Navigating the complexities of student loan interest can feel overwhelming, but understanding how it works is crucial for responsible financial management. This guide demystifies the process, exploring various interest types, calculation methods, and strategies to minimize your overall cost. From fixed versus variable rates to the impact of repayment plans and loan forgiveness programs, we’ll equip you with the knowledge to make informed decisions about your student loan debt.

We will delve into the intricacies of interest accrual, examining how daily interest is calculated and the significant influence of your chosen repayment plan. Furthermore, we’ll discuss effective strategies to reduce the total interest paid, including making extra payments and exploring refinancing options. By the end, you’ll have a comprehensive understanding of how interest impacts your student loans and how to effectively manage your debt.

Types of Student Loan Interest

Understanding the different types of interest applied to your student loans is crucial for effective financial planning. The interest rate significantly impacts the total amount you’ll repay, and choosing wisely can save you considerable money over the life of your loan. This section will clarify the key differences between fixed and variable rates and explain the process of interest capitalization.

The primary distinction lies between fixed and variable interest rates. A fixed interest rate remains constant throughout the loan’s repayment period, providing predictability in your monthly payments. A variable interest rate, on the other hand, fluctuates based on an underlying benchmark index, such as the prime rate or LIBOR (although LIBOR is being phased out). This means your monthly payments could increase or decrease over time, depending on market conditions.

Fixed vs. Variable Interest Rates

Choosing between a fixed and variable rate depends on your risk tolerance and financial outlook. A fixed rate offers stability and allows for accurate budgeting, while a variable rate could potentially result in lower payments initially if interest rates are low. However, if interest rates rise, your payments will increase, potentially making repayment more challenging. It’s essential to carefully weigh the pros and cons before making a decision.

Interest Capitalization

Interest capitalization is the process of adding accumulated unpaid interest to the principal loan balance. This typically occurs when you’re in a grace period (a period after graduation before repayment begins) or during periods of deferment or forbearance (temporary pauses in repayment). The capitalized interest increases the total loan amount, leading to higher overall interest payments over the life of the loan. For example, if you have $10,000 in outstanding loan balance and $1,000 in accumulated interest, after capitalization, your new principal balance becomes $11,000. Future interest will then be calculated on this larger amount.

Examples of Interest Rates from Different Lenders

Interest rates vary significantly depending on the lender (federal or private), your creditworthiness, and the type of loan. Federal student loans generally offer lower interest rates than private loans, but private loans may offer more flexible repayment options. The following table provides illustrative examples. Note that these are examples and actual rates may vary.

| Lender | Loan Type | Interest Rate (Example) | Repayment Terms (Example) |

|---|---|---|---|

| Federal Government (Direct Subsidized Loan) | Undergraduate | 4.5% | 10-20 years |

| Federal Government (Direct Unsubsidized Loan) | Graduate | 6.0% | 10-25 years |

| Private Lender A | Undergraduate | 7.0% – 12.0% (Variable) | 5-15 years |

| Private Lender B | Graduate | 8.5% (Fixed) | 10-20 years |

Interest Accrual and Calculation

Understanding how interest accrues on your student loans is crucial for effective repayment planning. The process might seem complex, but it’s based on straightforward calculations applied daily. This section will clarify the mechanics of interest accrual and provide a practical example.

Interest on student loans typically accrues daily, meaning interest is calculated and added to your principal balance each day. This daily interest is then added to the principal, creating a larger balance on which future interest is calculated—a process known as compound interest. This compounding effect means that the longer you take to repay your loan, the more interest you will pay over the life of the loan.

Daily Interest Accrual

The daily interest calculation is a simple process, though the compounding effect can significantly increase the total amount owed over time. The daily interest is calculated by dividing the annual interest rate by 365 (or 366 in a leap year) and multiplying that result by the current principal balance.

Interest Calculation Based on Principal and Interest Rate

The fundamental formula for calculating simple interest is:

Interest = Principal x Rate x Time

. However, with student loans, the time element is broken down into daily increments, leading to daily compounding. The “Rate” in this formula represents the annual interest rate, which needs to be converted to a daily rate for accurate daily calculations. The “Time” is expressed as a fraction of a year (e.g., one day is 1/365 of a year).

