Navigating the complex world of student loans can feel overwhelming, especially when deciding how much to borrow. The right amount depends on a careful assessment of your current financial situation, projected future earnings, and a realistic understanding of repayment options. This guide provides a structured approach to help you make informed decisions, ensuring you borrow only what’s necessary to achieve your educational goals without jeopardizing your long-term financial well-being.

Understanding your financial health is the cornerstone of responsible borrowing. This involves analyzing your income, expenses, existing debt, and credit score. Projecting future income and expenses post-graduation allows for a more accurate calculation of affordable monthly loan payments. Exploring various repayment plans—standard, graduated, extended, and income-driven—highlights the long-term implications of your borrowing decisions. Finally, considering alternative funding options, such as scholarships and grants, can significantly reduce your reliance on loans.

Understanding Your Financial Situation

Before determining how much you can borrow for student loans, a thorough assessment of your current financial health is crucial. This involves understanding your income, expenses, existing debt, and credit score. A clear picture of your financial standing will help you make informed decisions about borrowing and repayment.

Current Income and Expenses

Accurately tracking your income and expenses is the first step. This includes both your regular income sources (salary, part-time jobs, etc.) and all your spending, categorized as essential and non-essential. Essential expenses are those necessary for basic living, while non-essential expenses are discretionary spending. Careful budgeting allows you to identify areas where you can potentially reduce spending to accommodate loan repayments.

Monthly Income and Expenses Breakdown

| Category | Amount ($) |

|---|---|

| Monthly Income (Net) | 2500 |

| Fixed Expenses | 1200 |

| Rent | 800 |

| Utilities (Electricity, Water, Internet) | 400 |

| Variable Expenses | 800 |

| Groceries | 300 |

| Transportation | 200 |

| Entertainment | 300 |

| Savings | 500 |

This table represents a sample budget. Your specific amounts will vary depending on your circumstances. Note that this example shows a positive savings balance, which is ideal before taking on additional debt.

Existing Debt and Credit Score

Your existing debt significantly impacts your ability to manage student loans. High levels of existing debt, such as credit card debt or personal loans, reduce your capacity to handle additional financial obligations. Your credit score, a numerical representation of your creditworthiness, also plays a crucial role in determining loan eligibility and interest rates. A higher credit score generally leads to better loan terms. For example, someone with a high credit score might qualify for a lower interest rate on a student loan, reducing the overall cost of borrowing. Conversely, a low credit score might result in higher interest rates or even loan rejection.

Income Allocation Visualization

Imagine a pie chart. The entire circle represents your monthly net income of $2500. A large segment (48%) would represent Fixed Expenses ($1200), a significant portion (32%) would show Variable Expenses ($800), and a smaller segment (20%) would represent Savings ($500). This visual representation quickly demonstrates the proportion of income allocated to each spending category, highlighting areas for potential adjustments.

Estimating Future Earnings and Expenses

Accurately projecting your post-graduation financial situation is crucial for determining a responsible student loan amount. This involves realistically assessing your potential income and anticipated expenses, allowing you to understand your potential disposable income and repayment capacity. Failing to do so could lead to overwhelming debt.

Estimating your future financial picture requires careful consideration of several factors. While complete accuracy is impossible, a well-informed projection can significantly aid in your decision-making process.

Projected Post-Graduation Income

Your chosen career path and geographic location significantly influence your potential salary. For example, a software engineer in San Francisco will likely earn considerably more than a teacher in a rural area. Researching average salaries for your chosen profession in your target location is vital. Websites like Glassdoor, Salary.com, and Payscale provide salary data based on experience level, company size, and location. Let’s say you’re aiming to be a registered nurse in a mid-sized city. Research might indicate an average starting salary of $60,000 annually. This figure serves as a baseline for your income projection. Remember to consider potential salary increases based on experience and promotions. For instance, a 3% annual increase is a common assumption, but it varies by profession and location.

Additional Income Streams

Beyond your primary employment, consider potential supplementary income sources. Many graduates supplement their income with part-time jobs, freelance work, or gig economy participation. A part-time position at a retail store or tutoring could provide an additional $10,000-$15,000 annually. Freelance opportunities, such as writing, graphic design, or web development, can provide flexible income depending on your skills and demand. These additional income streams can significantly improve your ability to manage student loan repayments.

