Navigating the complexities of student loan repayment can feel daunting, especially understanding how interest accrues and impacts your overall debt. This guide demystifies the process of compound interest on student loans, exploring various interest rates, compounding frequencies, and repayment strategies to empower you with the knowledge needed to make informed financial decisions.

Understanding how interest compounds on your student loans is crucial for effective repayment planning. This involves comprehending different interest rate types (fixed vs. variable), the frequency of compounding (daily, monthly, annually), and the impact of interest capitalization. By grasping these concepts, you can better predict your total repayment amount and strategize for a more efficient debt reduction journey.

Types of Student Loan Interest Rates

Understanding the type of interest rate applied to your student loans is crucial, as it significantly impacts the total cost of your education. The two main types are fixed and variable rates, each with its own advantages and disadvantages. Choosing wisely can save you considerable money over the life of your loan.

The primary difference lies in how the interest rate is determined. A fixed interest rate remains constant throughout the loan’s repayment period. This predictability allows for accurate budgeting and repayment planning. Conversely, a variable interest rate fluctuates based on an underlying index, such as the prime rate or LIBOR (although LIBOR is being phased out). This means your monthly payment could increase or decrease over time, making long-term financial projections more challenging.

Fixed Interest Rates

With a fixed interest rate, the percentage you pay on your loan balance stays the same for the entire loan term. This stability makes it easier to create a consistent repayment plan and accurately predict the total amount you will pay over the loan’s lifetime. For example, imagine a $10,000 student loan with a 5% fixed annual interest rate over 10 years. The total interest paid would be predictable, although the exact amount depends on the repayment plan (e.g., simple interest vs. compound interest). A longer repayment period would result in higher total interest paid, even with a fixed rate.

Variable Interest Rates

Variable interest rates are tied to an index, meaning they change periodically based on market conditions. If the index rate rises, so will your interest rate and monthly payment. Conversely, if the index rate falls, your payment may decrease. Let’s consider the same $10,000 loan, but this time with a variable rate that starts at 4% but increases to 6% over the 10-year period due to market fluctuations. The total interest paid would be higher than the fixed rate example if the rate increases significantly, but potentially lower if the rate decreases. The unpredictability makes budgeting more difficult.

Comparison of Fixed and Variable Interest Rates

| Rate Type | Calculation Method | Advantages | Disadvantages |

|---|---|---|---|

| Fixed | A set percentage applied consistently throughout the loan term. | Predictable monthly payments; easier budgeting; provides financial certainty. | May offer a slightly higher initial interest rate compared to variable rates. |

| Variable | Interest rate fluctuates based on an underlying index. | Potentially lower initial interest rate; may result in lower total interest paid if index rates decline. | Unpredictable monthly payments; more difficult budgeting; potential for significantly higher total interest paid if index rates rise. |

Compounding Frequency

The frequency with which interest is compounded significantly impacts the total interest accrued on a student loan. Understanding the differences between daily, monthly, and annual compounding is crucial for borrowers to accurately assess the true cost of their loan. More frequent compounding leads to higher overall interest payments.

The interest calculation for each compounding frequency involves applying the interest rate to the principal balance over the specified period. This process is repeated for each compounding period throughout the loan term, with the accumulated interest added to the principal balance before the next interest calculation. This is known as compound interest, where interest earns interest.

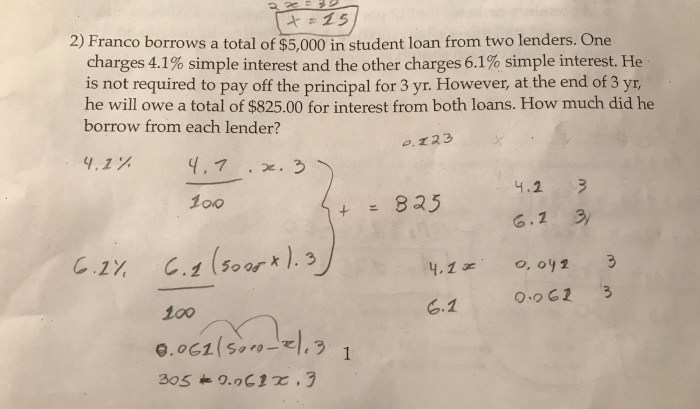

Daily Compounding

With daily compounding, the interest is calculated and added to the principal balance each day. This results in the most frequent compounding and, consequently, the highest total interest paid over the loan’s lifetime. The daily interest rate is calculated by dividing the annual interest rate by 365 (or 366 in a leap year). This daily rate is then multiplied by the outstanding principal balance each day to determine the daily interest accrued. For example, consider a $10,000 loan with a 5% annual interest rate compounded daily. The daily interest rate would be approximately 0.05/365 = 0.000137. The interest accrued on the first day would be $10,000 * 0.000137 = $1.37. This process is repeated for each day of the loan term. The daily interest is added to the principal, and the next day’s interest is calculated on this slightly larger amount.

