Navigating the complexities of student loan interest can feel like deciphering a financial code. Understanding how interest accrues, the impact of different loan types, and available repayment options is crucial for responsible debt management. This guide unravels the intricacies of student loan interest, empowering you to make informed decisions about your financial future. From understanding the difference between fixed and variable rates to exploring strategies for minimizing your overall loan cost, we’ll equip you with the knowledge to navigate this often-confusing landscape.

This exploration will cover various loan types, repayment plans, and strategies for managing your debt effectively. We will examine how interest rates are determined, the implications of deferment and forbearance, and the long-term financial effects of your choices. Ultimately, the goal is to provide you with a clear and comprehensive understanding of how student loan interest works, enabling you to make well-informed decisions.

Types of Student Loans

Choosing the right student loan is crucial for managing your education costs and future finances. Understanding the differences between federal and private loans, along with the various repayment options, is essential for making informed decisions. This section will clarify these key distinctions and provide examples to help you navigate the loan landscape.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government and generally offer more borrower protections than private loans. These protections include income-driven repayment plans, loan forgiveness programs, and deferment options during periods of financial hardship. Private student loans, on the other hand, are offered by banks, credit unions, and other private lenders. They typically require a credit check and a co-signer, and often come with higher interest rates and less flexible repayment options. The terms and conditions of private loans can vary significantly between lenders.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal student loans, allowing borrowers to tailor their payments to their financial situations. These include:

- Standard Repayment Plan: Fixed monthly payments over 10 years.

- Graduated Repayment Plan: Payments start low and gradually increase over time.

- Extended Repayment Plan: Longer repayment period (up to 25 years), resulting in lower monthly payments but higher total interest paid.

- Income-Driven Repayment Plans (IDR): Monthly payments are based on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR).

Choosing the right repayment plan depends on individual circumstances and financial goals. For example, an individual with a high income might prefer the standard repayment plan to pay off their loan quickly, while someone with a lower income might benefit from an IDR plan to manage their monthly payments.

Private Student Loan Terms and Conditions

Private student loans vary greatly in their terms and conditions depending on the lender and the borrower’s creditworthiness. Common features include:

- Variable or Fixed Interest Rates: Variable rates fluctuate with market conditions, while fixed rates remain constant throughout the loan term. Variable rates may offer lower initial payments but carry the risk of increasing over time.

- Loan Fees: Origination fees, late payment fees, and prepayment penalties are common. These fees can significantly increase the overall cost of the loan.

- Repayment Terms: Typically ranging from 5 to 15 years, though longer terms may be available. Longer repayment terms lead to lower monthly payments but higher total interest paid.

- Co-signer Requirements: Many private lenders require a co-signer with good credit, especially for borrowers with limited or no credit history.

For example, a private loan might have a 7% variable interest rate with a 3% origination fee and a 10-year repayment term. This contrasts with a federal loan that may offer a fixed interest rate with no origination fee and a variety of repayment options.

Comparison of Student Loan Types

| Feature | Federal Subsidized Loan | Federal Unsubsidized Loan | Private Student Loan |

|---|---|---|---|

| Interest During School | Government pays interest | Borrower pays interest | Borrower pays interest |

| Credit Check Required | No | No | Yes |

| Repayment Options | Multiple options, including IDR | Multiple options, including IDR | Fewer options, typically fixed term |

| Default Protections | Strong borrower protections | Strong borrower protections | Limited borrower protections |

Interest Rates and Accrual

Understanding how interest rates are determined and how interest accrues on your student loans is crucial for effective financial planning and managing your debt. This section will clarify the mechanics of interest rates and their impact on your overall loan repayment.