Post-Graduation Expenses

Your expenses will likely increase after graduation. Rent in a major city can be significantly higher than dorm fees. Transportation costs, including car payments, insurance, and public transport, also increase. Professional development, such as continuing education courses or professional certifications, adds further expenses. Let’s use the registered nurse example. Assume monthly rent of $1500, transportation costs of $300, and professional development fees of $500 annually. These are just examples, and your actual expenses will vary depending on your lifestyle and location.

Disposable Income Calculation

Comparing your projected income and expenses allows you to estimate your disposable income – the money left after covering your essential expenses. Using our example, a $60,000 annual salary, with a $15,000 supplemental income, yields a total of $75,000. Annual expenses, including rent, transportation, and professional development, might total $22,000. This results in a disposable income of approximately $53,000. This disposable income will be crucial in determining your ability to repay your student loans comfortably. Remember, this is a simplified calculation; a more detailed budget is advisable for a comprehensive assessment.

Exploring Student Loan Repayment Plans

Choosing the right student loan repayment plan is crucial for managing your debt and ensuring long-term financial stability. Different plans offer varying levels of flexibility and impact your monthly budget and overall interest paid. Understanding the nuances of each plan will allow you to make an informed decision that aligns with your financial circumstances and goals.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It involves fixed monthly payments over a 10-year period. This plan is generally the best choice for borrowers who can comfortably afford the higher monthly payments and want to pay off their loans quickly, minimizing the total interest paid.

- Pros: Fastest repayment, lowest total interest paid.

- Cons: Highest monthly payments, may be challenging for borrowers with limited income.

Graduated Repayment Plan

With a graduated repayment plan, your monthly payments start low and gradually increase over time, typically every two years, for a 10-year period. This option can be helpful for borrowers who anticipate increased income in the future.

- Pros: Lower initial payments, easier to manage in the early years of repayment.

- Cons: Payments increase significantly over time, potentially making later payments difficult to manage; higher total interest paid compared to standard repayment.

Extended Repayment Plan

This plan allows you to stretch your repayment period beyond the standard 10 years, usually up to 25 years. The longer repayment period results in lower monthly payments, but you’ll pay significantly more in interest over the life of the loan.

- Pros: Lower monthly payments, more manageable budget.

- Cons: Much higher total interest paid, longer repayment period.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base your monthly payment on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically offer lower monthly payments than other options, but the repayment period can extend beyond 20 years, and any remaining balance may be forgiven after a certain number of years (though this forgiveness is considered taxable income).

- Pros: Lower monthly payments, more manageable for borrowers with lower incomes.

- Cons: Longer repayment period, potentially higher total interest paid, forgiven balance is considered taxable income.

Repayment Plan Comparison

The following table provides a hypothetical comparison of monthly payments, total interest paid, and loan repayment period for each plan. Note that these figures are illustrative and will vary significantly based on the loan amount, interest rate, and individual circumstances. These figures are for a $30,000 loan at a 6% interest rate.

| Repayment Plan | Monthly Payment (approx.) | Total Interest Paid (approx.) | Repayment Period |

|---|---|---|---|

| Standard | $330 | $7,800 | 10 years |

| Graduated | Starts at ~$200, increases over time | ~$10,000 | 10 years |

| Extended | ~$165 | ~$15,000 | 25 years |

| Income-Driven (Example) | Varies based on income | Varies significantly | 20-25 years |

Calculating Affordable Loan Payments

Determining the maximum affordable monthly student loan payment is crucial for responsible borrowing. This involves carefully considering your projected income, existing expenses, and desired lifestyle after graduation. Failing to accurately assess your repayment capacity can lead to financial strain and potentially default.

The key to calculating an affordable payment lies in creating a realistic budget that incorporates all anticipated income and expenses. This includes not only tuition and living costs during your studies but also post-graduation expenses like rent, utilities, transportation, food, and any personal debt. A common rule of thumb is to allocate no more than 10-15% of your anticipated post-graduation gross monthly income to student loan repayments. However, this percentage is a guideline and may need adjustment based on individual circumstances.

Budgeting Strategies to Accommodate Student Loan Payments

A well-structured budget is essential for managing student loan repayments effectively. This requires a detailed overview of both your income and expenses, allowing you to identify areas where you can potentially reduce spending or increase income. Several strategies can help. For example, tracking expenses meticulously using budgeting apps or spreadsheets can reveal areas of unnecessary spending. Exploring opportunities for increased income through part-time work or freelance gigs can also significantly improve your repayment capacity. Prioritizing essential expenses and delaying non-essential purchases can further contribute to a manageable budget.

