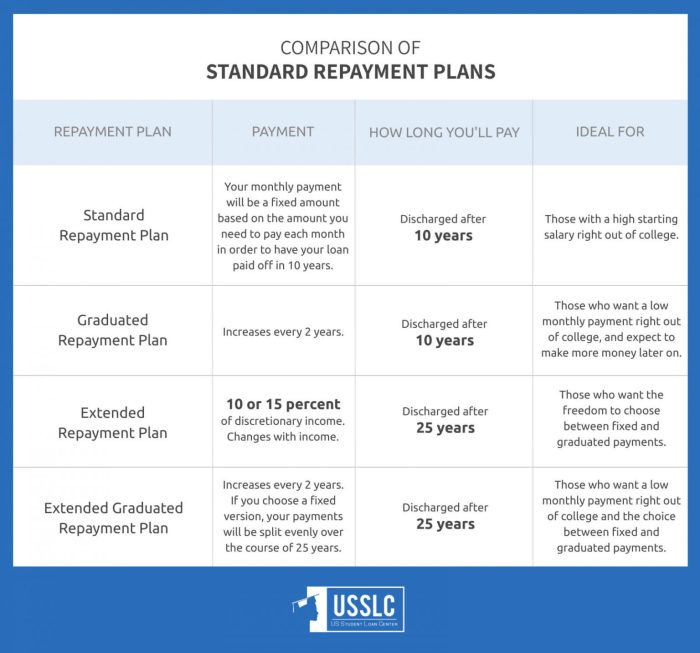

Comparison of Repayment Plans

Different repayment plans offer varying levels of flexibility and impact your repayment timeline. Understanding the implications of each plan is crucial for making an informed decision.

| Repayment Plan | Monthly Payment | Repayment Time | Pros & Cons |

|---|---|---|---|

| Standard Repayment Plan | Fixed, typically higher | 10 years | Pros: Fastest repayment, lower overall interest paid. Cons: Higher monthly payments may be challenging. |

| Extended Repayment Plan | Lower than standard | Up to 25 years | Pros: Lower monthly payments. Cons: Longer repayment period, higher overall interest paid. |

| Income-Driven Repayment Plan (IDR) | Based on income and family size | 20-25 years | Pros: Affordable monthly payments. Cons: Longer repayment period, potential for loan forgiveness (with implications), may result in higher overall interest paid. |

Note: The specific monthly payments and repayment times for each plan will vary depending on the individual loan amount, interest rate, and other factors. These are general examples to illustrate the differences.

Capitalized Interest and Repayment Duration

Capitalized interest is interest that is added to your principal loan balance. This occurs when you are in a period of forbearance or deferment, where you are not making payments on your loan. When this happens, the unpaid interest accrues and is added to your principal balance, increasing the total amount you owe. This significantly extends your repayment period and increases the total amount you pay over the life of the loan. For example, if you have $10,000 in student loan debt and accrue $1,000 in capitalized interest, your new principal balance becomes $11,000, meaning you’ll be paying interest on a larger amount, thus lengthening your repayment timeline.

Exploring Repayment Strategies

Accelerating your student loan repayment requires a proactive approach and a strategic understanding of available options. This section will explore several methods to help you pay off your loans faster, along with the advantages and disadvantages of each. We will also guide you through creating a budget that prioritizes your loan repayment.

Several strategies can significantly reduce your loan repayment timeline. These include making extra payments, refinancing your loans, and consolidating multiple loans into a single one. Each method offers unique benefits and drawbacks, and the best choice depends on your individual financial situation and loan terms.

Extra Payments

Making extra payments, even small ones, can substantially reduce the principal balance and the total interest paid over the life of your loan. Even an extra $50 or $100 per month can save you thousands of dollars in interest and shorten your repayment period considerably. Consider automating extra payments to ensure consistency. For example, if your monthly payment is $300, automating an additional $50 will reduce your loan term and total interest paid significantly. The impact is compounded over time, leading to faster repayment.

Refinancing and Debt Consolidation

Refinancing involves replacing your existing student loans with a new loan at a lower interest rate. Debt consolidation combines multiple loans into a single, new loan, often simplifying repayment.

