Navigating the world of student loans can feel overwhelming, especially when grappling with the crucial question: How long will it take to repay my debt? Understanding the repayment timeline is key to effective financial planning and minimizing long-term interest costs. This guide delves into the various factors influencing student loan repayment periods, offering clarity and actionable strategies for managing your debt effectively.

From standard repayment plans and income-driven options to loan forgiveness programs and the impact of interest rates, we’ll explore the multifaceted landscape of student loan repayment. We’ll examine how loan amounts, repayment plan choices, and personal financial situations all contribute to the overall length of your repayment journey. By understanding these factors, you can make informed decisions that align with your financial goals and ultimately lead to a debt-free future.

Standard Loan Repayment Periods

Understanding the various repayment options available for federal student loans is crucial for effective financial planning after graduation. Choosing the right repayment plan significantly impacts your monthly payments and the total amount of interest you’ll pay over the life of the loan. This section details standard repayment periods and factors to consider when making your selection.

Standard Federal Student Loan Repayment Plans

The length of your repayment plan directly affects your monthly payment amount and the total interest accrued. Federal student loans offer several standard repayment plans, each with a different term length. The following table Artikels some common options:

| Repayment Plan | Repayment Period | Monthly Payment (Example) | Total Interest Paid (Example) |

|---|---|---|---|

| Standard Repayment Plan | 10 years | $300 | $5,000 |

| Extended Repayment Plan | 12-25 years | $200 | $10,000 |

| Graduated Repayment Plan | 10 years | Starts low, increases over time | $7,000 |

| Income-Driven Repayment Plan (Example) | 20-25 years | Based on income | Variable, potentially high |

*Note: The example monthly payment and total interest amounts are illustrative and will vary significantly based on the loan principal, interest rate, and chosen repayment plan.*

Impact of Repayment Plan Length on Total Interest Paid

Longer repayment periods generally result in lower monthly payments. However, this convenience comes at a cost: you’ll pay significantly more interest over the life of the loan. For instance, a $10,000 loan with a 5% interest rate repaid over 10 years will accrue substantially less interest than the same loan repaid over 25 years. The difference can amount to thousands of dollars. Choosing a shorter repayment period can save considerable money in the long run, despite the higher monthly payments.

Factors Influencing Repayment Plan Length Selection

Several factors influence the choice of a repayment plan. These include your current financial situation, anticipated future income, risk tolerance, and long-term financial goals. Individuals with higher incomes might prefer shorter repayment periods to minimize total interest paid, while those with lower incomes might opt for longer periods with lower monthly payments to better manage their cash flow. Careful consideration of these factors is crucial for making an informed decision.

Student Loan Repayment Plan Selection Process

The process of selecting a student loan repayment plan can be visualized using a flowchart. The flowchart would begin with assessing your current financial situation and future income projections. This assessment would then lead to evaluating different repayment options based on your risk tolerance and financial goals. Finally, the process would culminate in the selection of the most suitable repayment plan, considering the trade-off between monthly payments and total interest paid. This systematic approach helps ensure a well-informed decision.

Factors Affecting Loan Repayment Time

Understanding the length of your student loan repayment journey requires considering several key factors. These factors interact in complex ways, significantly influencing the total time it takes to become debt-free. Let’s examine some of the most important variables.

Loan Amount’s Impact on Repayment Duration

The size of your initial loan significantly impacts repayment time. Larger loan balances naturally necessitate longer repayment periods, even with consistent monthly payments. For instance, a $50,000 loan will take considerably longer to repay than a $20,000 loan, assuming all other factors remain constant. A larger loan principal requires more time to amortize, meaning the principal is gradually reduced over the life of the loan through regular payments. Higher loan amounts often result in higher monthly payments as well, which may or may not shorten the repayment time depending on the chosen repayment plan.

Interest Rates and Repayment Timeline

Interest rates play a crucial role in determining the overall repayment timeline. Higher interest rates mean a larger portion of your monthly payment goes towards interest rather than principal reduction. This leads to a longer repayment period, as more of your money is effectively wasted on interest charges. Conversely, lower interest rates allow a larger portion of your payment to reduce the principal balance, accelerating the repayment process. For example, a loan with a 7% interest rate will take longer to repay than an identical loan with a 4% interest rate. The compounding effect of interest over time is significant, magnifying the difference between these rates over the life of the loan.

