Navigating the complexities of student loan repayment can feel overwhelming. The time it takes to become debt-free depends on a multitude of factors, from the initial loan amount and interest rate to the chosen repayment plan and any extra payments made. Understanding these variables is crucial for developing a realistic repayment strategy and achieving financial freedom sooner.

This guide will explore the key elements influencing student loan repayment timelines, providing practical tools and strategies to help you estimate your repayment duration and accelerate your progress towards financial independence. We’ll delve into different repayment plans, the impact of interest rates, and effective strategies for faster repayment, empowering you to take control of your financial future.

Factors Influencing Repayment Time

The length of time it takes to repay student loans is influenced by a complex interplay of factors. Understanding these factors is crucial for borrowers to develop a realistic repayment plan and manage their debt effectively. These factors range from the type of loan and its interest rate to the chosen repayment plan and the borrower’s financial circumstances.

Loan Type and Interest Rates

The type of student loan significantly impacts repayment timelines. Federal student loans generally offer more flexible repayment options and protections compared to private loans. Federal loans often have lower interest rates, particularly subsidized loans which don’t accrue interest while the borrower is in school. Private loans, on the other hand, typically have higher interest rates and less flexible repayment plans, leading to longer repayment periods and higher overall costs. For example, a borrower with a $50,000 federal loan at 4% interest will repay the loan faster than a borrower with a similar-sized private loan at 7% interest, even with the same repayment plan.

Repayment Plan Options and Their Impact

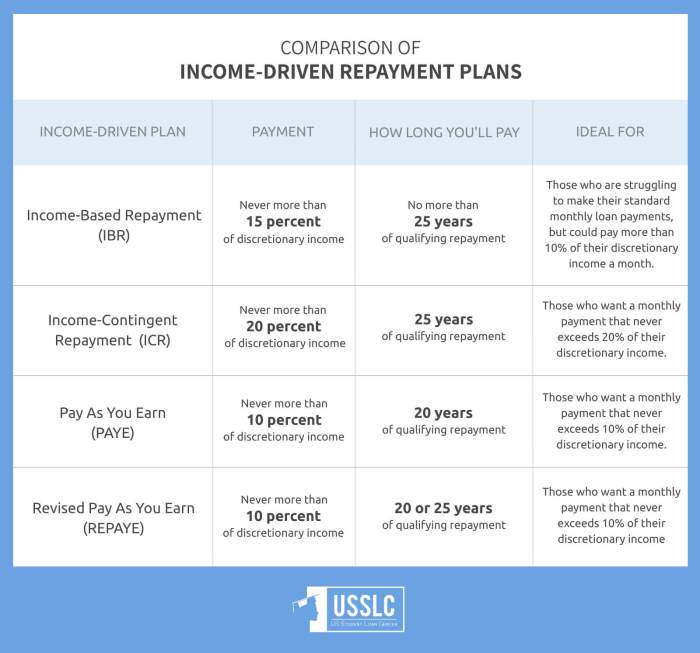

Several repayment plans are available for federal student loans, each affecting the monthly payment amount, total interest paid, and overall repayment time. The standard repayment plan requires a fixed monthly payment over 10 years. An extended repayment plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but significantly higher total interest paid. Income-driven repayment plans (IDR) tie monthly payments to the borrower’s income and family size, resulting in potentially lower payments but potentially longer repayment periods, often exceeding 20 years. Private loan repayment plans vary widely depending on the lender, and typically offer fewer options compared to federal loans.

Comparison of Repayment Plans

The following table compares three common repayment plans for a hypothetical $30,000 federal student loan with a 5% interest rate. These are illustrative examples and actual figures will vary based on individual loan terms and income.

| Repayment Plan | Approximate Monthly Payment | Approximate Total Interest Paid | Approximate Repayment Time |

|---|---|---|---|

| Standard (10-year) | $317 | $11,700 | 10 years |

| Extended (25-year) | $175 | $26,500 | 25 years |

| Income-Driven (Example – 20-year) | Varies based on income | Varies based on income and plan | 20+ years |

Calculating Repayment Time

Accurately calculating your student loan repayment time is crucial for effective financial planning. Understanding the factors involved and employing the right methods allows you to create a realistic budget and avoid unexpected financial strain. This section will guide you through the process of calculating your repayment time using a standard repayment plan, considering the impact of interest rates, and determining the total interest paid.

While precise calculations often require specialized loan calculators, we can use simplified methods to get a good approximation. These methods rely on understanding the relationship between your loan amount, interest rate, and monthly payment.

Standard Repayment Plan Calculation

Calculating repayment time under a standard repayment plan involves considering the loan’s principal, interest rate, and monthly payment amount. Unfortunately, there isn’t a single, simple formula to calculate the exact repayment time due to the compounding nature of interest. However, we can use iterative methods or online calculators to find the answer.

Let’s illustrate with an example. Suppose you have a $20,000 student loan with a 5% annual interest rate and a monthly payment of $400. Using a student loan amortization calculator (widely available online), you’d input these values. The calculator will then determine the number of months required to repay the loan, considering the interest that accrues each month. The result would show the exact number of months, and therefore the years, it takes to repay the loan in full.