Impact of Different Loan Amounts on Monthly Budget and Long-Term Financial Goals

The loan amount directly influences the monthly payment and long-term financial well-being. A larger loan necessitates a higher monthly payment, potentially impacting your ability to save for other financial goals such as a down payment on a house or investing. Conversely, a smaller loan reduces the monthly burden, freeing up resources for other financial priorities. For instance, borrowing $20,000 at a 5% interest rate over 10 years results in a significantly lower monthly payment than borrowing $50,000 under the same conditions. This difference can profoundly affect your ability to save for a down payment on a house or invest in retirement. The long-term financial implications are considerable, with a smaller loan leading to less accumulated interest and faster debt repayment.

Determining an Affordable Loan Payment Amount: A Flowchart

This flowchart Artikels the steps to determine your maximum affordable student loan payment.

Start –> Estimate your post-graduation monthly income –> List all monthly expenses (housing, food, transportation, etc.) –> Subtract total expenses from your estimated income –> Multiply the remaining amount by 0.10 (or 0.15 for a more conservative approach) –> The resulting amount represents your maximum affordable monthly student loan payment –> Compare this amount to potential loan repayment amounts based on different loan scenarios –> Adjust your borrowing amount or repayment plan based on the comparison –> End

Considering Alternative Funding Options

Securing funding for higher education often involves exploring options beyond traditional student loans. A diversified approach can significantly reduce your overall debt burden and improve your long-term financial health. This section will examine various alternative funding sources, their advantages and disadvantages, and how they compare to student loans.

Exploring alternative funding sources can lead to substantial savings and minimize the need for large student loans. These alternatives offer different benefits and drawbacks, which should be carefully considered before making financial decisions. Understanding the long-term financial implications of each option is crucial for responsible financial planning.

Scholarships and Grants

Scholarships and grants represent “free money” for education, meaning they don’t need to be repaid. They are often awarded based on academic merit, athletic ability, financial need, or specific criteria set by the awarding institution or organization. Many scholarships are highly competitive, requiring extensive application processes. Grants, on the other hand, are typically awarded based on financial need and are often administered through government programs or colleges. The availability of scholarships and grants varies widely depending on factors like your academic record, extracurricular activities, and financial circumstances. For example, a student with a high GPA and strong extracurricular involvement might be eligible for numerous merit-based scholarships, while a student from a low-income family could qualify for federal Pell Grants.

Part-Time Jobs and Summer Employment

Working part-time during the academic year or full-time during summer breaks can significantly contribute to your educational expenses. This strategy reduces your reliance on loans and instills financial responsibility. The income generated can cover tuition fees, living expenses, or even reduce the amount you need to borrow. However, balancing work and studies requires careful time management and can impact academic performance if not managed effectively. For example, a student working 10 hours a week might earn enough to cover their textbooks and some living expenses, lessening the overall financial burden. Conversely, working excessive hours could lead to burnout and negatively impact academic success.

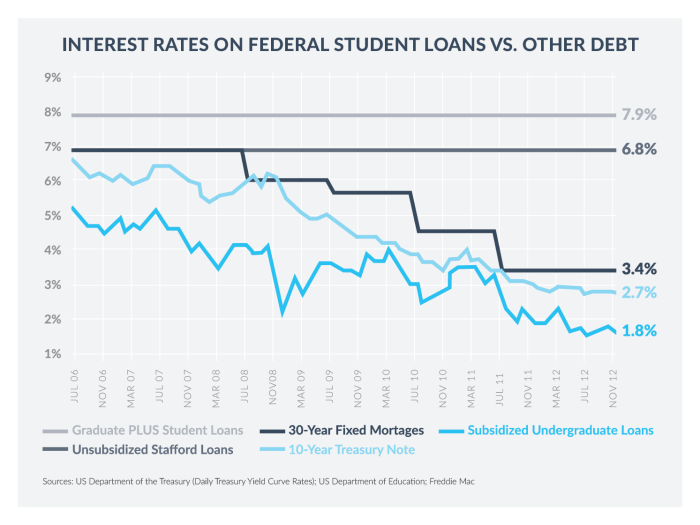

Comparison of Funding Options

Comparing student loans, personal loans, and alternative funding sources reveals significant differences in interest rates and repayment terms. Student loans typically offer lower interest rates than personal loans, especially federal student loans, which often come with government subsidies. However, personal loans might offer more flexibility in repayment terms. Scholarships and grants, as mentioned, are non-repayable, making them the most favorable option. The long-term financial impact of choosing different funding options can be substantial. For instance, a large student loan balance with high interest can lead to significant debt over many years, impacting future financial decisions such as buying a home or investing. Conversely, utilizing scholarships and grants minimizes long-term financial strain. A realistic budget and a well-defined funding strategy are crucial for minimizing long-term financial risk.

