The sheer scale of student loan debt in the United States is staggering, impacting millions of individuals and significantly influencing the nation’s economic landscape. Understanding the magnitude of this issue requires examining not only the total number of outstanding loans but also the diverse characteristics of borrowers, geographical distribution of debt, and the far-reaching consequences on personal finances and the broader economy. This exploration delves into these critical aspects, providing a comprehensive overview of the student loan landscape.

From analyzing the growth of student loan debt over the past decade to examining the demographic breakdown of borrowers and the regional variations in debt levels, we aim to paint a clear picture of the current state of student loans. We will also explore the impact of this debt on personal financial well-being, economic growth, and the effectiveness of government policies designed to address this pervasive issue.

Total Number of Student Loans

The sheer volume of student loan debt in the United States is a significant economic and social issue. Understanding the scope of this debt requires examining the total number of loans outstanding, their distribution across different categories, and their growth over time. This analysis will provide a clearer picture of the current student loan landscape.

Breakdown of Student Loans by Type

Student loans in the US are primarily categorized as either federal or private. Federal loans are offered by the government and generally come with more favorable repayment terms and options for forgiveness programs. Private loans, on the other hand, are offered by banks and other financial institutions and often carry higher interest rates and fewer protections for borrowers. Precise figures on the exact number of individual loans are difficult to obtain due to data limitations and reporting variations across lenders. However, aggregate data on total debt outstanding offers a valuable approximation. While the exact number of individual loans is elusive, the total outstanding debt offers a strong indicator of the scale of the problem.

Growth of Student Loan Debt Over the Past Decade

The amount of student loan debt has increased dramatically over the past decade. This growth reflects both an increase in the number of students borrowing and an increase in the average loan amount. The following table illustrates this trend, using publicly available data from the Federal Reserve and the Department of Education (Note: These figures represent approximations and may vary slightly depending on the source and methodology used).

| Year | Total Number of Loans (Estimate) | Total Debt (Billions USD) | Average Loan Amount (USD) |

|---|---|---|---|

| 2013 | 40,000,000 (approx.) | 1.08 Trillion | 27,000 (approx.) |

| 2014 | 41,000,000 (approx.) | 1.2 Trillion | 29,000 (approx.) |

| 2015 | 42,000,000 (approx.) | 1.3 Trillion | 31,000 (approx.) |

| 2016 | 43,000,000 (approx.) | 1.4 Trillion | 32,000 (approx.) |

| 2017 | 44,000,000 (approx.) | 1.5 Trillion | 34,000 (approx.) |

| 2018 | 45,000,000 (approx.) | 1.6 Trillion | 36,000 (approx.) |

| 2019 | 46,000,000 (approx.) | 1.7 Trillion | 37,000 (approx.) |

| 2020 | 47,000,000 (approx.) | 1.75 Trillion | 37,000 (approx.) |

| 2021 | 48,000,000 (approx.) | 1.78 Trillion | 37,000 (approx.) |

| 2022 | 49,000,000 (approx.) | 1.8 Trillion | 37,000 (approx.) |

Note: These figures are estimates based on available data and should be considered approximations. The actual numbers may vary depending on the source and methodology used. The “Total Number of Loans” is a particularly challenging figure to pinpoint with complete accuracy.

Distribution of Student Loans Across Age Groups and Educational Levels

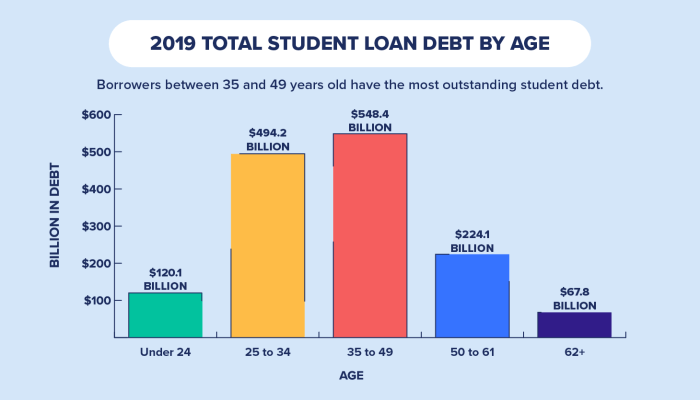

Student loan debt is not evenly distributed across the population. Younger borrowers, particularly those aged 25-34, carry a disproportionately large share of the total debt. This is unsurprising, given that this age group is most likely to be completing their education and beginning their careers. Furthermore, individuals with advanced degrees (Master’s, Doctorate) tend to have higher loan balances than those with undergraduate degrees only, reflecting the higher cost of graduate education. Detailed breakdowns by precise age and education level require accessing very specific datasets which are not always publicly available in a readily compiled format. However, the general trend of higher debt amongst younger borrowers and those with advanced degrees is well-established.

