Navigating the complexities of student loan repayment can feel overwhelming. The monthly payment amount significantly impacts your financial well-being, influencing your budget and long-term financial goals. This guide provides a clear and concise overview of factors affecting your monthly student loan payments, explores various repayment options, and offers practical strategies for effective debt management. Understanding these factors empowers you to make informed decisions and achieve financial stability.

From understanding the average monthly payments across different loan types and repayment plans to exploring strategies for reducing your monthly burden, we aim to demystify the process. We’ll delve into the impact of interest rates, loan principal, and repayment plan selection, providing you with the knowledge to navigate your student loan journey with confidence.

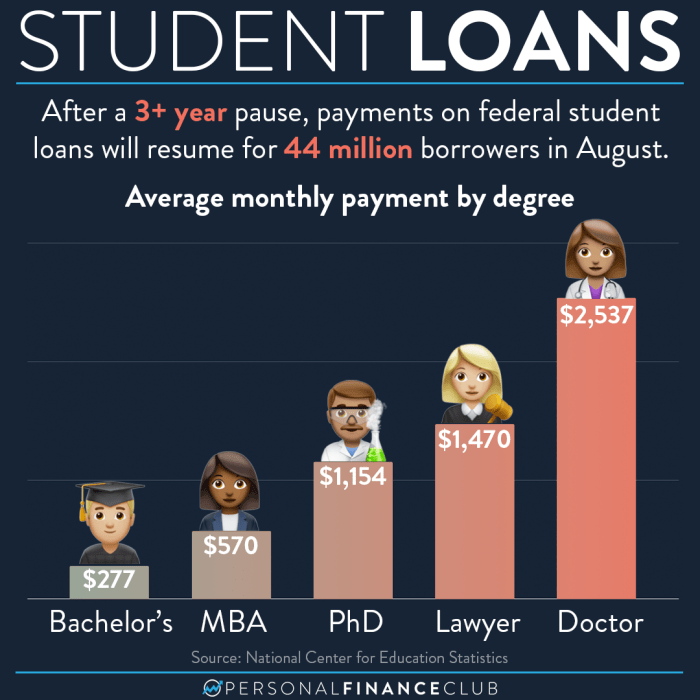

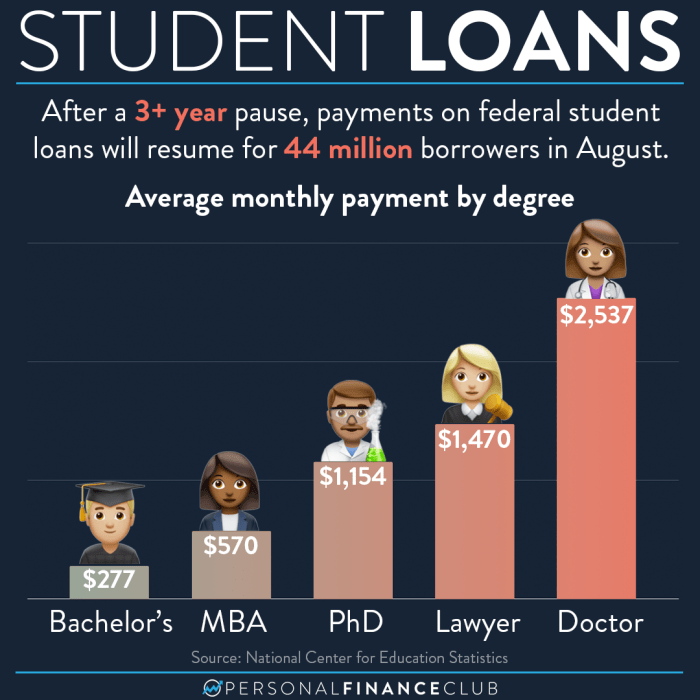

Average Monthly Student Loan Payments

Understanding the average monthly student loan payment is crucial for prospective and current borrowers. The amount varies significantly based on several factors, including loan type, amount borrowed, interest rate, and chosen repayment plan. This section will explore these variations and provide a clearer picture of what borrowers can expect.

