Securing a private student loan can feel like navigating a maze, with numerous factors influencing the time it takes to receive your funds. Understanding these factors is crucial for effective planning and minimizing potential delays. This guide explores the intricacies of the private student loan application process, providing insights into what you can expect and how to streamline the journey.

From the initial application to the final disbursement, the timeline can vary significantly depending on your credit score, the complexity of your application, the lender’s processing speed, and even the specifics of your chosen educational program. We’ll delve into each stage of the process, highlighting potential pitfalls and offering strategies for a smoother experience.

Factors Influencing Loan Processing Time

Securing a private student loan involves a multifaceted process, and the time it takes to receive funds can vary significantly. Several key factors influence the speed of loan processing, ranging from your personal financial history to the lender’s internal procedures. Understanding these factors can help you manage your expectations and potentially expedite the process.

Credit Score’s Impact on Processing Speed

Your credit score plays a crucial role in determining how quickly your private student loan application is processed. Lenders use credit scores to assess your creditworthiness and risk. A higher credit score typically indicates a lower risk to the lender, leading to faster processing times. Conversely, a lower credit score might trigger more stringent reviews and potentially longer processing times as lenders need to more thoroughly assess your repayment capabilities. For example, an applicant with a credit score above 750 might experience approval within a week, while an applicant with a score below 600 might face a significantly longer wait, potentially several weeks or even months.

Loan Application Complexity

The complexity of your loan application significantly impacts processing time. Simple applications with straightforward financial information are generally processed faster. However, applications with incomplete information, inconsistencies, or unusual financial situations might require additional review and documentation, leading to delays. For instance, an application with missing tax returns or unexplained gaps in employment history will likely take longer to process than a complete and clear application. The more information a lender needs to verify, the longer the process will take.

Lender Processing Time Variation

Lenders vary in their processing times due to differences in their internal procedures, staffing levels, and technological capabilities. Some lenders are known for their streamlined processes and quick turnaround times, while others may have more bureaucratic procedures, resulting in longer wait times. For example, online lenders often boast faster processing times compared to traditional brick-and-mortar institutions due to their automated systems. It’s advisable to research lender reviews and compare processing times before applying.

Situations Causing Processing Delays

Several situations can cause delays in loan processing. These include incomplete applications, requests for additional documentation, errors in the application, verification issues, and lender-side processing bottlenecks. For instance, a request for verification of employment or income can significantly delay the process if the necessary documentation isn’t promptly provided. Similarly, a high volume of applications received by a lender can lead to processing delays due to increased workload.

Comparison of Loan Processing Times

| Loan Type | Average Processing Time | Factors Affecting Time | Lender Examples |

|---|---|---|---|

| Federal Student Loans (Direct Loans) | 2-4 weeks (often faster) | Application completeness, verification of enrollment | Federal Student Aid (FSA) |

| Private Student Loans (Undergraduate) | 1-4 weeks (can vary widely) | Credit score, application complexity, lender processing speed | Sallie Mae, Discover, Citizens Bank |

| Private Student Loans (Graduate/Professional) | 2-6 weeks (can vary widely) | Credit score, co-signer availability, loan amount | Wells Fargo, PNC Bank, Laurel Road |

| Private Student Loans (Refinancing) | 1-3 weeks (often faster if credit is strong) | Credit score, existing debt, income verification | SoFi, Earnest, CommonBond |

The Application Process Step-by-Step

Securing a private student loan involves a multi-step process that requires careful attention to detail and thorough preparation. Understanding each step and the necessary documentation will streamline the application and increase the likelihood of a timely approval. This section Artikels the typical steps involved, highlighting potential delays at each stage.

The application process for a private student loan typically unfolds in a sequential manner. Each step builds upon the previous one, and delays at any point can impact the overall timeline. Prospective borrowers should be prepared to provide comprehensive information and documentation to expedite the process.

Required Documentation for Private Student Loan Applications

Private lenders require various documents to verify your identity, financial situation, and academic standing. Failure to provide complete and accurate documentation will lead to delays. Commonly requested documents include:

- Completed Application Form: This is the foundation of your application, requiring detailed personal and financial information.

- Proof of Identity: Typically, a driver’s license or passport is sufficient.

- Social Security Number: Necessary for credit checks and loan processing.

- Student Status Verification: An official acceptance letter from your chosen institution, along with enrollment details, is essential.

- Financial Aid Award Letter (if applicable): This document Artikels any federal or institutional aid you’ve received, impacting your loan amount needs.

- Proof of Income (for co-signer, if required): This might include tax returns, pay stubs, or bank statements, demonstrating the co-signer’s ability to repay the loan if you cannot.

