Navigating the complexities of student loan repayment often leaves borrowers wondering about the often-overlooked aspect of interest accrual. Understanding how interest is calculated and applied to your loan is crucial for effective financial planning and minimizing long-term costs. This guide delves into the various methods of interest accrual, exploring the nuances of fixed versus variable rates, in-school versus grace period interest, and the impact of deferment and forbearance. By understanding these factors, you can make informed decisions to manage your student loan debt effectively.

From the initial disbursement of your loan to the final payment, interest steadily accumulates, potentially significantly increasing the total amount you repay. This accumulation isn’t uniform; it’s influenced by your loan type, repayment plan, and even the timing of your payments. This guide aims to clarify these processes, empowering you to take control of your student loan journey and minimize the financial burden.

Types of Student Loan Interest

Understanding the different types of interest applied to student loans is crucial for effective financial planning and responsible repayment. The type of interest significantly impacts the total cost of your education over time. This section will clarify the key differences between fixed and variable interest rates and explain the process of interest capitalization.

Fixed and variable interest rates represent two distinct approaches to calculating the interest charged on student loans. A fixed interest rate remains constant throughout the loan’s life, providing predictable monthly payments. Conversely, a variable interest rate fluctuates based on market conditions, leading to potentially unpredictable payment amounts. The choice between these options influences the overall cost of borrowing and should be carefully considered.

Fixed Interest Rates

With a fixed interest rate, the percentage applied to your principal loan amount remains the same for the duration of the loan repayment period. This predictability makes budgeting and financial planning simpler. Borrowers know exactly how much they will pay each month and can accurately forecast their total repayment cost. This consistency can provide peace of mind, particularly for those on a tight budget.

Variable Interest Rates

A variable interest rate, on the other hand, is tied to an index, such as the prime rate or LIBOR (London Interbank Offered Rate). As this index changes, so does the interest rate on your loan. This can result in lower monthly payments initially if the index falls, but it also carries the risk of higher payments if the index rises. The fluctuation can make long-term financial planning more challenging.

Interest Capitalization

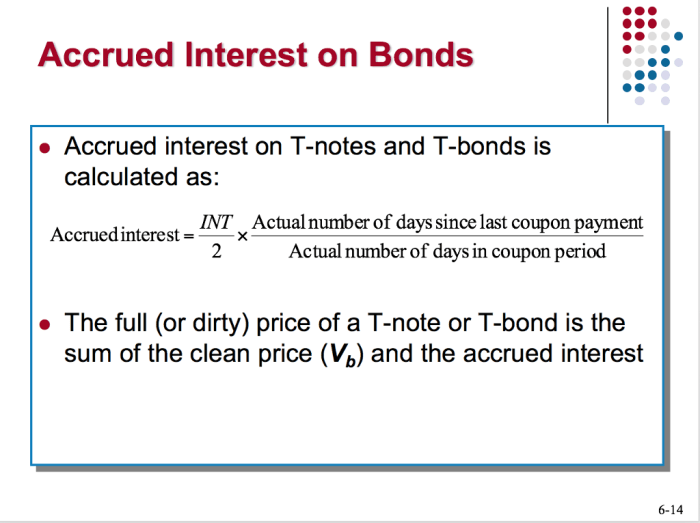

Interest capitalization is the process of adding accrued but unpaid interest to the principal loan balance. This typically occurs when a borrower is in deferment or forbearance, periods where payments are temporarily suspended or reduced. The capitalized interest increases the total loan amount, leading to higher future payments and a greater overall cost of borrowing. Understanding how capitalization works is essential for managing student loan debt effectively.