Monthly Compounding

Monthly compounding calculates and adds interest to the principal balance at the end of each month. The monthly interest rate is calculated by dividing the annual interest rate by 12. Using the same $10,000 loan with a 5% annual interest rate, the monthly interest rate would be 0.05/12 = 0.004167. The interest accrued in the first month would be $10,000 * 0.004167 = $41.67. This amount is added to the principal, and the next month’s interest is calculated on the new balance.

Annual Compounding

Annual compounding is the least frequent method. Interest is calculated and added to the principal only once a year. The annual interest rate is applied directly to the principal balance at the end of each year. For our example, the interest accrued in the first year would be $10,000 * 0.05 = $500. This $500 is added to the principal balance, and the next year’s interest is calculated on this increased amount.

Visual Representation of Interest Accrual

Imagine three bar graphs, each representing the total interest paid over the life of a $10,000 loan with a 5% annual interest rate. The first bar represents daily compounding, showing the tallest bar, indicating the highest total interest paid. The second bar represents monthly compounding, shorter than the daily compounding bar but taller than the annual compounding bar. The third bar, representing annual compounding, is the shortest, indicating the lowest total interest paid. The differences in bar heights visually demonstrate the significant impact of compounding frequency on the total interest accrued. The visual clearly shows that more frequent compounding leads to substantially higher total interest payments over the loan’s lifespan.

Capitalization of Interest

Interest capitalization on student loans is a process where accumulated unpaid interest is added to the principal loan balance. This effectively increases the amount you owe, leading to higher future interest payments and a longer repayment period. Understanding how capitalization works is crucial for effectively managing your student loan debt.

Interest capitalization occurs when your loan enters a period of deferment, forbearance, or grace period, during which you’re not required to make payments. During these periods, interest continues to accrue on your loan. When the period ends, this accumulated interest is capitalized—added to your principal balance. This new, larger principal balance then accrues interest at your loan’s interest rate. The impact of capitalization is cumulative; each time interest is capitalized, the subsequent interest payments grow larger. This can significantly increase the total cost of your loan over its lifetime.

Interest Capitalization Example

Let’s illustrate with an example. Suppose you have a $10,000 student loan with a 5% annual interest rate. You enter a one-year deferment period. During that year, the interest accrued is $500 ($10,000 x 0.05). At the end of the deferment, this $500 is capitalized, increasing your principal balance to $10,500. Your subsequent monthly payments will now be calculated based on this higher principal, resulting in higher overall interest payments throughout the life of the loan. If you continue to defer, this process repeats, exponentially increasing the total loan cost.

Calculating the Impact of Interest Capitalization

Calculating the precise impact of interest capitalization requires understanding the specifics of your loan. However, a simplified approach can illustrate the effect.

A step-by-step guide:

1. Determine the interest accrued: Calculate the interest accrued during the deferment, forbearance, or grace period. This typically involves multiplying the outstanding principal balance by the daily or monthly interest rate and the number of days or months in the period. The formula for simple interest is: Interest = Principal x Rate x Time.

2. Add the accrued interest to the principal: Add the calculated interest to your current principal balance. This becomes your new principal balance.

3. Calculate future payments: Use a loan amortization calculator or your loan servicer’s website to determine how your monthly payments and total interest paid will change with this increased principal. This will show the impact of capitalization on your overall loan cost.

It’s important to note that the exact calculation can be complex, depending on the loan’s terms and the frequency of compounding. Using a loan amortization calculator or consulting your loan servicer is recommended for accurate calculations.

Impact of Repayment Plans

Choosing the right student loan repayment plan significantly impacts the total cost of your education. Different plans offer varying monthly payment amounts and repayment timelines, directly affecting the total interest accrued over the life of the loan. Understanding these differences is crucial for making informed financial decisions.

Different repayment plans offer distinct advantages and disadvantages depending on your individual financial circumstances and long-term goals. The standard repayment plan provides the shortest repayment period, minimizing the total interest paid but potentially resulting in higher monthly payments. Conversely, income-driven repayment plans offer lower monthly payments, but often extend the repayment period, leading to higher total interest paid over time. Graduated repayment plans offer a compromise, starting with lower payments that gradually increase.

