Navigating the complexities of student loan repayment can feel overwhelming, especially when considering deferment options. Understanding how long you can defer your student loans is crucial for responsible financial planning. This guide explores the various factors influencing deferment periods for both federal and private loans, helping you make informed decisions about your repayment strategy.

From understanding eligibility requirements and the application process to analyzing the long-term financial implications of deferment, we aim to provide a comprehensive overview. We’ll also examine alternatives to deferment, such as forbearance and income-driven repayment plans, to offer a holistic perspective on managing your student loan debt.

Federal Student Loan Deferment

Deferment allows eligible borrowers to temporarily postpone their student loan payments. Understanding the different types of deferments and their eligibility requirements is crucial for managing your student loan debt effectively. This section details the various federal student loan deferment options and the application process.

Types of Federal Student Loan Deferments

Several types of deferments are available for federal student loans, each with specific eligibility criteria. These deferments provide temporary relief from loan repayment, but interest may still accrue on unsubsidized loans during the deferment period.

Economic Hardship Deferment

This deferment is available to borrowers experiencing temporary economic hardship. To qualify, you must demonstrate an inability to make your loan payments due to circumstances such as unemployment, reduced income, or medical expenses. Documentation supporting your claim of economic hardship will be required. The deferment period is typically granted for a period of up to 12 months, with the possibility of extension under certain circumstances.

Unemployment Deferment

Borrowers who are unemployed and actively seeking employment may be eligible for an unemployment deferment. Proof of unemployment, such as a termination letter or unemployment benefits documentation, is usually required. Similar to the economic hardship deferment, the initial period is typically up to 12 months, with potential for extension.

Graduate Fellowship Deferment

This deferment is specifically designed for students enrolled in a graduate fellowship program. Proof of enrollment in a full-time graduate fellowship program is necessary to qualify. The deferment period generally covers the duration of the fellowship program.

In-School Deferment

This deferment applies to students enrolled at least half-time in an eligible degree or certificate program. Enrollment verification from the educational institution is required. The deferment continues as long as the borrower remains enrolled at least half-time.

Applying for a Federal Student Loan Deferment

The application process typically involves these steps:

1. Gather necessary documentation: This includes proof of eligibility (e.g., unemployment documentation, enrollment verification, etc.).

2. Complete the deferment application: This is usually done online through the loan servicer’s website. The specific forms and processes may vary depending on your loan servicer.

3. Submit the application and supporting documentation: Ensure all required information is complete and accurate to avoid delays.

4. Monitor your loan account: After submitting your application, keep an eye on your loan account online to track the status of your request.

Deferment Period Lengths

The length of a deferment varies depending on the type of deferment and the individual circumstances. Note that extensions may be possible in certain situations, subject to the loan servicer’s approval.

| Deferment Type | Maximum Initial Period | Possible Extensions | Interest Accrual (Unsubsidized Loans) |

|---|---|---|---|

| Economic Hardship | 12 months | Possible | Yes |

| Unemployment | 12 months | Possible | Yes |

| Graduate Fellowship | Duration of Fellowship | Generally not applicable | Yes |

| In-School | Duration of Enrollment | Automatically renewed while enrolled | Yes (for unsubsidized loans) |

Private Student Loan Deferment

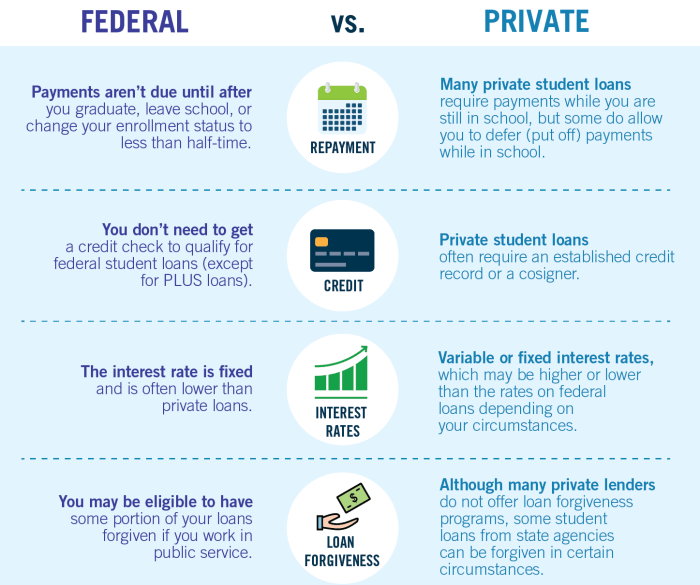

Unlike federal student loans, private student loans don’t offer a standardized deferment program mandated by the government. The availability and terms of deferment for private student loans vary significantly depending on the lender and the specific loan agreement. Understanding these differences is crucial for borrowers to manage their repayment effectively during times of financial hardship.

