Navigating the world of student loans can feel overwhelming, especially when faced with the crucial question: how much financial aid can you actually secure? The amount you can borrow depends on a complex interplay of factors, from your chosen institution and academic program to your credit history and the overall cost of your education. Understanding these elements is key to effectively planning your finances for higher education.

This guide provides a comprehensive overview of student loan eligibility, exploring both federal and private loan options, their respective limits, and the application process. We’ll delve into the various factors that influence loan amounts and offer practical strategies for managing your student loan debt after graduation. Ultimately, our aim is to equip you with the knowledge needed to make informed decisions about financing your education.

Factors Affecting Student Loan Amounts

Securing student loans involves a multifaceted process, with several key factors influencing the amount you can borrow. Understanding these factors is crucial for planning your education financing effectively. This section details the primary elements that lenders consider when determining loan eligibility and disbursement amounts.

Educational Institution Type

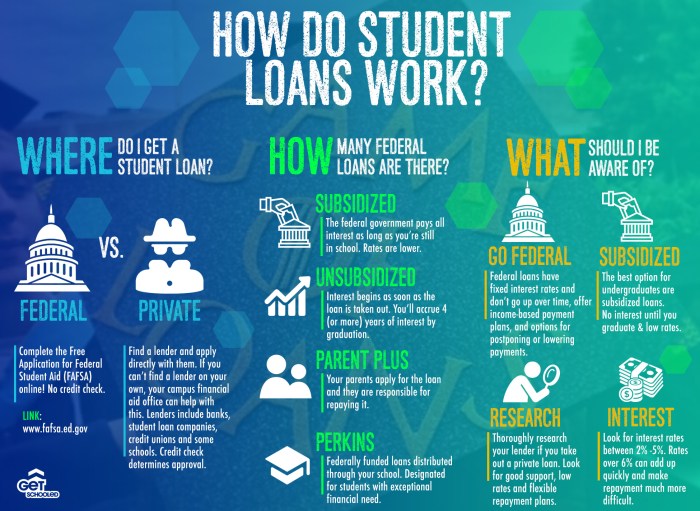

The type of institution you attend significantly impacts your loan eligibility and the amount you can borrow. Public institutions generally have lower tuition costs than private institutions, leading to lower overall loan amounts needed. However, private institutions often have more generous endowments and may offer their own institutional loans with varying eligibility criteria and amounts. Federal loan programs, while available to students at both public and private institutions, often have different maximum loan limits based on the school’s cost of attendance and the student’s dependency status. For example, a student attending a prestigious private university may qualify for higher loan amounts due to the higher cost of attendance, even though the percentage of need-based aid might be lower than a student at a public university.

Academic Program

The type of program you’re enrolled in (undergraduate, graduate, professional) also affects loan amounts. Graduate and professional programs typically have higher tuition costs, resulting in higher loan limits. Federal loan programs often allow students to borrow more for graduate studies than for undergraduate studies. This is because graduate programs generally require more intensive study and may involve higher living expenses due to the student’s increased age and potentially different living arrangements. For instance, a medical student pursuing an MD degree will likely be eligible for higher loan amounts compared to an undergraduate studying history.

Credit History and Co-signer Availability

For private student loans, your credit history plays a crucial role. A strong credit history with a good credit score significantly improves your chances of approval and can result in more favorable loan terms, including potentially higher loan amounts and lower interest rates. If you lack a credit history or have poor credit, securing a co-signer with good credit can substantially increase your eligibility and the loan amount you can obtain. A co-signer essentially guarantees the loan, reducing the lender’s risk. Federal student loans, however, generally don’t require a credit check or co-signer, focusing instead on factors such as enrollment status and financial need.

Cost of Attendance

The cost of attendance (COA) at your chosen institution is a critical determinant of loan amounts. COA includes tuition, fees, room and board, books, and other living expenses. Lenders use the COA to determine your financial need and the maximum loan amount they’re willing to provide. A higher COA naturally leads to a higher potential loan amount, as the institution’s costs directly influence the amount of financial aid needed. The institution’s financial aid office usually provides a detailed breakdown of the COA for each academic year.