Repayment Plan Comparison

The following table illustrates the differences between three common repayment plans: Standard, Graduated, and Income-Driven (using a simplified example of a $30,000 loan at a fixed 5% interest rate). Note that actual payments and interest will vary based on loan amount, interest rate, and individual circumstances. Income-driven repayment plans require specific income documentation and calculations which are beyond the scope of this simple illustration. This example uses a simplified income-driven plan for illustrative purposes only.

| Repayment Plan | Monthly Payment | Total Interest Paid | Loan Payoff Time |

|---|---|---|---|

| Standard | $590 | $10,000 (approx.) | 60 months |

| Graduated | $450 (initially), increasing gradually | $12,000 (approx.) | 72 months (approx.) |

| Income-Driven (Simplified Example) | $300 (approx.) | $18,000 (approx.) | 120 months (approx.) |

Long-Term Financial Implications

Selecting a repayment plan has significant long-term financial implications. The standard plan, while resulting in the lowest total interest paid, may present a challenge for borrowers with limited immediate income. This could lead to financial strain and potentially impact credit scores if payments are missed. Conversely, while income-driven plans provide immediate financial relief through lower monthly payments, they significantly increase the total interest paid, delaying the payoff and potentially accumulating a larger debt burden over time. Graduated plans offer a middle ground but still may result in higher total interest compared to the standard plan. The optimal choice depends on a careful consideration of individual financial circumstances, risk tolerance, and long-term financial goals. For example, a borrower prioritizing early debt elimination might opt for the standard plan, while one prioritizing immediate affordability might choose an income-driven plan. Careful budgeting and financial planning are crucial regardless of the repayment plan chosen.

Factors Influencing Interest Rates

Several key factors interact to determine the interest rate you’ll pay on your student loans. Understanding these factors can help you make informed decisions and potentially secure a more favorable rate. These factors are not always equally weighted, and the precise impact can vary between lenders and loan programs.

The interest rate you receive is a reflection of the lender’s assessment of your risk. A higher perceived risk translates to a higher interest rate to compensate the lender for the increased chance of default. Conversely, a lower risk profile allows for a lower interest rate.

Credit History

A strong credit history significantly impacts your interest rate. Lenders use your credit score and history to gauge your creditworthiness. A higher credit score, demonstrating responsible borrowing and repayment behavior, typically qualifies you for lower interest rates. Conversely, a lower credit score or a lack of credit history often leads to higher rates or even loan denial. Lenders view individuals with a proven track record of managing debt effectively as less risky borrowers. For example, a borrower with a high credit score and a history of on-time payments on credit cards and other loans might qualify for a federal student loan with a significantly lower interest rate compared to a borrower with a poor credit history or no credit history.

Loan Type

Different types of student loans carry different interest rates. Federal student loans, backed by the government, generally have lower interest rates than private student loans. Within federal loans, the interest rate may vary based on the loan program (e.g., subsidized vs. unsubsidized loans). Private student loans, on the other hand, are offered by banks and credit unions and typically have variable interest rates that fluctuate based on market conditions. These rates are often influenced by the borrower’s creditworthiness and the lender’s risk assessment. The interest rate for a subsidized federal loan, for example, might be significantly lower than the rate for a private loan, reflecting the lower risk associated with government-backed loans.

School Type

The type of school you attend can indirectly influence your interest rate. Students attending graduate programs often face higher interest rates than undergraduate students, reflecting the generally higher loan amounts and potentially increased risk associated with graduate-level borrowing. Furthermore, the reputation and accreditation of the institution can sometimes influence lender perceptions of risk. While not a direct determinant, a student borrowing for a program at a prestigious and well-established institution might, in some cases, receive slightly better rates than a student borrowing for a program at a lesser-known institution. This is because lenders might perceive a lower risk of default for graduates of reputable institutions.

Strategies for Securing a Lower Interest Rate

Before listing strategies, it is important to remember that securing the lowest possible interest rate involves proactive steps taken well in advance of applying for student loans.

- Maintain a good credit score: A high credit score is a significant factor in obtaining favorable interest rates.

- Explore federal student loan options: Federal loans typically offer lower interest rates than private loans.

- Shop around for private loans: Compare interest rates from multiple private lenders to find the best deal.

- Consider a co-signer: A co-signer with good credit can help secure a lower interest rate.

- Maintain a low debt-to-income ratio: A lower debt-to-income ratio demonstrates responsible financial management.

- Graduate with minimal debt: Borrowing only what is absolutely necessary can improve your ability to manage repayments.

