Navigating the complex world of student loan repayment can feel overwhelming. The length of your repayment journey depends on several interwoven factors, from the initial loan amount and interest rate to the repayment plan you choose. Understanding these variables is crucial for effective financial planning and avoiding potential pitfalls. This guide will explore the key elements influencing repayment time, empowering you to make informed decisions about your financial future.

We’ll delve into various repayment plans, their eligibility criteria, and the advantages and disadvantages of each. We’ll also examine strategies to accelerate repayment, such as budgeting, extra principal payments, and refinancing, alongside practical advice for managing unexpected financial challenges. By the end, you’ll possess a clearer understanding of how long it might take to repay your student loans and the steps you can take to optimize your repayment strategy.

Factors Influencing Student Loan Repayment Time

The length of time it takes to repay student loans is a crucial factor influencing a borrower’s financial well-being. Several interconnected elements determine how long this process will take, impacting both the total repayment amount and the overall financial burden. Understanding these factors allows borrowers to make informed decisions and plan accordingly.

Loan Amount’s Impact on Repayment Duration

The principal loan amount significantly impacts repayment time. Larger loan balances necessitate longer repayment periods, even with consistent monthly payments, due to the sheer volume needing to be repaid. For instance, a $50,000 loan will naturally take longer to repay than a $20,000 loan, assuming all other factors remain constant. A higher loan amount often leads to higher monthly payments to maintain a reasonable repayment timeframe, unless a longer repayment plan is chosen.

Interest Rates and Repayment Timeline

Interest rates play a critical role in extending repayment timelines. Higher interest rates mean a larger portion of each monthly payment goes towards interest, leaving less to reduce the principal balance. This slows down the repayment process considerably. A loan with a 7% interest rate will accrue interest much faster than one with a 3% interest rate, leading to a significantly longer repayment period for the higher-rate loan, even with the same monthly payment amount.

Repayment Plan Type and Repayment Length

The type of repayment plan chosen directly influences the length of the repayment period. Standard repayment plans typically involve a fixed monthly payment over a 10-year period. Extended repayment plans stretch this out to 25 years, resulting in lower monthly payments but substantially higher total interest paid. Income-driven repayment plans, such as ICR, PAYE, and REPAYE, adjust monthly payments based on income and family size, potentially extending the repayment period to 20 or even 25 years.

Federal vs. Private Student Loan Repayment Timeframes

Federal student loans generally offer more flexible repayment options, including income-driven plans and deferment or forbearance possibilities, potentially lengthening the repayment period. Private student loans typically have less flexibility and shorter standard repayment terms, often ranging from 5 to 15 years, with fewer options for extending the repayment timeline. The specific terms and conditions depend on the lender and the loan agreement.

Examples of Repayment Plans and Their Impact

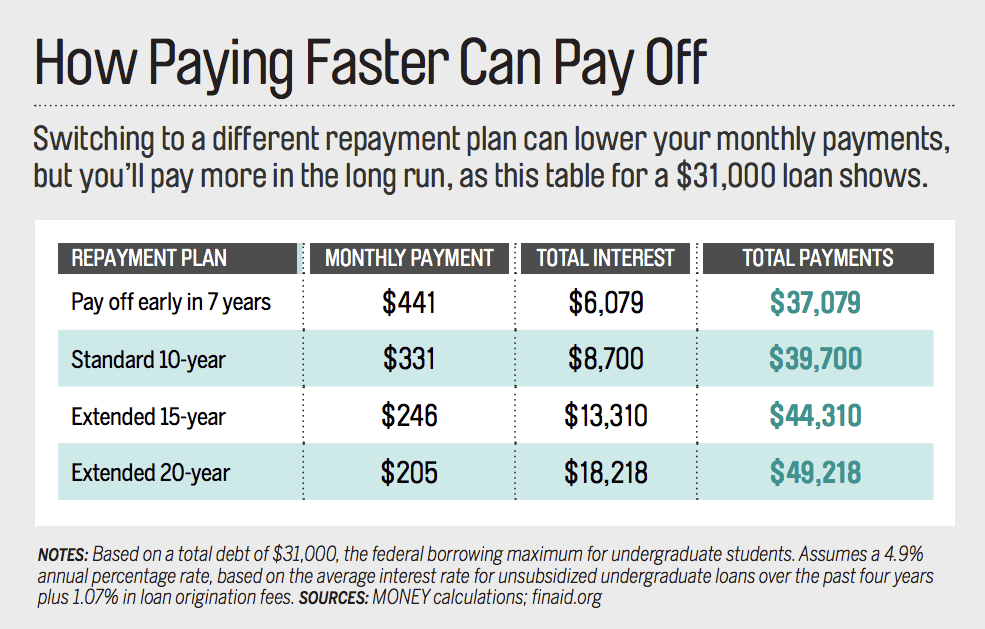

The following table illustrates how different repayment plans can affect total interest paid and overall repayment time. These are examples and actual figures will vary based on loan amount, interest rate, and individual circumstances.