Examples of Interest Rate Impact

The following table illustrates how different interest rates and loan amounts affect the total interest paid over the life of a loan. These are simplified examples and do not account for factors such as fees or specific repayment plans.

| Loan Type | Interest Rate | Loan Amount | Total Interest Paid (Estimated) |

|---|---|---|---|

| Federal Subsidized Loan | 4.5% (Fixed) | $20,000 | $4,500 (over 10 years) |

| Private Loan | 7% (Fixed) | $20,000 | $7,000 (over 10 years) |

| Private Loan | 6% (Variable, average over 10 years) | $20,000 | $6,000 (over 10 years) |

| Federal Unsubsidized Loan (with capitalization) | 6% (Fixed) | $20,000 (initial) $22,000 (after capitalization) | $7,200 (over 10 years, including impact of capitalization) |

Accrual Methods

Understanding how interest accrues on your student loans is crucial for effective repayment planning. The frequency of interest calculation significantly impacts the total amount you’ll pay over the life of your loan. Different lenders may use varying methods, so it’s essential to know which applies to your specific loan.

Interest accrual on student loans typically follows one of three methods: daily, monthly, or annually. While the underlying principle remains the same – interest is calculated on the outstanding principal balance – the frequency of calculation leads to differences in the final amount owed. The more frequently interest is calculated, the faster the debt grows due to compounding.

Daily Interest Accrual

With daily accrual, interest is calculated each day based on the outstanding principal balance. This daily interest is then added to the principal, increasing the amount on which future interest calculations are based. This method results in the highest total interest paid over the loan’s life due to the constant compounding effect. For example, a $10,000 loan with a 5% annual interest rate would accrue approximately $1.37 in interest daily (5%/365 days). This small amount compounds significantly over time.

Monthly Interest Accrual

Monthly interest accrual calculates interest at the end of each month based on the outstanding principal balance at the beginning of the month. This method is less frequent than daily accrual, leading to slightly lower total interest paid compared to daily accrual, although the difference might be minimal depending on the loan amount and interest rate. Using the same $10,000 loan example with a 5% annual interest rate, approximately $41.67 in interest would accrue each month (5%/12 months * $10,000).

Annual Interest Accrual

Annual interest accrual is the least frequent method, calculating interest only once per year based on the outstanding principal balance at the beginning of the year. This results in the lowest total interest paid among the three methods because compounding occurs less often. Continuing with the example, the annual interest would be $500 (5% * $10,000). However, it’s important to note that annual accrual is less common for student loans.

Impact of Payment Timing on Interest Accrual

The timing of your loan payments significantly influences the total interest you pay. Payments made earlier reduce the principal balance, thus lowering the base amount on which future interest is calculated.

- On-time payments: Consistent, on-time payments minimize the amount of interest accrued over the life of the loan.

- Late payments: Late payments allow interest to accrue on a larger principal balance, increasing the total interest paid.

- Early payments: Making extra payments or paying ahead of schedule significantly reduces the principal and, consequently, the amount of interest accrued. This can save a considerable amount of money over the long term.

- Principal-focused payments: Designating extra payments specifically to reduce the principal balance accelerates loan repayment and minimizes overall interest paid.

In-School vs. Grace Period Interest

Understanding how student loan interest accrues during your studies and the subsequent grace period is crucial for effective financial planning. The way interest accumulates differs significantly between these two phases, impacting the overall loan repayment amount. This section clarifies the distinctions and provides illustrative examples.

Interest accrual on federal student loans typically follows different rules during the in-school period and the grace period. During the in-school period, the rules governing interest capitalization and accrual depend on the loan type. Subsidized loans often do not accrue interest while the borrower is enrolled at least half-time, while unsubsidized loans accrue interest throughout the entire loan period, regardless of enrollment status. The grace period, usually six months after graduation or leaving school, offers a temporary reprieve before repayment begins, but interest may still accrue during this time, depending on the loan type. Failing to understand these differences can lead to unexpected increases in the total amount owed.