Refinancing Pros and Cons

Refinancing can be beneficial if you qualify for a lower interest rate than your current loans. This can save you money on interest and shorten your repayment term. However, refinancing might involve fees and could extend your repayment period if you choose a longer loan term, potentially increasing the total interest paid.

| Pros | Cons |

|---|---|

| Lower interest rate | Potential fees |

| Simplified repayment (single payment) | May extend repayment period |

| Potentially shorter repayment term | Risk of losing benefits (e.g., income-driven repayment plans) |

Debt Consolidation Pros and Cons

Debt consolidation simplifies repayment by combining multiple loans into one, making it easier to manage. However, it might not always lower your interest rate, and you could lose benefits associated with individual loans, such as income-driven repayment plans.

| Pros | Cons |

|---|---|

| Simplified repayment (single payment) | May not lower interest rate |

| Easier to track payments | Potential for higher interest rate if not carefully chosen |

| Improved budgeting | Risk of losing benefits (e.g., income-driven repayment plans) |

Creating a Realistic Budget for Accelerated Repayment

A well-structured budget is crucial for allocating more funds towards your student loan payments. This involves tracking your income and expenses to identify areas where you can cut back and redirect funds towards loan repayment.

A step-by-step process for creating a realistic budget includes:

- Track your income: Record all sources of income, including your salary, side hustles, and any other income streams.

- Track your expenses: Categorize your expenses (housing, transportation, food, entertainment, etc.) using a budgeting app, spreadsheet, or notebook. Be meticulous in tracking every expense.

- Identify areas to cut back: Analyze your expenses to find areas where you can reduce spending without significantly impacting your lifestyle. This might involve reducing dining out, canceling subscriptions, or finding cheaper alternatives for certain expenses.

- Allocate funds for loan repayment: Once you’ve identified areas to cut back, allocate the saved funds towards your student loan payments. Start with small, manageable increases and gradually increase your payments as your budget allows.

- Review and adjust: Regularly review your budget to ensure it remains accurate and effective. Adjust your spending and savings as needed based on changes in your income or expenses.

Impact of Interest Rates and Payment Amounts

Understanding the interplay between interest rates, payment amounts, and loan repayment time is crucial for effective student loan management. Higher interest rates and lower payment amounts significantly extend the repayment period, leading to increased overall interest paid. Conversely, lower interest rates and higher payment amounts drastically reduce the repayment time and the total cost of borrowing.

The total amount repaid is a function of both the principal loan amount and the accumulated interest. The interest rate directly impacts how quickly interest accrues on the outstanding loan balance. Larger payment amounts reduce the principal balance faster, thus minimizing the amount of interest that accrues over time.

Interest Rate Impact on Repayment Time

Let’s consider two hypothetical scenarios with a $30,000 student loan:

Scenario 1: A 6% interest rate with a $500 monthly payment would result in a repayment period of approximately 7 years.

Scenario 2: An 8% interest rate with the same $500 monthly payment would extend the repayment period to roughly 8 years. This illustrates how even a seemingly small increase in the interest rate can noticeably lengthen the repayment timeframe. The difference in total interest paid between these two scenarios would be substantial.

Relationship Between Payment Amount and Repayment Duration

Imagine a graph with “Monthly Payment Amount” on the x-axis and “Repayment Duration (in years)” on the y-axis. The graph would show a negative correlation. As the monthly payment amount increases (moving along the x-axis to the right), the repayment duration decreases (moving along the y-axis downwards). This relationship isn’t perfectly linear; the decrease in repayment time slows down as the payment amount gets larger. The curve would be steeper at lower payment amounts and gradually flatten as the payment amount approaches a level that quickly amortizes the loan. For example, a small increase in payment from $300 to $400 might significantly reduce repayment time, while an increase from $900 to $1000 might have a smaller impact.

The Compounding Effect of Interest

Interest compounding is the process where interest is added to the principal balance, and future interest is then calculated on this increased balance. This effect significantly accelerates the growth of debt over time. Consider a simple example: if you owe $1,000 with a 10% annual interest rate, the first year’s interest is $100. The next year’s interest is calculated on $1,100 (principal + interest), resulting in $110 interest. The interest is not simply $100 each year; it grows exponentially. This compounding effect makes early repayment strategies highly beneficial, as it reduces the total amount of time the interest has to compound. Minimizing the loan’s lifespan through higher payments directly combats the compounding effect, resulting in significant savings over the long run.

Factors Beyond Your Control

Paying off student loans is a marathon, not a sprint, and unforeseen circumstances can significantly impact your repayment timeline. While diligent planning and budgeting are crucial, acknowledging and preparing for factors outside your direct control is equally important for successful loan repayment. Life throws curveballs, and understanding how to navigate them financially is key to staying on track.

Unexpected events can derail even the most meticulously crafted repayment plan. Job loss, unexpected medical expenses, or family emergencies are just a few examples of situations that can severely strain your finances and make consistent loan payments challenging. These events are inherently unpredictable, but proactive strategies can help minimize their disruptive effect on your student loan repayment journey.