| Repayment Plan | Monthly Payment | Total Interest Paid | Total Repayment Time |

|---|---|---|---|

| Standard (10-year) | $500 | $10,000 | 10 years |

| Extended (25-year) | $250 | $30,000 | 25 years |

| Income-Driven (20-year) | $300 (variable) | $20,000 | 20 years |

| Private Loan (15-year) | $400 | $15,000 | 15 years |

Repayment Plan Options and Their Implications

Choosing the right student loan repayment plan is crucial for managing debt effectively and minimizing long-term financial strain. Several federal repayment plans cater to different financial situations and income levels, each with its own set of advantages and disadvantages. Understanding these options allows borrowers to make informed decisions aligned with their individual circumstances.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loan borrowers. It involves fixed monthly payments over a 10-year period. Eligibility is automatic upon loan disbursement. The advantage lies in its simplicity and relatively short repayment timeframe. However, the monthly payments can be substantial, potentially causing financial hardship for some borrowers. This plan is best suited for borrowers with stable incomes and a strong capacity for higher monthly payments. A borrower with $30,000 in loans at a 5% interest rate would have a monthly payment of approximately $316 and pay approximately $37,900 total.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time, typically every two years, for a 10-year repayment period. Eligibility is automatic upon loan disbursement. This plan offers lower initial payments, making it more manageable during the early stages of a career when income is often lower. However, the increasing payments can become burdensome later on. The total amount paid might be higher compared to the Standard Plan due to accruing interest. This option is preferable for borrowers anticipating significant income growth in the future.

Extended Repayment Plan

The Extended Repayment Plan stretches payments over a longer period, up to 25 years, leading to lower monthly payments. Eligibility is automatic upon loan disbursement, but it is often chosen by those with higher loan balances. The lower monthly payments provide significant short-term relief, but the total interest paid will be substantially higher compared to shorter-term plans. This plan is ideal for borrowers who prioritize affordability in the short-term even at the cost of higher overall repayment. A borrower with $50,000 in loans might see a monthly payment difference of hundreds of dollars compared to the standard plan.

Income-Driven Repayment Plans (IDR)

Income-Driven Repayment Plans (IDR) link monthly payments to the borrower’s discretionary income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Eligibility requirements vary slightly across plans, generally requiring borrowers to meet certain income thresholds and demonstrate financial need. IDR plans are advantageous for borrowers with low incomes or high loan balances. Monthly payments are significantly lower, and any remaining balance may be forgiven after 20 or 25 years, depending on the plan. However, the longer repayment period leads to higher total interest paid. These plans are best suited for borrowers who need immediate financial relief and anticipate long-term income instability.

Choosing a Repayment Plan: A Decision Flowchart

The following describes a flowchart for choosing a repayment plan. The flowchart would visually represent a decision tree. The starting point would be: “What is your current financial situation and income projection?” Branches would then lead to different options based on answers such as: “High income, stable job” leading to the Standard or Graduated Repayment plan options; “Low income, expecting income growth” leading to the Graduated or IDR plans; “High debt, need immediate relief” leading to the Extended or IDR plans; “Uncertain income, need flexibility” leading to an IDR plan. The flowchart would conclude with the selection of a specific repayment plan.

Strategies for Faster Student Loan Repayment

Accelerating your student loan repayment can significantly impact your financial future, freeing up resources for other goals like saving for a home, investing, or simply enjoying more financial freedom. Several effective strategies exist to help you pay off your loans faster and reduce the overall interest paid. These strategies require careful planning, discipline, and a commitment to prioritizing debt reduction.

Budgeting and Debt Consolidation

Creating a detailed budget is fundamental to accelerating loan repayment. By tracking your income and expenses meticulously, you can identify areas where you can cut back and allocate those funds towards your student loans. Debt consolidation involves combining multiple loans into a single loan, often with a lower interest rate. This simplifies repayment and can potentially shorten the repayment timeline. For example, a borrower with several loans at varying interest rates might consolidate them into a single loan with a lower average interest rate, resulting in lower monthly payments and faster repayment. Effective budgeting techniques involve using budgeting apps, creating a spreadsheet, or employing the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt repayment).