Private student loan deferment options are determined solely by the individual lender. This contrasts sharply with federal student loans, which offer specific deferment programs based on qualifying circumstances such as unemployment or enrollment in school. The process, eligibility requirements, and potential impact on credit scores differ substantially. Borrowers should carefully review their loan agreements and contact their lender directly to understand their specific options.

Differences Between Federal and Private Student Loan Deferment

Federal student loan deferment programs provide a structured framework with clearly defined eligibility criteria and processes. These programs often offer forbearance as an alternative option, while private lenders may not provide such flexibility. Federal deferments generally don’t negatively impact credit scores, whereas private loan deferments frequently do. Furthermore, federal deferments may offer interest subsidies during the deferment period, whereas private lenders rarely do, leading to a larger overall loan balance upon resumption of payments.

Private Lender Deferment Processes

The process for obtaining a deferment varies considerably among private lenders. Some lenders may have online portals where borrowers can submit a deferment request, while others may require submitting a paper application with supporting documentation. The required documentation can range from proof of unemployment to medical bills, depending on the lender’s specific requirements and the reason for the deferment request. Contacting the lender directly is essential to determine the specific process and required documents. It’s crucial to start the process well in advance of the payment due date to avoid late fees and negative impacts on credit scores.

Impact of Deferment on Credit Scores for Private Loans

A private student loan deferment will typically negatively affect your credit score. This is because deferment indicates to credit bureaus that you are not making timely payments on your debt. The severity of the negative impact depends on factors such as your credit history, the length of the deferment period, and your overall credit utilization. While a short-term deferment might have a minimal impact, a prolonged deferment can significantly lower your credit score, potentially making it harder to secure future loans or obtain favorable interest rates. It’s important to weigh the benefits of deferment against the potential negative impact on your credit. For example, a borrower with a high credit score might choose to make minimum payments even if struggling financially to avoid a substantial credit score drop, while a borrower with a lower credit score may prioritize the immediate financial relief of a deferment.

Applying for a Private Loan Deferment: A Flowchart

The following describes a generalized flowchart, as the specific steps may vary depending on the lender.

[Imagine a flowchart here. The flowchart would begin with “Contact your lender.” The next step would be “Determine eligibility requirements and needed documentation.” This would branch to “Meet requirements?” with a “Yes” branch leading to “Submit application,” and a “No” branch leading to “Explore alternative options (e.g., forbearance, repayment plan).” The “Submit application” branch would lead to “Application approved?” with a “Yes” branch leading to “Deferment granted,” and a “No” branch leading to “Appeal or explore alternative options.” The “Deferment granted” branch would end the flowchart, while the “Appeal or explore alternative options” branch would loop back to “Explore alternative options.”]

Factors Affecting Deferment Length

The length of a student loan deferment isn’t fixed; it depends on several interacting factors related to the type of loan, the borrower’s circumstances, and the lender’s policies. Understanding these factors is crucial for borrowers seeking deferment, as it impacts their repayment schedule and overall financial planning. The duration can range from a few months to several years, depending on the circumstances.

The primary factors influencing deferment length fall into several key categories: the type of loan (federal vs. private), the reason for the deferment request, and the lender’s specific policies. Federal loans, for example, generally offer more standardized deferment options and eligibility criteria compared to private loans, where the terms are often determined on a case-by-case basis by the lender.

Types of Deferments and Their Duration

Federal student loan deferments are categorized by reason, such as economic hardship or unemployment. Each category typically has a defined maximum deferment period. For instance, unemployment deferments might be limited to a specific number of months within a given timeframe, while economic hardship deferments might have a longer duration but require documentation of financial difficulties. Private loan deferment periods vary greatly; some lenders may offer deferments for a limited time, while others may be more flexible, especially if the borrower has a strong history of on-time payments.