Influence of Different Repayment Plan Options

Various repayment plans offer different approaches to managing student loan debt. Income-driven repayment (IDR) plans, for example, adjust monthly payments based on your income and family size. While this can lead to lower monthly payments, it often extends the repayment period significantly, potentially to 20 or 25 years. Standard repayment plans, on the other hand, typically have shorter repayment periods (usually 10 years) but may result in higher monthly payments. Choosing the right plan depends on your individual financial circumstances and long-term goals. A longer repayment period under an IDR plan offers lower monthly payments, providing immediate financial relief, but ultimately leads to paying more in interest over the life of the loan.

Repayment Timelines for Subsidized and Unsubsidized Loans

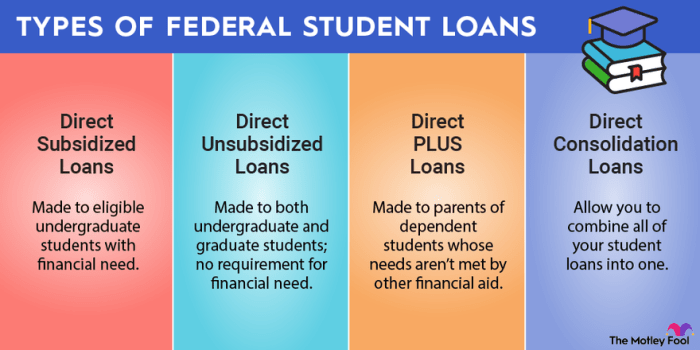

Subsidized and unsubsidized loans differ in how interest accrues. With subsidized loans, the government pays the interest while you are in school and during grace periods. This means the principal balance remains unchanged during these periods, potentially leading to a shorter repayment period once repayment begins. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, even while you are in school. This added interest increases the principal balance, extending the overall repayment timeline. The difference can be substantial, especially for longer educational programs. The added interest on unsubsidized loans increases the total amount that must be repaid, leading to a longer repayment period.

Loan Forgiveness and Early Repayment

Navigating student loan repayment can feel overwhelming, but understanding the options available, including loan forgiveness programs and the benefits of early repayment, can significantly impact your financial future. This section details the conditions for loan forgiveness, examples of eligible professions, and the application process. It also explores the advantages and disadvantages of accelerating your loan repayment.

Loan forgiveness programs offer the possibility of eliminating a portion or all of your student loan debt under specific circumstances. These programs are generally designed to incentivize borrowers to pursue careers in public service or areas of national need. Eligibility requirements vary widely depending on the specific program and the type of loan.

Loan Forgiveness Program Eligibility

Several federal and state programs offer loan forgiveness. The Public Service Loan Forgiveness (PSLF) program, for example, forgives the remaining balance on Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying employer. Qualifying employers typically include government organizations or non-profit organizations. Other programs, such as the Teacher Loan Forgiveness program, target specific professions like teaching in underserved schools. Eligibility often depends on factors such as the type of loan, the borrower’s employment history, and the type of work performed. It’s crucial to thoroughly research the specific requirements of each program to determine eligibility.

Examples of Professions Eligible for Loan Forgiveness

Many professions qualify for loan forgiveness programs. These often include roles in public service, healthcare, and education within underserved communities. Examples include teachers in low-income schools, social workers, nurses working in rural areas, and government employees at various levels. The specific requirements and eligibility criteria for each profession vary based on the loan forgiveness program. Some programs may require a certain number of years of service, while others may have specific requirements regarding the type of employer or the location of employment.

Applying for Loan Forgiveness Programs

The application process for loan forgiveness programs can be complex and time-consuming. It typically involves gathering extensive documentation, including employment verification, proof of loan repayment history, and possibly additional forms depending on the specific program. Borrowers must meticulously track their payments and ensure they meet all the program’s requirements. Failure to meet even one requirement can result in application rejection. It is advisable to carefully review the program guidelines and seek assistance from a financial advisor or student loan counselor to navigate the application process efficiently. Many programs require annual recertification to maintain eligibility.