Extra Principal Payments

Making extra principal payments on your student loans can significantly reduce the overall time it takes to repay them. While your monthly payment covers the interest and a portion of the principal, any extra amount you pay goes directly towards the principal balance, lowering the total amount owed and reducing the overall interest paid. For instance, if your monthly payment is $500, an extra $100 payment each month will dramatically decrease the loan’s lifespan. However, it’s important to consider your financial situation; prioritize essential expenses and emergency funds before allocating extra funds towards loan repayment. This strategy is particularly effective in the early stages of loan repayment when interest accrual is highest.

Loan Refinancing

Refinancing involves replacing your existing student loans with a new loan, typically at a lower interest rate. This can substantially reduce your monthly payments and shorten the repayment period. A step-by-step guide to exploring refinancing options includes: 1) Checking your credit score; 2) Comparing offers from multiple lenders; 3) Carefully reviewing the terms and conditions of each offer; 4) Considering the potential impact on your overall financial situation; and 5) Completing the application process. For example, a borrower with a 7% interest rate might refinance to a 4% rate, significantly reducing their monthly payments and total interest paid over the life of the loan. However, refinancing may not always be beneficial; carefully weigh the pros and cons before proceeding.

Budgeting Techniques for Increased Loan Repayment

Several budgeting techniques can help allocate more funds towards loan repayment. The 50/30/20 rule, as mentioned earlier, provides a framework for allocating income. Zero-based budgeting, where you allocate every dollar of your income to a specific expense category, can also be highly effective. Tracking expenses using budgeting apps or spreadsheets provides a clear picture of spending habits, allowing for informed adjustments. Additionally, setting financial goals and visualizing the benefits of faster loan repayment can enhance motivation and commitment. For instance, visualizing the freedom from debt or the ability to invest the money saved can be a powerful motivator.

Potential Challenges and Solutions During Repayment

Navigating student loan repayment can be a complex and challenging process, often fraught with unexpected hurdles. Borrowers frequently encounter unforeseen financial difficulties that can significantly impact their ability to meet their repayment obligations. Understanding these challenges and proactively developing strategies to address them is crucial for successful repayment and avoiding long-term financial distress.

Successfully managing student loan repayment requires careful planning and adaptability. Life throws curveballs, and it’s essential to have a plan in place to handle unexpected events. This involves not only sticking to a repayment schedule but also anticipating potential problems and having strategies to mitigate their impact. This section will explore common challenges, effective management strategies, and available resources to help borrowers navigate these difficulties.

Unexpected Expenses and Job Loss

Unexpected expenses, such as medical bills, car repairs, or home emergencies, can significantly strain a borrower’s budget, making it difficult to meet their monthly loan payments. Similarly, job loss or a reduction in income can severely impact repayment capacity. These events can create a domino effect, leading to missed payments and potentially default. Strategies to mitigate these challenges include building an emergency fund, exploring options for short-term financial assistance, and proactively communicating with loan servicers to discuss potential repayment modifications. For example, someone facing unexpected medical bills might consider using savings or seeking a short-term loan to cover the immediate expenses, while simultaneously contacting their loan servicer to explore temporary payment deferment. A person experiencing job loss could explore unemployment benefits, actively seek new employment, and immediately contact their loan servicer to discuss income-driven repayment plans.

Managing Financial Hardship and Avoiding Default

When facing financial hardship, borrowers should prioritize open communication with their loan servicers. Many servicers offer programs designed to assist borrowers experiencing temporary difficulties. These programs may include forbearance, deferment, or income-driven repayment plans. It’s crucial to act proactively and avoid letting missed payments accumulate. The longer a borrower delays seeking assistance, the more difficult it becomes to resolve the situation. A proactive approach can prevent the situation from escalating into default. For instance, contacting the servicer as soon as a hardship is anticipated allows for the exploration of options and the creation of a plan before payments are missed. This prevents the negative impact on credit scores and avoids potential legal repercussions.

Loan Forbearance and Deferment Options

Forbearance and deferment are temporary pauses in loan repayment. Forbearance allows borrowers to temporarily reduce or suspend their payments, while deferment postpones payments altogether. Eligibility requirements and terms vary depending on the loan type and the borrower’s circumstances. While these options provide temporary relief, interest may still accrue during forbearance, increasing the total loan amount over time. Deferment, in some cases, may suspend interest accrual. It’s essential to carefully weigh the pros and cons of each option and understand the long-term implications before making a decision. For example, a borrower might choose forbearance if they anticipate a temporary dip in income, allowing them to make reduced payments while still making progress on the loan. Deferment might be a better option if facing a more significant financial crisis, as it can temporarily stop interest from accumulating.