Maximum Loan Amounts: Federal vs. Private

| Loan Type | Maximum Loan Amount | Interest Rate Range | Repayment Options |

|---|---|---|---|

| Federal Subsidized/Unsubsidized Loans (Undergraduate) | Varies by year and dependency status; check current federal guidelines | Varies by loan type and year; check current federal guidelines | Standard, graduated, income-driven |

| Federal Graduate PLUS Loans | Up to the total cost of attendance, minus other financial aid | Varies by year; check current federal guidelines | Standard, graduated, income-driven |

| Private Student Loans | Varies greatly by lender and applicant; often capped at the cost of attendance | Highly variable, often higher than federal loans | Varies by lender; often standard or graduated |

Types of Student Loans and Their Limits

Navigating the world of student loans can be complex, with various types offering different benefits and drawbacks. Understanding the distinctions between federal and private loans, as well as the nuances within each category, is crucial for making informed borrowing decisions. This section will clarify the key differences between various student loan types and their associated borrowing limits.

Federal Subsidized and Unsubsidized Loans

Federal subsidized and unsubsidized loans are offered by the U.S. government and generally have lower interest rates than private loans. The key difference lies in interest accrual. Subsidized loans do not accrue interest while the student is enrolled at least half-time, during grace periods, or while in deferment. Unsubsidized loans, however, begin accruing interest from the time the loan is disbursed. Eligibility for both loan types is determined by financial need (for subsidized loans) and enrollment status. Borrowing limits vary depending on the student’s year in school (undergraduate or graduate) and their dependency status. These limits are adjusted annually and are available on the Federal Student Aid website. For example, a dependent undergraduate student might have a maximum annual limit of $5,500 for subsidized loans and $5,500 for unsubsidized loans in their first year.

Federal PLUS Loans

Federal PLUS loans are designed for parents of dependent undergraduate students (Parent PLUS Loans) and for graduate or professional students (Graduate PLUS Loans). These loans do not require a demonstrated financial need but do involve a credit check. The maximum loan amount is generally the cost of attendance minus other financial aid received. For example, if a student’s cost of attendance is $20,000 and they receive $10,000 in grants and scholarships, the maximum Parent PLUS loan could be $10,000. Graduate students may also borrow up to the cost of attendance less other financial aid received. It’s important to note that interest rates for PLUS loans are typically higher than those for subsidized and unsubsidized loans.

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. These loans typically have higher interest rates and less favorable repayment terms compared to federal loans. Eligibility requirements vary among lenders, but generally involve a credit check and often require a co-signer if the student has limited or no credit history. Lending limits are also variable and depend on the lender’s policies and the student’s creditworthiness. Interest rates are often variable, meaning they can fluctuate throughout the repayment period, unlike federal loans which usually have fixed interest rates. The terms and conditions, including repayment plans and fees, will differ considerably from one lender to another.

Combining Federal and Private Loans

Many students find it necessary to combine federal and private loans to cover their educational expenses. This is often the case when the amount of federal aid available is insufficient to meet the total cost of attendance. For instance, a student might max out their federal loan limits but still need additional funds for tuition, room, and board. In such situations, private loans can fill the gap. However, it’s important to prioritize federal loans due to their generally more favorable terms and protections.

Summary of Student Loan Types

- Federal Subsidized Loans: Low interest rates, interest does not accrue during certain periods, eligibility based on financial need.

- Federal Unsubsidized Loans: Low interest rates, interest accrues from disbursement, eligibility based on enrollment status.

- Federal Parent PLUS Loans: For parents of dependent undergraduate students, credit check required, maximum loan amount is cost of attendance minus other aid.

- Federal Graduate PLUS Loans: For graduate and professional students, credit check required, maximum loan amount is cost of attendance minus other aid.

- Private Student Loans: Higher interest rates, variable terms and conditions, credit check required, often requires a co-signer.

The Application and Approval Process

Securing student loans, whether federal or private, involves a multi-step process that requires careful planning and attention to detail. Understanding the requirements and timelines for each type of loan is crucial for a smooth application and approval experience. This section details the steps involved in applying for both federal and private student loans, highlighting key differences and providing examples of necessary documentation.