Economic Hardship and its Impact on Deferment Length

Economic hardship is a common reason for seeking a deferment. This typically involves demonstrating a significant reduction in income or an unexpected financial burden. The required documentation might include tax returns, pay stubs, or proof of significant medical expenses. The length of the deferment granted under economic hardship is often dependent on the severity and duration of the hardship, as assessed by the lender. A prolonged period of unemployment or a significant unexpected expense like a major home repair could potentially qualify for a longer deferment than a temporary dip in income.

Medical Reasons for Extended Deferments

Serious illness or injury can significantly impact a borrower’s ability to repay their student loans. Medical deferments often require documentation from a physician or other healthcare professional confirming the severity and duration of the illness or injury. The length of the deferment granted is usually tied to the expected recovery time or the duration of the medical treatment. For example, a serious illness requiring extensive rehabilitation could justify a longer deferment than a short-term injury requiring minimal treatment.

Circumstances Affecting Deferment Length

The following list illustrates situations that can either extend or shorten a deferment period:

- Extending Deferment: Severe and prolonged illness requiring extensive medical care; job loss resulting in prolonged unemployment; natural disaster causing significant financial hardship; birth or adoption of a child leading to significant financial strain; active duty military service.

- Shortening Deferment: Improved financial circumstances during a deferment period; failure to provide required documentation to support the deferment request; a deferment exceeding the lender’s maximum allowable period; early repayment of the loan.

Consequences of Deferment

Deferring student loans, while offering temporary relief, carries significant financial implications that can impact borrowers for years to come. Understanding these consequences is crucial for making informed decisions about loan management. The primary concern is the accumulation of interest, which can substantially increase the total loan amount owed. Beyond this immediate impact, deferment can also affect future repayment plans and overall financial stability.

Interest Accrual During Deferment

During a deferment period, while payments are suspended, interest continues to accrue on most federal and many private student loans. This means that the principal loan amount increases over time, leading to a larger total debt at the end of the deferment period. This added interest can significantly lengthen the repayment period and increase the total cost of the loan. The longer the deferment, the greater the interest burden. For example, a $20,000 loan with a 6% interest rate accruing interest only for a year will accumulate $1200 in interest ($20,000 x 0.06). This added $1200 becomes part of the principal, meaning that future interest will be calculated on $21,200.

Long-Term Financial Effects of Deferment

The long-term financial consequences of deferring student loans can be substantial. Extended deferment periods can lead to a significantly larger overall debt, requiring higher monthly payments during repayment. This can strain borrowers’ budgets, potentially delaying major financial goals like homeownership, saving for retirement, or investing. Furthermore, a large student loan debt can negatively impact credit scores, making it more difficult to secure loans for other purposes in the future. The accumulated interest can easily dwarf the initial loan amount, leading to a prolonged period of financial stress. For instance, a borrower who defers their loan for several years might find their total debt has doubled or even tripled by the time repayment begins.

Impact on Future Repayment Plans

The length of a deferment period can directly influence the repayment plan options available to borrowers. Longer deferments often result in a higher total loan amount, making it more challenging to qualify for income-driven repayment plans that cap monthly payments at a percentage of income. Additionally, deferment can push back the timeline for loan forgiveness programs, as these often require a certain number of qualifying payments. In some cases, borrowers may find themselves needing to extend their repayment terms to manage the increased debt load, resulting in higher overall interest payments.

Example Calculation of Accrued Interest

Let’s consider a hypothetical scenario: A student has a federal unsubsidized loan of $15,000 with a 4.5% annual interest rate. They defer their loan for two years. During this deferment, no payments are made, but interest accrues. The interest accrued during the first year would be $675 ($15,000 x 0.045). This amount is added to the principal, increasing the loan balance to $15,675. In the second year, interest accrues on this new balance, resulting in an additional $705.38 ($15,675 x 0.045). After two years of deferment, the total amount owed would be $16,380.38 ($15,000 + $675 + $705.38). This illustrates how quickly interest can accumulate, even with a relatively low interest rate.