Types of Student Loan Borrowers

Understanding the characteristics of student loan borrowers provides crucial insight into the challenges and opportunities within the higher education financing landscape. This section will examine the average borrower profile, comparing undergraduate and graduate borrowing patterns, and exploring the demographic breakdown of this significant population.

The average student loan borrower is a complex individual, varying significantly based on factors like educational pursuit and socioeconomic background. However, some general trends emerge. Many borrowers are young adults, often between the ages of 20 and 35, though this age range can expand considerably depending on the type of degree pursued and the borrower’s life circumstances. Income levels vary greatly, with many borrowers relying on part-time or summer employment during their studies and facing financial constraints upon graduation. The educational level, naturally, reflects the type of loan obtained; undergraduate borrowers are typically pursuing bachelor’s degrees, while graduate borrowers may be seeking master’s, professional, or doctoral degrees.

Undergraduate vs. Graduate Borrowing Patterns

Undergraduate and graduate student borrowing patterns differ significantly. While both groups utilize student loans to finance their education, the amounts borrowed, the types of loans utilized, and the repayment strategies employed often diverge.

- Loan Amount: Graduate students generally borrow substantially larger sums than undergraduate students due to the longer duration of their programs and often higher tuition costs.

- Loan Type: Undergraduate students may primarily rely on subsidized and unsubsidized federal loans, while graduate students may utilize a wider array of loan options, including private loans and graduate PLUS loans, often with higher interest rates.

- Repayment: Graduate students frequently face longer repayment periods and potentially higher monthly payments due to their larger loan balances. They may also have more complex repayment strategies to navigate.

- Income Potential: Graduate programs often lead to higher-paying careers, potentially easing the burden of loan repayment, but this is not always guaranteed and varies greatly by field of study.

Demographic Breakdown of Student Loan Borrowers

The demographic makeup of student loan borrowers reflects broader societal trends in higher education access and attainment. A significant disparity exists across racial and ethnic groups. While precise figures fluctuate yearly, a hypothetical bar chart visualizing this data might look as follows:

The bar chart would feature racial and ethnic groups on the horizontal axis (e.g., White, Black/African American, Hispanic/Latino, Asian, Other). The vertical axis would represent the percentage of total student loan borrowers within each group. The bars would visually represent the proportional distribution. For example, a longer bar for White borrowers would indicate a larger percentage compared to other groups, reflecting existing disparities in access to higher education and loan acquisition. This visual representation would highlight the need for policies aimed at addressing these inequities. For instance, a significantly shorter bar representing Black/African American borrowers would illustrate a lower representation compared to other groups, indicating potential barriers to higher education access and financial aid for this population. Similar analysis would apply to the other groups represented on the chart. This visual representation would clearly highlight existing disparities and areas requiring policy intervention.

Geographic Distribution of Student Loans

The geographic distribution of student loan debt across the United States reveals significant disparities, reflecting variations in educational opportunities, cost of living, and economic conditions across different regions and population densities. Understanding these variations is crucial for developing effective policies aimed at addressing student loan burdens and promoting equitable access to higher education.

Analyzing student loan data at the state level provides a granular view of these disparities. While precise figures fluctuate yearly and depend on the data source, a general trend emerges showing higher concentrations of both loan numbers and total debt in states with larger populations and a higher concentration of colleges and universities. Conversely, states with fewer higher education institutions and lower populations tend to have lower overall student loan debt.