Benefits and Drawbacks of Early Repayment

Making extra payments on your student loans can significantly reduce the total interest paid and shorten the repayment period. Before deciding on this strategy, it’s essential to weigh the benefits against the potential drawbacks.

- Benefits: Reduced total interest paid, faster loan repayment, improved credit score, increased financial flexibility after loan repayment.

- Drawbacks: Reduced liquidity (less readily available cash), potential missed opportunities for higher-return investments, and the need to carefully manage your budget to accommodate extra payments.

Early repayment offers substantial long-term financial benefits, but it requires careful planning and prioritization of financial resources. Consider your overall financial situation and risk tolerance before committing to extra payments.

Understanding Loan Terms and Conditions

Navigating the complexities of student loan repayment requires a thorough understanding of the terms and conditions associated with your loan. This section will clarify key aspects, empowering you to make informed decisions and manage your debt effectively. Understanding these details is crucial for avoiding pitfalls and ensuring a smoother repayment journey.

Grace Periods and Deferment Options

Grace periods and deferment options offer temporary relief from loan repayment. A grace period is a period after graduation or leaving school before repayment begins. The length of the grace period varies depending on the loan type and lender. Deferment, on the other hand, allows for the temporary suspension of loan payments due to specific circumstances, such as unemployment or enrollment in further education. These options provide crucial flexibility during times of financial hardship or transition. It’s vital to check your loan documents to determine the specifics of your grace period and eligibility for deferment. Failure to understand these provisions can lead to unnecessary late payment fees and damage to your credit score.

Implications of Defaulting on a Student Loan

Defaulting on a student loan, which occurs when you fail to make payments for a specified period (typically 90 days), has severe consequences. These consequences extend far beyond a damaged credit score. They can include wage garnishment, tax refund offset (where the government intercepts your tax refund to pay the debt), and difficulty obtaining future loans or credit. In some cases, the lender may pursue legal action to recover the debt. The impact on your financial future can be substantial and long-lasting, making it imperative to prioritize loan repayment even during challenging financial times. Explore options like income-driven repayment plans or contacting your lender before defaulting to avoid these severe consequences.

Student Loan Refinancing

Refinancing your student loans involves replacing your existing loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total amount you pay over the life of the loan. However, refinancing may lengthen your repayment period, potentially increasing the overall interest paid. The decision to refinance should be carefully considered, weighing the benefits of a lower interest rate against the potential increase in the total interest paid. Factors such as your credit score, income, and the interest rates offered by various lenders will influence the terms of your refinanced loan. Thorough research and comparison shopping are crucial before making a decision.

Consequences of Missing Loan Payments

Missing even a single student loan payment can trigger a cascade of negative consequences. Late payment fees are immediately incurred, increasing your total debt. Your credit score will take a significant hit, impacting your ability to secure loans, rent an apartment, or even get a job in certain fields. Repeated missed payments can lead to loan delinquency and ultimately, default, as described previously. The impact on your financial well-being is profound and long-lasting, emphasizing the importance of proactive repayment planning and seeking assistance if you anticipate difficulties in making your payments. The stress and anxiety associated with managing delinquent debt are also significant considerations. For example, a missed payment resulting in a late fee of $50 might seem insignificant initially, but this can compound over time, leading to hundreds of dollars in extra costs and impacting your credit score severely, making it difficult to secure a mortgage or car loan in the future.

The Role of Income and Expenses

Your income and expenses play a crucial role in determining your student loan repayment strategy and timeline. Higher income generally allows for larger monthly payments, leading to faster repayment and less overall interest paid. Conversely, lower income may necessitate exploring income-driven repayment plans, which adjust payments based on your earnings. Effective budgeting and expense management are key to navigating student loan repayment regardless of your income level.