Alternatives to Deferment

Deferment, while offering temporary relief from student loan payments, isn’t always the best solution. It can postpone, but not eliminate, your debt, and interest may still accrue on unsubsidized loans. Fortunately, several alternatives exist, each with its own set of benefits and drawbacks. Choosing the right option depends on your individual financial situation and loan type.

Forbearance

Forbearance is another option that temporarily suspends or reduces your student loan payments. Unlike deferment, forbearance is typically granted at the lender’s discretion and is often used for shorter periods. While it provides immediate relief from payments, it usually results in accumulating interest, which is added to your principal balance, increasing the total amount you ultimately owe. This can lead to a larger overall debt burden compared to deferment, particularly for unsubsidized loans.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. These plans are designed to make student loan repayment more manageable, especially during periods of low income. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). The key advantage is lower monthly payments, making them more affordable. However, IDR plans typically extend the repayment period significantly, leading to higher overall interest payments compared to standard repayment plans. Also, any remaining balance after a set period (usually 20 or 25 years) might be forgiven, but this forgiven amount is considered taxable income.

Comparison of Alternatives

Understanding the differences between deferment, forbearance, and income-driven repayment is crucial for making informed decisions. The following table summarizes key features:

| Feature | Deferment | Forbearance | Income-Driven Repayment |

|---|---|---|---|

| Payment Status | Temporarily suspended | Temporarily suspended or reduced | Adjusted based on income |

| Interest Accrual (Unsubsidized Loans) | Accrues | Accrues | Accrues |

| Interest Accrual (Subsidized Loans) | Does not accrue (Federal) | Accrues | Accrues |

| Eligibility | Specific criteria must be met | Lender’s discretion | Based on income and family size |

| Loan Type | Federal and some private | Federal and private | Primarily Federal |

| Repayment Period | Extended | Extended | Extended (potentially 20-25 years) |

Resources for Further Information

Borrowers seeking more information on these options should consult the following resources:

* Federal Student Aid (FSA): The official website for federal student aid provides comprehensive information on deferment, forbearance, and income-driven repayment plans.

* Your Loan Servicer: Contact your loan servicer directly for personalized guidance and information specific to your loans. They can explain your options and help you determine the best course of action.

* National Student Loan Data System (NSLDS): This system provides access to your federal student loan information, including your loan servicer contact information.

Forbearance vs. Deferment

Both forbearance and deferment offer temporary pauses on student loan payments, but they differ significantly in their impact on your loan and your credit score. Understanding these differences is crucial for making informed decisions about managing your student loan debt. Choosing the right option depends heavily on your individual circumstances and financial goals.

Forbearance and deferment are both ways to temporarily postpone your student loan payments, providing relief during periods of financial hardship. However, they operate differently and have distinct consequences. Deferment is generally preferred as it often involves no interest accrual on subsidized federal loans, unlike forbearance.

Key Differences Between Forbearance and Deferment

Deferment and forbearance are distinct options for pausing student loan payments. Deferment is generally a more favorable option, particularly for federal student loans, as it often prevents interest from accruing on subsidized loans. Forbearance, while offering payment flexibility, usually results in accumulating interest, leading to a larger overall loan balance. The eligibility criteria also differ, with deferment often having stricter requirements.

Situations Where Forbearance Might Be a Better Option Than Deferment

While deferment is often the preferred option, forbearance may be a better choice in specific situations. For instance, if you have unsubsidized federal loans or private student loans, the interest will accrue regardless of deferment. In such cases, forbearance might be a more practical option, allowing you to temporarily stop payments while strategically managing the accruing interest. Another situation where forbearance might be advantageous is when you don’t meet the eligibility requirements for deferment. It provides a temporary reprieve even when deferment isn’t available.

Visual Representation of Forbearance vs. Deferment

Imagine two parallel lines representing the growth of your loan balance over time. For the “Deferment” line, the line would remain relatively flat during the deferment period, possibly even slightly decreasing if you have subsidized loans. After the deferment period, the line would resume its upward slope. The “Forbearance” line, however, would continue to rise during the forbearance period, reflecting the accumulating interest. The steeper the slope, the higher the interest rate. After the forbearance period, the line would continue its upward trajectory from the higher point. The visual clearly shows that the final loan balance is significantly higher with forbearance due to accumulated interest.