Average Monthly Payments by Loan Type

Federal and private student loans differ significantly in their terms and conditions, leading to variations in monthly payments. Federal student loans generally offer more flexible repayment options and lower interest rates compared to private loans. While precise averages fluctuate with market conditions and borrowing patterns, a general range can be offered. For example, a typical monthly payment on a federal student loan might range from $200 to $1000, depending on factors discussed below, while private loan payments could fall within a broader range, potentially exceeding $1000 for larger loan amounts or less favorable interest rates. It’s important to note that these are broad estimations, and individual experiences will vary.

Factors Influencing Monthly Payments

Several key factors interact to determine a borrower’s monthly student loan payment. These include the loan amount, the interest rate, and the repayment plan selected.

Loan Amount: A larger loan balance naturally leads to higher monthly payments, all other factors being equal. For instance, a $50,000 loan will require substantially larger monthly payments than a $20,000 loan.

Interest Rate: The interest rate directly impacts the total amount owed and, consequently, the monthly payment. A higher interest rate will result in larger monthly payments over the life of the loan. For example, a loan with a 5% interest rate will have lower monthly payments than a loan with a 7% interest rate, assuming all other factors are the same.

Repayment Plan: The repayment plan significantly affects monthly payments. Standard repayment plans typically have shorter repayment periods and higher monthly payments compared to extended or income-driven repayment plans. Income-driven repayment plans adjust monthly payments based on income and family size, resulting in potentially lower monthly payments but longer repayment periods and higher total interest paid.

Comparison of Average Monthly Payments Across Repayment Plans

The following table illustrates the potential variation in average monthly payments for a hypothetical $50,000 student loan with a 5% interest rate across different repayment plans. These are illustrative examples, and actual payments will vary based on individual loan terms and circumstances.

| Repayment Plan | Loan Term (Years) | Estimated Average Monthly Payment | Total Interest Paid (Estimate) |

|---|---|---|---|

| Standard | 10 | $550 | $15,000 |

| Extended | 25 | $275 | $37,500 |

| Income-Driven (Example) | 20-30 | $200 – $400 (Variable) | $30,000 – $50,000 (Variable) |

Factors Influencing Monthly Student Loan Payments

Several key factors interact to determine the amount you pay monthly on your student loans. Understanding these factors allows for better financial planning and informed decision-making regarding repayment strategies. This section will explore the major influences on your monthly student loan payment.

Interest Rates and Monthly Payments

Interest rates significantly impact your monthly payment. A higher interest rate means a larger portion of your payment goes towards interest, leaving less to reduce the principal loan balance. Conversely, a lower interest rate results in a smaller monthly payment and faster principal reduction. For example, consider two identical $20,000 loans, one with a 5% interest rate and another with a 7% interest rate, both repaid over 10 years. The 5% loan would have a significantly lower monthly payment than the 7% loan. The higher interest rate necessitates a larger monthly payment to cover both the principal and the accumulated interest over the loan term. Precise calculations require using loan amortization schedules, readily available online through various financial calculators.

Loan Principal Amount and Monthly Payments

The principal loan amount—the original amount borrowed—is directly proportional to your monthly payment. A larger principal balance will invariably lead to a higher monthly payment, all other factors being equal. A $30,000 loan will require a substantially larger monthly payment than a $10,000 loan with the same interest rate and repayment period. This is because a larger principal necessitates a greater monthly payment to amortize the debt over the loan’s lifespan.

Repayment Plan Selection and Monthly Payments

The repayment plan you choose dramatically affects your monthly payment. Standard repayment plans typically spread payments over 10 years, resulting in higher monthly payments. Income-driven repayment plans, however, adjust your monthly payment based on your income and family size, often leading to lower monthly payments but potentially extending the repayment period significantly. For instance, an income-driven repayment plan might reduce your monthly payment considerably, but this often comes at the cost of paying interest for a longer period, resulting in a higher total amount paid over the life of the loan. Deferment and forbearance options temporarily suspend payments but still accrue interest, potentially increasing the total amount owed.

Other Factors Influencing Monthly Payments

Several other factors can influence your monthly student loan payment. Loan fees, charged upfront or throughout the loan term, increase the overall cost and may slightly elevate monthly payments. Capitalization of interest, where unpaid interest is added to the principal balance, increases the principal amount and thus increases future monthly payments. Furthermore, the length of the repayment period directly impacts monthly payments. A longer repayment period leads to lower monthly payments but higher total interest paid over the life of the loan. Conversely, a shorter repayment period results in higher monthly payments but less overall interest paid.

