Navigating the complexities of student loan repayment can feel overwhelming. Understanding how much interest you’ll ultimately pay is crucial for effective financial planning. This guide provides a clear framework for estimating your total interest costs, exploring various factors that influence the final amount, and outlining strategies to minimize your overall debt burden.

From fixed versus variable interest rates to the impact of different repayment plans and the power of extra payments, we’ll demystify the process of calculating and managing student loan interest. We’ll explore both manual calculation methods and the use of online tools to provide you with a comprehensive understanding of your financial obligations.

Understanding Interest Accrual on Student Loans

Understanding how interest accrues on your student loans is crucial for effective repayment planning and minimizing your overall cost. Failing to grasp this can lead to significantly higher total payments. This section will clarify the different types of interest, how it compounds, and its impact under various repayment plans.

Fixed vs. Variable Interest Rates

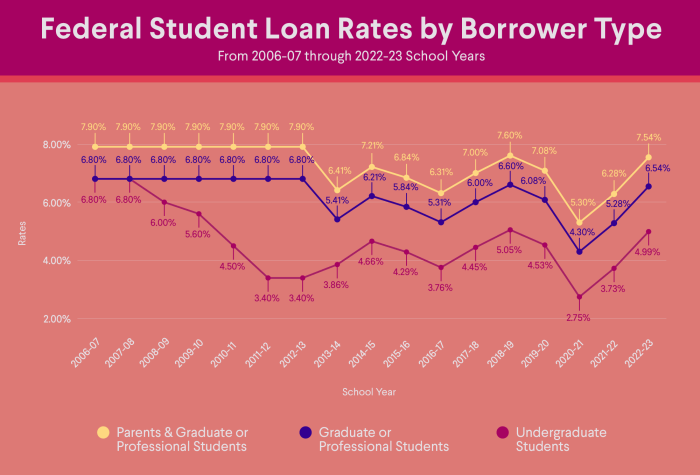

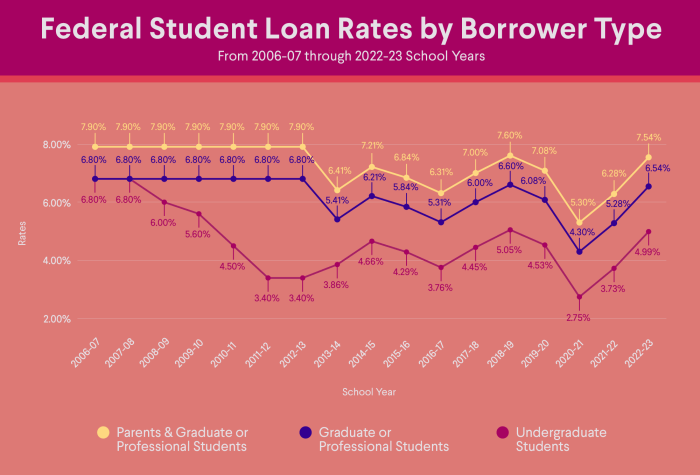

Student loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictable monthly payments. A variable interest rate, however, fluctuates based on an underlying index, such as the prime rate or LIBOR. This means your monthly payment could change over time, potentially increasing or decreasing depending on market conditions. Choosing between a fixed and variable rate depends on your risk tolerance and predictions about future interest rate trends. A fixed rate offers stability, while a variable rate could offer lower initial payments but carries greater uncertainty.

Interest Capitalization

Interest capitalization occurs when accrued but unpaid interest is added to your principal loan balance. This increases the amount of your loan and, consequently, the amount of interest you’ll accrue in the future. Capitalization typically happens during periods of deferment or forbearance, when you’re not required to make payments. For example, if you have a $10,000 loan with a 5% interest rate and defer payments for one year, the interest accrued ($500) will be added to your principal balance, making your new principal $10,500. Future interest calculations will then be based on this higher amount, leading to a larger total interest paid over the life of the loan.

Interest Accrual on Different Repayment Plans

The repayment plan you choose significantly impacts how quickly your loan balance decreases and the total amount of interest you pay.

Standard Repayment: This plan involves fixed monthly payments over a 10-year period. Interest accrues daily on the outstanding principal balance, and payments are applied first to interest, then to principal. The earlier you pay down the principal, the less interest you pay overall.