The Impact of Loan Amount on Future Financial Decisions

The amount you borrow for your education significantly impacts your financial future, influencing major life decisions and long-term financial stability. Understanding this impact is crucial for making informed borrowing choices. Failing to consider the long-term implications of your loan amount can lead to considerable financial strain and limit your opportunities.

The size of your student loan debt directly affects your ability to achieve significant financial milestones. Larger loan amounts often necessitate more aggressive repayment strategies, leaving less room for other financial goals.

Major Life Decisions and Loan Amounts

Different loan amounts can drastically alter your ability to pursue major life goals. For example, someone with $50,000 in student loan debt might find buying a house significantly more challenging than someone with $20,000. The larger debt requires a higher monthly payment, reducing the amount available for a mortgage down payment and potentially limiting the type of home they can afford. Similarly, starting a family might be delayed or require more careful budgeting for someone with substantial student loan debt. The added expenses of childcare and other family-related costs can strain finances already burdened by loan repayments. Consider a scenario where one graduate has $100,000 in loans and another has $30,000. The former might delay having children or buying a home until significantly later in life to manage debt, while the latter could pursue these goals sooner with less financial pressure.

Impact of High Student Loan Debt on Credit Scores and Future Borrowing

High student loan debt can negatively impact your credit score. Late or missed payments can significantly lower your score, making it more difficult to obtain loans in the future for things like a car, a mortgage, or even a business loan. Lenders view a high debt-to-income ratio as a risk, resulting in higher interest rates or loan denials. For instance, a credit score below 670 might lead to significantly higher interest rates on a mortgage, increasing the overall cost of homeownership. Furthermore, the impact on your credit score extends beyond the repayment period, potentially affecting your financial health for years to come.

Creating a Realistic Financial Plan That Accounts for Student Loan Repayment

Developing a comprehensive financial plan that incorporates student loan repayment is essential. This plan should include a realistic budget that accounts for all expenses, including loan payments, and sets clear financial goals. It’s important to prioritize high-interest debt and explore options like income-driven repayment plans to manage monthly payments effectively. For example, a detailed budget could Artikel monthly income, expenses, and the portion allocated towards loan repayment, leaving a clear picture of disposable income. This plan should be regularly reviewed and adjusted to reflect changing circumstances and financial goals. Consider using budgeting apps or spreadsheets to track expenses and monitor progress towards repayment goals.

Financial Resources and Tools for Managing Student Loan Debt

Several resources can assist in effectively managing student loan debt. These include:

- Student Loan Repayment Calculators: These online tools help estimate monthly payments based on different repayment plans.

- Federal Student Aid Website: This website provides information on repayment plans, loan forgiveness programs, and other resources.

- Credit Counseling Agencies: These agencies can offer guidance on debt management and consolidation options.

- Financial Advisors: A financial advisor can provide personalized advice on creating a comprehensive financial plan that includes student loan repayment.

Utilizing these resources can provide valuable support and guidance throughout the repayment process. They offer different perspectives and strategies to help manage debt effectively and achieve financial goals.

Final Conclusion

Ultimately, determining the appropriate amount of student loan debt requires a thorough and personalized assessment. By carefully considering your current financial situation, projected income and expenses, available repayment plans, and alternative funding sources, you can make an informed decision that aligns with your financial goals. Remember, responsible borrowing empowers you to pursue your education without compromising your future financial stability. Utilize the resources and tools available to create a realistic financial plan that incorporates student loan repayment, ensuring a smooth transition into your post-graduate life.

FAQ Overview

What if my income projections are inaccurate?

Inaccurate income projections can lead to difficulties in repayment. Regularly review your budget and repayment plan, adjusting as needed. Consider exploring income-driven repayment options for flexibility.

How do I improve my credit score before applying for loans?

Pay down existing debts, maintain a consistent payment history, and keep credit utilization low. Monitor your credit report regularly for errors.

What happens if I can’t make my loan payments?

Contact your loan servicer immediately to explore options like deferment, forbearance, or alternative repayment plans. Ignoring the problem can lead to serious consequences, including damage to your credit score.

Are there any government programs to help with student loan repayment?

Yes, various government programs offer assistance, including income-driven repayment plans and loan forgiveness programs for specific professions. Research your eligibility for these programs.