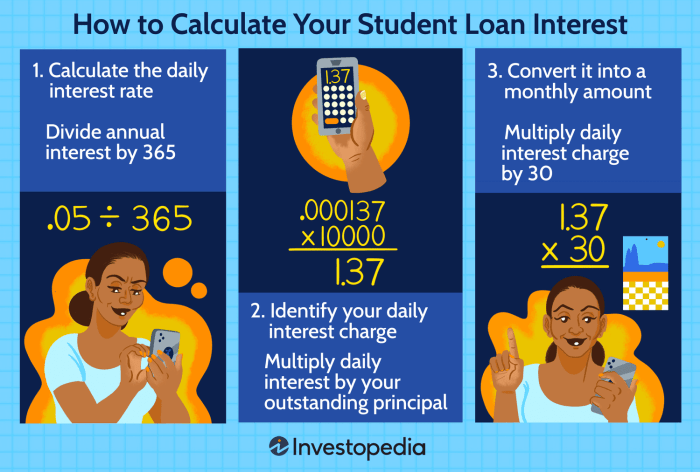

Step-by-Step Interest Calculation Example

Let’s illustrate this with a hypothetical example: Assume a student loan with a principal balance of $10,000 and a fixed annual interest rate of 5%. We’ll calculate the interest accrued over one year.

- Step 1: Calculate the daily interest rate. Divide the annual interest rate by 365: 5% / 365 = 0.0137% (approximately).

- Step 2: Calculate the daily interest. Multiply the daily interest rate by the principal balance: 0.000137 x $10,000 = $1.37 (approximately).

- Step 3: Calculate the interest for the year. Multiply the daily interest by 365: $1.37 x 365 = $500.05. This is the approximate total interest accrued over the year.

- Step 4: Note the compounding effect. While this example shows a simplified calculation, in reality, the daily interest is added to the principal balance each day. Therefore, the interest calculated on subsequent days will be slightly higher because the principal balance increases each day.

It’s important to remember that this is a simplified example. Actual student loan interest calculations may vary slightly depending on the lender and the specific loan terms. Factors such as loan type, repayment plan, and any grace periods will influence the total interest paid.

Impact of Repayment Plans

Choosing a student loan repayment plan significantly impacts the total cost of your loan. Different plans offer varying monthly payments and repayment timelines, directly affecting the amount of interest accrued over the life of the loan. Understanding these differences is crucial for making informed financial decisions.

The total interest paid on a student loan is heavily influenced by the chosen repayment plan. Longer repayment periods generally result in higher total interest costs, while shorter periods lead to higher monthly payments but lower overall interest. Income-driven plans offer lower monthly payments based on income, but they often extend the repayment period, leading to potentially higher total interest payments. Let’s explore how these factors interact.

Comparison of Repayment Plan Effects on Total Interest

The following table illustrates the estimated total interest paid under different repayment plans for a hypothetical $30,000 loan with a 6% fixed interest rate. These figures are estimates and actual amounts may vary based on individual circumstances and lender policies. For example, a standard repayment plan might require a significantly higher monthly payment compared to an income-driven plan, but this higher payment would translate to paying off the loan quicker and thus incurring less interest overall. Conversely, an income-driven plan offers lower monthly payments, but the longer repayment period means you’ll pay more interest in the long run.

| Repayment Plan | Monthly Payment (Estimate) | Total Interest Paid (Estimate) | Total Repayment Time (Years) |

|---|---|---|---|

| Standard | $590 | $15,000 | 10 |

| Graduated | $400 (Initially), increasing over time | $16,000 | 10 |

| Income-Driven (Example: PAYE) | $300 (Based on income, potentially fluctuating) | $20,000 | 20 |

Strategies to Minimize Interest

Minimizing interest payments on student loans is crucial for reducing the overall cost of your education. By strategically managing your repayment, you can significantly decrease the amount you pay over the life of your loan and save thousands of dollars. Several effective strategies exist, each with varying degrees of impact and feasibility. Prioritizing these strategies based on your individual financial situation is key to achieving optimal results.