Interest Rate’s Effect on Repayment Time

The interest rate significantly impacts the repayment time. A higher interest rate means more interest accrues each month, increasing the total amount you need to repay and extending the repayment period. Conversely, a lower interest rate reduces the total amount owed and shortens the repayment period.

Consider two scenarios: both loans are $20,000 with a $400 monthly payment. Loan A has a 5% interest rate, while Loan B has a 7% interest rate. Loan A will have a shorter repayment period than Loan B. Using an online calculator, you would see a noticeable difference in the number of months required to repay each loan. The higher interest rate on Loan B results in a longer repayment period, and a significantly higher total interest paid.

Calculating Total Interest Paid

Determining the total interest paid over the life of the loan is essential for understanding the true cost of borrowing. This is easily found using a loan amortization calculator; the calculator will show the total interest paid alongside the total number of payments.

Using our previous example of a $20,000 loan at 5% interest with a $400 monthly payment, the amortization calculator would not only show the repayment period (in months) but also the total interest paid over the loan’s lifetime. This figure represents the extra amount paid beyond the original principal amount due to interest accumulation.

Approximate Repayment Time Formula

While a precise calculation requires an amortization schedule, a rough approximation of repayment time can be obtained using the following formula:

Approximate Repayment Time (in years) ≈ (Loan Amount) / (12 * Monthly Payment)

This formula ignores the effect of compounding interest, providing a simplified estimate. It’s most accurate for loans with very low interest rates or short repayment periods. For example, a $10,000 loan with a $500 monthly payment would yield an approximate repayment time of 1.67 years (10000 / (12 * 500)). Remember this is a very rough estimate and doesn’t factor in interest.

Impact of Interest Rates

Interest rates play a pivotal role in determining the length of time it takes to repay student loans. Higher interest rates significantly increase the total amount owed and extend the repayment period, while lower rates accelerate repayment and reduce the overall cost. Understanding this relationship is crucial for effective financial planning.

Interest rates directly influence the total cost of your loan and the time it takes to repay it. This is because the interest is calculated on the principal loan amount, and this interest then accrues to the principal, leading to a snowball effect.

Compounding Interest and Loan Repayment

Compounding interest is the process where interest is calculated not only on the principal loan amount but also on the accumulated interest. This means that as time passes, you’re paying interest on increasingly larger amounts, making repayment slower and more expensive. The effect is more pronounced with higher interest rates and longer repayment terms. For example, a loan with a 7% interest rate will accumulate interest much faster than a loan with a 3% interest rate, leading to a substantial difference in total repayment cost and duration. A simple illustration: imagine you owe $10,000. In the first year, 7% interest adds $700, whereas 3% adds only $300. The following year, the 7% interest is calculated on $10,700, while the 3% interest is calculated on only $10,300. This difference compounds year after year.

Interest Rate Fluctuations and Repayment Schedules

Fluctuations in interest rates can impact repayment schedules. Variable interest rate loans are particularly susceptible to these changes. An increase in interest rates will lead to higher monthly payments or a longer repayment period, while a decrease can lead to lower payments or faster repayment. For example, a borrower with a variable rate loan might experience an increase in their monthly payment if market interest rates rise, potentially straining their budget. Conversely, a decrease in rates could provide some financial relief. It’s important to understand the potential impact of rate fluctuations when choosing a loan. Fixed-rate loans offer predictability, shielding borrowers from interest rate volatility.

Comparison of Repayment Scenarios with Varying Interest Rates

The following scenarios illustrate the impact of varying interest rates on repayment timelines, assuming a $20,000 loan with a 10-year repayment plan:

- Scenario 1: 3% Interest Rate: Monthly payments would be relatively low, and the loan would be repaid within 10 years with a manageable total interest paid.

- Scenario 2: 6% Interest Rate: Monthly payments would increase compared to Scenario 1, and the total interest paid would be significantly higher. The 10-year repayment might still be achievable, but with a higher financial burden.

- Scenario 3: 9% Interest Rate: Monthly payments would be considerably higher than in the previous scenarios, and the total interest paid would be substantially greater. Maintaining the 10-year repayment might be difficult without adjusting the repayment plan.

These scenarios demonstrate how even seemingly small differences in interest rates can lead to significant variations in total repayment costs and timeframes. Careful consideration of interest rates is essential when choosing a student loan and planning for repayment.

Strategies for Faster Repayment

Paying off student loans faster can significantly reduce the overall cost and free up your finances sooner. Several strategies can help you achieve this goal, impacting your financial well-being and long-term planning. This section explores effective approaches to accelerate your repayment journey.

Making Extra Payments

Accelerated repayment is achievable by making additional payments beyond your minimum monthly obligation. Even small, consistent extra payments can substantially reduce the principal balance and the total interest accrued over the loan’s lifetime. For example, if you can afford an extra $50 per month on a $10,000 loan, you’ll pay it off much faster and save thousands in interest. Consider automating extra payments through your bank’s online bill pay system for consistent effort. Prioritizing this extra payment, perhaps treating it as a non-negotiable bill, can make a substantial difference.