Federal Student Loan Application

Applying for federal student loans begins with completing the Free Application for Federal Student Aid (FAFSA). This form collects information about your financial situation and is used to determine your eligibility for federal student aid, including grants, scholarships, and loans. The FAFSA is available online and requires information such as your Social Security number, tax information, and your parents’ financial information (if you are a dependent student). After submitting the FAFSA, you’ll receive a Student Aid Report (SAR) summarizing your information and indicating your eligibility for federal aid. You then select your loan type and lender (usually your school’s financial aid office). The school certifies your loan amount, and the funds are disbursed directly to your school to cover tuition and fees.

Private Student Loan Application

The process for private student loans differs significantly from federal loans. Private lenders, unlike the federal government, consider your creditworthiness. This means they will perform a credit check and assess your credit history, including your credit score, debt-to-income ratio, and payment history. A strong credit history is essential for securing favorable loan terms. If you have limited or poor credit history, you may need a co-signer – an individual with good credit who agrees to share responsibility for repaying the loan. The application process typically involves completing a loan application with the lender, providing documentation like tax returns, bank statements, and proof of enrollment. The lender reviews your application, and if approved, you’ll receive a loan offer outlining the terms and conditions, including the interest rate, repayment schedule, and fees.

Required Documents

The specific documents required for both federal and private student loan applications can vary depending on the lender and your individual circumstances. However, some common documents include:

- FAFSA: Required for federal student loans.

- Social Security Number: Needed for both federal and private loans.

- Tax Returns (W-2s, 1040s): Often required for both federal and private loans to verify income.

- Bank Statements: May be requested by private lenders to assess your financial stability.

- Proof of Enrollment: Required to verify your student status for both loan types.

- Transcript (Unofficial): Sometimes requested to verify enrollment and academic standing.

- Co-signer Information (if applicable): Required for private loans if a co-signer is needed.

Student Loan Application Flowchart

A flowchart illustrating the student loan application process would show a branching path, starting with the decision of federal vs. private loans. The federal loan path would involve completing the FAFSA, receiving the SAR, loan selection, and disbursement. The private loan path would involve applying with a lender, undergoing a credit check, potentially requiring a co-signer, loan approval, and disbursement. The final stage for both paths would be receiving the loan funds.

Comparing Loan Offers

Once you receive loan offers from multiple lenders, it’s crucial to compare them carefully. Key factors to consider include the interest rate (APR), loan fees, repayment terms, and any potential penalties for early repayment or late payments. For example, a loan with a lower interest rate might seem more appealing initially, but higher fees could offset the savings. Similarly, a shorter repayment period might lead to higher monthly payments but lower overall interest costs. Using a loan comparison tool or spreadsheet can help organize and analyze the offers effectively. A detailed comparison ensures you select the loan that best suits your financial situation and long-term goals.

Managing Student Loan Debt

Successfully navigating student loan repayment requires careful planning and proactive management. Understanding your options and developing a sound financial strategy is crucial to avoid overwhelming debt and maintain financial stability after graduation. This section Artikels key strategies and resources to help you effectively manage your student loans.

Budgeting and Managing Repayment

Creating a realistic budget is paramount to successful loan repayment. This involves tracking your income and expenses to identify areas where you can reduce spending and allocate funds towards your loan payments. Consider using budgeting apps or spreadsheets to monitor your financial progress. Prioritize essential expenses (housing, food, transportation) and allocate a specific amount each month towards your student loans. Building an emergency fund is also vital, providing a safety net for unexpected expenses that could otherwise jeopardize your repayment plan. Regularly reviewing and adjusting your budget is essential as your financial circumstances evolve.

Student Loan Repayment Plans

Several repayment plans cater to different financial situations and repayment preferences. Understanding these options is key to selecting the most suitable plan for your circumstances.

| Repayment Plan | Monthly Payment Calculation | Loan Forgiveness Options | Eligibility Requirements |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payment over 10 years. | None | All federal student loan borrowers. |

| Graduated Repayment Plan | Payments start low and gradually increase over time. | None | All federal student loan borrowers. |

| Income-Driven Repayment (IDR) Plans (e.g., ICR, PAYE, REPAYE,IBR) | Monthly payment is based on your discretionary income and family size. | Potential for loan forgiveness after 20-25 years, depending on the plan. | All federal student loan borrowers. Specific income and family size requirements apply. |

| Extended Repayment Plan | Fixed monthly payment over a longer period (up to 25 years). | None | All federal student loan borrowers. |

Consequences of Loan Default and Default Avoidance

Loan default occurs when you fail to make payments for a specified period. The consequences can be severe, including damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. To avoid default, consistently make your loan payments on time. If you anticipate difficulties, contact your loan servicer immediately to explore options such as forbearance or deferment. These programs offer temporary pauses or reduced payments, providing relief during challenging financial periods. Proactive communication with your lender is crucial in preventing default.