In-School Interest Accrual

During the in-school period, the treatment of interest varies considerably based on the loan type. For subsidized federal loans, the government pays the interest while the borrower is enrolled at least half-time and during certain deferment periods. This means that no interest is added to the principal loan balance during these times. Unsubsidized federal loans, however, accrue interest from the moment the loan is disbursed, regardless of the borrower’s enrollment status. This interest is added to the principal, increasing the total loan amount over time. This difference can result in a significantly larger total loan amount upon graduation for borrowers with unsubsidized loans.

Grace Period Interest Accrual

The grace period, typically six months after graduation or leaving school, provides a temporary buffer before loan repayment begins. However, this doesn’t mean interest is waived. For unsubsidized federal loans, interest continues to accrue during the grace period. This means that by the time repayment begins, the principal balance will be higher than the original loan amount. For subsidized federal loans, interest does not accrue during the grace period if it didn’t accrue during the in-school period. Understanding this nuance is crucial to avoiding a larger-than-expected first payment.

Scenario Comparing Interest Paid With and Without In-School Accrual

Let’s consider two scenarios for a $10,000 unsubsidized loan with a 5% annual interest rate.

Scenario 1: Interest accrues during the four-year in-school period. Assuming simple interest calculation for simplification, the interest accrued over four years would be approximately $2,000. The total loan amount at the end of the in-school period would be $12,000.

Scenario 2: A hypothetical situation where interest does not accrue during the four-year in-school period. In this case, the loan amount remains at $10,000 at the end of the four-year period.

The difference in the total interest paid in these two scenarios illustrates the significant impact of in-school interest accrual. In Scenario 1, the borrower starts repayment with a $2,000 higher principal, leading to higher monthly payments and significantly more interest paid over the life of the loan. In Scenario 2, the borrower begins repayment with the original $10,000 principal.

Deferment and Forbearance Impact

Deferment and forbearance are two options available to student loan borrowers who are experiencing temporary financial hardship and are unable to make their scheduled loan payments. While both postpone payments, they have distinct impacts on interest accrual and ultimately, the total amount owed. Understanding these differences is crucial for responsible loan management.

Both deferment and forbearance temporarily suspend your required loan payments. However, the key difference lies in how interest accrues. With deferment, the type of loan determines whether interest accrues. Forbearance, on the other hand, typically results in interest accruing on unsubsidized loans, and sometimes subsidized loans, depending on the lender and the reason for forbearance. This accumulated interest can significantly increase the total loan balance over time.

Interest Accrual During Deferment and Forbearance

During a deferment period, the type of loan determines whether interest accrues. For subsidized federal student loans, the government typically pays the interest while you are in deferment, preventing the interest from being added to your principal balance. Unsubsidized federal loans and most private student loans, however, will accrue interest during a deferment period, adding to the principal balance. This is a crucial distinction and will greatly affect the ultimate cost of the loan. Forbearance, in contrast, usually leads to interest accruing on both subsidized and unsubsidized federal loans, and always on private loans, regardless of the loan type. This accumulated interest is added to the principal balance, increasing the total amount owed.

Circumstances for Granting Deferment or Forbearance

Deferment and forbearance are granted under specific circumstances, often requiring documentation to support the borrower’s claim. Common reasons for deferment include unemployment, graduate school enrollment, or economic hardship. For forbearance, reasons can be more varied and may include temporary financial setbacks, medical emergencies, or natural disasters. The specific eligibility criteria and required documentation will vary depending on the lender (federal or private) and the type of loan. It’s essential to contact your loan servicer to determine eligibility and the application process.

Interest Capitalization During Deferment or Forbearance

Interest capitalization is the process of adding accumulated interest to the principal loan balance. This occurs at the end of a deferment or forbearance period, or sometimes at other specified times determined by the lender. For example, if you have $10,000 in unsubsidized loan debt and accrue $1,000 in interest during a deferment period, capitalization would increase your principal balance to $11,000. This means you’ll now be paying interest on the larger amount ($11,000), leading to higher monthly payments and a greater total cost over the life of the loan. Understanding interest capitalization is vital as it significantly increases the total amount owed and the long-term cost of borrowing. Borrowers should strive to minimize the length of deferment or forbearance periods to limit the impact of interest capitalization.