Impact on Total Loan Amount Owed

Deferment, particularly for subsidized federal loans, minimizes the increase in your total loan amount. Only the principal remains, and in some cases, no interest accrues. However, the total loan repayment period extends, potentially leading to higher overall interest payments over the extended repayment period. Forbearance, on the other hand, leads to a significantly higher total loan amount due to the accumulation of interest during the forbearance period. This increased principal significantly impacts the total cost of the loan. For example, a $10,000 loan with a 5% interest rate could easily accumulate hundreds, even thousands, of dollars in interest during a forbearance period.

Impact of Deferment on Different Loan Types

Deferment’s effects vary significantly depending on the type of federal student loan. Understanding these differences is crucial for borrowers to make informed decisions about managing their debt. The key distinctions lie in interest accrual, capitalization, and the specific eligibility criteria for each loan type.

The primary federal student loan types—subsidized, unsubsidized, and Graduate PLUS loans—each have unique deferment rules. These rules determine whether interest accrues during deferment, how long a deferment can last, and the overall impact on the loan’s repayment.

Subsidized Federal Student Loans

Subsidized loans are need-based and offer a significant advantage during deferment periods. The government pays the interest that accrues while the loan is in deferment, provided the borrower meets the eligibility requirements. This means the borrower’s loan balance remains unchanged throughout the deferment period, preventing the debt from growing larger.

- Interest does not accrue during deferment periods while the borrower is eligible.

- Deferment periods are typically limited to a certain total number of months, though specific periods may vary based on the borrower’s circumstances.

- Example: A student deferring their subsidized loan for 12 months due to unemployment would not see their loan balance increase, as the government covers the interest.

Unsubsidized Federal Student Loans

Unsubsidized loans differ from subsidized loans in that interest accrues during deferment, regardless of the borrower’s eligibility. This means the loan balance increases over time, even while payments are paused. The accrued interest is typically capitalized at the end of the deferment period, adding to the principal balance and increasing the total amount owed.

- Interest accrues during deferment; the borrower is responsible for this interest.

- The accrued interest is typically capitalized at the end of the deferment period, increasing the principal loan amount.

- Example: A borrower deferring an unsubsidized loan for 6 months might see their loan balance increase significantly, depending on the interest rate, as interest continues to accrue.

Graduate PLUS Loans

Graduate PLUS loans are designed for graduate and professional students. Similar to unsubsidized loans, interest accrues during deferment periods. Borrowers are responsible for paying this interest to prevent capitalization. While deferment options exist, understanding the implications of accruing interest is critical for managing this loan type effectively.

- Interest accrues during deferment; the borrower is responsible for paying this interest to avoid capitalization.

- Deferment options are generally available, but the borrower needs to actively manage interest payments to avoid increasing the principal balance.

- Example: A graduate student deferring their PLUS loan for 2 years will need to pay the accrued interest to avoid a significant increase in their overall loan amount upon exiting deferment.

Final Conclusion

Successfully managing student loan debt requires a proactive and informed approach. While deferment can offer temporary relief, understanding its implications and exploring alternative options is vital for long-term financial well-being. By carefully weighing the pros and cons of deferment and considering alternative repayment strategies, you can create a sustainable plan that aligns with your individual circumstances and financial goals. Remember to consult with a financial advisor for personalized guidance.

FAQ Overview

What happens to interest during a deferment period?

For subsidized federal loans, the government pays the interest during certain deferment periods. Unsubsidized federal loans and private loans accrue interest, increasing the total loan amount.

Can I defer my student loans indefinitely?

No, deferment periods are typically limited and subject to eligibility requirements and specific program rules. There are maximum deferment periods for most loan types.

What if I miss a payment during a deferment?

Missing payments during a deferment period can negatively impact your credit score and potentially jeopardize the deferment agreement. It’s crucial to maintain communication with your lender.

How does deferment affect my credit score?

While deferment itself doesn’t directly impact your credit score, consistently missing payments during or after a deferment can negatively affect your credit rating.

What are the consequences of repeatedly deferring my loans?

Repeated deferments can lead to a significantly larger total loan amount due to accumulated interest, potentially delaying the payoff and increasing overall cost.