Resources for Struggling Borrowers

Numerous resources are available to assist borrowers facing challenges in managing their student loan debt. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services, including guidance on creating a budget and developing a repayment plan. Your loan servicer can also provide information on repayment options, hardship programs, and available resources. The Federal Student Aid website (studentaid.gov) provides comprehensive information on federal student loans, repayment plans, and debt management strategies. Additionally, many colleges and universities offer financial aid counseling services to their alumni.

Illustrative Examples of Loan Amounts

Understanding how much you might borrow for your education requires considering various factors, including your educational expenses, available financial aid, and loan limits. The following examples illustrate different scenarios and the potential impact of various financial aid sources and loan types.

Example of Total Educational Expenses and Financial Aid Coverage

Let’s consider a student, Sarah, attending a four-year public university. Her total estimated educational expenses for four years, including tuition, fees, room, board, books, and supplies, amount to $80,000. Sarah receives a Pell Grant of $6,000 per year ($24,000 total), and a merit-based scholarship of $5,000 per year ($20,000 total). This leaves her with $36,000 in uncovered expenses ($80,000 – $24,000 – $20,000). She could cover this remaining amount through a combination of federal student loans (such as subsidized and unsubsidized Stafford Loans) and potentially a smaller private loan. The specific loan amounts would depend on her eligibility and borrowing limits for federal loans.

Scenario: Exhausting Federal Loan Limits and Considering Private Loans

Suppose Michael, pursuing a specialized engineering degree, exhausts his federal loan limits after three years of undergraduate study. He still needs $25,000 to complete his final year. To cover this shortfall, he might need to take out a private loan. Private loan interest rates are typically higher than federal loan rates. For example, Michael might secure a private loan with a 7% interest rate and a 10-year repayment term. This means he’ll pay significantly more in interest over the life of the loan compared to a federal loan with a lower interest rate and potentially more favorable repayment options. The total cost of the private loan, including principal and interest, would likely exceed the initial $25,000 borrowed.

Undergraduate vs. Graduate Loan Amounts in the Same Field

Consider Maria, who is pursuing a career in medicine. For her undergraduate degree in biology, she borrows a total of $40,000 in federal student loans over four years. After graduating, she attends medical school, where the cost of tuition and living expenses is substantially higher. Over four years of medical school, she borrows an additional $200,000 in federal and potentially private loans. This significant increase reflects the higher cost of graduate professional education and the potential need for additional borrowing to cover the expenses. The total amount borrowed for her undergraduate and graduate studies combined would be $240,000. This highlights the substantial difference in borrowing needs between undergraduate and graduate programs, even within the same field.

Wrap-Up

Securing sufficient funding for higher education requires careful planning and a thorough understanding of the student loan landscape. From exploring federal and private loan options to strategically managing repayment, the journey towards financial literacy in this area is crucial. By carefully considering factors like your chosen institution, academic program, and credit history, you can effectively navigate the process and make informed decisions to finance your education. Remember to explore all available resources and seek guidance when needed.

Commonly Asked Questions

What is the FAFSA, and why is it important?

The Free Application for Federal Student Aid (FAFSA) is a form used to determine your eligibility for federal student aid, including grants, loans, and work-study programs. Completing it is essential for accessing federal student loan funds.

Can I get student loans without a co-signer?

While federal student loans generally don’t require a co-signer, private student loans often do, especially for students with limited or no credit history. The need for a co-signer can impact the loan amount you qualify for.

What happens if I default on my student loans?

Defaulting on your student loans can have serious consequences, including damage to your credit score, wage garnishment, and difficulty obtaining future loans or credit. It’s crucial to explore repayment options if you anticipate difficulties.

Are there any loan forgiveness programs available?

Yes, several loan forgiveness programs exist, often targeting specific professions (like teaching or public service) or borrowers with specific repayment difficulties. Eligibility requirements vary significantly.