- Credit Report: Lenders will pull your credit report to assess your creditworthiness. A strong credit history will expedite the process.

- Bank Statements: These provide evidence of your financial stability and account activity.

The Step-by-Step Application Process

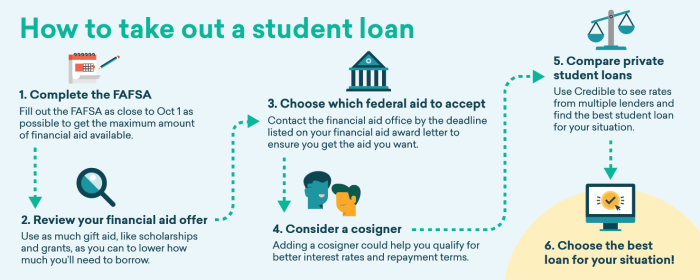

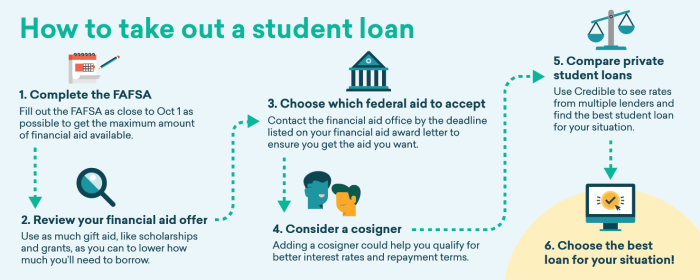

The application process typically involves these key steps:

- Pre-qualification/Comparison Shopping: Research different lenders and compare interest rates and terms. Delays can occur if you spend too much time comparing without narrowing down your options.

- Application Submission: Complete and submit the lender’s application form online or via mail. Inaccurate or incomplete information will lead to delays and requests for further documentation.

- Credit and Background Check: The lender will conduct a credit check and verify your information. Poor credit or discrepancies in information can cause significant delays.

- Verification of Enrollment and Financial Aid: The lender will verify your student status and financial aid package. Delays can arise from slow responses from your institution or incomplete documentation.

- Loan Approval or Denial: The lender will review your application and determine whether to approve or deny your loan request. A denial may require you to re-apply with a co-signer or address credit concerns.

- Loan Disbursement: Once approved, the funds will be disbursed directly to your educational institution. Delays can be caused by processing issues at the institution.

Flowchart of the Private Student Loan Application Process

The following describes a flowchart illustrating the application process. Imagine a diagram with boxes and arrows. The process begins with “Start,” then flows through “Pre-qualification,” “Application Submission,” “Credit Check,” “Verification of Information,” “Loan Approval/Denial,” and finally “Disbursement” which leads to “End”. Arrows connect each step, showing the sequential flow. Any step that results in a “No” decision (e.g., loan denial) would loop back to a previous step, such as requiring additional documentation or finding a co-signer. A “Yes” decision in each step moves the process forward to the next stage.

Understanding Lender Policies and Procedures

Navigating the world of private student loans requires a thorough understanding of individual lender policies and procedures. These policies significantly impact the loan application process, from initial application to final disbursement. Variations exist between lenders, emphasizing the importance of careful research before selecting a loan provider.

Comparison of Loan Processing Procedures Across Three Major Lenders

This section compares the loan processing procedures of three hypothetical major private student loan lenders: Lender A, Lender B, and Lender C. While specific procedures are subject to change, this comparison highlights commonalities and differences to illustrate the range of experiences borrowers may encounter. Note that these are illustrative examples and do not represent any specific real-world lender.

| Procedure | Lender A | Lender B | Lender C |

|---|---|---|---|

| Application Submission | Online application portal, paper applications accepted. | Online application portal only. | Online application portal, limited phone support for application assistance. |

| Credit Check | Performed upon application submission. | Performed after preliminary application review. | Performed concurrently with verification of enrollment. |

| Verification of Enrollment | Requires electronic verification through the National Student Clearinghouse. | Accepts official transcripts or school certification. | Uses a combination of electronic and manual verification methods. |

| Disbursement | Funds disbursed directly to the school. | Funds disbursed directly to the borrower, with school certification required. | Funds disbursed in installments directly to the school. |

Reasons for Private Student Loan Application Rejection

Private student loan lenders employ rigorous criteria to assess loan applications. Rejection can stem from various factors, including adverse credit history, insufficient income, lack of co-signer, or failure to meet the lender’s minimum credit score requirements. Additionally, incomplete applications or discrepancies in provided information can also lead to rejection. For example, a borrower with a history of missed payments on previous loans might face rejection, as would a borrower unable to demonstrate sufficient income to repay the loan. Lenders often provide detailed explanations for rejections, though these explanations can sometimes lack specificity.