The most effective strategies involve proactive steps to accelerate principal repayment. This reduces the loan’s principal balance, thereby lessening the amount of interest that accrues. Combining multiple strategies often yields the best outcomes. Remember to always check with your loan servicer before implementing any significant changes to your repayment plan.

High-Interest Loan Prioritization

Prioritizing repayment of loans with the highest interest rates is a highly effective strategy. By focusing your extra payments on these loans first, you’ll save the most money in the long run. Imagine you have two loans: one with a 7% interest rate and another with a 4% interest rate. Every dollar you pay towards the 7% loan saves you more money in interest than the same dollar paid towards the 4% loan. This approach maximizes your return on investment in paying down your debt. You can easily track this using a spreadsheet or dedicated student loan repayment calculator.

Making Extra Payments

Making extra payments, even small ones, can significantly reduce your loan’s lifespan and the total interest paid. These extra payments directly reduce your principal balance, which in turn reduces the base upon which interest is calculated in the following months. For example, if you have a monthly payment of $300, an extra $50 payment each month accelerates your repayment and saves you substantial interest over time. This strategy is particularly effective when combined with high-interest loan prioritization.

Refinancing Student Loans

Refinancing your student loans can potentially lower your interest rate, leading to significant savings. This involves obtaining a new loan with a lower interest rate to pay off your existing loans. However, it’s crucial to carefully compare offers from different lenders and ensure that the new loan terms are favorable. Refinancing may not always be beneficial, particularly if your credit score is low or if the new loan has unfavorable fees. A thorough analysis of your current interest rate and the offered refinancing rate is essential before proceeding.

Income-Driven Repayment Plans

While income-driven repayment plans don’t necessarily accelerate repayment, they can make your monthly payments more manageable. This can prevent you from falling behind on payments, thus avoiding penalties and accruing further interest. These plans adjust your monthly payments based on your income and family size, potentially lowering your monthly payment amount. However, it’s important to understand that these plans often extend the repayment period, leading to a higher total interest paid over the life of the loan. Careful consideration of the long-term implications is necessary.

Understanding Interest Rate Changes

Understanding how interest rates fluctuate is crucial for borrowers with variable-rate student loans. Unlike fixed-rate loans, where the interest rate remains constant throughout the loan term, variable-rate loans are subject to changes based on market conditions. These changes directly impact your monthly payments and the total amount of interest you pay over the life of the loan.

Changes in interest rates directly affect the amount of interest accrued on a variable-rate student loan. When the benchmark interest rate (like the prime rate or LIBOR, depending on the loan) increases, so does your loan’s interest rate. This leads to higher monthly payments and a larger total interest paid over the loan’s duration. Conversely, a decrease in the benchmark rate results in lower monthly payments and reduced total interest. The magnitude of the impact depends on the loan’s initial interest rate, the size of the rate change, and the remaining loan term.

Variable Rate Loan Impact on Monthly Payments

Let’s consider an example. Suppose you have a $20,000 student loan with a variable interest rate initially set at 5%. Your monthly payment might be approximately $220. If the interest rate increases to 7%, your monthly payment could jump to approximately $240, a significant increase. Conversely, if the rate drops to 3%, your monthly payment could decrease to approximately $200. These are approximate figures, and the actual amounts would depend on the specific loan terms and amortization schedule.

Illustrative Representation of Interest Rate Changes and Loan Repayment

Imagine a graph with two lines. The horizontal axis represents time (in years), and the vertical axis represents the remaining loan balance. One line represents a loan with a fixed interest rate, showing a steady decline in the balance over time. The other line represents a loan with a variable interest rate. This line would fluctuate, showing steeper declines during periods of lower interest rates and shallower declines or even temporary increases during periods of higher interest rates. The area between the two lines visually represents the difference in total interest paid between the fixed-rate and variable-rate loans over the life of the loan. The variable-rate line’s fluctuations visually demonstrate the impact of interest rate changes on the loan repayment process. A steeper slope indicates faster repayment due to lower interest rates, while a shallower slope shows slower repayment due to higher interest rates. The difference in the total area under each curve highlights the overall cost difference.