Income levels directly influence the feasibility and selection of different repayment plans. Individuals with higher incomes can comfortably afford standard repayment plans, characterized by fixed monthly payments over a 10-year period. However, those with lower incomes might find standard plans financially burdensome, necessitating the exploration of income-driven repayment plans (IDR). IDRs, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, calculate monthly payments based on a percentage of discretionary income, often extending the repayment period to 20 or 25 years. This flexibility protects borrowers from overwhelming debt while acknowledging varying financial capacities. Choosing the right plan is critical to ensuring manageable monthly payments and avoiding default.

Income-Driven Repayment Plan Selection

The selection of an income-driven repayment plan hinges on a borrower’s current and projected income, as well as their overall financial circumstances. A borrower earning a substantial salary might opt for a standard repayment plan to minimize the total interest paid over the life of the loan. Conversely, a borrower with a lower income might find an income-driven repayment plan more suitable to manage their monthly expenses and prevent financial strain. The specific features and eligibility requirements of each IDR plan vary, necessitating careful consideration of individual circumstances before making a decision. Factors such as family size, number of dependents, and other financial obligations also play a role in determining the optimal plan. For example, a recent graduate with a low-paying job might qualify for a REPAYE plan with significantly lower monthly payments compared to a standard plan, allowing them to focus on establishing financial stability while still making progress on their student loan debt.

Budgeting and Expense Management Strategies

Effective budgeting and expense management are paramount for accelerating student loan repayment. Creating a detailed budget allows for identifying areas where expenses can be reduced, freeing up funds for loan payments. This involves tracking income and expenses meticulously, categorizing expenditures to pinpoint areas of overspending, and setting realistic financial goals. Strategies include identifying non-essential expenses that can be cut back on, such as dining out, entertainment, or subscriptions. Negotiating lower interest rates or consolidating loans can also significantly reduce the total cost of repayment and shorten the repayment period. For example, a borrower could reduce their monthly expenses by packing lunches instead of eating out, reducing their monthly food costs by approximately $200. This extra $200 can be directed towards their student loan payment, substantially reducing the loan repayment period.

Student Loan Consolidation

Consolidating multiple student loans into a single loan can simplify repayment and potentially lower monthly payments. This involves combining several loans with varying interest rates and repayment terms into one loan with a single monthly payment. While consolidation doesn’t necessarily reduce the total amount owed, it can streamline the repayment process and potentially secure a lower interest rate, leading to lower overall interest paid and faster repayment. However, it’s crucial to carefully weigh the pros and cons before consolidating, as it might extend the repayment term and increase the total interest paid in some cases. For instance, a borrower with three separate loans at 6%, 7%, and 8% interest rates might be able to consolidate them into a single loan with a lower average interest rate, making their monthly payments more manageable.

Sample Student Loan Repayment Budget

| Income | Amount |

|---|---|

| Monthly Net Income | $3000 |

| Expenses | Amount |

| Housing | $1000 |

| Food | $500 |

| Transportation | $300 |

| Utilities | $200 |

| Student Loan Payment | $500 |

| Other Expenses | $500 |

This sample budget demonstrates how a borrower with a monthly net income of $3000 can allocate $500 towards student loan repayment while still covering essential expenses. Adjusting this budget based on individual income and expenses is crucial for effective student loan management. Prioritizing loan repayment within the budget ensures consistent progress towards debt elimination.

End of Discussion

Successfully managing student loan repayment requires careful planning and a proactive approach. By understanding the various repayment options, factors influencing repayment duration, and available resources like loan forgiveness programs, borrowers can develop a tailored strategy to minimize their debt burden. Remember to carefully consider your individual circumstances, explore different repayment plans, and proactively manage your finances to achieve timely and efficient repayment. Taking control of your student loan repayment journey empowers you to build a strong financial foundation for the future.

General Inquiries

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, with serious consequences like wage garnishment.

Can I refinance my student loans to shorten the repayment period?

Yes, refinancing can potentially lower your interest rate and shorten your repayment term, but it often involves private lenders and may not be suitable for all borrowers.

What are income-driven repayment plans?

These plans base your monthly payments on your income and family size, potentially extending your repayment period but lowering monthly payments.

Are there any penalties for paying off my student loans early?

Generally, there are no penalties for early repayment, and it can save you significant interest in the long run.