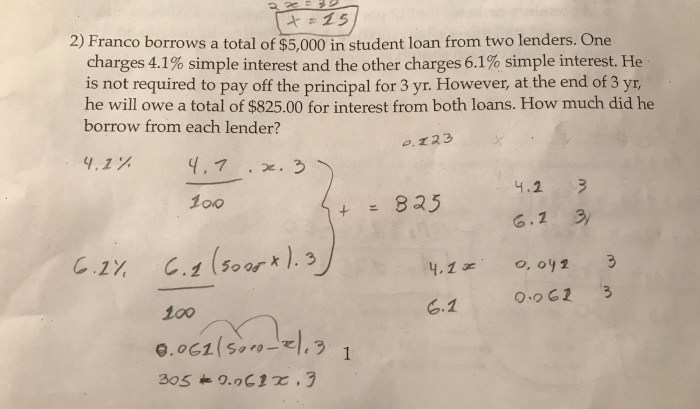

Calculating Total Interest Paid

Understanding how much interest you’ll pay on your student loan is crucial for effective financial planning. This section Artikels a method for calculating total interest paid and illustrates it with a practical example. Accurate calculation requires understanding the loan’s terms and the compounding process.

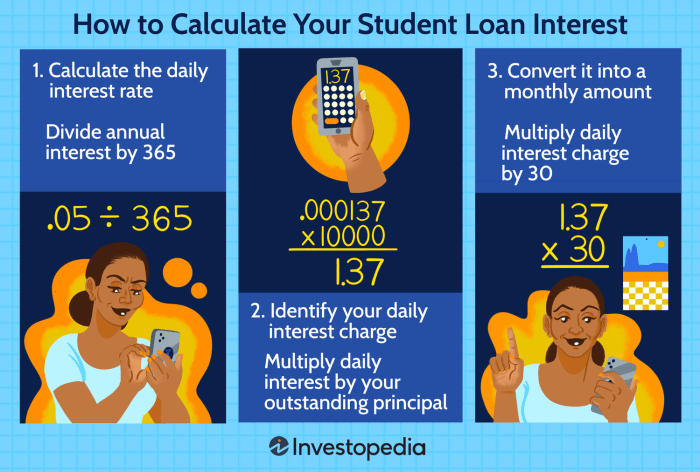

Calculating the total interest paid on a student loan involves several steps. First, you need to know the loan’s principal amount, interest rate, repayment period, and compounding frequency. Then, you can use an amortization schedule (or a loan calculator) to determine the interest paid over the loan’s lifetime. A simplified method, though less precise than a full amortization schedule, involves calculating the total amount repaid and subtracting the principal.

Loan Amortization Schedule Calculation

A loan amortization schedule provides a detailed breakdown of each payment, showing how much goes towards principal and how much goes towards interest. This allows for precise calculation of total interest paid. The formula itself is complex and best handled by financial calculators or spreadsheet software. However, the basic principle is that each payment first covers the accrued interest, and the remaining amount reduces the principal.

Hypothetical Loan Scenario and Calculation

Let’s consider a hypothetical student loan with the following parameters:

* Principal: $20,000

* Annual Interest Rate: 6%

* Repayment Period: 10 years (120 months)

* Monthly Payment: $222.04 (This is calculated using a standard loan amortization formula)

Using a loan amortization calculator (many free online calculators are available), we can generate the following simplified amortization schedule:

| Payment Number | Beginning Balance | Payment Amount | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $20,000.00 | $222.04 | $100.00 | $122.04 | $19,877.96 |

| 2 | $19,877.96 | $222.04 | $99.39 | $122.65 | $19,755.31 |

| 3 | $19,755.31 | $222.04 | $98.78 | $123.26 | $19,632.05 |

| … | … | … | … | … | … |

| 120 | $0.00 | $222.04 | $0.00 | $222.04 | $0.00 |

Note: This is a simplified representation. A full amortization schedule would include 120 rows. The total interest paid over the 10-year period, calculated using a full amortization schedule, would be approximately $4,644.80. This is found by summing the “Interest Paid” column for all 120 payments.

Final Conclusion

Successfully managing student loan debt requires a thorough understanding of how interest is compounded. By analyzing the interplay between interest rates, compounding frequencies, repayment plans, and capitalization, you can develop a comprehensive repayment strategy tailored to your individual circumstances. Remember to proactively monitor your loan details and explore available options to minimize your overall interest burden and accelerate your path to financial freedom.

Questions and Answers

What happens if I make extra payments on my student loan?

Extra payments reduce your principal balance, lowering the amount of interest accrued over time and potentially shortening your repayment period.

Can I refinance my student loans to a lower interest rate?

Yes, refinancing might offer a lower interest rate, but it depends on your credit score and current market rates. Carefully compare offers before refinancing.

What is the difference between simple and compound interest?

Simple interest is calculated only on the principal amount, while compound interest is calculated on the principal plus accumulated interest, leading to faster growth of the debt.

How does my credit score affect my student loan interest rate?

A higher credit score typically qualifies you for a lower interest rate, as lenders perceive you as a lower risk.