The Role of Loan Forgiveness Programs

Loan forgiveness programs offer a potential lifeline for borrowers struggling with student loan debt, but their impact is complex and varies significantly depending on the specific program and the borrower’s circumstances. These programs can dramatically reduce the total interest paid over the life of a loan by eliminating the remaining principal balance, thus halting further interest accrual. However, they also come with eligibility requirements and potential drawbacks that must be carefully considered.

Loan forgiveness programs can significantly reduce the total interest paid on student loans. By eliminating the principal balance, the need for further interest payments ceases. Consider a borrower with a $50,000 loan at 6% interest. If they successfully qualify for loan forgiveness after 10 years, they will have paid significantly less interest than if they continued to repay the loan over its full term. The exact savings depend on the repayment plan used and the amount of principal paid before forgiveness. The longer the repayment period before forgiveness, the greater the interest savings.

Public Service Loan Forgiveness (PSLF) Program Requirements and Benefits

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on federal Direct Loans after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. A key benefit is the complete elimination of the remaining debt, resulting in substantial interest savings. However, the stringent requirements, including the need for consistent employment and adherence to a specific repayment plan, make it challenging for many borrowers to qualify. Many borrowers have been denied forgiveness due to discrepancies in their repayment plan or employment history. The program has undergone significant changes to address these challenges and improve accessibility, but qualification remains a significant hurdle.

Teacher Loan Forgiveness Program Requirements and Benefits

The Teacher Loan Forgiveness Program provides forgiveness of up to $17,500 on federal Direct Subsidized and Unsubsidized Loans and Stafford Loans for teachers who have completed five years of full-time teaching in a low-income school or educational service agency. This program offers a significant reduction in loan debt and associated interest, benefiting teachers in underserved communities. The requirement of teaching in a low-income school or educational service agency limits eligibility to a specific group of educators.

Income-Driven Repayment Plans and Forgiveness

Several income-driven repayment plans (IDR) offer loan forgiveness after a set number of years (typically 20 or 25 years), based on the borrower’s income and family size. These plans, while offering forgiveness, may result in higher total interest paid over the life of the loan compared to standard repayment plans due to the extended repayment period. However, the lower monthly payments can be more manageable for borrowers with limited income. The amount of forgiveness and total interest paid will vary based on individual income and loan amount. For example, a borrower with a higher income might pay off more of their loan before reaching the forgiveness threshold, resulting in lower overall interest paid compared to a borrower with a lower income.

Limitations and Drawbacks of Loan Forgiveness Programs

Loan forgiveness programs are not without limitations. The stringent eligibility requirements, complex application processes, and potential for delays or denials can create significant challenges for borrowers. Furthermore, forgiven debt may be considered taxable income in some cases, offsetting some of the financial benefits. The potential for changes in program rules and eligibility criteria adds another layer of uncertainty. For example, changes to the PSLF program have resulted in many borrowers needing to reapply or having their progress reset. These factors must be considered carefully before relying on loan forgiveness as a primary debt reduction strategy.

Conclusion

Successfully managing student loan debt requires a proactive approach and a thorough understanding of how interest works. By understanding the different types of interest rates, the impact of repayment plans, and strategies for minimizing interest payments, you can take control of your financial future. Remember, careful planning and informed decision-making are key to navigating the complexities of student loan repayment and achieving long-term financial well-being. This knowledge empowers you to make strategic choices that minimize your overall debt burden and pave the way for a brighter financial future.

Detailed FAQs

What happens if I don’t make my student loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in collection actions.

Can I refinance my federal student loans?

While you can’t refinance federal loans with a private lender, you can consolidate them to potentially simplify payments. Refinancing options exist for private loans.

How often is interest calculated on my student loans?

Interest is typically calculated daily on most student loans.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.