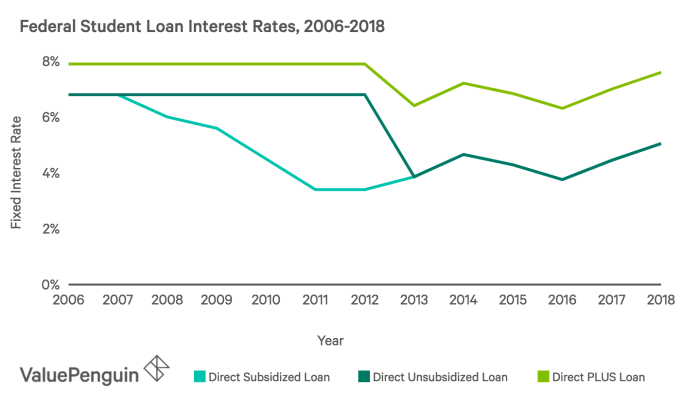

Interest rates on student loans are influenced by several factors. The type of loan (federal or private), the lender, the prevailing market interest rates, and your creditworthiness (for private loans) all play a significant role. Federal student loan interest rates are often set by Congress annually and are generally lower than those offered by private lenders. Private lenders, on the other hand, base their rates on a variety of factors including your credit score, the loan term, and the prevailing market conditions. A higher credit score generally results in a lower interest rate.

Variable vs. Fixed Interest Rates

Variable interest rates fluctuate over the life of the loan, reflecting changes in market interest rates. Fixed interest rates remain constant throughout the loan term, providing predictability in your monthly payments. Choosing between a fixed and variable rate depends on your risk tolerance and financial outlook. A variable rate may offer a lower initial interest rate, but carries the risk of increasing payments if market rates rise. A fixed rate provides stability, but might have a higher initial interest rate compared to a variable rate at the time of loan origination. For example, imagine two loans of $10,000, one with a fixed 5% interest rate and another with a variable rate starting at 4% but potentially rising to 7% over the loan term. The fixed-rate loan will have predictable monthly payments, while the variable-rate loan’s payments could significantly increase depending on market fluctuations.

Interest Accrual During Deferment or Forbearance

During periods of deferment or forbearance, you may not be required to make payments on your student loans. However, interest typically continues to accrue on the loan balance, meaning the amount you owe grows even though you are not making payments. This accumulated interest can significantly increase your overall loan cost over time. The type of deferment or forbearance granted can influence how interest accrues. Some deferment plans may capitalize interest (add it to the principal balance), while others may not. Understanding the terms of your specific deferment or forbearance plan is crucial to avoid unexpected increases in your loan balance.

Impact of Different Interest Rates on Total Loan Cost

Let’s consider a scenario to illustrate the effect of different interest rates. Suppose you have a $20,000 student loan with a 10-year repayment period. With a 5% fixed interest rate, the total interest paid over 10 years would be approximately $6,288. However, if the interest rate were 7%, the total interest paid would increase to approximately $8,972. This represents a difference of nearly $2700 in total interest paid, highlighting the substantial impact even a seemingly small difference in interest rate can have on the overall cost of the loan. A higher interest rate leads to substantially higher total loan repayment costs.

Repayment Methods and Schedules

Understanding your repayment options is crucial for successfully managing your student loans. Choosing the right plan can significantly impact your monthly payments, the total amount you pay over the life of the loan, and your overall financial health. Different plans cater to varying financial situations and repayment preferences.

Several repayment plans are available, each with its own set of advantages and disadvantages. The best plan for you will depend on your income, your loan amount, and your financial goals. Careful consideration of these factors is key to making an informed decision.

Standard Repayment Plan

The Standard Repayment Plan is the most common option. It involves fixed monthly payments over a 10-year period. This plan is straightforward and predictable, allowing for consistent budgeting. However, monthly payments can be relatively high, especially for borrowers with significant loan balances.

Extended Repayment Plan

This plan offers lower monthly payments than the Standard Repayment Plan by extending the repayment period to up to 25 years. This can be beneficial for borrowers with lower incomes or high loan balances who need more manageable monthly payments. However, extending the repayment period increases the total interest paid over the life of the loan.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. This can be helpful for borrowers who anticipate higher incomes in the future. However, it’s important to remember that the later payments will be significantly higher than the initial payments, requiring careful financial planning.