Refinancing Student Loans

Refinancing your student loans involves obtaining a new loan from a different lender to replace your existing loans. The primary benefit is the potential for a lower interest rate. A lower interest rate directly translates to lower monthly payments and faster repayment. However, it’s crucial to carefully compare offers from multiple lenders before refinancing. Consider factors such as fees, loan terms, and your credit score which significantly influence the interest rate you qualify for. For example, someone with excellent credit might secure a significantly lower rate, leading to substantial savings over the loan’s lifespan compared to someone with a lower credit score.

Impact of Income Changes on Repayment Timelines

Income fluctuations significantly influence repayment speed. An increase in income provides an opportunity to allocate more funds towards loan repayment, thus accelerating the payoff process. Conversely, a decrease in income might necessitate a change in repayment plan, potentially lengthening the repayment timeline. Budgeting carefully and adjusting your repayment strategy in response to income changes is vital. For instance, a promotion resulting in a salary increase could allow for an extra $200 monthly payment, drastically shortening the repayment period. Conversely, unexpected job loss may necessitate exploring income-driven repayment plans to avoid default.

Budgeting Effectively to Accelerate Loan Repayment

Effective budgeting is essential for accelerating loan repayment. A well-structured budget allows you to track income and expenses, identify areas for savings, and allocate extra funds toward your loans. A step-by-step guide to effective budgeting for faster loan repayment includes:

- Track your income and expenses: Use budgeting apps, spreadsheets, or notebooks to monitor all income sources and expenditures. This gives a clear picture of your financial situation.

- Identify areas for savings: Analyze your spending habits and identify areas where you can cut back. This could involve reducing dining out, entertainment, or subscriptions.

- Create a realistic budget: Allocate funds to essential expenses, savings, and loan repayment. Ensure the budget is achievable and sustainable in the long term.

- Prioritize loan repayment: Treat loan payments as a non-negotiable expense. Allocate a sufficient amount each month to meet your repayment goals.

- Regularly review and adjust: Periodically review your budget and make necessary adjustments based on your income and expenses. This ensures your budget remains relevant and effective.

Illustrative Examples

Understanding student loan repayment can be complex. Let’s clarify this with some concrete examples, illustrating different scenarios and the impact of various factors. These examples will highlight the importance of understanding your loan terms and exploring different repayment strategies.

A Standard Repayment Scenario

Let’s consider a student loan of $30,000 with a fixed interest rate of 6% and a 10-year standard repayment plan. This plan typically involves equal monthly payments over the loan term. Using a standard loan amortization calculator (widely available online), we can determine that the monthly payment would be approximately $330. Over the 10-year period, the total interest paid would be roughly $10,000, meaning the total cost of the loan would be $40,000.

Visual Representation of a Repayment Schedule

A bar graph effectively visualizes the repayment schedule. The horizontal axis (x-axis) represents the time in years (0-10). The vertical axis (y-axis) represents the dollar amount. Two sets of bars are displayed for each year: one representing the principal amount paid that year, and the other representing the interest paid that year. Initially, a larger portion of the payment goes towards interest. As time progresses, the proportion shifts, with a larger portion going towards principal repayment. The graph would show a gradual decrease in the interest paid per year and a corresponding increase in the principal paid per year. The total height of the bars for each year would represent the total monthly payment.

Impact of Extra Payments

Now, let’s imagine the same borrower decides to make an extra $100 payment each month. This accelerates the repayment process significantly. The additional payments primarily reduce the principal balance, lowering the interest accrued in subsequent months. Using a loan calculator incorporating extra payments, we would find that the loan would be repaid considerably faster, potentially within 7-8 years instead of 10, resulting in substantial interest savings.

Visual Representation of Refinancing Impact

A simple line graph could illustrate the impact of refinancing. The x-axis would represent the time in years, and the y-axis would represent the remaining loan balance. One line would depict the original loan’s repayment schedule (from the first example). A second line would show the repayment schedule after refinancing to a lower interest rate (e.g., 4%). This second line would show a steeper decline in the remaining balance, indicating faster repayment and lower overall interest paid. The difference between the two lines visually represents the savings achieved through refinancing. The intersection point of the lines would show the point where the loan is fully repaid.

End of Discussion

Successfully managing student loan repayment requires careful planning and a proactive approach. By understanding the factors that influence repayment time, utilizing available resources, and implementing effective strategies, you can create a personalized plan that aligns with your financial goals. Remember, consistent effort and informed decision-making are key to achieving timely and efficient repayment, ultimately leading to a brighter financial future.

Top FAQs

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage your credit score, and potentially lead to loan default. Contact your lender immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I refinance my federal student loans?

Federal student loans cannot be refinanced through private lenders. However, you may be able to consolidate them through the federal government to potentially simplify repayment.

What is the difference between deferment and forbearance?

Deferment temporarily suspends payments, often due to specific circumstances like returning to school. Forbearance also temporarily suspends or reduces payments but may accrue interest. The terms and conditions differ depending on the lender and loan type.

Are there tax benefits associated with student loan interest?

You may be able to deduct the amount of student loan interest you paid during the year from your federal income tax. Check the current IRS guidelines for eligibility and limitations.