Long-Term Consequences of Loan Default

Defaulting on student loans has severe long-term consequences. It negatively impacts credit scores, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wages can be garnished, and tax refunds can be seized to recover the debt. Default can also lead to legal action and damage an individual’s financial reputation for years to come. In extreme cases, default can lead to the loss of professional licenses or certifications. The financial and personal repercussions of default can be significant and long-lasting, making it crucial for borrowers to actively manage their loans and seek assistance when needed. For instance, a defaulted loan could lead to a significantly lower credit score, making it difficult to purchase a home or car in the future, even years after the default.

Resources for Borrowers Facing Financial Difficulties

Understanding the resources available is critical for navigating financial hardship related to student loan repayment. Many organizations offer support and guidance to borrowers facing challenges.

- Your Loan Servicer: Your primary point of contact for repayment options and assistance programs.

- The National Foundation for Credit Counseling (NFCC): Provides free and low-cost credit counseling services, including assistance with debt management.

- The U.S. Department of Education: Offers information on federal student loan programs, repayment options, and hardship assistance.

- StudentAid.gov: The official website for federal student aid, providing comprehensive information on loans, grants, and repayment options.

- State and Local Agencies: Many states and local communities offer resources and programs to assist individuals facing financial difficulties.

Illustrative Examples of Repayment Scenarios

Understanding different repayment scenarios is crucial for effective student loan management. The following examples illustrate how various repayment plans and refinancing options can impact your monthly payments and overall repayment time. We will use hypothetical scenarios for clarity, but these illustrate the principles involved in real-world situations. Remember that individual circumstances will vary.

Standard Repayment Plan Example

This example demonstrates a standard repayment plan with a fixed monthly payment. Let’s assume a loan of $30,000 with a 6% annual interest rate, amortized over 10 years.

| Month | Beginning Balance | Payment | Ending Balance |

|---|---|---|---|

| 1 | $30,000.00 | $330.37 | $29,669.63 |

| 2 | $29,669.63 | $330.37 | $29,339.26 |

| 3 | $29,339.26 | $330.37 | $29,008.89 |

| … | … | … | … |

| 120 | $33.04 | $330.37 | $0.00 |

The monthly payment would be approximately $330.37, and the total repayment time would be 10 years (120 months). The total interest paid over the life of the loan would be approximately $9,644.40. Note that these figures are approximate and the actual amounts may vary slightly due to rounding.

Income-Driven Repayment Plan Example

Income-driven repayment plans adjust monthly payments based on your income and family size. Let’s assume the same $30,000 loan with a 6% interest rate, but this time using an income-driven plan. Let’s further assume that the borrower’s income qualifies for a significantly reduced monthly payment of $150.

| Month | Beginning Balance | Payment | Ending Balance |

|---|---|---|---|

| 1 | $30,000.00 | $150.00 | $29,850.00 |

| 2 | $29,850.00 | $150.00 | $29,700.00 |

| 3 | $29,700.00 | $150.00 | $29,550.00 |

| … | … | … | … |

With a lower monthly payment, the repayment period will be significantly longer, potentially extending beyond 20 years, and accumulating substantially more interest over the life of the loan. The exact repayment time and total interest will depend on the borrower’s income fluctuations throughout the repayment period. This highlights the trade-off: lower monthly payments come at the cost of a longer repayment period and increased total interest paid.

Refinancing Scenario

Refinancing involves replacing your existing student loan with a new loan, often at a lower interest rate. Suppose a borrower has a $25,000 loan with a 7% interest rate and a remaining balance of $20,000. By refinancing to a new loan with a 4% interest rate and a 5-year repayment term, the borrower could significantly reduce their monthly payment and the total interest paid. This would result in a shorter repayment period and lower overall cost compared to continuing with the original loan terms. The exact savings would depend on the new loan’s terms, but the principle is a reduction in both monthly payments and total interest paid over the life of the refinanced loan.

Closing Notes

Successfully managing student loan repayment requires careful planning and proactive decision-making. By understanding the various factors influencing repayment timelines and exploring the available strategies for faster repayment, you can create a personalized plan that aligns with your financial goals and circumstances. Remember to regularly review your progress and adapt your strategy as needed to ensure a smooth and timely repayment process. Taking control of your student loan debt empowers you to achieve long-term financial stability and success.

Essential Questionnaire

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, which has serious consequences.

Can I consolidate my federal and private student loans?

You can’t consolidate federal and private loans together, but you can refinance them with a private lender to potentially get a lower interest rate.

What is the difference between forbearance and deferment?

Forbearance temporarily suspends or reduces your payments, but interest may still accrue. Deferment temporarily postpones payments, and in some cases, interest may not accrue.

Where can I find additional resources for student loan repayment assistance?

The National Foundation for Credit Counseling (NFCC) and the U.S. Department of Education website are excellent resources.