Income-Driven Repayment (IDR) Plans

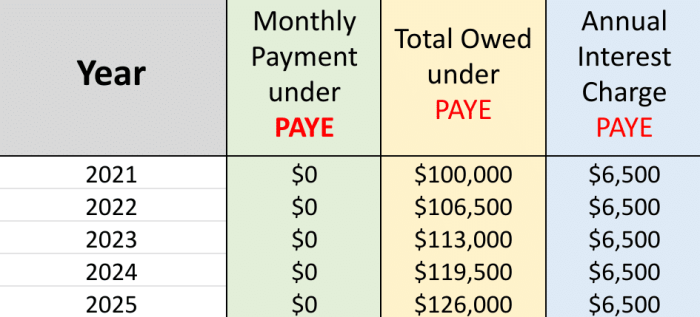

IDR plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, base your monthly payments on your income and family size. These plans offer lower monthly payments, potentially making them more manageable for borrowers with lower incomes. However, they often extend the repayment period, leading to higher total interest payments over the life of the loan. Furthermore, remaining loan balances may be forgiven after 20 or 25 years, depending on the plan, but this forgiveness is considered taxable income.

Choosing a Repayment Plan: A Step-by-Step Guide

- Assess your current financial situation: Consider your income, expenses, and overall debt load. A realistic budget is essential.

- Calculate your potential monthly payments under different plans: Use online loan calculators or contact your loan servicer to determine your monthly payments under each repayment option.

- Compare the total interest paid: While lower monthly payments might seem appealing, remember that extending the repayment period increases the total interest you’ll pay.

- Consider your long-term financial goals: Think about your career trajectory and anticipated income growth. This will help you choose a plan that aligns with your future financial stability.

- Review the terms and conditions of each plan carefully: Understand the implications of forgiveness and potential tax consequences associated with IDR plans.

Repayment Plan Summary

The following table summarizes the key features of each repayment plan:

| Repayment Plan | Repayment Period | Payment Amount | Total Interest Paid | Advantages | Disadvantages |

|---|---|---|---|---|---|

| Standard | 10 years | Fixed, relatively high | Lower than other plans with longer repayment periods | Predictable payments, shorter repayment period | Higher monthly payments |

| Extended | Up to 25 years | Lower than standard | Higher than standard | Lower monthly payments | Longer repayment period, higher total interest |

| Graduated | 10 years | Starts low, increases over time | Moderate | Lower initial payments | Payments significantly increase later |

| Income-Driven (IBR, PAYE, REPAYE) | Up to 20-25 years | Based on income and family size | Potentially high | Lower monthly payments, potential loan forgiveness | Longer repayment period, potential tax implications on forgiven amount |

Loan Consolidation and Refinancing

Managing multiple student loans can be overwhelming, juggling different interest rates, due dates, and lenders. Loan consolidation and refinancing offer potential solutions to simplify this process and potentially save money. However, it’s crucial to understand the nuances of each before making a decision.

Loan consolidation combines multiple federal student loans into a single, new loan with a single monthly payment. This simplifies repayment, but it doesn’t necessarily lower your interest rate. Refinancing, on the other hand, involves replacing your existing student loans (federal or private) with a new loan from a private lender, often at a lower interest rate. This can lead to significant savings over the life of the loan, but it comes with its own set of considerations.

Loan Consolidation Process

The process of consolidating federal student loans typically involves applying through the Federal Student Aid website. You’ll need to provide information about your existing loans and choose a repayment plan. Once approved, your old loans are paid off, and you’ll receive a single new loan with a new interest rate and repayment schedule. The new interest rate will be a weighted average of your existing loans’ rates, so you might not see a significant reduction. Consolidating private loans is generally done through a private lender and involves a similar application process.

Benefits and Drawbacks of Refinancing Student Loans

Refinancing can offer several advantages, primarily the potential for a lower interest rate, resulting in lower monthly payments and reduced total interest paid. It can also simplify repayment by consolidating multiple loans into one. However, refinancing also presents potential drawbacks. You may lose access to federal student loan benefits such as income-driven repayment plans or loan forgiveness programs. Furthermore, if your credit score is low, you may not qualify for a favorable interest rate, or you might face higher fees.