Repayment Plan Options and Their Monthly Costs

Choosing the right student loan repayment plan significantly impacts your monthly budget and overall repayment timeline. Understanding the differences between available plans is crucial for effective financial planning. This section compares four common repayment options: Standard, Extended, Graduated, and Income-Driven Repayment plans. We’ll illustrate the potential monthly payment variations using a hypothetical scenario.

Comparison of Repayment Plan Options

The choice of repayment plan directly affects your monthly payment amount and the total interest paid over the life of your loan. Each plan has its advantages and disadvantages depending on your individual financial circumstances.

- Standard Repayment Plan: This plan typically involves fixed monthly payments over a 10-year period. Payments are higher initially but result in less interest paid overall compared to longer-term plans.

- Extended Repayment Plan: This plan stretches payments over a longer period, usually up to 25 years. Monthly payments are lower, but you’ll pay significantly more in interest over the life of the loan.

- Graduated Repayment Plan: Payments start low and gradually increase over time, typically every two years. This can be helpful in the early stages of your career when income is often lower, but payments become substantially higher later on.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payment on your income and family size. Several IDR plans exist (e.g., PAYE, REPAYE, IBR), each with its own specific formula for calculating payments. Payments are typically lower than other plans, but repayment periods can be extended to 20 or 25 years, resulting in higher overall interest payments.

Hypothetical Scenario: Monthly Payment Differences

Let’s consider a hypothetical scenario: a $50,000 student loan with a 6% interest rate. The following table illustrates the estimated monthly payment differences under each plan:

| Repayment Plan | Monthly Payment (approx.) | Total Interest Paid (approx.) | Repayment Period |

|---|---|---|---|

| Standard | $550 | $16,000 | 10 years |

| Extended | $275 | $36,000 | 25 years |

| Graduated (Year 1) | $300 | $40,000+ | 25 years |

| Graduated (Year 10) | $600+ | $40,000+ | 25 years |

| Income-Driven (Example – varies greatly) | $200-$400 (depending on income) | $40,000+ | 20-25 years |

*Note: These are estimates and actual payments may vary based on individual loan terms and interest rates. Graduated repayment’s final payment amount will be significantly higher due to the gradual increase. Income-driven repayment amounts are highly variable and this is just an illustrative range.*

Impact of Income on Income-Driven Repayment Plans

The monthly payment under an IDR plan is directly tied to your adjusted gross income (AGI). Consider these examples:

- Low Income ($30,000 AGI): An individual with a $50,000 loan and a $30,000 AGI might have a monthly payment as low as $200 under an IDR plan.

- Moderate Income ($60,000 AGI): The same individual with a $60,000 AGI might see their monthly payment increase to around $350.

- High Income ($100,000 AGI): With a $100,000 AGI, the monthly payment could rise to approximately $500 or more, approaching the standard repayment plan amount.

Managing Student Loan Debt and Monthly Payments

Successfully navigating student loan repayment requires proactive strategies and a clear understanding of available resources. Effective management involves careful budgeting, exploring options to reduce monthly payments, and utilizing support systems when needed. This section details practical approaches to minimize financial strain and expedite the repayment process.

Budgeting and Managing Monthly Student Loan Payments

Creating a realistic budget is paramount to managing student loan payments. This involves tracking all income and expenses to identify areas for potential savings. Categorizing expenses helps visualize spending patterns and pinpoint unnecessary expenditures. By allocating a specific portion of monthly income towards student loan payments, borrowers can ensure consistent and timely repayments. Consider using budgeting apps or spreadsheets to simplify the process and monitor progress. For example, a borrower earning $3,000 per month might allocate $500 for student loan payments, $1000 for housing, $500 for food, and so on, leaving a remaining amount for other expenses and savings. Sticking to this budget ensures consistent payments and avoids late fees or default.

Strategies for Reducing Monthly Payments

Several options exist to lower monthly student loan payments. Refinancing involves obtaining a new loan with a lower interest rate from a private lender, potentially reducing the monthly payment. However, refinancing might not be suitable for all borrowers, particularly those with federal loans eligible for income-driven repayment plans. Consolidation combines multiple loans into a single loan, simplifying repayment and potentially leading to a lower monthly payment. Eligibility criteria and interest rate implications vary depending on the chosen method. For example, a borrower with multiple loans totaling $50,000 at various interest rates might consolidate them into a single loan with a lower average interest rate, resulting in a lower monthly payment. This simplifies the repayment process by managing a single monthly payment instead of multiple payments.