Lender’s Role in Verifying Student Enrollment and School Attendance

Verifying a borrower’s enrollment and attendance is crucial for private student loan lenders to ensure the funds are used for their intended purpose. Lenders typically utilize electronic verification systems that directly access student information from educational institutions. They may also request official transcripts or other documentation to confirm enrollment status and academic progress. This verification process helps mitigate the risk of fraud and ensures that the loan is granted to eligible students actively pursuing their education. Failure to provide the necessary verification documentation may delay or prevent loan disbursement.

Interpreting Lender Communications Regarding Application Status

Lenders typically communicate application status updates through email, online portals, or phone calls. Borrowers should carefully review these communications for updates on application progress, including requests for additional documentation or information. Understanding the terminology used by lenders is essential. For example, a status update indicating “application under review” signifies that the lender is assessing the application, while “verification required” means additional documentation is needed before processing can continue. Consistent monitoring of the application status is highly recommended to ensure timely loan disbursement.

Impact of School and Program Factors

The speed at which your private student loan application is processed isn’t solely determined by the lender; your school and the program you’re enrolled in play a significant role. Various factors related to your institution and course of study can influence the timeline, sometimes causing unexpected delays. Understanding these factors can help you manage expectations and proactively address potential issues.

The type of institution and program length directly impact disbursement timelines. Private lenders often have different procedures and requirements for public and private institutions, leading to variations in processing times. Similarly, longer programs naturally require more time for loan disbursement as funds are often released in installments tied to specific academic periods.

Institution Type and Loan Processing

Public and private institutions often have different relationships with private lenders. Public universities, due to their established processes and volume of student loan applications, might have streamlined systems resulting in faster processing times compared to smaller, private colleges. Private colleges may have less established relationships with lenders, potentially leading to longer processing times due to additional verification steps. For example, a lender might require more extensive documentation from a smaller, lesser-known private college to verify the institution’s legitimacy and the student’s enrollment status. This extra verification adds to the overall processing time.

Program Length and Disbursement Schedule

The length of your educational program directly affects the disbursement timeline. Loans for shorter programs, such as certificate programs or one-year master’s degrees, are typically processed and disbursed more quickly than loans for longer programs like four-year undergraduate degrees or doctoral programs. Lenders often release funds in installments, coinciding with academic terms or semesters. A longer program means more installments and therefore a longer overall disbursement period. For instance, a student in a four-year program will receive funds over a longer period compared to a student completing a one-year program. The loan disbursement will be spread across multiple semesters, potentially extending the overall processing time.

School Financial Aid Office Delays

Delays can occur due to issues within the school’s financial aid office. These might include: inaccurate or incomplete information submitted by the student; delays in processing the school’s certification; backlogs in the financial aid office due to high student volume; or even internal administrative errors. For example, a delay in the school certifying the student’s enrollment status can halt the loan processing until the certification is received by the lender. Similarly, an error in the student’s financial aid file could trigger a request for clarification, causing a delay.

Contacting the School’s Financial Aid Office

To obtain updates on your loan processing status, contact your school’s financial aid office directly. Most institutions provide contact information – phone numbers, email addresses, and online portals – on their financial aid website. When contacting them, have your student ID number and loan application details readily available to expedite the process. Be prepared to provide specific details about your loan application, such as the lender’s name and your application date, to help them quickly locate your file. Regularly checking your school’s online student portal for updates is also a proactive way to monitor your loan application’s progress.

Post-Approval Procedures and Disbursement

After your private student loan application is approved, several steps occur before you receive the funds. This process typically involves verification of your enrollment and finalizing the loan agreement. Understanding these steps can help manage expectations and ensure a smooth disbursement.

The lender will verify your enrollment at your chosen educational institution. This ensures you are actively pursuing your studies and eligible for the loan. Once this verification is complete, you will likely receive a loan agreement outlining the terms and conditions, including the interest rate, repayment schedule, and any fees. Carefully review this agreement before signing and returning it to the lender. Following the signing of the agreement, the disbursement process begins.

Loan Disbursement Methods

Private student loan disbursement typically occurs through either direct deposit or a mailed check. Direct deposit is generally the preferred and faster method, crediting the funds directly into your designated bank account. This reduces processing time and minimizes the risk of lost or stolen checks. If you choose a check disbursement, you will receive your funds via mail, which may take several business days longer than direct deposit. Lenders usually provide clear instructions on how to specify your preferred disbursement method during the application or loan agreement process.