Eligibility Requirements for Loan Consolidation and Refinancing

Eligibility for federal loan consolidation is relatively straightforward; you generally need to have federal student loans in good standing. Refinancing eligibility, however, is more stringent. Private lenders assess your credit score, debt-to-income ratio, and income to determine your eligibility. A higher credit score and a lower debt-to-income ratio generally improve your chances of securing a favorable refinance offer. Lenders may also require a certain level of income to ensure you can afford the new loan payments.

Impact of Consolidation and Refinancing on Overall Borrowing Costs

Consolidation typically doesn’t change the total amount you owe, but it can simplify repayment. Refinancing, however, can significantly alter the overall cost of borrowing. For example, refinancing a $50,000 loan with a 7% interest rate to a 4% interest rate could save thousands of dollars in interest over the life of the loan. However, this is contingent on securing a lower interest rate and maintaining consistent payments. It’s crucial to compare offers from multiple lenders to find the best terms. A lower interest rate may offset any increase in fees associated with the refinancing process. Always carefully review the terms and conditions before committing to a refinance.

Default and its Consequences

Defaulting on student loans is a serious matter with significant long-term financial repercussions. It occurs when a borrower fails to make payments for a specific period, typically 90 days or more, depending on the loan servicer and loan type. This can have a cascading effect on credit scores and future borrowing opportunities.

Defaulting on your student loans triggers a chain of events designed to recover the outstanding debt. The process is not immediate but rather unfolds gradually, starting with delinquency notices and escalating to more serious consequences if payments remain unpaid. Understanding this process is crucial for borrowers facing financial hardship.

The Student Loan Default Process

The process begins with missed payments. After several missed payments, the lender will typically contact the borrower repeatedly through phone calls, emails, and letters. If payments still remain unpaid, the loan is considered delinquent. Delinquency status is reported to credit bureaus, negatively impacting the borrower’s credit score. Continued non-payment eventually leads to the loan being declared in default. At this point, the lender may pursue aggressive collection methods.

Consequences of Student Loan Default

The consequences of student loan default are severe and far-reaching. These consequences can significantly impact a borrower’s financial stability for years to come.

Wage Garnishment

The government can garnish a portion of a borrower’s wages to recover the defaulted loan amount. This means a percentage of their paycheck is automatically deducted and sent to the lender to pay off the debt. The amount garnished depends on state and federal laws, and it can significantly reduce a borrower’s disposable income. For example, a borrower might find 15% or more of their paycheck withheld each month.

Tax Refund Offset

The federal government can also seize a portion or all of a borrower’s tax refund to pay off defaulted student loans. This means the borrower receives a reduced or zero tax refund, and the difference is applied to their outstanding debt. This can be particularly devastating for individuals who rely on their tax refund for essential expenses.

Negative Impact on Credit Score

A student loan default will drastically lower a borrower’s credit score, making it extremely difficult to obtain loans, credit cards, or even rent an apartment in the future. A damaged credit score can hinder major life decisions like buying a car or a house. Rebuilding credit after a default takes considerable time and effort.

Other Consequences

Beyond wage garnishment and tax refund offset, other consequences can include difficulty obtaining professional licenses in certain fields, and limitations on accessing federal benefits and programs. The severity of these additional consequences varies depending on the state and profession.

Resources for Borrowers Facing Hardship

Numerous resources are available for borrowers struggling to make their student loan payments. These resources can help borrowers avoid default and navigate their financial challenges.

Deferment and Forbearance

Deferment and forbearance programs temporarily postpone or reduce student loan payments. These programs are often available to borrowers experiencing financial hardship, such as unemployment or illness. Eligibility requirements and the terms of these programs vary depending on the loan type and lender.

Income-Driven Repayment Plans

Income-driven repayment plans adjust monthly payments based on the borrower’s income and family size. These plans can make student loan payments more manageable for borrowers with lower incomes. Several different income-driven repayment plans exist, each with its own specific eligibility criteria and payment calculation method.

Loan Counseling

Borrowers struggling with student loan payments can benefit from seeking guidance from a loan counselor. These counselors can provide personalized advice, explain available repayment options, and help borrowers develop a plan to manage their debt. Many non-profit organizations and government agencies offer free loan counseling services.