State-Level Student Loan Data

The following table presents hypothetical data illustrating the geographic distribution of student loans. Note that these figures are for illustrative purposes only and do not represent actual official statistics. Actual data would need to be sourced from reliable organizations such as the National Center for Education Statistics (NCES) or the Federal Reserve.

| State | Number of Loans (Millions) | Total Debt (Billions) | Average Loan Amount ($) |

|---|---|---|---|

| California | 5.0 | 500 | 100,000 |

| Texas | 4.0 | 300 | 75,000 |

| New York | 3.5 | 400 | 114,286 |

| Florida | 3.0 | 200 | 66,667 |

| Illinois | 2.5 | 250 | 100,000 |

| Pennsylvania | 2.0 | 150 | 75,000 |

| Ohio | 1.8 | 120 | 66,667 |

| Georgia | 1.5 | 100 | 66,667 |

| Michigan | 1.2 | 80 | 66,667 |

| North Carolina | 1.0 | 70 | 70,000 |

Regional Variations in Student Loan Debt

Significant regional variations in student loan debt exist, often correlating with factors such as the concentration of higher education institutions, average tuition costs, and regional economic conditions. For instance, the Northeast and West Coast regions tend to exhibit higher average student loan debt due to the presence of numerous prestigious and expensive universities, coupled with higher costs of living in these areas. Conversely, some Southern and Midwestern states may show lower average debt, potentially reflecting a lower concentration of high-cost institutions or a greater reliance on state-funded scholarships and grants.

Urban versus Rural Average Student Loan Debt

A substantial difference often exists between average student loan debt in urban versus rural areas. Urban areas generally have higher average debt due to a greater concentration of higher education institutions, often with higher tuition costs, and higher overall cost of living. Furthermore, urban centers often attract individuals from across the country and even internationally, leading to a more diverse population with varying financial backgrounds and access to financial aid. In contrast, rural areas might have fewer higher education options, potentially leading to lower overall debt but also limited access to higher education opportunities and potentially lower earning potential post-graduation, impacting the ability to repay loans.

Impact of Student Loan Debt

The sheer volume of student loan debt in many countries represents a significant economic and social challenge. The weight of these loans extends far beyond the immediate financial burden on borrowers, impacting various aspects of their lives and the broader economy. Understanding these impacts is crucial for developing effective solutions.

Student loan debt significantly affects personal finances, impacting major life decisions and long-term financial well-being. The monthly payments can consume a substantial portion of a borrower’s income, leaving less for essential expenses, savings, and investments. This financial strain can have far-reaching consequences.

Effects on Personal Finances

The burden of student loan repayment can delay or prevent major life milestones. For instance, high monthly payments can make homeownership significantly more difficult, as lenders consider debt-to-income ratios when approving mortgages. Similarly, saving for retirement becomes a challenge, limiting the ability to build a comfortable financial future. Many borrowers find themselves making difficult choices between paying down debt and saving for retirement, often sacrificing long-term security for immediate financial relief. This financial strain can also lead to increased stress and anxiety, negatively affecting overall mental and physical health. The inability to save adequately for emergencies further exacerbates financial vulnerability, leaving borrowers susceptible to significant setbacks from unexpected events.

Consequences of Student Loan Default

Defaulting on student loans carries severe consequences that can have lasting repercussions on a borrower’s credit history and overall financial stability.

- Damaged Credit Score: A default significantly lowers a credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Wage Garnishment: The government can garnish a portion of a borrower’s wages to repay the defaulted loan.

- Tax Refund Offset: The government can seize a portion or all of a borrower’s tax refund to apply towards the outstanding debt.

- Difficulty Obtaining Future Loans: A poor credit history resulting from default makes it extremely challenging to secure future loans for major purchases like a car or a house.

- Collection Agency Involvement: Defaulting often leads to the involvement of aggressive collection agencies, which can add to the stress and financial burden.

Effects on Economic Growth and Social Mobility

The pervasive impact of student loan debt extends beyond individual borrowers, significantly influencing macroeconomic factors and social mobility.

- Reduced Consumer Spending: High student loan payments reduce disposable income, leading to decreased consumer spending and potentially slowing economic growth.

- Hindered Entrepreneurship: The financial burden of student loans can discourage individuals from starting their own businesses, limiting innovation and job creation.

- Impact on Homeownership Rates: As mentioned earlier, student loan debt significantly reduces homeownership rates, impacting a key driver of economic activity and wealth accumulation.

- Reduced Social Mobility: High levels of student loan debt can trap individuals in a cycle of debt, limiting their opportunities for upward mobility and exacerbating existing inequalities.