Mitigating the Impact of Unforeseen Circumstances

Effective strategies for managing unexpected financial setbacks involve a combination of proactive planning and reactive adaptation. Building an emergency fund is paramount. This fund should ideally cover 3-6 months of essential living expenses, providing a financial buffer against job loss or unexpected medical bills. This allows you to continue making loan payments even during periods of reduced income. Additionally, exploring options like deferment or forbearance (temporary suspension of payments) offered by your loan servicer can provide short-term relief. It’s crucial to understand the terms and conditions of these options, as they often accrue interest, potentially increasing your overall loan cost. Open communication with your loan servicer is vital; they may be able to offer solutions you haven’t considered.

Contingency Planning for Consistent Payments

Contingency planning is not about predicting the future; it’s about preparing for its uncertainties. A well-defined plan should include several key elements. First, establishing a realistic budget that accounts for both essential and discretionary expenses is fundamental. This budget should be regularly reviewed and adjusted to reflect changes in income or expenses. Second, exploring alternative income sources, such as part-time work or freelance opportunities, can provide additional financial flexibility during challenging times. Finally, building a strong support network of family and friends can provide emotional and, potentially, financial support during difficult periods. Knowing you have people to lean on can significantly reduce stress and improve your ability to navigate financial difficulties. For example, if a family member experiences a medical emergency requiring significant expenses, having a support system can help alleviate some of the financial burden and maintain loan payments.

Long-Term Financial Planning

Successfully navigating student loan repayment requires integrating it into a comprehensive long-term financial strategy. Failing to do so can significantly hinder your progress toward major life goals. A holistic approach ensures that your debt repayment plan aligns with your broader financial aspirations, preventing unforeseen financial strain and maximizing your long-term financial well-being.

Successfully managing student loan debt requires careful consideration of its impact on other financial goals. Ignoring this crucial aspect can lead to significant setbacks. A well-structured plan addresses both short-term repayment and long-term financial objectives, allowing for a balanced approach to debt management and future financial security.

Student Loan Debt’s Impact on Major Financial Goals

Student loan debt can significantly influence your ability to achieve key financial milestones. High monthly payments can restrict your capacity for saving and investing, potentially delaying or even preventing homeownership and adequate retirement planning. For example, a large student loan payment might reduce the amount you can contribute to a retirement account each month, leading to a smaller nest egg upon retirement. Similarly, a substantial debt burden may make it difficult to save for a down payment on a house, delaying or even preventing homeownership. The earlier you address this, the better equipped you will be to mitigate these potential impacts.

The Benefits of Early Student Loan Repayment

Prioritizing early repayment offers substantial advantages in achieving long-term financial stability. Accelerated repayment reduces the total interest paid, saving you a significant amount of money over the life of the loan. This frees up more cash flow for other financial goals, like saving for a down payment, investing, or building an emergency fund. For instance, paying off your student loans early can free up hundreds or even thousands of dollars annually, money that can be used to reach other financial goals more quickly. The reduced financial burden also decreases overall stress and improves your overall financial health.

Incorporating Student Loan Repayment into a Financial Plan

A successful long-term financial plan integrates student loan repayment with other crucial aspects of financial well-being. This includes budgeting, saving, investing, and planning for major life events. A realistic budget should allocate sufficient funds for loan repayment while also covering essential living expenses and other financial goals. Consider creating a detailed budget that breaks down your income and expenses, highlighting how much you can allocate towards student loan repayment. This allows you to visualize the progress and make necessary adjustments to your plan. For example, you could explore different repayment strategies, such as the avalanche method (prioritizing the loan with the highest interest rate) or the snowball method (prioritizing the loan with the smallest balance). By systematically tracking your progress and adjusting your plan as needed, you can effectively manage your student loan debt and work towards your broader financial goals.

Closing Notes

Successfully navigating student loan repayment requires a proactive approach, careful planning, and a commitment to consistent effort. By understanding the factors influencing your repayment speed, exploring various strategies, and building a realistic budget, you can significantly reduce your repayment timeline and achieve your financial aspirations sooner. Remember that seeking professional financial advice can provide personalized guidance tailored to your specific circumstances.

Helpful Answers

What if I can’t afford my monthly payments?

Contact your loan servicer immediately. They may offer forbearance or deferment options, but understand that interest may still accrue during these periods.

Can I pay off my loan early without penalty?

Generally, you can pay off your student loan early without penalty. However, check your loan agreement for any specific clauses.

What’s the difference between refinancing and consolidation?

Refinancing replaces your existing loan with a new one, potentially at a lower interest rate. Consolidation combines multiple loans into a single one, simplifying payments but not necessarily lowering the interest rate.

How does my credit score affect my refinancing options?

A higher credit score typically qualifies you for better interest rates when refinancing your student loans.