Student Questions Regarding Disbursement Timelines

Students frequently inquire about the expected timeframe for receiving their loan funds after approval. The typical disbursement timeline is between a few business days to several weeks, depending on the lender, disbursement method chosen, and any unforeseen delays. Another common question involves the timing of disbursements relative to academic terms; funds are usually disbursed according to the school’s payment schedule, often coinciding with the start of semesters or quarters. Finally, students often seek clarity on the process for contacting the lender if they have not received their funds within the expected timeframe. Proactive communication with the lender is always advisable in case of any delays.

Potential Disbursement Delays and Solutions

Several factors can cause delays in the disbursement process.

- Incomplete Application or Documentation: Missing information or documents can significantly delay processing. Solution: Ensure all required forms are completed accurately and submitted on time. Contact the lender immediately if you are missing any information.

- Verification Issues: Problems verifying your enrollment or other information may halt the process. Solution: Cooperate fully with the lender’s verification requests and respond promptly to any inquiries. Contact your school’s financial aid office if needed.

- Technical Glitches: Occasionally, technical issues on the lender’s side may cause delays. Solution: Contact the lender’s customer service department to report the issue and inquire about the status of your disbursement.

- Bank Processing Times: If using direct deposit, the time it takes for the funds to appear in your account depends on your bank’s processing speed. Solution: While this is beyond the lender’s direct control, choosing a reputable bank with efficient processing is recommended.

- Incorrect Bank Information: Providing inaccurate banking details will result in failed deposits. Solution: Double-check your bank account information carefully before submitting it to the lender.

Illustrative Examples of Processing Times

Understanding the timeframe for private student loan processing can be challenging due to the variability involved. Several factors, as discussed previously, significantly influence how quickly a lender approves and disburses funds. To illustrate this variability, let’s examine some specific scenarios. These examples are illustrative and should not be considered definitive predictions of your own experience.

Processing times depend heavily on the applicant’s financial situation, the completeness of their application, and the lender’s internal processes. A straightforward application with readily available documentation will typically process much faster than a complex application requiring additional verification or clarification.

Fast Loan Processing Scenario

This scenario depicts a situation where a loan application is processed swiftly. Imagine a recent graduate, Sarah, applying for a $10,000 private student loan to cover remaining tuition costs. Sarah has excellent credit, a stable co-signer with strong financial history, and meticulously prepared her application, including all required documentation. The lender, recognizing the low risk and complete application, processes the loan within 7 business days. The speed is attributed to the minimal need for verification and the straightforward nature of her financial profile.

Slow Loan Processing Scenario

In contrast, consider John’s application for a $50,000 private student loan. John is a new graduate with limited credit history and no co-signer. His application is incomplete, requiring multiple follow-up requests for additional documentation from the lender. The lender needs to verify his income and employment history, leading to delays. Furthermore, John’s chosen lender has a historically longer processing time due to a large volume of applications. As a result, John’s loan application takes over 30 business days to process.

Table of Loan Processing Scenarios

The following table summarizes these scenarios and others, highlighting the contributing factors to varying processing times.

| Scenario | Loan Amount | Processing Time | Contributing Factors |

|---|---|---|---|

| Sarah (Fast Processing) | $10,000 | 7 Business Days | Excellent credit, stable co-signer, complete application, low-risk profile, efficient lender |

| John (Slow Processing) | $50,000 | >30 Business Days | Limited credit history, no co-signer, incomplete application, income verification required, high application volume at lender |

| Maria (Moderate Processing) | $25,000 | 14 Business Days | Good credit, complete application, some minor documentation clarifications needed |

| David (Delayed Processing) | $40,000 | 21 Business Days | Average credit, required additional financial documentation, lender experienced temporary system issues |

Conclusive Thoughts

Obtaining a private student loan requires patience and attention to detail. While the process can be lengthy, understanding the factors influencing processing times empowers you to proactively address potential delays. By carefully preparing your application, choosing a reputable lender, and maintaining open communication, you can significantly improve your chances of a timely loan disbursement and focus on your studies.

Essential FAQs

What happens if my loan application is rejected?

Lenders typically provide reasons for rejection. Common causes include poor credit, insufficient income, or incomplete application materials. Review the reasons provided and consider reapplying after addressing any identified issues.

Can I track my loan application’s progress?

Most lenders offer online portals or allow you to contact customer service for updates on your application status. Regularly check for updates to stay informed.

What if my school delays the process?

Contact your school’s financial aid office to inquire about the status of your loan and any potential delays from their end. Provide them with your loan application number if necessary.

What are the different disbursement methods?

Common disbursement methods include direct deposit to your bank account and paper checks mailed to your address. The method you choose may depend on the lender and your preferences.