Repayment Plans and Interest

Choosing the right student loan repayment plan significantly impacts the total amount you’ll pay back, largely due to variations in interest accrual and repayment schedules. Understanding these differences is crucial for minimizing long-term costs. Different plans offer varying monthly payment amounts and repayment periods, directly affecting how much interest accumulates over the life of the loan.

The interplay between repayment plan and interest is complex. A shorter repayment period, while resulting in higher monthly payments, generally leads to less overall interest paid because the principal is reduced faster. Conversely, longer repayment periods, although offering lower monthly payments, often result in significantly higher total interest payments over the life of the loan due to prolonged interest accrual.

Repayment Plan Comparison

The following table compares three common repayment plans: Standard, Graduated, and Extended. Note that specific terms and interest rates can vary depending on the lender and loan type. The figures below are illustrative examples and should not be taken as definitive.

| Repayment Plan | Monthly Payment (Example) | Repayment Period (Example) | Total Interest Paid (Example) |

|---|---|---|---|

| Standard | $500 | 10 years | $6,000 |

| Graduated | $300 (increasing annually) | 10 years | $7,000 |

| Extended | $250 | 25 years | $15,000 |

In this example, the Standard repayment plan, despite having the highest monthly payment, results in the lowest total interest paid. The Graduated plan, with its initially lower payments, ultimately incurs more interest. The Extended plan, while offering the lowest monthly payments, demonstrates the substantial impact of a longer repayment period on total interest costs. This illustrates how a seemingly small difference in monthly payments can accumulate to a large difference in total interest paid over the life of the loan.

Understanding Your Loan Documents

Navigating the complexities of student loan interest requires a thorough understanding of your loan documents. These documents contain crucial information about your interest rate, repayment terms, and overall loan costs. Failing to review these documents carefully can lead to unexpected expenses and difficulties in managing your debt.

Understanding your loan documents is paramount to effectively managing your student loan debt. This includes carefully reviewing your promissory note and regularly checking your loan statements for accuracy. By actively engaging with these documents, you can gain a clearer picture of your interest accrual and make informed decisions about your repayment strategy.

Promissory Note Details Regarding Interest Accrual

The promissory note is a legally binding agreement between you and your lender. It Artikels the terms and conditions of your loan, including the interest rate, repayment schedule, and other important details. Key sections to focus on regarding interest accrual include the stated interest rate (fixed or variable), the calculation method used to determine daily or monthly interest charges, and the specific dates when interest begins accruing (e.g., in-school, grace period, deferment). The note should clearly state whether your interest rate is fixed or variable, the annual percentage rate (APR), and any associated fees. For example, a promissory note might state, “Your interest rate is a fixed 6.8% APR, calculated daily on your outstanding principal balance.” This information allows you to accurately predict your future interest payments.

Interpreting Loan Statements

Your monthly loan statements provide a snapshot of your loan’s current status. These statements detail your outstanding principal balance, the interest accrued during the billing cycle, the total amount due, and any payments made. It’s crucial to review each statement carefully to ensure accuracy and identify any discrepancies. Look for a clear breakdown of the interest charged, showing the daily or monthly interest calculation. For instance, the statement might show a breakdown like: “Principal balance: $10,000; Interest accrued this month: $68; Total payment due: $10068”. Comparing this information to your promissory note helps verify that the interest calculation aligns with the loan agreement. Regularly reviewing these statements allows you to track your progress in paying down your principal and identify any potential errors in interest calculations.

Impact of Loan Consolidation

Consolidating multiple student loans into a single loan can significantly alter your repayment strategy, primarily by impacting your overall interest rate and the way interest accrues. While it often simplifies repayment by reducing the number of monthly payments, the effect on your total interest paid can be complex and depends on several factors. Understanding these factors is crucial to determining if consolidation is the right choice for your financial situation.