Graduated Repayment: Payments start low and gradually increase over time. While this offers lower initial payments, it often results in a longer repayment period and higher total interest paid compared to standard repayment.

Income-Driven Repayment (IDR): Payments are calculated based on your income and family size. While IDR plans typically extend repayment terms significantly (potentially up to 20 or 25 years), they can result in lower monthly payments, making them manageable for borrowers with limited income. However, this extended repayment period generally leads to substantially higher total interest paid over the life of the loan.

Comparison of Total Interest Paid

| Loan Type | Interest Rate | Repayment Plan | Total Interest Paid (Estimate) |

|---|---|---|---|

| Federal Subsidized Loan | 4.5% | Standard (10 years) | $2,700 (on a $10,000 loan) |

| Federal Unsubsidized Loan | 6.8% | Graduated (12 years) | $4,000 (on a $10,000 loan) |

| Private Loan | 7.5% | Income-Driven (20 years) | $7,000 (on a $10,000 loan) |

| Federal Consolidation Loan | 5.0% | Standard (10 years) | $3,000 (on a $10,000 loan) |

*Note: These are estimates and actual interest paid will vary based on individual loan terms and repayment behavior.*

Visualizing Interest Paid Over Time

Understanding the accumulation of interest on student loans is crucial for effective financial planning. A visual representation can significantly clarify the impact of different repayment strategies and the overall cost of borrowing. This section will explore how a graph can illuminate this complex financial picture.

A line graph is an effective tool for visualizing interest paid over time. The horizontal (x) axis represents the time elapsed, typically in years, from the loan disbursement to the final repayment. The vertical (y) axis represents the cumulative interest paid in dollars. Multiple lines can be plotted on the same graph, each representing a different repayment strategy (e.g., standard repayment, extended repayment, income-driven repayment).

Interest Accumulation Under Different Repayment Plans

The graph would show several distinct lines. For instance, a line representing the standard repayment plan would initially show a steep incline, reflecting higher monthly payments and faster principal reduction, resulting in less overall interest paid. In contrast, a line for an extended repayment plan would have a gentler incline initially, due to lower monthly payments, but ultimately reach a higher cumulative interest paid due to the longer repayment period. An income-driven repayment plan would show a more variable line, reflecting fluctuating monthly payments based on income, potentially leading to a significantly longer repayment period and higher total interest. Key data points would include the total interest paid under each plan and the total time to repayment. The graph’s legend would clearly identify each line representing a specific repayment strategy.

Interpreting the Visualization to Understand Overall Borrowing Costs

By comparing the lines on the graph, borrowers can readily see the significant differences in total interest paid under various repayment plans. For example, a visual comparison might reveal that choosing an extended repayment plan could result in paying $20,000 more in interest over the life of the loan compared to the standard repayment plan. This visual representation makes the financial implications of different repayment strategies instantly clear, allowing borrowers to make informed decisions aligned with their financial goals and risk tolerance. The total cost of borrowing, including both principal and interest, can also be visually represented by adding a secondary y-axis displaying the total amount repaid. This would provide a complete picture of the financial burden associated with each repayment strategy. Consider a scenario where a $50,000 loan under a standard plan might cost $70,000 in total, while the same loan under an extended plan could cost $90,000. This difference is easily and powerfully communicated visually.

Final Wrap-Up

Successfully managing your student loan debt requires a proactive approach. By understanding the factors that influence interest accrual, utilizing available resources, and employing smart repayment strategies, you can significantly reduce your overall interest payments and achieve financial freedom sooner. Remember to regularly review your loan details and explore options to optimize your repayment plan to suit your evolving financial circumstances.

FAQ Explained

What is interest capitalization?

Interest capitalization is the addition of accrued but unpaid interest to your principal loan balance. This increases the total amount you owe and, consequently, the total interest you’ll pay over the life of the loan.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, it’s crucial to compare offers carefully and consider the potential loss of federal loan benefits before refinancing.

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score, lead to late fees, and potentially result in loan default, with severe financial consequences.

Are there any government programs to help with student loan repayment?

Yes, several government programs offer assistance, such as income-driven repayment plans and loan forgiveness programs for specific professions. Research these options to see if you qualify.