Resources for Borrowers Struggling with Student Loan Payments

Numerous resources assist borrowers facing financial hardship. The federal government offers income-driven repayment plans, adjusting monthly payments based on income and family size. These plans include options such as the Income-Driven Repayment (IDR) plan, which caps monthly payments at a percentage of discretionary income. Non-profit organizations provide free financial counseling and guidance on managing student loan debt. These organizations often offer workshops and one-on-one consultations to help borrowers navigate repayment options and develop personalized strategies. For instance, the National Foundation for Credit Counseling (NFCC) offers free financial counseling services, including assistance with student loan management.

Impact of Making Extra Payments

Making extra payments on student loans significantly accelerates the repayment process and reduces the total interest paid. Even small additional payments can substantially shorten the loan term and save money in the long run. For example, a borrower with a $30,000 loan at 5% interest might save thousands of dollars in interest and pay off the loan several years earlier by consistently making extra payments of $100 per month. The impact is amplified by the compounding effect of interest; reducing the principal balance early lowers the amount of interest accrued in subsequent months. This results in a faster repayment timeline and considerable savings.

Visual Representation of Monthly Payment Data

Understanding the relationship between loan amount, interest rate, repayment plan, and monthly payment is crucial for effective student loan management. Visual representations offer a clear and concise way to grasp this complex interplay. Two key visualizations can illuminate these relationships.

Loan Amount vs. Monthly Payment

A scatter plot effectively illustrates the relationship between the principal loan amount and the resulting monthly payment. The horizontal axis represents the loan amount (e.g., ranging from $10,000 to $100,000), while the vertical axis represents the corresponding monthly payment. Each point on the plot represents a specific loan amount and its associated monthly payment, assuming a fixed interest rate and repayment period (e.g., a standard 10-year repayment plan). The plot will show a clear positive correlation: as the loan amount increases, so does the monthly payment. Lines could be added to represent different interest rates, showing how a higher interest rate leads to higher monthly payments for the same loan amount. For example, a $50,000 loan at 5% interest might have a monthly payment of $500, while the same loan at 7% interest might have a monthly payment closer to $550. The visual would clearly demonstrate the significant impact of interest rates on monthly payments.

Comparison of Total Interest Paid Across Repayment Plans

A bar chart is ideal for comparing the total interest paid over the life of a loan under different repayment plans. Each bar represents a different repayment plan (e.g., Standard, Extended, Graduated, Income-Driven Repayment). The height of each bar corresponds to the total interest paid under that plan for a given loan amount. For instance, a $50,000 loan might show significantly less total interest paid under a 10-year standard plan compared to a 25-year extended plan, even though the monthly payment would be higher for the shorter plan. This visual clearly demonstrates the trade-off between lower monthly payments and higher total interest costs associated with longer repayment periods. The chart could include data labels showing the exact total interest paid for each plan, allowing for a direct comparison. For example, the standard plan might show $15,000 in total interest, while the extended plan might show $35,000, highlighting the considerable difference in long-term costs.

Ultimate Conclusion

Successfully managing student loan debt requires a proactive and informed approach. By understanding the factors influencing your monthly payments, exploring available repayment options, and implementing effective budgeting strategies, you can significantly improve your financial outlook. Remember, resources are available to assist borrowers facing challenges, and proactive planning can lead to a smoother and more manageable repayment process. Take control of your financial future by utilizing the information provided and seeking additional support when needed.

Detailed FAQs

What happens if I miss a student loan payment?

Missing a payment can result in late fees, negatively impact your credit score, and potentially lead to loan default. Contact your loan servicer immediately if you anticipate difficulties making a payment.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payment. However, it’s crucial to compare offers carefully and consider the long-term implications before refinancing.

What are income-driven repayment plans?

Income-driven repayment plans base your monthly payment on your income and family size. They often result in lower monthly payments but may extend the repayment period.

How can I consolidate my student loans?

Loan consolidation combines multiple loans into a single loan, potentially simplifying repayment. This can streamline payments but may not always lower your interest rate.