Consolidation typically involves taking out a new loan to pay off all your existing student loans. The new loan will have a single interest rate, which is usually a weighted average of your previous loan interest rates. However, this new rate isn’t always lower. In some cases, the new rate may be higher, especially if you have a mix of subsidized and unsubsidized loans or if your credit score has declined since taking out the original loans. The length of the repayment term also plays a significant role; extending the repayment period can lower your monthly payments but ultimately increases the total interest you pay over the life of the loan.

Weighted Average Interest Rate Calculation

The interest rate on a consolidated loan is usually a weighted average of the interest rates of the individual loans being consolidated. This means that loans with larger balances will have a greater influence on the final consolidated interest rate than smaller loans. For example, if you have two loans, one for $10,000 at 5% interest and another for $20,000 at 7% interest, the weighted average interest rate would be calculated as follows: [(10,000 * 0.05) + (20,000 * 0.07)] / (10,000 + 20,000) = 0.06 or 6%. This calculation demonstrates how larger loan balances disproportionately affect the final consolidated rate. This is a simplified example; the actual calculation performed by the lender may be more complex.

Example: Consolidation Benefits and Drawbacks

Let’s consider a scenario with two federal student loans: Loan A: $15,000 at 6% interest, 10-year repayment; Loan B: $10,000 at 4% interest, 10-year repayment. Before consolidation, the borrower would be paying interest on both loans separately. After consolidation, assuming the consolidated loan has a 5% interest rate and a 10-year repayment term, the monthly payments might be slightly lower. However, extending the repayment period to, say, 15 years, while reducing monthly payments, would significantly increase the total interest paid over the life of the loan. The total interest paid on the original loans would be approximately $5,400 (Loan A: $4,500 + Loan B: $900). If the consolidated loan at 5% is repaid over 15 years, the total interest could be considerably higher, potentially exceeding $7,000. This demonstrates how a seemingly lower interest rate combined with a longer repayment period can lead to a substantial increase in overall interest paid.

Interest Paid Before and After Consolidation

| Loan | Original Amount | Interest Rate | Repayment Term (Years) | Total Interest Paid (Estimate) |

|---|---|---|---|---|

| Loan A | $15,000 | 6% | 10 | $4,500 |

| Loan B | $10,000 | 4% | 10 | $900 |

| Consolidated Loan (Scenario 1: 10 years) | $25,000 | 5% | 10 | $6,250 |

| Consolidated Loan (Scenario 2: 15 years) | $25,000 | 5% | 15 | $9,375 |

This table illustrates how the total interest paid can change depending on the terms of the consolidated loan. While Scenario 1 shows a slightly higher total interest compared to the original loans, Scenario 2 demonstrates the significant increase in total interest when the repayment period is extended. It’s crucial to carefully analyze the potential impact of any proposed consolidation before making a decision.

Summary

Successfully managing student loan debt requires a thorough understanding of interest accrual. This guide has explored the key factors influencing how interest accumulates, from the type of loan and repayment plan to the impact of deferment and forbearance. By carefully reviewing your loan documents, understanding the different accrual methods, and making informed decisions about your repayment strategy, you can navigate the complexities of student loan interest and work towards timely and efficient repayment. Remember, proactive engagement with your loan servicer can help resolve any questions or concerns you may have along the way.

Questions Often Asked

What happens if I don’t make my student loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in fees and collection actions.

Can I refinance my student loans to lower my interest rate?

Refinancing is a possibility, but eligibility depends on your credit score and financial situation. Shop around for the best rates before making a decision.

How often does my student loan interest accrue?

Interest typically accrues daily, but the calculation and billing may be done monthly or annually depending on your loan servicer.

What is the difference between deferment and forbearance?

Deferment temporarily suspends payments, sometimes with interest accruing, while forbearance suspends or reduces payments, often with interest accruing.