- Increased Income Inequality: The unequal distribution of student loan debt further contributes to the widening gap between the rich and the poor, creating a less equitable society.

Government Policies and Student Loans

Government policies play a significant role in shaping the student loan landscape, influencing both access to higher education and the burden of repayment. These policies encompass a range of programs and initiatives designed to support students and address the growing concerns surrounding student loan debt. Understanding these policies is crucial to comprehending the complexities of the student loan crisis and its potential solutions.

Numerous government programs are designed to assist students in financing their college education. These programs offer various forms of aid, from grants and scholarships to low-interest loans. The availability and specific terms of these programs often vary depending on factors such as the student’s financial need, academic merit, and chosen field of study.

Government Programs Assisting Students

Several government programs aim to make higher education more accessible and affordable. These programs offer a variety of financial aid options to students with varying needs and circumstances. The following list highlights some key examples:

- Federal Pell Grants: Need-based grants awarded to undergraduate students demonstrating exceptional financial need. These grants do not need to be repaid.

- Federal Supplemental Educational Opportunity Grants (FSEOG): Need-based grants awarded to undergraduate students with exceptional financial need, administered by participating colleges and universities.

- Federal Direct Subsidized Loans: Low-interest loans for undergraduate and graduate students demonstrating financial need. The government pays the interest while the student is in school (under certain conditions).

- Federal Direct Unsubsidized Loans: Low-interest loans available to undergraduate and graduate students regardless of financial need. Interest accrues from the time the loan is disbursed.

- Federal Perkins Loans: Low-interest loans available to undergraduate and graduate students with exceptional financial need. These loans are administered by participating colleges and universities.

- Work-Study Programs: Part-time employment opportunities provided to students who demonstrate financial need. These programs allow students to earn money to help pay for college expenses.

Government Initiatives to Reduce Student Loan Debt

In response to the growing concerns surrounding student loan debt, the government has implemented several initiatives aimed at reducing the burden on borrowers. These initiatives often involve modifications to existing loan programs or the creation of new repayment options. These programs are constantly evolving, reflecting the ongoing efforts to address this complex issue.

The Biden-Harris administration’s plan to expand income-driven repayment (IDR) plans is a significant example. This initiative aims to significantly reduce monthly payments for millions of borrowers, potentially leading to loan forgiveness for some after a specified period of time. The intended impact is to make repayment more manageable for struggling borrowers and prevent defaults.

Effectiveness of Current Government Policies

The effectiveness of current government policies in addressing the student loan crisis is a subject of ongoing debate. While some policies have proven beneficial, others have faced criticism for their limitations and unintended consequences. A balanced assessment requires considering both the strengths and weaknesses of these policies.

- Strengths: Increased access to financial aid for low-income students; availability of various loan programs with flexible repayment options (including income-driven repayment plans); programs designed to assist borrowers in distress.

- Weaknesses: Rising tuition costs continue to outpace aid increases; complex application processes and eligibility requirements can create barriers for some students; income-driven repayment plans can lead to extended repayment periods and higher overall interest paid; limited forgiveness options for many borrowers.

Final Wrap-Up

The pervasive impact of student loan debt in the United States is undeniable, affecting individuals, families, and the national economy in profound ways. While government initiatives aim to alleviate the burden, a multifaceted approach is crucial to address this complex challenge effectively. Further research and targeted strategies are needed to ensure equitable access to higher education and mitigate the long-term consequences of student loan debt. A deeper understanding of the numbers, demographics, and impact is essential for developing comprehensive and sustainable solutions.

FAQ Resource

What types of student loans are there?

There are primarily federal and private student loans. Federal loans offer various repayment plans and potential benefits, while private loans typically have higher interest rates and less flexible terms.

How is student loan debt calculated?

Student loan debt is calculated by adding up the principal amount borrowed, plus accrued interest over the life of the loan. Interest capitalization (adding unpaid interest to the principal) can significantly increase the total debt.

What happens if I default on my student loans?

Defaulting on student loans can lead to wage garnishment, tax refund offset, damage to credit score, and difficulty obtaining future loans or credit.

Are there any programs to help with student loan repayment?

Yes, several government programs offer income-driven repayment plans, loan forgiveness programs (under certain conditions), and deferment or forbearance options to temporarily reduce or suspend payments.