Visual Representation of Student Loan Default and its Repercussions

Imagine a flowchart. The first box would read “Missed Student Loan Payments.” An arrow leads to “Delinquency (Reported to Credit Bureaus).” Another arrow branches from this box to “Default.” From the “Default” box, multiple arrows branch out to represent the consequences: “Wage Garnishment,” “Tax Refund Offset,” “Damaged Credit Score,” and “Limited Access to Future Credit/Opportunities.” Each consequence box could contain a brief description of its impact. This flowchart visually depicts the progression from missed payments to the serious consequences of default.

Government Programs and Subsidies

Navigating the complexities of student loan repayment can be daunting. Fortunately, several federal government programs offer assistance to borrowers facing financial hardship or seeking to manage their debt more effectively. These programs provide various benefits, from reduced monthly payments to loan forgiveness, depending on the borrower’s eligibility and the specific program. Understanding these options is crucial for responsible debt management.

Understanding the eligibility requirements and limitations of each program is key to maximizing their benefits. Careful consideration of individual circumstances is essential to determine which program, if any, is the most suitable.

Income-Driven Repayment (IDR) Plans

Income-Driven Repayment plans adjust your monthly student loan payments based on your income and family size. Several IDR plans exist, each with slightly different eligibility requirements and payment calculation methods. These plans aim to make repayment more manageable for borrowers facing financial challenges. They often lead to loan forgiveness after a set number of qualifying payments.

- Income-Based Repayment (IBR): Generally available to borrowers with Direct Loans. Payment is calculated based on your discretionary income and loan balance.

- Pay As You Earn (PAYE): Also for Direct Loans, PAYE caps your monthly payment at 10% of your discretionary income.

- Revised Pay As You Earn (REPAYE): A broader program including Direct and Federal Family Education Loans (FFEL). Payments are capped at 10% of discretionary income, but can be lower depending on the loan type and balance.

- Income-Contingent Repayment (ICR): Available for both Direct and FFEL loans. Payments are based on your income and family size, and the loan is generally forgiven after 25 years of payments.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program offers complete loan forgiveness for borrowers who work full-time for qualifying government or non-profit organizations and make 120 qualifying monthly payments under an IDR plan. This program is designed to incentivize public service and reward those who dedicate their careers to serving the community.

- Eligibility: Borrowers must work full-time for a qualifying employer and make 120 qualifying monthly payments under an IDR plan. The type of employment and the loan type are crucial factors for eligibility.

- Benefits: Complete loan forgiveness after 120 qualifying payments.

- Limitations: Strict requirements regarding employment and payment plans. Even small discrepancies can jeopardize forgiveness.

Teacher Loan Forgiveness Program

This program provides forgiveness for qualified teachers who have completed five years of full-time teaching in low-income schools or educational service agencies. It aims to attract and retain talented educators in underserved communities.

- Eligibility: Full-time teaching for five consecutive academic years in a low-income school or educational service agency. Specific requirements may vary depending on the state and school district.

- Benefits: Partial loan forgiveness up to $17,500. The amount forgiven depends on the type of loan and the years of service.

- Limitations: Limited to teachers working in specific settings and meeting stringent eligibility criteria. The program requires verification of employment and service.

Closing Notes

Successfully managing student loan debt requires a proactive approach and a thorough understanding of the associated interest. By carefully considering loan types, interest rates, repayment options, and available government programs, you can create a personalized strategy that aligns with your financial goals. Remember, responsible planning and informed decision-making are key to minimizing the long-term impact of student loan debt and achieving financial well-being. Proactive management and a comprehensive understanding are your best allies in this journey.

FAQs

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and eventually, default. Contact your loan servicer immediately if you anticipate difficulties.

Can I deduct student loan interest on my taxes?

Yes, under certain circumstances, you may be able to deduct the interest you paid on your student loans. Check the IRS website for current eligibility requirements.

What is the difference between deferment and forbearance?

Deferment temporarily suspends your payments, while forbearance allows for reduced payments or temporary suspension. Eligibility criteria vary.

How does my credit score affect my interest rate?

A higher credit score generally qualifies you for lower interest rates. Lenders consider your creditworthiness when setting rates.